The unprecedented demand for medical supplies has compelled manufacturers in the IV bottles market to work at breakneck speeds during the COVID-19 outbreak. This stress has been reduced, since coronavirus cases have been significantly reduced worldwide, except in the U.K. and Russia. Stakeholders in the IV bottles market are drawing an analysis to understand their high-risk clients and customers where recovery of debt may be an issue. Manufacturers are taking help of government stimulus packages and making use of BFSI schemes to stay financially afloat, owing to the challenges created by the pandemic.

Manufacturers are maintaining robust supply chains, since these bottles are essentially used in healthcare settings. They are ensuring business continuity by maintaining optimum inventory of raw materials.

Clinical challenges are influencing the demand for IV (intravenous) bottles, as the IV therapy is associated with issues such as extravasation, which is an unintentional condition wherein the therapy is administered outside a vein. Moreover, the piercing action for infusion is a painful task for the patient. Nevertheless, advantages of the IV therapy, including one of the fastest ways to deliver medication is offsetting its disadvantages. The IV therapy is ideal for patients who cannot take medication or nutrients from the mouth.

Manufacturers in the IV bottles market are increasing production in macro and micro drip IV sets. Macro drip sets are suitable for normal applications where precision is not of high concern.

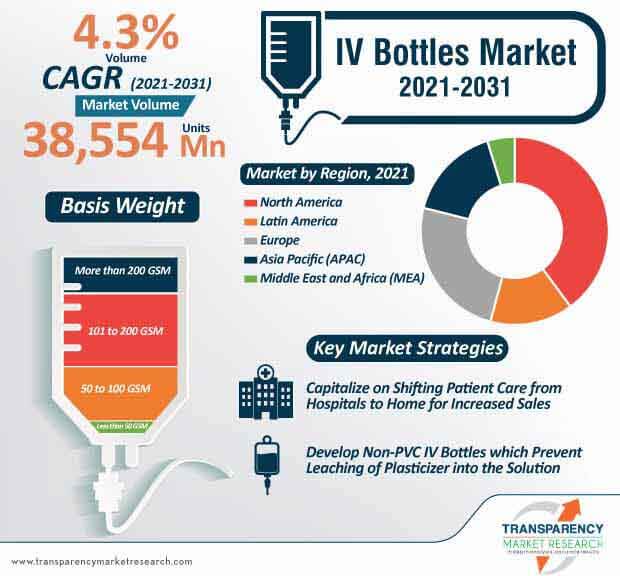

The IV bottles market is projected to reach US$ 4 Bn by 2031. Companies are making use of low density polyethlene (LDPE) made from medical grade granules to design IV bottles. Manufacturers are increasing the availability of non-PVC (polyvinyl chloride) and DEHP-free IV bottles, which prevent leaching of the plasticizer into the solution.

Manufacturers in the IV bottles market are boosting the production of latex and additive-free containers that are safe for drug infusion. There is a steady demand for sterile IV bottles that are EU GMP (good manufacturing practice) certified. Manufacturers are developing totally collapsible IV bottles that are eliminating the need for air vent.

Self-sealing septum in both ports of IV bottles is eliminating the risks of contamination, leakage, and accidental loss of solution. Companies in the IV bottles market are sterilizing containers at high degrees to maintain aseptic conditions.

The need to improve patient safety and trends such as shifting patient care from hospitals to the home are translating into revenue opportunities for manufacturers in the IV bottles market. Although continued growth of plastics in the medical sector is benefitting market stakeholders, companies are increasing research for recyclable plastics that can be used in IV bottles. As such, manufacturers are increasing the focus on a new class of soft propylene to produce IV bottles.

Analysts’ Viewpoint

Due to disruptions caused by the COVID-19 pandemic, manufacturers are boosting their local production capabilities to ensure business continuity. IV bottles are linked with issues such as chances of inflammation and infection in patients, if IV therapy is not administered appropriately. Hence, manufacturers in the IV bottles market should offer training programs in healthcare facilities to educate medical staff about the appropriate use of IV bottles for drug delivery. Companies should increase awareness about different modes of infusion therapy such as bolus, drip, or extended infusion to boost product sales. Multiple medications and fast delivery of nutrients is possible with the help of IV bottles.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

US$ 4 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & Mn Units for Volume |

|

Market Analysis |

It includes cross segment analysis at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, pricing analysis, and parent industry overview. |

|

Format |

Electronic (PDF) |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The IV Bottles Market is studied from 2021 - 2031.

