Analysts’ Viewpoint on Ethylene Propylene Diene Monomer (EPDM) Market Scenario

Ethylene Propylene Diene Monomer (EPDM) is a popular synthetic rubber utilized across various industries due to its low cost, durability, and moldability. Numerous roof attachments in the solar racking industry use EPDM gaskets to create a watertight seal around the roof penetration. The ethylene propylene diene monomer (EPDM) market is estimated to grow considerably during the forecast period primarily due to its extensive application in car bumpers, fender extensions, and rubber strips in the automotive industry. EPDM is used as a cheaper alternative to silicone rubber for parts that are expected to experience significant exposure to moisture, or for electrical insulation. EPDM can be found in parts such as water system O-rings, hoses, and gaskets, as well as in electrical insulators and connectors for wires and cables. It is also used in accumulator bladders, diaphragms, grommets, and belts. Therefore, companies operating in the global ethylene propylene diene monomer (EPDM) market around the world are expected to focus more on enhancement of their manufacturing capacities due to increase in demand in automotive, construction, and mechanical applications.

Ethylene propylene diene monomer (EPDM) rubber, a type of synthetic rubber, is primarily used in automotive, roofing, and plastic modification applications. Synthetic rubbers are predominantly polymers synthesized by using petroleum products. Ethylene propylene diene terpolymer of propylene, ethylene, and diene component. The ethylene content is around 45%, while the diene component ranges between 2.5% and 12%. The percentage content of ethylene decides the mixing and extrusion properties of the final rubber product.

Ethylene propylene diene terpolymer can be used over a wide temperature range (-50°C to 150°C) and has considerable mechanical strength. This makes it suitable for usage in diverse applications. EPDM is extensively employed in the automotive industry owing to its chemical properties such as high temperature sustainability, and resistance to heat, harsh weather conditions, ozone, and steam. It is typically utilized in the manufacture of interior panels, rear lamp gaskets, hoses, sidewalls, inner tubes, front and rear bumpers, brake systems, v-belts, door seals, and various other automotive components.

The global automotive industry has been growing significantly for the last few years (specifically in the Indian subcontinent). This trend is likely to continue in the future. Currently, the two most important factors affecting the automotive industry are change in consumer buying dynamics, i.e. increase in per capita income; preference for cost-effective and extreme luxury cars, and change in the regulatory scenarios; i.e. emission norms, increase in safety features, etc.

Presently, ethylene propylene diene manufacturing is one of the fastest growing segment of the synthetic rubber market, as it is the primary choice for automotive and industrial applications. It has long replaced natural rubber. EPDM is used in automotive and industrial hose products, such as rear lamp gaskets, hoses, tire sidewalls, inner tire tubes, front and rear bumpers, braking systems, belt drives, door seals, and interior panels of cars, due to their thermal and oxidative stability and chemical resistance to polar organic and aqueous inorganic fluids.

Propylene diene has great noise reduction properties and it also bonds rapidly with metal, which offers a strong barrier against weather conditions as well as the environment, road surface, and engine vibration. Therefore, diverse applications of EPDM in the automotive industry is expected to boost the market.

Ethylene propylene monomer rubber is an extremely robust material, extremely resilient to puncture or penetration, unaffected by atmospheric pollution, UV light ozone or acid rain. It is unlike most bituminous materials, as it does not degrade, crack, or turn brittle after long periods of exposure to harsh elements of the weather. Installation of EPDM on roofs has proven its longevity in Artic conditions, temperate zones, and tropical climates. Therefore, EPDM coatings offer long lasting waterproof roofs.

Ethylene propylene diene monomer rubber membrane is excellent for the flat roof renovation of older domestic roofs or brand new residential or commercial installations, resulting in a total waterproofing covering. Any flat roof would benefit significant from this modern flat roofing material that flexes with ambient temperature variants and would not split, tear, or become porous. It is not only suitable for flat roofs rather it also best fits metal roofs, concrete roofs, for RV roofs, and other roofing types.

The commercial roofing industry witnesses high preference for the following three modern-day roofing systems: EPDM (ethylene propylene diene monomer), PVC (polyvinyl chloride), and TPO (thermoplastic polyolefin). Each system has individual advantages; however, one advantage they all share is that installation does not generate fumes. Therefore, suitability and acceptance of ethylene propylene monomer in the construction industry is expected to propel the demand for ethylene propylene diene monomer.

