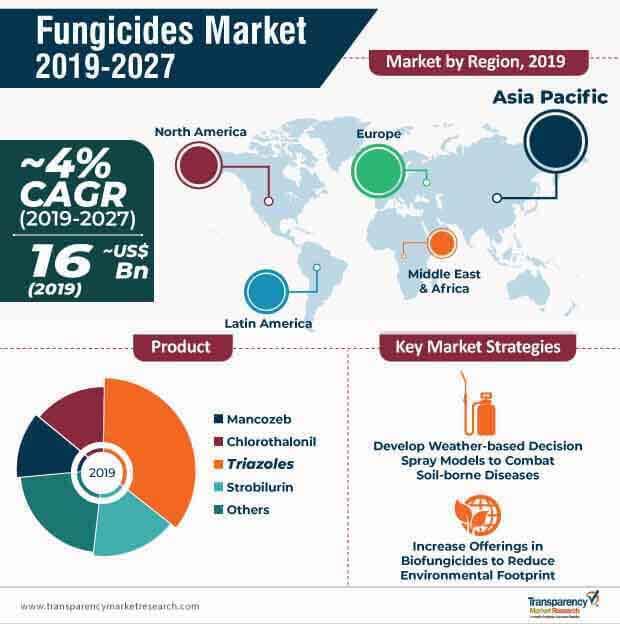

Manufacturers in the fungicides market are developing weather-based decision spray models that help farmers and other stakeholders in the agricultural landscape to combat soil-borne diseases. These decision-based models assist crop growers in deciding when to use fungicides, depending on the weather condition. This model is best used to prevent the growth activity of late blight disease in potatoes. The model’s efficiency, cost effectiveness, and environmental-friendly attributes are increasingly gaining the attention of crop growers.

Late blight disease has serious consequences on crops, both on field and in storage spaces. Due to the growth of late blight due to certain weather conditions, crop growers suffer huge production losses. Thus, manufacturers can develop innovative forecast models, as crop growers are willing to invest in high-performance models to avoid production losses.

A lot of farmers are adopting these forecast models to gain insights about the humidity and weather conditions over a period of 3-7 days. Thus, weather-based decision spray models help consumers spray-controlled dosages of fungicides, thereby decreasing costs and reducing environmental footprint.

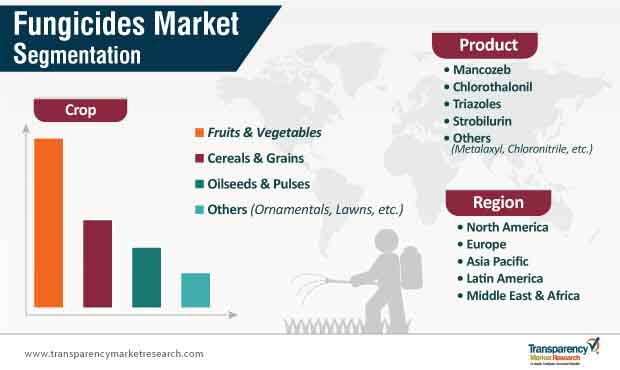

There is growing demand from cereal farmers for the innovation of tailored solutions that are overlooked by market players in the fungicides ecosystem. These challenges include limited natural resources, fluctuating yield of crops, and the risk of soil-borne diseases while catering to the growing world population with increasing demand for high-quality cereals. Since the fungicides market is anticipated to grow from ~US$ 15.3 Bn in 2018 to ~US$ 22.3 Bn in 2027, market players are adopting strategic measures to facilitate cereal farmers with innovative fungicide offerings.

Manufacturers are developing high-technology fungicides to deliver exceptional disease control that results in higher-yielding and healthy-looking cereal crops. The use of high-technology fungicides supports high grain quality, long-lasting protection against fungal activity, and surplus production for the growing population. This sustainable solution is adding greater cost value to cereal growers, and also helping market players sustain their business of fungicides in the long run. For instance, Bayer AG - a leading German multinational pharmaceutical company, announced the launch of iblon™ technology based on active ingredient isoflucypram, to control fungal activity in cereals.

