Analysts’ Viewpoint

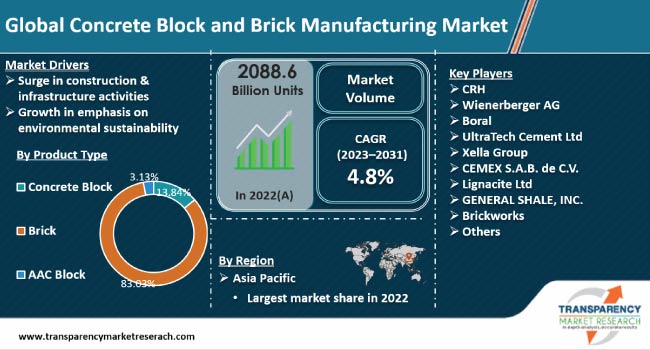

Changing environments defined by rapid urbanization, infrastructure development, and sustainable construction methods are expected to fuel the concrete block and brick manufacturing market size during the forecast period.

Demand for concrete blocks and bricks is robust as worldwide building activity continues to rise. Urbanization trends, particularly in emerging nations, are boosting the demand for long-lasting and cost-effective construction materials, propelling market progress.

Technological innovations play an important role in this landscape, boosting manufacturing efficiency and broadening the spectrum of accessible materials. Furthermore, the emphasis on sustainable buildings are increasingly driving innovations in eco-friendly materials and resource-efficient production methods. As the industry navigates these trends, technical improvements, and a dedication to environmental responsibility, are significant drivers affecting the trajectory of the concrete block and brick manufacturing market growth.

The concrete block and brick manufacturing industry is a cornerstone industry in the global construction scene, supplying key building materials for a wide range of projects. The significance of this sector is inextricably linked to the ever-expanding area of building operations globally.

As urbanization accelerates, resulting in vast cities and infrastructure expansions, the demand for concrete blocks and bricks is expected to rise sharply. These adaptable and long-lasting building materials are used in residential, commercial, and industrial construction, serving as the essential building blocks of modern construction.

The market's growth is not only propelled by the sheer volume of construction projects but also by the industry's responsiveness to evolving trends. Governments and industries worldwide are emphasizing the importance of green building solutions, and the concrete block and brick manufacturing sector is actively contributing to this paradigm shift.

As the world's population continues to urbanize and sustainability becomes more important, the concrete block and brick manufacturing market is at the forefront of defining the built environment, assuring a balance of durability, affordability, and environmental responsibility.

As nations embark on ambitious urbanization and infrastructure development projects, the need for dependable and adaptable building materials such as concrete blocks and bricks has reached new heights. The development of the construction industry encompasses residential, commercial, and industrial projects, all of which rely largely on the consistent and considerable supply of these materials.

The emphasis on smart city initiatives and sustainable urban development fuels the need for efficient and long-lasting construction solutions, propelling the concrete block and brick manufacturing industry demand forward.

Infrastructure projects, such as roads, bridges, and public utility development, offer lucrative opportunities for market expansion. Concrete blocks and bricks are vital in infrastructure building due to their durability and adaptability. Governments throughout the world are investing substantially in such projects to improve connectivity and generate economic growth, increasing long-term demand for these critical architectural components.

Thus, the surge in building and infrastructure activities throughout the world is a major factor boosting the concrete block and brick manufacturing market revenue.

One of the major concrete block and brick manufacturing market trends is the increased emphasis on environmental sustainability. The focus on green and sustainable construction processes has a substantial influence on demand for eco-friendly building materials. Concrete blocks and bricks, particularly Autoclaved Aerated Concrete (AAC) blocks, have emerged as significant participants in this paradigm change.

AAC blocks, noted for their lightweight nature and thermal insulation capabilities, are gaining popularity as an environmentally viable option. When compared to typical clay bricks, the production process for AAC blocks has a lower environmental effect, resulting in lower energy usage and emissions. This is in line with the growth in demand for building materials that contribute to energy efficiency and carbon footprint reduction.

The emphasis on sustainable construction extends to the lifespan of the building itself. Because of its insulating characteristics, AAC blocks help in energy efficiency by minimizing the need for extra heating or cooling. As a result, they are a popular choice among ecologically aware builders and architects seeking to achieve green construction requirements and certifications. As the industry continues to prioritize environmental responsibility, AAC blocks are poised to play a critical role in addressing the need for sustainable construction solutions.

Asia Pacific dominated the worldwide concrete block and brick manufacturing market in 2022 and its dominance is predicted to grow further during the forecast period. The region is home to more than half of the world's brick kilns and is experiencing a significant increase in demand for bricks, mostly due to surge in construction activity.

