The global airless packaging market is currently being propelled by its appeal in terms of minimizing space taken. The ability of airless packaging to provide zero wastage of space and product material required is putting it far ahead of its competitive packaging types. The market is also being driven by the massive incoming demand from the cosmetics industry, where airless packaging can be far more beneficial than other types. The global airless packaging market is, however, currently restricted in its overall growth rate by factors such as high machinery costs, the extremely low scope of product differentiation, and the steadily growing demand for its direct competitor – modified atmosphere packaging.

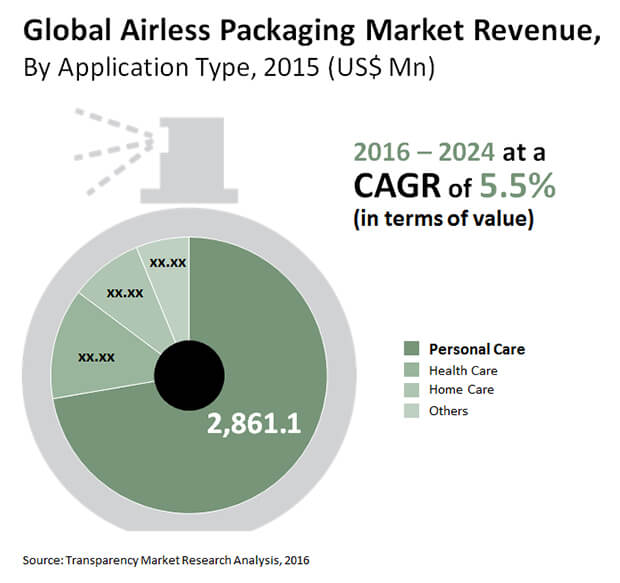

The global airless packaging market is expected to expand at a CAGR of 5.5% within a forecast period from 2016 to 2024, in terms of value. The market’s overall value by the end of 2016 is expected to reach US$4.13 bn. Assuming the above CAGR and incorporating the ups and downs that the market may experience over the given forecast period, it is expected to reach US$6.34 bn by the end of 2024. By volume, the global airless packaging market is expected to reach 29,303.2 kilo tons by the end of 2024.

Based on the type of packaging, the global airless packaging market can be segmented into the two generalized segments of plastics and glass. Of these, the market has consistently been dominated by plastics in the recent past. It is also highly likely for plastics to remain the leading material type used in the global airless packaging market for the coming years. The typical process of airless packaging allows users to seal the contents – especially food and beverage products – into an airless environment, thereby considerably increasing the product’s life expectancy. Plastics make the entire process much easier than glasses or any other material, owing to their elasticity and the ease with which they can be molded. Plastics also provide a much greater storage life than the other packaging materials, thereby making it a highly popular material for airless packaging.

For a regional assessment, the global airless packaging market is segmented into the key regions of North America, Europe, Asia Pacific, The Middle East and Africa, and Latin America. For the forecast period from 2016 to 2024, Europe is expected to remain the dominant region in terms of demand for airless packaging, registering a positive CAGR of 5.1% for the same. The packaging industry holds a strong ground in Europe owing to a high demand in general coupled with speedy rates of product innovation and development. The airless packaging market in Europe is also being pushed towards providing greener alternatives to conventional plastic airless packaging. North America is also likely to continue contributing a large stream of revenue in the global airless packaging market, primarily due to the massive demand originating from the U.S.

Meanwhile, Asia Pacific is expected to register a phenomenally high rate of growth in demand for airless packaging. A high and still increasing urban population in this region is expected to ramp up its demand for several types of packaging in the consumer goods industry, providing plenty of opportunities for players in the global airless packaging market.

The key players that have been a part of the global airless packaging market to date, include Albéa Beauty Holdings S.A., Aptar Group, Inc., HCP Packaging, LUMSON SPA, Libo Cosmetics Company, Ltd., Quadpack Industries, WestRock, Fusion Packaging, and ABC Packaging, Ltd.

