Global Power System Analysis Software Market: Snapshot

The solutions in the global power system analysis software market are utilized by the players in the power utilities industry to analyze, simulate, and model an efficient electrical system. Analysis provided by the solutions in the global power system analysis software market provides a number of benefits that can aid the players in power utilities industry to detect and diagnose various abnormalities as well as any types of defects. Moreover, these solutions offer a 24 by 7 access to historic data, various trends, and operational data. Solutions in the global power system analysis software market are also used by the vendors in the power utilities industry to measure adequacy calculations among the generation and the capacities of the electrical network.

Increasing demand for energy as well as inefficacies in the existing electrical supply are two of the most prominent driving factors influencing the growth in the global power system analysis software market in coming years. It is anticipated that the global demand for energy may exceed 778 joules by the year 2035. Vendors in the power utilities sector are hence rapidly adopting solutions from the global power system analysis software market to meet this rising demand. Furthermore, various government agencies and authorities across the globe are implementing strict rules and regulations in order to meet the required sustainable energy goals. This trend is also expected to favor the growth in the global power system analysis software market in coming years.

Rising urbanization has led to a staggering demand for electricity across the world. This has resulted in increase in the production of the electricity. Hence, various players in electricity generation are also adopting these novel solutions from the global power system analysis software market. Moreover, rising requirement for effective network for power transmission lines in order to improve electricity generation as well as distribution has also favored the expansion of the global power system analysis software market in recent past. Furthermore, rising need to boost the existing power distribution network by enhancing the transmission lines, and related infrastructure such as electric grids is also influencing the growth in the global power system analysis software market.

Global Power System Analysis Software Market: Snapshot

Power system analysis software facilitates utility companies to minimize loss of energy during electricity generation and electricity distribution, thereby optimizing operational efficiency. Due to incessant energy consumption along with challenges in energy production, utility providers are increasingly shifting towards power system analysis software to analyze data collected from smart power systems.

The increasing investment in smart power technologies is the primary factor boosting the global power system analysis software market. Apart from this, advancements in Big Data analytics and Internet of Things is also a major factor boosting the demand for power system analysis software. Furthermore, energy conservancy property of the software is gathering the attention of governments across the world for long-term energy security, which is another factor fuelling the market’s growth.

The power system analysis software market is highly fragmented with the presence of several local players. However, a handful of companies, namely General Electric Company, ABB Ltd., and Siemens AG have established themselves via mergers and acquisitions and strategic alliances with domestic players. For example, in 2016, General Electric Company acquired Alstom and has been making huge investments in India to build smart cities, mission critical facilities, process industries, and government operations.

The global power system analysis software market stood at a valuation of US$3,540.4 mn in 2015 and is expected to be worth US$10,245.6 mn by 2024 rising at a CAGR of 12.6% between 2016 and 2024.

Cloud-based Implementation to Gain Prominence in Near Future

In terms of implementation, the global market for power system analysis software is divided into on-premise and cloud-based models. Of the two, on-premise led the market in 2015 accounting for almost 82% revenue of the overall power system analysis software market. The on-premise implementation segment is expected to rise at a CAGR of 12.3% between 2016 and 2024. The on-premise model offers better system uptime as servers are owned and maintained at the power utilities’ buildings, which is one of the key factors for the lead position of the segment.

However, cloud-based implementation segment is also expected to rise steadily due to the far-reach capabilities of the Internet.

On the basis of application, distribution and transmission are the segments into which the power system analysis software market is divided. In 2015, distribution held 62% of the overall market and is expected to display leading demand through the forecast period.

