Analysts’ Viewpoint on Digital Dose Inhalers Market Scenario

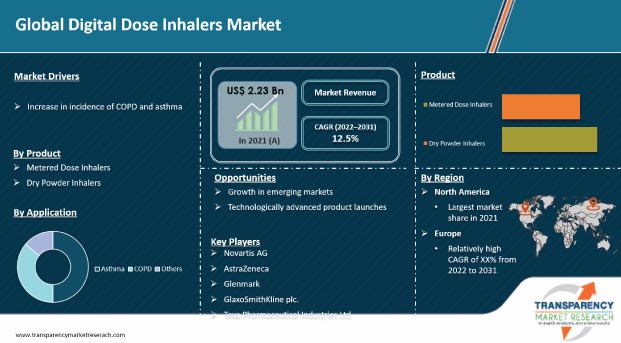

Digital dose inhalers, which feature sensors and wireless connectivity, help address the need for optimized adherence to maintenance medication in patients with respiratory diseases. Physicians tend to prescribe these products for respiratory diseases such as COPD and asthma. This is driving the digital dose inhalers market. Investment in technologically advanced products, such as smart inhalers, is expected to enable manufacturers to achieve high ROI. However, low awareness about digital dose inhalers among the population could hamper sales. Nevertheless, introduction of reimbursement plans to cushion healthcare expenditure is projected to lead to positive sentiment among patients toward effective treatment.

Digital dose inhalers are advanced, smart devices intended to treat and manage drug delivery for various respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD). Digital dose inhalers are used to provide a simple, accurate, and reliable dose counter, which enables patients to track adherence to their therapy. Increase in patient population, adoption of novel technologies, and surge in research & development in developed and developing countries are driving the global digital dose inhalers market. Furthermore, rise in prevalence of respiratory diseases such as asthma and COPD (chronic obstructive pulmonary disorder) across the globe and increase in geriatric population are projected to drive the global digital dose inhalers market in the next few years. Thus, demand for digital inhalers for chronic obstructive pulmonary disease is anticipated to increase substantially across the globe. Introduction of data integration with EHR (electronic health records) or EMR (electronic medical records) is a major trend in the global digital dose inhalers market. However, management of chronic airway diseases is 10% medication and 90% education. Inability of patients to effectively use inhaler devices can be largely ascribed to deficiencies in clinicians’ knowledge of inhaler techniques. Thus, lack of knowledge, awareness, and training required to instruct patients in proper usage of digital inhalers is restraining the global digital dose inhalers market.

Emerging economies such as India, China, Brazil, and Mexico offer significant opportunities in the global digital dose inhalers market. Presence of large geriatric population; government initiatives to improve healthcare sector; rise in research & development activities; and increase in pollution, allergens, and occupational dust are factors driving the market in these countries. The highest rate of hospitalization in India is for cardiac and respiratory problems, and for asthma in Bangladesh. In 2020, the WHO estimated geriatric population of around 1,000 million, with 700 million of them living in developing countries. This offers lucrative opportunities for market players.

Request a sample to get extensive insights into the Digital Dose Inhalers Market

The outbreak of COVID-19 has had a positive effect on the global digital dose inhalers market. Governments of affected countries gave instructions for the postponement of non-essential surgeries and patient visits. Respiratory support devices such as atomizers, life-support machines, oxygen generators, and monitors are among the majorly used medical devices in primary clinical treatment. Hence, COVID-19 has led to a surge in demand for these products. Furthermore, worsening of the pandemic situation affected the supply and demand gap and increased the demand for digital dose inhaler devices. Patients with asthma are at a higher risk of contracting COVID-19. As the virus continues to spread, hospitals are increasingly using metered dose inhaler. COVID-19 is sparking fear of medication shortage and panic buying, which could lead to a shortage of critical inhalers. Therefore, increase in panic buying, high risk of COVID-19 among patients with respiratory diseases, and high demand and supply gap are driving the global digital dose inhalers market.

In terms of product, the metered dose inhalers segment accounted for major share of the global digital dose inhalers market in 2021. This can be ascribed to the rise in penetration and product launch of metered dose inhalers; and increase in awareness about these products among patients. According to NCBI, the inherent multi-dose nature of MDIs makes them more affordable than most competing inhalation delivery systems. Thu, metered dose inhalers are considered highly popular inhalers to treat local respiratory diseases such as asthma and COPD.

Increase in regulatory approvals is driving the metered dose inhalers segment. For instance, in December 2018, AstraZeneca received approval from the European Commission (EC) for Bevespi Aerosphere, which is used in a pressurized metered dose inhaler (pMDI) indicated as maintenance dual bronchodilator treatment in adult patients with COPD. This approval enabled the company to add a technologically advanced product to its existing product offerings for patients in Europe.

