Analysts’ Viewpoint

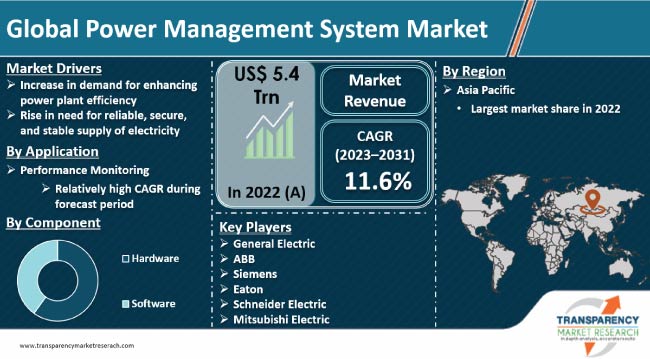

Increase in demand for enhancing power plant efficiency and rise in need for a reliable, secure, and stable supply of electricity are the major factors contributing to the demand for power management systems. Increase in utilization of PMS in commercial buildings, industrial facilities, and residential complexes to control and monitor power usage, regulate lighting and HVAC systems, and manage energy distribution is driving the global power management system market.

Manufacturers in the global market are focusing on developing efficient and sustainable power management systems that contribute to energy savings, cost reduction, and improved operational performance. These systems enable load balancing, fault detection, and optimal utilization of renewable energy sources. However, rise in cyberattacks in the power sector is anticipated to hamper power management system market progress during the forecast period.

Power management system (PMS) is a collection of hardware, software, and control algorithms designed to efficiently manage and control the distribution of electrical power in various applications.

Its primary purpose is to optimize the use of power resources, ensure the reliable delivery of electricity, and monitor & regulate power consumption. The specific implementation of a power management system can vary depending on the application and requirements.

PMS involves the management of power generation, distribution, and consumption to ensure efficient utilization, reliability, and cost-effectiveness. PMS is vital for integrating renewable energy sources such as solar panels and wind turbines into the electrical grid.

It helps manage the fluctuating nature of these sources, balance supply and demand, and optimize energy storage systems. It facilitates demand response capabilities, which involve adjusting power consumption during peak demand periods or in response to pricing signals.

By voluntarily reducing or shifting loads, consumers can help balance supply and demand, reduce strain on the grid, and potentially benefit from incentive programs. It could include the integration of energy storage systems such as batteries.

These systems help store excess power during periods of low demand or high renewable energy generation and release it when needed. PMS controls the charging and discharging of energy storage devices for optimal utilization and grid stability.

Power plants require efficient management of power generation, distribution, and control processes. Advanced power management systems enable automation, real-time monitoring, and optimization of these operations, resulting in improved efficiency, reduced downtime, and enhanced overall plant performance.

Power plants are essential components of the electrical grid, and their integration and stability are crucial for reliable power supply. Advanced power management systems help in synchronizing the plant's power output with the grid's demand, maintaining frequency and voltage stability, and facilitating seamless grid integration.

With the increase in penetration of renewable energy sources, such as solar and wind, power plants need to adapt to the fluctuating nature of these resources. Advanced power management systems allow for the effective integration of renewable energy, managing intermittent power generation and balancing it with conventional power sources or energy storage systems.

Advanced power management systems leverage automation, sensors, and data analytics to enable intelligent monitoring and diagnostics of power plant equipment. This enables proactive maintenance, early fault detection, and predictive analytics, leading to optimized asset performance, reduced downtime, and improved maintenance planning.

Power plants strive to maximize energy efficiency and minimize operational costs. Advanced power management systems provide real-time data on power consumption, load profiling, and energy losses, enabling plant operators to identify areas for improvement and implement energy-saving measures.

Power management systems play a crucial role in ensuring reliable operation of electrical grids. These systems monitor power generation, transmission, and distribution in real-time, allowing for effective management of grid stability. By actively monitoring and managing the grid, power management systems help minimize power outages and disruptions, ensuring a reliable supply of electricity.

