Analyst’s Viewpoint on Ambulance Services Market

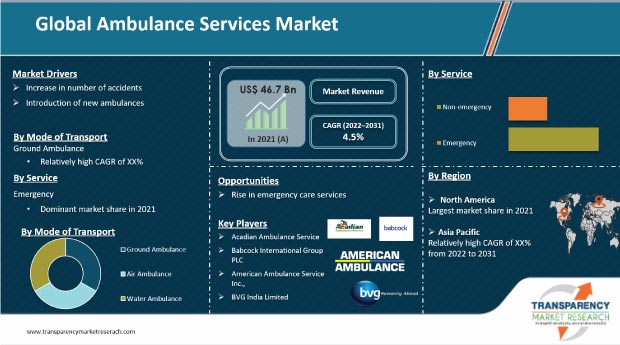

Surge in number of accidents, entry of new ambulance service providers with highly equipped ambulances, and favorable reimbursement policies are some of the key factors contributing to the growth of the global ambulance services market. The global ambulance services market is also expected to grow at a steady pace during the forecast period, owing to the strengthening healthcare infrastructure in emerging economies. Companies in the global ambulance services market are focusing on meeting the increasing demand for emergency ambulance services to keep their businesses growing. Companies are also diversifying their revenue streams by increasing the availability of air ambulance services.

Ambulances or ambulance services provide emergency pre-hospital treatment and stabilization of serious illnesses & injuries, as well as patient transport service for definitive care. Ambulance services are an important link between medical care and disaster management systems, providing pre-hospital care for the injured. The scope of ambulance services covers treatment for the people in need of emergency care or arrangement of timely transportation of patients to the next point of care.

Global emergency medical services (EMS) are advanced enough to make a significant contribution to the overall functioning of the healthcare system. The World Health Organization considers the EMS system to be an integral part of an effective and functional healthcare system.

Increase in number of accidents, introduction of new ambulances with the latest technology that addresses primary healthcare needs, and favorable reimbursement policies drive the demand for ambulance services.

Rise in adoption rate of commercial and personal vehicles has resulted in a higher number of accidents. Accidents often create a need for immediate hospital visits for medical treatment and support. Hence, patients require ambulance services for transportation to-and-from hospitals. The U.S. is one of the busiest countries in the world in terms of road traffic accidents. Around 10 million road accidents take place every year in the U.S. Among these, nearly 2 million to 4 million drivers experience permanent injuries every year. According to the Ministry of Road Transport & Highways (MORTH) of India, about 6,800 people died and 18,000 were injured in drunk driving accidents in 2015–2016. Thus, surge in number of accidents is anticipated to propel the ambulance services market from 2022 to 2031.

Improving healthcare reforms in various regional markets such as the U.S., Japan, and China has increased the life expectancy of the population. According to the World Health Organization (WHO), the global geriatric population stood at around 524 million in 2010 and is expected to reach around 2 billion by 2050. Thus, constant rise in geriatric population is likely to propel the demand for ambulance services, as the elderly are more prone to acquiring diseases and infections. The geriatric population is also prone to physical disabilities such as immobility, which is likely to drive the demand for ambulance services for transportation to hospitals for medical treatment on a regular basis.

Brazil, China, Thailand, and South Korea are expected to have a large geriatric population in the next few years. Japan, the U.S., and the U.K. are also likely to follow suit. The ratio of geriatric population to adult population in these countries is projected to be higher in the near future. Thus, increase in geriatric population is estimated to augment the ambulance services market.

Established and new players are launching new and advanced ambulances and services to provide high level of comfort and medical services to patients. This is expected to drive the ambulance services market. In 2019, the State Government Health Department of Odisha, India, launched the first-ever boat ambulance service at Batighar in the Kendrapara district. Large numbers of riverside villagers in Odisha still depend on passenger boats, which are not available at night. The boat ambulance service plays a key role during medical emergencies. The government plans to launch five more such boats in the near future.

Dutch Health BV launched a new water ambulance, Rescue Eagle 1, in Djibouti during 2014–2015. The boat has been designed to accommodate advanced life support (ALS) systems in compliance with the guidelines of functional requirements set by the Ministry of Health in Djibouti.