IV Bottles Market To Reach Valuation Of US$ 4 Bn By 2031.

The global IV bottles market is expected to expand ~1.8 times to the current market value at a CAGR of 5.4% during the forecast period

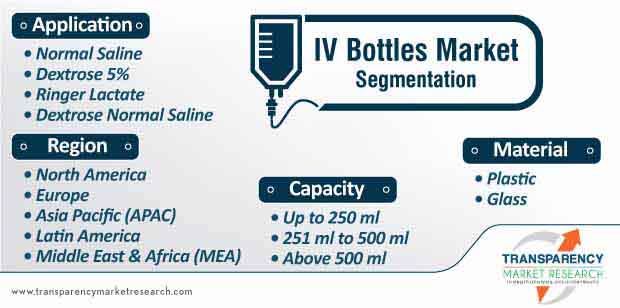

The global IV Bottles Market is segmented on basis of application, imaging modality and key regions.

Baxter International, Inc., Vioser S.A., B. Braun Melsungen AG, Fresenius Kabi AG, JW Lifescience Corp., Polycine GmbH, Kraton Corporation, Medicopack A/S, EuroLife Healthcare Pvt. Ltd., JOTOP Glass, ICU Medical, Inc., BAUCH Advanced Technology Group, Technoflex S.A., Sippex IV Bag, The Metrix Company

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. IV Bottles Market Overview

3.1. Introduction

3.2. Global IV Bottles Market Overview

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. IV Bottles Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Raw Material Suppliers

3.5.1.2. Manufacturers

3.5.1.3. Distributors/Retailers

3.5.1.4. End users

3.5.2. Profitability Margins

4. IV Bottles Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. IV Bottles Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. Global IV Bottles Market Analysis and Forecast, By Material Type

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

6.1.2. Y-o-Y Growth Projections, By Material Type

6.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

6.2.1. Plastic

6.2.2. Glass

6.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

6.3.1. Plastic

6.3.2. Glass

6.4. Market Attractiveness Analysis, By Material Type

7. Global IV Bottles Market Analysis and Forecast, By Capacity

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

7.1.2. Y-o-Y Growth Projections, By Capacity

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

7.2.1. Up to 250 ml

7.2.2. 251-500 ml

7.2.3. Above 500 ml

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

7.3.1. Up to 250 ml

7.3.2. 251-500 ml

7.3.3. Above 500 ml

7.4. Market Attractiveness Analysis, By Capacity

8. Global IV Bottles Market Analysis and Forecast, By Application

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Application

8.1.2. Y-o-Y Growth Projections, By Application

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

8.2.1. Normal Saline

8.2.2. Dextrose 5%

8.2.3. Ringer Lactate

8.2.4. Dextrose Normal Saline

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

8.3.1. Normal Saline

8.3.2. Dextrose 5%

8.3.3. Ringer Lactate

8.3.4. Dextrose Normal Saline

8.4. Market Attractiveness Analysis, By Application

9. Global IV Bottles Market Analysis and Forecast, By Region

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Region

9.1.2. Y-o-Y Growth Projections By Region

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East and Africa (MEA)

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029 By Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East and Africa (MEA)

9.4. Market Attractiveness Analysis By Region

10. North America IV Bottles Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Country

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

10.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

10.5.1. Plastic

10.5.2. Glass

10.6. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

10.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

10.7.1. Up to 250 ml

10.7.2. 251-500 ml

10.7.3. Above 500 ml

10.8. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

10.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

10.9.1. Normal Saline

10.9.2. Dextrose 5%

10.9.3. Ringer Lactate

10.9.4. Dextrose Normal Saline

10.10. Market Attractiveness Analysis

10.10.1. By Country

10.10.2. By Material Type

10.10.3. By Capacity

10.10.4. By Application

10.11. Drivers and Restraints: Impact Analysis

11. Latin America IV Bottles Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Country

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029 By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

