Analyst Viewpoint

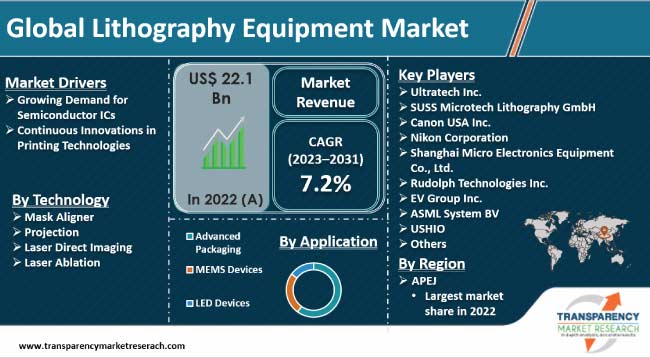

Rapid growth in demand for smart devices worldwide is fueling the demand for semiconductor ICs. Rise in need for equipment to cater to the complexities involved in the fabrication of semiconductor ICs is expected to boost the lithography equipment industry growth in the next few years. Enhancements in resolution and use of ultra-violet rays help in fabricating semiconductor components as small as a few nanometers.

Continuous advancements in lithography equipment to cater to the demand for miniaturized semiconductor ICs is estimated to propel the lithography equipment market growth during the forecast period. Additionally, rise in demand for greater accuracy during the production of semiconductors is expected to offer considerable lithography equipment business opportunities for manufacturers to innovate.

Exponential expansion of electronic device sector is driving the demand for semiconductor ICs for applications in several areas such as memory devices, sensor devices, consumer electronics, and communication devices. This, in turn, is driving the need for cost-effective printing equipment such as lithography machines. Additionally, increase in adoption of large panel displays and compact electronics has fueled the demand for excimer (ArF and KrF) laser lithography equipment.

However, disadvantages of lithography equipment such as unavailability of variable data printing, longer turnaround, and smaller color gamut are expected to restrain the lithography equipment market demand during the forecast period.

Adoption of smart devices is increasing at a remarkable pace. According to GSMA, 1,100 million individuals would be equipped with 5G broadband connections by the year 2025. It further states that 34% of global population would be witnessing 5G rollout by 2025.

More than half of the total cost of semiconductor fabrication comprises cost of tools and equipment used to make it. Lithography equipment drives the ‘yield’ as well as ‘defect’ part of the semiconductor FAB. SEMI states that semiconductor manufacturing equipment witnessed a surge of 44% in their sales worldwide in 2021. Semiconductor ICs are preferred, as they can help with space management on the PCB as well as perform complex functions as a single source, i.e. without the need of multiple resistors, capacitors, and inductors. This factor is expected to influence the lithography equipment market forecast in the next few years.

Currently, the demand for higher circuit densities and smaller feature sizes is rising significantly. This, in turn, is boosting the demand for advanced lithography technologies such as multiple patterning and extreme ultraviolet (EUV) lithography. Therefore, lithography equipment suppliers are focused on providing lithography equipment that can handle the complexities related to miniaturized ICs. Applications of these ICs include robots and mobile tools.

According to the latest lithography equipment market research, in March 2022, Nikon Corporation announced the launch of Gen 8 plate FPD lithography system for extending support to production of several HD panels for premium displays such as smart devices, huge TVs, and high-end monitors. Rise in demand for floating complex and compact ICs to run complex equipment is expected to drive the lithography equipment industry growth during the forecast period.

Rise in disposable income, rapid increase in population and growth in demand for advanced consumer electronics, such as smartphones, laptops, tablets, automatic washing machines across countries such as India, China, Malaysia, Singapore, and Philippines contributed to the prominent lithography equipment market share held by APEJ. Furthermore, the region is a major hub for semiconductor manufacturing, which is estimated to further fuel the lithography machinery industry. According to DigiTimes Asia, China, as of 2022, had presence of 160 new semiconductor-related projects and 352 continuing projects. In December 2021, The Government of India announced a US$ 10 Bn package for incentivizing production of semiconductors in India.

Rise in adoption of latest technology and innovations such as machine learning, 3D printing, and AI, which improve healthcare services, facilitate advancements in science, and strengthen the food supply chain, in North America are expected to offer significant business opportunities for lithography equipment manufacturers in the region. Furthermore, the Biden Administration, in September 2022, announced a US$ 50 Bn package to boost the domestic semiconductor industry. Furthermore, in August 2022, President Joe Biden inked a CHIPS bill worth US$ 280 Bn for boosting high-tech manufacturing at the domestic level. Such initiatives are expected to drive the lithography equipment market size in North America during the forecast period.

