In response to the COVID-19 pandemic, stakeholders in the EMI/RFI filtering market are increasing efforts to stay up and running to ensure the supply of live-saving drugs, medicines, medical devices, and other equipment to hospitals and pharmacies. The second wave of the coronavirus pandemic has affected India, Brazil, and Europe. During these challenging times, the semiconductor industry is supporting vital parts of the global economy, critical infrastructure, and national security.

In order to keep economies running, companies in the EMI/RFI filtering market are increasing R&D for breakthrough innovations to combat the global health crisis. Although it is debatable whether the semiconductor industry is essential or not, stakeholders are focusing on mission-critical industries such as in automotive battery chargers, CNC (Computer Numerical Control) machinery, and telecom infrastructure, among others. Government, food distribution, and power supply are important applications that are fueling the demand for steady supply of semicon devices and materials.

Shields and filters are both valuable tools for reducing electronic emissions caused by the EMI (electromagnetic interference). It has been found that using both is one of the most effective solutions to reduce electronic emissions. For instance, EMI shielding methods are used to overcome a range of EMI problems and can adequately reflect EMI.

On the other hand, filters help to eliminate the EMI. They help to solve issues related to penetrations through shields as well as the inputs and outputs of an electrical system. Such combination of filters and shields is contributing to the growth of the EMI/RFI filtering market. Using EMI filtering techniques, a transient suppression at a shielded enclosure interface is found to be a highly efficient way to protect against compatibility issues in several electronic machines and devices.

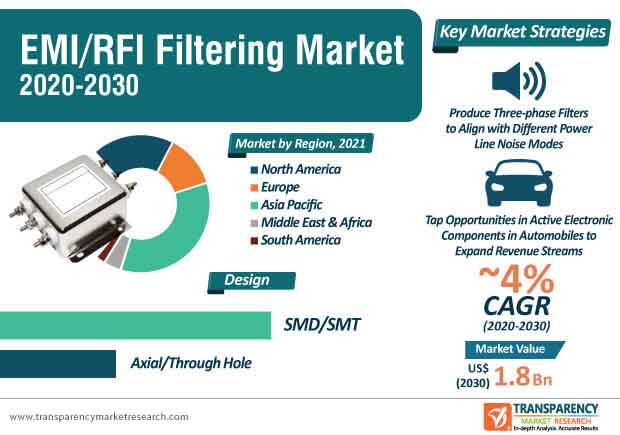

The global EMI/RFI filtering market is expected to grow at a modest CAGR of ~4% during the assessment period. This is evident since issues such as harmonic distortions and conducted emissions are leading to concerns about compliance of devices and machinery with certification regulations worldwide. Hence, companies including EMI Solutions - a manufacturer of EMI/RFI filters in Karnataka, India, is focusing on problem solving by offering EMC (Electro-Magnetic Compatibility) compliance to its industrial corporation clients and OEMs (Original Equipment Manufacturer).

Stakeholders in the India EMI/RFI filtering market are becoming aware about the EMC Compliance Certification Scheme in India, which is necessary for manufacturers to meet various IS, EN, FCC, and IEC EMC standards requirements.

The EMI/RFI filtering market is expected to cross the value mark of US$ 1.8 Bn by the end of 2030. Power supply is one of the most important applications of EMI/RFI filters. Since manufacturers are adhering to compliance regulations recognized and accepted in domestic and international markets for quality, delivery & cost, popular sources such as motors, household appliances, Wi-Fi devices, and the likes are gaining sales impetus.

There is a growing demand for EMI/RFI power line filters to trap noise and prevent it from entering or leaving an equipment. Companies in the EMI/RFI filtering market are increasing their production capabilities in single-phase filters, three-phase filters, and DC filters to align with different power line noise modes. DC filters are being designed for filtering DC power and control lines. These filters are gaining prominence in solar panels, photovoltaic (PV) charging systems, inverters, and battery charging systems.

Compact nanocrystalline single-phase filters that suppress EMI are offering greater design flexibility in applications. An increasingly connected world, which is highly dependent on electronic equipment and devices, is contributing toward the growth of the EMI/RFI filtering market. One of the most common and effective types of EMI filters is mode chokes. Manufacturers are bolstering their production capacities to develop common mode toroidal chokes that are being designed with nanocrystalline metal cores that are useful in multiple noise countermeasure fields.

