The number of mobile phone owners around the globe has increased drastically. All regions around the globe are getting access tointernet and mobile phones. According to World Bank data, in developing regions like sub-Saharan Africa, more than 60% of the population have mobile phones. Today, mobile phones are affordable, easy to use, and provide several benefits with minimum requirement of any expertise to handle the device. The capability of mobile phones to provide diverse interactive activities including text messaging, calling,mobile apps, and web browsing have made them highly popular. Not only simple mobile phones but smartphones have also witnessed strong penetration around the globe. More than half of the global population own smartphones today. Smartphone owners are spending more and more time on their device for social networking and calling purposes. This in turn has given a boost to prepaid wireless service across the globe. Moreover, with cheaper voice and data plans available, mobile owners are opting for prepaid services over postpaid.

Mobile owners are opting for prepaid wireless services over postpaid and contract based services due to affordability and flexibility to switch operators. Moreover, millennials and senior population around the globe prefer prepaid services more, which in turn have made prepaid services highly popular in regions like North America and Europe. Internet users are another major factor that has given a push to the market. Active internet users around the globe have gained momentum in recent years which has increased the demand for affordable data plans.Growing dependency on mobile phonesto organize work and personal data is also driving the market. Additionally, opportunity for further smartphone penetration in developing regionssuch as Asia, Africa, and the MiddleEast is anticipated to propel the prepaid wireless servicemarket.

Globally, the prepaid wireless service market is segmented based on connectivity and type. In terms of connectivity, the market is segmented into 2G, 3G, and 4G connectivity. Based on type, the market is segregated into data and voice. In terms of connectivity, 4G occupies the largest share of more than 50% in the overall prepaid wireless service market. Demand for 2G connectivity has drastically fallen over a period of time largely due to rollout of 4G/LTE connectivity which is much faster. Moreover, TMR believes that after the commercial roll out of 5G services, 3G connectivity services will also start losing its market. The year-on-year growth in 3G connectivity services have become stable and will start declining from the initial months of 2019. As and when large populations around the globe become active users of internet, the demand for affordable and fast data plans will increase, which in turn will increase the demand for 4G, 4.5G, and 5G connectivity services.

In terms of type, voice occupies the largest share in the market. However, the compound annual growth rate (CAGR) of data is expected to be higher than voce during the forecastperiod. The reason for the same is behavioral shift among individuals. Today, people are spending significant amount of time on their smartphone, using it to complete all kinds of crucial work, right from socializing to financial transactions. This is therefore creating demand for internet data plans.

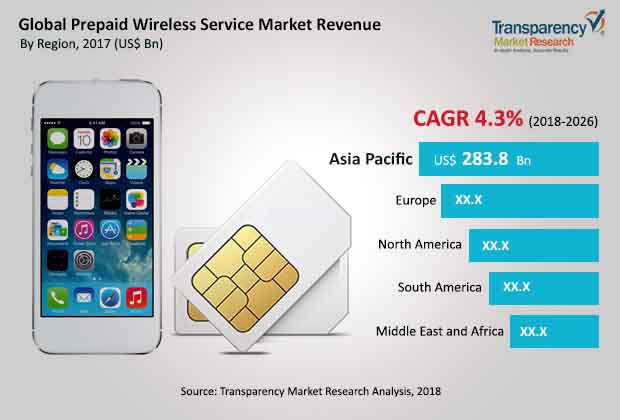

Based on region, the global prepaid wireless service market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. AsiaPacific dominates the market, followed by Europe and North America. In North America, mobile owners are shifting from contract based services to prepaid services in the last few years.However, the share of postpaid wireless service is still higher than prepaid wireless service, when compared with other regions such as AsiaPacific and the Middle East and Africa. The largest market for prepaid wireless service is Asia Pacific largely due to the population size and people’s preference for prepaid services over postpaid services. Europe is the second largest market (in terms of revenue) for prepaid wireless services. The prepaid wireless services market received a further boost with the popularity of the MVNO (mobile virtual network operator) model in Europe. These MVNOs provide attractive voice and data plans at affordable rates, thus creating demand for prepaid wireless services specifically in developing countries.