In September 2023, The European Chips Act was tabled to raise Europe’s contribution to the global semiconductors market to 20% by the year 2030. The Act is meant to mobilize more than US$ 45 Mn in public as well as private funding for production and next-generation R&D regarding semiconductors. Extensive research regarding semiconductors is thus turning out to be one of the advanced lithography equipment market trends witnessed in the region.

According to the latest lithography equipment industry analysis, key players are following the latest lithography equipment market trends and focusing on pattern overlay accuracy in the manufacturing process in order to cater to the demand for higher-resolution patterning for high-definition flat panel displays. For instance, Nikon Corporation, in 2022, launched Lu Fact, a compact machine vision camera aimed at driving digital transformation (DX) in various manufacturing facilities. Photolithography equipment are used when it becomes difficult to carve out images through lithography equipment.

Ultratech Inc., SUSS MicroTec Lithography GmbH, Canon USA Inc., Nikon Corporation, Shanghai Micro Electronics Equipment Co., Ltd., Rudolph Technologies Inc., EV Group Inc., ASML System BV, USHIO, ORC, Orbotech, and Screen Holdings Co., Ltd. have been profiled in the lithography equipment market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 22.1 Bn |

| Forecast (Value) in 2031 | US$ 41.3 Bn |

| Growth Rate (CAGR) | 7.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Lithography Equipment Industry Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 22.1 Bn in 2022

It is projected to expand at a CAGR of 7.2% from 2023 to 2031

Rise in demand for semiconductor ICs and continuous innovations in printed technologies

In terms of application, the advanced packaging segment held largest share in 2022

APEJ is estimated to dominate in the next few years

Ultratech Inc., SUSS Microtech Lithography GmbH, Canon USA Inc., Nikon Corporation, Shanghai Micro Electronics Equipment Co., Ltd., Rudolph Technologies Inc., EV Group Inc., ASML System BV, USHIO, ORC, Orbotech, and Screen Holdings Co., Ltd.

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Lithography Equipment Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. End-use Industry Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Lithography Equipment Market Analysis, by Technology

5.1. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

5.1.1. Mask Aligner

5.1.2. Projection

5.1.3. Laser Direct Imaging

5.1.4. Laser Ablation

5.2. Market Attractiveness Analysis, by Technology

6. Global Lithography Equipment Market Analysis, by Packaging Platform

6.1. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

6.1.1. 3D IC

6.1.2. 2.5D interposer

6.1.3. FO WLP Wafer

6.1.4. WL CSP

6.1.5. Flip Chip Bumping

6.1.6. 3D WLP

6.1.7. Embedded die

6.1.8. FO WKP Panel

6.1.9. Glass Panel Imposer

6.2. Market Attractiveness Analysis, by Packaging Platform

7. Global Lithography Equipment Market Analysis, by Application

7.1. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

7.1.1. Advanced Packaging

7.1.2. MEMS Devices

7.1.3. LED Devices

7.2. Market Attractiveness Analysis, by Application

8. Global Lithography Equipment Market Analysis and Forecast, by Region

8.1. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Region, 2023–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. Latin America

8.2. Market Attractiveness Analysis, by Region

9. North America Lithography Equipment Market Analysis and Forecast

9.1. Market Snapshot

9.2. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

9.2.1. Mask Aligner

9.2.2. Projection

9.2.3. Laser Direct Imaging

9.2.4. Laser Ablation

9.3. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

9.3.1. 3D IC

9.3.2. 2.5D interposer

9.3.3. FO WLP Wafer

9.3.4. WL CSP

9.3.5. Flip Chip Bumping

9.3.6. 3D WLP

9.3.7. Embedded die

9.3.8. FO WKP Panel

9.3.9. Glass Panel Imposer

9.4. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

9.4.1. Advanced Packaging

9.4.2. MEMS Devices

9.4.3. LED Devices

9.5. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Country, 2023–2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Technology

