Analysts’ Viewpoint on Market Scenario

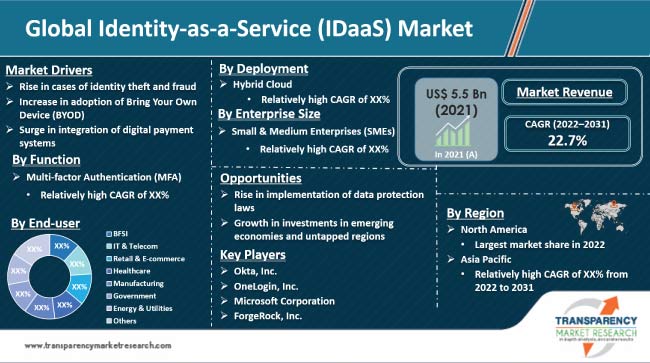

Rise in adoption of Identity-as-a-Service (IDaaS) solutions in SMEs and large enterprises is driving the global market. Various IDaaS solutions, such as cloud identity and access management, help to prevent identity theft. The complex business infrastructure of various industry verticals has fueled the adoption of data and cybersecurity solutions. Increase in cases of identity theft and fraud, surge in adoption of Bring Your Own Device (BYOD), and rise in the integration of digital payment systems are expected to augment the global identity-as-a-service market size during the forecast period. Some of the best IDaaS vendors are launching new solutions with advanced identity governance and administration functions to extend their security offerings.

Identity-as-a-Service (IDaaS) refers to identity and access management (IAM) services provided through the cloud on a subscription basis. IDaaS offers administrators protection against security incidents, as it automates various user account-related tasks. It standardizes and automates important components of identity, authentication, and authorization management, thereby saving time and money, while lowering business risk. IDaaS contains a wide range of services such as ID verification, user access management, Multi-factor Authentication (MFA), and compliance management. IDaaS offers the combined benefits of an enterprise-class identity and access management-as-a-service and a cloud computing identity-as-a-service. It is used to manage and authenticate user identities. IDaaS helps block cyber criminals and other unauthorized users from accessing sensitive data.

Identity theft and fraud cases include credit card fraud, tax identity theft, employment identity theft, and medical identity theft. According to the recently released data by the Federal Trade Commission (FTC), consumers lost more than US$ 5.8 Bn to fraud in 2021, an increase of more than 70% as compared to the previous year. Tech companies are reducing their dependence on desktop-to-desktop communication by switching to technology-oriented communication platforms. However, advanced mobile communication technologies are prone to cyber-attacks, identity thefts, and frauds. This, in turn, is expected to boost the demand for physical identity and access management in the next few years.

Several countries across the globe are implementing stringent user data protection laws to reduce the risk of insider threats and identity fraud. Brazil’s Lei Geral de Proteção de Dados (LGPD), a data protection law, came into effect in October 2020. Organizations that come under LGPD are expected to appoint a Data Protection Officer (DPO) to handle complaints and data breach activities. Organizations need to ensure the accuracy of the technical and administrative measures to secure personal and confidential data from unauthorized access.

North America is expected to hold a dominant share of the global Identity-as-a-Service (IDaaS) market during the forecast period. Rise in adoption of BYOD and increase in the number of online transactions are driving the market in the region. Demand for IDaaS is high in countries such as the U.S. and Canada. Europe is anticipated to account for the second-largest share of the market during the forecast period. Surge in adoption of advanced technologies such as the cloud, consumer identity and access management, Artificial Intelligence (AI), and IoT identity access management is propelling the market in the region. The market in Asia Pacific and South America is driven by rise in the number of SMEs in these regions.

The global Identity-as-a-Service (IDaaS) market is consolidated, with a few large-scale vendors controlling majority of the share. Most identity-as-a-service providers are investing significantly in comprehensive R&D activities to enhance their market share. Expansion of product portfolios and mergers & acquisitions are notable strategies adopted by key players. Okta, Inc., Ping Identity Corporation, OneLogin, Inc., Microsoft Corporation, ForgeRock, Inc., IBM Corporation, CyberArk Software Ltd., ManageEngine, Oracle Corporation, SailPoint Technologies Inc., and JumpCloud Inc. are prominent entities operating in the market.