On the other hand, plastic case filters catering to single-phase EMC requirements are grabbing the attention of manufacturers in the EMI/RFI filtering market. Companies are capitalizing on the opportunity to innovate in next-gen devices by taking advantage of patented refinements and soft nanocrystalline materials that are giving rise to optimized cores delivering unique performance benefits.

The ever-increasing automotive industry is creating stable revenue streams for manufacturers in the EMI/RFI filtering market. Two-wheelers, cars, rickshaws, and heavy vehicles are highly dependent on electro-mechanical components and sub-assemblies. Manufacturers are boosting their output capacities to increase the availability of active electronic components in automotive range from ABS and ECO automotive powertrains, car navigation systems, safety equipment, and automotive infotainment devices.

Automotive components and assemblies tend to emit RF (radio frequency) noise, and are potentially exposed to external sources of energy, resulting in unanticipated changes in system operation. This is where manufacturers in the EMI/RFI filtering market are stepping in to boost their output capabilities for single-phase EMI filters, 3 phase filters, and harmonic filters. Vehicle OEMs are addressing issues of broadband and narrowband noises of EMI with filters build immunity characteristics in automotive systems and components.

Shielded rooms, energy managements, and communication applications are creating revenue streams for companies in the EMI/RFI filtering market. Shielded rooms are popular in SCIFs (Sensitive Compartmented Information Facility) utilized in military applications, MRI rooms in hospitals, and server rooms for commercial businesses. EMI/RFI filters are being used in energy management systems to keep emissions from affecting sensitive equipment in smart home applications and renewable energy systems.

Communications systems such as data lines, telephones, and fire alarms are fueling the demand for EMI/RFI filters to avoid interference on the lines. EMI/RFI filters help to prevent false alarms or noise being projected over the alerting system. Electronics applications are helping manufacturers expand their business streams, since automation or test equipment electronics and laboratory equipment are integrated with EMI/RFI filters to prevent emissions.

Analysts’ Viewpoint

Essential industries such as agriculture, telecom, and medical devices have become key focus points of companies operating in the EMI/RFI filtering market during the COVID-19 pandemic. Next-gen nanocrystalline materials are offering high permeability and lower losses than ferrite variants found in traditional EMI filters. However, Indian manufacturers need to abide with stringent compliance regulations including CE marking for European market and Industrial (FCC) & Military Standards (MIL) for the U.S. market. Thus, Indian manufacturers should capitalize on this opportunity to boost credibility by adhering to compliance requirements to gain a competitive edge in India’s highly unstructured and fragmented market landscape. Automotive components and communication systems are creating stable revenue streams for manufacturers.

The EMI/RFI Filtering Market To Surpass Valuation Of US$ 1.8 Bn By 2030.

The global EMI/RFI filtering market is estimated to expand at a CAGR of ~4% during the forecast period.

EMI (Electromagnetic Interference)/RFI (Radio Frequency Interference) Filter is a type of device which is generally electronic and used to compress the conducted interference present on a signal or power line

Key players operating in the global EMI/RFI filtering market are Astrodyne TDI Corporation, AVX Corporation, API Tech, Coilcraft Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors, ON Semiconductors, Schaffner, TDK Corporation, TE Connectivity, TOKIN Corporation, and Vishay Intertechnology, Inc.

The Global EMI/RFI Filters Market is segmented based on Type, Application, and Geography.

1. Global EMI/RFI Filtering Market- Executive Summary

1.1. Global EMI/RFI Filtering Market Country Analysis

1.2. Competition Blueprint

1.3. Technology Time Line Mapping

1.4. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Market Trends

3.5. Trend Analysis- Impact on Time Line (2020-2030)

3.6. Key Regulations By Regions

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.2.1. Profitability and Gross Margin Analysis By Competition

