The future of the composites market appears promising, with prospects in aerospace, automotive and transportation, construction, wind energy, marine, and electrical and electronics, among others. The global composites market is expected to reach US$ 101.8773 billion, expanding at a CAGR of 8.9% from 2017 to 2025 (forecast period). Increasing demand for lightweight materials in the aerospace and automotive industries are the primary factors driving the composites market.

Carbon fiber reinforced plastics (CFRPs) are among the most popular products in the worldwide composites market due to features such as excellent tensile strength, fatigue resistance, and improved modulus. The CFRP has a wide range of applications in aircraft and component manufacturing due to its improved performance under harsh circumstances. The industry is embracing these composite materials to meet the demand for lighter aircraft with lower fuel consumption. CFRPs are the main revenue generators for the participants operating in the global composites market due to their strong demand in the aircraft manufacturing sector. In terms of revenue, the CFPR segment is projected to generate US$ 10276.2 million by the end of 2025, providing growth opportunities for the participants.

Composite materials have several applications in the automotive and transportation segment due to numerous benefits such as weight-to-strength advantage and reusability. Composites are used in the manufacture of cars, motorbikes, and cycles. The exhilarating sense of speed in numerous sports vehicles is accomplished by the use of long-lasting and lightweight composite materials such as carbon fiber. Composites are used to make the chassis of several two-wheelers and cycles. Moreover, the growing electrification of vehicles to replace traditional fuels has greatly expanded the use of composites in the automotive industry. Due to the widespread usage of composite materials, the segment is projected to outperform all other segments in the global composites market. The segment's dominance is also a result of the use of novel composite materials in automobile manufacture, which can increase a vehicle's fuel efficiency.

Several studies have shown that lowering the weight of the vehicle by 10% can increase the economy by 8%. Businesses that replace traditional cast iron and steel components with lightweight materials like glass fiber polymer can immediately enhance vehicle effectiveness by 50%. As a consequence, many manufacturers are using composites materials in their vehicles, which is fueling the expansion of the segment in the global composites market.

The manufacturing resources become prohibitively expensive owing to the long cycle time necessary to create composite materials. Due to this, the price of carbon and glass fibers that are essential in the manufacturing of composite materials also increases. The high cost of manufacturing materials is likely to stymie the expansion of the global composites market from 2017 to 2025. However, in collaboration with composite material manufacturers, numerous automotive OEMs are working on creating new methods and technologies that can produce composite materials faster. This is expected to reduce the costs associated with the manufacture of composite materials and further support the composites market growth during the forecast period.

To remain competitive in the global composites market, leading companies have employed a number of business strategies, including capacity growth, company expansion, partnerships, mergers and acquisitions, and application development. Key industry players are likely to maintain their market position by releasing innovative products and increasing their product portfolio.

Key players operating in the global composites market are The Quadrant Group of Companies, Hexcel Corporation, Owens Corning, TPI Composites, Inc, Fokker Aerostructures, Faurecia, Performance Composites Inc., Toray Industries, APPLIED POLERAMIC INC., KINECO, HITCO Carbon Composites, Inc., VELLO NORDIC AS, Hexagon Composites, Enduro Composites, Inc., Teijin Limited, Creative Composites Ltd., BGF Industries, Inc., Kangde Xin Composite Material Group Co., Ltd., PLASAN CARBON COMPOSITES, FACC AG, Premium Aerotec, COTESA GmbH, Wethje Carbon Composites, Akiet B.V., Fiberdur GmbH & Co. KG, and FILL GESELLSCHAFT M.B.H.

Composites Market is expected to reach US$ 54561.7 million by 2025

Composites Market is estimated to rise at a CAGR of 8.9% during forecast period

Increasing demand for lightweight materials in various industries such as aerospace, defense, and automobile sectors are the key factors driving the growth of Composites Market

Key players operating in the global composites market are The Quadrant Group of Companies, Hexcel Corporation, Owens Corning, TPI Composites, Inc, Fokker Aerostructures, Faurecia, Performance Composites Inc., Toray Industries, APPLIED POLERAMIC INC., KINECO, HITCO Carbon Composites, Inc., VELLO NORDIC AS, Hexagon Composites, Enduro Composites, Inc., Teijin Limited, Creative Composites Ltd., BGF Industries, Inc., Kangde Xin Composite Material Group Co., Ltd., PLASAN CARBON COMPOSITES, FACC AG, Pr

Automotive & Transportation, Construction, Aerospace & Defense, Electrical & Electronics, Marine & Oil & Gas are the application segments in the Composites Market