The fungicides industry is moderately consolidated, thus allowing the entry of new players in the market. However, emerging market players need to innovate on offerings that are sustainable and reduce environmental load.

Fungicides are used to protect crops from fungal diseases. However, certain species of fungi develop resistance to fungicides after prolonged usage. Certain synthetic fungicides can also kill the crops and plants if not handled skilfully, as they contain highly toxic elements such as phytotoxicity. This is why crop growers are adopting biofungicides made from organic formulations that aid in the management of crop diseases. Biofungicides also help reduce environmental footprint when compared to chemical/synthetic fungicides. Thus, manufacturers need to harness the power of plant micro biomes to develop effective biofungicides with multiple modes of action.

Analysts’ Viewpoint

The production of fungicides for fruits and vegetables is expected to reach a benchmark of ~403 kilotons by the year 2027. Hence, manufacturers are increasing production capacities to cater to the needs of fruit and vegetable growers. For instance, BASF SE - a leading German chemical company, announced the launch of two new fungicides - Acrobat® Complete and Sercadis® Plus, which contribute to the growth of high-quality grapes that can stay free from diseases. The use of synthetic fungicides leads to complications in crop health, and increases harmful emissions to the environment. Thus, manufacturers should increase offerings in biofungicides, and tap into the available incremental opportunities in Asia Pacific and Europe.

Fungicides: Increase in Area Harvested for Fruits & Vegetables to Drive Market

Global Market: Highlights

Demand for Triazole Fungicides Likely to Increase

Asia Pacific Market to Grow Rapidly

Global Fungicides Market: Competition Landscape

The fungicides market size was valued at US$ 16 Bn in 2019

The market is expected to grow at a CAGR of 4% from 2019-2027

Increase in Area Harvested for Fruits & Vegetables to Drive Market

Asia Pacific and Europe is a more attractive region for vendors in the global market

Sumitomo Chemical Co., Ltd., PI Industries, FMC Corporation, ADAMA Ltd., BASF SE, UPL, Corteva Agriscience, Nufarm Ltd., Quimetal Industrial S.A., Bayer AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

1.4. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: Global Fungicides Market

4. Market Overview

4.1. Introduction

4.2. Product Definition

4.3. Key Developments

4.4. Market Indicators

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. Global Fungicides Market Analysis and Forecast, 2018