4.2.2. List of Active Participants- By Region

4.2.2.1. Raw Material Suppliers

4.2.2.2. Key Manufacturers

4.2.2.3. Integrators

4.2.2.4. Key Distributor/Retailers

4.3. Technology Roadmap Analysis

4.4. Porter Five Forces Analysis

5. Global EMI/RFI Filtering Market Pricing Analysis

5.1. Price Point Assessment by Filter Type

5.2. Country wise Average Pricing Analysis

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East & Africa

5.2.5. South America

5.3. Price Forecast till 2030

5.4. Factors Influencing Pricing

6. Global EMI/RFI Filtering Market Analysis and Forecast

6.1. Market Size Analysis (2018-2019) and Forecast (2020-2030)

6.1.1. Market Value (US$ Mn) and Volume (Million Units) and Y-o-Y Growth

6.2. Global EMI/RFI Filtering Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

6.2.1. Forecast Factors and Relevance of Impact

6.2.2. RegionalEMI/RFI Filtering Market Business Performance Summary

7. Global EMI/RFI Filtering Market Analysis By Filter Type

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison By Filter Type

7.2. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

7.2.1. Single Phase Filters

7.2.2. DC Filters

7.2.3. Medical Filters

7.2.4. Power Entry Modules

7.2.5. Three Phase Filters

7.2.6. Others (Custom Filters, etc.)

7.3. Market Attractiveness Analysis By Filter Type

8. Global EMI/RFI Filtering Market Analysis By Design

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Design

8.2. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

8.2.1. SMD/SMT

8.2.2. Axial/Through Hole

8.3. Market Attractiveness Analysis By Design

9. Global EMI/RFI Filtering Market Analysis By Application

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Application

9.2. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

9.2.1. Automotive Battery Chargers

9.2.2. Automated Test Equipment

9.2.3. CNC Machinery

9.2.4. Renewable Energy

9.2.5. Robotics Automation

9.2.6. Smart Homes

9.2.7. Street Lighting

9.2.8. Medical Equipment

9.2.9. Power Supply

9.2.10. Industrial Motor Drives

9.2.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

9.3. Market Attractiveness Analysis By Application

10. Global EMI/RFI Filtering Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Region

10.2. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2018 - 2030

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

10.3. Market Attractiveness Analysis By Country

11. North America EMI/RFI Filtering Market Analysis and Forecast

11.1. Introduction

11.2. Drivers and Restraints: Impact Analysis

11.3. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

11.3.1. Single Phase Filters

11.3.2. DC Filters

11.3.3. Medical Filters

11.3.4. Power Entry Modules

11.3.5. Three Phase Filters

11.3.6. Others (Custom Filters, etc.)

11.4. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

11.4.1. SMD/SMT

11.4.2. Axial/Through Hole

11.5. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

11.5.1. Automotive Battery Chargers

11.5.2. Automated Test Equipment

11.5.3. CNC Machinery

11.5.4. Renewable Energy

11.5.5. Robotics Automation

11.5.6. Smart Homes

11.5.7. Street Lighting

11.5.8. Medical Equipment

11.5.9. Power Supply

11.5.10. Industrial Motor Drives

11.5.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

11.6. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country, 2018 - 2030

11.6.1. U.S.

11.6.2. Canada

11.6.3. Mexico

11.7. Market Attractiveness Analysis

11.7.1. Filter Type

11.7.2. Design

11.7.3. Application

11.7.4. Country

