Labels are mainly used for any sequence of credentials, knowledge, warnings, direction for use, environmental advocacy, or promotional activity. Most labels are in the form of stickers, or temporary and permanent labels printed on the packaging. Due to its significant role in every industry, the shelf life of labels has become a critical concern for producers and consumers. Labels are used everywhere in the daily life. From individuals to big businesses, labels have their consumers in every industry. Thus, manufacturers have introduced eco-friendly labels for individuals with environmental concerns about waste labels and their contribution toward pollution, thus driving the eco-friendly labels market.

Environmentally favorable and organic products are idealized and evaluated positively compared to conventional alternatives. The planet is facing a sustainability challenge due to pollution, landfills, and non-recyclable scraps. In order to reduce the environmental impact of products, consumers are demanding environment-friendly packaging and labeling solutions. Eco-friendly labels limit pollution by reducing car carbon footprints. They are sustainable, biodegradable, and recyclable, and growing in popularity among consumers. These factors are fueling the growth of the eco-friendly labels market during the forecast period.

The growing demand for eco-friendly labels has enabled an extensive range of sustainable labels produced from renewable fabrics and papers, post-consumer scrap, dissolvable and repulpable papers, etc. With the rise of environment-conscious consumers around the world, the eco-friendly labels market is expected to grow during the forecast period. Eco-friendly labels have a variety of applications and markets, thus, they are made from various materials. Mostly, they are made to be applied on steel, metal, cardboard, and glass, depending on consumer demand.

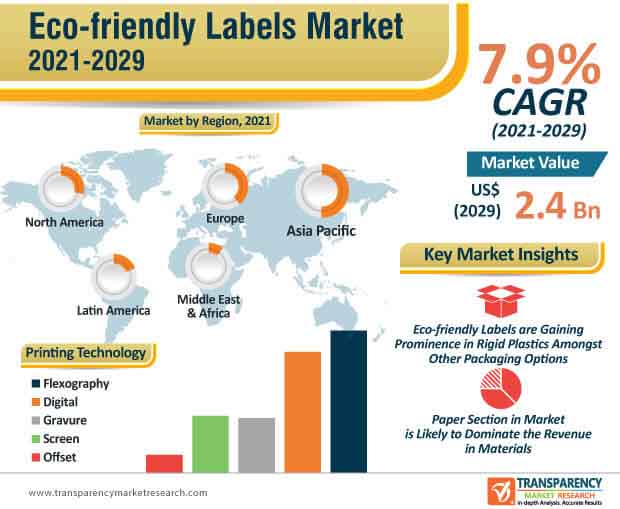

In the upcoming years, eco-friendly labels are anticipated to expand with the growth of the sustainable packaging segment. End-use industries such as food & beverages, cosmetics, and personal care are major consumers of eco-friendly labels. Sustainable market trends also include soy-based inks and renewable paper & films with corn-based products. All these factors are contributing to the growth of the eco-friendly labels market, which is expected to clock a CAGR of 7.9% during the forecast period.

The large eco-conscious consumer base in the North American countries is helping the region to dominate the eco-friendly labels market. Manufacturers in Europe are also moving from conventional to sustainable packaging solutions and expected to witness huge demand for eco-friendly labels. Some regions such as Latin America are still recovering from the recession of 2015. However, with eco-friendly labels in the retail sector, it is expected to rise in sales in the packaging industry.

Compared to North America and Europe, Asia Pacific is projected to account for the highest share of the eco-friendly labels market, with the market in the region anticipated to expand at a CAGR of 7.2% during the forecast period. Growing population and environmental awareness are driving the demand for eco-friendly products. China and India being the major consumer base, the eco-friendly labels market in the Asia Pacific is anticipated to create several opportunities. In many regions, government regulations are restricting the use of non-degradable and non-renewable materials in packaging products. This is likely to expand possibilities for the market in the upcoming years.