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Mn)

3.2. Top 3 Trends

4. Market Overview

4.1. Composites Market Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers and Restraints Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.5. Global Composites Market Analysis and Forecast

4.6. Composites Market - Global Supply Demand Scenario

4.7. Porter’s Analysis

4.7.1. Threat of Substitutes

4.7.2. Bargaining Power of Buyers

4.7.3. Bargaining Power of Suppliers

4.7.4. Threat of New Entrants

4.7.5. Degree of Competition

4.8. Value Chain Analysis

4.9. Future of Composites in Drill Pipes

5. Composites Market Analysis, by Product

5.1. Key Findings

5.2. Introduction

5.3. Composites Market Value Share Analysis, by Product

5.4. Composites Market Forecast, by Product

5.4.1. CFRP, 2016 – 2025

5.4.2. GFRP, 2016 – 2025

5.4.3. Others, 2016 – 2025

5.5. Comparison Matrix

5.6. Market Attractiveness Analysis, by Product

6. Composites Market Analysis, by Technology

6.1. Key Findings

6.2. Introduction

6.3. Composites Market Value Share Analysis, by Technology

6.4. Composites Market Forecast, by Technology

6.4.1. Pultrusion Process, 2016 – 2025

6.4.2. Layup Process, 2016 – 2025

6.4.3. Filament Winding, 2016 – 2025

6.4.4. Compression Molding, 2016 – 2025

6.4.5. Injection Molding, 2016 – 2025

6.4.6. Resin Transfer Molding, 2016 – 2025

6.4.7. Others, 2016 – 2025

6.5. Market Attractiveness Analysis, by Technology

7. Composites Market Analysis, by Application

7.1. Key Findings

7.2. Introduction

7.3. Composites Market Value Share Analysis, by Application

7.4. Composites Market Forecast, by Application

7.4.1. Automotive & Transportation, 2016 – 2025

7.4.1.1. Interior

7.4.1.2. Exterior

7.4.1.3. Power Train Components

7.4.1.4. Others

7.4.2. Construction, 2016 – 2025

7.4.3. Aerospace & Defense, 2016 – 2025

7.4.4. Electrical & Electronics, 2016 – 2025

7.4.5. Marine & Oil & Gas, 2016 – 2025

7.4.5.1. Pipes

7.4.5.2. Others

7.4.6. Wind Energy, 2016 – 2025

7.4.7. Others, 2016 – 2025

7.5. Comparison Matrix

7.6. Market Attractiveness Analysis, by Application

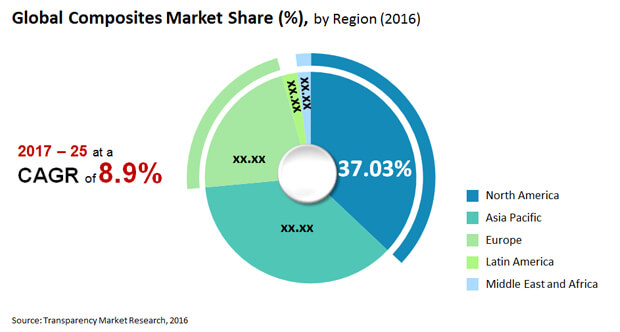

8. Composites Market Analysis, by Region

8.1. Composites Market Value Share Analysis, by Region

8.2. Composites Market Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Composites Market Analysis

9.1. Key Findings

9.2. North America Composites Market Overview

9.3. North America Composites Market Value Share Analysis, by Product

9.4. North America Composites Market Forecast, by Product

9.4.1. CFRP, 2016 – 2025

9.4.2. GFRP, 2016 – 2025

9.4.3. Others, 2016 – 2025

9.5. North America Composites Market Value Share Analysis, by Technology

9.6. North America Composites Market Forecast, by Technology

9.6.1. Pultrusion Process, 2016 – 2025

9.6.2. Layup Process, 2016 – 2025

9.6.3. Filament Winding, 2016 – 2025

9.6.4. Compression Molding, 2016 – 2025

9.6.5. Injection Molding, 2016 – 2025

9.6.6. Resin Transfer Molding, 2016 – 2025

9.6.7. Others, 2016 – 2025

9.7. North America Composites Market Value Share Analysis, by Application

9.8. North America Composites Market Forecast, by Application

9.8.1. Automotive & Transportation, 2016 – 2025

9.8.1.1. Interior

9.8.1.2. Exterior

9.8.1.3. Power Train Components

9.8.1.4. Others

9.8.2. Construction, 2016 – 2025

9.8.3. Aerospace & Defense, 2016 – 2025

9.8.4. Electrical & Electronics, 2016 – 2025

9.8.5. Marine & Oil & Gas, 2016 – 2025

9.8.5.1. Pipes

9.8.5.2. Others

9.8.6. Wind Energy, 2016 – 2025

9.8.7. Others, 2016 – 2025

