Analysts’ Viewpoint on Collagen Peptide and Gelatin Market Scenario

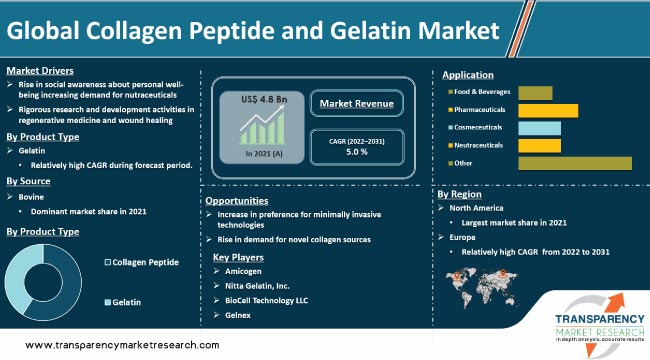

Rise in population-wide concerns about health and wellness has created significant opportunities in the global collagen peptide and gelatin market. Increase in demand for nutraceuticals and research & development studies pertaining to novel drug delivery systems is propelling the global collagen peptide and gelatin market share. Demand for nutraceuticals is likely to rise significantly due to rising social awareness about individual wellbeing. Usage of collagen in food and beverage production is also increasing as well as the demand for dietary supplements. Application of collagen peptide and gelatin is increasing in the nutricosmetics, pharmaceutical, and healthcare industries. Furthermore, mergers & acquisitions and novel prebiotic/probiotic product launches that improve heart health are anticipated to boost the market.

Protein collagen is used in several fields, including food, biomedicine, and skincare. Various beneficial properties of collagen support its usage as a potential biomaterial as compared to other natural polymers and their synthetic equivalents. Collagen is a highly preferred biomaterial due to its biological properties such as high biocompatibility, biodegradability, and low antigenicity. Approximately 30% of all proteins in the body are made of this protein, which is primarily found in bones, ligaments, and tendons. These collagen peptides are also known as hydrolysed collagen. Primary sources of collagen are cattle, pigs, and fish, while minor sources include chicken, equines, rat tails, silkworms, and sheep. Gelatin is also known as a multifunctional ingredient due to its properties, such as gelation, water binding, foaming, elasticity, binding, emulsifying, film forming, and viscosity, which provide texture and stability to products. Several companies are focusing on these products, as the demand is increasing. This, in turn, is fueling the gelatin market and collagen peptide market.

Demand for nutritional supplements, such as collagen peptide and hydrolyzed gelatin, has increased due to rise in focus on health and lifestyle. People are choosing functional foods and nutraceuticals to ward off age-related illnesses and enhance quality of life. Applications of nutraceuticals are increasing due to factors such as easy accessibility, affordability, and awareness. The geriatric population and athletes use nutraceuticals, as these are rich sources of proteins and other essential supplements. The European Nutraceutical Association (ENA) estimates that malnutrition was responsible for 38.6% of deaths in developing countries such as China, India, and Brazil. Therefore, nutritional deficiencies are caused by the types of food that people eat, not by their socioeconomic class. Increase in age-related health concerns, economic growth, rise in health awareness, surge in geriatric population, and changing lifestyles are increasing the demand for nutraceuticals.

Collagen-based drug delivery products used in various disease areas include collagen sponges, shields, liposomes, microspheres, and nanoparticles. Liposomes and nanoparticles are novel types of collagen-based drug delivery system for sustained release. Collagen is also widely used in the encapsulation of active pharmaceutical ingredients (API) to protect them from disintegration in acidic gastric juices.

Liposomes are superior carriers because these can encapsulate both hydrophilic and lipophilic drugs and protect them from degradation. Furthermore, they improve absorption rates and can function as an efficient solubilizing matrix. Liposome gel formulations outperform conventional formulations, resulting in higher patient compliance and efficacy. These advantages lead to increased acceptance of collagen-based liposome drug delivery systems, which in turn drives the collagen market. In comparison to other synthetic polymers, protein-based nano carriers (such as collagen, elastin, and fibronectin) have shown to be advantageous due to their low toxicity, lack of immunogenicity, high stability, and high nutritional value. Collagen nanoparticles possess high capacity for adsorption and high dispersion ability in water, which enables high sustained release of different drugs.

In terms of product type, the global collagen peptide and gelatin market has been bifurcated into collagen peptide and gelatin. Gelatin is known as a multifunctional ingredient because of its properties such as gelation, water binding, foaming, elasticity, binding, emulsifying, film forming, and viscosity, which drives its usage in various products. Utilization of gelatin to treat health-related issues, such as arthritis and joint pain, is increasing significantly, as it also aids in the treatment of skin and hair issues. Moreover, it is widely used in the manufacturing process of products that cater to wound healing market and empty capsule market.

Based on source, the global collagen peptide and gelatin market has been segregated into bovine, porcine, poultry, marine, and others. The bovine segment dominated the global market in 2021. The segment is driven by rise in demand for bovine-based collagen in the treatment of osteoporosis, osteoarthritis, and even skin-related diseases.