Favorable reimbursement policies in various countries such as the U.K., the U.S., and Japan are driving the ambulance services market. Reimbursements are provided for availing ambulance services in order to make these services affordable for the patient population. For instance, Canada-based Sun Life Assurance Company reimburses around 80% of the total amount for availing emergency ambulance services. Bupa Australia Pty Ltd. provides emergency ambulance cover per person in Australia (insured person). Similarly, the State Ambulance Insurance Plan of New South Wales provides insurance cover for ambulance services in various states such as Queensland and South Australia. Availability of such reimbursement policies in various countries is augmenting the ambulance services market.

The basic life support (BLS) segment accounted for a relatively large share of the global ambulance services market in 2021. The segment is projected to grow at a moderate pace during the forecast period. Medical services are provided by emergency medical practitioners and partially-trained personnel in BLS ambulances.

BLS ambulance services are usually provided to patients with complex fractures; medical or surgical patients; patients being discharged home or sub-acute care facilities; and psychiatric patients. Increase in number of surgeries across the globe is likely to drive the segment, as BLS ambulance services could be needed to transport patients from hospitals to homes and vice-versa.

Patients who have undergone surgery and do not require medical monitoring are advised to avail BLS ambulance services, as personal vehicle transport could create post-medical surgery complications (because of their build). This is projected to propel the demand for BLS ambulance services.

North America dominated the global market, with more than 36% share in terms of revenue in 2021. High share of the region can be ascribed to the growth in adoption of advanced treatment approaches and favorable reimbursement policies due to the increase in geriatric and obese population that is more susceptible to various chronic and acute diseases.

Asia Pacific was the fastest-growing market in 2021. The market in the region is expected to grow at a CAGR of 4% during the forecast period. Large patient population in countries such as India and China accounts for significant share of the market in Asia Pacific.

The global ambulance services market is consolidated, with a small number of key players accounting for a significant share. Most companies are making substantial investments in technology development.

Diversification of product portfolios and mergers & acquisitions are the key strategies adopted by market players. Prominent players operating in the market include Acadian Ambulance Service, Inc., Babcock International Group plc, BVG India Limited, American Ambulance Service Inc., Air Methods, and Aeromedevac.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 46.7 Bn |

|

Market Forecast Value in 2031 |

US$ 70.7 Bn |

|

Growth Rate |

CAGR of 4.5% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global ambulance services market was valued at US$ 46.7 Bn in 2021

The global ambulance services market is projected to reach more than US$ 70 Bn by 2031

The global ambulance services market expanded at a CAGR of 5.7% from 2017 to 2021

The global ambulance services market is anticipated to expand at a CAGR of 4.5% from 2022 to 2031

Prominent players in the global ambulance services market include Acadian Ambulance Service, Inc., Babcock International Group plc, BVG India Limited, American Ambulance Service, Inc., Air Methods, and Aeromedevac

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ambulance Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ambulance Services Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. PESTEL analysis

5.2. Recent Technological Developments in Ambulance Services

5.3. Number of Ambulances by Country/Region

5.4. Number of ambulances respond to stroke calls (best effort bases)

5.5. Education level of ambulance operators (by region)

5.6. Who owns the ambulances in each geographical region

5.7. Decisions makers for purchasing onboard equipment in each region

6. Global Ambulance Services Market Analysis and Forecast, by Mode of Transport

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Mode of Transport, 2017–2031

6.3.1. Air Ambulance

6.3.2. Water Ambulance

6.3.3. GroundAmbulance

6.4. Market Attractiveness Analysis, by Mode of Transport

7. Global Ambulance Services Market Analysis and Forecast, by Type of Equipment

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Type of Equipment, 2017–2031

7.3.1. Basic Life Support (BLS)

7.3.2. Advanced Life Support (ALS)

7.4. Market Attractiveness Analysis, by Type of Equipment

8. Global Ambulance Services Market Analysis and Forecast, by Service

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Service, 2017–2031

8.3.1. Emergency

8.3.2. Non-emergency

8.4. Market Attractiveness Analysis, by Service

9. Global Ambulance Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North AmericaAmbulance Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Mode of Transport, 2017–2031