Key players operating in this market adopt strategies such as product innovation, strategic alliances, partnerships, and acquisitions. The prepaid wireless service market is rather competitive; however, it is dominated by a few key players.Some of the major players in the global prepaid wireless service market include AT&T Inc., Sprint Corporation, Verizon Wireless, T-Mobile International AG, Deutsche Telekom, Vodafone Group plc, Orange S.A., Telefónica, S.A., Telstra Corporation Ltd., Telenor ASA, Emirates Telecommunication Group, Axiata Group, Bharti Airtel Limited, China Mobile Communications Corporation and AméricaMóvil.

Prepaid Wireless Service Market - Snapshot

A prepaid wireless service provides most of the services offered by a mobile phone operator. The big difference is that with prepaid wireless service, payment for service is made before use. As calls and texts are made, and as data is used, deductions are made against the prepaid balance amount until no funds remain (at which time services stop functioning). A user may avoid interruptions in service by making payments to increase the remaining balance.

AT&T, Sprint, T-Mobile, and Verizon Wireless are some of the big cell phone carriers across the globe. Often called mobile network operators (MNOs), they own their networks and compete aggressively on price, plans, and phones. Prepaid wireless service, on the other hand, typically price their no-contract plans much lower than the MNOs, because these carriers don't maintain their own network infrastructure and licensed radio spectrum. Instead, most prepaid wireless service are mobile virtual network operators (MVNOs) that buy minutes wholesale from the major carriers and resell them to you at retail prices.

A prepaid wireless service may have a lower cost (often for low usage patterns e.g. a telephone for emergency use) and make it easier to control spending by limiting debt and controlling usage. They often have fewer contractual obligations – no early termination fee, freedom to change providers, plans, able to be used by those unable to take out a contract (i.e. under age of majority). Depending on the local laws, they may be available to those who do not have a permanent address, phone number, or credit card.

Sometimes, pay-as-you-go customers pay more for their calls, SMS and data, than contract customers. In some cases they are limited in what they can do with their phone – calls to international or premium-rate telephone numbers may be blocked, and they may not be able to roam. Current models being deployed by prepeaid wireless service carriers are capable of setting the price points for all services on an individual basis (via packages), such that higher pricing is a marketing decision.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary : Global Prepaid Wireless Service Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. Key Regional Socio-Political-Technological Developments and their Impact Considerations