Based on application, the global collagen peptide and gelatin market has been divided into pharmaceuticals, food & beverages, cosmeceuticals, nutraceuticals, and others. The food & beverages segment dominated the global market in 2021. Gelatin is used more often in food production processes to produce diets high in protein. Gelatin is used as an active ingredient in the creation of capsules and hard gels due to its capacity to shield delicate contents from air and microbial growth. Additionally, it can be utilized in various food products owing to its neutral flavor and ability to blend with various flavors.

North America is expected to dominate the global market during the forecast period. Well-established health-care infrastructure, technological advancement in innovative treatment, and favorable government support contribute to the dominance of the region in the global market. Presence of well-established collagen manufacturing facilities and usage of advanced extraction methodologies are driving the market in the U.S. Increase in R&D activities is likely to drive the development of novel drug formulations. This in turn is projected to lead to the introduction of collagen-based products, such as bone graft substitutes and wound repair products, and consequently, lead to growth of novel drug delivery systems market.

Europe held the second-largest share of the global collagen peptide and gelatin market in 2021. The region offers significant opportunities to market participants focused on the introduction of collagen-based products. The collagen peptide and gelatin market trends in Europe indicate rapid growth during the forecast period. However, a closer assessment of the collagen peptide and gelatin market analysis reveals that it is likely to face some challenges, including a rise in the threat of external substitutes, such as vegetables, to boost the collagen-producing capability and growing concerns about the quality of collagen-based products. These factors are likely to retrain the collagen market in Europe.

Developing countries in Asia Pacific are projected to present lucrative growth opportunities in the collagen peptide and gelatin market due to production of cost-effective collagen and availability of skilled labor. Rapid growth of the pharmaceutical manufacturing industry in Asia Pacific, increase in number of food processing units, and rise in public awareness about nutritional dietary supplements are propelling the demand for collagen peptide products in the region.

The global collagen peptide and gelatin market is fragmented, with the presence of a large number of large-scale players. Key players operating in the global collagen peptide and gelatin market include Amicogen, BioCell Technology LLC, Lonza Group Ltd., Nitta Gelatin, Inc., GELITA AG, Norland Products, Inc., Gelnex, Ewald-Gelatine GmbH, and Tessenderlo Group NV. These players are adopting growth strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers.

Each of these players has been profiled in the collagen peptide and gelatin market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 4.8 Bn |

| Market Forecast Value in 2031 | More than US$ 7.8 Bn |

| Growth Rate (CAGR) 2022-2031 | 5.0% |

| Forecast Period | 2022–2031 |

| Historical Data Available for | 2017–2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global collagen peptide and gelatin market was valued at US$ 4.8 Bn in 2021.

The global collagen peptide and gelatin market is projected to reach more than US$ 7.8 Bn by 2031.

The global collagen peptide and gelatin market grew at a CAGR of 4.6% from 2017 to 2021.

The global collagen peptide and gelatin market is anticipated to grow at a CAGR of 5.0% from 2022 to 2031.

The gelatin segment held major share of around 68% of the global collagen peptide and gelatin market in 2021.

North America is expected to account for major share of the global collagen peptide and gelatin market during the forecast period.

Amicogen, BioCell Technology LLC, Lonza Group Ltd., Nitta Gelatin, Inc., GELITA AG, Norland Products, Inc., Gelnex, Ewald-Gelatine GmbH, and Tessenderlo Group NV.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Collagen Peptide and Gelatin Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definitions

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Collagen Peptide and Gelatin Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key product/brand Analysis

5.2. Key Mergers & Acquisitions

5.3. Covid-19 Impact Analysis

6. Global Collagen Peptide and Gelatin Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Collagen Peptide

6.3.2. Gelatin

6.4. Market Attractiveness Analysis, by Product Type

7. Global Collagen Peptide and Gelatin Market Analysis and Forecast, by Source

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Source, 2017-2031

7.3.1. Bovine

7.3.2. Porcine

7.3.3. Poultry

7.3.4. Marine

7.3.5. Others

7.4. Market Attractiveness Analysis, by Source

8. Global Collagen Peptide and Gelatin Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Pharmaceuticals

8.3.2. Food & Beverages

8.3.3. Cosmeceuticals

8.3.4. Nutraceuticals

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Collagen Peptide and Gelatin Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Collagen Peptide and Gelatin Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Collagen Peptide

10.2.2. Gelatin

10.3. Market Value Forecast, by Source, 2017-2031

10.3.1. Bovine

10.3.2. Porcine

10.3.3. Poultry

10.3.4. Marine

10.3.5. Others

10.4. Market Value Forecast, by Application, 2017-2031

10.4.1. Pharmaceuticals

10.4.2. Food & Beverages

10.4.3. Cosmeceuticals

10.4.4. Nutraceuticals

10.4.5. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Source

10.6.3. By Application

10.6.4. By Country

11. Europe Collagen Peptide and Gelatin Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Collagen Peptide

11.2.2. Gelatin

11.3. Market Value Forecast, by Source, 2017-2031

11.3.1. Bovine

11.3.2. Porcine

11.3.3. Poultry

11.3.4. Marine

11.3.5. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Pharmaceuticals

11.4.2. Food & Beverages

11.4.3. Cosmeceuticals

11.4.4. Nutraceuticals

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Source

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Collagen Peptide and Gelatin Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Collagen Peptide

