At-home convenience of HIV self-testing is serving as an advantage for companies in the HIV self-test kits market in order to overcome the barriers that individuals face in testing performed at conventional healthcare settings. HIV self-test kits are acquiring popularity, owing to its growing awareness on social media and innovations in technology-based solutions. The introduction of mHealth (Mobile Health) and availability of various distribution modes are creating incremental opportunities for companies in the HIV self-test kits market.

HIV self-test kits are gaining prominence in the U.S. This is justified since North America dominates the market for HIV self-test kits and this market in the region is projected for exponential growth during the forecast period. Thus, healthcare companies are increasing efforts to reach at-risk individuals. A study published in the Journal of the American Medical Association suggested that strategically distributed HIV self-test kits have the potential to bolster HIV screening rates and encourage individuals to seek out treatment.

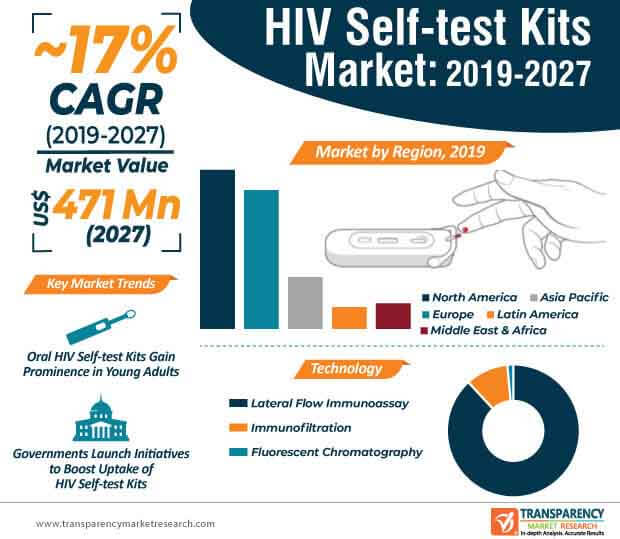

Oral HIV self-test kits are gaining prominence among young adults. Social initiatives targeted to boost the uptake of oral HIV self-test kits act as a driver contributing to market growth. For instance, the Ministry of Health, Kampala launched a novel device OraQuick® HIV self-test, developed by OraSure Technologies-a Pennsylvania-based medical device company, to support the government’s initiative to reduce HIV/AIDS infections by the end of 2020. As such, oral liquid specimen type segment of the HIV self-test kits market is anticipated for exponential growth. The global HIV self-test kits market is expected to expand at a staggering CAGR of ~17 during the forecast period.

As far as testing is concerned, companies in the HIV self-test kits market and governments have collaborated to encourage the adoption of HIV self-test kits in empowering citizens, especially men. Moreover, other at-risk individuals such as sex workers are also being targeted to take up HIV testing. Healthcare companies are increasing research to assess the prevalence of HIV among children who are at the risk of contracting the infection.

HIV testing programs are being designed to make people aware of their status who might be at the risk of contracting HIV. These programs are being strategically targeted by companies in the HIV self-test kits market at individuals in under-developed economies, such as Africa and developing countries of Asia Pacific. As such, there has been success in testing pregnant women. Hence, manufacturers are making HIV self-test kits easily available to pregnant women.

New testing technologies in oral fluid and urine specimen types have revolutionized the HIV response in local communities. Innovative testing approaches are anticipated to catalyze growth of the HIV self-test kits market, since individuals refrain from taking tests with traditional health service providers.

HIV self-testing (HIVST) and pre-exposure prophylaxis (PrEP) are highly publicized tools that are transforming the HIV self-test kits market. High prevalence of HIV in Asia Pacific region has triggered the uptake of HIV self-test kits. As such, according to analysts of Transparency Market Research, the HIV self-test kits market in Asia Pacific is projected for aggressive growth during the forecast period and the global HIV self-test kits market is estimated to reach a revenue of ~US$ 471 Mn by the end of 2027. However, existing services are not adequately reaching these populations, which poses as a barrier for healthcare companies. Hence, companies are creating awareness through developmental workshops in Asia Pacific to boost the uptake of HIV self-test kits.