The growing complexity of energy demand patterns requires effective demand management strategies. Power management systems enable demand response programs, allowing utilities to manage peak demand by incentivizing consumers to adjust their power usage during high-demand periods. By optimizing load distribution and balancing supply and demand, power management systems help prevent grid instability and ensure a stable power supply.

Demand for power management systems is increasing due to the evolving energy landscapes and emerging challenges such as cybersecurity threats and renewable energy integration. These systems enable efficient grid operation, demand management, renewable energy integration, and resilience, contributing to a more robust and sustainable power infrastructure.

Hardware components of the power management system efficiently monitor, control, and distribute electrical power. Power meters are devices that measure electrical parameters such as voltage, current, power factor, and energy consumption. These provide real-time data on power usage, allowing for accurate monitoring and analysis of energy consumption patterns.

Sensors are used to detect and measure various parameters in the power system. For example, current sensors monitor the flow of electric current, temperature sensors monitor equipment temperature, and voltage sensors measure electrical voltage levels. Sensors provide essential input for monitoring and control algorithms in power management systems.

PLCs are industrial-grade digital computers used to control and automate various processes in power management systems. These are responsible for executing control algorithms, managing inputs and outputs, and coordinating the operation of different components within the system.

Switchgear and circuit breakers are used for electrical circuit protection, isolation, and control. These ensure the safety of the power system by interrupting the flow of current in case of faults or overloads. These devices help protect equipment and maintain the stability of the electrical network.

Performance monitoring involves continuous measurement and analysis of various parameters and metrics to assess the performance and efficiency of the power system. It provides valuable insights into the system's operation, identifies potential issues or inefficiencies, and enables informed decision-making for optimization and improvement.

Performance monitoring involves usage of sensors, meters, and other monitoring devices to collect real-time data on parameters such as voltage, current, power factor, energy consumption, and equipment status. This data provides a comprehensive view of the power system's performance. It allows for the early detection of faults or abnormalities in the power system. By continuously monitoring critical parameters, deviations from expected values or abnormal trends can be quickly identified, enabling prompt action to address the issue and minimize downtime.

By leveraging performance monitoring capabilities, power management systems can operate more efficiently, ensure reliable power supply, optimize energy usage, and proactively address potential issues. It enables operators to make data-driven decisions and continuously improve the performance and sustainability of the power system.

According to the power management system market forecast, Asia Pacific accounted for major share of the global industry in 2022. It is anticipated to grow at a significant CAGR in the near future, owing to the growth in industries including petrochemical, healthcare, and oil & gas in countries such as China, Japan, and India.

Asia Pacific has experienced rapid industrialization, urbanization, and population growth, leading to a substantial increase in energy consumption. Power management systems help meet the growing demand for electricity by optimizing power generation, transmission, and distribution, ensuring efficient utilization of resources. This is propelling the power management system market growth in the region.

Asia Pacific has a diverse power infrastructure that includes a mix of conventional power plants, renewable energy sources, and complex grids. Power management systems enable the effective integration and management of these diverse energy sources, ensuring a stable and reliable power supply across the region. This factor is contributing to the power management system market development in the region.

According to the latest power management system market analysis, the global industry is dominated by a small number of large and medium-sized players. The leading players cumulatively accounted for 50% to 55% power management system market share in 2022. These players are focusing on technological innovations, mergers, and acquisitions to increase their global presence in the market.

General Electric, ABB, Siemens, Eaton, Schneider Electric, Mitsubishi Electric, Rockwell Automation, Emerson, World Benchmarking Alliance, and ETAP are the prominent power management system market leaders operating worldwide. These leading companies are following the latest power management system market trends to increase their market share and revenue.