The eco-friendly labels market is expanding rapidly with few segments holding more value than others. Paper-based labels have witnessed increased demand in recent years, and expected to hold more than 4/5th of the value share during the forecast period. Paper segments such as matte and semi-gloss are anticipated to generate 130 bps of current market share in the upcoming future. Additionally, ease of application and good tear stability are influencing segments such as pressure sensitive labels, and are estimated to grow twice the present market value by 2029.

The technology and devices used in manufacturing are improved with the rising demand for labels in recent years. Printing technologies such as Flexography ensure the durability of inks and ease of printing. Such technologies are expected to remain profitable at a steady rate in upcoming years. Furthermore, owing to the excellent print quality of emerging technologies and environmental factors, the digital segment of the eco-friendly labels market is predicted to progress at a notable CAGR of 8.7% during the projected period.

The global eco-friendly labels market has witnessed a decline in sales, due to the COVID-19 pandemic. Barriers in the expansion of major end users, including pharmaceuticals, cosmetics, food & beverages, personal care, and others are major causes in the slump of the global market. Other significant factors such as disrupted supply chain management networks, limitations on trading activities, product management, and frequently varying financial conditions in many countries are hindering the growth of the eco-friendly labels market.

The declining eco-friendly labels market is anticipated to gain momentum from 2022, as the demand from the food & beverages industry is expected to rise shortly. On the other hand, the involvement of regulatory administrations for adequate planning and market players' competitive strategies are contributing toward the expansion of the eco-friendly labels market in the near future.

Analysts’ Viewpoint

In the upcoming years, the outlook toward sustainable packaging might change. The adoption of eco-friendly techniques in manufacturing processes and products is attracting a major consumer base across various industries. Apart from government regulatory authorities and industrial laws for the environment, consumers are now demanding and pressurizing label and packaging companies to limit the content of non-biodegradable elements in their products. The rising awareness regarding eco-friendly products in urban regions is expected to contribute to the growth of the eco-friendly labels market during the forecast period. The major factor restraining the growth for eco-friendly labels is the ongoing COVID-19 pandemic. Restricting working regulations for manufacturers across various industries, inconsistent trading laws, and limited workflow in the units are impacting the growth of the eco-friendly labels market. However, the market is anticipated to propel shortly due to the increased amount of vaccination and medical developments across the world.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Eco-friendly Labels Market Overview

3.1. Introduction

3.2. Global Packaging Growth Overview

3.3. Global Labels Market Growth Overview

3.4. Industry Trends and Recent Developments

3.5. Eco-friendly Labels Market and Y-o-Y Growth Analysis

3.6. Eco-friendly Labels Market (US$ Mn) and Forecast

3.7. Eco-friendly Labels Market Value Chain Analysis

3.7.1. Exhaustive List of Active Participants

3.7.1.1. Raw material Suppliers

3.7.1.2. Eco-friendly Labels Manufacturers

3.7.1.3. End User

3.7.2. Profitability Margins

4. Eco-friendly Labels Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

4.3. Macro-economic Factors – Correlation Analysis

4.4. Forecast Factors – Relevance & Impact

5. Eco-friendly Labels Market Dynamics

5.1. Drivers

5.1.1. Supply Side

5.1.2. Demand Side

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. Global Eco-friendly Labels Market Analysis and Forecast, By Material Type

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

6.1.2. Y-o-Y Growth Projections, By Material Type

6.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Material Type

6.2.1. Paper

6.2.1.1. Semi-gloss/Matte Paper

6.2.1.2. Vellum Paper

6.2.1.3. Direct thermal label paper

6.2.1.4. Others

6.2.2. Plastic

6.2.2.1. PLA

6.2.2.2. PHB

6.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Material Type

6.3.1. Paper

6.3.1.1. Semi-gloss/Matte Paper

6.3.1.2. Vellum Paper

6.3.1.3. Direct thermal label paper

6.3.1.4. Others

6.3.2. Plastic

6.3.2.1. PLA

6.3.2.2. PHB

6.4. Market Attractiveness Analysis, By Material Type

6.5. Prominent Trends

7. Global Eco-friendly Labels Market Analysis and Forecast, By Label Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Label Type