11.5.1. Plastic

11.5.2. Glass

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

11.7.1. Up to 250 ml

11.7.2. 251-500 ml

11.7.3. Above 500 ml

11.8. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

11.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

11.9.1. Normal Saline

11.9.2. Dextrose 5%

11.9.3. Ringer Lactate

11.9.4. Dextrose Normal Saline

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Material Type

11.10.3. By Capacity

11.10.4. By Application

11.11. Drivers and Restraints: Impact Analysis

12. Europe IV Bottles Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029 By Country

12.3.1. Germany

12.3.2. Spain

12.3.3. Italy

12.3.4. France

12.3.5. U.K.

12.3.6. BENELUX

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

12.5.1. Plastic

12.5.2. Glass

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

12.7.1. Up to 250 ml

12.7.2. 251-500 ml

12.7.3. Above 500 ml

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

12.9.1. Normal Saline

12.9.2. Dextrose 5%

12.9.3. Ringer Lactate

12.9.4. Dextrose Normal Saline

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Material Type

12.10.3. By Capacity

12.10.4. By Application

12.11. Drivers and Restraints: Impact Analysis

13. Asia Pacific IV Bottles Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029 By Country

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Australia and New Zealand

13.3.6. Rest of APAC

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

13.5.1. Plastic

13.5.2. Glass

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

13.7.1. Up to 250 ml

13.7.2. 251-500 ml

13.7.3. Above 500 ml

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

13.9.1. Normal Saline

13.9.2. Dextrose 5%

13.9.3. Ringer Lactate

13.9.4. Dextrose Normal Saline

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Material Type

13.10.3. By Capacity

13.10.4. By Application

13.11. Drivers and Restraints: Impact Analysis

14. Middle East and Africa IV Bottles Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Country

14.3.1. North Africa

14.3.2. GCC countries

14.3.3. South Africa

14.3.4. Rest of MEA

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Material Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Material Type

14.5.1. Plastic

14.5.2. Glass

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Capacity

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Capacity

14.7.1. Up to 250 ml

14.7.2. 251-500 ml

14.7.3. Above 500 ml

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2015–2020, By Application

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021–2029, By Application

14.9.1. Normal Saline

14.9.2. Dextrose 5%

14.9.3. Ringer Lactate

14.9.4. Dextrose Normal Saline

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Material Type

14.10.3. By Capacity

14.10.4. By Application

14.11. Drivers and Restraints: Impact Analysis

15. IV Bottles Market Country wise Analysis 2021 & 2029

15.1. U.S. IV Bottles Market Analysis

15.1.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.1.1.1. By Material Type

15.1.1.2. By Capacity

15.1.1.3. By Application

15.2. Brazil IV Bottles Market Analysis

15.2.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.2.1.1. By Material Type

15.2.1.2. By Capacity

15.2.1.3. By Application

15.3. Mexico IV Bottles Market Analysis

15.3.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.3.1.1. By Material Type

15.3.1.2. By Capacity

15.3.1.3. By Application

15.4. Germany IV Bottles Market Analysis

15.4.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.4.1.1. By Material Type

15.4.1.2. By Capacity

15.4.1.3. By Application

15.5. France IV Bottles Market Analysis

15.5.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.5.1.1. By Material Type

15.5.1.2. By Capacity

15.5.1.3. By Application

15.6. U.K. IV Bottles Market Analysis

15.6.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.6.1.1. By Material Type

15.6.1.2. By Capacity

15.6.1.3. By Application

15.7. GCC Countries IV Bottles Market Analysis

15.7.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.7.1.1. By Material Type

15.7.1.2. By Capacity

15.7.1.3. By Application

15.8. China IV Bottles Market Analysis

15.8.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.8.1.1. By Material Type

15.8.1.2. By Capacity

15.8.1.3. By Application

15.9. Japan IV Bottles Market Analysis

15.9.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.9.1.1. By Material Type

15.9.1.2. By Capacity

15.9.1.3. By Application

15.10. India IV Bottles Market Analysis

15.10.1. Market Volume and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

15.10.1.1. By Material Type

15.10.1.2. By Capacity

15.10.1.3. By Application

16. Competitive Landscape

16.1. Market Structure

16.2. Competition Dashboard

16.3. Company Market Share Analysis

16.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

16.5. Competition Deep Dive

(Key Global Market Players)