10.2.1. Air Ambulance

10.2.2. Water Ambulance

10.2.3. GroundAmbulance

10.3. Market Value Forecast, by Type of Equipment, 2017–2031

10.3.1. Basic Life Support (BLS)

10.3.2. Advanced Life Support (ALS)

10.4. Market Value Forecast, by Service, 2017–2031

10.4.1. Emergency

10.4.2. Non-emergency

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Mode of Transport

10.6.2. By Type of Equipment

10.6.3. By Service

10.6.4. By Country

11. Europe Ambulance Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Mode of Transport, 2017–2031

11.2.1. Air Ambulance

11.2.2. Water Ambulance

11.2.3. GroundAmbulance

11.3. Market Value Forecast, by Type of Equipment, 2017–2031

11.3.1. Basic Life Support (BLS)

11.3.2. Advanced Life Support (ALS)

11.4. Market Value Forecast, by Service, 2017–2031

11.4.1. Emergency

11.4.2. Non-emergency

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Mode of Transport

11.6.2. By Type of Equipment

11.6.3. By Service

11.6.4. By Country/Sub-region

12. Asia Pacific Ambulance Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Mode of Transport, 2017–2031

12.2.1. Air Ambulance

12.2.2. Water Ambulance

12.2.3. GroundAmbulance

12.3. Market Value Forecast, by Type of Equipment, 2017–2031

12.3.1. Basic Life Support (BLS)

12.3.2. Advanced Life Support (ALS)

12.4. Market Value Forecast, by Service, 2017–2031

12.4.1. Emergency

12.4.2. Non-emergency

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Mode of Transport

12.6.2. By Type of Equipment

12.6.3. By Service

12.6.4. By Country/Sub-region

13. Latin America Ambulance Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Mode of Transport, 2017–2031

13.2.1. Air Ambulance

13.2.2. Water Ambulance

13.2.3. GroundAmbulance

13.3. Market Value Forecast, by Type of Equipment, 2017–2031

13.3.1. Basic Life Support (BLS)

13.3.2. Advanced Life Support (ALS)

13.4. Market Value Forecast, by Service, 2017–2031

13.4.1. Emergency

13.4.2. Non-emergency

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Mode of Transport

13.6.2. By Type of Equipment

13.6.3. By Service

13.6.4. By Country/Sub-region

14. Middle East & Africa Ambulance Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Mode of Transport, 2017–2031

14.2.1. Air Ambulance

14.2.2. Water Ambulance

14.2.3. GroundAmbulance

14.3. Market Value Forecast, by Type of Equipment, 2017–2031

14.3.1. Basic Life Support (BLS)

14.3.2. Advanced Life Support (ALS)

14.4. Market Value Forecast, by Service, 2017–2031

14.4.1. Emergency

14.4.2. Non-emergency

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Mode of Transport

14.6.2. By Type of Equipment

14.6.3. By Service

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Acadian Ambulance Service, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Babcock International Group plc

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. BVG India Limited

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. American Ambulance Service, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.5. Air Methods

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Aeromedevac

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

List of Tables

Table 01: Global Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 02: Global Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 03: Global Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

Table 04: Global Ambulance Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Ambulance Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 07: North America Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 08: North America Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

Table 09: Europe Ambulance Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 11: Europe Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 12: Europe Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

Table 13: Asia Pacific Ambulance Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 15: Asia Pacific Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 16: Asia Pacific Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

Table 17: Latin America Ambulance Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 19: Latin America Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 20: Latin America Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

Table 21: Middle East & Africa Ambulance Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Ambulance Services Market Value (US$ Mn) Forecast, by Service 2017–2031

Table 23: Middle East & Africa Ambulance Services Market Value (US$ Mn) Forecast, by Mode of Transport, 2017‒2031

Table 24: Middle East & Africa Ambulance Services Market Value (US$ Mn) Forecast, by Type of Equipment, 2017‒2031

List of Figures

Figure 01: Global Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Ambulance Services Market Value Share, by Mode of Transport, 2021

