Analyst Viewpoint

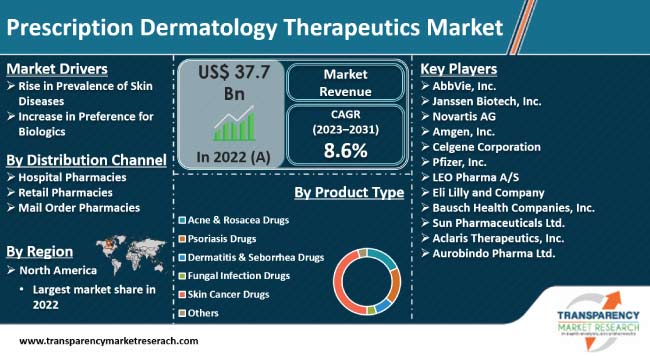

Rise in prevalence of skin diseases across the globe is a key factor propelling the prescription dermatology therapeutics market size. Increase in pollution, worsening lifestyle habits, and environmental changes are contributing to the growth in incidence of skin disorders. Surge in popularity of skin care products, often propagated by celebrities and social media influencers, is also boosting market progress.

Prominent players operating in the global market are investing in research and development of novel drugs for relief or treatment of chronic dermatological disorders. In line with the latest prescription dermatology therapeutics market trends, leading manufacturers are also striving to introduce innovative drugs such as biologics in a targeted manner.

Skin is the most exposed, vulnerable, and largest organ of the body. It is also the first point of contact for microbes and toxins. Prescription dermatology therapeutics is a pharmaceutical vertical that focuses on development, production, and commercialization of drugs and therapies for skin illnesses and conditions such as acne, psoriasis, eczema, dermatitis, and skin cancer.

Aging, trauma, and environmental and genetic factors can lead to the development of skin diseases. According to American Academy of Dermatology, acne is the most common global skin condition. Baldness treatment is a lucrative therapeutic process, while skin care drugs are the leading product type.

Increase in pollution, changes in lifestyle, and environmental vagaries are contributing to the rise in incidence of skin disorders. This growth in prevalence necessitates effective prescription of treatments to address a range of dermatological conditions.

Currently, dermatological requirements of a large section of population of skincare patients, especially in developing countries, are not being met due to factors such as high cost of topical dermatology medications and unavailability of proper prescription skin care solutions. These issues can be addressed through prescription dermatology therapeutic drugs. Thus, companies operating in the sector can avail of the lucrative prescription dermatology therapeutics business opportunities available across the globe.

Surge in popularity of skin health pharmaceuticals propagated by celebrities and influencers is also spurring prescription dermatology therapeutics industry growth. The American Academy of Dermatology examined prevalence, economic burdens, and mortality for skin disease in the U.S. using 2013 healthcare claims data drawn from insurance enrollment and claims data and found that, one in four people or over 84.5 million people in the U.S., are affected by skin disease.

Demand for specialized prescription drugs reflects the continuous pursuit of precise and targeted solutions for common and rare skin ailments. Biologics are such specialized medicines made from living organisms or components of living organisms.

Biologics demonstrate the remarkable efficiency of addressing several skin disorders, including autoimmune dermatoses, eczema, and psoriasis, with a targeted approach. They offer potent long-term management solutions.

The popularity of biologics has been rising across the globe, led by the surge in disposable income and parallel growth in awareness about skin health among the general population. Advancements in biotechnology and improvement in understanding of dermatological care are augmenting the prescription dermatology therapeutics market value.

North America held the largest prescription dermatology therapeutics market share across the globe in 2022. Surge in cases of chronic skin disorders and increase in healthcare expenditure are augmenting the market dynamics of the region.

According to the latest prescription dermatology therapeutics market forecast, the industry in Asia Pacific is projected to grow at a steady pace from 2023 to 2031. Increase in awareness about skin diseases and improvement in access to skin care treatment in developing economies such as China and India are propelling the prescription dermatology therapeutics industry statistics in the region.

Prominent prescription dermatology therapeutics manufacturers are investing significantly in the development of clinical skin therapeutics or skin disorder medications for chronic dermatological disorders. Several small molecular and biological products are in different phases of clinical trials for the treatment of dermatological diseases.

AbbVie, Inc., Janssen Biotech, Inc., Novartis AG, Amgen, Inc., Celgene Corporation, Pfizer, Inc., LEO Pharma A/S, Eli Lilly and Company, Bausch Health Companies, Inc., Sun Pharmaceuticals Ltd., Aclaris Therapeutics, Inc., and Aurobindo Pharma Ltd. are key companies operating in the global landscape.

