The COVID-19 crisis has reshaped the marine sector’s risk landscape, whilst compelling the marine insurance market to change the way it views risks. Tim Martin, head of casualty/marine at Gallagher Bassett - a premier claims services provider, states that the pandemic has heavily disrupted airline travel and the aviation freight industry, which has caused ripple effects, impacting the demand for goods being shipped and transferred across the world.

Companies in the marine insurance market are witnessing significant supply chain disruptions, since major manufacturing points have been impacted by the virus. Stakeholders in the marine insurance market are facing international border restrictions that are causing a delay in shipments. Due to the pandemic’s direct and indirect interruptions in the marine sector, marine operators are becoming more competitive and investing in stronger & faster technologies to support claimants & clients.

The speed of the process is one of the biggest challenges faced by marine insurance claims managers. In a research conducted by Marine Judge - an AI-driven marine insurance platform, it has been found that more than 40% of managers involved in maritime insurance claims state that the claims process is potentially time consuming. High cost of processes and poor communication are among other challenges faced by claims managers in the marine insurance market. Thus, to overcome these challenges, stakeholders are introducing insurtech products that hold promising potentials to reduce the time and expense of settling claims. The adoption rate for insurtech products is anticipated to increase dynamically.

With the influx of insurtech products, the digitalization of marine insurance is emerging as one of the key drivers for market growth. Artificial intelligence (AI)-driven insurance platforms and real-time data are empowering brokers and insurers with insights to react swiftly. Digitalization is minimizing poor communication in processes within the marine insurance market. The broker’s role is transitioning from providing only transactional information to providing better insight on risk and exposure through analyzing meaningful data.

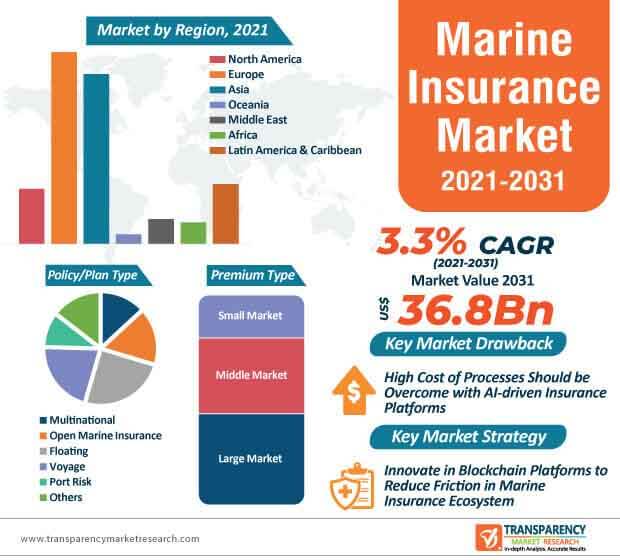

The digitalization of marine insurance is helping insurers to react swiftly to a vessel on the move, adapt prices, and coverage in real time in order to manage risks more accurately. Such trends are translating into revenue opportunities for stakeholders in the marine insurance market, which is estimated to cross a valuation of US$ 36.8 Bn by 2031.

Blockchain platforms are gaining recognition in the global marine insurance market. Ernst & Young - a multinational professional services network, has joined forces with Guardtime - a specialist in cyber-security and blockchain, to work with Microsoft’s Azure Blockchain to reduce risk and friction in global trade & the marine insurance ecosystem.

Companies in the marine insurance market are increasing their R&D capabilities to develop blockchain-enabled platforms that meet the needs of different parties involved in a marine insurance contract.

Analysts’ Viewpoint

Brokers and insurers are increasing their R&D efforts to calculate the risk of business interruptions in the pandemic-influenced trade economy. The marine insurance market is slated to register a modest CAGR of 3.3% during the assessment period. This is evident since marine insurance claims managers are facing time, cost, and communication challenges in claims processes. Hence, companies should increase the availability of insurtech products, digitalization of processes, and blockchain-enabled platforms to streamline claims processes. Brokers are suggested to acquire new talent with a strong data and analytics skillset. Blockchain-enabled platforms are being developed with the consultation of large shipping companies, international brokers, and multiple specialty insurance firms.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Capacity Trend

5.5. Losses and Loss trending, by Coverage Type

5.6. Key Market Indicators

5.6.1. Overall Insurance Market

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Covid-19 Impact Analysis

5.11. Global Marine Insurance Market Analysis and Forecast, 2016-2031

5.11.1. Market Value Projections (US$ Mn)

6. Global Marine Insurance Market Analysis and Forecast, By Risk Type

6.1. Global Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

6.1.1.1. Ocean Cargo

6.1.1.1.1. Importers / Exporters of General Merchandise

6.1.1.1.2. Project Cargo with Delay in Start-up Risk

6.1.1.1.3. Manufacturers of General Merchandise

6.1.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

6.1.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

6.1.1.1.6. Heavy Equipment Manufacturers / Distributors

6.1.1.1.7. High Tech

6.1.1.1.8. Wearing Apparel

6.1.1.1.9. Coffee & Cocoa

6.1.1.1.10. Sugar in bags and Bulk

6.1.1.1.11. Freight Forwarders

6.1.1.1.12. Specie

6.1.1.1.13. Fine Arts

6.1.1.2. Marine Liability

6.1.1.2.1. Shipyards / Ship Repair

6.1.1.2.2. Marine Terminal Operators (dry & liquid)

6.1.1.2.3. Port Authorities

6.1.1.2.4. Stevedores

6.1.1.2.5. Fleeting / Wharf Operations

6.1.1.2.6. Marine Contractors

6.1.1.2.7. Marine Product Manufacturers

6.1.1.2.8. Charterers Liabilities (commercial only)

6.1.1.2.9. Excess Protection & Indemnity

6.1.1.2.10. Marinas

6.1.1.2.11. US L&H: Longshore and Harbor Workers Compensation

6.1.1.3. Hull & Machinery Insurance

6.1.1.3.1. Tugs and Barges

6.1.1.3.2. Offshore Support / Platform

6.1.1.3.3. Support

6.1.1.3.4. Miscellaneous Workboat Fleets

6.1.1.3.5. Research Vessels

6.1.1.3.6. Hull Builders Risk

6.1.1.3.7. Yachts

6.1.1.4. Inland Marine

6.1.1.4.1. Specie

6.1.1.4.2. Fine Arts

6.1.1.4.3. Armored Cars

6.2. Incremental Opportunity, By Risk Type

7. Global Marine Insurance Market Analysis and Forecast, By Policy/Plan Type

7.1. Global Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

7.1.1. Multinational

7.1.2. Open Marine Insurance

7.1.3. Floating

7.1.4. Voyage

7.1.5. Port Risk

7.1.6. Others

7.2. Incremental Opportunity, By Policy/Plan Type

8. Global Marine Insurance Market Analysis and Forecast, By Premium Type

8.1. Global Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

8.1.1. Large Market

8.1.2. Middle Market

8.1.3. Small Market

8.2. Incremental Opportunity, By Premium Type

9. Global Marine Insurance Market Analysis and Forecast, By Region

9.1. Global Marine Insurance Market (US$ Mn) Forecast, By Region, 2016-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia

9.1.4. Oceania

9.1.5. Middle East

9.1.6. Africa

9.1.7. Latin America & Caribbean

9.2. Incremental Opportunity, By Region

10. North America Marine Insurance Market Analysis and Forecast

10.1. Regional Snapshot

10.1.1. By Risk Type

10.1.2. By Policy/Plan Type

10.1.3. By Premium Type

10.1.4. By Country

10.2. COVID-19 Impact Analysis

10.3. Capacity Trend

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supply Side

10.5. Losses and Loss trending

10.6. Market Structure

10.6.1. Top competitors

10.6.2. Nature of top competitors

10.6.3. Top competitor growth

10.6.4. Insured Premium Segments

10.6.5. Mergers & Acquisition activity

10.6.6. Multinational Programs

10.6.7. Distribution Channels & Proportion

10.6.8. Primary Operators/Platforms

10.6.9. Channel Commissions

10.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

10.7.1.1. Ocean Cargo

10.7.1.1.1. Importers / Exporters of General Merchandise

10.7.1.1.2. Project Cargo with Delay in Start-up Risk

10.7.1.1.3. Manufacturers of General Merchandise

10.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

10.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

10.7.1.1.6. Heavy Equipment Manufacturers / Distributors

10.7.1.1.7. High Tech

10.7.1.1.8. Wearing Apparel

10.7.1.1.9. Coffee & Cocoa

10.7.1.1.10. Sugar in bags and Bulk

10.7.1.1.11. Freight Forwarders

10.7.1.1.12. Specie

10.7.1.1.13. Fine Arts

10.7.1.2. Marine Liability

10.7.1.2.1. Shipyards / Ship Repair

10.7.1.2.2. Marine Terminal Operators (dry & liquid)

10.7.1.2.3. Port Authorities

10.7.1.2.4. Stevedores

10.7.1.2.5. Fleeting / Wharf Operations

10.7.1.2.6. Marine Contractors

10.7.1.2.7. Marine Product Manufacturers

10.7.1.2.8. Charterers Liabilities (commercial only)

10.7.1.2.9. Excess Protection & Indemnity

10.7.1.2.10. Marinas

10.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

10.7.1.3. Hull & Machinery Insurance

10.7.1.3.1. Tugs and Barges

10.7.1.3.2. Offshore Support / Platform Support

10.7.1.3.3. Miscellaneous Workboat Fleets

10.7.1.3.4. Research Vessels

10.7.1.3.5. Hull Builders Risk

10.7.1.3.6. Yachts

10.7.1.4. Inland Marine

10.7.1.4.1. Specie

10.7.1.4.2. Fine Arts

10.7.1.4.3. Armored Cars

10.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

10.8.1. Multinational

10.8.2. Open Marine Insurance

10.8.3. Floating

10.8.4. Voyage

10.8.5. Port Risk

10.8.6. Others

10.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

10.9.1. Large Market

10.9.2. Middle Market

10.9.3. Small Market

10.10. Marine Insurance Market (US$ Mn) Forecast, by Country, 2016-2031

10.10.1. Canada

10.10.2. U.S.

10.10.3. Rest of North America

10.11. Incremental Opportunity Analysis

11. Canada Marine Insurance Market Analysis and Forecast

11.1. Country Snapshot

11.1.1. By Risk Type

11.1.2. By Policy/Plan Type

11.1.3. By Premium Type

11.2. COVID-19 Impact Analysis

11.3. Capacity Trend

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Market Dynamics

11.5.1. Drivers

11.5.2. Restraints

11.5.3. Opportunities

11.6. Losses and Loss trending

11.7. Market Structure

11.7.1. Top competitors

11.7.2. Nature of top competitors

11.7.3. Top competitor growth

11.7.4. Insured Premium Segments

11.7.5. Mergers & Acquisition activity

11.7.6. Multinational Programs

11.7.7. Distribution Channels & Proportion

11.7.8. Primary Operators/Platforms

11.7.9. Channel Commissions

11.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

11.8.1.1. Ocean Cargo

11.8.1.1.1. Importers / Exporters of General Merchandise

11.8.1.1.2. Project Cargo with Delay in Start-up Risk

11.8.1.1.3. Manufacturers of General Merchandise

11.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

11.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

11.8.1.1.6. Heavy Equipment Manufacturers / Distributors

11.8.1.1.7. High Tech

11.8.1.1.8. Wearing Apparel

11.8.1.1.9. Coffee & Cocoa

11.8.1.1.10. Sugar in bags and Bulk

11.8.1.1.11. Freight Forwarders

11.8.1.1.12. Specie

11.8.1.1.13. Fine Arts

11.8.1.2. Marine Liability

11.8.1.2.1. Shipyards / Ship Repair

11.8.1.2.2. Marine Terminal Operators (dry & liquid)

11.8.1.2.3. Port Authorities

11.8.1.2.4. Stevedores

11.8.1.2.5. Fleeting / Wharf Operations

11.8.1.2.6. Marine Contractors

11.8.1.2.7. Marine Product Manufacturers

11.8.1.2.8. Charterers Liabilities (commercial only)

11.8.1.2.9. Excess Protection & Indemnity

11.8.1.2.10. Marinas

11.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

11.8.1.3. Hull & Machinery Insurance

11.8.1.3.1. Tugs and Barges

11.8.1.3.2. Offshore Support / Platform Support

11.8.1.3.3. Miscellaneous Workboat Fleets

11.8.1.3.4. Research Vessels

11.8.1.3.5. Hull Builders Risk

11.8.1.3.6. Yachts

11.8.1.4. Inland Marine

11.8.1.4.1. Specie

11.8.1.4.2. Fine Arts

11.8.1.4.3. Armored Cars

11.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

11.9.1. Multinational

11.9.2. Open Marine Insurance

11.9.3. Floating

11.9.4. Voyage

11.9.5. Port Risk

11.9.6. Others

11.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

11.10.1. Large Market

11.10.2. Middle Market

11.10.3. Small Market

11.11. Incremental Opportunity Analysis

12. U.S. Marine Insurance Market Analysis and Forecast

12.1. Country Snapshot

12.1.1. By Risk Type

12.1.2. By Policy/Plan Type

12.1.3. By Premium Type

12.2. COVID-19 Impact Analysis

12.3. Capacity Trend

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Market Dynamics

12.5.1. Drivers

12.5.2. Restraints

12.5.3. Opportunities

12.6. Losses and Loss trending

12.7. Market Structure

12.7.1. Top competitors

12.7.2. Nature of top competitors

12.7.3. Top competitor growth

12.7.4. Insured Premium Segments

12.7.5. Mergers & Acquisition activity

12.7.6. Multinational Programs

12.7.7. Distribution Channels & Proportion

12.7.8. Primary Operators/Platforms

12.7.9. Channel Commissions

12.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

12.8.1.1. Ocean Cargo

12.8.1.1.1. Importers / Exporters of General Merchandise

12.8.1.1.2. Project Cargo with Delay in Start-up Risk

12.8.1.1.3. Manufacturers of General Merchandise

12.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

12.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

12.8.1.1.6. Heavy Equipment Manufacturers / Distributors

12.8.1.1.7. High Tech

12.8.1.1.8. Wearing Apparel

12.8.1.1.9. Coffee & Cocoa

12.8.1.1.10. Sugar in bags and Bulk

12.8.1.1.11. Freight Forwarders

12.8.1.1.12. Specie

12.8.1.1.13. Fine Arts

12.8.1.2. Marine Liability

12.8.1.2.1. Shipyards / Ship Repair

12.8.1.2.2. Marine Terminal Operators (dry & liquid)

12.8.1.2.3. Port Authorities

12.8.1.2.4. Stevedores

12.8.1.2.5. Fleeting / Wharf Operations

12.8.1.2.6. Marine Contractors

12.8.1.2.7. Marine Product Manufacturers

12.8.1.2.8. Charterers Liabilities (commercial only)

12.8.1.2.9. Excess Protection & Indemnity

12.8.1.2.10. Marinas

12.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

12.8.1.3. Hull & Machinery Insurance

12.8.1.3.1. Tugs and Barges

12.8.1.3.2. Offshore Support / Platform Support

12.8.1.3.3. Miscellaneous Workboat Fleets

12.8.1.3.4. Research Vessels

12.8.1.3.5. Hull Builders Risk

12.8.1.3.6. Yachts

12.8.1.4. Inland Marine

12.8.1.4.1. Specie

12.8.1.4.2. Fine Arts

12.8.1.4.3. Armored Cars

12.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

12.9.1. Multinational

12.9.2. Open Marine Insurance

12.9.3. Floating

12.9.4. Voyage

12.9.5. Port Risk

12.9.6. Others

12.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

12.10.1. Large Market

12.10.2. Middle Market

12.10.3. Small Market

12.11. Incremental Opportunity Analysis

13. Europe Marine Insurance Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Risk Type

13.1.2. By Policy/Plan Type

13.1.3. By Premium Type

13.1.4. By Country

13.2. COVID-19 Impact Analysis

13.3. Capacity Trend

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supply Side

13.5. Losses and Loss trending

13.6. Market Structure

13.6.1. Top competitors

13.6.2. Nature of top competitors

13.6.3. Top competitor growth

13.6.4. Insured Premium Segments

13.6.5. Mergers & Acquisition activity

13.6.6. Multinational Programs

13.6.7. Distribution Channels & Proportion

13.6.8. Primary Operators/Platforms

13.6.9. Channel Commissions

13.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

13.7.1.1. Ocean Cargo

13.7.1.1.1. Importers / Exporters of General Merchandise

13.7.1.1.2. Project Cargo with Delay in Start-up Risk

13.7.1.1.3. Manufacturers of General Merchandise

13.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

13.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

13.7.1.1.6. Heavy Equipment Manufacturers / Distributors

13.7.1.1.7. High Tech

13.7.1.1.8. Wearing Apparel

13.7.1.1.9. Coffee & Cocoa

13.7.1.1.10. Sugar in bags and Bulk

13.7.1.1.11. Freight Forwarders

13.7.1.1.12. Specie

13.7.1.1.13. Fine Arts

13.7.1.2. Marine Liability

13.7.1.2.1. Shipyards / Ship Repair

13.7.1.2.2. Marine Terminal Operators (dry & liquid)

13.7.1.2.3. Port Authorities

13.7.1.2.4. Stevedores

13.7.1.2.5. Fleeting / Wharf Operations

13.7.1.2.6. Marine Contractors

13.7.1.2.7. Marine Product Manufacturers

13.7.1.2.8. Charterers Liabilities (commercial only)

13.7.1.2.9. Excess Protection & Indemnity

13.7.1.2.10. Marinas

13.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

13.7.1.3. Hull & Machinery Insurance

13.7.1.3.1. Tugs and Barges

13.7.1.3.2. Offshore Support / Platform Support

13.7.1.3.3. Miscellaneous Workboat Fleets

13.7.1.3.4. Research Vessels

13.7.1.3.5. Hull Builders Risk

13.7.1.3.6. Yachts

13.7.1.4. Inland Marine

13.7.1.4.1. Specie

13.7.1.4.2. Fine Arts

13.7.1.4.3. Armored Cars

13.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

13.8.1. Multinational

13.8.2. Open Marine Insurance

13.8.3. Floating

13.8.4. Voyage

13.8.5. Port Risk

13.8.6. Others

13.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

13.9.1. Large Market

13.9.2. Middle Market

13.9.3. Small Market

13.10. Marine Insurance Market (US$ Mn) Forecast, by Country, 2016-2031

13.10.1. Belgium

13.10.2. France

13.10.3. Germany

13.10.4. Greece

13.10.5. Italy

13.10.6. Netherlands

13.10.7. Spain

13.10.8. United Kingdom

13.10.9. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Belgium Marine Insurance Market Analysis and Forecast

