Analysts’ Viewpoint on Macular Degeneration Treatment Market Scenario

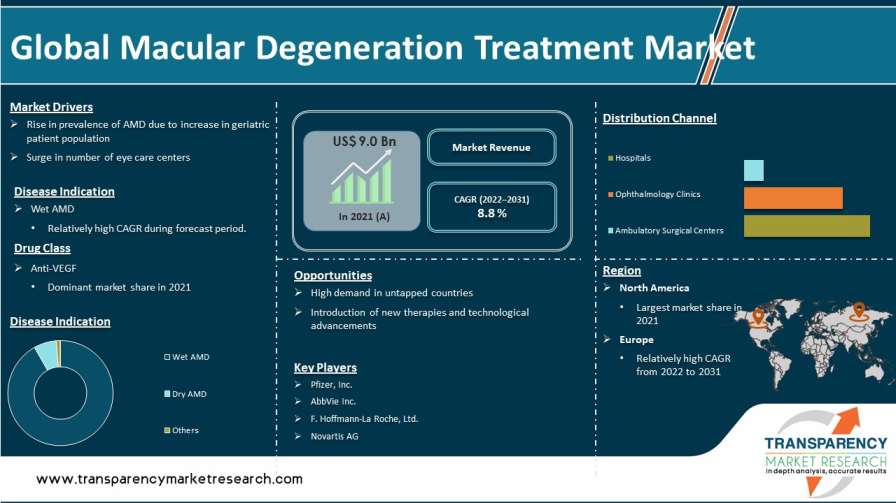

Macular degeneration is an eye condition that could deteriorate over time. It is the primary factor in severe, lifelong vision loss in adults over 60 years of age. Rise in prevalence and incidence of retinal disorders, increase in geriatric population, high annual cost of therapy (ACOT) for pipeline drugs, improved health care infrastructure, introduction of novel therapies, and surge in number of programs and initiatives to spread awareness are expected to drive the global macular degeneration treatment market during the forecast period. The global market is likely to be restrained in the near future by continual pressure from players mandating the use of Avastin for wAMD and invasive administration methods.

Treatment innovations for macular degeneration are providing hope that the disease could be cured one day. Promising treatments are dependent on the stage of disease progression. Nutritional therapy can help in dry macular degeneration treatment during the early stage of the disease. It includes a healthy diet that is high in antioxidants to support the cells of the macula. If macular degeneration is advanced but still dry, supplements to increase the number of certain vitamins and minerals that could increase healthy pigments and support cell structure are prescribed. Each affected eye is assigned to either laser treatment or observation at random. Laser treatment reduces the risk of severe visual loss in eligible eyes with CNV in extrafoveal, juxtafoveal, and subfoveal locations.

Rise in prevalence of age-related macular degeneration (AMD) is primarily expected to propel the global macular degeneration treatment market in the next few years. Increase in healthcare spending and rise in patient awareness are also likely to fuel the global market during the forecast period. Launch of novel products for the treatment of geographic atrophy, late stage of dry age-related macular degeneration treatment (dAMD), and wet AMD (wAMD) are projected to augment the age-related macular degeneration market. Drugs such as Apellis’ APL-2, Ophthotech’s Zimura, and Novartis’ brolucizumab, a longer-acting anti-VEGF, are anticipated to drive the global macular degeneration treatment market size in the near future. In particular, the launch of drugs in the AMD market to treat dAMD is anticipated to be a major driver, as currently, no prescription medications are available for this condition.

Patent expiry is likely to pose a threat to the market players' expansion strategies. On the other hand, exorbitant pricing may not be a good strategy to adopt for players who hold patents for their drugs. For instance, the patent for Lucentis expired in the U.S. in 2020, while its European patent expired in July 2022. Several companies are in the race to introduce Lucentis biosimilar for the monthly treatment of neovascular age-related macular degeneration treatment (nAMD). Lack of prescription drugs in the international AMD market is expected to hamper demand in the near future.

In terms of disease indication, the global maculation degeneration market has been bifurcated into wet age-related macular degeneration and dry age-related macular degeneration. The wet age-related macular degeneration segment accounted for major share of the global market in 2021. Wet AMD is treated with intravitreal injections (IVT), with an estimated 22.3 million procedures performed globally in 2017. Around 75% of anti-VEGF injections were given to treat wet AMD. High prevalence of the condition, branded medications, growth in awareness, and increase in the number of treatments for wet AMD contributed to the segment's dominant market share.

Based on drug class, the global macular degeneration treatment market has been bifurcated into anti-vascular endothelial growth factors and others. Blinding retinal conditions, such as diabetic macular edoema (DME), age-related macular degeneration (AMD), and retinal diseases, are largely attributed to the pathogenesis of vascular endothelial growth factor (VEGF). It has been demonstrated that inhibiting VEGF activity within the eye can improve and restore visual function in AMD patients. Direct macular degeneration injections of anti-VEGF medications are made into the eye's vitreous cavity. Large patient pool across the globe is another factor likely to propel the anti-vascular endothelial growth factors segment in the near future.