Asia Pacific to Emerge as Significant Market

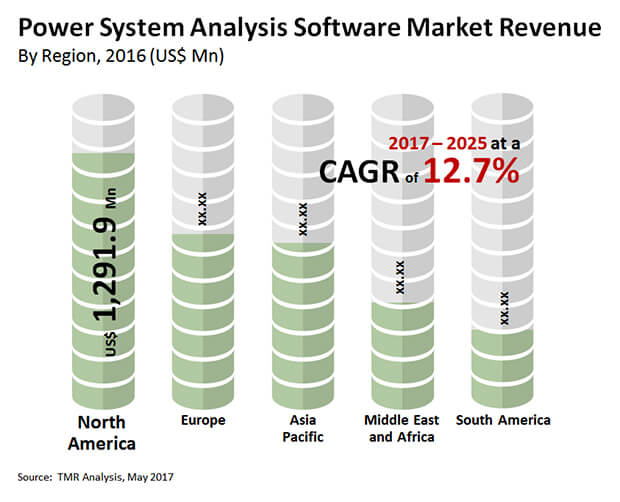

Region-wise, North America is the leading contributor to the power system analysis software market. The region held almost 33.0% of the revenue in the global market in 2015. This is mainly due to massive investments in smart grid systems. Furthermore, ongoing efforts in Canada to upgrade its electricity infrastructure with the objective to minimize energy loss during production and transmission is expected to have a positive impact on the power system analysis software market in the coming years.

However, rapid urbanization in emerging economies of Asia Pacific is expected to bode well for the growth of this regional market. In Asia Pacific, countries such as China, India, Japan, South Korea, and Australia are the leading domestic markets with large populations and high unmet energy needs.

Key companies operating in the power system analysis software market include ABB Ltd., General Electric Company, ETAP/Operation Technology Inc., PSI AG, Unicorn Systems, Electricity Coordinating Center Ltd., Open Systems International Inc., Electrocon International Inc., Eaton Corporation plc, Siemens AG, Schneider Electric DMS NS, Atos SE, Artleys SA, Energy Exemplar, PowerWorld Corporation, Nexant Inc., Pöyry, Neplan AG, and DIgSILENT GmbH

Global Power System Analysis Software Market to Expand as Industries Pay Attention to Electrical Safety

The presence of a seamless industry for electrical systems management has created new opportunities for growth across the global power system analysis software market. The use of cutting-edge technologies for studying the load and bearing capacity of electrical lines and circuits has brought power system analysis software under the radar of focus. Moreover, large industries and organizations have become increasingly aware of the need for proper management electrical lines and circuits in their premises. Therefore, use of power system analysis software is slated to advance in the times to follow. In light of these factors, the total volume of revenues flowing into the global power system analysis software market is set to increase in the years to come by.

Power System Analysis Software Market to Exceed Valuation Of US$10,245.6 mn by 2024.

The global Power System Analysis Software Market is estimated to expand at a 12.6% CAGR during 2016-2024.

Major factor driving the growth of global power system analysis software market during the forecast period increasing demand for electric power.

Major factors hampering the growth of the power system analysis software market during the forecast period constitutes high upfront investment and security challenges.

Key companies operating in the power system analysis software market include ABB Ltd., General Electric Company, ETAP/Operation Technology Inc., PSI AG, Unicorn Systems, Electricity Coordinating Center Ltd., Open Systems International Inc., Electrocon International Inc., Eaton Corporation plc, Siemens AG, Schneider Electric DMS NS, Atos SE, Artleys SA, Energy Exemplar, PowerWorld Corporation, Nexant Inc., Pöyry, Neplan AG, and DIgSILENT GmbH.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Power System Analysis Software Market Snapshot

2.2. Global Power System Analysis Software Market Revenue, 2014 - 2024 (US$ Mn) and Year-on-Year Growth (%)

3. Global Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

3.1. Overview

3.2. Key Trends Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Global Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