7.1.2. Y-o-Y Growth Projections, By Label Type

7.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

7.2.1. Pressure Sensitive Labels (PSL)

7.2.2. Shrink Labels

7.2.3. Stretch Labels

7.2.4. Wet Glue Labels

7.2.5. Others (In-mould, Pre-gummed, etc.)

7.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

7.3.1. Pressure Sensitive Labels (PSL)

7.3.2. Shrink Labels

7.3.3. Stretch Labels

7.3.4. Wet Glue Labels

7.3.5. Others (In-mould, Pre-gummed, etc.)

7.4. Market Attractiveness Analysis, By Label Type

7.5. Prominent Trends

8. Global Eco-friendly Labels Market Analysis and Forecast, By Printing Technology

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis By Printing Technology

8.1.2. Y-o-Y Growth Projections By Printing Technology

8.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

8.2.1. Flexography

8.2.2. Digital

8.2.3. Gravure

8.2.4. Screen

8.2.5. Offset

8.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029 By Printing Technology

8.3.1. Flexography

8.3.2. Digital

8.3.3. Gravure

8.3.4. Screen

8.3.5. Offset

8.4. Market Attractiveness Analysis By Printing Technology

8.5. Prominent Trends

9. Global Eco-friendly Labels Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By End Use

9.1.2. Y-o-Y Growth Projections By End Use

9.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

9.2.1. Food & beverages

9.2.2. Pharmaceuticals

9.2.3. Cosmetics & Personal Care

9.2.4. Homecare & Toiletries

9.2.5. Clothing & Apparels

9.2.6. Chemicals

9.2.7. Automotive

9.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029 By End Use

9.3.1. Food & beverages

9.3.2. Pharmaceuticals

9.3.3. Cosmetics & Personal Care

9.3.4. Homecare & Toiletries

9.3.5. Clothing & Apparels

9.3.6. Chemicals

9.3.7. Automotive

9.4. Market Attractiveness Analysis By End Use

9.5. Prominent Trends

10. North America Eco-friendly Labels Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Country

10.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Material Type

10.5. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2020-2029, By Material Type

10.5.1. Paper

10.5.1.1. Semi-gloss/Matte Paper

10.5.1.2. Vellum Paper

10.5.1.3. Direct thermal label paper

10.5.1.4. Others

10.5.2. Plastic

10.5.2.1. PLA

10.5.2.2. PHB

10.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

10.7. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

10.7.1. Pressure Sensitive Labels (PSL)

10.7.2. Shrink Labels

10.7.3. Stretch Labels

10.7.4. Wet Glue Labels

10.7.5. Others (In-mould, Pre-gummed,etc.)

10.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

10.8.1. Flexography

10.8.2. Digital

10.8.3. Gravure

10.8.4. Screen

10.8.5. Offset

10.9. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

10.10. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By End Use

10.10.1. Food & beverages

10.10.2. Pharmaceuticals

10.10.3. Cosmetics & Personal Care

10.10.4. Homecare & Toiletries

10.10.5. Clothing & Apparels

10.10.6. Chemicals

10.10.7. Automotive

10.11. Market Attractiveness Analysis

10.11.1. By Country

10.11.2. By Material

10.11.3. By Label Type

10.11.4. By Printing Technology

10.11.5. By End Use

10.12. Prominent Trends

11. Latin America Eco-friendly Labels Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Country

11.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Material Type

11.5. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2020-2029, By Material Type