Rise in Demand for Smaller Packaging to Influence Growth of Airless Packaging Market

The airless packaging market is expected to attract expansive growth prospects across the assessment period of 2016-2024. The growing demand for airless packaging on the back of the varied benefits they provide may prove to be a growth-accelerating factor for the airless packaging market. Furthermore, the increasing demand from the cosmetics industry may serve as a vital growth indicator for the airless packaging market.

1. Executive Summary

2. Assumptions and Acronyms Used

3. Research Methodology

4. Global Airless Packaging Market Introduction

4.1. Global Airless Packaging Market Definition

4.2. Global Airless Packaging Market Taxonomy

4.3. Global Packaging Market Overview

5. Global Airless Packaging Market Analysis Scenario

5.1. Global Airless Packaging Market (US$ Mn) and Forecast

5.1.1. Global Airless Packaging Market and Y-o-Y Growth

5.1.2. Absolute $ Opportunity

5.2. Global Airless Packaging Market Overview

5.2.1. Value Chain

5.2.2. Profitability Margins

6. Global Airless Packaging Market Dynamics

6.1. Macro-economic Factors

6.2. Drivers

6.3. Restraints

6.4. Opportunity

6.5. Forecast Factors – Relevance and Impact

7. Global Airless Packaging Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Material Type

7.1.2. Y-o-Y Growth Projections By Material Type

7.2. Global Airless Packaging Market Value (US$ Mn) Forecast By Material Type

7.2.1. Plastics

7.2.2. Glass

7.2.3. Others

7.3. Global Airless Packaging Market Attractiveness Analysis By, Material Type

7.4. Prominent Trends

8. Global Airless Packaging Market Analysis and Forecast, By Packaging Type

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Packaging Type

8.1.2. Y-o-Y Growth Projections By Packaging Type

8.2. Global Airless Packaging Market Value (US$ Mn) Forecast

8.2.1. Bottles & Jars

8.2.2. Bags & Pouches

8.2.3. Tubes

8.2.4. Others

8.3. Global Airless Packaging Market Attractiveness Analysis By Packaging Type

8.4. Prominent Trends

9. Global Airless Packaging Market Analysis and Forecast, By Dispenser Type

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Dispenser Type

9.1.2. Y-o-Y Growth Projections By Dispenser Type

9.2. Global Airless Packaging Market Value (US$ Mn) Forecast

9.2.1. Pumps

9.2.2. Droppers

9.2.3. Twist & Click

9.3. Global Airless Packaging Market Attractiveness Analysis By Dispenser Type

9.4. Prominent Trends

10. Global Airless Packaging Market Analysis and Forecast, By End Use

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By End Use

10.1.2. Y-o-Y Growth Projections By End Use

10.2. Global Airless Packaging Market Value (US$ Mn) Forecast By End Use

10.2.1. Personal Care

10.2.1.1. Skin Care

10.2.1.2. Hair Care

10.2.1.3. Baby Care

10.2.2. Home Care

10.2.3. Healthcare

10.2.4. Others

10.3. Global Airless Packaging Market Attractiveness Analysis By End Use

10.4. Prominent Trends

11. Global Airless Packaging Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Global Airless Packaging Market Value (US$ Mn) Forecast By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific (APAC)