12. Europe EMI/RFI Filtering Market Analysis and Forecast

12.1. Introduction

12.2. Drivers and Restraints: Impact Analysis

12.3. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

12.3.1. Single Phase Filters

12.3.2. DC Filters

12.3.3. Medical Filters

12.3.4. Power Entry Modules

12.3.5. Three Phase Filters

12.3.6. Others (Custom Filters, etc.)

12.4. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

12.4.1. SMD/SMT

12.4.2. Axial/Through Hole

12.5. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

12.5.1. Automotive Battery Chargers

12.5.2. Automated Test Equipment

12.5.3. CNC Machinery

12.5.4. Renewable Energy

12.5.5. Robotics Automation

12.5.6. Smart Homes

12.5.7. Street Lighting

12.5.8. Medical Equipment

12.5.9. Power Supply

12.5.10. Industrial Motor Drives

12.5.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

12.6. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

12.6.1. U.K.

12.6.2. Germany

12.6.3. France

12.6.4. Italy

12.6.5. Russia

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. Filter Type

12.7.2. Design

12.7.3. Application

12.7.4. Country

13. Asia Pacific EMI/RFI Filtering Market Analysis and Forecast

13.1. Introduction

13.2. Drivers and Restraints: Impact Analysis

13.3. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

13.3.1. Single Phase Filters

13.3.2. DC Filters

13.3.3. Medical Filters

13.3.4. Power Entry Modules

13.3.5. Three Phase Filters

13.3.6. Others (Custom Filters, etc.)

13.4. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

13.4.1. SMD/SMT

13.4.2. Axial/Through Hole

13.5. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

13.5.1. Automotive Battery Chargers

13.5.2. Automated Test Equipment

13.5.3. CNC Machinery

13.5.4. Renewable Energy

13.5.5. Robotics Automation

13.5.6. Smart Homes

13.5.7. Street Lighting

13.5.8. Medical Equipment

13.5.9. Power Supply

13.5.10. Industrial Motor Drives

13.5.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

13.6. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Taiwan

13.6.6. Australia & New Zealand

13.6.7. ASEAN

13.6.8. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. Filter Type

13.7.2. Design

13.7.3. Application

13.7.4. Country

14. Middle East & Africa EMI/RFI Filtering Market Analysis and Forecast

14.1. Introduction

14.2. Drivers and Restraints: Impact Analysis

14.3. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

14.3.1. Single Phase Filters

14.3.2. DC Filters

14.3.3. Medical Filters

14.3.4. Power Entry Modules

14.3.5. Three Phase Filters

14.3.6. Others (Custom Filters, etc.)

14.4. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

14.4.1. SMD/SMT

14.4.2. Axial/Through Hole

14.5. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

14.5.1. Automotive Battery Chargers

14.5.2. Automated Test Equipment

14.5.3. CNC Machinery

14.5.4. Renewable Energy

14.5.5. Robotics Automation

14.5.6. Smart Homes

14.5.7. Street Lighting

14.5.8. Medical Equipment

14.5.9. Power Supply

14.5.10. Industrial Motor Drives

14.5.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

14.6. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

14.6.1. GCC

14.6.2. South Africa

14.6.3. North Africa

14.6.4. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. Filter Type

14.7.2. Design

14.7.3. Application

14.7.4. Country

15. South America EMI/RFI Filtering Market Analysis and Forecast

15.1. Introduction

15.2. Drivers and Restraints: Impact Analysis

15.3. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Filter Type, 2018 - 2030

