Analyst Viewpoint

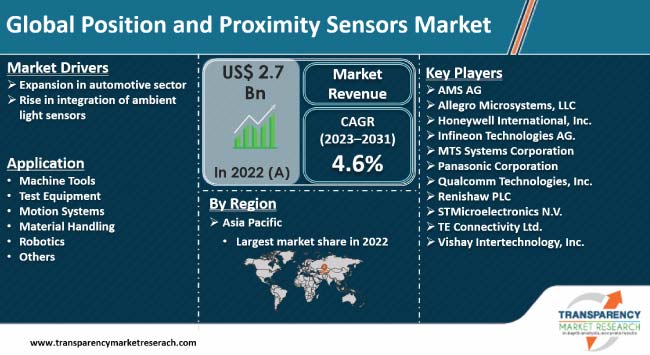

Expansion in automotive sector and rise in integration of ambient light sensors are fueling the position and proximity sensors market size. Position and proximity sensors can identify objects or signals without any physical contact between the sensor and the object being sensed. Innovative position-sensing technologies in automotive systems are utilized to unlock vehicles automatically when their keys are around.

Major players operating in the position and proximity sensors market landscape are developing miniature sensors for use in microelectronics. They are also launching Time-of-Flight (ToF) sensors with multi-target detection capabilities.

Position and proximity sensors are electronic devices embedded with sensors to identify the location and presence of objects remotely. These sensors are commonly used in robotics, automation, and industrial control. They are designed to detect the position or displacement of an object around a reference point.

Linear motion sensors are employed to measure linear or angular displacement and generate information regarding the direction and speed of the object. These sensors can also identify the presence of objects from a distance using various techniques such as infrared, ultrasonic, capacitive, or magnetic fields. Sensors usually utilize automated systems to identify objects, monitor movement, or trigger alarms or security systems. Position and proximity sensors offer precise and reliable details about the location and presence of objects which is important in several modern applications.

Position and proximity sensors can identify objects or signals without any physical contact between the sensor and the object being sensed. Displacement position and proximity sensors come in several shapes and sizes, varying on the utilization of their application. These sensors play a crucial role in the automotive sector as they are utilized to protect the car when someone is trying to break into the car or temper it. They can also be employed to unlock the doors automatically.

There is a gradual shift in consumer preference for automated automobiles due rise in awareness of monitoring and safety systems. Position and proximity sensors are significantly utilized in several automobile parts such as front assist, rare view assist, and side assist monitoring systems. These sensors are also employed as gesture control for audio, navigation, HVAC, and smartphone connectivity functions. Thus, growth in automotive sector is propelling the position and proximity sensors market value.

Hyundai’s HCD-14 is a luxury sedan featuring gesture controls for audio, HVAC, navigation, and smartphone connectivity functions. The driver selects a main function by gazing at a heads-up display (HUD), presses a thumb button on the steering wheel to confirm his/her selection, and then performs gestures, which include moving a hand in or out from the dashboard to zoom in or out on the navigation system, a dialing motion to adjust volume, and a side-to-side gesture to change radio stations.

Visteon’s Horizon cockpit concept, which the company has been demonstrating to global vehicle manufacturers, uses 3D gesture recognition to transform the way a driver controls interior temperature, audio, and navigation. In the Horizon cockpit concept, controls can be manipulated by moving the hand or just a finger. For example, radio volume can be adjusted by making a turning motion with one’s hand without making contact with the instrument cluster. The gesture recognition technology uses a camera system to map the user’s hand and replicates a virtual hand on the center stack display. Hence, rise in adoption of 3D gesture recognition is expected to spur the position and proximity sensors market growth in the near future.

Ambient Light Sensors (ALSs) and proximity sensors are electronic systems employed in several applications to identify and measure the amount of ambient light present in an environment and to detect the presence or absence of objects or people nearby. The adoption of ambient light and proximity sensors offers multiple advantages such as upgraded user experience, enhanced energy efficiency, and increased convenience. These sensors enable consumers to adjust the backlight intensity of devices without any physical contact leading to enhanced visibility and reduced power consumption.