9.6.2. By Packaging Platform

9.6.3. By Application

9.6.4. By Country/Sub-region

10. Europe Lithography Equipment Market Analysis and Forecast

10.1. Market Snapshot

10.2. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

10.2.1. Mask Aligner

10.2.2. Projection

10.2.3. Laser Direct Imaging

10.2.4. Laser Ablation

10.3. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

10.3.1. 3D IC

10.3.2. 2.5D interposer

10.3.3. FO WLP Wafer

10.3.4. WL CSP

10.3.5. Flip Chip Bumping

10.3.6. 3D WLP

10.3.7. Embedded die

10.3.8. FO WKP Panel

10.3.9. Glass Panel Imposer

10.4. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

10.4.1. Advanced Packaging

10.4.2. MEMS Devices

10.4.3. LED Devices

10.5. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By Packaging Platform

10.6.3. By Application

10.6.4. By Country/Sub-region

11. Asia Pacific Lithography Equipment Market Analysis and Forecast

11.1. Market Snapshot

11.2. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

11.2.1. Mask Aligner

11.2.2. Projection

11.2.3. Laser Direct Imaging

11.2.4. Laser Ablation

11.3. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

11.3.1. 3D IC

11.3.2. 2.5D interposer

11.3.3. FO WLP Wafer

11.3.4. WL CSP

11.3.5. Flip Chip Bumping

11.3.6. 3D WLP

11.3.7. Embedded die

11.3.8. FO WKP Panel

11.3.9. Glass Panel Imposer

11.4. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

11.4.1. Advanced Packaging

11.4.2. MEMS Devices

11.4.3. LED Devices

11.5. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By Packaging Platform

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Middle East & Africa Lithography Equipment Market Analysis and Forecast

12.1. Market Snapshot

12.2. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

12.2.1. Mask Aligner

12.2.2. Projection

12.2.3. Laser Direct Imaging

12.2.4. Laser Ablation

12.3. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

12.3.1. 3D IC

12.3.2. 2.5D interposer

12.3.3. FO WLP Wafer

12.3.4. WL CSP

12.3.5. Flip Chip Bumping

12.3.6. 3D WLP

12.3.7. Embedded die

12.3.8. FO WKP Panel

12.3.9. Glass Panel Imposer

12.4. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

12.4.1. Advanced Packaging

12.4.2. MEMS Devices

12.4.3. LED Devices

12.5. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By Packaging Platform

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Lithography Equipment Market Analysis and Forecast

13.1. Market Snapshot

13.2. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Technology, 2023–2031

13.2.1. Mask Aligner

13.2.2. Projection

13.2.3. Laser Direct Imaging

13.2.4. Laser Ablation

13.3. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Packaging Platform, 2023–2031

13.3.1. 3D IC

13.3.2. 2.5D interposer

13.3.3. FO WLP Wafer

13.3.4. WL CSP

13.3.5. Flip Chip Bumping

13.3.6. 3D WLP

13.3.7. Embedded die

13.3.8. FO WKP Panel

13.3.9. Glass Panel Imposer

13.4. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Application, 2023–2031

13.4.1. Advanced Packaging

13.4.2. MEMS Devices

13.4.3. LED Devices

13.5. Lithography Equipment Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

13.5.1. Brazil

13.5.2. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Technology

13.6.2. By Packaging Platform

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Lithography Equipment Market Competition Matrix - a Dashboard View

14.1.1. Global Lithography Equipment Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Ultratech Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. SUSS Microtech Lithography GmbH

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Canon USA Inc.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Nikon Corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Shanghai Micro Electronics Equipment Co., Ltd.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Rudolph Technologies Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. EV Group Inc.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. ASML System BV

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. ORC

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. USHIO

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Orbotech

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Screen Holdings Co., Ltd.

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 2: Global Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 3: Global Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 4: Global Lithography Equipment Market Value (US$ Mn) & Forecast, by Region, 2023‒2031

Table 5: North America Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 6: North America Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 7: North America Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 8: North America Lithography Equipment Market Value (US$ Mn) & Forecast, by Country, 2023‒2031

Table 9: Europe Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 10: Europe Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 11: Europe Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 12: Europe Lithography Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 13: Asia Pacific Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 14: Asia Pacific Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 15: Asia Pacific Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 16: Asia Pacific Lithography Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 17: Middle East & Africa Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 18: Middle East & Africa Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 19: Middle East & Africa Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 20: Middle East & Africa Lithography Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 21: Latin America Lithography Equipment Market Value (US$ Mn) & Forecast, by Technology, 2023‒2031

Table 22: Latin America Lithography Equipment Market Value (US$ Mn) & Forecast, by Packaging Platform, 2023‒2031

Table 23: Latin America Lithography Equipment Market Value (US$ Mn) & Forecast, by Application, 2023‒2031

Table 24: Latin America Lithography Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Lithography Equipment Market

Figure 02: Porter Five Forces Analysis – Global Lithography Equipment Market

Figure 03: End-use Industry Road Map - Global Lithography Equipment Market

Figure 04: Global Lithography Equipment Market, Value (US$ Mn), 2023-2031

Figure 05: Global Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 06: Global Lithography Equipment Market Projections, by Technology, Value (US$ Mn), 2023‒2031