4.6.1. Global Fungicides Market Volume (Tons)

4.6.2. Global Fungicides Market Value (US$ Mn)

4.7. Porter’s Five Forces Analysis

4.8. Regulatory Scenario

4.9. Value Chain Analysis

4.9.1. List of Key Manufacturers

4.9.2. List of Potential Customers

4.10. Cost Structure Analysis

4.11. Global Fungicides Import-Export Scenario (HS Code: 380892), 2018

4.12. Snapshot of Global Agricultural Scenario

4.13. Global Fungicides Price Trend Analysis (US$ Mn/Kilo Tons), by Region, 2018–2027

4.14. Global Fungicides Production Scenario, 2018

5. Global Fungicides Market Analysis and Forecast, by Product

5.1. Introduction & Definitions

5.2. Global Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

5.2.1. Mancozeb

5.2.2. Chlorothalonil

5.2.3. Triazole

5.2.4. Strobilurin

5.2.5. Others

5.3. Global Fungicides Market Attractiveness Analysis, by Product

6. Global Fungicides Market Analysis and Forecast, by Crop

6.1. Introduction & Definitions

6.2. Global Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

6.2.1. Fruits & Vegetables

6.2.2. Cereals & Grains

6.2.3. Oilseeds & Pulses

6.2.4. Others

6.3. Global Fungicides Market Attractiveness Analysis, by Crop

7. Global Fungicides Market Analysis and Forecast, by Region, 2018–2027

7.1. Global Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Latin America

7.1.5. Middle East & Africa

8. North America Fungicides Market Analysis and Forecast

8.1. Key Findings

8.2. North America Fungicides Market Value Share Analysis and Forecast, by Product

8.3. North America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

8.3.1. Mancozeb

8.3.2. Chlorothalonil

8.3.3. Triazole

8.3.4. Strobilurin

8.3.5. Others

8.4. North America Fungicides Market Attractiveness Analysis, by Product

8.5. North America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

8.5.1. Fruits & Vegetables

8.5.2. Cereals & Grains

8.5.3. Oilseeds & Pulses

8.5.4. Others

8.6. North America Fungicides Market Attractiveness Analysis, by Crop

8.7. North America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Country, 2018–2027

8.7.1. U.S.

8.7.2. Canada

8.8. U.S. Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

8.8.1. Mancozeb

8.8.2. Chlorothalonil

8.8.3. Triazole

8.8.4. Strobilurin

8.8.5. Others

8.9. U.S. Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

8.9.1. Fruits & Vegetables

8.9.2. Cereals & Grains

8.9.3. Oilseeds & Pulses

8.9.4. Others

8.10. Canada Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

8.10.1. Granule

8.10.2. Powder

8.11. Canada Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

8.11.1. Fruits & Vegetables

8.11.2. Cereals & Grains

8.11.3. Oilseeds & Pulses

8.11.4. Others

9. Europe Fungicides Market Analysis and Forecast

9.1. Key Findings

9.2. Europe Fungicides Market Value Share Analysis and Forecast, by Product

9.3. Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.3.1. Mancozeb

9.3.2. Chlorothalonil

9.3.3. Triazole

9.3.4. Strobilurin

9.3.5. Others

9.4. Europe Fungicides Market Attractiveness Analysis, by Product

9.5. Europe Fungicides Market Value Share Analysis and Forecast, by Crop

9.6. Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.6.1. Fruits & Vegetables

9.6.2. Cereals & Grains

9.6.3. Oilseeds & Pulses

9.6.4. Others

9.7. Europe Fungicides Market Attractiveness Analysis, by Crop

9.8. Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Country and Sub-region, 2018–2027