In terms of distribution channel, the global macular degeneration treatment market has been divided into hospitals, ophthalmology clinics, and ambulatory surgical centers. The hospitals segment is expected to account for more than 51.6% share of the global market by 2031. The segment is likely to grow at a CAGR of 6.6% during the forecast period. Hospitals treat the majority of new AMD cases in developed countries.

North America accounted for the largest global macular degeneration treatment market share in 2021. The trend is projected to continue during the forecast period. Adoption rate of prescription AMD drugs is high in the U.S., and the number of new drug approvals in the country is increasing.

Europe accounted for more than 32.1% share of the global macular degeneration treatment market in 2021. The macular degeneration treatment market in the region is expected to grow at a rapid pace during the forecast period due to large unmet needs and increase in purchasing power to obtain branded drugs. Improvement in lifestyle, particularly among the urban population, and the introduction of new drugs for macular degeneration are expected to boost the demand for macular degeneration treatment drugs in Europe.

Asia Pacific accounted for more than 13% share of the global market in 2021 due to large population base and increase in treatment adoption rate in the region. Rise in disposable income and health awareness have increased the diagnosis and treatment rates. This has resulted in a rise in number of macular degeneration drugs in the market. Key players are investing significantly to establish themselves in Asia Pacific. This is expected to augment the market in the region.

The global macular degeneration treatment market is fragmented, with the presence of a vast number of large-scale players. Key players operating in the global macular degeneration treatment market include AbbVie, Inc., Pfizer, Inc., Bayer AG, F. Hoffmann-La Roche Ltd., Regeneron Pharmaceuticals, Inc., Novartis AG, and Santen Pharmaceutical Co., Ltd. These players are adopting growth strategies such as new product development, product launches, agreements, partnerships, and mergers.

Each of these players has been profiled in the macular degeneration treatment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 9.0 Bn |

|

Market Forecast Value in 2031 |

More than US$ 21.1 Bn |

|

Growth Rate (CAGR) 2022-2031 |

8.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global macular degeneration treatment market was valued at US$ 9.0 Bn in 2021

The global macular degeneration treatment market is projected to reach more than US$ 21.1 Bn by 2031

The global macular degeneration treatment market grew at a CAGR of 7.4% from 2017 to 2021

The global macular degeneration treatment market is anticipated to grow at a CAGR of 8.8% from 2022 to 2031

The wet AMD segment held major share of around 94% of the global macular degeneration treatment market in 2021

North America is expected to account for major share of the global macular degeneration treatment market during the forecast period.

Pfizer, Inc., AbbVie Inc., F. Hoffmann-La Roche, Ltd., Regeneron Pharmaceuticals, Inc., Bayer AG, Novartis AG, and Santen Pharmaceutical Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Macular Degeneration Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Macular Degeneration Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario

5.2. Pipeline Analysis

5.3. Disease Prevalence & incidence rate with key countries

5.4. Covid-19 Impact Analysis

6. Global Macular Degeneration Treatment Market Analysis and Forecast, by Disease Indication

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Disease Indication, 2017–2031

6.3.1. Wet Age-related Macular Degeneration

6.3.2. Dry Age-related Macular Degeneration

6.3.3. Others

6.4. Market Attractiveness Analysis, by Disease Indication

7. Global Macular Degeneration Treatment Market Analysis and Forecast, by Drug Class

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Drug Class, 2017–2031

7.3.1. Anti-vascular Endothelial Growth Factor

7.3.2. Others

7.4. Market Attractiveness Analysis, by Drug Class

8. Global Macular Degeneration Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospitals

8.3.2. Ophthalmology Clinics

8.3.3. Ambulatory Surgical Centers

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Macular Degeneration Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Macular Degeneration Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Disease Indication, 2017–2031

10.2.1. Wet Age-related Macular Degeneration

10.2.2. Dry Age-related Macular Degeneration

10.2.3. Others

10.3. Market Value Forecast, by Drug Class, 2017–2031

10.3.1. Anti-vascular Endothelial Growth Factor

10.3.2. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospitals

10.4.2. Ophthalmology Clinics

10.4.3. Ambulatory Surgical Centers

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Disease Indication

10.6.2. By Drug Class

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Macular Degeneration Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Disease Indication, 2017–2031

11.2.1. Wet Age-related Macular Degeneration

11.2.2. Dry Age-related Macular Degeneration

11.2.3. Others

11.3. Market Value Forecast, by Drug Class, 2017–2031

11.3.1. Anti-vascular Endothelial Growth Factor

11.3.2. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospitals

11.4.2. Ophthalmology Clinics

11.4.3. Ambulatory Surgical Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Disease Indication

11.6.2. By Drug Class

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Macular Degeneration Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Disease Indication, 2017–2031