In contrast, Europe, with a market share of 5.17% in 2022, is predicted to have a small loss in market share by the end of the forecast period. As per the latest concrete block and brick manufacturing market forecast, Latin America and Middle East & Africa are positioned for moderate growth, reflecting the regions consistent pace of increase in building activity. As building remains a primary driver of demand for concrete blocks and bricks, these regional dynamics reflect the industry's changing environment, affected by differing degrees of market growth and variations in market share throughout the forecast years.

The cutting-edge concrete block and brick manufacturing industry is dominated by multiple companies who employ a number of strategies to expand their market share and retain their leadership. Most firms are investing significantly in the R&D of new products to expand their product portfolio. Manufacturers are also collaborating with other companies to increase their concrete block and brick manufacturing market share.

CRH, Wienerberger AG, Boral, UltraTech Cement Ltd, Xella Group, CEMEX S.A.B. de C.V., Lignacite Ltd, GENERAL SHALE, INC., Brickworks, Midwest Block & Brick, Monaprecast, Midland Concrete Products, Magicrete Building Solutions Pvt. Ltd., and Lightweight Construction Co. (LCC-Siporex) are the significant players in the market.

Each of these companies has been profiled in the concrete block and brick manufacturing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | 2,088.6 Billion Units |

| Forecast (Volume) in 2031 | 3,198.3 Billion Units |

| Growth Rate (CAGR) | 4.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | Billion Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It stood at 2,088.6 Billion Units in 2022

The CAGR is projected to be 4.8% from 2023 to 2031

Surge in construction & infrastructure activities, and emphasis on environmental sustainability

Brick held the largest share under the product type segment in 2022

Asia Pacific was the most lucrative region in 2022

CRH, Wienerberger AG, Boral, UltraTech Cement Ltd, Xella Group, CEMEX S.A.B. de C.V., Lignacite Ltd, GENERAL SHALE, INC., Brickworks, Midwest Block & Brick, Monaprecast, Midland Concrete Products, Magicrete Building Solutions Pvt. Ltd., and Lightweight Construction Co. (LCC-Siporex)

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Concrete Block and Brick Manufacturing Market Analysis and Forecasts, 2023-2031

2.6.1. Concrete Block and Brick Manufacturing Market Volume (Billion Units)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Concrete Block and Brick Manufacturing

3.2. Impact on the Demand for Concrete Block and Brick Manufacturing– Pre & Post Crisis

4. Production Output Analysis (Billion Units), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Concrete Block and Brick Manufacturing Market Analysis and Forecast, by Product Type, 2023-2031

6.1. Introduction and Definitions

6.2. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

6.2.1. Concrete Block

6.2.1.1. Hollow

6.2.1.2. Cellular

6.2.1.3. Fully Solid

6.2.1.4. Others

6.2.2. Brick

6.2.2.1. Clay

6.2.2.2. Sand Lime

6.2.2.3. Fly Ash Clay

6.2.2.4. Others

6.2.3. AAC Block

6.3. Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

7. Concrete Block and Brick Manufacturing Market Analysis and Forecast, by Region, 2023-2031

7.1. Key Findings

7.2. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Region, 2023-2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Concrete Block and Brick Manufacturing Market Attractiveness, by Region

8. North America Concrete Block and Brick Manufacturing Market Analysis and Forecast, 2023-2031

8.1. Key Findings

8.2. North America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

8.3. North America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country, 2023-2031

8.3.1. U.S. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

8.3.2. Canada Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

8.4. North America Concrete Block and Brick Manufacturing Market Attractiveness Analysis

9. Europe Concrete Block and Brick Manufacturing Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.2. Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.3. Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2021-2031

9.3.1. Germany Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Type, 2023-2031

9.3.2. France Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.3.3. U.K. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.3.4. Italy Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.3.5. Russia & CIS Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.3.6. Rest of Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