11.5.1. Paper

11.5.1.1. Semi-gloss/Matte Paper

11.5.1.2. Vellum Paper

11.5.1.3. Direct thermal label paper

11.5.1.4. Others

11.5.2. Plastic

11.5.2.1. PLA

11.5.2.2. PHB

11.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

11.7. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

11.7.1. Pressure Sensitive Labels (PSL)

11.7.2. Shrink Labels

11.7.3. Stretch Labels

11.7.4. Wet Glue Labels

11.7.5. Others ( In-mould, Pre-gummed,etc.)

11.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

11.8.1. Flexography

11.8.2. Digital

11.8.3. Gravure

11.8.4. Screen

11.8.5. Offset

11.9. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

11.10. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By End Use

11.10.1. Food & beverages

11.10.2. Pharmaceuticals

11.10.3. Cosmetics & Personal Care

11.10.4. Homecare & Toiletries

11.10.5. Clothing & Apparels

11.10.6. Chemicals

11.10.7. Automotive

11.11. Market Attractiveness Analysis

11.11.1. By Country

11.11.2. By Material

11.11.3. By Label Type

11.11.4. By Printing Technology

11.11.5. By End Use

11.12. Prominent Trends

12. Europe Eco-friendly Labels Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Country

12.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029 By Country

12.3.1. Germany

12.3.2. Spain

12.3.3. Italy

12.3.4. France

12.3.5. U.K.

12.3.6. BENELUX

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

12.5. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

12.5.1. Pressure Sensitive Labels (PSL)

12.5.2. Shrink Labels

12.5.3. Stretch Labels

12.5.4. Wet Glue Labels

12.5.5. Others (In-mold, Pre-gummed, etc.)

12.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

12.6.1. Flexography

12.6.2. Digital

12.6.3. Gravure

12.6.4. Screen

12.6.5. Offset

12.7. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

12.8. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By End Use

12.8.1. Food & beverages

12.8.2. Pharmaceuticals

12.8.3. Cosmetics & Personal care

12.8.4. Homecare & Toiletries

12.8.5. Clothing & Apparels

12.8.6. Chemicals

12.8.7. Automobiles

12.9. Market Attractiveness Analysis

12.9.1. By Country

12.9.2. By Material

12.9.3. By Label Type

12.9.4. By Printing Technology

12.9.5. By End Use

12.10. Prominent Trends

13. Asia Pacific Eco-friendly Labels Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029 By Country

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Australia and New Zealand

13.3.6. South Korea

13.3.7. Rest of APAC

13.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

13.5. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

13.5.1. Pressure Sensitive Labels (PSL)

13.5.2. Shrink Labels

13.5.3. Stretch Labels

13.5.4. Wet Glue Labels

13.5.5. Others (In-mold, Pre-gummed, etc.)

13.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

13.6.1. Flexography

13.6.2. Digital

13.6.3. Gravure

13.6.4. Screen

13.6.5. Offset

13.7. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

13.8. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By End Use

13.8.1. Food & beverages

13.8.2. Pharmaceuticals

13.8.3. Cosmetics & Personal care

13.8.4. Homecare & Toiletries

13.8.5. Clothing & Apparels

13.8.6. Chemicals

13.8.7. Automobiles

13.9. Market Attractiveness Analysis

13.9.1. By Country

13.9.2. By Material

13.9.3. By Label Type

13.9.4. By Printing Technology

13.9.5. By End Use

13.10. Prominent Trends

14. Middle East & Africa Eco-friendly Labels Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029 By Country

14.3.1. North Africa

14.3.2. GCC countries

14.3.3. South Africa

14.3.4. Turkey

14.3.5. Israel

14.3.6. Rest of MEA

14.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Label Type

14.5. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By Label Type

14.5.1. Pressure Sensitive Labels (PSL)

14.5.2. Shrink Labels

14.5.3. Stretch Labels

14.5.4. Wet Glue Labels

14.5.5. Others (In-mold, Pre-gummed, etc.)

14.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By Printing Technology

14.6.1. Flexography

14.6.2. Digital

14.6.3. Gravure

14.6.4. Screen

14.6.5. Offset

14.7. Historical Market Value (US$ Mn) and Volume (Mn. Sq.M.), 2015-2020, By End Use

14.8. Market Size (US$ Mn) and Volume (Mn. Sq.M.) Forecast Analysis 2021-2029, By End Use

14.8.1. Food & beverages

14.8.2. Pharmaceuticals

14.8.3. Cosmetics & Personal care