14.1. Country Snapshot

14.1.1. By Risk Type

14.1.2. By Policy/Plan Type

14.1.3. By Premium Type

14.2. COVID-19 Impact Analysis

14.3. Capacity Trend

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supply Side

14.5. Market Dynamics

14.5.1. Drivers

14.5.2. Restraints

14.5.3. Opportunities

14.6. Losses and Loss trending

14.7. Market Structure

14.7.1. Top competitors

14.7.2. Nature of top competitors

14.7.3. Top competitor growth

14.7.4. Insured Premium Segments

14.7.5. Mergers & Acquisition activity

14.7.6. Multinational Programs

14.7.7. Distribution Channels & Proportion

14.7.8. Primary Operators/Platforms

14.7.9. Channel Commissions

14.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

14.8.1.1. Ocean Cargo

14.8.1.1.1. Importers / Exporters of General Merchandise

14.8.1.1.2. Project Cargo with Delay in Start-up Risk

14.8.1.1.3. Manufacturers of General Merchandise

14.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

14.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

14.8.1.1.6. Heavy Equipment Manufacturers / Distributors

14.8.1.1.7. High Tech

14.8.1.1.8. Wearing Apparel

14.8.1.1.9. Coffee & Cocoa

14.8.1.1.10. Sugar in bags and Bulk

14.8.1.1.11. Freight Forwarders

14.8.1.1.12. Specie

14.8.1.1.13. Fine Arts

14.8.1.2. Marine Liability

14.8.1.2.1. Shipyards / Ship Repair

14.8.1.2.2. Marine Terminal Operators (dry & liquid)

14.8.1.2.3. Port Authorities

14.8.1.2.4. Stevedores

14.8.1.2.5. Fleeting / Wharf Operations

14.8.1.2.6. Marine Contractors

14.8.1.2.7. Marine Product Manufacturers

14.8.1.2.8. Charterers Liabilities (commercial only)

14.8.1.2.9. Excess Protection & Indemnity

14.8.1.2.10. Marinas

14.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

14.8.1.3. Hull & Machinery Insurance

14.8.1.3.1. Tugs and Barges

14.8.1.3.2. Offshore Support / Platform Support

14.8.1.3.3. Miscellaneous Workboat Fleets

14.8.1.3.4. Research Vessels

14.8.1.3.5. Hull Builders Risk

14.8.1.3.6. Yachts

14.8.1.4. Inland Marine

14.8.1.4.1. Specie

14.8.1.4.2. Fine Arts

14.8.1.4.3. Armored Cars

14.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

14.9.1. Multinational

14.9.2. Open Marine Insurance

14.9.3. Floating

14.9.4. Voyage

14.9.5. Port Risk

14.9.6. Others

14.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

14.10.1. Large Market

14.10.2. Middle Market

14.10.3. Small Market

14.11. Incremental Opportunity Analysis

15. France Marine Insurance Market Analysis and Forecast

15.1. Country Snapshot

15.1.1. By Risk Type

15.1.2. By Policy/Plan Type

15.1.3. By Premium Type

15.2. COVID-19 Impact Analysis

15.3. Capacity Trend

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supply Side

15.5. Market Dynamics

15.5.1. Drivers

15.5.2. Restraints

15.5.3. Opportunities

15.6. Losses and Loss trending

15.7. Market Structure

15.7.1. Top competitors

15.7.2. Nature of top competitors

15.7.3. Top competitor growth

15.7.4. Insured Premium Segments

15.7.5. Mergers & Acquisition activity

15.7.6. Multinational Programs

15.7.7. Distribution Channels & Proportion

15.7.8. Primary Operators/Platforms

15.7.9. Channel Commissions

15.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

15.8.1.1. Ocean Cargo

15.8.1.1.1. Importers / Exporters of General Merchandise

15.8.1.1.2. Project Cargo with Delay in Start-up Risk

15.8.1.1.3. Manufacturers of General Merchandise

15.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

15.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

15.8.1.1.6. Heavy Equipment Manufacturers / Distributors

15.8.1.1.7. High Tech

15.8.1.1.8. Wearing Apparel

15.8.1.1.9. Coffee & Cocoa

15.8.1.1.10. Sugar in bags and Bulk

15.8.1.1.11. Freight Forwarders

15.8.1.1.12. Specie

15.8.1.1.13. Fine Arts

15.8.1.2. Marine Liability

15.8.1.2.1. Shipyards / Ship Repair

15.8.1.2.2. Marine Terminal Operators (dry & liquid)

15.8.1.2.3. Port Authorities

15.8.1.2.4. Stevedores

15.8.1.2.5. Fleeting / Wharf Operations

15.8.1.2.6. Marine Contractors

15.8.1.2.7. Marine Product Manufacturers

15.8.1.2.8. Charterers Liabilities (commercial only)

15.8.1.2.9. Excess Protection & Indemnity

15.8.1.2.10. Marinas

15.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

15.8.1.3. Hull & Machinery Insurance

15.8.1.3.1. Tugs and Barges

15.8.1.3.2. Offshore Support / Platform Support

15.8.1.3.3. Miscellaneous Workboat Fleets

15.8.1.3.4. Research Vessels

15.8.1.3.5. Hull Builders Risk

15.8.1.3.6. Yachts

15.8.1.4. Inland Marine

15.8.1.4.1. Specie

15.8.1.4.2. Fine Arts

15.8.1.4.3. Armored Cars

15.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

15.9.1. Multinational

15.9.2. Open Marine Insurance

15.9.3. Floating

15.9.4. Voyage

15.9.5. Port Risk

15.9.6. Others

15.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

15.10.1. Large Market

15.10.2. Middle Market

15.10.3. Small Market

15.11. Incremental Opportunity Analysis

16. Germany Marine Insurance Market Analysis and Forecast

16.1. Country Snapshot

16.1.1. By Risk Type

16.1.2. By Policy/Plan Type

16.1.3. By Premium Type

16.2. COVID-19 Impact Analysis

16.3. Capacity Trend

16.4. Key Trends Analysis

16.4.1. Demand Side

16.4.2. Supply Side

16.5. Market Dynamics

16.5.1. Drivers

16.5.2. Restraints

16.5.3. Opportunities

16.6. Losses and Loss trending

16.7. Market Structure

16.7.1. Top competitors

16.7.2. Nature of top competitors

16.7.3. Top competitor growth

16.7.4. Insured Premium Segments

16.7.5. Mergers & Acquisition activity

16.7.6. Multinational Programs

16.7.7. Distribution Channels & Proportion

16.7.8. Primary Operators/Platforms

16.7.9. Channel Commissions

16.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

16.8.1.1. Ocean Cargo

16.8.1.1.1. Importers / Exporters of General Merchandise

16.8.1.1.2. Project Cargo with Delay in Start-up Risk

16.8.1.1.3. Manufacturers of General Merchandise

16.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

16.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

16.8.1.1.6. Heavy Equipment Manufacturers / Distributors

16.8.1.1.7. High Tech

16.8.1.1.8. Wearing Apparel

16.8.1.1.9. Coffee & Cocoa

16.8.1.1.10. Sugar in bags and Bulk

16.8.1.1.11. Freight Forwarders

16.8.1.1.12. Specie

16.8.1.1.13. Fine Arts

16.8.1.2. Marine Liability

16.8.1.2.1. Shipyards / Ship Repair

16.8.1.2.2. Marine Terminal Operators (dry & liquid)

16.8.1.2.3. Port Authorities

16.8.1.2.4. Stevedores

16.8.1.2.5. Fleeting / Wharf Operations

16.8.1.2.6. Marine Contractors

16.8.1.2.7. Marine Product Manufacturers

16.8.1.2.8. Charterers Liabilities (commercial only)

16.8.1.2.9. Excess Protection & Indemnity

16.8.1.2.10. Marinas

16.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

16.8.1.3. Hull & Machinery Insurance

16.8.1.3.1. Tugs and Barges

16.8.1.3.2. Offshore Support / Platform Support

16.8.1.3.3. Miscellaneous Workboat Fleets

16.8.1.3.4. Research Vessels

16.8.1.3.5. Hull Builders Risk

16.8.1.3.6. Yachts

16.8.1.4. Inland Marine

16.8.1.4.1. Specie

16.8.1.4.2. Fine Arts

16.8.1.4.3. Armored Cars

16.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

16.9.1. Multinational

16.9.2. Open Marine Insurance

16.9.3. Floating

16.9.4. Voyage

16.9.5. Port Risk

16.9.6. Others

16.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

16.10.1. Large Market

16.10.2. Middle Market

16.10.3. Small Market

16.11. Incremental Opportunity Analysis

17. Greece Marine Insurance Market Analysis and Forecast

17.1. Country Snapshot

17.1.1. By Risk Type

17.1.2. By Policy/Plan Type

17.1.3. By Premium Type

17.2. COVID-19 Impact Analysis

17.3. Capacity Trend

17.4. Key Trends Analysis

17.4.1. Demand Side

17.4.2. Supply Side

17.5. Market Dynamics

17.5.1. Drivers

17.5.2. Restraints

17.5.3. Opportunities

17.6. Losses and Loss trending

17.7. Market Structure

17.7.1. Top competitors

17.7.2. Nature of top competitors

17.7.3. Top competitor growth

17.7.4. Insured Premium Segments

17.7.5. Mergers & Acquisition activity

17.7.6. Multinational Programs

17.7.7. Distribution Channels & Proportion

17.7.8. Primary Operators/Platforms

17.7.9. Channel Commissions