In terms of value, Asia Pacific dominated the global ethylene propylene diene monomer (EPDM) market with a major share of 41.3% in 2021 and it is expected to rise to 43.2% by 2031. Expansion of the automotive industry in growing economies such as China, India, and Brazil is likely to propel the global ethylene propylene diene monomer (EPDM) market size.

The market in North America is expected to grow at a CAGR of 5.3% during the forecast period, due to high demand for lubricant additives and rapid growth of plastics, rubber, and automotive industries in the U.S. and Canada. Furthermore, the ethylene propylene diene monomer (EPDM) market demand analysis revealed that increased need for eco-friendly products as replacements for PVC is projected to drive the thermoplastic elastomers sector in North America, which in turn is likely to fuel the EPDM market in region.

Europe also holds a major share of the global market. Demand for EPDM roofing is rising in Spain, Italy, U.K., and countries in Western Europe, due to an increase in the demand for waterproofing solutions for use in non-residential and commercial buildings in these countries.

The global market study on ethylene propylene diene monomer (EPDM) also revealed that countries in Middle East & Africa, especially those in GCC, are likely to be key markets for EPDM in the near future. Currently, South Africa and other countries in Africa are less lucrative markets for EPDM; however, growth of downstream industries is expected to propel the EPDM market in these countries in the next few years.

Each of these players has been profiled in the ethylene propylene diene monomer (EPDM) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 4.4 Bn |

| Market Forecast Value in 2031 | US$ 7.2 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2022–2031 |

| Historical Data Available for | 2020 |

| Quantitative Units | US$ Bn for Value & Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

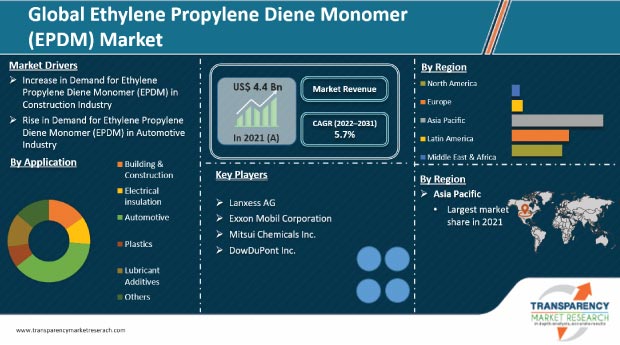

The ethylene propylene diene monomer (EPDM) market stood at US$ 4.4 Bn in 2021

The ethylene propylene diene monomer (EPDM) market is expected to grow at a CAGR of 5.7% from 2022 to 2031

Rise in demand for ethylene propylene diene monomer (EPDM) in the automotive industry and increase in demand for ethylene propylene diene monomer (EPDM) in the construction industry

Automotive was the largest application segment that held 38.6% value share in 2021

Asia Pacific was the most lucrative region and held 41.3% share of the global ethylene propylene diene monomer (EPDM) market in 2021

Lanxess AG, Exxon Mobil Corporation, Mitsui Chemicals Inc., and DowDuPont Inc.

1. Executive Summary

1.1. Ethylene Propylene Diene Monomer (EPDM) Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Ethylene Propylene Diene Monomer (EPDM) Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customer

3. COVID-19 Impact Analysis

4. Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, by Application, 2022-2031

4.1. Introduction and Definitions

4.2. Global Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

4.2.1. Building and Construction

4.2.2. Electrical Insulation

4.2.3. Automotive

4.2.4. Plastics

4.2.5. Lubricant Additives

4.2.6. Others

4.3. Global Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

5. Global Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, by Region, 2022-2031

5.1. Key Findings

5.2. Global Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022-2031

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Latin America

5.2.5. Middle East & Africa

5.3. Global Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Region

6. North America Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, 2022-2031

6.1. Key Findings

6.2. North America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

6.3. North America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2022-2031

6.3.1. U.S. Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

6.3.2. Canada Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

6.4. North America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness Analysis

7. Europe Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, 2022-2031

7.1. Key Findings

7.2. Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3. Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

7.3.1. Germany Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3.2. France Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3.3. U.K. Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3.4. Italy Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3.5. Russia & CIS Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.3.6. Rest of Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

7.4. Europe Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness Analysis

8. Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, 2022-2031

8.1. Key Findings

8.2. Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application

8.3. Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

8.3.1. China Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

8.3.2. Japan Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

8.3.3. India Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

8.3.4. ASEAN Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

8.3.5. Rest of Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

8.4. Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness Analysis

9. Latin America Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, 2022-2031

9.1. Key Findings

9.2. Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

9.3. Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

9.3.1. Brazil Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

9.3.2. Mexico Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

9.3.3. Rest of Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

9.4. Latin America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness Analysis

10. Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Analysis and Forecast, 2022-2031