9.8.1. Germany

9.8.2. U.K.

9.8.3. France

9.8.4. Italy

9.8.5. Spain

9.8.6. Russia & CIS

9.8.7. Rest of Europe

9.9. Germany Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.9.1. Mancozeb

9.9.2. Chlorothalonil

9.9.3. Triazole

9.9.4. Strobilurin

9.9.5. Others

9.10. Germany Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.10.1. Fruits & Vegetables

9.10.2. Cereals & Grains

9.10.3. Oilseeds & Pulses

9.10.4. Others

9.11. U.K. Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.11.1. Mancozeb

9.11.2. Chlorothalonil

9.11.3. Triazole

9.11.4. Strobilurin

9.11.5. Others

9.12. U.K. Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.12.1. Fruits & Vegetables

9.12.2. Cereals & Grains

9.12.3. Oilseeds & Pulses

9.12.4. Others

9.13. France Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.13.1. Mancozeb

9.13.2. Chlorothalonil

9.13.3. Triazole

9.13.4. Strobilurin

9.13.5. Others

9.14. France Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.14.1. Fruits & Vegetables

9.14.2. Cereals & Grains

9.14.3. Oilseeds & Pulses

9.14.4. Others

9.15. Italy Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.15.1. Mancozeb

9.15.2. Chlorothalonil

9.15.3. Triazole

9.15.4. Strobilurin

9.15.5. Others

9.16. Italy Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.16.1. Fruits & Vegetables

9.16.2. Cereals & Grains

9.16.3. Oilseeds & Pulses

9.16.4. Others

9.17. Spain Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.17.1. Mancozeb

9.17.2. Chlorothalonil

9.17.3. Triazole

9.17.4. Strobilurin

9.17.5. Others

9.18. Spain Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.18.1. Fruits & Vegetables

9.18.2. Cereals & Grains

9.18.3. Oilseeds & Pulses

9.18.4. Others

9.19. Russia & CIS Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.19.1. Mancozeb

9.19.2. Chlorothalonil

9.19.3. Triazole

9.19.4. Strobilurin

9.19.5. Others

9.20. Russia & CIS Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.20.1. Fruits & Vegetables

9.20.2. Cereals & Grains

9.20.3. Oilseeds & Pulses

9.20.4. Others

9.21. Rest of Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

9.21.1. Mancozeb

9.21.2. Chlorothalonil

9.21.3. Triazole

9.21.4. Strobilurin

9.21.5. Others

9.22. Rest of Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

9.22.1. Fruits & Vegetables

9.22.2. Cereals & Grains

9.22.3. Oilseeds & Pulses

9.22.4. Others

10. Asia Pacific Fungicides Market Analysis and Forecast

10.1. Key Findings

10.2. Asia Pacific Fungicides Market Overview

10.3. Asia Pacific Fungicides Market Value Share Analysis and Forecast, by Product

10.4. Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.4.1. Mancozeb

10.4.2. Chlorothalonil

10.4.3. Triazole

10.4.4. Strobilurin

10.4.5. Others

10.5. Asia Pacific Fungicides Market Attractiveness Analysis, by Product

10.6. Asia Pacific Fungicides Market Value Share Analysis and Forecast, by Crop

10.7. Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.7.1. Fruits & Vegetables

10.7.2. Cereals & Grains

10.7.3. Oilseeds & Pulses

10.7.4. Others

10.8. Asia Pacific Fungicides Market Attractiveness Analysis, by Crop

10.9. Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Country and Sub-region, 2018–2027

10.9.1. China

10.9.2. Japan

10.9.3. India

10.9.4. ASEAN

10.9.5. Rest of Asia Pacific

10.10. China Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.10.1. Mancozeb

10.10.2. Chlorothalonil

10.10.3. Triazole

10.10.4. Strobilurin

10.10.5. Others

10.11. China Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.11.1. Fruits & Vegetables

10.11.2. Cereals & Grains

10.11.3. Oilseeds & Pulses

10.11.4. Others

10.12. Japan Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.12.1. Mancozeb

10.12.2. Chlorothalonil

10.12.3. Triazole

10.12.4. Strobilurin

10.12.5. Others

10.13. Japan Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.13.1. Fruits & Vegetables

10.13.2. Cereals & Grains

10.13.3. Oilseeds & Pulses

10.13.4. Others

10.14. India Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.14.1. Mancozeb

10.14.2. Chlorothalonil

10.14.3. Triazole

10.14.4. Strobilurin

10.14.5. Others

10.15. India Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.15.1. Fruits & Vegetables

10.15.2. Cereals & Grains

10.15.3. Oilseeds & Pulses

10.15.4. Others

10.16. ASEAN Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.16.1. Mancozeb

10.16.2. Chlorothalonil

10.16.3. Triazole

10.16.4. Strobilurin

10.16.5. Others

10.17. ASEAN Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.17.1. Fruits & Vegetables

10.17.2. Cereals & Grains

10.17.3. Oilseeds & Pulses

10.17.4. Others

10.18. Rest of Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

10.18.1. Mancozeb

10.18.2. Chlorothalonil

10.18.3. Triazole

10.18.4. Strobilurin

10.18.5. Others

10.19. Rest of Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

10.19.1. Fruits & Vegetables

10.19.2. Cereals & Grains

10.19.3. Oilseeds & Pulses

10.19.4. Others

11. Latin America Fungicides Market Analysis and Forecast

11.1. Key Findings

11.2. Latin America Carbon Black Market Overview

11.3. Latin America Fungicides Market Value Share Analysis and Forecast, by Product

11.4. Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

11.4.1. Mancozeb

11.4.2. Chlorothalonil

11.4.3. Triazole

11.4.4. Strobilurin

11.4.5. Others

11.5. Latin America Fungicides Market Attractiveness Analysis, by Product

11.6. Latin America Fungicides Market Value Share Analysis and Forecast, by Crop

11.7. Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

11.7.1. Fruits & Vegetables

11.7.2. Cereals & Grains

11.7.3. Oilseeds & Pulses

11.7.4. Others

11.8. Latin America Fungicides Market Attractiveness Analysis, by Crop

11.9. Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Country and Sub-region, 2018–2027