11.2.4. Latin America

11.2.5. Middle East and Africa (MEA)

11.3. Global Airless Packaging Market Attractiveness Analysis By Region

12. North America Airless Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Value (US$ Mn) Forecast By Country

12.2.1. U.S.

12.2.2. Canada

12.3. Market Value (US$ Mn) Forecast By Material Type

12.3.1. Plastics

12.3.2. Glass

12.3.3. Others

12.4. Market Value (US$ Mn) Forecast By Packaging Type

12.4.1. Bottles & Jars

12.4.2. Bags & Pouches

12.4.3. Tubes

12.4.4. Others

12.5. Market Value (US$ Mn) Forecast By Dispenser Type

12.5.1. Pumps

12.5.2. Droppers

12.5.3. Twist & Click

12.6. Market Value (US$ Mn) Forecast By End Use

12.6.1. Personal Care

12.6.1.1. Skin Care

12.6.1.2. Hair Care

12.6.1.3. Baby Care

12.6.2. Home Care

12.6.3. Healthcare

12.6.4. Others

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Material Type

12.7.3. By Packaging Type

12.7.4. By Dispenser Type

12.7.5. By End Use Type

12.8. Prominent Trends

12.9. Drivers and Restraints: Impact Analysis

13. Europe Airless Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Europe Airless Packaging Market Value (US$ Mn) Forecast By Country

13.2.1. Germany

13.2.2. Spain

13.2.3. Italy

13.2.4. France

13.2.5. U.K.

13.2.6. BENELUX

13.2.7. Russia

13.2.8. Rest of Europe

13.3. Market Value (US$ Mn) Forecast By Material Type

13.3.1. Plastics

13.3.2. Glass

13.3.3. Others

13.4. Market Value (US$ Mn) Forecast By Packaging Type

13.4.1. Bottles & Jars

13.4.2. Bags & Pouches

13.4.3. Tubes

13.4.4. Others

13.5. Market Value (US$ Mn) Forecast By Dispenser Type

13.5.1. Pumps

13.5.2. Droppers

13.5.3. Twist & Click

13.6. Market Value (US$ Mn) Forecast By End Use

13.6.1. Personal Care

13.6.1.1. Skin Care

13.6.1.2. Hair Care

13.6.1.3. Baby Care

13.6.2. Home Care

13.6.3. Healthcare

13.6.4. Others

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Material Type

13.7.3. By Packaging Type

13.7.4. By Dispenser Type

13.7.5. By End Use Type

13.8. Prominent Trends

13.9. Drivers and Restraints: Impact Analysis

14. Asia Pacific (APAC) Airless Packaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Asia Pacific (APAC) Airless Packaging Market Value (US$ Mn) Forecast By Country

14.2.1. China

14.2.2. India

14.2.3. Japan

14.2.4. Australia and New Zealand

14.2.5. Rest of APAC

14.3. Market Value (US$ Mn) Forecast By Material Type

14.3.1. Plastics

14.3.2. Glass

14.3.3. Others

14.4. Market Value (US$ Mn) Forecast By Packaging Type

14.4.1. Bottles & Jars

14.4.2. Bags & Pouches

14.4.3. Tubes

14.4.4. Others

14.5. Market Value (US$ Mn) Forecast By Dispenser Type

14.5.1. Pumps

14.5.2. Droppers

14.5.3. Twist & Click

14.6. Market Value (US$ Mn) Forecast By End Use

14.6.1. Personal Care

14.6.1.1. Skin Care

14.6.1.2. Hair Care

14.6.1.3. Baby Care

14.6.2. Home Care

14.6.3. Healthcare

14.6.4. Others

14.7. Market Attractiveness Analysis

14.7.1. By Country

14.7.2. By Material Type

14.7.3. By Packaging Type

14.7.4. By Dispenser Type

14.7.5. By End Use Type

14.8. Prominent Trends

14.9. Drivers and Restraints: Impact Analysis

15. Latin America Airless Packaging Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Latin America Airless Packaging Market Value (US$ Mn) Forecast By Country