17.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

17.8.1.1. Ocean Cargo

17.8.1.1.1. Importers / Exporters of General Merchandise

17.8.1.1.2. Project Cargo with Delay in Start-up Risk

17.8.1.1.3. Manufacturers of General Merchandise

17.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

17.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

17.8.1.1.6. Heavy Equipment Manufacturers / Distributors

17.8.1.1.7. High Tech

17.8.1.1.8. Wearing Apparel

17.8.1.1.9. Coffee & Cocoa

17.8.1.1.10. Sugar in bags and Bulk

17.8.1.1.11. Freight Forwarders

17.8.1.1.12. Specie

17.8.1.1.13. Fine Arts

17.8.1.2. Marine Liability

17.8.1.2.1. Shipyards / Ship Repair

17.8.1.2.2. Marine Terminal Operators (dry & liquid)

17.8.1.2.3. Port Authorities

17.8.1.2.4. Stevedores

17.8.1.2.5. Fleeting / Wharf Operations

17.8.1.2.6. Marine Contractors

17.8.1.2.7. Marine Product Manufacturers

17.8.1.2.8. Charterers Liabilities (commercial only)

17.8.1.2.9. Excess Protection & Indemnity

17.8.1.2.10. Marinas

17.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

17.8.1.3. Hull & Machinery Insurance

17.8.1.3.1. Tugs and Barges

17.8.1.3.2. Offshore Support / Platform Support

17.8.1.3.3. Miscellaneous Workboat Fleets

17.8.1.3.4. Research Vessels

17.8.1.3.5. Hull Builders Risk

17.8.1.3.6. Yachts

17.8.1.4. Inland Marine

17.8.1.4.1. Specie

17.8.1.4.2. Fine Arts

17.8.1.4.3. Armored Cars

17.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

17.9.1. Multinational

17.9.2. Open Marine Insurance

17.9.3. Floating

17.9.4. Voyage

17.9.5. Port Risk

17.9.6. Others

17.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

17.10.1. Large Market

17.10.2. Middle Market

17.10.3. Small Market

17.11. Incremental Opportunity Analysis

18. Italy Marine Insurance Market Analysis and Forecast

18.1. Country Snapshot

18.1.1. By Risk Type

18.1.2. By Policy/Plan Type

18.1.3. By Premium Type

18.2. COVID-19 Impact Analysis

18.3. Capacity Trend

18.4. Key Trends Analysis

18.4.1. Demand Side

18.4.2. Supply Side

18.5. Market Dynamics

18.5.1. Drivers

18.5.2. Restraints

18.5.3. Opportunities

18.6. Losses and Loss trending

18.7. Market Structure

18.7.1. Top competitors

18.7.2. Nature of top competitors

18.7.3. Top competitor growth

18.7.4. Insured Premium Segments

18.7.5. Mergers & Acquisition activity

18.7.6. Multinational Programs

18.7.7. Distribution Channels & Proportion

18.7.8. Primary Operators/Platforms

18.7.9. Channel Commissions

18.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

18.8.1.1. Ocean Cargo

18.8.1.1.1. Importers / Exporters of General Merchandise

18.8.1.1.2. Project Cargo with Delay in Start-up Risk

18.8.1.1.3. Manufacturers of General Merchandise

18.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

18.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

18.8.1.1.6. Heavy Equipment Manufacturers / Distributors

18.8.1.1.7. High Tech

18.8.1.1.8. Wearing Apparel

18.8.1.1.9. Coffee & Cocoa

18.8.1.1.10. Sugar in bags and Bulk

18.8.1.1.11. Freight Forwarders

18.8.1.1.12. Specie

18.8.1.1.13. Fine Arts

18.8.1.2. Marine Liability

18.8.1.2.1. Shipyards / Ship Repair

18.8.1.2.2. Marine Terminal Operators (dry & liquid)

18.8.1.2.3. Port Authorities

18.8.1.2.4. Stevedores

18.8.1.2.5. Fleeting / Wharf Operations

18.8.1.2.6. Marine Contractors

18.8.1.2.7. Marine Product Manufacturers

18.8.1.2.8. Charterers Liabilities (commercial only)

18.8.1.2.9. Excess Protection & Indemnity

18.8.1.2.10. Marinas

18.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

18.8.1.3. Hull & Machinery Insurance

18.8.1.3.1. Tugs and Barges

18.8.1.3.2. Offshore Support / Platform Support

18.8.1.3.3. Miscellaneous Workboat Fleets

18.8.1.3.4. Research Vessels

18.8.1.3.5. Hull Builders Risk

18.8.1.3.6. Yachts

18.8.1.4. Inland Marine

18.8.1.4.1. Specie

18.8.1.4.2. Fine Arts

18.8.1.4.3. Armored Cars

18.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

18.9.1. Multinational

18.9.2. Open Marine Insurance

18.9.3. Floating

18.9.4. Voyage

18.9.5. Port Risk

18.9.6. Others

18.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

18.10.1. Large Market

18.10.2. Middle Market

18.10.3. Small Market

18.11. Incremental Opportunity Analysis

19. Netherlands Marine Insurance Market Analysis and Forecast

19.1. Country Snapshot

19.1.1. By Risk Type

19.1.2. By Policy/Plan Type

19.1.3. By Premium Type

19.2. COVID-19 Impact Analysis

19.3. Capacity Trend

19.4. Key Trends Analysis

19.4.1. Demand Side

19.4.2. Supply Side

19.5. Market Dynamics

19.5.1. Drivers

19.5.2. Restraints

19.5.3. Opportunities

19.6. Losses and Loss trending

19.7. Market Structure

19.7.1. Top competitors

19.7.2. Nature of top competitors

19.7.3. Top competitor growth

19.7.4. Insured Premium Segments

19.7.5. Mergers & Acquisition activity

19.7.6. Multinational Programs

19.7.7. Distribution Channels & Proportion

19.7.8. Primary Operators/Platforms

19.7.9. Channel Commissions

19.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

19.8.1.1. Ocean Cargo

19.8.1.1.1. Importers / Exporters of General Merchandise

19.8.1.1.2. Project Cargo with Delay in Start-up Risk

19.8.1.1.3. Manufacturers of General Merchandise

19.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

19.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

19.8.1.1.6. Heavy Equipment Manufacturers / Distributors

19.8.1.1.7. High Tech

19.8.1.1.8. Wearing Apparel

19.8.1.1.9. Coffee & Cocoa

19.8.1.1.10. Sugar in bags and Bulk

19.8.1.1.11. Freight Forwarders

19.8.1.1.12. Specie

19.8.1.1.13. Fine Arts

19.8.1.2. Marine Liability

19.8.1.2.1. Shipyards / Ship Repair

19.8.1.2.2. Marine Terminal Operators (dry & liquid)

19.8.1.2.3. Port Authorities

19.8.1.2.4. Stevedores

19.8.1.2.5. Fleeting / Wharf Operations

19.8.1.2.6. Marine Contractors

19.8.1.2.7. Marine Product Manufacturers

19.8.1.2.8. Charterers Liabilities (commercial only)

19.8.1.2.9. Excess Protection & Indemnity

19.8.1.2.10. Marinas

19.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

19.8.1.3. Hull & Machinery Insurance

19.8.1.3.1. Tugs and Barges

19.8.1.3.2. Offshore Support / Platform Support

19.8.1.3.3. Miscellaneous Workboat Fleets

19.8.1.3.4. Research Vessels

19.8.1.3.5. Hull Builders Risk

19.8.1.3.6. Yachts

19.8.1.4. Inland Marine

19.8.1.4.1. Specie

19.8.1.4.2. Fine Arts

19.8.1.4.3. Armored Cars

19.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

19.9.1. Multinational

19.9.2. Open Marine Insurance

19.9.3. Floating

19.9.4. Voyage

19.9.5. Port Risk

19.9.6. Others

19.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

19.10.1. Large Market

19.10.2. Middle Market

19.10.3. Small Market

19.11. Incremental Opportunity Analysis

20. Spain Marine Insurance Market Analysis and Forecast

20.1. Country Snapshot

20.1.1. By Risk Type

20.1.2. By Policy/Plan Type

20.1.3. By Premium Type

20.2. COVID-19 Impact Analysis

20.3. Capacity Trend

20.4. Key Trends Analysis

20.4.1. Demand Side

20.4.2. Supply Side

20.5. Market Dynamics

20.5.1. Drivers

20.5.2. Restraints

20.5.3. Opportunities

20.6. Losses and Loss trending

20.7. Market Structure

20.7.1. Top competitors

20.7.2. Nature of top competitors

20.7.3. Top competitor growth

20.7.4. Insured Premium Segments

20.7.5. Mergers & Acquisition activity

20.7.6. Multinational Programs

20.7.7. Distribution Channels & Proportion

20.7.8. Primary Operators/Platforms

20.7.9. Channel Commissions

20.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

20.8.1.1. Ocean Cargo

20.8.1.1.1. Importers / Exporters of General Merchandise

20.8.1.1.2. Project Cargo with Delay in Start-up Risk

20.8.1.1.3. Manufacturers of General Merchandise

20.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

20.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

20.8.1.1.6. Heavy Equipment Manufacturers / Distributors

20.8.1.1.7. High Tech

20.8.1.1.8. Wearing Apparel

20.8.1.1.9. Coffee & Cocoa

20.8.1.1.10. Sugar in bags and Bulk

20.8.1.1.11. Freight Forwarders

20.8.1.1.12. Specie

20.8.1.1.13. Fine Arts

20.8.1.2. Marine Liability

20.8.1.2.1. Shipyards / Ship Repair

