Analysts’ Viewpoint

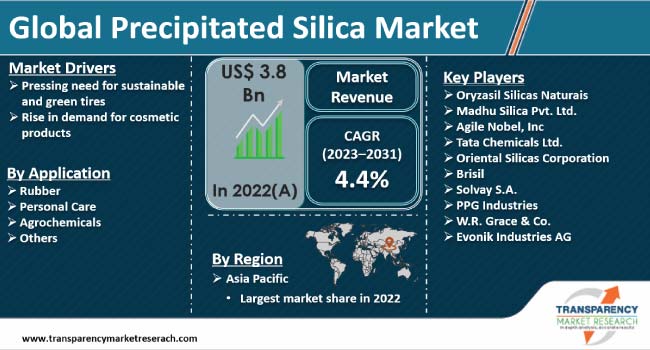

Growth in rubber and agrochemical industries is driving the global precipitated silica market. Rise in usage of cosmetics and personal care products is also augmenting market progress. Furthermore, pressing demand for sustainable solutions, such as green tires, in the automobile sector is boosting the precipitated silica industry value. Technological advancements and increase in usage of rice husk as a feedstock material are also fueling market dynamics.

Key global precipitated silica market players are focusing on product diversity, optimization of production methods, and improvement in product quality to obtain competitive advantage. Value addition and product innovation are likely to remain prominent areas of focus for companies operating in the industry.

Precipitated silica is a form of amorphous silica, which is produced by precipitation from a solution containing silicate salts. Feedstock used to manufacture precipitated silica includes hydrochloric acid, sulfuric acid, silica sand, and sodium silicate. Precipitated silica is used as an additive in diverse industries such as personal care, rubber, food and feed, and paints and coatings.

Consistent rise in demand for precipitated silica for the manufacture of silicone rubber, industrial rubber, and footwear is a leading factor that is driving the precipitated silica market size. Demand for green tires is increasing across the globe due to ongoing regulatory pressure to improve environmental safety. This is projected to steer market development in the near future.

Precipitated silica market insights reveal significant scope for expansion owing to the surge in demand for green tires across the globe due to their safety, comfort, energy saving, and environmental preservation features.

Vehicle firms across the world are striving to meet the stringent road safety standards. These include rolling resistance and wet traction, notably in the European Union's passenger automobile category. Usage of precipitated silica in these applications is likely to augment the market trajectory during the forecast period.

The cosmetics and personal care sector has been growing rapidly since the last few years due to changing lifestyles, rise in disposable income of consumers, and increase in awareness about skin care. Precipitated silica is used in cosmetics and personal care products due to its capacity to act as a suspending, anti-caking, bulking, abrasive, and opacifying agent.

Precipitated silica is also commonly employed as an absorbent powder in cosmetics owing to its ability to absorb moisture and perspiration. Furthermore, synthetic amorphous silica is often utilized in compact powders, blushes, and sunscreens because of its improved spreadability. Thus, expansion in the global cosmetics and personal care sector is likely to augment the precipitated silica market growth during the forecast period.

The global automobile business has grown significantly across the globe, notably in Asia Pacific, over the last few years. In recent years, the production of environmentally friendly and low-pollution tires, also known as green tires, has increased consistently. This has resulted in the gradual replacement of carbon black with high-dispersion precipitated silica.

Several tire firms are progressively shifting toward using eco-friendly precipitated silica for green tires and similar variants to meet the evolving consumer and regulatory demands. Growth in the automotive sector is likely to create lucrative opportunities for high-performance precipitated silica for tire manufacturers.

Rice husk (RH) is one of the most common agricultural wastes in rice-producing countries. It is widely available throughout Southeast Asia. Rice husk is created after rice is milled. It includes between 80% and 90% silica.

If the conversion efficiency is more than 70%, the rate of recovery of precipitated silica from rice husk ash stands at 90%-95%. As a result, rice husk ash is one of the most cost-effective feedstock for synthesizing precipitated silica.

Low capital inputs, easy availability of raw materials, and high profitability in generating silica from rice husk ash are expected to generate significant opportunities for precipitated silica manufacturers throughout the forecast period.

Asia Pacific accounted for significant global precipitated silica market share in 2022. This trend is likely to continue over the projection period, owing to the increase in tire demand in the vehicle sector in the region. China constituted the largest share of precipitated silica sales in Asia Pacific 2022 due to the high requirement for rubber in the tire sector in the country.

The business in North America is expected to grow at a steady pace in the near future. Expansion in personal care and rubber industries is largely responsible for market growth in the region. Furthermore, increase in demand for energy-efficient tires is expected to drive market dynamics of North America.

The precipitated silica market forecast for Europe also appears positive. Introduction of tire-labeling laws and increased efforts by manufacturers to optimize vehicle fuel economy are projected to fuel the market trajectory in Europe during the forecast period.

Key players in the global precipitated silica industry are increasingly focusing on strengthening their foothold in domestic and international markets through inorganic growth strategies. Acquisitions, partnerships, and mergers are a common occurrence in this landscape.

Prominent players operating in the global precipitated silica business are Oryzasil Silicas Naturais, Madhu Silica Pvt. Ltd, Agile Nobel, Inc, Tata Chemicals Ltd., Oriental Silicas Corporation, Brisil, Solvay S.A. and PPG Industries.