11.9.1. Brazil

11.9.2. Mexico

11.9.3. Rest of Latin America

11.10. Brazil Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

11.10.1. Mancozeb

11.10.2. Chlorothalonil

11.10.3. Triazole

11.10.4. Strobilurin

11.10.5. Others

11.11. Brazil Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

11.11.1. Fruits & Vegetables

11.11.2. Cereals & Grains

11.11.3. Oilseeds & Pulses

11.11.4. Others

11.12. Mexico Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

11.12.1. Mancozeb

11.12.2. Chlorothalonil

11.12.3. Triazole

11.12.4. Strobilurin

11.12.5. Others

11.13. Mexico Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

11.13.1. Fruits & Vegetables

11.13.2. Cereals & Grains

11.13.3. Oilseeds & Pulses

11.13.4. Others

11.14. Rest of Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

11.14.1. Mancozeb

11.14.2. Chlorothalonil

11.14.3. Triazole

11.14.4. Strobilurin

11.14.5. Others

11.15. Rest of Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

11.15.1. Fruits & Vegetables

11.15.2. Cereals & Grains

11.15.3. Oilseeds & Pulses

11.15.4. Others

12. Middle East & Africa Fungicides Market Analysis and Forecast

12.1. Key Findings

12.2. Middle East & Africa Fungicides Market Overview

12.3. Middle East & Africa Fungicides Market Value Share Analysis and Forecast, by Product

12.4. Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

12.4.1. Mancozeb

12.4.2. Chlorothalonil

12.4.3. Triazole

12.4.4. Strobilurin

12.4.5. Others

12.5. Middle East & Africa Fungicides Market Attractiveness Analysis, by Product

12.6. Middle East & Africa Fungicides Market Value Share Analysis and Forecast, by Crop

12.7. Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

12.7.1. Fruits & Vegetables

12.7.2. Cereals & Grains

12.7.3. Oilseeds & Pulses

12.7.4. Others

12.8. Middle East & Africa Fungicides Market Attractiveness Analysis, by Crop

12.9. Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Country and Sub-region, 2018–2027

12.9.1. GCC

12.9.2. South Africa

12.9.3. Rest of Middle East & Africa

12.10. GCC Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

12.10.1. Mancozeb

12.10.2. Chlorothalonil

12.10.3. Triazole

12.10.4. Strobilurin

12.10.5. Others

12.11. GCC Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

12.11.1. Fruits & Vegetables

12.11.2. Cereals & Grains

12.11.3. Oilseeds & Pulses

12.11.4. Others

12.12. South Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

12.12.1. Mancozeb

12.12.2. Chlorothalonil

12.12.3. Triazole

12.12.4. Strobilurin

12.12.5. Others

12.13. South Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

12.13.1. Fruits & Vegetables

12.13.2. Cereals & Grains

12.13.3. Oilseeds & Pulses

12.13.4. Others

12.14. Rest of Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Product, 2018–2027

12.14.1. Mancozeb

12.14.2. Chlorothalonil

12.14.3. Triazole

12.14.4. Strobilurin

12.14.5. Others

12.15. Rest of Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn), by Crop, 2018–2027

12.15.1. Fruits & Vegetables

12.15.2. Cereals & Grains

12.15.3. Oilseeds & Pulses

12.15.4. Others

13. Competition Landscape

13.1. Global Fungicides Market Share Analysis, by Company, 2018

13.2. Competition Matrix

13.3. Company Profiles

13.3.1. ADAMA Ltd.

13.3.1.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.1.2. Business Segments

13.3.1.3. Product Segment

13.3.1.4. Application

13.3.1.5. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

13.3.1.6. Breakdown of Revenue, by Business Segment, 2018

13.3.2. Quimetal Industrial S.A.

13.3.2.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.2.2. Business Segments

13.3.2.3. Brands

13.3.2.4. Applications

13.3.3. Corteva Agriscience

13.3.3.1. Headquarters, Year of Establishment, Key Management, Number of Employees

13.3.3.2. Business Segments

13.3.3.3. Product Segment

13.3.3.4. Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2018

13.3.3.5. Breakdown of Revenue, by Business Segment, 2018

13.3.3.6. Strategic Initiatives

13.3.4. BASF SE

13.3.4.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.4.2. Business Segment