20.8.1.2.2. Marine Terminal Operators (dry & liquid)

20.8.1.2.3. Port Authorities

20.8.1.2.4. Stevedores

20.8.1.2.5. Fleeting / Wharf Operations

20.8.1.2.6. Marine Contractors

20.8.1.2.7. Marine Product Manufacturers

20.8.1.2.8. Charterers Liabilities (commercial only)

20.8.1.2.9. Excess Protection & Indemnity

20.8.1.2.10. Marinas

20.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

20.8.1.3. Hull & Machinery Insurance

20.8.1.3.1. Tugs and Barges

20.8.1.3.2. Offshore Support / Platform Support

20.8.1.3.3. Miscellaneous Workboat Fleets

20.8.1.3.4. Research Vessels

20.8.1.3.5. Hull Builders Risk

20.8.1.3.6. Yachts

20.8.1.4. Inland Marine

20.8.1.4.1. Specie

20.8.1.4.2. Fine Arts

20.8.1.4.3. Armored Cars

20.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

20.9.1. Multinational

20.9.2. Open Marine Insurance

20.9.3. Floating

20.9.4. Voyage

20.9.5. Port Risk

20.9.6. Others

20.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

20.10.1. Large Market

20.10.2. Middle Market

20.10.3. Small Market

20.11. Incremental Opportunity Analysis

21. United Kingdom Marine Insurance Market Analysis and Forecast

21.1. Country Snapshot

21.1.1. By Risk Type

21.1.2. By Policy/Plan Type

21.1.3. By Premium Type

21.2. COVID-19 Impact Analysis

21.3. Capacity Trend

21.4. Key Trends Analysis

21.4.1. Demand Side

21.4.2. Supply Side

21.5. Market Dynamics

21.5.1. Drivers

21.5.2. Restraints

21.5.3. Opportunities

21.6. Losses and Loss trending

21.7. Market Structure

21.7.1. Top competitors

21.7.2. Nature of top competitors

21.7.3. Top competitor growth

21.7.4. Insured Premium Segments

21.7.5. Mergers & Acquisition activity

21.7.6. Multinational Programs

21.7.7. Distribution Channels & Proportion

21.7.8. Primary Operators/Platforms

21.7.9. Channel Commissions

21.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

21.8.1.1. Ocean Cargo

21.8.1.1.1. Importers / Exporters of General Merchandise

21.8.1.1.2. Project Cargo with Delay in Start-up Risk

21.8.1.1.3. Manufacturers of General Merchandise

21.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

21.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

21.8.1.1.6. Heavy Equipment Manufacturers / Distributors

21.8.1.1.7. High Tech

21.8.1.1.8. Wearing Apparel

21.8.1.1.9. Coffee & Cocoa

21.8.1.1.10. Sugar in bags and Bulk

21.8.1.1.11. Freight Forwarders

21.8.1.1.12. Specie

21.8.1.1.13. Fine Arts

21.8.1.2. Marine Liability

21.8.1.2.1. Shipyards / Ship Repair

21.8.1.2.2. Marine Terminal Operators (dry & liquid)

21.8.1.2.3. Port Authorities

21.8.1.2.4. Stevedores

21.8.1.2.5. Fleeting / Wharf Operations

21.8.1.2.6. Marine Contractors

21.8.1.2.7. Marine Product Manufacturers

21.8.1.2.8. Charterers Liabilities (commercial only)

21.8.1.2.9. Excess Protection & Indemnity

21.8.1.2.10. Marinas

21.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

21.8.1.3. Hull & Machinery Insurance

21.8.1.3.1. Tugs and Barges

21.8.1.3.2. Offshore Support / Platform Support

21.8.1.3.3. Miscellaneous Workboat Fleets

21.8.1.3.4. Research Vessels

21.8.1.3.5. Hull Builders Risk

21.8.1.3.6. Yachts

21.8.1.4. Inland Marine

21.8.1.4.1. Specie

21.8.1.4.2. Fine Arts

21.8.1.4.3. Armored Cars

21.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

21.9.1. Multinational

21.9.2. Open Marine Insurance

21.9.3. Floating

21.9.4. Voyage

21.9.5. Port Risk

21.9.6. Others

21.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

21.10.1. Large Market

21.10.2. Middle Market

21.10.3. Small Market

21.11. Incremental Opportunity Analysis

22. Asia Marine Insurance Market Analysis and Forecast

22.1. Regional Snapshot

22.1.1. By Risk Type

22.1.2. By Policy/Plan Type

22.1.3. By Premium Type

22.1.4. By Country

22.2. COVID-19 Impact Analysis

22.3. Capacity Trend

22.4. Key Trends Analysis

22.4.1. Demand Side

22.4.2. Supply Side

22.5. Losses and Loss trending

22.6. Market Structure

22.6.1. Top competitors

22.6.2. Nature of top competitors

22.6.3. Top competitor growth

22.6.4. Insured Premium Segments

22.6.5. Mergers & Acquisition activity

22.6.6. Multinational Programs

22.6.7. Distribution Channels & Proportion

22.6.8. Primary Operators/Platforms

22.6.9. Channel Commissions

22.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

22.7.1.1. Ocean Cargo

22.7.1.1.1. Importers / Exporters of General Merchandise

22.7.1.1.2. Project Cargo with Delay in Start-up Risk

22.7.1.1.3. Manufacturers of General Merchandise

22.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

22.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

22.7.1.1.6. Heavy Equipment Manufacturers / Distributors

22.7.1.1.7. High Tech

22.7.1.1.8. Wearing Apparel

22.7.1.1.9. Coffee & Cocoa

22.7.1.1.10. Sugar in bags and Bulk

22.7.1.1.11. Freight Forwarders

22.7.1.1.12. Specie

22.7.1.1.13. Fine Arts

22.7.1.2. Marine Liability

22.7.1.2.1. Shipyards / Ship Repair

22.7.1.2.2. Marine Terminal Operators (dry & liquid)

22.7.1.2.3. Port Authorities

22.7.1.2.4. Stevedores

22.7.1.2.5. Fleeting / Wharf Operations

22.7.1.2.6. Marine Contractors

22.7.1.2.7. Marine Product Manufacturers

22.7.1.2.8. Charterers Liabilities (commercial only)

22.7.1.2.9. Excess Protection & Indemnity

22.7.1.2.10. Marinas

22.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

22.7.1.3. Hull & Machinery Insurance

22.7.1.3.1. Tugs and Barges

22.7.1.3.2. Offshore Support / Platform Support

22.7.1.3.3. Miscellaneous Workboat Fleets

22.7.1.3.4. Research Vessels

22.7.1.3.5. Hull Builders Risk

22.7.1.3.6. Yachts

22.7.1.4. Inland Marine

22.7.1.4.1. Specie

22.7.1.4.2. Fine Arts

22.7.1.4.3. Armored Cars

22.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

22.8.1. Multinational

22.8.2. Open Marine Insurance

22.8.3. Floating

22.8.4. Voyage

22.8.5. Port Risk

22.8.6. Others

22.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

22.9.1. Large Market

22.9.2. Middle Market

22.9.3. Small Market

22.10. Marine Insurance Market (US$ Mn) Forecast, by Country, 2016-2031

22.10.1. China

22.10.2. Japan

22.10.3. Philippines

22.10.4. Singapore

22.10.5. South Korea

22.10.6. Rest of Asia

22.11. Incremental Opportunity Analysis

23. China Marine Insurance Market Analysis and Forecast

23.1. Country Snapshot

23.1.1. By Risk Type

23.1.2. By Policy/Plan Type

23.1.3. By Premium Type

23.2. COVID-19 Impact Analysis

23.3. Capacity Trend

23.4. Key Trends Analysis

23.4.1. Demand Side

23.4.2. Supply Side

23.5. Market Dynamics

23.5.1. Drivers

23.5.2. Restraints

23.5.3. Opportunities

23.6. Losses and Loss trending

23.7. Market Structure

23.7.1. Top competitors

23.7.2. Nature of top competitors

23.7.3. Top competitor growth

23.7.4. Insured Premium Segments

23.7.5. Mergers & Acquisition activity

23.7.6. Multinational Programs

23.7.7. Distribution Channels & Proportion

23.7.8. Primary Operators/Platforms

23.7.9. Channel Commissions

23.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

23.8.1.1. Ocean Cargo

23.8.1.1.1. Importers / Exporters of General Merchandise

23.8.1.1.2. Project Cargo with Delay in Start-up Risk

23.8.1.1.3. Manufacturers of General Merchandise

23.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

23.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

23.8.1.1.6. Heavy Equipment Manufacturers / Distributors

23.8.1.1.7. High Tech

23.8.1.1.8. Wearing Apparel

23.8.1.1.9. Coffee & Cocoa

23.8.1.1.10. Sugar in bags and Bulk

23.8.1.1.11. Freight Forwarders

23.8.1.1.12. Specie

23.8.1.1.13. Fine Arts

23.8.1.2. Marine Liability

23.8.1.2.1. Shipyards / Ship Repair

23.8.1.2.2. Marine Terminal Operators (dry & liquid)

23.8.1.2.3. Port Authorities

23.8.1.2.4. Stevedores

23.8.1.2.5. Fleeting / Wharf Operations

23.8.1.2.6. Marine Contractors

23.8.1.2.7. Marine Product Manufacturers

23.8.1.2.8. Charterers Liabilities (commercial only)

23.8.1.2.9. Excess Protection & Indemnity

23.8.1.2.10. Marinas

23.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

23.8.1.3. Hull & Machinery Insurance

23.8.1.3.1. Tugs and Barges

23.8.1.3.2. Offshore Support / Platform Support

23.8.1.3.3. Miscellaneous Workboat Fleets

23.8.1.3.4. Research Vessels