Key players have been profiled in the power management system market report based on parameters including company overview, recent developments, financial overview, product portfolio, business strategies, and business segments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 5.4 Trn |

|

Forecast (Value) in 2031 |

US$ 14.4 Trn |

|

Growth Rate (CAGR) |

11.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 5.4 Trn in 2022

It is expected to advance at a CAGR of 11.6% from 2023 to 2031

Increase in demand for enhancing power plant efficiency and rise in demand for reliable, secure, and stable supply of electricity are driving the market

The hardware was the largest segment in 2022

Asia Pacific was the most lucrative region in 2022

General Electric, ABB, Siemens, Eaton, Schneider Electric, Mitsubishi Electric, Rockwell Automation, Emerson, World Benchmarking Alliance, and ETAP are the prominent players in the market.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Power Management System Market Analysis and Forecasts, 2022-2031

2.6.1. Global Power Management System Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Power Management System

3.2. Impact on the Demand of Power Management System- Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Global Power Management System Market Analysis and Forecast, by Component, 2022-2031

5.1. Introduction and Definitions

5.2. Global Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

5.2.1. Hardware

5.2.1.1. Computer Server

5.2.1.2. Controller

5.2.1.3. Sensor

5.2.1.4. Communication Network

5.2.1.5. Others

5.2.2. Software

5.2.2.1. Supervisory Control & Data Acquisition (SCADA)

5.2.2.2. Advanced Distribution Management Solution (ADMS)

5.2.2.3. Outage Management System (OMS)

5.2.2.4. Generation Management System (GMS)

5.2.2.5. Internet of Things (IoT)

5.2.2.6. Others

5.3. Global Power Management System Market Attractiveness, by Component

6. Global Power Management System Market Analysis and Forecast, by Application, 2022-2031

6.1. Introduction and Definitions

6.2. Global Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

6.2.1. Performance Monitoring

6.2.2. Load Profiling & Scheduling

6.2.3. Outage Scheduling

6.2.4. Maintenance & Inspection

6.2.5. Optimal Power Flow

6.2.6. Automatic Generation Control and Dispatch

6.2.7. Data Security

6.2.8. Others

6.3. Global Power Management System Market Attractiveness, by Application

7. Global Power Management System Market Analysis and Forecast, End-use, 2022-2031

7.1. Introduction and Definitions

7.2. Global Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

7.2.1. Oil & Gas

7.2.2. Petrochemical

7.2.3. Marine

7.2.4. Power & Energy

7.2.5. Manufacturing

7.2.6. Healthcare

7.2.7. Others

7.3. Global Power Management System Market Attractiveness, by End-use

8. Global Power Management System Market Analysis and Forecast, by Region, 2022-2031

8.1. Key Findings

8.2. Global Power Management System Market Value (US$ Bn) Forecast, by Region, 2022-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Power Management System Market Attractiveness, by Region

9. North America Power Management System Market Analysis and Forecast, 2022-2031

9.1. Key Findings

9.2. North America Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

9.3. North America Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

9.4. North America Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

9.5. North America Power Management System Market and Value (US$ Bn) Forecast, by Country, 2022-2031

9.5.1. U.S. Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

9.5.2. U.S. Power Management System Market and Value (US$ Bn) Forecast, by Application, 2022-2031

9.5.3. U.S. Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

9.5.4. Canada Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

9.5.5. Canada Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

9.5.6. Canada Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

9.6. North America Power Management System Market Attractiveness Analysis

10. Europe Power Management System Market Analysis and Forecast, 2022-2031

10.1. Key Findings

10.2. Europe Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.3. Europe Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.4. Europe Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5. Europe Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

10.5.1. Germany Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.2. Germany Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.3. Germany Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5.4. France Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.5. France Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.6. France Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5.7. U.K. Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.8. U.K. Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.9. U.K. Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5.10. Italy Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.11. Italy. Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.12. Italy Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5.13. Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.14. Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.15. Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.5.16. Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