9.9. North America Composites Market Value Share Analysis, by Country

9.10. North America Composites Market Forecast, by Country

9.10.1. U.S., 2016 – 2025

9.10.2. Canada, 2016 – 2025

9.11. North America Composites Market Attractiveness Analysis

9.11.1. By Product

9.11.2. By Application

10. Europe Composites Market Analysis

10.1. Key Findings

10.2. Europe Composites Market Overview

10.3. Europe Composites Market Value Share Analysis, by Product

10.4. Europe Composites Market Forecast, by Product

10.4.1. CFRP, 2016 – 2025

10.4.2. GFRP, 2016 – 2025

10.4.3. Others, 2016 – 2025

10.5. Europe Composites Market Value Share Analysis, by Technology

10.6. Europe Composites Market Forecast, by Technology

10.6.1. Pultrusion Process, 2016 – 2025

10.6.2. Layup Process, 2016 – 2025

10.6.3. Filament Winding, 2016 – 2025

10.6.4. Compression Molding, 2016 – 2025

10.6.5. Injection Molding, 2016 – 2025

10.6.6. Resin Transfer Molding, 2016 – 2025

10.6.7. Others, 2016 – 2025

10.7. Europe Composites Market Value Share Analysis, by Application

10.8. Europe Composites Market Forecast, by Application

10.8.1. Automotive & Transportation, 2016 – 2025

10.8.1.1. Interior

10.8.1.2. Exterior

10.8.1.3. Power Train Components

10.8.1.4. Others

10.8.2. Construction, 2016 – 2025

10.8.3. Aerospace & Defense, 2016 – 2025

10.8.4. Electrical & Electronics, 2016 – 2025

10.8.5. Marine & Oil & Gas, 2016 – 2025

10.8.5.1. Pipes

10.8.5.2. Others

10.8.6. Wind Energy, 2016 – 2025

10.8.7. Others, 2016 – 2025

10.9. Europe Composites Market Value Share Analysis, by Country

10.10. Europe Composites Market Forecast, by Country

10.10.1. France, 2016 – 2025

10.10.2. Germany, 2016 – 2025

10.10.3. Italy, 2016 – 2025

10.10.4. Spain, 2016 – 2025

10.10.5. U.K., 2016 – 2025

10.10.6. Rest of Europe, 2016 – 2025

10.11. Europe Composites Market Attractiveness Analysis

10.11.1. By Product

10.11.2. By Application

11. Asia Pacific Composites Market Analysis

11.1. Key Findings

11.2. Asia Pacific Composites Market Overview

11.3. Asia Pacific Composites Market Value Share Analysis, by Product

11.4. Asia Pacific Composites Market Forecast, by Product

11.4.1. CFRP, 2016 – 2025

11.4.2. GFRP, 2016 – 2025

11.4.3. Others, 2016 – 2025

11.5. Asia Pacific Composites Market Value Share Analysis, by Technology

11.6. Asia Pacific Composites Market Forecast, by Technology

11.6.1. Pultrusion Process, 2016 – 2025

11.6.2. Layup Process, 2016 – 2025

11.6.3. Filament Winding, 2016 – 2025

11.6.4. Compression Molding, 2016 – 2025

11.6.5. Injection Molding, 2016 – 2025

11.6.6. Resin Transfer Molding, 2016 – 2025

11.6.7. Others, 2016 – 2025

11.7. Asia Pacific Composites Market Value Share Analysis, by Application

11.8. Asia Pacific Composites Market Forecast, by Application

11.8.1. Automotive & Transportation, 2016 – 2025

11.8.1.1. Interior

11.8.1.2. Exterior

11.8.1.3. Power Train Components

11.8.1.4. Others

11.8.2. Construction, 2016 – 2025

11.8.3. Aerospace & Defense, 2016 – 2025

11.8.4. Electrical & Electronics, 2016 – 2025

11.8.5. Marine & Oil & Gas, 2016 – 2025

11.8.5.1. Pipes

11.8.5.2. Others

11.8.6. Wind Energy, 2016 – 2025

11.8.7. Others, 2016 – 2025

11.9. Asia Pacific Composites Market Value Share Analysis, by Country

11.10. Asia Pacific Composites Market Forecast, by Country

11.10.1. China, 2016 – 2025

11.10.2. India, 2016 – 2025

11.10.3. Japan, 2016 – 2025

11.10.4. ASEAN, 2016 – 2025

11.10.5. Rest of Asia Pacific, 2016 – 2025

11.11. Asia Pacific Composites Market Attractiveness Analysis

11.11.1. By Product

11.11.2. By Application