23.8.1.3.5. Hull Builders Risk

23.8.1.3.6. Yachts

23.8.1.4. Inland Marine

23.8.1.4.1. Specie

23.8.1.4.2. Fine Arts

23.8.1.4.3. Armored Cars

23.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

23.9.1. Multinational

23.9.2. Open Marine Insurance

23.9.3. Floating

23.9.4. Voyage

23.9.5. Port Risk

23.9.6. Others

23.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

23.10.1. Large Market

23.10.2. Middle Market

23.10.3. Small Market

23.11. Incremental Opportunity Analysis

24. Japan Marine Insurance Market Analysis and Forecast

24.1. Country Snapshot

24.1.1. By Risk Type

24.1.2. By Policy/Plan Type

24.1.3. By Premium Type

24.2. COVID-19 Impact Analysis

24.3. Capacity Trend

24.4. Key Trends Analysis

24.4.1. Demand Side

24.4.2. Supply Side

24.5. Market Dynamics

24.5.1. Drivers

24.5.2. Restraints

24.5.3. Opportunities

24.6. Losses and Loss trending

24.7. Market Structure

24.7.1. Top competitors

24.7.2. Nature of top competitors

24.7.3. Top competitor growth

24.7.4. Insured Premium Segments

24.7.5. Mergers & Acquisition activity

24.7.6. Multinational Programs

24.7.7. Distribution Channels & Proportion

24.7.8. Primary Operators/Platforms

24.7.9. Channel Commissions

24.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

24.8.1.1. Ocean Cargo

24.8.1.1.1. Importers / Exporters of General Merchandise

24.8.1.1.2. Project Cargo with Delay in Start-up Risk

24.8.1.1.3. Manufacturers of General Merchandise

24.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

24.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

24.8.1.1.6. Heavy Equipment Manufacturers / Distributors

24.8.1.1.7. High Tech

24.8.1.1.8. Wearing Apparel

24.8.1.1.9. Coffee & Cocoa

24.8.1.1.10. Sugar in bags and Bulk

24.8.1.1.11. Freight Forwarders

24.8.1.1.12. Specie

24.8.1.1.13. Fine Arts

24.8.1.2. Marine Liability

24.8.1.2.1. Shipyards / Ship Repair

24.8.1.2.2. Marine Terminal Operators (dry & liquid)

24.8.1.2.3. Port Authorities

24.8.1.2.4. Stevedores

24.8.1.2.5. Fleeting / Wharf Operations

24.8.1.2.6. Marine Contractors

24.8.1.2.7. Marine Product Manufacturers

24.8.1.2.8. Charterers Liabilities (commercial only)

24.8.1.2.9. Excess Protection & Indemnity

24.8.1.2.10. Marinas

24.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

24.8.1.3. Hull & Machinery Insurance

24.8.1.3.1. Tugs and Barges

24.8.1.3.2. Offshore Support / Platform Support

24.8.1.3.3. Miscellaneous Workboat Fleets

24.8.1.3.4. Research Vessels

24.8.1.3.5. Hull Builders Risk

24.8.1.3.6. Yachts

24.8.1.4. Inland Marine

24.8.1.4.1. Specie

24.8.1.4.2. Fine Arts

24.8.1.4.3. Armored Cars

24.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

24.9.1. Multinational

24.9.2. Open Marine Insurance

24.9.3. Floating

24.9.4. Voyage

24.9.5. Port Risk

24.9.6. Others

24.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

24.10.1. Large Market

24.10.2. Middle Market

24.10.3. Small Market

24.11. Incremental Opportunity Analysis

25. Philippines Marine Insurance Market Analysis and Forecast

25.1. Country Snapshot

25.1.1. By Risk Type

25.1.2. By Policy/Plan Type

25.1.3. By Premium Type

25.2. COVID-19 Impact Analysis

25.3. Capacity Trend

25.4. Key Trends Analysis

25.4.1. Demand Side

25.4.2. Supply Side

25.5. Market Dynamics

25.5.1. Drivers

25.5.2. Restraints

25.5.3. Opportunities

25.6. Losses and Loss trending

25.7. Market Structure

25.7.1. Top competitors

25.7.2. Nature of top competitors

25.7.3. Top competitor growth

25.7.4. Insured Premium Segments

25.7.5. Mergers & Acquisition activity

25.7.6. Multinational Programs

25.7.7. Distribution Channels & Proportion

25.7.8. Primary Operators/Platforms

25.7.9. Channel Commissions

25.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

25.8.1.1. Ocean Cargo

25.8.1.1.1. Importers / Exporters of General Merchandise

25.8.1.1.2. Project Cargo with Delay in Start-up Risk

25.8.1.1.3. Manufacturers of General Merchandise

25.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

25.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

25.8.1.1.6. Heavy Equipment Manufacturers / Distributors

25.8.1.1.7. High Tech

25.8.1.1.8. Wearing Apparel

25.8.1.1.9. Coffee & Cocoa

25.8.1.1.10. Sugar in bags and Bulk

25.8.1.1.11. Freight Forwarders

25.8.1.1.12. Specie

25.8.1.1.13. Fine Arts

25.8.1.2. Marine Liability

25.8.1.2.1. Shipyards / Ship Repair

25.8.1.2.2. Marine Terminal Operators (dry & liquid)

25.8.1.2.3. Port Authorities

25.8.1.2.4. Stevedores

25.8.1.2.5. Fleeting / Wharf Operations

25.8.1.2.6. Marine Contractors

25.8.1.2.7. Marine Product Manufacturers

25.8.1.2.8. Charterers Liabilities (commercial only)

25.8.1.2.9. Excess Protection & Indemnity

25.8.1.2.10. Marinas

25.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

25.8.1.3. Hull & Machinery Insurance

25.8.1.3.1. Tugs and Barges

25.8.1.3.2. Offshore Support / Platform Support

25.8.1.3.3. Miscellaneous Workboat Fleets

25.8.1.3.4. Research Vessels

25.8.1.3.5. Hull Builders Risk

25.8.1.3.6. Yachts

25.8.1.4. Inland Marine

25.8.1.4.1. Specie

25.8.1.4.2. Fine Arts

25.8.1.4.3. Armored Cars

25.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

25.9.1. Multinational

25.9.2. Open Marine Insurance

25.9.3. Floating

25.9.4. Voyage

25.9.5. Port Risk

25.9.6. Others

25.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

25.10.1. Large Market

25.10.2. Middle Market

25.10.3. Small Market

25.11. Incremental Opportunity Analysis

26. Singapore Marine Insurance Market Analysis and Forecast

26.1. Country Snapshot

26.1.1. By Risk Type

26.1.2. By Policy/Plan Type

26.1.3. By Premium Type

26.2. COVID-19 Impact Analysis

26.3. Capacity Trend

26.4. Key Trends Analysis

26.4.1. Demand Side

26.4.2. Supply Side

26.5. Market Dynamics

26.5.1. Drivers

26.5.2. Restraints

26.5.3. Opportunities

26.6. Losses and Loss trending

26.7. Market Structure

26.7.1. Top competitors

26.7.2. Nature of top competitors

26.7.3. Top competitor growth

26.7.4. Insured Premium Segments

26.7.5. Mergers & Acquisition activity

26.7.6. Multinational Programs

26.7.7. Distribution Channels & Proportion

26.7.8. Primary Operators/Platforms

26.7.9. Channel Commissions

26.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

26.8.1.1. Ocean Cargo

26.8.1.1.1. Importers / Exporters of General Merchandise

26.8.1.1.2. Project Cargo with Delay in Start-up Risk

26.8.1.1.3. Manufacturers of General Merchandise

26.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

26.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

26.8.1.1.6. Heavy Equipment Manufacturers / Distributors

26.8.1.1.7. High Tech

26.8.1.1.8. Wearing Apparel

26.8.1.1.9. Coffee & Cocoa

26.8.1.1.10. Sugar in bags and Bulk

26.8.1.1.11. Freight Forwarders

26.8.1.1.12. Specie

26.8.1.1.13. Fine Arts

26.8.1.2. Marine Liability

26.8.1.2.1. Shipyards / Ship Repair

26.8.1.2.2. Marine Terminal Operators (dry & liquid)

26.8.1.2.3. Port Authorities

26.8.1.2.4. Stevedores

26.8.1.2.5. Fleeting / Wharf Operations

26.8.1.2.6. Marine Contractors

26.8.1.2.7. Marine Product Manufacturers

26.8.1.2.8. Charterers Liabilities (commercial only)

26.8.1.2.9. Excess Protection & Indemnity

26.8.1.2.10. Marinas

26.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

26.8.1.3. Hull & Machinery Insurance

26.8.1.3.1. Tugs and Barges

26.8.1.3.2. Offshore Support / Platform Support

26.8.1.3.3. Miscellaneous Workboat Fleets

26.8.1.3.4. Research Vessels

26.8.1.3.5. Hull Builders Risk

26.8.1.3.6. Yachts

26.8.1.4. Inland Marine

26.8.1.4.1. Specie

26.8.1.4.2. Fine Arts

26.8.1.4.3. Armored Cars

26.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

26.9.1. Multinational

26.9.2. Open Marine Insurance

26.9.3. Floating

26.9.4. Voyage

26.9.5. Port Risk

26.9.6. Others

26.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

26.10.1. Large Market

26.10.2. Middle Market

26.10.3. Small Market

26.11. Incremental Opportunity Analysis

27. South Korea Marine Insurance Market Analysis and Forecast

27.1. Country Snapshot

27.1.1. By Risk Type

27.1.2. By Policy/Plan Type

27.1.3. By Premium Type