Developmental workshops that impart knowledge about the best practices and innovations in HIVST and PrEP act as key drivers for the market. For instance, the United Nations co-sponsored the Workshop on Building Capacity for Roll-out of PrEP and HIV Testing Innovations program, which was supported by the Population Services International (PSI) in Thailand.

Analysts’ Viewpoint

Internet-distributed HIV self-tests encourage individuals to seek treatment and recommend their peers to gain awareness on their status. This is evident since HIV self-tests are being integrated with mHealth to cater to the convenience of users. Manufacturers are focusing on increasing awareness about easy-to-use oral HIV self-tests kits to target young adults.

Moreover, government initiatives are helping in increased uptake of HIV self-tests kits. However, challenges in HIVST scale-up with regard to cost, registration, and availability of test kits are likely to slow down market growth. Hence, governments are collaborating with medical device companies to increase awareness about testing devices and increase efforts in PrEP implementation projects.

HIV self-test kits market to reach a valuation of US$ 471 Mn by 2027

HIV self-test kits market to expand at a CAGR of ~17% from 2019 to 2027

HIV self-test kits market is driven by rise in prevalence of HIV infection worldwide

North America accounted for a major share of the global HIV self-test kits market, owing to the presence of large population suffering from HIV infection

Key players in the global HIV self-test kits market include OraSure Technologies, Inc., Chembio Diagnostic Systems, Atomo Diagnostics, BioSure UK, Biosynex Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global HIV Self-test Kits Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global HIV Self-test Kits Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Price and Brand Analysis

5.2. Pipeline Analysis

5.3. Epidemiological Overview

5.4. Number of HIV Self-tests, by WHO Region

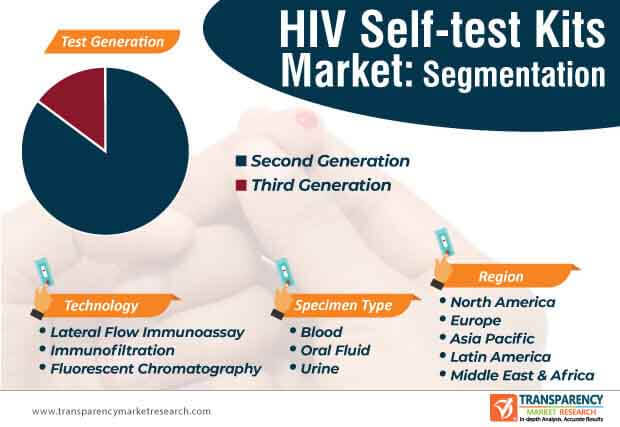

6. Global HIV Self-test Kits Market Value and Forecast, by Technology

6.1. Introduction & Definition

6.2. Global HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

6.2.1. Immunofiltration

6.2.2. Lateral Flow Immunoassay

6.2.3. Fluorescent Chromatography

6.3. Global HIV Self-test Kits Market Attractiveness, by Technology

7. Global HIV Self-test Kits Market Value and Forecast, by Specimen Type

7.1. Introduction

7.2. Global HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017–2027

7.2.1. Blood

7.2.2. Oral Fluid

7.2.3. Urine

7.3. Global HIV Self-test Kits Market Attractiveness, by Specimen Type

8. Global HIV Self-test Kits Market Value and Forecast, by Test Generation

8.1. Introduction

8.2. Global HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

8.2.1. Second Generation

8.2.2. Third Generation

8.3. Global HIV Self-test Kits Market Attractiveness, by Test Generation

9. Global HIV Self-test Kits Market Value and Forecast, by Region

9.1. Introduction

10.2 HIV Self-test Kits Market Value Forecast, by Region, 2017–2027

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Latin America

9.1.5. Middle East & Africa

10.3. Global HIV Self-test Kits Market Attractiveness, by Region

10. North America HIV Self-test Kits Market Analysis and Forecast

10.1. Introduction

10.2. North America HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

10.2.1. Immunofiltration

10.2.2. Lateral Flow Immunoassay

10.2.3. Fluorescent Chromatography

10.3. North America HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017-2027

10.3.1. Blood

10.3.2. Oral Fluid

10.3.3. Urine

10.4. North America HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

10.4.1. Second Generation

10.4.2. Third Generation

10.5. North America HIV Self-test Kits Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. North America HIV Self-test Kits Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By Specimen Type