12. Latin America Composites Market Analysis

12.1. Key Findings

12.2. Latin America Composites Market Overview

12.3. Latin America Composites Market Value Share Analysis, by Product

12.4. Latin America Composites Market Forecast, by Product

12.4.1. CFRP, 2016 – 2025

12.4.2. GFRP, 2016 – 2025

12.4.3. Others, 2016 – 2025

12.5. Latin America Composites Market Value Share Analysis, by Technology

12.6. Latin America Composites Market Forecast, by Technology

12.6.1. Pultrusion Process, 2016 – 2025

12.6.2. Layup Process, 2016 – 2025

12.6.3. Filament Winding, 2016 – 2025

12.6.4. Compression Molding, 2016 – 2025

12.6.5. Injection Molding, 2016 – 2025

12.6.6. Resin Transfer Molding, 2016 – 2025

12.6.7. Others, 2016 – 2025

12.7. Latin America Composites Market Value Share Analysis, by Application

12.8. Latin America Composites Market Forecast, by Application

12.8.1. Automotive & Transportation, 2016 – 2025

12.8.1.1. Interior

12.8.1.2. Exterior

12.8.1.3. Power Train Components

12.8.1.4. Others

12.8.2. Construction, 2016 – 2025

12.8.3. Aerospace & Defense, 2016 – 2025

12.8.4. Electrical & Electronics, 2016 – 2025

12.8.5. Marine & Oil & Gas, 2016 – 2025

12.8.5.1. Pipes

12.8.5.2. Others

12.8.6. Wind Energy, 2016 – 2025

12.8.7. Others, 2016 – 2025

12.9. Latin America Composites Market Value Share Analysis, by Country

12.10. Latin America Composites Market Forecast, by Country

12.10.1. Brazil, 2016 – 2025

12.10.2. Mexico, 2016 – 2025

12.10.3. Rest of Latin America, 2016 – 2025

12.11. Latin America Composites Market Attractiveness Analysis

12.11.1. By Product

12.11.2. By Application

13. Middle East & Africa Composites Market Analysis

13.1. Key Findings

13.2. Middle East & Africa Composites Market Overview

13.3. Middle East & Africa Composites Market Value Share Analysis, by Product

13.4. Middle East & Africa Composites Market Forecast, by Product

13.4.1. CFRP, 2016 – 2025

13.4.2. GFRP, 2016 – 2025

13.4.3. Others, 2016 – 2025

13.5. Middle East & Africa Composites Market Value Share Analysis, by Technology

13.6. Middle East & Africa Composites Market Forecast, by Technology

13.6.1. Pultrusion Process, 2016 – 2025

13.6.2. Layup Process, 2016 – 2025

13.6.3. Filament Winding, 2016 – 2025

13.6.4. Compression Molding, 2016 – 2025

13.6.5. Injection Molding, 2016 – 2025

13.6.6. Resin Transfer Molding, 2016 – 2025

13.6.7. Others, 2016 – 2025

13.7. Middle East & Africa Composites Market Value Share Analysis, by Application

13.8. Middle East & Africa Composites Market Forecast, by Application

13.8.1. Automotive & Transportation, 2016 – 2025

13.8.1.1. Interior

13.8.1.2. Exterior

13.8.1.3. Power Train Components

13.8.1.4. Others

13.8.2. Construction, 2016 – 2025

13.8.3. Aerospace & Defense, 2016 – 2025

13.8.4. Electrical & Electronics, 2016 – 2025

13.8.5. Marine & Oil & Gas, 2016 – 2025

13.8.5.1. Pipes

13.8.5.2. Others

13.8.6. Wind Energy, 2016 – 2025

13.8.7. Others, 2016 – 2025

13.9. Middle East & Africa Composites Market Value Share Analysis, by Country

13.10. Middle East & Africa Composites Market Forecast, by Country

13.10.1. GCC, 2016 – 2025

13.10.2. South Africa, 2016 – 2025

13.10.3. Rest of Middle East & Africa, 2016 – 2025

13.11. Middle East & Africa Composites Market Attractiveness Analysis

13.11.1. By Product

13.11.2. By Application

14. Competition Landscape

14.1. Competition Matrix

14.2. Composites Market Share Analysis by Company (2016)

14.3. Company Profiles

14.3.1. Hexcel Corporation

14.3.1.1. Company Description

14.3.1.2. Business Overview