14.8.4. Homecare & Toiletries

14.8.5. Clothing & Apparels

14.8.6. Chemicals

14.8.7. Automobiles

14.9. Market Attractiveness Analysis

14.9.1. By Country

14.9.2. By Material

14.9.3. By Label Type

14.9.4. By Printing Technology

14.9.5. By End Use

14.10. Prominent Trends

15. Competitive Landscape

15.1. Market Structure

15.2. Competition Dashboard

15.3. Company Market Share Analysis

15.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

15.5. Competition Deep Dive

15.5.1. SATO Holdings Corporation

15.5.1.1. Overview

15.5.1.2. Financials

15.5.1.3. Strategy

15.5.1.4. Recent Developments

15.5.1.5. SWOT Analysis

15.5.2. Elevate Packaging Inc.

15.5.2.1. Overview

15.5.2.2. Financials

15.5.2.3. Strategy

15.5.2.4. Recent Developments

15.5.2.5. SWOT Analysis

15.5.3. JK Labels

15.5.3.1. Overview

15.5.3.2. Financials

15.5.3.3. Strategy

15.5.3.4. Recent Developments

15.5.3.5. SWOT Analysis

15.5.4. VR Labels & Stickers

15.5.4.1. Overview

15.5.4.2. Financials

15.5.4.3. Strategy

15.5.4.4. Recent Developments

15.5.4.5. SWOT Analysis

15.5.5. CCL Industries

15.5.5.1. Overview

15.5.5.2. Financials

15.5.5.3. Strategy

15.5.5.4. Recent Developments

15.5.5.5. SWOT Analysis

15.5.6. Signal Ltd.

15.5.6.1. Overview

15.5.6.2. Financials

15.5.6.3. Strategy

15.5.6.4. Recent Developments

15.5.6.5. SWOT Analysis

15.5.7. Labels Plus

15.5.7.1. Overview

15.5.7.2. Financials

15.5.7.3. Strategy

15.5.7.4. Recent Developments

15.5.7.5. SWOT Analysis

15.5.8. Weber Packaging Solutions

15.5.8.1. Overview

15.5.8.2. Financials

15.5.8.3. Strategy

15.5.8.4. Recent Developments

15.5.8.5. SWOT Analysis

15.5.9. Crown Labels Mfg. Co. Ltd.

15.5.9.1. Overview

15.5.9.2. Financials

15.5.9.3. Strategy

15.5.9.4. Recent Developments

15.5.9.5. SWOT Analysis

15.5.10. Interfas

15.5.10.1. Overview

15.5.10.2. Financials

15.5.10.3. Strategy

15.5.10.4. Recent Developments

15.5.10.5. SWOT Analysis

15.5.11. Berkshire Labels

15.5.11.1. Overview

15.5.11.2. Financials

15.5.11.3. Strategy

15.5.11.4. Recent Developments

15.5.11.5. SWOT Analysis

15.5.12. WEAVABEL LTD.

15.5.12.1. Overview

15.5.12.2. Financials

15.5.12.3. Strategy

15.5.12.4. Recent Developments

15.5.12.5. SWOT Analysis

15.5.13. Zebra Technologies Corp.

15.5.13.1. Overview

15.5.13.2. Financials

15.5.13.3. Strategy

15.5.13.4. Recent Developments

15.5.13.5. SWOT Analysis

15.5.14. HERMA Labels

15.5.14.1. Overview

15.5.14.2. Financials

15.5.14.3. Strategy

15.5.14.4. Recent Developments

15.5.14.5. SWOT Analysis

15.5.15. The Label Makers Limited

15.5.15.1. Overview

15.5.15.2. Financials

15.5.15.3. Strategy

15.5.15.4. Recent Developments

15.5.15.5. SWOT Analysis

15.5.16. Hally Labels

15.5.16.1. Overview

15.5.16.2. Financials

15.5.16.3. Strategy

15.5.16.4. Recent Developments

15.5.16.5. SWOT Analysis

15.5.17. Blair Labeling Inc.

15.5.17.1. Overview

15.5.17.2. Financials

15.5.17.3. Strategy

15.5.17.4. Recent Developments

15.5.17.5. SWOT Analysis

15.5.18. Paramount Labels

15.5.18.1. Overview

15.5.18.2. Financials

15.5.18.3. Strategy

15.5.18.4. Recent Developments

15.5.18.5. SWOT Analysis

15.5.19. inkREADible Labels

15.5.19.1. Overview

15.5.19.2. Financials

15.5.19.3. Strategy

15.5.19.4. Recent Developments

15.5.19.5. SWOT Analysis

15.5.20. Genesis Patterns(Labels)

15.5.20.1. Overview

15.5.20.2. Financials

15.5.20.3. Strategy

15.5.20.4. Recent Developments

15.5.20.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

16. Assumptions and Acronyms Used

17. Research Methodology

List of Tables

Table 01: Global Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 02: Global Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 03: Global Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 04: Global Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 05: Global Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 06: Global Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 07: Global Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 08: Global Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 09: Global Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Region, 2015H-2029F

Table 10: Global Eco-friendly Labels Market Value (US$ Mn) Analysis by Region, 2015H-2029F