15.3.1. Single Phase Filters

15.3.2. DC Filters

15.3.3. Medical Filters

15.3.4. Power Entry Modules

15.3.5. Three Phase Filters

15.3.6. Others (Custom Filters, etc.)

15.4. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Design, 2018 - 2030

15.4.1. SMD/SMT

15.4.2. Axial/Through Hole

15.5. EMI/RFI Filtering Market Size (US$ Mn) Analysis & Forecast, By Application, 2018 - 2030

15.5.1. Automotive Battery Chargers

15.5.2. Automated Test Equipment

15.5.3. CNC Machinery

15.5.4. Renewable Energy

15.5.5. Robotics Automation

15.5.6. Smart Homes

15.5.7. Street Lighting

15.5.8. Medical Equipment

15.5.9. Power Supply

15.5.10. Industrial Motor Drives

15.5.11. Others (Treadmills, Military Communication Equipment, Telephone Lines, etc.)

15.6. EMI/RFI Filtering Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

15.6.1. Brazil

15.6.2. Argentina

15.6.3. Rest of South America

15.7. Market Attractiveness Analysis

15.7.1. Filter Type

15.7.2. Design

15.7.3. Application

15.7.4. Country

16. Competition Assessment

16.1. GlobalEMI/RFI Filtering Market Competition - a Dashboard View

16.2. GlobalEMI/RFI Filtering Market Structure Analysis

16.3. GlobalEMI/RFI Filtering Market Company Share Analysis, by Value and Volume (2019)

17. Competition Deep-dive (Manufacturers/Suppliers)

17.1. Astrodyne TDI Corporation

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Channel Footprint

17.1.4.1. Distributors List

17.1.5. Strategy Overview

17.1.5.1. Marketing Strategy

17.1.5.2. Culture Strategy

17.1.5.3. Channel Strategy

17.1.6. SWOT Analysis

17.1.7. Financial Analysis

17.1.8. Revenue Share

17.1.8.1. By Region

17.1.9. Key Clients

17.1.10. Analyst Comments

17.2. AVX Corporation

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Channel Footprint

17.2.4.1. Distributors List

17.2.5. Strategy Overview

17.2.5.1. Marketing Strategy

17.2.5.2. Culture Strategy

17.2.5.3. Channel Strategy

17.2.6. SWOT Analysis

17.2.7. Financial Analysis

17.2.8. Revenue Share

17.2.8.1. By Region

17.2.9. Key Clients

17.2.10. Analyst Comments

17.3. Coilcraft Inc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Channel Footprint

17.3.4.1. Distributors List

17.3.5. Strategy Overview

17.3.5.1. Marketing Strategy

17.3.5.2. Culture Strategy

17.3.5.3. Channel Strategy

17.3.6. SWOT Analysis

17.3.7. Financial Analysis

17.3.8. Revenue Share

17.3.8.1. By Region

17.3.9. Key Clients

17.3.10. Analyst Comments

17.4. Murata Manufacturing Co., Ltd.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Channel Footprint

17.4.4.1. Distributors List

17.4.5. Strategy Overview

17.4.5.1. Marketing Strategy

17.4.5.2. Culture Strategy

17.4.5.3. Channel Strategy

17.4.6. SWOT Analysis

17.4.7. Financial Analysis

17.4.8. Revenue Share

17.4.8.1. By Region

17.4.9. Key Clients

17.4.10. Analyst Comments

17.5. NXP Semiconductors

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Channel Footprint

17.5.4.1. Distributors List

17.5.5. Strategy Overview

17.5.5.1. Marketing Strategy

17.5.5.2. Culture Strategy

17.5.5.3. Channel Strategy

17.5.6. SWOT Analysis

17.5.7. Financial Analysis

17.5.8. Revenue Share

17.5.8.1. By Region

17.5.9. Key Clients

17.5.10. Analyst Comments

17.6. ON Semiconductors

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Channel Footprint

17.6.4.1. Distributors List

17.6.5. Strategy Overview

17.6.5.1. Marketing Strategy

17.6.5.2. Culture Strategy

17.6.5.3. Channel Strategy

17.6.6. SWOT Analysis

17.6.7. Financial Analysis

17.6.8. Revenue Share

17.6.8.1. By Region

17.6.9. Key Clients

17.6.10. Analyst Comments

17.7. Panasonic Corporation

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Channel Footprint

17.7.4.1. Distributors List

17.7.5. Strategy Overview

17.7.5.1. Marketing Strategy

17.7.5.2. Culture Strategy

17.7.5.3. Channel Strategy

17.7.6. SWOT Analysis

17.7.7. Financial Analysis

17.7.8. Revenue Share

17.7.8.1. By Region

17.7.9. Key Clients

17.7.10. Analyst Comments

17.8. Schaffner

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Channel Footprint

17.8.4.1. Distributors List

17.8.5. Strategy Overview

17.8.5.1. Marketing Strategy

17.8.5.2. Culture Strategy

17.8.5.3. Channel Strategy

17.8.6. SWOT Analysis

17.8.7. Financial Analysis

17.8.8. Revenue Share

17.8.8.1. By Region

17.8.9. Key Clients

17.8.10. Analyst Comments

17.9. Shanghai Aide Electronic Co., Ltd.

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Channel Footprint

17.9.4.1. Distributors List

17.9.5. Strategy Overview

17.9.5.1. Marketing Strategy

17.9.5.2. Culture Strategy

17.9.5.3. Channel Strategy

17.9.6. SWOT Analysis

17.9.7. Financial Analysis

17.9.8. Revenue Share

17.9.8.1. By Region

17.9.9. Key Clients

17.9.10. Analyst Comments

17.10. TDK Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Channel Footprint

17.10.4.1. Distributors List

