Healthcare providers in the ACL reconstruction procedures market are navigating through challenging times during the coronavirus pandemic to provide urgent care for patients whose knee or shoulder requires immediate medical attention. The New York-based Manhattan Orthopedic Care center is gaining recognition for improving the patient quality of life with less pain and more comfort in the knees, especially during the pandemic.

Even though medical professionals are offering optimum care services, the pandemic has squeezed financial situation for many patients, leading to the postponement of ACL (anterior cruciate ligament) procedures. Such trends are affecting the revenue generation in the ACL reconstruction procedures market. Nevertheless, medical professionals are ensuring a risk-free and healthy environment for both surgery and recovery of patients.

Bioceramics, including hydroxyapatite (HA), beta-tricalcium phosphate (β-TCP) or their mixtures with most similar composition to the inorganic component of bone, have been widely used in bone implants due to their advantages of biocompatibility and osteoinductive properties. However, their poor mechanical properties such as brittleness, low fracture toughness, and extremely high stiffness are emerging as major challenges for their use in load-bearing skeletal sites. Hence, companies in the ACL reconstruction procedures market are increasing research in biodegradable metals such as zinc and magnesium to address poor mechanical properties.

Zinc-based alloy systems are showing outstanding mechanical strength and distinct osteopromotive properties, thus exhibiting great potential as novel orthopedic implants.

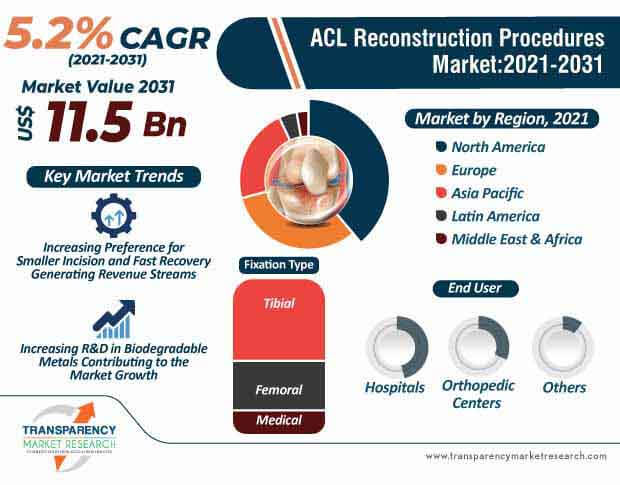

The ACL reconstruction procedures market is projected to mature from a revenue of US$ 6.8 Bn in 2020 and reach US$ 11.5 Bn by 2031. In order to boost credibility credentials, healthcare companies are answering frequently asked questions (FAQs) of potential patients in order to win their faith for surgical procedures. Medical centers are providing evidence-based and patient-centric treatments with the help of trained doctors that are highly experienced in diagnosing and treating orthopedic conditions of the knee. Thus, to avoid potential complications such as infection around surgical wound and viral transmission from an allograft, medical practitioners in the ACL reconstruction procedures market are thoroughly assessing the patient’s condition and personalizing treatments.

The ACL reconstruction procedures market is undergoing a significant change with innovations in grafts for ACL injuries. In order to create the hamstring tendon autograft for ACL reconstruction, the semitendinosus hamstring tendon on the inner side of the knee is used. Proponents of the hamstring graft say that compared to the patellar tendon graft, there are less issues linked with graft harvesting, including fewer problems with anterior knee pain, smaller incision, and faster recovery.

Companies in the ACL reconstruction procedures market are improving their design capabilities in patellar tendon autograft. This graft is greatly known as the gold standard for ACL reconstruction by some surgeons. High demand athletes and patients are fueling the demand for patellar tendon autografts whose occupations do not entail a large amount of kneeling.

ACL reconstruction is recommended for active adult patients involved in sports or jobs that require pivoting, turning, and heavy manual work. The approach of using iron (Fe) or its alloys is being studied by an increasing number of researchers in the orthopedic field due to their excellent biocompatibility and desirable mechanical properties.

Owing to the magnetic nature of iron and the production of iron oxide degradation by-products, there are still challenges for the clinical use of iron-based orthopedic implants. Hence, companies in the ACL reconstruction procedures market are continuously investing in R&D to innovate in biodegradable interference screws used in ACL reconstruction procedures.

On the other hand, innovations in biodegradable magnesium-based orthopedics are grabbing the attention of companies in the ACL reconstruction procedures market.