3.4.1. On-premise

3.4.2. Cloud-based

3.5. Global Power System Analysis Software Market Analysis, By Application, 2014 - 2024 (US$ Mn)

3.5.1. Distribution

3.5.2. Transmission

3.6. Competitive Landscape

3.6.1. Market Positioning of Key Players, 2015

3.6.2. Competitive Strategies Adopted by Key Players

3.6.3. Recommendations

4. North America Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

4.1. Key Trends Analysis

4.2. North America Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

4.2.1. On-premise

4.2.2. Cloud-based

4.3. North America Power System Analysis Software Market Revenue, By Application, 2014 - 2024 (US$ Mn)

4.3.1. Distribution

4.3.2. Transmission

4.4. North America Power System Analysis Software Market Analysis, By Geography, 2014 – 2024 (US$ Mn)

4.4.1. The U.S.

4.4.2. Rest of North America

5. Europe Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

5.1. Key Trends Analysis

5.2. Europe Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

5.2.1. On-premise

5.2.2. Cloud-based

5.3. Europe Power System Analysis Software Market Analysis, By Application, 2014 - 2024 (US$ Mn)

5.3.1. Distribution

5.3.2. Transmission

5.4. Europe Power System Analysis Software Market Analysis, By Geography, 2014 – 2024 (US$ Mn)

5.4.1. EU7 (The U.K., Italy, Spain, France, Germany, Belgium, and the Netherlands)

5.4.2. CIS

5.4.3. Rest of Europe

6. Asia Pacific (APAC) Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

6.1. Key Trends Analysis

6.2. APAC Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

6.2.1. On-premise

6.2.2. Cloud-based

6.3. APAC Power System Analysis Software Market Analysis, By Application, 2014 - 2024 (US$ Mn)

6.3.1. Distribution

6.3.2. Transmission

6.4. APAC Power System Analysis Software Market Analysis, By Geography, 2014 – 2024 (US$ Mn)

6.4.1. Japan

6.4.2. China

6.4.3. South Asia (India, Pakistan, Bangladesh, & Sri Lanka)

6.4.4. Australasia (Australia, NZ & Guinea)

6.4.5. Rest of APAC

7. Middle East and Africa (MEA) Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

7.1. Key Trends Analysis

7.2. Middle East and Africa Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

7.2.1. On-premise

7.2.2. Cloud-based

7.3. Middle East and Africa Power System Analysis Software Market Analysis, By Application, 2014 - 2024 (US$ Mn)

7.3.1. Distribution

7.3.2. Transmission

7.4. Middle East and Africa Power System Analysis Software Market Analysis, By Geography, 2014 – 2024 (US$ Mn)

7.4.1. GCC Countries

7.4.2. South Africa

7.4.3. Rest of MEA

8. Latin America Power System Analysis Software Market Analysis, 2014 - 2024 (US$ Mn)

8.1. Key Trends Analysis

8.2. Latin America Power System Analysis Software Market Analysis, By Implementation Model, 2014 - 2024 (US$ Mn)

8.2.1. On-premise

8.2.2. Cloud-based

8.3. Latin America Power System Analysis Software Market Analysis, By Application, 2014 - 2024 (US$ Mn)

8.3.1. Distribution

8.3.2. Transmission

8.4. Latin America Power System Analysis Software Market Analysis, By Geography, 2014 – 2024 (US$ Mn)

8.4.1. Brazil

8.4.2. Rest of Latin America

9. Company Profiles

9.1. ABB Ltd.

9.1.1. Company Details (HQ, Foundation Year, Employee Strength)

9.1.2. Market Presence, By Segment and Geography

9.1.3. Key Developments

9.1.4. Strategy and Historical Roadmap

9.1.5. Revenue and Operating Profits

* Similar details would be provided for all the players mentioned below

9.2. Siemens AG

9.2.1. Company Details (HQ, Foundation Year, Employee Strength)

9.2.2. Market Presence, By Segment and Geography

9.2.3. Key Developments

9.2.4. Strategy and Historical Roadmap

9.2.5. Revenue and Operating Profits

9.3. General Electric Company

9.3.1 Company Details (HQ, Foundation Year, Employee Strength)

9.3.2 Market Presence, By Segment and Geography

9.3.3 Key Developments

9.3.4 Strategy and Historical Roadmap