17.10.5. Strategy Overview

17.10.5.1. Marketing Strategy

17.10.5.2. Culture Strategy

17.10.5.3. Channel Strategy

17.10.6. SWOT Analysis

17.10.7. Financial Analysis

17.10.8. Revenue Share

17.10.8.1. By Region

17.10.9. Key Clients

17.10.10. Analyst Comments

17.11. TOKIN Corporation

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Channel Footprint

17.11.4.1. Distributors List

17.11.5. Strategy Overview

17.11.5.1. Marketing Strategy

17.11.5.2. Culture Strategy

17.11.5.3. Channel Strategy

17.11.6. SWOT Analysis

17.11.7. Financial Analysis

17.11.8. Revenue Share

17.11.8.1. By Region

17.11.9. Key Clients

17.11.10. Analyst Comments

17.12. Vishay Intertechnology, Inc.

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Channel Footprint

17.12.4.1. Distributors List

17.12.5. Strategy Overview

17.12.5.1. Marketing Strategy

17.12.5.2. Culture Strategy

17.12.5.3. Channel Strategy

17.12.6. SWOT Analysis

17.12.7. Financial Analysis

17.12.8. Revenue Share

17.12.8.1. By Region

17.12.9. Key Clients

17.12.10. Analyst Comments

17.13. Others (On additional request)

18. Recommendation- Critical Success Factors

19. Research Methodology

20. Assumptions & Acronyms Used

List of Tables

Table 01: Global EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 02: Global EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 03: Global EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 04: Global EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 05: Global EMI/RFI Filtering Market Revenue (US$ Mn), by Region, 2018–2030

Table 06: Global EMI/RFI Filtering Market Volume (Million Units), by Region, 2018–2030

Table 07: North America EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 08: North America EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 09: North America EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 10: North America EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 11: North America EMI/RFI Filtering Market Revenue (US$ Mn), by Country, 2018–2030

Table 12: North America EMI/RFI Filtering Market Volume (Million Units), by Country, 2018–2030

Table 13: Europe EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 14: Europe EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 15: Europe EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 16: Europe EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 17: Europe EMI/RFI Filtering Market Revenue (US$ Mn), by Country, 2018–2030

Table 18: Europe EMI/RFI Filtering Market Volume (Million Units), by Country, 2018–2030

Table 19: Asia Pacific EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 20: Asia Pacific EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 21: Asia Pacific EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 22: Asia Pacific EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 23: Asia Pacific EMI/RFI Filtering Market Revenue (US$ Mn), by Country, 2018–2030

Table 24: Asia Pacific EMI/RFI Filtering Market Volume (Million Units), by Country, 2018–2030

Table 25: Middle East & Africa EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 26: Middle East & Africa EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 27: Middle East & Africa EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 28: Middle East & Africa EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 29: Middle East & Africa EMI/RFI Filtering Market Revenue (US$ Mn), by Country, 2018–2030

Table 30: Middle East & Africa EMI/RFI Filtering Market Volume (Million Units), by Country, 2018–2030

Table 31: South America EMI/RFI Filtering Market Revenue (US$ Mn), By Filter Type, 2018–2030

Table 32: South America EMI/RFI Filtering Market Volume (Million Units), By Filter Type, 2018–2030

Table 33: South America EMI/RFI Filtering Market Revenue (US$ Mn), By Design, 2018–2030

Table 34: South America EMI/RFI Filtering Market Revenue (US$ Mn), By Application, 2018–2030

Table 35: South America EMI/RFI Filtering Market Revenue (US$ Mn), by Country, 2018–2030

Table 36: South America EMI/RFI Filtering Market Volume (Million Units), by Country, 2018–2030

List of Figures

Figure 01: Global EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 02: Global EMI/RFI Filtering Market Size Analysis (2018-2019) and Forecast (2020-2030)

Figure 03: Global EMI/RFI Filtering Market Revenue, by Value, 2018 - 2030

Figure 04: Global EMI/RFI Filtering Market Volume, by Volume, 2018 - 2030

Figure 05: Global EMI/RFI Filtering Market, by Single Phase Filters

Figure 06: Global EMI/RFI Filtering Market, by DC Filters

Figure 07: Global EMI/RFI Filtering Market, by Medical Filters

Figure 08: Global EMI/RFI Filtering Market, by Power Entry Modules

Figure 09: Global EMI/RFI Filtering Market, by Three Phase Filters

Figure 10: Global EMI/RFI Filtering Market, by Others (Custom Filters, etc.)