12.2.2. Gelatin

12.3. Market Value Forecast, by Source, 2017-2031

12.3.1. Bovine

12.3.2. Porcine

12.3.3. Poultry

12.3.4. Marine

12.3.5. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Pharmaceuticals

12.4.2. Food & Beverages

12.4.3. Cosmeceuticals

12.4.4. Nutraceuticals

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia and New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Source

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Collagen Peptide and Gelatin Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Collagen Peptide

13.2.2. Gelatin

13.3. Market Value Forecast, by Source, 2017-2031

13.3.1. Bovine

13.3.2. Porcine

13.3.3. Poultry

13.3.4. Marine

13.3.5. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Pharmaceuticals

13.4.2. Food & Beverages

13.4.3. Cosmeceuticals

13.4.4. Nutraceuticals

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Source

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Collagen Peptide and Gelatin Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017-2031

14.2.1. Collagen Peptide

14.2.2. Gelatin

14.3. Market Value Forecast, by Source, 2017-2031

14.3.1. Bovine

14.3.2. Porcine

14.3.3. Poultry

14.3.4. Marine

14.3.5. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Pharmaceuticals

14.4.2. Food & Beverages

14.4.3. Cosmeceuticals

14.4.4. Nutraceuticals

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Source

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Amicogen

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. BioCell Technology LLC

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Lonza Group Ltd.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Nitta Gelatin, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. GELITA AG

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Norland Products, Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Gelnex

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Ewald-Gelatine GmbH

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Tessenderlo Group NV

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Others Prominent Players

List of Tables

Table 01: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 03: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin, 2017-2031

Table 04: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 05: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 06: Global Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 09: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 10: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin 2017-2031

Table 11: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source 2017-2031

Table 12: North America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 13: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 14: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 16: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin 2017-2031

Table 17: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 18: Europe Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 20: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 21: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 22: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin, 2017-2031

Table 23: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 24: Asia Pacific Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 25: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 27: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 28: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin, 2017-2031

Table 29: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 30: Latin America Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 31: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 33: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Collagen Peptide, 2017-2031

Table 34: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Gelatin 2017-2031

Table 35: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 36: Middle East & Africa Collagen Peptide & Collagen Market Value (US$ Mn) Forecast, by Application, 2017-2031

List of Figures

Figure 01: Global Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Collagen Peptide and Gelatin Market Value Share, by Product Type, 2021

Figure 03: Global Collagen Peptide and Gelatin Market Value Share, by Source, 2021

Figure 04: Global Collagen Peptide and Gelatin Market Value Share, by Application, 2021

Figure 05: Global Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 06: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 07: Global Collagen Peptide and Gelatin Market Value (US$ Mn), by Collagen Peptide, 2017-2031

Figure 08: Global Collagen Peptide and Gelatin Market Value (US$ Mn), by Gelatin, 2017-2031

Figure 09: Global Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 10: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 11: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Bovine, 2017-2031

Figure 12: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Porcine, 2017-2031

Figure 13: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Poultry, 2017-2031

Figure 14: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Marine, 2017-2031

Figure 15: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Others, 2017-2031

Figure 16: Global Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 17: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 18: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Pharmaceuticals, 2017-2031

Figure 19: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Food & Beverages, 2017-2031

Figure 20: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Cosmeceuticals, 2017-2031

Figure 21: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Nutraceuticals, 2017-2031

Figure 22: Global Collagen Peptide and Gelatin Market Revenue (US$ Mn), by Others, 2017-2031

Figure 23: Global Collagen Peptide and Gelatin Market Value Share Analysis, by Region, 2021 and 2031

Figure 24: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, by Region, 2022-2031

Figure 25: North America Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 26: North America Collagen Peptide and Gelatin Market Value Share Analysis, by Country, 2021 and 2031

Figure 27: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country, 2022-2031

Figure 28: North America Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 29: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 30: North America Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 31: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 32: North America Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 33: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 34: Europe Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 35: Europe Collagen Peptide and Gelatin Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 37: Europe Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 38: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 39: Europe Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 40: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 41: Europe Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 42: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 43: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 44: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 46: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 47: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 48: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 49: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 50: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 51: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 52: Latin America Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 53: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 54: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 55: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 56: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 57: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 58: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 59: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 60: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 61: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Mn) Forecast, 2017-2031

Figure 62: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 63: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 64: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 65: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 66: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, by Source, 2021 and 2031

Figure 67: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, by Source, 2022-2031

Figure 68: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, by Application, 2021 and 2031

Figure 69: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, by Application, 2022-2031

Figure 70: Company Share Analysis, 2021