Key players have been profiled in the Identity-as-a-Service (IDaaS) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 5.5 Bn |

|

Market Forecast Value in 2031 |

US$ 41.9 Bn |

|

Growth Rate (CAGR) |

22.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2016–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 5.5 Bn in 2021.

The global market is estimated to advance at a CAGR of 22.7% during the forecast period.

Rise in cases of identity theft and fraud and increase in implementation of data protection laws.

North America is more attractive for companies in the global Identity-as-a-Service (IDaaS) business.

Okta, Inc., Ping Identity Corporation, OneLogin, Inc., Microsoft Corporation, ForgeRock, Inc., IBM Corporation, CyberArk Software Ltd., ManageEngine, Oracle Corporation, SailPoint Technologies Inc., and JumpCloud Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Identity-as-a-Service (IDaaS) Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Identity-as-a-Service (IDaaS) Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Function

4.5.2. By Deployment

4.5.3. By Enterprise Size

4.5.4. By End-user

5. Global Identity-as-a-Service (IDaaS) Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Identity-as-a-Service (IDaaS) Market Analysis, by Function

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Function, 2018 - 2031

6.3.1. Single Sign-on (SSO)

6.3.2. Multi-factor Authentication (MFA)

6.3.3. Provisioning

6.3.4. Directory Services

6.3.5. Compliance Management

7. Global Identity-as-a-Service (IDaaS) Market Analysis, by Deployment

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

7.3.1. Public Cloud

7.3.2. Private Cloud

7.3.3. Hybrid Cloud

8. Global Identity-as-a-Service (IDaaS) Market Analysis, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

8.3.1. Small & Medium Enterprises (SMEs)

8.3.2. Large Enterprises

9. Global Identity-as-a-Service (IDaaS) Market Analysis, by End-user

9.1. Key Segment Analysis

9.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

9.2.1. BFSI

9.2.2. IT & Telecom

9.2.3. Retail & E-commerce

9.2.4. Healthcare

9.2.5. Manufacturing

9.2.6. Government

9.2.7. Energy & Utilities

9.2.8. Others

10. Global Identity-as-a-Service (IDaaS) Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Identity-as-a-Service (IDaaS) Market Analysis and Forecast

11.1. Regional Outlook

11.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

11.2.1. By Function

11.2.2. By Deployment

11.2.3. By Enterprise Size

11.2.4. By End-user

11.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

11.3.1. U.S.

11.3.2. Canada

11.3.3. Mexico

12. Europe Identity-as-a-Service (IDaaS) Market Analysis and Forecast

12.1. Regional Outlook

12.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Function

12.2.2. By Deployment

12.2.3. By Enterprise Size

12.2.4. By End-user

12.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Italy

12.3.5. Spain

12.3.6. Rest of Europe

13. Asia Pacific Identity-as-a-Service (IDaaS) Market Analysis and Forecast

13.1. Regional Outlook

13.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Function

13.2.2. By Deployment

13.2.3. By Enterprise Size

13.2.4. By End-user

13.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Rest of Asia Pacific

14. Middle East & Africa Identity-as-a-Service (IDaaS) Market Analysis and Forecast

14.1. Regional Outlook

14.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Function

14.2.2. By Deployment

14.2.3. By Enterprise Size

14.2.4. By End-user

14.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

14.3.1. Saudi Arabia

14.3.2. United Arab Emirates

14.3.3. South Africa

14.3.4. Rest of Middle East & Africa

15. South America Identity-as-a-Service (IDaaS) Market Analysis and Forecast

15.1. Regional Outlook

15.2. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

15.2.1. By Function

15.2.2. By Deployment

15.2.3. By Enterprise Size

15.2.4. By End-user

15.3. Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

15.3.1. Brazil

15.3.2. Argentina

15.3.3. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Market Revenue Share Analysis (%), by Leading Players (2021)

16.3. Competitive Scenario

16.3.1. List of Emerging, Prominent and Leading Players

16.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

17. Company Profiles

17.1. Okta, Inc.

17.1.1. Business Overview

17.1.2. Company Revenue

17.1.3. Product Portfolio

17.1.4. Geographic Footprint

17.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.2. Ping Identity Corporation

17.2.1. Business Overview

17.2.2. Company Revenue

17.2.3. Product Portfolio

17.2.4. Geographic Footprint

17.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.3. OneLogin, Inc.