13.3.4.3. Products

13.3.4.4. Applications

13.3.4.5. Geographical Footprint

13.3.4.6. Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2018

13.3.4.7. Breakdown of Revenue, by Business Segment, 2018

13.3.4.8. Breakdown of Revenue, by Region, 2018

13.3.4.9. Strategic Initiatives

13.3.5. Nufarm Ltd

13.3.5.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.5.2. Business Segment

13.3.5.3. Applications

13.3.5.4. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

13.3.5.5. Breakdown of Revenue, by Region, 2018

13.3.5.6. Strategic Overview

13.3.6. FMC Corporation

13.3.6.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.6.2. Business Segment

13.3.6.3. Product

13.3.6.4. Applications

13.3.6.5. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

13.3.6.6. Breakdown of Revenue, by Region, 2018

13.3.6.7. Strategic Overview

13.3.7. Pl Industries

13.3.7.1 Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.7.2. Business Segment

13.3.7.3. Product Segments

13.3.7.4. Applications

13.3.7.5. Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2018

13.3.7.6. Breakdown of Revenue, by Business Segment, 2018

13.3.7.7. Strategic Overview

13.3.8. Sumitomo Chemical Co., Ltd.

13.3.8.1. Headquarters, Year of Establishment, Headquarters, Key Management

13.3.8.2. Business Segment

13.3.8.3. Products

13.3.8.4. Applications

13.3.8.5. Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2018

13.3.8.6. Breakdown of Revenue, by Business Segment, 2018

13.3.8.7. Breakdown of Revenue, by Geography, 2018

13.3.8.8. Strategic Initiatives

13.3.9. Syngenta International AG

13.3.9.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.9.2. Product Segment

13.3.9.3. Applications

13.3.9.4. Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2018

13.3.9.4. Breakdown of Revenue, by Business Segment, 2018

13.3.9.5. Strategic Initiatives

13.3.10. UPL

13.3.10.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

13.3.10.2. Business Segment

13.3.10.3. Product Segments

13.3.10.4. Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2018

13.3.10.5. Breakdown of Revenue, by Business Segment, 2018

13.3.10.6. Breakdown of Revenue, by Geography, 2018

13.3.10.7. Strategic Initiatives

List of Table

Table 01: Global Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 02: Global Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 03: Global Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 04: Global Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 05: Global Fungicides Market Volume (Kilo Tons) Forecast, by Region, 2018–2027

Table 06: Global Fungicides Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 07: North America Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 08: North America Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 09: North America Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 10: North America Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 11: North America Fungicides Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 12: North America Fungicides Value (US$ Mn) Forecast, by Country, 2018–2027

Table 13: U.S. Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 14: U.S. Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 15: U.S. Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 16: U.S. Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 17: Canada Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 18: Canada Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 19: Canada Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 20: Canada Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 21: Europe Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 22: Europe Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 23: Europe Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 24: Europe Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 25: Europe Fungicides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 26: Europe Fungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 27: Germany Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 28: Germany Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 29: Germany Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 30: Germany Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 31: U.K. Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 32: U.K. Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 33: U.K. Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 34: U.K. Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 35: France Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 36: France Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 37: France Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 38: France Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 39: Italy Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 40: Italy Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 41: Italy Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 42: Italy Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 43: Spain Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 44: Spain Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 45: Spain Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 46: Spain Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 47: Rest of Europe Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 48: Rest of Europe Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 49: Rest of Europe Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 50: Rest of Europe Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 51: Asia Pacific Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 52: Asia Pacific Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 53: Asia Pacific Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 54: Asia Pacific Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 55: Asia Pacific Fungicides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 56: Asia Pacific Fungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 57: China Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 58: China Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 59: China Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 60: China Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 61: India Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 62: India Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 63: India Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 64: India Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 65: Japan Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 66: Japan Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 67: Japan Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 68: Japan Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 69: ASEAN Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 70: ASEAN Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 71: ASEAN Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 72: ASEAN Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 73: Rest of Asia Pacific Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 74: Rest of Asia Pacific Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 75: Rest of Asia Pacific Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 76: Rest of Asia Pacific Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 77: Latin America Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 78: Latin America Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 79: Latin America Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 80: Latin America Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 81: Latin America Fungicides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 82: Latin America Fungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 83: Brazil Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 84: Brazil Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 85: Brazil Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 86: Brazil Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 87: Mexico Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 88: Mexico Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 89: Mexico Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 90: Mexico Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 91: Rest of Latin America Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 92: Rest of Latin America Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 93: Rest of Latin America Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 94: Rest of Latin America Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 95: Middle East & Africa Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 96: Middle East & Africa Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 97: Middle East & Africa Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 98: Middle East & Africa Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 99: Middle East & Africa Fungicides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 100: Middle East & Africa Fungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 101: GCC Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 102: GCC Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 103: GCC Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 104: GCC Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 105: South Africa Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 106: South Africa Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 107: South Africa Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 108: South Africa Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