4.3. Porter’s Five Forces Analysis – Global Prepaid Wireless Service Market

4.4. PESTEL Analysis - Global Prepaid Wireless Service Market

4.5. Ecosystem Analysis - Global Prepaid Wireless Service Market

4.6. Market Dynamics

4.6.1. Drivers

4.6.2. Restraints

4.6.3. Opportunities

4.6.4. Impact Analysis of Drivers & Restraints

4.7. MVNO Business Model

4.8. Competitive Scenario

4.8.1. Prepaid and Post-paid Market Strategy

4.8.2. Concentration ratio Analysis

4.8.3. Merger and Acquisition Analysis

4.8.4. Monthly ARPU Forecast 2018 – 2023

4.9. Market Attractiveness Analysis – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.9.1. By Region/Country

4.9.2. By Connectivity

4.9.3. By Data

4.10. Market Outlook

5. Global Prepaid Wireless Service Market Forecast, by Connectivity, 2016 – 2026

5.1. Overview

5.2. Prepaid Wireless Market Size (US$ Bn) Forecast, By Connectivity, 2016 - 2026

5.2.1. 2G

5.2.2. 3G

5.2.3. 4G

5.3. Market Share Analysis By Connectivity

6. Global Prepaid Wireless Service Market Forecast, by Type, 2016 – 2026

6.1. Overview

6.2. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

6.2.1. Data

6.2.2. Voice

6.3. Market Share Analysis By Type

7. Global Prepaid Wireless Service Market Forecast, by Region

7.1. Overview

7.2. Key Segment Analysis

7.3. Prepaid Wireless Service Market Size (US$ Bn) Forecast, by Region, 2016 - 2026

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East &Africa

7.3.5. South America

8. North America Prepaid Wireless Market Analysis and Forecast

8.1. Key Findings

8.2. Market Dynamics

8.2.1. Opportunity (US$ Bn)

8.2.2. Impact Analysis of Drivers & Restraints

8.3. Prepaid Wireless Market Size (US$ Bn) Forecast, by Connectivity, 2016 - 2026

8.3.1. 2G

8.3.2. 3G

8.3.3. 4G

8.4. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

8.4.1. Data

8.4.2. Voice

8.5. Prepaid Wireless Market Size (US$ Bn) Forecast, by Country, 2016 - 2026

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

9. Europe Prepaid Wireless Market Analysis and Forecast

9.1. Key Findings

9.2. Market Dynamics

9.2.1. Opportunity (US$ Bn)

9.2.2. Impact Analysis of Drivers & Restraints

9.3. Prepaid Wireless Market Size (US$ Bn) Forecast, by Connectivity, 2016 - 2026

9.3.1. 2G

9.3.2. 3G

9.3.3. 4G

9.4. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

9.4.1. Data

9.4.2. Voice

9.5. Prepaid Wireless Market Size (US$ Bn) Forecast, by Country, 2016 - 2026

9.5.1. Germany

9.5.2. France

9.5.3. UK

9.5.4. Rest of Europe

10. Asia Pacific Prepaid Wireless Market Analysis and Forecast

10.1. Key Findings

10.2. Market Dynamics

10.2.1. Opportunity (US$ Bn)

10.2.2. Impact Analysis of Drivers & Restraints

10.3. Prepaid Wireless Market Size (US$ Bn) Forecast, by Connectivity, 2016 - 2026

10.3.1. 2G

10.3.2. 3G

10.3.3. 4G

10.4. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

10.4.1. Data

10.4.2. Voice

10.5. Prepaid Wireless Market Size (US$ Bn) Forecast, by Country, 2016 - 2026

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. Indonesia

10.5.5. Rest of Asia Pacific

11. Middle East & Africa Prepaid Wireless Market Analysis and Forecast

11.1. Key Findings

11.2. Market Dynamics

11.2.1. Opportunity (US$ Bn)

11.2.2. Impact Analysis of Drivers & Restraints

11.3. Prepaid Wireless Market Size (US$ Bn) Forecast, by Connectivity, 2016 - 2026

11.3.1. 2G

11.3.2. 3G

11.3.3. 4G

11.4. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

11.4.1. Data

11.4.2. Voice

11.5. Prepaid Wireless Market Size (US$ Bn) Forecast, by Country, 2016 - 2026

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of MEA

12. South America Prepaid Wireless Market Analysis and Forecast

12.1. Key Findings

12.2. Market Dynamics

12.2.1. Opportunity (US$ Bn)

12.2.2. Impact Analysis of Drivers & Restraints

12.3. Prepaid Wireless Market Size (US$ Bn) Forecast, by Connectivity, 2016 - 2026

12.3.1. 2G

12.3.2. 3G

12.3.3. 4G

12.4. Prepaid Wireless Market Size (US$ Bn) Forecast, by Type, 2016 - 2026