10.5.17. Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

10.5.18. Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

10.6. Europe Power Management System Market Attractiveness Analysis

11. Asia Pacific Power Management System Market Analysis and Forecast, 2022-2031

11.1. Key Findings

11.2. Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Component

11.3. Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.4. Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.5. Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.5.1. China Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

11.5.2. China Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.5.3. China Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.5.4. Japan Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

11.5.5. Japan Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.5.6. Japan Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.5.7. India Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

11.5.8. India Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.5.9. India Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.5.10. ASEAN Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

11.5.11. ASEAN Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.5.12. ASEAN Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.5.13. Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

11.5.14. Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

11.5.15. Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

11.6. Asia Pacific Power Management System Market Attractiveness Analysis

12. Latin America Power Management System Market Analysis and Forecast, 2022-2031

12.1. Key Findings

12.2. Latin America Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

12.3. Latin America Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

12.4. Latin America Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

12.5. Latin America Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.5.1. Brazil Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

12.5.2. Brazil Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

12.5.3. Brazil Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

12.5.4. Mexico Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

12.5.5. Mexico Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

12.5.6. Mexico Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

12.5.7. Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

12.5.8. Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

12.5.9. Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

12.6. Latin America Power Management System Market Attractiveness Analysis

13. Middle East & Africa Power Management System Market Analysis and Forecast, 2022-2031

13.1. Key Findings

13.2. Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

13.3. Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

13.4. Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5. Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.5.1. GCC Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

13.5.2. GCC Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

13.5.3. GCC Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.4. South Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

13.5.5. South Africa Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

13.5.6. South Africa Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.7. Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2022-2031

13.5.8. Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Application, 2022-2031

13.5.9. Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by End-use, 2022-2031

13.6. Middle East & Africa Power Management System Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Players - Competition Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, 2022

14.3. Market Footprint Analysis

14.3.1. By Component

14.3.2. By Application

14.4. Company Profiles

14.4.1. General Electric

14.4.1.1. Company Revenue

14.4.1.2. Business Overview

14.4.1.3. Product Segments

14.4.1.4. Geographic Footprint

14.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.2. ABB

14.4.2.1. Company Revenue

14.4.2.2. Business Overview

14.4.2.3. Product Segments

14.4.2.4. Geographic Footprint

14.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.3. Siemens

14.4.3.1. Company Revenue

14.4.3.2. Business Overview

14.4.3.3. Product Segments

14.4.3.4. Geographic Footprint

14.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.4. Eaton

14.4.4.1. Company Revenue

14.4.4.2. Business Overview

14.4.4.3. Product Segments

14.4.4.4. Geographic Footprint

14.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.5. ETAP

14.4.5.1. Company Revenue

14.4.5.2. Business Overview

14.4.5.3. Product Segments

14.4.5.4. Geographic Footprint

14.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.6. Schneider Electric

14.4.6.1. Company Revenue

14.4.6.2. Business Overview

14.4.6.3. Product Segments

14.4.6.4. Geographic Footprint

14.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.7. Mitsubishi Electric

14.4.7.1. Company Revenue

14.4.7.2. Business Overview

14.4.7.3. Product Segments

14.4.7.4. Geographic Footprint

14.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.8. Rockwell Automation

14.4.8.1. Company Revenue

14.4.8.2. Business Overview

14.4.8.3. Product Segments

14.4.8.4. Geographic Footprint

14.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.9. World Benchmarking Alliance

14.4.9.1. Company Revenue

14.4.9.2. Business Overview

14.4.9.3. Product Segments

14.4.9.4. Geographic Footprint

14.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.4.10. Emerson

14.4.10.1. Company Revenue

14.4.10.2. Business Overview

14.4.10.3. Product Segments

14.4.10.4. Geographic Footprint

14.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 2: Global Power Management System Market Volume (US$ Bn) Forecast, by Application, 2023-2031

Table 3: Global Power Management System Market Volume (US$ Bn) Forecast, by End-use, 2023-2031

Table 4: Global Power Management System Market Volume (US$ Bn) Forecast, by Region, 2023-2031