Figure 11: Global EMI/RFI Filtering Market Comparison Matrix, By Filter Type

Figure 12: Global EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 13: Global EMI/RFI Filtering Market, by SMD/SMT

Figure 14: Global EMI/RFI Filtering Market, by Axial/Through Hole

Figure 15: Global EMI/RFI Filtering Market Comparison Matrix, By Design

Figure 16: Global EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 17: Global EMI/RFI Filtering Market, by Automotive Battery Chargers

Figure 18: Global EMI/RFI Filtering Market, by CNC Machinery

Figure 19: Global EMI/RFI Filtering Market, by Telecom Infrastructure

Figure 20: Global EMI/RFI Filtering Market, by Renewable Energy

Figure 21: Global EMI/RFI Filtering Market, by Smart Homes

Figure 22: Global EMI/RFI Filtering Market, by Street Lighting

Figure 23: Global EMI/RFI Filtering Market, by Medical Equipment

Figure 24: Global EMI/RFI Filtering Market, by Power Supply

Figure 25: Global EMI/RFI Filtering Market, by Industrial Motor Drives

Figure 26: Global EMI/RFI Filtering Market, by Others

Figure 27: Global EMI/RFI Filtering Market Comparison Matrix, By Application

Figure 28: Global EMI/RFI Filtering Market Attractiveness Analysis, By Application

Figure 29: Global EMI/RFI Filtering Market Value Share Analysis, by Region (2020F)

Figure 30: Global EMI/RFI Filtering Market Value Share Analysis, by Region (2030F)

Figure 31: Global EMI/RFI Filtering Market Volume Share Analysis, by Region (2020F)

Figure 32: Global EMI/RFI Filtering Market Volume Share Analysis, by Region (2030F)

Figure 33: Global EMI/RFI Filtering Market Attractiveness Analysis, by Region

Figure 34: North America EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 35: North America EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 36: North America EMI/RFI Filtering Market Volume (Million Units) Forecast, 2018–2030

Figure 37: North America EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 38: North America EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2020)

Figure 39: North America EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2030)

Figure 40: North America EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2020)

Figure 41: North America EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2030)

Figure 42: North America EMI/RFI Filtering Market Value Share Analysis, By Design (2020)

Figure 43: North America EMI/RFI Filtering Market Value Share Analysis, By Design (2030)

Figure 44: North America EMI/RFI Filtering Market Value Share Analysis, By Application (2020)

Figure 45: North America EMI/RFI Filtering Market Value Share Analysis, By Application (2030)

Figure 46: North America EMI/RFI Filtering Market Value Share Analysis, by Country (2020F)

Figure 47: North America EMI/RFI Filtering Market Value Share Analysis, by Country (2030F )

Figure 48: North America EMI/RFI Filtering Market Volume Share Analysis, by Country (2020F)

Figure 49: North America EMI/RFI Filtering Market Volume Share Analysis, by Country (2030F )

Figure 50: North America EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 51: North America EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 52: North America EMI/RFI Filtering Market Attractiveness Analysis, by Application

Figure 53: North America EMI/RFI Filtering Market Attractiveness Analysis, by Country

Figure 54: Europe EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 55: Europe EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 56: Europe EMI/RFI Filtering Market Volume (Million Units) Forecast, 2018–2030

Figure 57: Europe EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 58: Europe EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2020)

Figure 59: Europe EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2030)

Figure 60: Europe EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2020)

Figure 61: Europe EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2030)

Figure 62: Europe EMI/RFI Filtering Market Value Share Analysis, By Design (2020)

Figure 63: Europe EMI/RFI Filtering Market Value Share Analysis, By Design (2030)

Figure 64: Europe EMI/RFI Filtering Market Value Share Analysis, By Application (2020)

Figure 65: Europe EMI/RFI Filtering Market Value Share Analysis, By Application (2030)

Figure 66: Europe EMI/RFI Filtering Market Value Share Analysis, by Country (2020F)

Figure 67: Europe EMI/RFI Filtering Market Value Share Analysis, by Country (2030F )

Figure 68: Europe EMI/RFI Filtering Market Volume Share Analysis, by Country (2020F)

Figure 69: Europe EMI/RFI Filtering Market Volume Share Analysis, by Country (2030F )

Figure 70: Europe EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 71: Europe EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 72: Europe EMI/RFI Filtering Market Attractiveness Analysis, by Component