Table 11: North America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 12: North America Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 13: North America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 14: North America Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 15: North America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 16: North America Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 17: North America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 18: North America Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 19: North America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Region, 2015H-2029F

Table 20: North America Eco-friendly Labels Market Value (US$ Mn) Analysis by Region, 2015H-2029F

Table 21: Latin America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 22: Latin America Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 23: Latin America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 24: Latin America Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 25: Latin America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 26: Latin America Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 27: Latin America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 28: Latin America Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 29: Latin America Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Region, 2015H-2029F

Table 30: Latin America Eco-friendly Labels Market Value (US$ Mn) Analysis by Region, 2015H-2029F

Table 31: Europe Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 32: Europe Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 33: Europe Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 34: Europe Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 35: Europe Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 36: Europe Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 37: Europe Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 38: Europe Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 39: Europe Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Country, 2015H-2029F

Table 40: Europe Eco-friendly Labels Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 41: Asia Pacific Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 42: Asia Pacific Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 43: Asia Pacific Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 44: Asia Pacific Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 45: Asia Pacific Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 46: Asia Pacific Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 47: Asia Pacific Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 48: Asia Pacific Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 49: Asia Pacific Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Country, 2015H-2029F

Table 50: Asia Pacific Eco-friendly Labels Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 51: MEA Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Material, 2015H-2029F

Table 52: MEA Eco-friendly Labels Market Value (US$ Mn) Analysis by Material, 2015H-2029F

Table 53: MEA Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Label Type, 2015H-2029F

Table 54: MEA Eco-friendly Labels Market Value (US$ Mn) Analysis by Label Type, 2015H-2029F

Table 55: MEA Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Printing Technology, 2015H-2029F

Table 56: MEA Eco-friendly Labels Market Value (US$ Mn) Analysis by Printing Technology, 2015H-2029F

Table 57: MEA Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by End Use, 2015H-2029F

Table 58: MEA Eco-friendly Labels Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 59: MEA Eco-friendly Labels Market Volume (Mn. Sq.M) Analysis by Region, 2015H-2029F

Table 60: MEA Eco-friendly Labels Market Value (US$ Mn) Analysis by Region, 2015H-2029F

List of Figures

Figure 01: Global Eco-friendly Labels Market Share Analysis by Material, 2021E & 2029F

Figure 02: Global Eco-friendly Labels Market Y-o-Y Analysis by Material, 2020A-2029F

Figure 03: Global Eco-friendly Labels Market Attractiveness Analysis by Material, 2021E-2029F

Figure 04: Global Eco-friendly Labels Market Share Analysis by Label Type, 2021E & 2029F

Figure 05: Global Eco-friendly Labels Market Y-o-Y Analysis by Material, 2020A-2029F

Figure 06: Global Eco-friendly Labels Market Attractiveness Analysis by Material, 2021E-2029F

Figure 07: Global Eco-friendly Labels Market Share Analysis by Printing Technology, 2021E & 2029F