16.5.1. Baxter International Inc.

16.5.1.1. Overview

16.5.1.2. Financials

16.5.1.3. Strategy

16.5.1.4. Recent Developments

16.5.1.5. SWOT Analysis

16.5.2. Vioser SA

16.5.2.1. Overview

16.5.2.2. Financials

16.5.2.3. Strategy

16.5.2.4. Recent Developments

16.5.2.5. SWOT Analysis

16.5.3. B. Braun Melsungen AG

16.5.3.1. Overview

16.5.3.2. Financials

16.5.3.3. Strategy

16.5.3.4. Recent Developments

16.5.3.5. SWOT Analysis

16.5.4. Fresenius Kabi AG

16.5.4.1. Overview

16.5.4.2. Financials

16.5.4.3. Strategy

16.5.4.4. Recent Developments

16.5.4.5. SWOT Analysis

16.5.5. JW Lifescience Corp.

16.5.5.1. Overview

16.5.5.2. Financials

16.5.5.3. Strategy

16.5.5.4. Recent Developments

16.5.5.5. SWOT Analysis

16.5.6. Polycine GmbH

16.5.6.1. Overview

16.5.6.2. Financials

16.5.6.3. Strategy

16.5.6.4. Recent Developments

16.5.6.5. SWOT Analysis

16.5.7. Kraton Corporation

16.5.7.1. Overview

16.5.7.2. Financials

16.5.7.3. Strategy

16.5.7.4. Recent Developments

16.5.7.5. SWOT Analysis

16.5.8. The Metrix Company

16.5.8.1. Overview

16.5.8.2. Financials

16.5.8.3. Strategy

16.5.8.4. Recent Developments

16.5.8.5. SWOT Analysis

16.5.9. Medicopack A/S

16.5.9.1. Overview

16.5.9.2. Financials

16.5.9.3. Strategy

16.5.9.4. Recent Developments

16.5.9.5. SWOT Analysis

16.5.10. Sippex IV bag

16.5.10.1. Overview

16.5.10.2. Financials

16.5.10.3. Strategy

16.5.10.4. Recent Developments

16.5.10.5. SWOT Analysis

16.5.11. ICU Medical, Inc.

16.5.11.1. Overview

16.5.11.2. Financials

16.5.11.3. Strategy

16.5.11.4. Recent Developments

16.5.11.5. SWOT Analysis

16.5.12. Technoflex S.A

16.5.12.1. Overview

16.5.12.2. Financials

16.5.12.3. Strategy

16.5.12.4. Recent Developments

16.5.12.5. SWOT Analysis

16.5.13. BAUSCH Advanced Technology Group

16.5.13.1. Overview

16.5.13.2. Financials

16.5.13.3. Strategy

16.5.13.4. Recent Developments

16.5.13.5. SWOT Analysis

16.5.14. Euro Healthcare Pvt. Ltd.

16.5.14.1. Overview

16.5.14.2. Financials

16.5.14.3. Strategy

16.5.14.4. Recent Developments

16.5.14.5. SWOT Analysis

16.5.15. JOTOP Glass

16.5.15.1. Overview

16.5.15.2. Financials

16.5.15.3. Strategy

16.5.15.4. Recent Developments

16.5.15.5. SWOT Analysis

17. Assumptions and Acronyms Used

18. Research Methodology

LIST OF TABLES

Table 01: Global IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 02: Global Bagasse Plates Market Value (US$ Mn) Analysis by Plate Size, 2015H-2029F

Table 03: Global IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 04: Global IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 05: Global IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 06: Global IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 07: Global IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 08: Global IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

Table 09: North America IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 10: North America IV Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2031F

Table 11: North America IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 12: North America IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 13: North America IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 14: North America IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 15: North America IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 16: North America IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

Table 17: Latin America IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 18: Latin America IV Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2031F

Table 19: Latin America IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 20: Latin America IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 21: Latin America IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 22: Latin America IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 23: Latin America IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 24: Latin America IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

Table 25: Europe IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 26: Europe IV Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2031F

Table 27: Europe IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 28: Europe IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 29: Europe IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 30: Europe IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 31: Europe IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 32: Europe IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

Table 33: Asia Pacific IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 34: Asia Pacific IV Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2031F

Table 35: Asia Pacific IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 36: Asia Pacific IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 37: Asia Pacific IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 38: Asia Pacific IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 39: Asia Pacific IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 40: Asia Pacific IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