Figure 03: Global Ambulance Services Market Value Share, by Type of Equipment, 2021

Figure 04: Global Ambulance Services Market Value Share, by Service, 2021

Figure 05: Global Ambulance Services Market, by Mode of Transport, 2021 and 2031

Figure 06: Global Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 07: Global Ambulance Services Market (US$ Mn), by Air Ambulance, 2017–2031

Figure 08: Global Ambulance Services Market (US$ Mn), by Water Ambulance, 2017–2031

Figure 09: Global Ambulance Services Market (US$ Mn), by Ground Ambulance, 2017–2031

Figure 10: Global Ambulance Services Market, by Type of Equipment, 2021 and 2031

Figure 11: Global Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 12: Global Ambulance Services Market (US$ Mn), by Basic Life Support (BLS), 2017–2031

Figure 13: Global Ambulance Services Market (US$ Mn), by Advanced Life Support (ALS), 2017–2031

Figure 14: Global Ambulance Services Market, by Service, 2021 and 2031

Figure 15: Global Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 16: Global Ambulance Services Market (US$ Mn), by Emergency, 2017–2031

Figure 17: Global Ambulance Services Market (US$ Mn), by Non-emergency, 2017–2031

Figure 18: Global Ambulance Services Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global Ambulance Services Market Attractiveness Analysis, by Region, 2017–2031

Figure 20: North America Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America Ambulance Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 22: North America Ambulance Services Market Attractiveness Analysis, by Country, 2021–2031

Figure 23: North America Ambulance Services Market Value Share Analysis, by Mode of Transport, 2020 and 2031

Figure 24: North America Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 25: North America Ambulance Services Market Value Share Analysis, by Type of Equipment, 2020 and 2031

Figure 26: North America Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 27: North America Ambulance Services Market Value Share Analysis, by Service, 2021 and 2031

Figure 28: North America Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 29: Europe Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe Ambulance Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Ambulance Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 32: Europe Ambulance Services Market Value Share Analysis, by Mode of Transport, 2020 and 2031

Figure 33: Europe Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 34: Europe Ambulance Services Market Value Share Analysis, by Type of Equipment, 2020 and 2031

Figure 35: Europe Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 36: Europe Ambulance Services Market Value Share Analysis, by Service, 2021 and 2031

Figure 37: Europe Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 38: Asia Pacific Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific Ambulance Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Ambulance Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 41: Asia Pacific Ambulance Services Market Value Share Analysis, by Mode of Transport, 2020 and 2031

Figure 42: Asia Pacific Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 43: Asia Pacific Ambulance Services Market Value Share Analysis, by Type of Equipment, 2020 and 2031

Figure 44: Asia Pacific Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 45: Asia Pacific Ambulance Services Market Value Share Analysis, by Service, 2021 and 2031

Figure 46: Asia Pacific Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 47: Latin America Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Latin America Ambulance Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Latin America Ambulance Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 50: Latin America Ambulance Services Market Value Share Analysis, by Mode of Transport, 2020 and 2031

Figure 51: Latin America Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 52: Latin America Ambulance Services Market Value Share Analysis, by Type of Equipment, 2020 and 2031

Figure 53: Latin America Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 54: Latin America Ambulance Services Market Value Share Analysis, by Service, 2021 and 2031

Figure 55: Latin America Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 56: Middle East & Africa Ambulance Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Middle East & Africa Ambulance Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Middle East & Africa Ambulance Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 59: Middle East & Africa Ambulance Services Market Value Share Analysis, by Mode of Transport, 2020 and 2031

Figure 60: Middle East & Africa Ambulance Services Market Attractiveness Analysis, by Mode of Transport, 2021–2031

Figure 61: Middle East & Africa Ambulance Services Market Value Share Analysis, by Type of Equipment, 2020 and 2031

Figure 62: Middle East & Africa Ambulance Services Market Attractiveness Analysis, by Type of Equipment, 2021–2031

Figure 63: Middle East & Africa Ambulance Services Market Value Share Analysis, by Service, 2021 and 2031

Figure 64: Middle East & Africa Ambulance Services Market Attractiveness Analysis, by Service, 2021–2031