Table 109: Rest of Middle East & Africa Fungicides Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 110: Rest of Middle East & Africa Fungicides Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 111: Rest of Middle East & Africa Fungicides Market Volume (Kilo Tons) Forecast, by Crop, 2018–2027

Table 112: Rest of Middle East & Africa Fungicides Market Value (US$ Mn) Forecast, by Crop, 2018–2027

List of Figure

Figure 01: Summary: Global Fungicides Market Snap Shot

Figure 02: Global Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 03: Global Fungicides Market Attractiveness Analysis by Product

Figure 04: Global Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 05: Global Fungicides Market Attractiveness Analysis, by Crop

Figure 06: Global Fungicides Market Value Share Analysis, by Region, 2018 and 2027

Figure 07: Global Fungicides Market Attractiveness Analysis, by Region

Figure 08: North America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

Figure 09: North America Fungicides Market Attractiveness Analysis, by Country

Figure 10: North America Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 11: North America Fungicides Market Value Share Analysis, by Crop, 2018 and 2027

Figure 12: North America Market Value Share Analysis By Country, 2018 and 2027

Figure 13: North America Fungicides Market Attractiveness Analysis, by Product

Figure 14: North America Fungicides Market Attractiveness Analysis, by Crop

Figure 15: Europe Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

Figure 16: Europe Fungicides Market Attractiveness Analysis, by Country and Sub-region

Figure 17: Europe Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 18: Europe Fungicides Market Value Share Analysis, by Crop, 2018 and 2027

Figure 19: Europe Market Value Share Analysis, by Country and Sub-region, 2018-2017

Figure 20: Europe Fungicides Market Attractiveness Analysis, by Product

Figure 21: Europe Fungicides Market Attractiveness Analysis, by Crop

Figure 22: Asia Pacific Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

Figure 23: Asia Pacific Fungicides Market Attractiveness Analysis, by Country and Sub-region

Figure 23: Global Fungicides Market Share Analysis, by Company, 2018

Figure 24: Asia Pacific Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 25: Asia Pacific Fungicides Market Value Share Analysis, by Crop, 2018 and 2027

Figure 26: Asia Pacific Market Value Share Analysis, by Country and Sub-region, 2018-2017

Figure 27: Asia Pacific Fungicides Market Attractiveness Analysis, by Product

Figure 28: Asia Pacific Fungicides Market Attractiveness Analysis, by Crop

Figure 29: Latin America Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

Figure 30: Latin America Fungicides Market Attractiveness Analysis, by Country and Sub-region

Figure 31: Latin America Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 32: Latin America Fungicides Market Value Share Analysis, by Crop, 2018 and 2027

Figure 33: Latin America Market Value Share Analysis, by Country and Sub-region, 2018-2027

Figure 34: Latin America Fungicides Market Attractiveness Analysis, by Product

Figure 35: Latin America Fungicides Market Attractiveness Analysis, by Crop

Figure 36: Middle East & Africa Fungicides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

Figure 37: Middle East & Africa Fungicides Market Attractiveness Analysis, by Country and Sub-region

Figure 38: Middle East & Africa Fungicides Market Value Share Analysis, by Product, 2018 and 2027

Figure 39: Middle East & Africa Fungicides Market Value Share Analysis, by Crop, 2018 and 2027

Figure 40: Middle East & Africa Market Value Share Analysis, by Country and Sub-region, 2018-2027

Figure 41: Middle East & Africa Fungicides Market Attractiveness Analysis, by Product

Figure 42: Middle East & Africa Fungicides Market Attractiveness Analysis, by Crop