The finance sector is on the cusp of becoming a completely digital landscape, and its transformation is set to change the face of the banking industry in the coming years. While digitalization is promising the finance sector with improved customer experience and lowered expenses, it is also dictating completely new requirements for enterprise risk management companies willing to enter this digitally-transforming sector.

Risk and regulatory compliance functions of financial institutions are seeing a sea change with the convergence of the technology and finance sector, which has given rise to FinTech. Financial service firms are under relentless pressure to keep up with the speed of advancing technologies and implement risk management protocols by deploying digital strategies.

The enterprise risk management market is rapidly moving away from offering solutions to manage analog risks to those that manage digital risks. As the finance sector is being controlled by the labyrinth of strict regulations and rapidly changing customer expectations, the digital functions of enterprise risk management will continue to be compelling for tomorrow’s financial institutions.

Transparency Market Research (TMR), in its latest study, provides a complete 360-degree viewpoint of the enterprise risk management market, and unveils exclusive data about its growth potential in the banking and finance sector.

Though the negative impacts of the 2008 Great Recession are ebbing away, it has changed the definition of risk for financial institutions. The enterprise risk management market has been witnessing a significant push ever since, and it has evolved through the pressures of regulators and the rise of technology in the finance sector.

In 2018, the enterprise risk management market reached a valuation of ~ US$ 3.7 billion. Financial institutions are proactively seeking advanced enterprise risk management solutions to manage process and data risks more efficiently, and most importantly, digitally. In the coming years, the adoption of enterprise risk management software, which can be deployed on premise or through the cloud, is expected to grow at the fastest rate in the finance sector.

With the recent advancements in cloud technology, enterprise risk management companies are focusing on developing cloud-deployed software solutions to manage risks, compliances, and vendors, as well as audits. However, cloud computing technology can make software-based enterprise risk management solutions highly vulnerable to severe data theft threats and cyber-attacks. Thereby, increasing security concerns over cloud-deployed enterprise risk management solutions may create critical challenges for stakeholders in this landscape.

In addition, the high initial installation costs of enterprise risk management solutions and the complexity of developing software that are compatible with traditional banking systems are among the major barriers for stakeholders to increase their client base. This is restricting enterprise risk management firms from expanding their customer base and capitalize on the mounting number of financial institutions sprouting up in the global banking sector.

Though developing software that are compatible with conventional operations in the finance sector is challenging, most financial institutions have been voicing the need for establishing a collaboration between information technology and the rest of the operations in their organizations.

Financial institutions, including specialty finance, credit unions, and thrifts, are preparing for the digital future with a strategic plan for technological innovations. However, for banks, investing in technology-driven enterprise risk management services has become a strategy, which is beyond just chasing recent market trends. Banks are putting heavy investments into enterprise risk management solutions to develop their risk operating culture for implementing risk strategies efficiently.

In 2018, banks accounted for ~ 55% revenue share of the enterprise risk management market, and this trend is likely to grow even stronger in the coming years. Leading stakeholders in the enterprise risk management market are focusing on offering digital risk management software and services for banks to capitalize on this trend and improve their sales performance.

Enterprise risk management services are likely to witness high demand, as these services gobble half the revenue share in the market. However, with the advent of next-generation technologies such as artificial intelligence and blockchain, leading enterprise risk management companies are expected to focus on deploying tech-driven software to gain a competitive edge in the market.

Sensing a rise in the number of banks willing to optimize their digital risk management organizational models, stakeholders in the enterprise risk management market are focusing on selecting the right technology and appropriate data foundation to meet the exact demand of their customers.

The need for catering to a wide range of risk management demands from end-user institutions in a coordinated way is giving rise to the popular strategy of tailoring features of enterprise risk management services according to end users’ requirements. In addition, horizontal expansion of the product portfolio is also emerging as a winning strategy for market players in the banking, financial services, and insurance (BFSI) sector.

Leading players in the enterprise risk management market are adopting strategies to offer solutions and services that can transform an organization’s risk culture and performance, though it is challenging in the dynamic finance sector. Stakeholders are incorporating advanced technologies to further improve the features of enterprise risk management solutions for the digitally-evolving finance sector.