27.2. COVID-19 Impact Analysis

27.3. Capacity Trend

27.4. Key Trends Analysis

27.4.1. Demand Side

27.4.2. Supply Side

27.5. Market Dynamics

27.5.1. Drivers

27.5.2. Restraints

27.5.3. Opportunities

27.6. Losses and Loss trending

27.7. Market Structure

27.7.1. Top competitors

27.7.2. Nature of top competitors

27.7.3. Top competitor growth

27.7.4. Insured Premium Segments

27.7.5. Mergers & Acquisition activity

27.7.6. Multinational Programs

27.7.7. Distribution Channels & Proportion

27.7.8. Primary Operators/Platforms

27.7.9. Channel Commissions

27.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

27.8.1.1. Ocean Cargo

27.8.1.1.1. Importers / Exporters of General Merchandise

27.8.1.1.2. Project Cargo with Delay in Start-up Risk

27.8.1.1.3. Manufacturers of General Merchandise

27.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

27.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

27.8.1.1.6. Heavy Equipment Manufacturers / Distributors

27.8.1.1.7. High Tech

27.8.1.1.8. Wearing Apparel

27.8.1.1.9. Coffee & Cocoa

27.8.1.1.10. Sugar in bags and Bulk

27.8.1.1.11. Freight Forwarders

27.8.1.1.12. Specie

27.8.1.1.13. Fine Arts

27.8.1.2. Marine Liability

27.8.1.2.1. Shipyards / Ship Repair

27.8.1.2.2. Marine Terminal Operators (dry & liquid)

27.8.1.2.3. Port Authorities

27.8.1.2.4. Stevedores

27.8.1.2.5. Fleeting / Wharf Operations

27.8.1.2.6. Marine Contractors

27.8.1.2.7. Marine Product Manufacturers

27.8.1.2.8. Charterers Liabilities (commercial only)

27.8.1.2.9. Excess Protection & Indemnity

27.8.1.2.10. Marinas

27.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

27.8.1.3. Hull & Machinery Insurance

27.8.1.3.1. Tugs and Barges

27.8.1.3.2. Offshore Support / Platform Support

27.8.1.3.3. Miscellaneous Workboat Fleets

27.8.1.3.4. Research Vessels

27.8.1.3.5. Hull Builders Risk

27.8.1.3.6. Yachts

27.8.1.4. Inland Marine

27.8.1.4.1. Specie

27.8.1.4.2. Fine Arts

27.8.1.4.3. Armored Cars

27.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

27.9.1. Multinational

27.9.2. Open Marine Insurance

27.9.3. Floating

27.9.4. Voyage

27.9.5. Port Risk

27.9.6. Others

27.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

27.10.1. Large Market

27.10.2. Middle Market

27.10.3. Small Market

27.11. Incremental Opportunity Analysis

28. Oceania Marine Insurance Market Analysis and Forecast

28.1. Regional Snapshot

28.1.1. By Risk Type

28.1.2. By Policy/Plan Type

28.1.3. By Premium Type

28.1.4. By Country

28.2. COVID-19 Impact Analysis

28.3. Capacity Trend

28.4. Key Trends Analysis

28.4.1. Demand Side

28.4.2. Supply Side

28.5. Losses and Loss trending

28.6. Market Structure

28.6.1. Top competitors

28.6.2. Nature of top competitors

28.6.3. Top competitor growth

28.6.4. Insured Premium Segments

28.6.5. Mergers & Acquisition activity

28.6.6. Multinational Programs

28.6.7. Distribution Channels & Proportion

28.6.8. Primary Operators/Platforms

28.6.9. Channel Commissions

28.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

28.7.1.1. Ocean Cargo

28.7.1.1.1. Importers / Exporters of General Merchandise

28.7.1.1.2. Project Cargo with Delay in Start-up Risk

28.7.1.1.3. Manufacturers of General Merchandise

28.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

28.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

28.7.1.1.6. Heavy Equipment Manufacturers / Distributors

28.7.1.1.7. High Tech

28.7.1.1.8. Wearing Apparel

28.7.1.1.9. Coffee & Cocoa

28.7.1.1.10. Sugar in bags and Bulk

28.7.1.1.11. Freight Forwarders

28.7.1.1.12. Specie

28.7.1.1.13. Fine Arts

28.7.1.2. Marine Liability

28.7.1.2.1. Shipyards / Ship Repair

28.7.1.2.2. Marine Terminal Operators (dry & liquid)

28.7.1.2.3. Port Authorities

28.7.1.2.4. Stevedores

28.7.1.2.5. Fleeting / Wharf Operations

28.7.1.2.6. Marine Contractors

28.7.1.2.7. Marine Product Manufacturers

28.7.1.2.8. Charterers Liabilities (commercial only)

28.7.1.2.9. Excess Protection & Indemnity

28.7.1.2.10. Marinas

28.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

28.7.1.3. Hull & Machinery Insurance

28.7.1.3.1. Tugs and Barges

28.7.1.3.2. Offshore Support / Platform Support

28.7.1.3.3. Miscellaneous Workboat Fleets

28.7.1.3.4. Research Vessels

28.7.1.3.5. Hull Builders Risk

28.7.1.3.6. Yachts

28.7.1.4. Inland Marine

28.7.1.4.1. Specie

28.7.1.4.2. Fine Arts

28.7.1.4.3. Armored Cars

28.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

28.8.1. Multinational

28.8.2. Open Marine Insurance

28.8.3. Floating

28.8.4. Voyage

28.8.5. Port Risk

28.8.6. Others

28.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

28.9.1. Large Market

28.9.2. Middle Market

28.9.3. Small Market

28.10. Incremental Opportunity Analysis

29. Middle East Marine Insurance Market Analysis and Forecast

29.1. Regional Snapshot

29.1.1. By Risk Type

29.1.2. By Policy/Plan Type

29.1.3. By Premium Type

29.1.4. By Country

29.2. COVID-19 Impact Analysis

29.3. Capacity Trend

29.4. Key Trends Analysis

29.4.1. Demand Side

29.4.2. Supply Side

29.5. Losses and Loss trending

29.6. Market Structure

29.6.1. Top competitors

29.6.2. Nature of top competitors

29.6.3. Top competitor growth

29.6.4. Insured Premium Segments

29.6.5. Mergers & Acquisition activity

29.6.6. Multinational Programs

29.6.7. Distribution Channels & Proportion

29.6.8. Primary Operators/Platforms

29.6.9. Channel Commissions

29.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

29.7.1.1. Ocean Cargo

29.7.1.1.1. Importers / Exporters of General Merchandise

29.7.1.1.2. Project Cargo with Delay in Start-up Risk

29.7.1.1.3. Manufacturers of General Merchandise

29.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

29.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

29.7.1.1.6. Heavy Equipment Manufacturers / Distributors

29.7.1.1.7. High Tech

29.7.1.1.8. Wearing Apparel

29.7.1.1.9. Coffee & Cocoa

29.7.1.1.10. Sugar in bags and Bulk

29.7.1.1.11. Freight Forwarders

29.7.1.1.12. Specie

29.7.1.1.13. Fine Arts

29.7.1.2. Marine Liability

29.7.1.2.1. Shipyards / Ship Repair

29.7.1.2.2. Marine Terminal Operators (dry & liquid)

29.7.1.2.3. Port Authorities

29.7.1.2.4. Stevedores

29.7.1.2.5. Fleeting / Wharf Operations

29.7.1.2.6. Marine Contractors

29.7.1.2.7. Marine Product Manufacturers

29.7.1.2.8. Charterers Liabilities (commercial only)

29.7.1.2.9. Excess Protection & Indemnity

29.7.1.2.10. Marinas

29.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

29.7.1.3. Hull & Machinery Insurance

29.7.1.3.1. Tugs and Barges

29.7.1.3.2. Offshore Support / Platform Support

29.7.1.3.3. Miscellaneous Workboat Fleets

29.7.1.3.4. Research Vessels

29.7.1.3.5. Hull Builders Risk

29.7.1.3.6. Yachts

29.7.1.4. Inland Marine

29.7.1.4.1. Specie

29.7.1.4.2. Fine Arts

29.7.1.4.3. Armored Cars

29.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

29.8.1. Multinational

29.8.2. Open Marine Insurance

29.8.3. Floating

29.8.4. Voyage

29.8.5. Port Risk

29.8.6. Others

29.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

29.9.1. Large Market

29.9.2. Middle Market

29.9.3. Small Market

29.10. Marine Insurance Market (US$ Mn) Forecast, by Country, 2016-2031

29.10.1. United Arab Emirates

29.10.2. Rest of Middle East

29.11. Incremental Opportunity Analysis

30. United Arab Emirates Marine Insurance Market Analysis and Forecast

30.1. Country Snapshot

30.1.1. By Risk Type

30.1.2. By Policy/Plan Type

30.1.3. By Premium Type

30.2. COVID-19 Impact Analysis

30.3. Capacity Trend

30.4. Key Trends Analysis

30.4.1. Demand Side

30.4.2. Supply Side

30.5. Market Dynamics

30.5.1. Drivers

30.5.2. Restraints

30.5.3. Opportunities

30.6. Losses and Loss trending

30.7. Market Structure

30.7.1. Top competitors

30.7.2. Nature of top competitors

30.7.3. Top competitor growth

30.7.4. Insured Premium Segments

30.7.5. Mergers & Acquisition activity

30.7.6. Multinational Programs

30.7.7. Distribution Channels & Proportion

30.7.8. Primary Operators/Platforms

30.7.9. Channel Commissions

30.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

30.8.1.1. Ocean Cargo