15.2.1. Brazil

15.2.2. Mexico

15.2.3. Rest of Latin America

15.3. Market Value (US$ Mn) Forecast By Material Type

15.3.1. Plastics

15.3.2. Glass

15.3.3. Others

15.4. Market Value (US$ Mn) Forecast By Packaging Type

15.4.1. Bottles & Jars

15.4.2. Bags & Pouches

15.4.3. Tubes

15.4.4. Others

15.5. Market Value (US$ Mn) Forecast By Dispenser Type

15.5.1. Pumps

15.5.2. Droppers

15.5.3. Twist & Click

15.6. Market Value (US$ Mn) Forecast By End Use

15.6.1. Personal Care

15.6.1.1. Skin Care

15.6.1.2. Hair Care

15.6.1.3. Baby Care

15.6.2. Home Care

15.6.3. Healthcare

15.6.4. Others

15.7. Market Attractiveness Analysis

15.7.1. By Country

15.7.2. By Material Type

15.7.3. By Packaging Type

15.7.4. By Dispenser Type

15.7.5. By End Use Type

15.8. Prominent Trends

15.9. Drivers and Restraints: Impact Analysis

16. Middle East and Africa (MEA) Airless Packaging Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.2. Middle East and Africa (MEA) Airless Packaging Market Value (US$ Mn) Forecast By Country

16.2.1. North Africa

16.2.2. South Africa

16.2.3. GCC countries

16.2.4. Rest of MEA

16.3. Market Value (US$ Mn) Forecast By Material Type

16.3.1. Plastics

16.3.2. Glass

16.3.3. Others

16.4. Market Value (US$ Mn) Forecast By Packaging Type

16.4.1. Bottles & Jars

16.4.2. Bags & Pouches

16.4.3. Tubes

16.4.4. Others

16.5. Market Value (US$ Mn) Forecast By Dispenser Type

16.5.1. Pumps

16.5.2. Droppers

16.5.3. Twist & Click

16.6. Market Value (US$ Mn) Forecast By End Use

16.6.1. Personal Care

16.6.1.1. Skin Care

16.6.1.2. Hair Care

16.6.1.3. Baby Care

16.6.2. Home Care

16.6.3. Healthcare

16.6.4. Others

16.7. Market Attractiveness Analysis

16.7.1. By Country

16.7.2. By Material Type

16.7.3. By Packaging Type

16.7.4. By Dispenser Type

16.7.5. By End Use Type

16.8. Prominent Trends

16.9. Drivers and Restraints: Impact Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT Analysis)

17.3. Market Share Analysis

17.4. Global Players

17.4.1. Aptar Group, Inc.

17.4.1.1. Overview

17.4.1.2. Financials

17.4.1.3. Strategy

17.4.1.4. Recent Developments

17.4.1.5. SWOT Analysis

17.4.2. Albéa Beauty Holdings S.A.

17.4.2.1. Overview

17.4.2.2. Financials

17.4.2.3. Strategy

17.4.2.4. Recent Developments

17.4.2.5. SWOT Analysis

17.4.3. LUMSON SPA

17.4.3.1. Overview

17.4.3.2. Financials

17.4.3.3. Strategy

17.4.3.4. Recent Developments

17.4.3.5. SWOT Analysis

17.4.4. HCP Packaging

17.4.4.1. Overview

17.4.4.2. Financials

17.4.4.3. Strategy

17.4.4.4. Recent Developments

17.4.4.5. SWOT Analysis

17.4.5. Quadpack Industries

17.4.5.1. Overview

17.4.5.2. Financials

17.4.5.3. Strategy

17.4.5.4. Recent Developments

17.4.5.5. SWOT Analysis

17.4.6. Libo Cosmetics Company, Ltd.

17.4.6.1. Overview

17.4.6.2. Financials

17.4.6.3. Strategy

17.4.6.4. Recent Developments

17.4.6.5. SWOT Analysis

17.4.7. Fusion Packaging

17.4.7.1. Overview

17.4.7.2. Financials

17.4.7.3. Strategy

17.4.7.4. Recent Developments

17.4.7.5. SWOT Analysis

17.4.8. WestRock Company

17.4.8.1. Overview

17.4.8.2. Financials

17.4.8.3. Strategy

17.4.8.4. Recent Developments

17.4.8.5. SWOT Analysis

17.4.9. ABC Packaging Ltd.

17.4.9.1. Overview

17.4.9.2. Financials

17.4.9.3. Strategy

17.4.9.4. Recent Developments

17.4.9.5. SWOT Analysis

List of Tables

Table 01: Global Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 02: Global Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 03: Global Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 04: Global Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