10.6.3. By Test Generation

10.6.4. By Country

11. Europe HIV Self-test Kits Market Analysis and Forecast

11.1. Introduction

11.2. Europe HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

11.2.1. Immunofiltration

11.2.2. Lateral Flow Immunoassay

11.2.3. Fluorescent Chromatography

11.3. Europe HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017–2027

11.3.1. Blood

11.3.2. Oral Fluid

11.3.3. Urine

11.4. Europe HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

11.4.1. Second Generation

11.4.2. Third Generation

11.5. Europe HIV Self-test Kits Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe HIV Self-test Kits Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By Specimen Type

11.6.3. By Test Generation

11.6.4. By Country/Sub-region

12. Asia Pacific HIV Self-test Kits Market Analysis and Forecast

12.1. Introduction

12.2. Asia Pacific HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

12.2.1. Immunofiltration

12.2.2. Lateral Flow Immunoassay

12.2.3. Fluorescent Chromatography

12.3. Asia Pacific HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017–2027

12.3.1. Blood

12.3.2. Oral Fluid

12.3.3. Urine

12.4. Asia Pacific HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

12.4.1. Second Generation

12.4.2. Third Generation

12.5. Asia Pacific HIV Self-test Kits Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific HIV Self-test Kits Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By Specimen Type

12.6.3. By Test Generation

12.6.4. By End-user

12.6.5. By Country/Sub-region

13. Latin America HIV Self-test Kits Market Analysis and Forecast

13.1. Introduction

13.2. Latin America HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

13.2.1. Immunofiltration

13.2.2. Lateral Flow Immunoassay

13.2.3. Fluorescent Chromatography

13.3. Latin America HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017–2027

13.3.1. Blood

13.3.2. Oral Fluid

13.3.3. Urine

13.4. Latin America HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

13.4.1. Second Generation

13.4.2. Third Generation

13.5. Latin America HIV Self-test Kits Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America HIV Self-test Kits Market Attractiveness Analysis

13.6.1. By Technology

13.6.2. By Specimen Type

13.6.3. By Test Generation

13.6.4. By Country/Sub-region

14. Middle East & Africa HIV Self-test Kits Market Analysis and Forecast

14.1. Introduction

14.2. Middle East & Africa HIV Self-test Kits Market Value Forecast, by Technology, 2017–2027

14.2.1. Immunofiltration

14.2.2. Lateral Flow Immunoassay

14.2.3. Fluorescent Chromatography

14.3. Middle East & Africa HIV Self-test Kits Market Value Forecast, by Specimen Type, 2017–2027

14.3.1. Blood

14.3.2. Oral Fluid

14.3.3. Urine

14.4. Middle East & Africa HIV Self-test Kits Market Value Forecast, by Test Generation, 2017–2027

14.4.1. Second Generation

14.4.2. Third Generation

14.5. Middle East & Africa HIV Self-test Kits Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa HIV Self-test Kits Market Attractiveness Analysis

14.6.1. By Technology

14.6.2. By Specimen Type

14.6.3. By Test Generation

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. OraSure Technologies, Inc.

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.1.5. SWOT Analysis

15.2.2. Chembio Diagnostic Systems

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.2.5. SWOT Analysis

15.2.3. Atomo Diagnostics

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Strategic Overview

15.2.3.4. SWOT Analysis

15.2.4. BioSure UK

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. SWOT Analysis

15.2.5. Biosynex Group

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. SWOT Analysis

15.2.6. bioLytical Laboratories Inc.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Strategic Overview

15.2.6.4. SWOT Analysis

15.2.7. Orange Life

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. SWOT Analysis

15.2.8. Bedfordbiotech

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. SWOT Analysis

15.2.9. Sedia Biosciences Corporation

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. SWOT Analysis

List of Tables

Table 01: Global HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 02: Global HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 03: Global HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