9.4. Europe Concrete Block and Brick Manufacturing Market Attractiveness Analysis

10. Asia Pacific Concrete Block and Brick Manufacturing Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type

10.3. Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2021-2031

10.3.1. China Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

10.3.2. Japan Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

10.3.3. India Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

10.3.4. ASEAN Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

10.3.5. Rest of Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

10.4. Asia Pacific Concrete Block and Brick Manufacturing Market Attractiveness Analysis

11. Latin America Concrete Block and Brick Manufacturing Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

11.3. Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2021-2031

11.3.1. Brazil Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

11.3.2. Mexico Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

11.3.3. Rest of Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

11.4. Latin America Concrete Block and Brick Manufacturing Market Attractiveness Analysis

12. Middle East & Africa Concrete Block and Brick Manufacturing Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

12.3. Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2021-2031

12.3.1. GCC Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

12.3.2. South Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

12.3.3. Rest of Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

12.4. Middle East & Africa Concrete Block and Brick Manufacturing Market Attractiveness Analysis

13. Competition Landscape

13.1. Concrete Block and Brick Manufacturing Company Market Share Analysis, 2021

13.1.1. CRH

13.1.1.1. Company Revenue

13.1.1.2. Business Overview

13.1.1.3. Product Segments

13.1.1.4. Geographic Footprint

13.1.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.2. Wienerberger AG

13.1.2.1. Company Revenue

13.1.2.2. Business Overview

13.1.2.3. Product Segments

13.1.2.4. Geographic Footprint

13.1.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.3. Boral

13.1.3.1. Company Revenue

13.1.3.2. Business Overview

13.1.3.3. Product Segments

13.1.3.4. Geographic Footprint

13.1.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.4. UltraTech Cement Ltd

13.1.4.1. Company Revenue

13.1.4.2. Business Overview

13.1.4.3. Product Segments

13.1.4.4. Geographic Footprint

13.1.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.5. Xella Group

13.1.5.1. Company Revenue

13.1.5.2. Business Overview

13.1.5.3. Product Segments

13.1.5.4. Geographic Footprint

13.1.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.6. CEMEX S.A.B. de C.V.

13.1.6.1. Company Revenue

13.1.6.2. Business Overview

13.1.6.3. Product Segments

13.1.6.4. Geographic Footprint

13.1.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.7. Lignacite Ltd

13.1.7.1. Company Revenue

13.1.7.2. Business Overview

13.1.7.3. Product Segments

13.1.7.4. Geographic Footprint

13.1.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.8. GENERAL SHALE, INC.

13.1.8.1. Company Revenue

13.1.8.2. Business Overview

13.1.8.3. Product Segments

13.1.8.4. Geographic Footprint

13.1.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.9. Brickworks

13.1.9.1. Company Revenue

13.1.9.2. Business Overview

13.1.9.3. Product Segments

13.1.9.4. Geographic Footprint

13.1.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.10. Midwest Block & Brick

13.1.10.1. Company Revenue

13.1.10.2. Business Overview

13.1.10.3. Product Segments

13.1.10.4. Geographic Footprint

13.1.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.11. Monapercast

13.1.11.1. Company Revenue

13.1.11.2. Business Overview

13.1.11.3. Product Segments

13.1.11.4. Geographic Footprint

13.1.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.12. Midland Concrete Products

13.1.12.1. Company Revenue

13.1.12.2. Business Overview

13.1.12.3. Product Segments

13.1.12.4. Geographic Footprint

13.1.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.13. Magicrete Building Solutions Pvt. Ltd.

13.1.13.1. Company Revenue

13.1.13.2. Business Overview

13.1.13.3. Product Segments

13.1.13.4. Geographic Footprint

13.1.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.1.14. Lightweight Construction Co. (LCC-Siporex)

13.1.14.1. Company Revenue

13.1.14.2. Business Overview

13.1.14.3. Product Segments

13.1.14.4. Geographic Footprint

13.1.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.1.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14. Primary Research: Key Insights

15. Appendix

List of Tables

Table 1: Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 2: Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Region, 2023-2031

Table 3: North America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 4: North America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country, 2023-2031

Table 5: U.S. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 6: Canada Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 7: Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 8: Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023-2031

Table 9: Germany Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 10: France Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 11: U.K. Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 12: Italy Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 13: Spain Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 14: Russia & CIS Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 15: Rest of Europe Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 16: Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 17: Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023-2031

Table 18: China Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 19: Japan Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 20: India Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 21: ASEAN Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 22: Rest of Asia Pacific Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 23: Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 24: Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023-2031

Table 25: Brazil Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 26: Mexico Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 27: Rest of Latin America Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 28: Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 29: Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023-2031

Table 30: GCC Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 31: South Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

Table 32: Rest of Middle East & Africa Concrete Block and Brick Manufacturing Market Volume (Billion Units) Forecast, by Product Type, 2023-2031

List of Figures

Figure 1: Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 2: Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 3: Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Concrete Block and Brick Manufacturing Market Attractiveness, by Region

Figure 5: North America Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 6: North America Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 7: North America Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 8: North America Concrete Block and Brick Manufacturing Market Attractiveness, by Country and Sub-region

Figure 9: Europe Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 10: Europe Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 11: Europe Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Concrete Block and Brick Manufacturing Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 14: Asia Pacific Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 15: Asia Pacific Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Concrete Block and Brick Manufacturing Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 18: Latin America Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 19: Latin America Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Concrete Block and Brick Manufacturing Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Product Type, 2023,2027, and 2031

Figure 22: Middle East & Africa Concrete Block and Brick Manufacturing Market Attractiveness, by Product Type

Figure 23: Middle East & Africa Concrete Block and Brick Manufacturing Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Concrete Block and Brick Manufacturing Market Attractiveness, by Country and Sub-region