The precipitated silica market report summarizes these companies based on criteria such as company profiles, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 3.8 Bn |

| Market Forecast Value in 2031 | US$ 5.7 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020–2022 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 3.8 Bn in 2022

It is likely to grow at a CAGR of 4.4% from 2023 to 2031

Demand from rubber, personal care, and agrochemical industries, expansion of cosmetics and personal care applications, and the automobile industry's pressing need for sustainable solutions, like green tires

Rubber, by industry, commands a bulk of the market share

Asia Pacific was the leading market globally in 2022

Oryzasil Silicas Naturais, Madhu Silica Pvt. Ltd, Agile Nobel, Inc, Tata Chemicals Ltd., Oriental Silicas Corporation, Brisil, Solvay S.A. and PPG Industries, etc.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Precipitated Silica Market Analysis and Forecast, 2023-2031

2.6.1. Global Precipitated Silica Market Volume (Kilo Tons)

2.6.2. Global Precipitated Silica Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Precipitated Silica

3.2. Impact on Demand for Precipitated Silica – Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Application

6.2. Price Trend Analysis by Region

7. Global Precipitated Silica Market Analysis and Forecast, by Application, 2023–2031

7.1. Introduction and Definitions

7.2. Global Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Rubber

7.2.2. Personal Care

7.2.3. Agrochemicals

7.2.4. Others

7.3. Global Precipitated Silica Market Attractiveness, by Application

8. Global Precipitated Silica Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Precipitated Silica Market Attractiveness, by Region

9. North America Precipitated Silica Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3. North America Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.3.1. U.S. Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3.2. Canada Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.4. North America Precipitated Silica Market Attractiveness Analysis

10. Europe Precipitated Silica Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3. Europe Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. Germany Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.3.2. France Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.3. U.K. Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.4. Italy Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.5. Russia & CIS Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.6. Rest of Europe Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. Europe Precipitated Silica Market Attractiveness Analysis

11. Asia Pacific Precipitated Silica Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

11.3. Asia Pacific Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.3.1. China Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.2. Japan Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.3. India Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.4. ASEAN Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.5. Rest of Asia Pacific Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Asia Pacific Precipitated Silica Market Attractiveness Analysis

12. Latin America Precipitated Silica Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3. Latin America Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.3.1. Brazil Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.2. Mexico Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.3. Rest of Latin America Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Latin America Precipitated Silica Market Attractiveness Analysis

13. Middle East & Africa Precipitated Silica Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3. Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.3.1. GCC Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.2. South Africa Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.3. Rest of Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Middle East & Africa Precipitated Silica Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Precipitated Silica Market Company Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Orizasil Silicas Naturais

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.2. Madhu Silica Pvt. Ltd.

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.3. Agile Nobel, Inc.

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.4. Tata Chemicals Ltd.

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.5. Oriental Silicas Corporation

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.6. Brisil

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.7. Solvay S.A.

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.8. PPG Industries

14.2.8.1. Company Revenue

14.2.8.2. Business Overview

14.2.8.3. Product Segments

14.2.8.4. Geographic Footprint

14.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.9. W.R. Grace & Co.

14.2.9.1. Company Revenue

14.2.9.2. Business Overview

14.2.9.3. Product Segments

14.2.9.4. Geographic Footprint

14.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.10. Evonik Industries AG

14.2.10.1. Company Revenue

14.2.10.2. Business Overview

14.2.10.3. Product Segments

14.2.10.4. Geographic Footprint

14.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 2: Global Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 3: Global Precipitated Silica Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 4: Global Precipitated Silica Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 5: North America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 6: North America Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: North America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 8: North America Precipitated Silica Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 9: U.S. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 10: U.S. Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Canada Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 12: Canada Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 14: Europe Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe Precipitated Silica Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 18: Germany Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: France Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 20: France Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: U.K. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 22: U.K. Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Italy Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 24: Italy Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 25: Spain Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 26: Spain Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Russia & CIS Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 28: Russia & CIS Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Rest of Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 30: Rest of Europe Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 31: Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 32: Asia Pacific Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 33: Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific Precipitated Silica Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 36: China Precipitated Silica Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 37: Japan Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 38: Japan Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 39: India Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 40: India Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 41: ASEAN Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 42: ASEAN Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 43: Rest of Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 44: Rest of Asia Pacific Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 45: Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 46: Latin America Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 47: Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America Precipitated Silica Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 50: Brazil Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 51: Mexico Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 52: Mexico Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 53: Rest of Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Latin America Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 55: Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 56: Middle East & Africa Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 57: Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa Precipitated Silica Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 60: GCC Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 61: South Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 62: South Africa Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 63: Rest of Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 64: Rest of Middle East & Africa Precipitated Silica Market Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 2: Global Precipitated Silica Market Attractiveness, by Application

Figure 3: Global Precipitated Silica Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Precipitated Silica Market Attractiveness, by Region

Figure 5: North America Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: North America Precipitated Silica Market Attractiveness, by Application

Figure 7: North America Precipitated Silica Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Precipitated Silica Market Attractiveness, by Country

Figure 9: Europe Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: Europe Precipitated Silica Market Attractiveness, by Application

Figure 11: Europe Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 14: Asia Pacific Precipitated Silica Market Attractiveness, by Application

Figure 15: Asia Pacific Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 18: Latin America Precipitated Silica Market Attractiveness, by Application

Figure 19: Latin America Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Precipitated Silica Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Middle East & Africa Precipitated Silica Market Attractiveness, by Application

Figure 23: Middle East & Africa Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Precipitated Silica Market Attractiveness, by Country and Sub-region