Table 05: Global Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Region, 2015–2024

Table 06: North America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 07: North America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 08: North America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 09: North America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

Table 10: Latin America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 11: Latin America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 12: Latin America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 13: Latin America Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

Table 14: Europe Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 15: Europe Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 16: Europe Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 17: Europe Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

Table 18: APAC Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 19: APAC Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 20: APAC Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 21: APAC Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

Table 22: MEA Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Material Type, 2015–2024

Table 23: MEA Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Packaging Type, 2015–2024

Table 24: MEA Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by Dispenser Type, 2015–2024

Table 25: MEA Airless Packaging Market Size (US$ Mn) and Volume (Mn Units) by End Use, 2015–2024

List of Figures

Figure 01: Global Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 02: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 03: Global Airless Packaging Market Value Share by Packaging Type, 2016

Figure 04: Global Airless Packaging Market Value Share by Material Type, 2016

Figure 05: Global Airless Packaging Market Value Share by Dispenser Type, 2016

Figure 06: Global Airless Packaging Market Value Share by Region, 2016

Figure 07: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Plastic, 2016–2024

Figure 08: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Glass, 2016–2024

Figure 09: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by, 2016–2024

Figure 10: Global Airless Packaging Market Share & BPS Analysis by Material Type, 2016 & 2024

Figure 11: Global Airless Packaging Market Revenue Y-o-Y Growth by Material Type, 2015–2024

Figure 12: Global Airless Packaging Market Attractiveness by Material Type, 2016–2024

Figure 13: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Bottles & Jars, 2016–2024

Figure 14: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Bags & Pouches, 2016–2024

Figure 15: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Tubes, 2016–2024

Figure 16: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Others, 2016–2024

Figure 17: Global Airless Packaging Market Share & BPS Analysis by Packaging Type, 2016 & 2024

Figure 18: Global Airless Packaging Market Revenue Y-o-Y Growth by Packaging Type, 2015–2024

Figure 19: Global Airless Packaging Market Attractiveness by Packaging Type, 2016–2024

Figure 20: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Pump, 2016–2024

Figure 20: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Pump, 2016–2024

Figure 21: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Dropper, 2016–2024

Figure 22: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Others, 2016–2024

Figure 23: Global Airless Packaging Market Share & BPS Analysis by Dispenser Type, 2016 & 2024

Figure 24: Global Airless Packaging Market Revenue Y-o-Y Growth by Dispenser Type, 2015–2024

Figure 25: Global Airless Packaging Market Attractiveness by End Use, 2016–2024

Figure 26: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Personal Care Segment, 2016–2024

Figure 27: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Home Care Segment, 2016–2024

Figure 28: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Health Care Segment, 2016–2024

Figure 29: Global Airless Packaging Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2016–2024

Figure 30: Global Airless Packaging Market Share & BPS Analysis by End Use, 2016 & 2024

Figure 31: Global Airless Packaging Market Revenue Y-o-Y Growth by End Use, 2015–2024

Figure 32: Global Airless Packaging Market Attractiveness by End Use, 2016–2024

Figure 33: Global Airless Packaging Market Share & BPS Analysis by Region, 2016 & 2024

Figure 34: Global Airless Packaging Market Revenue Y-o-Y Growth by Region, 2015–2024

Figure 35: Global Airless Packaging Market Attractiveness by Region, 2016–2024

Figure 36: North America Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 37: North America Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 38: U.S. Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 39: Canada Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 40: North America Airless Packaging Market Share & BPS Analysis, by Material, 2016 & 2024

Figure 41: North America Airless Packaging Market Y-o-Y Growth Rate, by Material, 2015–2024

Figure 42: North America Airless Packaging Market Share & BPS Analysis, by Packaging Type, 2016 & 2024

Figure 43: North America Airless Packaging Market Attractiveness Analysis by Packaging Type, 2016–2024

Figure 44: North America Airless Packaging Market Share & BPS Analysis, by Dispenser Type, 2016 & 2024

Figure 45: North America Airless Packaging Market Y-o-Y Growth Rate, by Dispenser Type, 2015–2024