Table 04: Global HIV Self-test Kits Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 05: North America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 06: North America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 07: North America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 08: North America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

Table 09: Europe HIV Self-test Kits Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Europe HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 11: Europe HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 12: Europe HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

Table 13: Asia Pacific HIV Self-test Kits Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: Asia Pacific HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 15: Asia Pacific HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 16: Asia Pacific HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

Table 17: Latin America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 18: Latin America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 19: Latin America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 20: Latin America HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

Table 21: Middle East & Africa HIV Self-test Kits Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Middle East & Africa HIV Self-test Kits Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 23: Middle East & Africa HIV Self-test Kits Market Value (US$ Mn) Forecast, by Specimen Type, 2017–2027

Table 24: Middle East & Africa HIV Self-test Kits Market Value (US$ Mn) Forecast, by Test Generation, 2017–2027

List of Figures

Figure 01: Global HIV Self-test Kits Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global HIV Self-test Kits Market Revenue (US$ Mn), by Test Generation, 2018

Figure 03: Global HIV Self-test Kits Market Revenue (US$ Mn), by Specimen Type, 2018

Figure 04: Global HIV Self-test Kits Market Revenue, by Technology (US$ Mn), 2018

Figure 05: Global HIV Self-test Kits Market Value (US$ Mn) Forecast, 2017–2027

Figure 06: Global HIV Self-test Kits Market Value Share, by Technology, 2018

Figure 07: Global HIV Self-test Kits Market Value Share, by Specimen Type, 2018

Figure 08: Global HIV Self-test Kits Market Value Share, by Test Generation, 2018

Figure 09: Global HIV Self-test Kits Market Value Share, by Region, 2018

Figure 10: Global HIV Self-test Kits Market Value Share Analysis, by Technology, 2018 and 2027

Figure 11: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Immunofiltration, 2017–2027

Figure 12: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Lateral Flow Immunoassay, 2017–2027

Figure 13: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Fluorescent Chromatography, 2017–2027

Figure 14: Global HIV Self-test Kits Market Attractiveness, by Technology, 2019–2027

Figure 15: Global HIV Self-test Kits Market Value Share Analysis, by Specimen Type, 2018 and 2027

Figure 16: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Blood, 2017–2027

Figure 17: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Oral Fluid, 2017–2027

Figure 18: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Urine, 2017–2027

Figure 19: Global HIV Self-test Kits Market Attractiveness, by Specimen Type, 2019–2027

Figure 20: Global HIV Self-test Kits Market Value Share (%), by Test Generation, 2018 and 2027

Figure 21: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Second Generation, 2017–2027

Figure 22: Global HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Third Generation, 2017–2027

Figure 23: Global HIV Self-test Kits Market Attractiveness, by Test Generation, 2019–2027

Figure 24: Global HIV Self-test Kits Market Value Share Analysis, by Region, 2018 and 2027

Figure 25: Global HIV Self-test Kits Market Attractiveness Analysis, by Region, 2019–2027

Figure 26: North America HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 27: North America HIV Self-test Kits Market Value Share (%) Analysis, by Country, 2018 and 2027

Figure 28: North America HIV Self-test Kits Market Attractiveness Analysis, by Country, 2019?2027

Figure 29: North America HIV Self-test Kits Market Value Share (%) Analysis, by Technology, 2018 and 2027

Figure 30: North America HIV Self-test Kits Market Attractiveness Analysis, by Technology, 2019–2027

Figure 31: North America HIV Self-test Kits Market Value Share (%) Analysis, by Specimen Type, 2018 and 2027

Figure 32: North America HIV Self-test Kits Market Attractiveness Analysis, by Specimen Type, 2019–2027

Figure 33: North America HIV Self-test Kits Market Value Share (%) Analysis, by Test Generation, 2018 and 2027

Figure 34: North America HIV Self-test Kits Market Attractiveness Analysis, by Test Generation, 2019–2027