Table 5: North America Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 6: North America Power Management System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 7: North America Power Management System Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 8: North America Power Management System Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 9: U.S. Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 10: U.S. Power Management System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 11: U.S. Power Management System Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 12: Canada Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 13: Canada Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 14: Canada Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 15: Europe Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 16: Europe Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 17: Europe Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 18: Europe Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 19: Germany Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 20: Germany Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 21: Germany Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 22: France Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 23: France Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 24: France Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 25: U.K. Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 26: U.K. Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 27: U.K. Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 28: Italy Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 29: Italy Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 30: Italy Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 31: Spain Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 32: Spain Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 33: Spain Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 34: Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 35: Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 36: Russia & CIS Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 37: Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 38: Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 39: Rest of Europe Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 40: Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 41: Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 42: Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 43: Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 44: China Power Management System Market Value (US$ Bn) Forecast, by Component 2023-2031

Table 45: China Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 46: China Power Management System Market Value (US$ Bn) Forecast, by End-use. 2023-2031

Table 47: Japan Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 48: Japan Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 49: Japan Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 50: India Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 51: India Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 52: India Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 53: ASEAN Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 54: ASEAN Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 55: ASEAN Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 56: Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 57: Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 58: Rest of Asia Pacific Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 59: Latin America Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 60: Latin America Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 61: Latin America Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 62: Latin America Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 63: Brazil Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 64: Brazil Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 65: Brazil Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 66: Mexico Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 67: Mexico Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 68: Mexico Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 69: Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 70: Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 71: Rest of Latin America Power Management System Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 72: Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 73: Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 74: Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 75: Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 76: GCC Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 77: GCC Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 78: GCC Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 79: South Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 80: South Africa Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 81: South Africa Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 82: Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Component, 2023-2031

Table 83: Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 84: Rest of Middle East & Africa Power Management System Market Value (US$ Bn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Global Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 2: Global Power Management System Market Attractiveness, by Component

Figure 3: Global Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Power Management System Market Attractiveness, by Application

Figure 5: Global Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 6: Global Power Management System Market Attractiveness, by End-use

Figure 7: Global Power Management System Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 8: Global Power Management System Market Attractiveness, by Region

Figure 9: North America Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 10: North America Power Management System Market Attractiveness, by Component

Figure 11: North America Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 12: North America Power Management System Market Attractiveness, by Application

Figure 13: North America Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 14: North America Power Management System Market Attractiveness, by End-use

Figure 15: North America Power Management System Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: North America Power Management System Market Attractiveness, by Country and Sub-region

Figure 17: Europe Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 18: Europe Power Management System Market Attractiveness, by Component

Figure 19: Europe Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 20: Europe Power Management System Market Attractiveness, by Application

Figure 21: Europe Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Europe Power Management System Market Attractiveness, by End-use

Figure 23: Europe Power Management System Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Europe Power Management System Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 26: Asia Pacific Power Management System Market Attractiveness, by Component

Figure 27: Asia Pacific Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Asia Pacific Power Management System Market Attractiveness, by Application

Figure 29: Asia Pacific Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 30: Asia Pacific Power Management System Market Attractiveness, by End-use

Figure 31: Asia Pacific Power Management System Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 32: Asia Pacific Power Management System Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 34: Latin America Power Management System Market Attractiveness, by Component

Figure 35: Latin America Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 36: Latin America Power Management System Market Attractiveness, by Application

Figure 37: Latin America Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 38: Latin America Power Management System Market Attractiveness, by End-use

Figure 39: Latin America Power Management System Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Latin America Power Management System Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Power Management System Market Volume Share Analysis, by Component, 2022, 2027, and 2031

Figure 42: Middle East & Africa Power Management System Market Attractiveness, by Component

Figure 43: Middle East & Africa Power Management System Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 44: Middle East & Africa Power Management System Market Attractiveness, by Application

Figure 45: Middle East & Africa Power Management System Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 46: Middle East & Africa Power Management System Market Attractiveness, by End-use

Figure 47: Middle East & Africa Power Management System Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Middle East & Africa Power Management System Market Attractiveness, by Country and Sub-region