Analysts’ Viewpoint

Medical practitioners are ensuring a clean, safe, and coronavirus-free environment for patients in order to make them feel safe during and after surgical procedures. It has been found that magnesium (Mg) ions released from Mg-based implants after surgical implantation in vivo can promote bone regeneration and accelerate healing of bone diseases. However, potential complications of an ACL reconstruction such as kneecap pain or stiffness and blood clots forming in the veins of the calf or thighs are causing concerns among patients. Hence, medical practitioners in the ACL reconstruction procedures market should provide evidence-based treatments that are personalized for the patient. Healthcare companies are increasing awareness about the rehabilitation therapy for enabling speedy recovery from surgeries.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 6.8 Bn |

|

Market Forecast Value in 2031 |

US$ 11.5 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & ‘000 Units for Volume |

|

Market Analysis |

The report includes cross segment analysis at global as well as regional level. Qualitative analysis includes drivers, restraints, opportunities, key trends, etc. The report includes volume of various ACL reconstruction procedures across regional and global level. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

ACL reconstruction procedures market to reach US$ 11.5 Bn by 2031

ACL reconstruction procedures market is projected to expand at a moderate CAGR from 2021 to 2031

ACL reconstruction procedures market is driven by increase in awareness about sports injuries and emphasis on the treatment of orthopedic disorders.

North America accounted for a major share of the global ACL reconstruction procedures market

Key players in the global ACL reconstruction procedures market include Zimmer Biomet Holdings, Inc., Stryker Corporation, Johnson & Johnson Services, Inc., Medtronic, DJO

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global ACL Reconstruction Procedures Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global ACL Reconstruction Procedures Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

5.2. Technological Advancements

5.3. Key Industry Events

5.4. Regulatory Scenario

5.5. Overview of ACL Reconstruction Surgeries

5.6. Overview of Orthopedic Injuries and Disease prevalence across globe

6. Global ACL Reconstruction Procedures Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

6.3.1. Extra-articular

6.3.2. Intra-articular

6.3.2.1. Patellar Tendon Autograft

6.3.2.2. Hamstring Tendon Autograft

6.3.2.3. Quadriceps Tendon Autograft

6.3.2.4. Others

6.4. Global ACL Reconstruction Procedures Market Attractiveness Analysis, by Type

7. Global ACL Reconstruction Procedures Market Analysis and Forecast, by Fixation Type, 2017-2031

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

7.3.1. Femoral

7.3.2. Tibial

7.4. Global ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type

8. Global ACL Reconstruction Procedures Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Orthopedic Centers

8.3.3. Others

8.4. Global ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user

9. Global ACL Reconstruction Procedures Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global ACL Reconstruction Procedures Market Attractiveness Analysis, by Region

10. North America ACL Reconstruction Procedures Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

10.2.1. Extra-articular

10.2.2. Intra-articular

10.2.2.1. Patellar Tendon Autograft

10.2.2.2. Hamstring Tendon Autograft

10.2.2.3. Quadriceps Tendon Autograft

10.2.2.4. Others

10.3. North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

10.3.1. Femoral

10.3.2. Tibial

10.4. North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Orthopedic Centers

10.4.3. Others

10.5. North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

11. Europe ACL Reconstruction Procedures Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

11.2.1. Extra-articular

11.2.2. Intra-articular

11.2.2.1. Patellar Tendon Autograft

11.2.2.2. Hamstring Tendon Autograft

11.2.2.3. Quadriceps Tendon Autograft

11.2.2.4. Others

11.3. Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

11.3.1. Femoral

11.3.2. Tibial

11.4. Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Orthopedic Centers

11.4.3. Others

11.5. Europe ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

12. Asia Pacific ACL Reconstruction Procedures Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

12.2.1. Extra-articular

12.2.2. Intra-articular

12.2.2.1. Patellar Tendon Autograft

12.2.2.2. Hamstring Tendon Autograft

12.2.2.3. Quadriceps Tendon Autograft

12.2.2.4. Others

12.3. Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

12.3.1. Femoral

12.3.2. Tibial

12.4. Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Orthopedic Centers

12.4.3. Others

12.5. Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

13. Latin America ACL Reconstruction Procedures Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

13.2.1. Extra-articular

13.2.2. Intra-articular

13.2.2.1. Patellar Tendon Autograft

13.2.2.2. Hamstring Tendon Autograft

13.2.2.3. Quadriceps Tendon Autograft

13.2.2.4. Others

13.3. Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

13.3.1. Femoral

13.3.2. Tibial

13.4. Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Orthopedic Centers

13.4.3. Others

13.5. Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

14. Middle East & Africa ACL Reconstruction Procedures Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

14.2.1. Extra-articular

14.2.2. Intra-articular

14.2.2.1. Patellar Tendon Autograft

14.2.2.2. Hamstring Tendon Autograft

14.2.2.3. Quadriceps Tendon Autograft

14.2.2.4. Others

14.3. Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

14.3.1. Femoral

14.3.2. Tibial

14.4. Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Orthopedic Centers

14.4.3. Others

14.5. Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa ACL Reconstruction Procedures Market Attractiveness Analysis, 2017–2031

15. Competitive Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2020

15.3. Company Profiles

15.3.1. Arthrex, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Strategic Overview

15.3.1.4. SWOT Analysis

15.3.2. CITIEFFE S.R.L.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Strategic Overview

15.3.2.4. SWOT Analysis

15.3.3. CONMED Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. DJO Global, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Strategic Overview