Figure 08: Global Eco-friendly Labels Market Y-o-Y Analysis by Printing Technology, 2020A-2029F

Figure 09: Global Eco-friendly Labels Market Attractiveness Analysis by Printing Technology, 2021E-2029F

Figure 10: Global Eco-friendly Labels Market Share Analysis by End Use, 2021E & 2029F

Figure 11: Global Eco-friendly Labels Market Y-o-Y Analysis by End Use, 2020A-2029F

Figure 12: Global Eco-friendly Labels Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 13: Global Eco-friendly Labels Market Share Analysis by Region, 2021E & 2029F

Figure 14: Global Eco-friendly Labels Market Y-o-Y Analysis by Region, 2020A-2029F

Figure 15: Global Eco-friendly Labels Market Attractiveness Analysis by Region, 2021E-2029F

Figure 16: North America Eco-friendly Labels Market Attractiveness Analysis by Material 2021(E) - 2029(F)

Figure 18: North America Eco-friendly Labels Market Value Share Analysis, by Printing Technology 2021(E) & 2029(F)

Figure 17: North America Eco-friendly Labels Market Value Share Analysis, by Label Type 2021(E) & 2029(F)

Figure 19: North America Eco-friendly Labels Market Attractiveness Analysis by End Use 2021(E) - 2029(F)

Figure 20: North America Eco-friendly Labels Market Value Share Analysis, by Country 2021(E) & 2029(F)

Figure 21: Latin America Eco-friendly Labels Market Attractiveness Analysis by Material 2021(E) - 2029(F)

Figure 23: Latin America Eco-friendly Labels Market Value Share Analysis, by Printing Technology 2021(E) & 2029(F)

Figure 22: Latin America Eco-friendly Labels Market Value Share Analysis, by Label Type 2021(E) & 2029(F)

Figure 24: Latin America Eco-friendly Labels Market Attractiveness Analysis by End Use 2021(E) - 2029(F)

Figure 25: Latin America Eco-friendly Labels Market Value Share Analysis, by Country 2021(E) & 2029(F)

Figure 26: Europe Eco-friendly Labels Market Attractiveness Analysis by Material 2021(E) - 2029(F)

Figure 28: Europe Eco-friendly Labels Market Value Share Analysis, by Printing Technology 2021(E) & 2029(F)

Figure 27: Europe Eco-friendly Labels Market Value Share Analysis, by Label Type 2021(E) & 2029(F)

Figure 29: Europe Eco-friendly Labels Market Attractiveness Analysis by End Use 2021(E) - 2029(F)

Figure 30: Europe Eco-friendly Labels Market Value Share Analysis, by Country 2021(E) & 2029(F)

Figure 31: Asia Pacific Eco-friendly Labels Market Attractiveness Analysis by Material 2021(E) - 2029(F)

Figure 33: Asia Pacific Eco-friendly Labels Market Value Share Analysis, by Printing Technology 2021(E) & 2029(F)

Figure 32: Asia Pacific Eco-friendly Labels Market Value Share Analysis, by Label Type 2021(E) & 2029(F)

Figure 34: Asia Pacific Eco-friendly Labels Market Attractiveness Analysis by End Use 2021(E) - 2029(F)

Figure 35: Asia Pacific Eco-friendly Labels Market Value Share Analysis, by Country 2021(E) & 2029(F)

Figure 36: MEA Eco-friendly Labels Market Attractiveness Analysis by Material 2021(E) - 2029(F)

Figure 38: MEA Eco-friendly Labels Market Value Share Analysis, by Printing Technology 2021(E) & 2029(F)

Figure 37: MEA Eco-friendly Labels Market Value Share Analysis, by Label Type 2021(E) & 2029(F)

Figure 39: MEA Eco-friendly Labels Market Attractiveness Analysis by End Use 2021(E) - 2029(F)

Figure 40: MEA Eco-friendly Labels Market Value Share Analysis, by Country 2021(E) & 2029(F)