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Details

14.3.1.5. Strategic Overview

14.3.2. TPI Composites, Inc

14.3.2.1. Company Description

14.3.2.2. Business Overview

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Details

14.3.2.5. Strategic Overview

14.3.3. Owens Corning

14.3.3.1. Company Description

14.3.3.2. Business Overview

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Details

14.3.3.5. Strategic Overview

14.3.4. Teijin Limited

14.3.4.1. Company Description

14.3.4.2. Business Overview

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Details

14.3.4.5. Strategic Overview

14.3.5. Faurecia

14.3.5.1. Company Description

14.3.5.2. Business Overview

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Details

14.3.6. Performance Composites Inc.

14.3.6.1. Company Description

14.3.6.2. Business Overview

14.3.7. Excel Industries Limited

14.3.7.1. Company Description

14.3.7.2. Business Overview

14.3.7.3. Strategic Overview

14.3.8. Enduro Composites, Inc.

14.3.8.1. Company Description

14.3.8.2. Business Overview

14.3.9. Wethje Carbon Composites

14.3.9.1. Company Description

14.3.9.2. Business Overview

14.3.10. VELLO NORDIC AS

14.3.10.1. Company Description

14.3.10.2. Business Overview

14.3.11. Fiberdur GmbH & Co. KG

14.3.11.1. Company Description

14.3.11.2. Business Overview

14.3.12. Akiet B.V.

14.3.12.1. Company Description

14.3.12.2. Business Overview

14.3.13. FILL GESELLSCHAFT M.B.H.

14.3.13.1. Company Description

14.3.13.2. Business Overview

14.3.14. Toray Industries

14.3.14.1. Company Description

14.3.14.2. Business Overview

14.3.14.3. SWOT Analysis

14.3.14.4. Financial Details

14.3.14.5. Strategic Overview

14.3.15. APPLIED POLERAMIC INC.

14.3.15.1. Company Description

14.3.15.2. Business Overview

14.3.15.3. Strategic Overview

14.3.16. Hexagon Composites

14.3.16.1. Company Description

14.3.16.2. Business Overview

14.3.16.3. SWOT Analysis

14.3.16.4. Financial Details

14.3.16.5. Strategic Overview

14.3.17. KINECO

14.3.17.1. Company Description

14.3.17.2. Business Overview

14.3.17.3. Strategic Overview

14.3.18. Creative Composites Ltd.

14.3.18.1. Company Description

14.3.18.2. Business Overview

14.3.18.3. Strategic Overview

14.3.19. HITCO Carbon Composites, Inc.

14.3.19.1. Company Description

14.3.19.2. Business Overview

14.3.19.3. Strategic Overview

14.3.20. The Quadrant Group of Companies

14.3.20.1. Company Description

14.3.20.2. Business Overview

14.3.20.3. Strategic Overview

14.3.21. Kangde Xin Composite Material Group Co., Ltd

14.3.21.1. Company Description

14.3.21.2. Business Overview

14.3.21.3. Strategic Overview

14.3.22. BGF Industries, Inc.

14.3.22.1. Company Description

14.3.22.2. Business Overview

14.3.22.3. Strategic Overview

14.3.23. FACC AG

14.3.23.1. Company Description

14.3.23.2. Business Overview

14.3.23.3. SWOT Analysis

14.3.23.4. Financial Details

14.3.23.5. Strategic Overview

14.3.24. Premium Aerotec

14.3.24.1. Company Description

14.3.24.2. Business Overview

14.3.24.3. Strategic Overview

14.3.25. Fokker Aerostructures

14.3.25.1. Company Description

14.3.25.2. Business Overview

14.3.25.3. Strategic Overview

14.3.26. COTESA GmbH

14.3.26.1. Company Description

14.3.26.2. Business Overview

14.3.26.3. Strategic Overview

14.3.27. PLASAN CARBON COMPOSITES

14.3.27.1. Company Description

14.3.27.2. Business Overview

14.3.27.3. Strategic Overview

15. Key Takeaways

List of Tables

Table 1: Global Composites Market Size (US$ Mn) and Volume (Tons) Forecast, by Product, 2016–2025