17.3.1. Business Overview

17.3.2. Company Revenue

17.3.3. Product Portfolio

17.3.4. Geographic Footprint

17.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.4. Microsoft Corporation

17.4.1. Business Overview

17.4.2. Company Revenue

17.4.3. Product Portfolio

17.4.4. Geographic Footprint

17.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.5. ForgeRock, Inc.

17.5.1. Business Overview

17.5.2. Company Revenue

17.5.3. Product Portfolio

17.5.4. Geographic Footprint

17.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.6. IBM Corporation

17.6.1. Business Overview

17.6.2. Company Revenue

17.6.3. Product Portfolio

17.6.4. Geographic Footprint

17.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.7. ManageEngine

17.7.1. Business Overview

17.7.2. Company Revenue

17.7.3. Product Portfolio

17.7.4. Geographic Footprint

17.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.8. CyberArk Software Ltd.

17.8.1. Business Overview

17.8.2. Company Revenue

17.8.3. Product Portfolio

17.8.4. Geographic Footprint

17.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.9. Oracle Corporation

17.9.1. Business Overview

17.9.2. Company Revenue

17.9.3. Product Portfolio

17.9.4. Geographic Footprint

17.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.10. SailPoint Technologies Inc.

17.10.1. Business Overview

17.10.2. Company Revenue

17.10.3. Product Portfolio

17.10.4. Geographic Footprint

17.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.11. JumpCloud Inc.

17.11.1. Business Overview

17.11.2. Company Revenue

17.11.3. Product Portfolio

17.11.4. Geographic Footprint

17.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17.12. Others

17.12.1. Business Overview

17.12.2. Company Revenue

17.12.3. Product Portfolio

17.12.4. Geographic Footprint

17.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

18. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Identity-as-a-Service (IDaaS) Market

Table 2: North America Identity-as-a-Service (IDaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 3: Europe Identity-as-a-Service (IDaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 4: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 5: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Analysis, by Country, 2021 and 2031 (US$ Mn)

Table 6: South America Identity-as-a-Service (IDaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 11: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 12: Global Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 13: Global Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 14: Global Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 15: Global Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 16: Global Identity-as-a-Service (IDaaS) Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 17: North America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 18: North America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 19: North America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 20: North America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 21: North America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 22: U.S. Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Canada Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Mexico Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Europe Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 26: Europe Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 27: Europe Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 28: Europe Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 29: Europe Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 30: Germany Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: U.K. Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: France Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: Italy Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Spain Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Asia Pacific Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 36: Asia Pacific Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 37: Asia Pacific Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 38: Asia Pacific Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 39: Asia Pacific Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 40: China Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: India Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Japan Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: ASEAN Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 45: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 46: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 47: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 48: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 49: Saudi Arabia Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: The United Arab Emirates Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: South Africa Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 52: South America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Function, 2018 – 2031

Table 53: South America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 54: South America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 55: South America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 56: South America Identity-as-a-Service (IDaaS) Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 57: Brazil Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 58: Argentina Identity-as-a-Service (IDaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 59: Mergers & Acquisitions, Partnerships (1/2)

Table 60: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Identity-as-a-Service (IDaaS) Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global Identity-as-a-Service (IDaaS) Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Identity-as-a-Service (IDaaS) Market

Figure 4: Global Identity-as-a-Service (IDaaS) Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Identity-as-a-Service (IDaaS) Market Attractiveness Assessment, by Function

Figure 6: Global Identity-as-a-Service (IDaaS) Market Attractiveness Assessment, by Deployment

Figure 7: Global Identity-as-a-Service (IDaaS) Market Attractiveness Assessment, by Enterprise Size

Figure 8: Global Identity-as-a-Service (IDaaS) Market Attractiveness Assessment, by End-user

Figure 9: Global Identity-as-a-Service (IDaaS) Market Attractiveness Assessment, by Region

Figure 10: Global Identity-as-a-Service (IDaaS) Market Revenue (US$ Mn) Historic Trends, 2016 – 2021

Figure 11: Global Identity-as-a-Service (IDaaS) Market Revenue Opportunity (US$ Mn) Historic Trends, 2016 – 2021

Figure 12: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 13: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 14: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 15: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 16: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 17: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 18: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 19: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 20: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 21: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 22: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 23: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 24: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 25: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 26: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 27: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 28: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 29: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 30: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 31: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 32: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 33: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 34: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 35: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 36: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 37: Global Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 38: Global Identity-as-a-Service (IDaaS) Market Opportunity (US$ Mn), by Region