12.4.1. Data

12.4.2. Voice

12.5. Prepaid Wireless Market Size (US$ Bn) Forecast, by Country, 2016 - 2026

12.5.1. Brazil

12.5.2. Rest of South America

13. Competition Landscape

13.1. Market Players – Competition Matrix

13.2. Prepaid Wireless Service Provider Market Share (%), 2017

14. Company Profiles

14.1. AT&T Inc.

14.1.1. Basic Overview

14.1.2. Sales Area/Geographical Presence

14.1.3. Revenue

14.1.4. SWOT Analysis

14.1.5. Strategy

14.2. Sprint Corporation

14.2.1. Basic Overview

14.2.2. Sales Area/Geographical Presence

14.2.3. Revenue

14.2.4. SWOT Analysis

14.2.5. Strategy

14.3. Verizon

14.3.1. Basic Overview

14.3.2. Sales Area/Geographical Presence

14.3.3. Revenue

14.3.4. SWOT Analysis

14.3.5. Strategy

14.4. Deutsche Telekom

14.4.1. Basic Overview

14.4.2. Sales Area/Geographical Presence

14.4.3. Revenue

14.4.4. SWOT Analysis

14.4.5. Strategy

14.5. Vodafone Group plc

14.5.1. Basic Overview

14.5.2. Sales Area/Geographical Presence

14.5.3. Revenue

14.5.4. SWOT Analysis

14.5.5. Strategy

14.6. Orange S.A.

14.6.1. Basic Overview

14.6.2. Sales Area/Geographical Presence

14.6.3. Revenue

14.6.4. SWOT Analysis

14.6.5. Strategy

14.7. Telefónica, S.A.

14.7.1. Basic Overview

14.7.2. Sales Area/Geographical Presence

14.7.3. Revenue

14.7.4. SWOT Analysis

14.7.5. Strategy

14.8. Telstra Corporation Ltd.

14.8.1. Basic Overview

14.8.2. Sales Area/Geographical Presence

14.8.3. Revenue

14.8.4. SWOT Analysis

14.8.5. Strategy

14.9. Telenor ASA

14.9.1. Basic Overview

14.9.2. Sales Area/Geographical Presence

14.9.3. Revenue

14.9.4. SWOT Analysis

14.9.5. Strategy

14.10. Emirates Telecommunication Group

14.10.1. Basic Overview

14.10.2. Sales Area/Geographical Presence

14.10.3. Revenue

14.10.4. SWOT Analysis

14.10.5. Strategy

14.11. Axiata Group

14.11.1. Basic Overview

14.11.2. Sales Area/Geographical Presence

14.11.3. Revenue

14.11.4. SWOT Analysis

14.11.5. Strategy

14.12. Bharti Airtel Limited

14.12.1. Basic Overview

14.12.2. Sales Area/Geographical Presence

14.12.3. Revenue

14.12.4. SWOT Analysis

14.12.5. Strategy

14.13. China Mobile Communications Corporation

14.13.1. Basic Overview

14.13.2. Sales Area/Geographical Presence

14.13.3. Revenue

14.13.4. SWOT Analysis

14.13.5. Strategy

14.14. América Móvil

14.14.1. Basic Overview

14.14.2. Sales Area/Geographical Presence

14.14.3. Revenue

14.14.4. SWOT Analysis

14.14.5. Strategy

15. Key Takeaways

List of Tables

Table 1: An overview of select Acquisitions and Merger transactions

Table 2: Global Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 3: Global Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 4: Global Prepaid Wireless Service Market Forecast, By Region, 2016–2026 (US$ Bn)

Table 5: North America Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 6: North America Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 7: North America Prepaid Wireless Service Market Forecast, By Country, 2016–2026 (US$ Bn)

Table 8: Europe Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 9: Europe Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 10: Europe Prepaid Wireless Service Market Forecast, By Country , 2016–2026 (US$ Bn)

Table 11: Asia-Pacific Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 12: Asia-Pacific Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 13: Asia-Pacific Prepaid Wireless Service Market Forecast, By Country , 2016–2026 (US$ Bn)

Table 14: MEA Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 15: MEA Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 16: MEA Prepaid Wireless Service Market Forecast, By Country , 2016–2026 (US$ Bn)

Table 17: South America Prepaid Wireless Service Market Forecast, By connectivity, 2016–2026 (US$ Bn)

Table 18: South America Prepaid Wireless Service Market Forecast, By Type, 2016–2026 (US$ Bn)

Table 19: South America Prepaid Wireless Service Market Forecast, By Country , 2016–2026 (US$ Bn)