Request a custom report on Digital Dose Inhalers Market

In terms of application, the asthma segment accounted for significant share of the global digital dose inhalers market in 2021. This can be ascribed to high prevalence and product launches. According to the WHO, asthma was a major non-communicable disease in 2019. Asthma affected an estimated 262 million people and caused 455,000 deaths in 2019. According to the Asthma and Allergy Foundation of America, more than 26 million people in the U.S. suffer from asthma. Incidence of asthma has been increasing since the early 1980s in all ages, sexes, and racial groups.

Rise in launch of digital inhalers for asthma is driving the asthma segment. For instance, in January 2017, Teva Pharmaceutical Industries Ltd. announced that the U.S. Food and Drug Administration (FDA) approved two of its products for adolescent and adult patients with asthma. These products, i.e. AirDuo RespiClick (fluticasone propionate and salmeterol inhalation powder) and ArmonAir RespiClick (fluticasone propionate inhalation powder), include medication delivered via Teva’s RespiClick breath-activated, multi-dose dry powder inhaler (mDPI), which is also used with other approved medicines from Teva’s respiratory inhaler product portfolio.

North America dominated the global digital dose inhalers market in 2021. The region’s dominance of the global market can be ascribed to high prevalence and increase in incidence of COPD and asthma in the U.S. and Canada; well-established healthcare infrastructure; and high risk of lifestyle-related diseases. Furthermore, increase in trend of smoking in North America is propelling the risk of asthma. Smoking is directly responsible for around 90% of lung cancer deaths and nearly 80% of deaths caused by chronic obstructive pulmonary disease (COPD) including emphysema and chronic bronchitis. Additionally, robust product pipeline of key players is projected to drive the global digital dose inhalers market in North America.

Asia Pacific is anticipated to be the fastest growing market for digital dose inhalers during the forecast period. China dominated the digital dose inhalers market in the region in 2021. The digital dose inhalers market in India is likely to grow at a high CAGR during the forecast period. According to Lung India, a recent Indian study on Epidemiology of Asthma, Respiratory Symptoms and Chronic Bronchitis (INSEARCH) conducted on 85,105 men and 84,470 women from 12 urban and 11 rural sites in India, the rate of prevalence of asthma in India stands at 2.05% among individuals aged over 15 years, with a burden of around 18 million asthma patients across the country.

The digital dose inhalers market in Latin America and Middle East & Africa is likely to grow at a decent CAGR owing to the increase in respiratory disease patient pool and focus of manufacturers on the development of novel products.

This report includes vital information about the key players operating in the global digital dose inhalers market. Digital dose inhaler companies are focusing on strategies such as new product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Novartis AG, AstraZeneca, Glenmark, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., 3M, Sensirion AG Switzerland, AptarGroup, Inc., Cipla, Inc., and H&T Presspart Manufacturing Ltd. are the prominent players operating in the global digital dose inhalers market.

Each of these players has been profiled in the digital dose inhalers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.23 Bn |

|

Market Forecast Value in 2031 |

More than US$ 7.22 Bn |

|

Compound Annual Growth Rate (CAGR) |

12.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global digital dose inhalers market was valued at US$ 2.23 Bn in 2021.

The global digital dose inhalers market is projected to reach more than US$ 7.22 Bn by 2031.

The global digital dose inhalers market is anticipated to grow at a CAGR of 12.5% from 2022 to 2031.

Increase in incidence of COPD and asthma is driving the global digital dose inhalers market

North America is expected to account for major share of the global digital dose inhalers market during the forecast period

Novartis AG, AstraZeneca, Glenmark, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., 3M, Sensirion AG Switzerland, AptarGroup, Inc., Cipla, Inc., and H&T Presspart Manufacturing Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Digital Dose Inhalers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Digital Dose Inhalers Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Technological Advancements

5.2. Key Industry Events (Mergers, Acquisitions, Product Launch , etc.)

5.3. Epidemiology of Respiratory Diseases, such as Asthma, COPD (Chronic Obstructive Pulmonary Disease),etc.

6. Global Digital Dose Inhalers Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Metered Dose Inhalers

6.3.2. Dry Powder Inhalers

6.4. Market Attractiveness Analysis, by Product

7. Global Digital Dose Inhalers Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Asthma

7.3.2. COPD (chronic obstructive pulmonary disease)

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Digital Dose Inhalers Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Digital Dose Inhalers Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Metered Dose Inhalers