Leading companies in the enterprise risk management market, including Oracle Corporation, Fidelity National Information Services, Inc. (FIS), SAP SE, and Infosys Limited hold half the revenue share of the global market. Market leaders have consolidated their position in the landscape, mainly with their technological expertise. Frontrunners are also strengthening their networks across geographical regions by establishing collaborations and partnerships with technology companies to upscale their position in the enterprise risk management market by bolstering new product development.

The monopolistic nature of the enterprise risk management market will create numerous barriers to entry for small businesses, start-ups, and other new entrants. However, leading competitors in the market, such as LogicManager, Inc., IBM Corporation, and SAI Global Pty Limited, are gaining momentum in the market with one-third revenue share of the market.

Competitors are focusing on strengthening their research & development (R&D) base to develop innovative software by deploying cutting-edge technologies. Offering enterprise risk management solutions in the form of software as a service (SaaS) is expected to augur well for competitors in the enterprise risk management market.

Authors of TMR’s study on the enterprise risk management market are of the opinion that, the market will witness healthy growth at a CAGR of ~ 5% between 2019 and 2027. A dramatic rise in the focus on the risk management aspect of a business has been providing a fillip to the growth of the enterprise risk management market. In addition, constant changes in regulatory frameworks in different countries will continue to force financial institutions to adopt efficient and effective enterprise risk management solutions in the coming years.

Market players will have to increase focus on offering regulatory compliance and risk identification & management services to cater to the tomorrow’s needs of end users in the finance sector. Market players will also have to keep in mind that, a 'one-size-fits-all' approach with enterprise risk management never works with the finance services industry. Offering tailored solutions to meet the specific requirements of end users can help stakeholders gain a competitive edge in the enterprise risk management market.

Enterprise Risk Management Market: Taxonomy

The research study includes profiles of leading companies operating in the global enterprise risk management market. Key players profiled in the report include

Key Segments of the Enterprise Risk Management Market

TMR’s study on the enterprise risk management market divides information into three important segments—component, institution, and region. The study can help readers understand how growth of the enterprise risk management market is influenced by the market dynamics, including the emerging trends based on these segments.

|

Component |

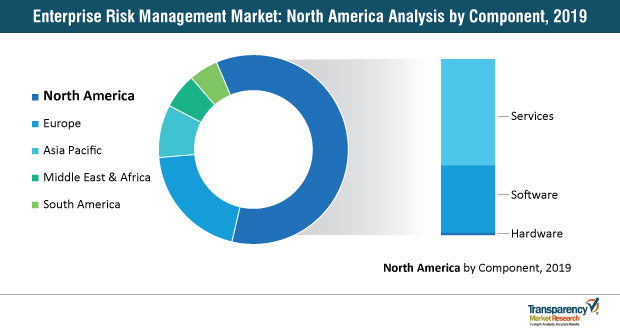

Hardware Software Services |

|

Institution |

Banks Credit Unions Specialty Finance Thrifts |

|

Region |

North America Europe Asia Pacific Middle East & Africa South America |

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Enterprise Risk Management Market

4. Market Overview

4.1. Introduction

4.1.1. Enterprise Risk Management Overview

4.2. Global Market – Macro Economic Factors Overview

4.2.1. Global GDP Indicator – For Top Countries

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2027

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Global Enterprise Risk Management Market Analysis and Forecast, 2017 - 2027