12.2.1. Wet Age-related Macular Degeneration

12.2.2. Dry Age-related Macular Degeneration

12.2.3. Others

12.3. Market Value Forecast, by Drug Class, 2017–2031

12.3.1. Anti-vascular Endothelial Growth Factor

12.3.2. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospitals

12.4.2. Ophthalmology Clinics

12.4.3. Ambulatory Surgical Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Disease Indication

12.6.2. By Drug Class

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Macular Degeneration Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Disease Indication, 2017–2031

13.2.1. Wet Age-related Macular Degeneration

13.2.2. Dry Age-related Macular Degeneration

13.2.3. Others

13.3. Market Value Forecast, by Drug Class, 2017–2031

13.3.1. Anti-vascular Endothelial Growth Factor

13.3.2. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospitals

13.4.2. Ophthalmology Clinics

13.4.3. Ambulatory Surgical Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Disease Indication

13.6.2. By Drug Class

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Macular Degeneration Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Disease Indication, 2017–2031

14.2.1. Wet Age-related Macular Degeneration

14.2.2. Dry Age-related Macular Degeneration

14.2.3. Others

14.3. Market Value Forecast, by Drug Class, 2017–2031

14.3.1. Anti-vascular Endothelial Growth Factor

14.3.2. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospitals

14.4.2. Ophthalmology Clinics

14.4.3. Ambulatory Surgical Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Disease Indication

14.6.2. By Drug Class

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Pfizer, Inc.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. AbbVie, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. F. Hoffmann-La Roche, Ltd.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Regeneron Pharmaceuticals, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Bayer AG

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Novartis AG

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Santen Pharmaceutical Co., Ltd.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

List of Tables

Table 01: Global Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 02: Global Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 03: Global Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 06: North America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 07: North America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 08: North America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: Europe Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 09: Europe Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 10: Europe Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 11: Europe Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Asia Pacific Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 13: Asia Pacific Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 14: Asia Pacific Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Asia Pacific Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Latin America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 17: Latin America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 18: Latin America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 19: Latin America Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Middle East & Africa Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 21: Middle East & Africa Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 22: Middle East & Africa Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 23: Middle East & Africa Macular Degeneration Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Macular Degeneration Treatment Market Snapshot

Figure 02: Global Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 03: Global Macular Degeneration Treatment Market Value Share, by Disease Indication, 2021

Figure 04: Global Macular Degeneration Treatment Market Value Share, by Drug Class, 2021

Figure 05: Global Macular Degeneration Treatment Market Value Share, by Distribution Channel, 2021

Figure 06: Global Macular Degeneration Treatment Market Value Share, by Region, 2021

Figure 07: Global Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 08: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Wet AMD, 2017–2031

Figure 09: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Dry AMD, 2017–2031

Figure 10: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Other Indications, 2017–2031

Figure 11: Global Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 12: Global Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 13: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Anti-vascular Endothelial Growth Factor, 2017–2031

Figure 14: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2031

Figure 15: Global Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 16: Global Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 17: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Hospitals, 2017–2031

Figure 18: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Ophthalmology Clinics, 2017–2031

Figure 19: Global Macular Degeneration Treatment Market Value (US$ Mn) and Y-o-Y Growth, by Ambulatory Surgical Centers, 2017–2031

Figure 20: Global Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 21: Macular Degeneration Treatment Market Value Share Analysis, by Region, 2017 and 2031

Figure 22: Macular Degeneration Treatment Market Attractiveness Analysis by Region, 2022–2031

Figure 23: North America Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 24 North America Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 25: North America Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 26: North America Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 27: North America Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 28: North America Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2017–2031

Figure 29: North America Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 30: North America Macular Degeneration Treatment Market Value Share Analysis, by Country, 2017 and 2031

Figure 31: North America Macular Degeneration Treatment Market Attractiveness Analysis, by Country, 2022–2031

Figure 32: Europe Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 33: Europe Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 34: Europe Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 35: Europe Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 36: Europe Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 37: Europe Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2021–2031

Figure 38: Europe Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 39: Europe Macular Degeneration Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 40: Europe Macular Degeneration Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Asia Pacific Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 42: Asia Pacific Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 43: Asia Pacific Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 44: Asia Pacific Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 45: Asia Pacific Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 46: Asia Pacific Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2017–2031

Figure 47: Asia Pacific Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 48: Asia Pacific Macular Degeneration Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 49: Asia Pacific Macular Degeneration Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 50: Latin America Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Latin America Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 52: Latin America Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 53: Latin America Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 54: Latin America Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 55: Latin America Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2017–2031

Figure 56: Latin America Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 57: Latin America Macular Degeneration Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 58: Latin America Macular Degeneration Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 59: Middle East & Africa Macular Degeneration Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 60: Middle East & Africa Macular Degeneration Treatment Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 61: Middle East & Africa Macular Degeneration Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 62: Middle East & Africa Macular Degeneration Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 63: Middle East & Africa Macular Degeneration Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 64: Middle East & Africa Macular Degeneration Treatment Market Value Share Analysis, by Distribution Channel, 2017–2031

Figure 65: Middle East & Africa Macular Degeneration Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 66: Middle East & Africa Macular Degeneration Treatment Market Value Share Analysis, by Country, 2017 and 2031

Figure 67: Middle East & Africa Macular Degeneration Treatment Market Attractiveness Analysis, by Country, 2022–2031