Table 2: Global Composites Market Size (US$ Mn) and Volume (Tons) Forecast, by Product, 2016–2025

Table 3: Global Composites Market Size (US$ Mn) and Volume (Tons) Forecast, by Technology, 2016 - 2025

Table 4: Global Composites Market Size (US$ Mn) and Volume (Tons) Forecast, by Technology, 2016–2025

Table 5: Global Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 6: Globe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Automotive & Transportation Application, 2016–2025

Table 7: Globe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Marine and Oil & Gas Application, 2016–2025

Table 8: Global Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2016–2025

Table 9: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 10: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by PMC Segment, 2016–2025

Table 11: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 12: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Marine and Oil & Gas Segment, 2016–2025

Table 13: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Automotive & Transportation Segment, 2016–2025

Table 14: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 15: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 16: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, PMC, 2016–2025

Table 17: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 18: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Marine and Oil & Gas Application, 2016–2025

Table 19: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Automotive & Transportation Application, 2016–2025

Table 20: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 21: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 22: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, PMC, 2016–2025

Table 23: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 24: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Marine and Oil & Gas Application, 2016–2025

Table 25: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Automotive & Transportation Application, 2016–2025

Table 26: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 27: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2016–2025

Table 28: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, PMC, 2016–2025

Table 29: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 30: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Marine and Oil & Gas Application, 2016–2025

Table 31: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Automotive & Transportation Application, 2016–2025

Table 32: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 33: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 34: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, PMC, 2016–2025

Table 35: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2016–2025

Table 36: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Marine and Oil & Gas Application, 2016–2025

Table 37: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, for Automotive & Transportation Application, 2016–2025

Table 38: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 1: Global Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 2: Global Composites Average Selling Prices, by Product Type (US$/ton), 2016

Figure 3: Global Composites Market Value Share Analysis, by Product, 2016 and 2025

Figure 4: Global Composites Market Value Share Analysis, by Product, 2016 and 2025

Figure 5: Composites Market Attractiveness Analysis, by Product

Figure 6: Composites Market Attractiveness Analysis, by Product

Figure 7: Global Composites Market Value Share Analysis, by Technology, 2016 and 2025

Figure 8: Global Composites Market Attractiveness Analysis, by Technology

Figure 9: Global Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 10: Composites Market, for Automotive & Transportation

Figure 11: Composites Market, for Construction

Figure 12: Composites Market, for Aerospace & Defense

Figure 13: Composites Market, for Electrical & Electronics

Figure 14: Composites Market, for Marine and Oil & Gas

Figure 15: Composites Market, for Wind Energy

Figure 16: Composites Market, for Others

Figure 17: Composites Market Attractiveness Analysis,

Figure 18: Global Composites Market Value Share Analysis, by Region, 2016 and 2025

Figure 19: Composites Market Attractiveness Analysis,

Figure 20: North America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 21: North America Composites Market Attractiveness Analysis, by Country

Figure 22: North America Composites Market Value Share Analysis, by Product, 2016 and 2025

Figure 23: North America Composites Market Value Share Analysis, by PMC Segment, 2016 and 2025

Figure 24: North America Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 25: North America Composites Market Value Share Analysis, by Country, 2016 and 2025

Figure 26: Europe Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 27: Europe Composites Market Attractiveness Analysis, by Country, 2016

Figure 28: Europe Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 29: Europe Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 30: Europe Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 31: Europe Composites Market Value Share Analysis, by Country, 2016 and 2025

Figure 32: Asia Pacific Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 33: Asia Pacific Composites Market Attractiveness Analysis, by Country

Figure 34: Asia Pacific Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 35: Asia Pacific Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 36: Asia Pacific Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 37: Asia Pacific Composites Market Value Share Analysis, by Country, 2016 and 2025

Figure 38: Latin America Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 39: Latin America Composites Market Attractiveness Analysis, by Country

Figure 40: Latin America Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 41: Latin America Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 42: Latin America Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 43: Latin America Composites Market Value Share Analysis, by Country, 2016 and 2025

Figure 44: Middle East & Africa Composites Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 45: Middle East & Africa Composites Market Attractiveness Analysis, by Country

Figure 46: Middle East & Africa Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 47: Middle East & Africa Composites Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 48: Middle East & Africa Composites Market Value Share Analysis, by Application, 2016 and 2025

Figure 49: Middle East & Africa Composites Market Value Share Analysis, by Country, 2016 and 2025