9.2.2. Dry Powder Inhalers

9.3. Market Value Forecast, by Application, 2017–2031

9.3.1. Asthma

9.3.2. COPD (chronic obstructive pulmonary disease)

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Application

9.5.3. By Country

10. Europe Digital Dose Inhalers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Metered Dose Inhalers

10.2.2. Dry Powder Inhalers

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Asthma

10.3.2. COPD (chronic obstructive pulmonary disease)

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Asia Pacific Digital Dose Inhalers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Metered Dose Inhalers

11.2.2. Dry Powder Inhalers

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Asthma

11.3.2. COPD (chronic obstructive pulmonary disease)

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Application

11.5.3. By Country/Sub-region

12. Latin America Digital Dose Inhalers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Metered Dose Inhalers

12.2.2. Dry Powder Inhalers

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Asthma

12.3.2. COPD (chronic obstructive pulmonary disease)

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Middle East & Africa Digital Dose Inhalers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Metered Dose Inhalers

13.2.2. Dry Powder Inhalers

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Asthma

13.3.2. COPD (chronic obstructive pulmonary disease)

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Israel

13.4.4. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Application

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share/Position Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Novartis AG

14.3.1.1. Company Overview

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. AstraZeneca

14.3.2.1. Company Overview

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Glenmark

14.3.3.1. Company Overview

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. GlaxoSmithKline plc

14.3.4.1. Company Overview

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Teva Pharmaceutical Industries Ltd.

14.3.5.1. Company Overview

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. 3M

14.3.6.1. Company Overview

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Sensirion AG Switzerland

14.3.7.1. Company Overview

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. AptarGroup, Inc.

14.3.8.1. Company Overview

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. Cipla, Inc.

14.3.9.1. Company Overview

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. H&T Presspart Manufacturing Ltd.

14.3.10.1. Company Overview

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

*Note: Financial details for companies that do not report this information in public domain might not be captured

List of Tables

Table 01: Epidemiology of Respiratory Diseases, such as Asthma, COPD (Chronic Obstructive Pulmonary Disease), etc.

Table 02: Epidemiology of Respiratory Diseases, such as Asthma, COPD (Chronic Obstructive Pulmonary Disease), etc.

Table 03: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 04: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Digital Dose Inhalers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Asia Pacific Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Latin America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Latin America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 17: Latin America Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Middle East & Africa Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Middle East & Africa Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 20: Middle East & Africa Digital Dose Inhalers Market Value (US$ Mn) Forecast, by Application, 2017–2031

List of Figures

Figure 01: Global Digital Dose Inhalers Market Size (US$ Mn) and Distribution, by Region, 2021 and 2031

Figure 02: Global Digital Dose Inhalers Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 04: Global Digital Dose Inhalers Market Value Share (%), by Product, 2021 and 2031

Figure 05: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Metered Dose Inhalers, 2017–2031

Figure 06: Global Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Dry Powder Inhalers, 2017–2031

Figure 07: Global Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 08: Global Digital Dose Inhalers Market Value Share, by Application, 2021 and 2031

Figure 09: Global Digital Dose Inhalers Market Attractiveness Analysis, by Application, 2017–2031

Figure 10: Global Digital Dose Inhalers Market Value (US$ Mn) and Y-o-Y Growth, by Asthma, 2017–2031

Figure 11: Global Digital Dose Inhalers Market Value (US$ Mn) and Y-o-Y Growth, by COPD (chronic obstructive pulmonary disease), 2017–2031

Figure 12: Global Digital Dose Inhalers Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2031

Figure 13: Global Digital Dose Inhalers Market Value Share, by Region, 2021 and 2031

Figure 14: Global Digital Dose Inhalers Market Attractiveness Analysis, by Region, 2017–2031

Figure 15: North America Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 16: North America Digital Dose Inhalers Market Value Share (%), by Country, 2021 and 2031

Figure 17: North America Digital Dose Inhalers Market Attractiveness Analysis, by Country, 2017–2031

Figure 18: North America Digital Dose Inhalers Market Value Share, by Product, 2021 and 2031

Figure 19: North America Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 20: North America Digital Dose Inhalers Market Value Share Analysis, by Application, 2021 and 2031

Figure 21: North America Digital Dose Inhalers Market Attractiveness Analysis, by Application, 2017–2031

Figure 22: Europe Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 23: Europe Digital Dose Inhalers Market Value Share (%), by Country / Sub-region, 2021 and 2031

Figure 24: Europe Digital Dose Inhalers Market Attractiveness Analysis, by Country / Sub-region, 2017–2031

Figure 25: Europe Digital Dose Inhalers Market Value Share, by Product, 2021 and 2031