4.4.1. Market Revenue Analysis (US$ Mn)

4.4.1.1. Historic Growth Trends, 2016-2018

4.4.1.2. Forecast Trends, 2019-2027

4.5. Market Opportunity Assessment

4.5.1. By Region/Country

4.5.2. By Component

4.5.3. By Institution

4.6. Competitive Scenario and Trends

4.6.1. Enterprise Risk Management Market Concentration Rate

4.6.1.1. List of Emerging, Prominent and Leading Players

4.6.2. Mergers & Acquisitions, Expansions

4.7. Market Outlook

5. Global Enterprise Risk Management Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Hardware

5.3.2. Software

5.3.3. Services

6. Global Enterprise Risk Management Market Analysis and Forecast, by Institution

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

6.3.1. Banks

6.3.2. Credit Unions

6.3.3. Specialty Finance

6.3.4. Thrifts

7. Global Enterprise Risk Management Market Analysis and Forecast, by Region

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

8. North America Enterprise Risk Management Market Analysis and Forecast

8.1. Key Findings

8.2. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

8.2.1. Hardware

8.2.2. Software

8.2.3. Services

8.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

8.3.1. Banks

8.3.2. Credit Unions

8.3.3. Specialty Finance

8.3.4. Thrifts

8.4. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

8.4.1. The U.S.

8.4.2. Canada

8.4.3. Rest of North America

9. Europe Enterprise Risk Management Market Analysis and Forecast

9.1. Key Findings

9.2. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

9.2.1. Hardware

9.2.2. Software

9.2.3. Services

9.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

9.3.1. Banks

9.3.2. Credit Unions

9.3.3. Specialty Finance

9.3.4. Thrifts

9.4. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

9.4.1. Germany

9.4.2. The U.K

9.4.3. Rest of Europe

10. Asia Pacific Enterprise Risk Management Market Analysis and Forecast

10.1. Key Findings

10.2. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

10.2.1. Hardware

10.2.2. Software

10.2.3. Services

10.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

10.3.1. Banks

10.3.2. Credit Unions

10.3.3. Specialty Finance

10.3.4. Thrifts

10.4. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Rest of Asia Pacific

11. Middle East & Africa Enterprise Risk Management Market Analysis and Forecast

11.1. Key Findings

11.2. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.2.1. Hardware

11.2.2. Software

11.2.3. Services

11.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

11.3.1. Banks

11.3.2. Credit Unions

11.3.3. Specialty Finance

11.3.4. Thrifts

11.4. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

11.4.1. UAE

11.4.2. Saudi Arabia

11.4.3. South Africa

11.4.4. Rest of Middle East & Africa

12. South America Enterprise Risk Management Market Analysis and Forecast

12.1. Key Findings

12.2. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.2.1. Hardware

12.2.2. Software

12.2.3. Services

12.3. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Institution, 2017 - 2027

12.3.1. Banks

12.3.2. Credit Unions

12.3.3. Specialty Finance

12.3.4. Thrifts

12.4. Enterprise Risk Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

12.4.1. Brazil

12.4.2. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Revenue Share Analysis (%), by Company (2018)

14. Company Profiles(Details – Business Overview, Revenue, Solutions Offered, Recent Developments)

14.1. BWise

14.1.1. Company Overview

14.1.2. Business Overview

14.1.3. Revenue

14.1.4. Strategic Overview

14.1.5. Recent Developments

14.2. Capgemini SE

14.2.1. Company Overview

14.2.2. Business Overview

14.2.3. Revenue

14.2.4. Strategic Overview

14.2.5. Recent Developments

14.3. Dell EMC

14.3.1. Company Overview

14.3.2. Business Overview

14.3.3. Revenue

14.3.4. Strategic Overview

14.3.5. Recent Developments

14.4. Fidelity National Information Services, Inc.

14.4.1. Company Overview

14.4.2. Business Overview

14.4.3. Revenue

14.4.4. Strategic Overview

14.4.5. Recent Developments

14.5. IBM Corporation

14.5.1. Company Overview

14.5.2. Business Overview

14.5.3. Revenue

14.5.4. Strategic Overview

14.5.5. Recent Developments

14.6. Infosys Limited

14.6.1. Company Overview

14.6.2. Business Overview

14.6.3. Revenue

14.6.4. Strategic Overview

14.6.5. Recent Developments

14.7. LogicManager, Inc.

14.7.1. Company Overview

14.7.2. Business Overview

14.7.3. Revenue

14.7.4. Strategic Overview

14.7.5. Recent Developments

14.8. MetricStream Inc.

14.8.1. Company Overview

14.8.2. Business Overview

14.8.3. Revenue

14.8.4. Strategic Overview

14.8.5. Recent Developments

14.9. Oracle Corporation

14.9.1. Company Overview

14.9.2. Business Overview

14.9.3. Revenue

14.9.4. Strategic Overview

14.9.5. Recent Developments

14.10. SAP SE

14.10.1. Company Overview

14.10.2. Business Overview

14.10.3. Revenue

14.10.4. Strategic Overview

14.10.5. Recent Developments

15. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: List of Emerging, Prominent and Leading Players

Table 7: Mergers & Acquisitions, Expansions

Table 8: Global Enterprise Risk Management Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 9: Global Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 10: Global Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table 11: North America - Impact Analysis of Drivers and Restraints

Table 12: North America Enterprise Risk Management Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 13: North America Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 14: North America Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 15: Europe - Impact Analysis of Drivers and Restraints