30.8.1.1.1. Importers / Exporters of General Merchandise

30.8.1.1.2. Project Cargo with Delay in Start-up Risk

30.8.1.1.3. Manufacturers of General Merchandise

30.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

30.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

30.8.1.1.6. Heavy Equipment Manufacturers / Distributors

30.8.1.1.7. High Tech

30.8.1.1.8. Wearing Apparel

30.8.1.1.9. Coffee & Cocoa

30.8.1.1.10. Sugar in bags and Bulk

30.8.1.1.11. Freight Forwarders

30.8.1.1.12. Specie

30.8.1.1.13. Fine Arts

30.8.1.2. Marine Liability

30.8.1.2.1. Shipyards / Ship Repair

30.8.1.2.2. Marine Terminal Operators (dry & liquid)

30.8.1.2.3. Port Authorities

30.8.1.2.4. Stevedores

30.8.1.2.5. Fleeting / Wharf Operations

30.8.1.2.6. Marine Contractors

30.8.1.2.7. Marine Product Manufacturers

30.8.1.2.8. Charterers Liabilities (commercial only)

30.8.1.2.9. Excess Protection & Indemnity

30.8.1.2.10. Marinas

30.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

30.8.1.3. Hull & Machinery Insurance

30.8.1.3.1. Tugs and Barges

30.8.1.3.2. Offshore Support / Platform Support

30.8.1.3.3. Miscellaneous Workboat Fleets

30.8.1.3.4. Research Vessels

30.8.1.3.5. Hull Builders Risk

30.8.1.3.6. Yachts

30.8.1.4. Inland Marine

30.8.1.4.1. Specie

30.8.1.4.2. Fine Arts

30.8.1.4.3. Armored Cars

30.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

30.9.1. Multinational

30.9.2. Open Marine Insurance

30.9.3. Floating

30.9.4. Voyage

30.9.5. Port Risk

30.9.6. Others

30.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

30.10.1. Large Market

30.10.2. Middle Market

30.10.3. Small Market

30.11. Incremental Opportunity Analysis

31. Africa Marine Insurance Market Analysis and Forecast

31.1. Regional Snapshot

31.1.1. By Risk Type

31.1.2. By Policy/Plan Type

31.1.3. By Premium Type

31.1.4. By Country

31.2. COVID-19 Impact Analysis

31.3. Capacity Trend

31.4. Key Trends Analysis

31.4.1. Demand Side

31.4.2. Supply Side

31.5. Losses and Loss trending

31.6. Market Structure

31.6.1. Top competitors

31.6.2. Nature of top competitors

31.6.3. Top competitor growth

31.6.4. Insured Premium Segments

31.6.5. Mergers & Acquisition activity

31.6.6. Multinational Programs

31.6.7. Distribution Channels & Proportion

31.6.8. Primary Operators/Platforms

31.6.9. Channel Commissions

31.7. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

31.7.1.1. Ocean Cargo

31.7.1.1.1. Importers / Exporters of General Merchandise

31.7.1.1.2. Project Cargo with Delay in Start-up Risk

31.7.1.1.3. Manufacturers of General Merchandise

31.7.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

31.7.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

31.7.1.1.6. Heavy Equipment Manufacturers / Distributors

31.7.1.1.7. High Tech

31.7.1.1.8. Wearing Apparel

31.7.1.1.9. Coffee & Cocoa

31.7.1.1.10. Sugar in bags and Bulk

31.7.1.1.11. Freight Forwarders

31.7.1.1.12. Specie

31.7.1.1.13. Fine Arts

31.7.1.2. Marine Liability

31.7.1.2.1. Shipyards / Ship Repair

31.7.1.2.2. Marine Terminal Operators (dry & liquid)

31.7.1.2.3. Port Authorities

31.7.1.2.4. Stevedores

31.7.1.2.5. Fleeting / Wharf Operations

31.7.1.2.6. Marine Contractors

31.7.1.2.7. Marine Product Manufacturers

31.7.1.2.8. Charterers Liabilities (commercial only)

31.7.1.2.9. Excess Protection & Indemnity

31.7.1.2.10. Marinas

31.7.1.2.11. US L&H: Longshore and Harbor Workers Compensation

31.7.1.3. Hull & Machinery Insurance

31.7.1.3.1. Tugs and Barges

31.7.1.3.2. Offshore Support / Platform Support

31.7.1.3.3. Miscellaneous Workboat Fleets

31.7.1.3.4. Research Vessels

31.7.1.3.5. Hull Builders Risk

31.7.1.3.6. Yachts

31.7.1.4. Inland Marine

31.7.1.4.1. Specie

31.7.1.4.2. Fine Arts

31.7.1.4.3. Armored Cars

31.8. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

31.8.1. Multinational

31.8.2. Open Marine Insurance

31.8.3. Floating

31.8.4. Voyage

31.8.5. Port Risk

31.8.6. Others

31.9. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

31.9.1. Large Market

31.9.2. Middle Market

31.9.3. Small Market

31.10. Marine Insurance Market (US$ Mn) Forecast, by Country, 2016-2031

31.10.1. Egypt

31.10.2. South Africa

31.10.3. Rest of Africa

31.11. Incremental Opportunity Analysis

32. Egypt Marine Insurance Market Analysis and Forecast

32.1. Country Snapshot

32.1.1. By Risk Type

32.1.2. By Policy/Plan Type

32.1.3. By Premium Type

32.2. COVID-19 Impact Analysis

32.3. Capacity Trend

32.4. Key Trends Analysis

32.4.1. Demand Side

32.4.2. Supply Side

32.5. Market Dynamics

32.5.1. Drivers

32.5.2. Restraints

32.5.3. Opportunities

32.6. Losses and Loss trending

32.7. Market Structure

32.7.1. Top competitors

32.7.2. Nature of top competitors

32.7.3. Top competitor growth

32.7.4. Insured Premium Segments

32.7.5. Mergers & Acquisition activity

32.7.6. Multinational Programs

32.7.7. Distribution Channels & Proportion

32.7.8. Primary Operators/Platforms

32.7.9. Channel Commissions

32.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

32.8.1.1. Ocean Cargo

32.8.1.1.1. Importers / Exporters of General Merchandise

32.8.1.1.2. Project Cargo with Delay in Start-up Risk

32.8.1.1.3. Manufacturers of General Merchandise

32.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

32.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

32.8.1.1.6. Heavy Equipment Manufacturers / Distributors

32.8.1.1.7. High Tech

32.8.1.1.8. Wearing Apparel

32.8.1.1.9. Coffee & Cocoa

32.8.1.1.10. Sugar in bags and Bulk

32.8.1.1.11. Freight Forwarders

32.8.1.1.12. Specie

32.8.1.1.13. Fine Arts

32.8.1.2. Marine Liability

32.8.1.2.1. Shipyards / Ship Repair

32.8.1.2.2. Marine Terminal Operators (dry & liquid)

32.8.1.2.3. Port Authorities

32.8.1.2.4. Stevedores

32.8.1.2.5. Fleeting / Wharf Operations

32.8.1.2.6. Marine Contractors

32.8.1.2.7. Marine Product Manufacturers

32.8.1.2.8. Charterers Liabilities (commercial only)

32.8.1.2.9. Excess Protection & Indemnity

32.8.1.2.10. Marinas

32.8.1.2.11. US L&H: Longshore and Harbor Workers Compensation

32.8.1.3. Hull & Machinery Insurance

32.8.1.3.1. Tugs and Barges

32.8.1.3.2. Offshore Support / Platform Support

32.8.1.3.3. Miscellaneous Workboat Fleets

32.8.1.3.4. Research Vessels

32.8.1.3.5. Hull Builders Risk

32.8.1.3.6. Yachts

32.8.1.4. Inland Marine

32.8.1.4.1. Specie

32.8.1.4.2. Fine Arts

32.8.1.4.3. Armored Cars

32.9. Marine Insurance Market (US$ Mn) Forecast, By Policy/Plan Type, 2016-2031

32.9.1. Multinational

32.9.2. Open Marine Insurance

32.9.3. Floating

32.9.4. Voyage

32.9.5. Port Risk

32.9.6. Others

32.10. Marine Insurance Market (US$ Mn) Forecast, By Premium Type, 2016-2031

32.10.1. Large Market

32.10.2. Middle Market

32.10.3. Small Market

32.11. Incremental Opportunity Analysis

33. South Africa Marine Insurance Market Analysis and Forecast

33.1. Country Snapshot

33.1.1. By Risk Type

33.1.2. By Policy/Plan Type

33.1.3. By Premium Type

33.2. COVID-19 Impact Analysis

33.3. Capacity Trend

33.4. Key Trends Analysis

33.4.1. Demand Side

33.4.2. Supply Side

33.5. Market Dynamics

33.5.1. Drivers

33.5.2. Restraints

33.5.3. Opportunities

33.6. Losses and Loss trending

33.7. Market Structure

33.7.1. Top competitors

33.7.2. Nature of top competitors

33.7.3. Top competitor growth

33.7.4. Insured Premium Segments

33.7.5. Mergers & Acquisition activity

33.7.6. Multinational Programs

33.7.7. Distribution Channels & Proportion

33.7.8. Primary Operators/Platforms

33.7.9. Channel Commissions

33.8. Marine Insurance Market (US$ Mn) Forecast, By Risk Type, 2016-2031

33.8.1.1. Ocean Cargo

33.8.1.1.1. Importers / Exporters of General Merchandise

33.8.1.1.2. Project Cargo with Delay in Start-up Risk

33.8.1.1.3. Manufacturers of General Merchandise

33.8.1.1.4. Auto Manufacturers / Distributors with substantial risk retention by the assured

33.8.1.1.5. Retail Stock Throughput accounts with limited static risk and substantial CAT & Fire deductible

33.8.1.1.6. Heavy Equipment Manufacturers / Distributors

33.8.1.1.7. High Tech

33.8.1.1.8. Wearing Apparel

33.8.1.1.9. Coffee & Cocoa

33.8.1.1.10. Sugar in bags and Bulk