Table 41: Middle-East & Africa IV Bottles Market Volume (Mn Units) Analysis by Capacity, 2015H-2031F

Table 42: Middle-East & Africa IV Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2031F

Table 43: Middle-East & Africa IV Bottles Market Volume (Mn Units) Analysis by Material, 2015H-2031F

Table 44: Middle-East & Africa IV Bottles Market Value (US$ Mn) Analysis by Material, 2015H-2031F

Table 45: Middle-East & Africa IV Bottles Market Volume (Mn Units) Analysis by Application, 2015H-2031F

Table 46: Middle-East & Africa IV Bottles Market Value (US$ Mn) Analysis by Application, 2015H-2031F

Table 47: Middle-East & Africa IV Bottles Market Volume (Mn Units) Analysis by Region, 2015H-2031F

Table 48: Middle-East & Africa IV Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2031F

LIST OF FIGURES

Figure 01: Global IV Bottles Market ASP (US$/Unit), by Capacity, 2020A

Figure 02: Global IV Bottles Market Share Analysis by Capacity, 2021E & 2031F

Figure 03: Global IV Bottles Market Y-o-Y Analysis by Capacity, 2016H-2031F

Figure 04: Global IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 05: Global IV Bottles Market Share Analysis by Material, 2021E & 2031F

Figure 06: Global IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 07: Global IV Bottles Market Attractiveness Analysis by Material, 2021E-2031F

Figure 08: Global IV Bottles Market Share Analysis by Application, 2021E & 2031F

Figure 09: Global IV Bottles Market Y-o-Y Analysis by Application, 2016H-2031F

Figure 10: Global IV Bottles Market Attractiveness Analysis by Application, 2021E-2031F

Figure 11: Global IV Bottles Market Share Analysis by Region, 2021E & 2031F

Figure 12: Global IV Bottles Market Y-o-Y Analysis by Region, 2016H-2031F

Figure 13: Global IV Bottles Market Attractiveness Analysis by Region, 2021E-2031F

Figure 14: North America IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 15: North America IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 16: North America IV Bottles Market Value Share Analysis by Application, 2021(E) & 2031 (F)

Figure 17: North America IV Bottles Market Share Analysis by Country, 2021E & 2031F

Figure 18: Latin America IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 19: Latin America IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 20: Latin America IV Bottles Market Value Share Analysis by Application, 2021(E) & 2031 (F)

Figure 21: Latin America IV Bottles Market Share Analysis by Country, 2021E & 2031F

Figure 22: Europe IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 23: Europe IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 24: Europe IV Bottles Market Value Share Analysis by Application, 2021(E) & 2031 (F)

Figure 25: Europe IV Bottles Market Share Analysis by Country, 2021E & 2031F

Figure 26: Asia Pacific IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 27: Asia Pacific IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 28: Asia Pacific IV Bottles Market Value Share Analysis by Application, 2021(E) & 2031 (F)

Figure 29: Asia Pacific IV Bottles Market Share Analysis by Country, 2021E & 2031F

Figure 30: Middle-East & Africa IV Bottles Market Attractiveness Analysis by Capacity, 2021E-2031F

Figure 31: Middle-East & Africa IV Bottles Market Y-o-Y Analysis by Material, 2016H-2031F

Figure 32: Middle-East & Africa IV Bottles Market Value Share Analysis by Application, 2021(E) & 2031 (F)

Figure 33: Middle-East & Africa IV Bottles Market Share Analysis by Country, 2021E & 2031F

Figure 34: U.S. IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 35: U.S. IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 36: U.S. IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 37: Brazil IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 38: Brazil IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 39: Brazil IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 40: Mexico IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 41: Mexico IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 42: Mexico IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 43: Germany IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 44: Germany IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 45: Germany IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 46: France IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 47: France IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 48: France IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 49: U.K IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 50: U.K IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 51: U.K IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 52: GCC Countries IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 53: GCC Countries IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 54: GCC Countries IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 55: China IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 56: China IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 57: China IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 58: Japan IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 59: Japan IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 60: Japan IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F

Figure 61: India IV Bottles Market Value Share Analysis, by Capacity, 2021E & 2031F

Figure 62: India IV Bottles Market Value Share Analysis, by Material, 2021E & 2031F

Figure 63: India IV Bottles Market Value Share Analysis, by Application, 2021E & 2031F