Figure 26: Europe Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 27: Europe Digital Dose Inhalers Market Value Share Analysis, by Application, 2021 and 2031

Figure 28: Europe Digital Dose Inhalers Market Attractiveness Analysis, by Application, 2017–2031

Figure 29: Asia Pacific Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 30: Asia Pacific Digital Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 31: Asia Pacific Digital Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 32: Asia Pacific Digital Dose Inhalers Market Value Share, by Product, 2021 and 2031

Figure 33: Asia Pacific Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 34: Asia Pacific Digital Dose Inhalers Market Value Share Analysis, by Application, 2021 and 2031

Figure 35: Asia Pacific Digital Dose Inhalers Market Attractiveness Analysis, by Application, 2017–2031

Figure 36: Latin America Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 37: Latin America Digital Dose Inhalers Market Value Share (%), by Country / Sub-region, 2021 and 2031

Figure 38: Latin America Digital Dose Inhalers Market Attractiveness Analysis, by Country / Sub-region, 2017–2031

Figure 39: Latin America Digital Dose Inhalers Market Value Share, by Product, 2021 and 2031

Figure 40: Latin America Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 41: Latin America Digital Dose Inhalers Market Value Share Analysis, by Application, 2021 and 2031

Figure 42: Latin America Digital Dose Inhalers Market Attractiveness Analysis, by Application, 2017–2031

Figure 43: Middle East & Africa Digital Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 44: Middle East & Africa Digital Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 45: Middle East & Africa Digital Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 46: Middle East & Africa Digital Dose Inhalers Market Value Share, by Product, 2021 and 2031

Figure 47: Middle East & Africa Digital Dose Inhalers Market Attractiveness Analysis, by Product, 2017–2031

Figure 48: Middle East & Africa Digital Dose Inhalers Market Value Share Analysis, by Application, 2021 and 2031

Figure 49: Middle East & Africa Digital Dose Inhalers Market Attractiveness, by Application, 2017–2031

Figure 50: Novartis AG Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 51: Novartis AG R&D Intensity and Sales & Marketing Intensity - Company Level, 2017–2021

Figure 52: Novartis AG Breakdown of Net Sales (%), by Region, 2021

Figure 53: Novartis AG Breakdown of Net Sales (%), by Business Segment, 2021

Figure 54: AstraZeneca Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 55: AstraZeneca R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 56: AstraZeneca Breakdown of Net Sales (%), by Region, 2021

Figure 57: AstraZeneca Respiratory Segment Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 58: Glenmark (US$ Mn) Revenue, 2017–2021

Figure 59: Distribution of Glenmark Revenue (%), by Region, 2021

Figure 60: GlaxoSmithKline plc. Revenue (US$ Mn), 2017–2021

Figure 61: GlaxoSmithKline plc. R&D Expenses (US$ Mn), 2017–2021

Figure 62: GlaxoSmithKline plc. Breakdown of Net Sales (%), by Region, 2021

Figure 63: GlaxoSmithKline plc. Breakdown of Net Sales (%), by Business Segment, 2021

Figure 64: Teva Pharmaceutical Industries Ltd Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 65: Teva Pharmaceutical Industries Ltd R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2021

Figure 66: Teva Pharmaceutical Industries Ltd Breakdown of Net Sales (%), by Region, 2021

Figure 67: 3M , Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2021

Figure 68: 3M , R&D Expenses (US$ Mn) & Y-o-Y Growth (%), 2016-2021

Figure 69: 3M, Breakdown of Net Sales (%), by Region, 2021

Figure 70: 3M Breakdown of Net Sales (%), by Business Segment, 2021

Figure 71: Sensirion AG Switzerland, Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2021

Figure 72: Sensirion AG Switzerland, R&D Expenses (US$ Mn), 2017-2021

Figure 73: Sensirion AG Switzerland, Breakdown of Net Sales (%), by Region, 2021

Figure 74: Sensirion AG Switzerland, Breakdown of Net Sales (%), by Business Segment, 2021

Figure 75: AptarGroup, Inc., Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2021

Figure 76: AptarGroup, Inc., R&D Expenses (US$ Mn), 2016-2021

Figure 77: AptarGroup, Inc., Breakdown of Net Sales (%), by Region, 2021

Figure 78: AptarGroup, Inc., Breakdown of Net Sales (US$ Mn), by Business Segment, 2021

Figure 79: Cipla Inc., Revenue (US$ Mn), 2017–2021

Figure 80: Cipla Inc., Breakdown of Net Sales (%), by Region, 2021

Figure 81: Cipla Inc., Breakdown of Net Sales (%), by Business Segment, 2021