Figure 07: Global Lithography Equipment Market Projections, by Packaging Platform, Value (US$ Mn), 2023‒2031

Figure 08: Global Lithography Equipment Market Projections, by Application, Value (US$ Mn), 2023‒2031

Figure 9: Global Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 10: Global Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 11: Global Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 12: Global Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 13: Global Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 14: Global Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global Lithography Equipment Market Projections, by Region, Value (US$ Mn), 2023‒2031

Figure 16: Global Lithography Equipment Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Lithography Equipment Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Lithography Equipment Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 19: North America Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 20: North America Lithography Equipment Market Projections, by Technology (US$ Mn), 2023‒2031

Figure 21: North America Lithography Equipment Market Projections, by Packaging Platform (US$ Mn), 2023‒2031

Figure 22: North America Lithography Equipment Market Projections, by Application (US$ Mn), 2023‒2031

Figure 23: North America Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 24: North America Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 25: North America Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 26: North America Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 27: North America Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 28: North America Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 29: North America Lithography Equipment Market Projections, by Country, Value (US$ Mn), 2023‒2031

Figure 30: North America Lithography Equipment Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 31: North America Lithography Equipment Market Share Analysis, by Country, 2023 and 2031

Figure 32: Europe Lithography Equipment Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 33: Europe Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 34: Europe Lithography Equipment Market Projections, by Technology, Value (US$ Mn), 2023‒2031

Figure 35: Europe Lithography Equipment Market Projections, by Packaging Platform, Value (US$ Mn), 2023‒2031

Figure 36: Europe Lithography Equipment Market Projections, by Application, Value (US$ Mn), 2023‒2031

Figure 37: Europe Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 38: Europe Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 39: Europe Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 40: Europe Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 41: Europe Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 42: Europe Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 43: Europe Lithography Equipment Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 44: Europe Lithography Equipment Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Lithography Equipment Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Lithography Equipment Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 47: Asia Pacific Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 48: Asia Pacific Lithography Equipment Market Projections, by Technology, Value (US$ Mn), 2023‒2031

Figure 49: Asia Pacific Lithography Equipment Market Projections, by Packaging Platform, Value (US$ Mn), 2023‒2031

Figure 50: Asia Pacific Lithography Equipment Market Projections, by Application, Value (US$ Mn), 2023‒2031

Figure 51: Asia Pacific Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 52: Asia Pacific Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 53: Asia Pacific Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 54: Asia Pacific Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 55: Asia Pacific Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 56: Asia Pacific Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 57: Asia Pacific Lithography Equipment Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 58: Asia Pacific Lithography Equipment Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Lithography Equipment Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Lithography Equipment Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 61: Middle East & Africa Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 62: Middle East & Africa Lithography Equipment Market Projections, by Technology, Value (US$ Mn), 2023‒2031

Figure 63: Middle East & Africa Lithography Equipment Market Projections, by Packaging Platform, Value (US$ Mn), 2023‒2031

Figure 64: Middle East & Africa Lithography Equipment Market Projections, by Application, Value (US$ Mn), 2023‒2031

Figure 65: Middle East & Africa Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 66: Middle East & Africa Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 67: Middle East & Africa Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 68: Middle East & Africa Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 69: Middle East & Africa Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 70: Middle East & Africa Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 71: Middle East & Africa Lithography Equipment Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 72: Middle East & Africa Lithography Equipment Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Lithography Equipment Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: Latin America Lithography Equipment Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 75: Latin America Lithography Equipment Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 76: Latin America Lithography Equipment Market Projections, by Technology, Value (US$ Mn), 2023‒2031

Figure 77: Latin America Lithography Equipment Market Projections, by Packaging Platform, Value (US$ Mn), 2023‒2031

Figure 78: Latin America Lithography Equipment Market Projections, by Application, Value (US$ Mn), 2023‒2031

Figure 79: Latin America Lithography Equipment Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 80: Latin America Lithography Equipment Market, Incremental Opportunity, by Packaging Platform, 2023‒2031

Figure 81: Latin America Lithography Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 82: Latin America Lithography Equipment Market Share Analysis, by Technology, 2023 and 2031

Figure 83: Latin America Lithography Equipment Market Share Analysis, by Packaging Platform, 2023 and 2031

Figure 84: Latin America Lithography Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 85: Latin America Lithography Equipment Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 86: Latin America Lithography Equipment Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: Latin America Lithography Equipment Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Lithography Equipment Market Competition

Figure 89: Global Lithography Equipment Market Company Share Analysis