Figure 35: Europe HIV Self-test Kits Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 36: Europe HIV Self-test Kits Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 37: Europe HIV Self-test Kits Market Attractiveness Analysis, by Country/Sub-region, 2019?2027

Figure 38: Europe HIV Self-test Kits Market Value Share (%) Analysis, by Technology, 2018 and 2027

Figure 39: Europe HIV Self-test Kits Market Attractiveness Analysis, by Technology, 2019–2027

Figure 40: Europe HIV Self-test Kits Market Value Share (%) Analysis, by Specimen Type, 2018 and 2027

Figure 41: Europe HIV Self-test Kits Market Attractiveness Analysis, by Specimen Type, 2019–2027

Figure 42: Europe HIV Self-test Kits Market Value Share (%) Analysis, by Test Generation, 2018 and 2027

Figure 43: Europe HIV Self-test Kits Market Attractiveness Analysis, by Test Generation, 2019–2027

Figure 44: Asia Pacific HIV Self-test Kits Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 45: Asia Pacific HIV Self-test Kits Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 46: Asia Pacific HIV Self-test Kits Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 47: Asia Pacific HIV Self-test Kits Market Value Share (%) Analysis, by Technology, 2018 and 2027

Figure 48: Asia Pacific HIV Self-test Kits Market Attractiveness Analysis, by Technology, 2019–2027

Figure 49: Asia Pacific HIV Self-test Kits Market Value Share (%) Analysis, by Specimen Type, 2018 and 2027

Figure 50: Asia Pacific HIV Self-test Kits Market Attractiveness Analysis, by Specimen Type, 2019–2027

Figure 51: Asia Pacific HIV Self-test Kits Market Value Share (%) Analysis, by Test Generation, 2018 and 2027

Figure 52: Asia Pacific HIV Self-test Kits Market Attractiveness Analysis, by Test Generation, 2019–2027

Figure 53: Latin America HIV Self-test Kits Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 54: Latin America HIV Self-test Kits Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 55: Latin America HIV Self-test Kits Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 56: Latin America HIV Self-test Kits Market Value Share (%) Analysis, by Technology, 2018 and 2027

Figure 57: Latin America HIV Self-test Kits Market Attractiveness Analysis, by Technology, 2019–2027

Figure 58: Latin America HIV Self-test Kits Market Value Share (%) Analysis, by Specimen Type, 2018 and 2027

Figure 59: Latin America HIV Self-test Kits Market Attractiveness Analysis, by Specimen Type, 2019–2027

Figure 60: Latin America HIV Self-test Kits Market Value Share (%) Analysis, by Test Generation, 2018 and 2027

Figure 61: Latin America HIV Self-test Kits Market Attractiveness Analysis, by Test Generation, 2019–2027

Figure 62: Middle East & Africa HIV Self-test Kits Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 63: Middle East & Africa HIV Self-test Kits Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 64: Middle East & Africa HIV Self-test Kits Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 65: Middle East & Africa HIV Self-test Kits Market Value Share (%) Analysis, by Technology, 2018 and 2027

Figure 66: Middle East & Africa HIV Self-test Kits Market Attractiveness Analysis, by Technology, 2019–2027

Figure 67: Middle East & Africa HIV Self-test Kits Market Value Share (%) Analysis, by Specimen Type, 2018 and 2027

Figure 68: Middle East & Africa HIV Self-test Kits Market Attractiveness Analysis, by Specimen Type, 2019–2027

Figure 69: Middle East & Africa HIV Self-test Kits Market Value Share (%) Analysis, by Test Generation, 2018 and 2027

Figure 70: Middle East & Africa HIV Self-test Kits Market Attractiveness Analysis, by Test Generation, 2019–2027

Figure 71: OraSure Technologies, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 72: OraSure Technologies, Inc. Breakdown of Net Sales (% Share), by Region, 2018

Figure 73: OraSure Technologies, Inc. Breakdown of Net Sales (% Share), by Business Segment, 2018

Figure 74: Chembio Diagnostic Systems Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2018

Figure 75: Chembio Diagnostic Systems Breakdown of Net Sales (% Share), by Region, 2018