Table 16: Europe Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 17: Europe Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 18: Europe Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 19: Asia Pacific - Impact Analysis of Drivers and Restraints

Table 20: Asia Pacific Enterprise Risk Management Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 21: Asia Pacific Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 22: Asia Pacific Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 23: Middle East & Africa - Impact Analysis of Drivers and Restraints

Table 24: Middle East & Africa Enterprise Risk Management Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 25: Middle East & Africa Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 26: Middle East & Africa Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 27: South America - Impact Analysis of Drivers and Restraints

Table 28: South America Enterprise Risk Management Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 29: South America Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Institution, 2017 - 2027

Table 30: South America Enterprise Risk Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 31: Business Segments - IBM Corporation

Table 32: Business Segments - Capgemini SE

Table 33: Business Segments - Fidelity National Information Services, Inc.,

Table 34: Business Segments - Infosys Limited

Table 35: Business Segments - Oracle Corporation

Table 36: Business Segments - SAP SE

List of Figures

Figure 1: Market Segmentation

Figure 2: Research Methodology

Figure 3: Global Enterprise Risk Management Solutions Market Size (US$ Mn) Forecast, 2017–2027

Figure 4: Global Top 3 Regions, Market Share Analysis, 2019 & 2027 (%)

Figure 5: Global Top 5 Countries – CAGR (2018-2027) Analysis

Figure 6: Global Top 2 Component Market Share Analysis, 2027

Figure 7: Global Top 2 Institution Market Share Analysis, 2027

Figure 8: GDP (US$ Bn), Top Economies 2017)

Figure 9: Top Economies GDP Landscape

Figure 10: Gross Domestic Product (GDP) Analysis,by Major Countries, 2017

Figure 11: ICT Spending (US$ Mn) Trend

Figure 12: Product/ Technology Roadmap

Figure 13: Porter’s Five Forces Analysis

Figure 14: PESTEL Analysis

Figure 15: Value Chain Analysis

Figure 16: Impact Analysis of Drivers & Restraints

Figure 17: Global Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 18: Global Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 19: Global Enterprise Risk Management Solutions Market Opportunity Assessment, by Component, (2019)

Figure 20: Global Enterprise Risk Management Solutions Market Opportunity Assessment, by Institution, (2019)

Figure 21: Global Enterprise Risk Management Solutions Market Opportunity Assessment, by Region, (2019)

Figure 22: Enterprise Risk Management Market Concentration Rate

Figure 23: Market Outlook

Figure 24: Global Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 25: Global Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 26: Global Enterprise Risk Management Solutions Market Share Analysis, by Region, 2019 & 2027

Figure 27: Key Findings

Figure 28: North America Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 29: North America Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 30: North America Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 31: North America Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 32: North America Enterprise Risk Management Solutions Market Share Analysis, by Country, 2019 & 2027

Figure 33: Key Findings

Figure 34: Europe Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 35: Europe Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 36: Europe Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 37: Europe Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 38: Europe Enterprise Risk Management Solutions Market Share Analysis, by Country, 2019 & 2027

Figure 39: Key Findings

Figure 40: Asia Pacific Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 41: Asia Pacific Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 42: Asia Pacific Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 43: Asia Pacific Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 44: Asia Pacific Enterprise Risk Management Solutions Market Share Analysis, by Country, 2019 & 2027

Figure 45: Key Findings

Figure 46: Middle East & Africa Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 47: Middle East & Africa Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 48: Middle East & Africa Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 49: Middle East & Africa Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 50: Middle East & Africa Enterprise Risk Management Solutions Market Share Analysis, by Country, 2019 & 2027

Figure 51: Key Findings

Figure 52: South America Enterprise Risk Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 53: South America Enterprise Risk Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 54: South America Enterprise Risk Management Solutions Market Share Analysis, by Component, 2019 & 2027

Figure 55: South America Enterprise Risk Management Solutions Market Share Analysis, by Institution, 2019 & 2027

Figure 56: South America Enterprise Risk Management Solutions Market Share Analysis, by Country, 2019 & 2027

Figure 57: Market Player – Competition Matrix

Figure 58: Market Revenue Share Analysis (%), by Company (2018)

Figure 59: Revenue - IBM Corporation

Figure 60: Revenue - Capgemini SE

Figure 61: Revenue - Fidelity National Information Services, Inc.,

Figure 62: Revenue - Infosys Limited

Figure 63: Revenue - Oracle Corporation

Figure 64: Revenue - SAP SE