10.1. Key Findings

10.2. Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

10.3. Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

10.3.1. GCC Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

10.3.2. South Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

10.3.3. Rest of Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022-2031

10.4. Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness Analysis

11. Competition Landscape

11.1. Global Ethylene Propylene Diene Monomer (EPDM) Company Market Share Analysis, 2021

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. Lanxess AG

11.2.1.1. Company Description

11.2.1.2. Business Overview

11.2.1.3. Financial Overview

11.2.1.4. Strategic Overview

11.2.2. Exxon Mobil Corporation

11.2.2.1. Company Description

11.2.2.2. Business Overview

11.2.2.3. Financial Overview

11.2.2.4. Strategic Overview

11.2.3. Mitsui Chemicals Inc.

11.2.3.1. Company Description

11.2.3.2. Business Overview

11.2.3.3. Financial Overview

11.2.3.4. Strategic Overview

11.2.4. DowDuPont Inc.

11.2.4.1. Company Description

11.2.4.2. Business Overview

11.2.4.3. Financial Overview

11.2.4.4. Strategic Overview

11.2.5. Lion Elastomers

11.2.5.1. Company Description

11.2.5.2. Business Overview

11.2.5.3. Financial Overview

11.2.5.4. Strategic Overview

11.2.6. Kumho Polychem (A JSR Group Company)

11.2.6.1. Company Description

11.2.6.2. Business Overview

11.2.6.3. Financial Overview

11.2.6.4. Strategic Overview

11.2.7. Sumitomo Chemical Co.Ltd.

11.2.7.1. Company Description

11.2.7.2. Business Overview

11.2.7.3. Financial Overview

11.2.7.4. Strategic Overview

11.2.8. Jilin Xingyun Chemical Co., Ltd.

11.2.8.1. Company Description

11.2.8.2. Business Overview

11.2.8.3. Financial Overview

11.2.9. Versalis S.p.A

11.2.9.1. Company Description

11.2.9.2. Business Overview

11.2.9.3. Financial Overview

11.2.10. Johns Manville

11.2.10.1. Company Description

11.2.10.2. Business Overview

11.2.10.3. Financial Overview

11.2.11. PJSC "Nizhnekamskneftekhim"

11.2.11.1. Company Description

11.2.11.2. Business Overview

11.2.11.3. Financial Overview

11.2.12. SK Global Chemical Co.Ltd.

11.2.12.1. Company Description

11.2.12.2. Business Overview

11.2.12.3. Financial Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Global Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 2: Global Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 3: Global Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Region, 2022-2031

Table 4: Global Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Region, 2022-2031

Table 5: North America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 6: North America Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 7: North America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Country, 2022-2031

Table 8: North America Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Country, 2022-2031

Table 9: U.S. Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 10: U.S. Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 11: Canada Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 12: Canada Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 13: Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 14: Europe Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 15: Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 16: Europe Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 17: Germany Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 18: Germany Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 19: France Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 20: France Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 21: U.K. Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 22: U.K. Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 23: Italy Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 24: Italy Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 25: Spain Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 26: Spain Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 27: Russia & CIS Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 28: Russia & CIS Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 29: Rest of Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 30: Rest of Europe Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 31: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 32: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 33: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 34: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 35: China Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 36: China Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application 2022-2031

Table 37: Japan Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 38: Japan Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 39: India Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 40: India Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 41: ASEAN Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 42: ASEAN Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 43: Rest of Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 44: Rest of Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 45: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 46: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 47: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 48: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 49: Brazil Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 50: Brazil Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 51: Mexico Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 52: Mexico Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 53: Rest of Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 54: Rest of Latin America Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 55: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 56: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 57: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 58: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 59: GCC Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 60: GCC Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 61: South Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 62: South Africa Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

Table 63: Rest of Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 64: Rest of Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Value (US$ Bn) Forecast, by Application, 2022-2031

List of Figures

Figure 1: Global Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 2: Global Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 3: Global Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 4: Global Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Region

Figure 5: North America Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 6: North America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 7: North America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 8: North America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Country and Sub-region

Figure 9: Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 10: Europe Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 11: Europe Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 12: Europe Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 14: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 15: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 16: Asia Pacific Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 18: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 19: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 20: Latin America Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Application

Figure 23: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Middle East & Africa Ethylene Propylene Diene Monomer (EPDM) Market Attractiveness, by Country and Sub-region