9.3.5 Revenue and Operating Profits

9.4. Schneider Electric DMS NS

9.4.1 Company Details (HQ, Foundation Year, Employee Strength)

9.4.2 Market Presence, By Segment and Geography

9.4.3 Key Developments

9.4.4 Strategy and Historical Roadmap

9.4.5 Revenue and Operating Profits

9.5. ETAP/Operation Technology, Inc.

9.5.1 Company Details (HQ, Foundation Year, Employee Strength)

9.5.2 Market Presence, By Segment and Geography

9.5.3 Key Developments

9.5.4 Strategy and Historical Roadmap

9.5.5 Revenue and Operating Profits

9.6. Atos SE

9.6.1 Company Details (HQ, Foundation Year, Employee Strength)

9.6.2 Market Presence, By Segment and Geography

9.6.3 Key Developments

9.6.4 Strategy and Historical Roadmap

9.6.5 Revenue and Operating Profits

9.7. Artelys SA

9.7.1 Company Details (HQ, Foundation Year, Employee Strength)

9.7.2 Market Presence, By Segment and Geography

9.7.3 Key Developments

9.7.4 Strategy and Historical Roadmap

9.7.5 Revenue and Operating Profits

9.8 PSI AG

9.8.1 Company Details (HQ, Foundation Year, Employee Strength)

9.8.2 Market Presence, By Segment and Geography

9.8.3 Key Developments

9.8.4 Strategy and Historical Roadmap

9.8.5 Revenue and Operating Profits

9.9. Operation Simulation Associates, Inc.

9.9.1 Company Details (HQ, Foundation Year, Employee Strength)

9.9.2 Market Presence, By Segment and Geography

9.9.3 Key Developments

9.9.4 Strategy and Historical Roadmap

9.9.5 Revenue and Operating Profits

9.10. Unicorn Systems

9.10.1 Company Details (HQ, Foundation Year, Employee Strength)

9.10.2 Market Presence, By Segment and Geography

9.10.3 Key Developments

9.10.4 Strategy and Historical Roadmap

9.10.5 Revenue and Operating Profits

9.11. Energy Exemplar

9.11.1 Company Details (HQ, Foundation Year, Employee Strength)

9.11.2 Market Presence, By Segment and Geography

9.11.3 Key Developments

9.11.4 Strategy and Historical Roadmap

9.11.5 Revenue and Operating Profits

9.12. Electricity Coordinating Center Ltd.

9.12.1 Company Details (HQ, Foundation Year, Employee Strength)

9.12.2 Market Presence, By Segment and Geography

9.12.3 Key Developments

9.12.4 Strategy and Historical Roadmap

9.12.5 Revenue and Operating Profits

9.13. PowerWorld Corporation

9.13.1 Company Details (HQ, Foundation Year, Employee Strength)

9.13.2 Market Presence, By Segment and Geography

9.13.3 Key Developments

9.13.4 Strategy and Historical Roadmap

9.13.5 Revenue and Operating Profits

9.14. Open Systems International, Inc.

9.14.1 Company Details (HQ, Foundation Year, Employee Strength)

9.14.2 Market Presence, By Segment and Geography

9.14.3 Key Developments

9.14.4 Strategy and Historical Roadmap

9.14.5 Revenue and Operating Profits

9.15. Nexant Inc.

9.15.1 Company Details (HQ, Foundation Year, Employee Strength)

9.15.2 Market Presence, By Segment and Geography

9.15.3 Key Developments

9.15.4 Strategy and Historical Roadmap

9.15.5 Revenue and Operating Profits

9.16. Electrocon International Inc.

9.16.1 Company Details (HQ, Foundation Year, Employee Strength)

9.16.2 Market Presence, By Segment and Geography

9.16.3 Key Developments

9.16.4 Strategy and Historical Roadmap

9.16.5 Revenue and Operating Profits

9.17. Pöyry

9.17.1 Company Details (HQ, Foundation Year, Employee Strength)

9.17.2 Market Presence, By Segment and Geography

9.17.3 Key Developments

9.17.4 Strategy and Historical Roadmap

9.17.5 Revenue and Operating Profits

9.18. DIgSILENT GmbH

9.18.1 Company Details (HQ, Foundation Year, Employee Strength)

9.18.2 Market Presence, By Segment and Geography

9.18.3 Key Developments

9.18.4 Strategy and Historical Roadmap

9.18.5 Revenue and Operating Profits

9.19. Eaton Corporation Plc

9.19.1 Company Details (HQ, Foundation Year, Employee Strength)

9.19.2 Market Presence, By Segment and Geography