Figure 39: Global Identity-as-a-Service (IDaaS) Market Opportunity Share (%), by Region, 2022–2031

Figure 40: Global Identity-as-a-Service (IDaaS) Market Size (US$ Mn), by Region, 2022 & 2031

Figure 41: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Region, 2022

Figure 42: Global Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Region, 2031

Figure 43: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 44: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 45: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 46: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 47: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 48: North America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Function

Figure 49: North America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Deployment

Figure 50: North America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 51: North America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by End-user

Figure 52: North America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Country

Figure 53: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 54: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 55: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 56: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 57: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 58: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 59: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 60: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 61: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 62: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 63: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 64: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 65: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 66: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 67: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 68: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 69: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 70: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 71: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 72: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 73: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 74: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 75: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 76: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 77: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 78: North America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 79: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2022

Figure 80: North America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2031

Figure 81: U.S. Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 82: Canada Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 83: Mexico Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 84: Europe Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Function

Figure 85: Europe Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Deployment

Figure 86: Europe Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 87: Europe Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by End-user

Figure 88: Europe Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Country

Figure 89: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 90: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 91: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 92: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 93: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 94: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 95: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 96: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 97: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 98: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 99: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 100: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 101: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 102: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 103: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 104: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 105: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 106: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 107: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 108: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 109: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 110: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 111: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 112: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 113: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 114: Europe Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 115: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2022

Figure 116: Europe Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2031

Figure 117: Germany Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 118: U.K. Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 119: France Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 120: Italy Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 121: Spain Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 122: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Function

Figure 123: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Deployment

Figure 124: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 125: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by End-user

Figure 126: Asia Pacific Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Country

Figure 127: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 128: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 129: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 130: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 131: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 132: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 133: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 134: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 135: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 136: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 137: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 138: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 139: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 140: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 141: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 142: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 143: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 144: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 145: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 146: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 147: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 148: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 149: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 150: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 151: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 152: Asia Pacific Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 153: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2022

Figure 154: Asia Pacific Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2031

Figure 155: China Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 156: India Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 157: Japan Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 158: ASEAN Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 159: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Function

Figure 160: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Deployment

Figure 161: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 162: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by End-user

Figure 163: Middle East & Africa Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Country

Figure 164: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 165: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 166: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 167: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 168: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 169: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 170: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 171: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 172: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 173: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 174: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 175: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 176: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 177: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 178: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 179: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 180: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 181: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 182: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 183: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 184: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 185: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 186: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 187: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 188: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 189: Middle East & Africa Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 190: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2022

Figure 191: Middle East & Africa Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2031

Figure 192: Saudi Arabia Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 193: The United Arab Emirates Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 194: South Africa Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 195: South America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Function

Figure 196: South America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Deployment

Figure 197: South America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 198: South America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by End-user

Figure 199: South America Identity-as-a-Service (IDaaS) Market Revenue Opportunity Share, by Country

Figure 200: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2022

Figure 201: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Function, 2031

Figure 202: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Single Sign-on (SSO), 2022 – 2031

Figure 203: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Multi-factor Authentication (MFA), 2022 – 2031

Figure 204: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Provisioning, 2022 – 2031

Figure 205: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Directory Services, 2022 – 2031

Figure 206: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Compliance Management, 2022 – 2031

Figure 207: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2022

Figure 208: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Deployment, 2031

Figure 209: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Public Cloud, 2022 – 2031

Figure 210: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Private Cloud, 2022 – 2031

Figure 211: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2022 – 2031

Figure 212: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 213: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 214: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises (SMEs), 2022 – 2031

Figure 215: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2022 – 2031

Figure 216: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2022

Figure 217: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by End-user, 2031

Figure 218: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 219: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 220: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Retail & E-commerce, 2022 – 2031

Figure 221: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Healthcare, 2022 – 2031

Figure 222: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Manufacturing, 2022 – 2031

Figure 223: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 224: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2022 – 2031

Figure 225: South America Identity-as-a-Service (IDaaS) Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 226: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2022

Figure 227: South America Identity-as-a-Service (IDaaS) Market Value Share Analysis, by Country, 2031

Figure 228: Brazil Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 229: Argentina Identity-as-a-Service (IDaaS) Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031