These companies have been profiled in the prescription dermatology therapeutics market research report based on various parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 37.7 Bn |

| Market Forecast Value in 2031 | US$ 78.7 Bn |

| Growth Rate (CAGR) | 8.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players - Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 37.7 Bn in 2022

It is projected to grow at a CAGR of 8.6% from 2023 to 2031

Rise in prevalence of skin diseases and increase in preference for biologics

The skin cancer drugs product type segment held the largest share in 2022

North America dominated the global landscape in 2022

AbbVie, Inc., Janssen Biotech, Inc., Novartis AG, Amgen, Inc., Celgene Corporation, Pfizer, Inc., LEO Pharma A/S, Eli Lilly and Company, Bausch Health Companies, Inc., Sun Pharmaceuticals Ltd., Aclaris Therapeutics, Inc., and Aurobindo Pharma Ltd.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Prescription Dermatology Therapeutics Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Prescription Dermatology Therapeutics Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Prescription Dermatology Therapeutics Market Analysis and Forecast, by Product Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Acne & Rosacea Drugs

6.3.2. Psoriasis Drugs

6.3.3. Dermatitis & Seborrhea Drugs

6.3.4. Fungal Infection Drugs

6.3.5. Skin Cancer Drugs

6.3.6. Others

6.4. Market Attractiveness, by Product Type

7. Global Prescription Dermatology Therapeutics Market Analysis and Forecast, by Distribution Channel

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Mail Order Pharmacies

7.4. Market Attractiveness, by Distribution Channel

8. Global Prescription Dermatology Therapeutics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Prescription Dermatology Therapeutics Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017–2031

9.2.1. Acne & Rosacea Drugs

9.2.2. Psoriasis Drugs

9.2.3. Dermatitis & Seborrhea Drugs

9.2.4. Fungal Infection Drugs

9.2.5. Skin Cancer Drugs

9.2.6. Others

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Mail Order Pharmacies

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Prescription Dermatology Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Acne & Rosacea Drugs

10.2.2. Psoriasis Drugs

10.2.3. Dermatitis & Seborrhea Drugs

10.2.4. Fungal Infection Drugs

10.2.5. Skin Cancer Drugs

10.2.6. Others

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Mail Order Pharmacies

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Prescription Dermatology Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Acne & Rosacea Drugs

11.2.2. Psoriasis Drugs

11.2.3. Dermatitis & Seborrhea Drugs

11.2.4. Fungal Infection Drugs

11.2.5. Skin Cancer Drugs

11.2.6. Others

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Mail Order Pharmacies

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Prescription Dermatology Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Acne & Rosacea Drugs

12.2.2. Psoriasis Drugs

12.2.3. Dermatitis & Seborrhea Drugs

12.2.4. Fungal Infection Drugs

12.2.5. Skin Cancer Drugs

12.2.6. Others

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Mail Order Pharmacies

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Prescription Dermatology Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Acne & Rosacea Drugs

13.2.2. Psoriasis Drugs

13.2.3. Dermatitis & Seborrhea Drugs

13.2.4. Fungal Infection Drugs

13.2.5. Skin Cancer Drugs

13.2.6. Others

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Mail Order Pharmacies

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. AbbVie, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Type Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Janssen Biotech, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Type Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Novartis AG

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Type Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Amgen, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Type Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Celgene Corporation

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Type Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Pfizer Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Type Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. LEO Pharma A/S

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Type Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Eli Lilly and Company

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Type Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Bausch Health Companies, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Type Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Sun Pharmaceuticals Ltd.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Type Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Aclaris Therapeutics, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Type Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Aurobindo Pharma Ltd.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Type Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

List of Tables

Table 01: Global Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 05: North America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: North America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: Europe Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Asia Pacific Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Asia Pacific Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Latin America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Latin America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Middle East & Africa Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 18: Middle East & Africa Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type 2022 and 2031

Figure 03: Global Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 04: Global Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 05: Global Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 06: Global Prescription Dermatology Therapeutics Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 10: North America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 11: North America Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 12: North America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 13: North America Prescription Dermatology Therapeutics Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 17: Europe Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 18: Europe Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 19: Europe Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 20: Europe Prescription Dermatology Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type 2022 and 2031

Figure 24: Asia Pacific Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: Asia Pacific Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 26: Asia Pacific Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 27: Asia Pacific Prescription Dermatology Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 31: Latin America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 32: Latin America Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Latin America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 34: Latin America Prescription Dermatology Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Prescription Dermatology Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Prescription Dermatology Therapeutics Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 38: Middle East & Africa Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 39: Middle East & Africa Prescription Dermatology Therapeutics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: Middle East & Africa Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 41: Middle East & Africa Prescription Dermatology Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Prescription Dermatology Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Prescription Dermatology Therapeutics Market Share Analysis, by Company, 2022