Table 20: Global Prepaid Wireless Service Market Share, By Key MNOs (2017)

List of Figures

Figure 1: PESTLE Analysis

Figure 2: Technology Roadmap

Figure 3: Value Chain Analysis

Figure 4: MVNO Business Model

Figure 5: Global Prepaid Wireless Service Market, 2016-2026

Figure 6: Trend Analysis

Figure 7: Global Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 8: Global Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 9: Global Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 10: Global Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 11: Global Prepaid Wireless Service Market Attractiveness Analysis, By Region

Figure 12: Global Prepaid Wireless Service Market Attractiveness Analysis, By Region

Figure 13: North America Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 14: North America Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 15: North America Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 16: North America Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 17: Europe Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 18: Europe Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 19: Europe Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 20: Europe Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 21: Asia-Pacific Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 22: Asia-Pacific Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 23: Asia-Pacific Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 24: Asia-Pacific Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 25: MEA Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 26: MEA Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 27: MEA Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 28: MEA Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 29: South America Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 30: South America Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 31: South America Prepaid Wireless Service Market Attractiveness Analysis, By Type

Figure 32: South America Prepaid Wireless Service Market Attractiveness Analysis, By Connectivity

Figure 33: Market Outlook, By Connectivity

Figure 34: Market Outlook, By Type

Figure 35: Global Prepaid Wireless Service Market Value Share Analysis and Forecast, By Region (20)

Figure 36: Global Prepaid Wireless Service Market Value Share Analysis and Forecast, By Region (2026)

Figure 37: North America Prepaid Wireless Service Revenue (US$ Bn) opportunity, 2018– 2026

Figure 38: North America Prepaid Wireless Service Market Revenue (US$ Bn) and Y-o-Y, 2016– 2026

Figure 39: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2017)

Figure 40: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 41: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2017)

Figure 42: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 43: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 44: North America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 45: Europe Prepaid Wireless Service Revenue (US$ Bn) opportunity, 2018– 2026

Figure 46: Europe Prepaid Wireless Service Market Revenue (US$ Bn) and Y-o-Y, 2016– 2026

Figure 47: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2017)

Figure 48: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 49: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 50: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 51: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 52: Europe Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 53: Asia-Pacific Prepaid Wireless Service Revenue (US$ Bn) opportunity, 2018– 2026

Figure 54: Asia-Pacific Prepaid Wireless Service Market Revenue (US$ Bn) and Y-o-Y, 2016– 2026

Figure 55: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 56: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 57: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2017)

Figure 58: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 59: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 60: Asia-Pacific Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 61: MEA Prepaid Wireless Service Revenue (US$ Bn) opportunity, 2018– 2026

Figure 62: MEA Prepaid Wireless Service Market Revenue (US$ Bn) and Y-o-Y, 2016– 2026

Figure 63: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2017)

Figure 64: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 65: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2017)

Figure 66: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 67: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2017)

Figure 68: MEA Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 69: South America Prepaid Wireless Service Revenue (US$ Bn) opportunity, 2018– 2026

Figure 70: South America Prepaid Wireless Service Market Revenue (US$ Bn) and Y-o-Y, 2016– 2026

Figure 71: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2017)

Figure 72: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Connectivity (2026)

Figure 73: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2017)

Figure 74: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Type (2026)

Figure 75: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 76: South America Prepaid Wireless Service Market Value Share Analysis and Forecast, By Country (2026)

Figure 77: Vendors Analysis

Figure 78: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017, Deutsche Telekom

Figure 79: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Vodafone Group plc

Figure 80: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Orange S.A.

Figure 81: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Telefonica, S.A.

Figure 82: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Telstra Corporation Ltd.

Figure 83: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017, Telenor SA

Figure 84: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Etisalat Group Company PJSC

Figure 85: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017, Axiata Group

Figure 86: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, Bharti Airtel Limited

Figure 87: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, China Mobile Communications Corporation

Figure 88: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017, America Movil

Figure 90: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017, Sprint Corporation

Figure 91: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017, Verizon Communication