9.19.3 Key Developments

9.19.4 Strategy and Historical Roadmap

9.19.5 Revenue and Operating Profits

9.20. Neplan AG

9.20.1 Company Details (HQ, Foundation Year, Employee Strength)

9.20.2 Market Presence, By Segment and Geography

9.20.3 Key Developments

9.20.4 Strategy and Historical Roadmap

9.20.5 Revenue and Operating Profits

List of Tables

Table 1: Global Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 2: Global Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 3: North America Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 4: North America Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 5: North America Power System Analysis Software Market Revenue, By Country, 2015 - 2025 (US$ Mn)

Table 6: Europe Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 7: Europe Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 8: Europe Power System Analysis Software Market Revenue, By Country, 2015 - 2025 (US$ Mn)

Table 9: Asia Pacific Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 10: Asia Pacific Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 11: Asia Pacific Power System Analysis Software Market Revenue, By Country, 2015 - 2025 (US$ Mn)

Table 12: Middle East & Africa Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 13: Middle East & Africa Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 14: Middle East & Africa Power System Analysis Software Market Revenue, By Country, 2015 - 2025 (US$ Mn)

Table 15: Latin America Power System Analysis Software Market Revenue, By Application, 2015 - 2025 (US$ Mn)

Table 16: Latin America Power System Analysis Software Market Revenue, By Implementation Model, 2015 - 2025 (US$ Mn)

Table 17: Latin America Power System Analysis Software Market Revenue, By Country, 2015 - 2025 (US$ Mn)

List of Figures

Figure 1: Electricity Production, 2010 – 2014, TWh

Figure 2: Average interruption duration index, 2012, in minutes (Source: Accenture Analysis, 2013)

Figure 3: Global Power System Analysis Software Market Revenues, 2015 - 2025 (US$ Mn) and Y-o-Y Growth (%)

Figure 4: Global Power System Analysis Software Market Revenues (US $ Mn) and CAGR (%)

Figure 5: Global Power System Analysis Software Market, By Region

Figure 6: Global Power System Analysis Software Market Revenue, By Application (US$ Mn), 2017 & 2025

Figure 7: Global Power System Analysis Software Market Revenue, 2017 & 2025 (US $ Mn), By Implementation Model

Figure 8: Market Positioning of Key Players, 2015

Figure 9: North America Power System Analysis Software Market Revenue, 2015 - 2025 (US$ Mn)

Figure 10: North America Power System Analysis Software Market Revenue, By Application, 2017 & 2025 (US$ Mn)

Figure 11: North America Power System Analysis Software Market Revenue, By Implementation Model, 2017 & 2025 (US$ Mn)

Figure 12: Europe Power System Analysis Software Market Revenue, 2015 - 2025 (US$ Mn)

Figure 13: Europe Power System Analysis Software Market Revenue, By Application, 2017 & 2025 (US$ Mn)

Figure 14: Europe Power System Analysis Software Market Revenue, By Implementation Model, 2014 & 2024 (US$ Mn)

Figure 15: Asia Pacific Power System Analysis Software Market Revenue, 2015 - 2025 (US$ Mn)

Figure 16: Asia Pacific Power System Analysis Software Market Revenue, By Application, 2017 & 2025 (US$ Mn)

Figure 17: Asia Pacific Power System Analysis Software Market Revenue, By Implementation Model, 2017 & 2025 (US$ Mn)

Figure 18: Middle East & Africa Power System Analysis Software Market Revenue, 2015 - 2025 (US$ Mn)

Figure 19: Middle East & Africa Power System Analysis Software Market Revenue, By Application, 2017 & 2025 (US$ Mn)

Figure 20: Middle East & Africa Power System Analysis Software Market Revenue, By Implementation Model, 2017 & 2025 (US$ Mn)

Figure 21: Latin America Power System Analysis Software Market Revenue, 2015 - 2025 (US$ Mn)