Figure 73: Europe EMI/RFI Filtering Market Attractiveness Analysis, by Country

Figure 74: Asia Pacific EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 75: Asia Pacific EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 76: Asia Pacific EMI/RFI Filtering Market Volume (Million Units) Forecast, 2018–2030

Figure 77: Asia Pacific EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 78: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2020)

Figure 79: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2030)

Figure 80: Asia Pacific EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2020)

Figure 81: Asia Pacific EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2030)

Figure 82: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Design (2020)

Figure 83: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Design (2030)

Figure 84: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Application (2020)

Figure 85: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, By Application (2030)

Figure 86: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, by Country (2020F)

Figure 87: Asia Pacific EMI/RFI Filtering Market Value Share Analysis, by Country (2030F )

Figure 88: Asia Pacific EMI/RFI Filtering Market Volume Share Analysis, by Country (2020F)

Figure 89: Asia Pacific EMI/RFI Filtering Market Volume Share Analysis, by Country (2030F )

Figure 90: Asia Pacific EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 91: Asia Pacific EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 92: Asia Pacific EMI/RFI Filtering Market Attractiveness Analysis, by Application

Figure 93: Asia Pacific EMI/RFI Filtering Market Attractiveness Analysis, by Country

Figure 94: Middle East & Africa EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 95: Middle East & Africa EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 96: Middle East & Africa EMI/RFI Filtering Market Volume (Million Units) Forecast, 2018–2030

Figure 97: Middle East & Africa EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 98: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2020)

Figure 99: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2030)

Figure 100: Middle East & Africa EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2020)

Figure 101: Middle East & Africa EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2030)

Figure 102: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Design (2020)

Figure 103: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Design (2030)

Figure 104: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Application (2020)

Figure 105: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, By Application (2030)

Figure 106: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, by Country (2020F)

Figure 107: Middle East & Africa EMI/RFI Filtering Market Value Share Analysis, by Country (2030F )

Figure 108: Middle East & Africa EMI/RFI Filtering Market Volume Share Analysis, by Country (2020F)

Figure 109: Middle East & Africa EMI/RFI Filtering Market Volume Share Analysis, by Country (2030F )

Figure 110: Middle East & Africa EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 111: Middle East & Africa EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 112: Middle East & Africa EMI/RFI Filtering Market Attractiveness Analysis, by Application

Figure 113: Middle East & Africa EMI/RFI Filtering Market Attractiveness Analysis, by Country

Figure 114: South America EMI/RFI Filtering Market Revenue (US$ Mn) Forecast, 2018–2030

Figure 115: South America EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 116: South America EMI/RFI Filtering Market Volume (Million Units) Forecast, 2018–2030

Figure 117: South America EMI/RFI Filtering Market Y-o-Y Growth Projection, 2018–2030

Figure 118: South America EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2020)

Figure 119: South America EMI/RFI Filtering Market Value Share Analysis, By Filter Type (2030)

Figure 120: South America EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2020)

Figure 121: South America EMI/RFI Filtering Market Volume Share Analysis, By Filter Type (2030)

Figure 122: South America EMI/RFI Filtering Market Value Share Analysis, By Design (2020)

Figure 123: South America EMI/RFI Filtering Market Value Share Analysis, By Design (2030)

Figure 124: South America EMI/RFI Filtering Market Value Share Analysis, By Application (2020)

Figure 125: South America EMI/RFI Filtering Market Value Share Analysis, By Application (2030)

Figure 126: South America EMI/RFI Filtering Market Value Share Analysis, by Country (2020F)

Figure 127: South America EMI/RFI Filtering Market Value Share Analysis, by Country (2030F)

Figure 128: South America EMI/RFI Filtering Market Volume Share Analysis, by Country (2020F)

Figure 129: South America EMI/RFI Filtering Market Volume Share Analysis, by Country (2030F )

Figure 130: South America EMI/RFI Filtering Market Attractiveness Analysis, By Filter Type

Figure 131: South America EMI/RFI Filtering Market Attractiveness Analysis, By Design

Figure 132: South America EMI/RFI Filtering Market Attractiveness Analysis, by Application

Figure 133: South America EMI/RFI Filtering Market Attractiveness Analysis, by Country

Figure 134: Global EMI/RFI Filtering Market Share Analysis, by Company