Figure 46: North America Airless Packaging Market Share & BPS Analysis, by Material, 2016 & 2024

Figure 47: North America Airless Packaging Market Y-o-Y Growth Rate, by Material, 2015–2024

Figure 48: Latin America Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 49: Latin America Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 50: Brazil Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 51: Mexico Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 52: Rest of LATAM Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 53: Latin America Airless Packaging Market Share & BPS Analysis, by Material, 2016 & 2024

Figure 54: Latin America Airless Packaging Market Y-o-Y Growth Rate, by Material, 2015–2024

Figure 55: Latin America Airless Packaging Market Share & BPS Analysis, by Packaging Type, 2016 & 2024

Figure 56: Latin America Airless Packaging Market Attractiveness Analysis by Packaging Type, 2016–2024

Figure 57: Latin America Airless Packaging Market Share & BPS Analysis, by Dispenser Type, 2016 & 2024

Figure 58: Latin America Airless Packaging Market Y-o-Y Growth Rate, by Dispenser, 2015–2024

Figure 59: Latin America Airless Packaging Market Share & BPS Analysis, by Material, 2016 & 2024

Figure 60: Latin America Airless Packaging Market Y-o-Y Growth Rate, by Material, 2015–2024

Figure 61: Europe Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 62: Europe Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 63: Germany Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 64: UK Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 65: Itlay Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 66: Spain Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 67: France Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 68: Rest of Europe Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 69: Europe Airless Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 70: Europe Airless Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 71: Europe Airless Packaging Market Share & BPS Analysis, by Packaging Type, 2016 & 2024

Figure 72: Europe Airless Packaging Market Attractiveness Analysis by Packaging Type, 2016–2024

Figure 73: Europe Airless Packaging Market Share & BPS Analysis, by Dispenser, 2016 & 2024

Figure 74: Europe Airless Packaging Market Y-o-Y Growth Rate, by Dispenser Type, 2015–2024

Figure 75: Europe Airless Packaging Market Share & BPS Analysis, by Material, 2016 & 2024

Figure 76: Europe Airless Packaging Market Y-o-Y Growth Rate, by Material, 2015–2024

Figure 77: APAC Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 78: APAC Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 79: China Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 80: India Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 81: Japan Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 82: Australia & New Zealand Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 83: Rest of APAC Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 84: APAC Airless Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 85: APAC Airless Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 86: APAC Airless Packaging Market Share & BPS Analysis, by Packaging Type, 2016 & 2024

Figure 87: APAC Airless Packaging Market Attractiveness Analysis by Packaging Type, 2016–2024

Figure 88: Europe Airless Packaging Market Share & BPS Analysis, by Dispenser, 2016 & 2024

Figure 89: Europe Airless Packaging Market Y-o-Y Growth Rate, by Dispenser Type, 2015–2024

Figure 90: APAC Airless Packaging Market Share & BPS Analysis, by End Use, 2016 & 2024

Figure 91: APAC Airless Packaging Market Y-o-Y Growth Rate, by End Use, 2015–2024

Figure 92: MEA Airless Packaging Market Value (US$ Mn), Volume (Mn Units) 2015–2024

Figure 93: MEA Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 94: GCC Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 95: South Af Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 96: China Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 97: India Airless Packaging Market Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 98: MEA Airless Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 99: MEA Airless Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 100: MEA Airless Packaging Market Share & BPS Analysis, by Packaging Type, 2016 & 2024

Figure 101: MEA Airless Packaging Market Attractiveness Analysis by Packaging Type, 2016–2024

Figure 102: MEA Airless Packaging Market Share & BPS Analysis, by Dispenser Type, 2016 & 2024

Figure 103: MEA Airless Packaging Market Y-o-Y Growth Rate, by Dispenser Type, 2015–2024

Figure 104: MEA Airless Packaging Market Share & BPS Analysis, by End Use, 2016 & 2024

Figure 105: MEA Airless Packaging Market Y-o-Y Growth Rate, by End Use, 2015–2024