15.3.4.4. SWOT Analysis

15.3.5. Johnson & Johnson Services, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Medtronic

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Miach Orthopaedics

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Strategic Overview

15.3.7.4. SWOT Analysis

15.3.8. Meira Corporation

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Strategic Overview

15.3.8.4. SWOT Analysis

15.3.9. RTI Surgical

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Strategic Overview

15.3.9.4. SWOT Analysis

15.3.10. Smith+Nephew

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. Strategic Overview

15.3.10.5. SWOT Analysis

15.3.11. Stryker Corporation

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. Strategic Overview

15.3.11.5. SWOT Analysis

15.3.12. Tissue Regenix Group

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Strategic Overview

15.3.12.4. SWOT Analysis

15.3.13. Zimmer Biomet Holdings, Inc.

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. Strategic Overview

15.3.13.5. SWOT Analysis

List of Tables

Table 01: Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global ACL Reconstruction Procedures Market Volume (Units) Forecast, by Type, 2017–2031

Table 03: Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 04: Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global ACL Reconstruction Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: North America ACL Reconstruction Procedures Market Volume (Units) Forecast, by Type, 2017–2031

Table 09: North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 10: North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 13: Europe ACL Reconstruction Procedures Market Volume (Units) Forecast, by Type, 2017–2031

Table 14: Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 15: Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 18: Asia Pacific ACL Reconstruction Procedures Market Value (Units) Forecast, by Type, 2017–2031

Table 19: Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 20: Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Latin America ACL Reconstruction Procedures Market Volume (Units) Forecast, by Type, 2017–2031

Table 24: Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 25: Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 28: Middle East & Africa ACL Reconstruction Procedures Market Volume (Units) Forecast, by Type, 2017–2031

Table 29: Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by Fixation Type, 2017–2031

Table 30: Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global ACL Reconstruction Procedures Market Value Share, by Type, 2020

Figure 03: Global ACL Reconstruction Procedures Market Value Share, by Fixation Type, 2020

Figure 04: Global ACL Reconstruction Procedures Value Share, by End-user, 2020

Figure 05: Global ACL Reconstruction Procedures Value Share, by Region, 2020

Figure 06: Global ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 07: Global ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 08: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Extra-articular, 2017–2031

Figure 09: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Intra-articular, 2017–2031

Figure 10: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Patellar Tendon Autograft, 2017–2031

Figure 11: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Hamstring Tendon Autograft, 2017–2031

Figure 12: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Quadriceps Tendon Autograft, 2017–2031

Figure 13: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Others, 2017–2031

Figure 14: Global ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 15: Global ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 16: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Femoral, 2017–2031

Figure 17: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Tibial, 2017–2031

Figure 18: Global ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 19: Global ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 20: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 21: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Orthopedic Centers, 2017–2031

Figure 22: Global ACL Reconstruction Procedures Market Revenue (US$ Mn), by Others, 2017–2031

Figure 23: Global ACL Reconstruction Market Value Share Analysis, by Region, 2020 and 2031

Figure 24: Global ACL Reconstruction Market Attractiveness Analysis, by Region, 2021–2031

Figure 25: North America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 26: North America ACL Reconstruction Procedures Market Value Share Analysis, by Country, 2020 and 2031

Figure 27: North America ACL Reconstruction Procedures Market Attractiveness Analysis, by Country, 2021–2031

Figure 28: North America ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 29: North America ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 30: North America ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 31: North America ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 32: North America ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 33: North America ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 34: Europe ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Europe ACL Reconstruction Procedures Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 36: Europe ACL Reconstruction Procedures Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 37: Europe ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 38: Europe ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 39: Europe ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 40: Europe ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 41: Europe ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 42: Europe ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 43: Asia Pacific ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 44: Asia Pacific ACL Reconstruction Procedures Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 45: Asia Pacific ACL Reconstruction Procedures Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 46: Asia Pacific ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 47: Asia Pacific ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 48: Asia Pacific ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 49: Asia Pacific ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 50: Asia Pacific ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 51: Asia Pacific ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 52: Latin America ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 53: Latin America ACL Reconstruction Procedures Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 54: Latin America ACL Reconstruction Procedures Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 55: Latin America ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 56: Latin America ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 57: Latin America ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 58: Latin America ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 59: Latin America ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 60: Latin America ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 61: Middle East & Africa ACL Reconstruction Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 62: Middle East & Africa ACL Reconstruction Procedures Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 63: Middle East & Africa ACL Reconstruction Procedures Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 64: Middle East & Africa ACL Reconstruction Procedures Market Value Share Analysis, by Type, 2020 and 2031

Figure 65: Middle East & Africa ACL Reconstruction Procedures Market Attractiveness Analysis, by Type, 2021–2031

Figure 66: Middle East & Africa ACL Reconstruction Procedures Market Value Share Analysis, by Fixation Type, 2020 and 2031

Figure 67: Middle East & Africa ACL Reconstruction Procedures Market Attractiveness Analysis, by Fixation Type, 2021–2031

Figure 68: Middle East & Africa ACL Reconstruction Procedures Market Value Share Analysis, by End-user, 2020 and 2031

Figure 69: Middle East & Africa ACL Reconstruction Procedures Market Attractiveness Analysis, by End-user, 2021–2031

Figure 70: Global ACL Reconstruction Procedures Market Share Analysis, by Company, 2020