Various manufacturers are offering advanced products to expand their position and proximity sensors market revenue. STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, offers an innovative full-color ALS. This sensor enables smartphones to take better pictures and present more visually accurate data on-screen displays.

According to the latest position and proximity sensors market trends, Asia Pacific held the largest share in 2022. Presence of major manufacturers is fueling the market dynamics of the region. Companies in the position and proximity sensors industry are developing products with features such as GPS, cameras, and displays which are utilized in the application of smartphones and smart home devices to detect motion and sensing location.

Smartphone manufacturers in Asia Pacific are offering new products, thereby driving the position and proximity sensors market statistics. In September 2020, Elliptic Labs introduced the AI Virtual Proximity Sensor, INNER BEAUTY. This is an integral component of Xiaomi Redmi K30 smartphone models, and the first phones in the Redmi series to feature Elliptic Labs' technology. INNER BEAUTY is a game-changing AI Virtual Proximity Sensor that enables OEMs to deliver phones with a simple, full-screen design.

Key players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to boost their portfolios and increase their position and proximity sensors market share across several regions.

AMS AG, Allegro MicroSystems, LLC, Honeywell International, Inc., Infineon Technologies AG, MTS Systems Corporation, Panasonic Corporation, Qualcomm Technologies, Inc., Renishaw PLC, STMicroelectronics N.V., TE Connectivity Ltd., and Vishay Intertechnology, Inc. are some of the key players operating in the global position and proximity sensors industry.

Each of these companies has been profiled in the position and proximity sensors market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 2.7 Bn |

| Market Forecast (Value) in 2031 | US$ 3.0 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.7 Bn in 2022

It is anticipated to grow at a CAGR of 4.6% from 2023 to 2031

Expansion in automotive sector and rise in integration of ambient light sensors

Asia Pacific was the leading region in 2022

AMS AG, Allegro MicroSystems, LLC, Honeywell International, Inc., Infineon Technologies AG, MTS Systems Corporation, Panasonic Corporation, Qualcomm Technologies, Inc., Renishaw PLC, STMicroelectronics N.V., TE Connectivity Ltd., and Vishay Intertechnology, Inc.

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Position and Proximity Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Position and Proximity Sensors Market Analysis, by Product Type

5.1. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

5.1.1. Linear Voltage Differential Transformers

5.1.2. Magnetostrictive Linear Position Sensors

5.1.3. Capacitive Linear Position Sensors

5.1.4. Eddy Current Linear Position Sensors

5.1.5. Fiber-optic Linear Position Sensors

5.1.6. Ultrasonic Linear Position and Proximity Sensors

5.1.7. Magnetic Proximity Sensors

5.1.8. Capacitive Proximity Sensors

5.1.9. Others

5.2. Market Attractiveness Analysis, by Product Type

6. Global Position and Proximity Sensors Market Analysis, by Contact Type

6.1. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

6.1.1. Contact Sensors

6.1.2. Non-contact Sensors

6.2. Market Attractiveness Analysis, by Contact Type

7. Global Position and Proximity Sensors Market Analysis, by Application

7.1. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Machine Tools

7.1.2. Test Equipment

7.1.3. Motion Systems

7.1.4. Material Handling

7.1.5. Robotics

7.1.6. Others

7.2. Market Attractiveness Analysis, by Application

8. Global Position and Proximity Sensors Market Analysis, by End-use Vertical

8.1. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

8.1.1. Industrial

8.1.2. Automotive

8.1.3. Aerospace & Defense

8.1.4. Healthcare

8.1.5. Security

8.1.6. Transport

8.1.7. Consumer & Home Appliances

8.1.8. IT Infrastructure

8.1.9. Energy & Utility

8.1.10. Others

8.2. Market Attractiveness Analysis, by End-use Vertical

9. Global Position and Proximity Sensors Market Analysis and Forecast, by Region

9.1. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Position and Proximity Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

10.2.1. Linear Voltage Differential Transformers

10.2.2. Magnetostrictive Linear Position Sensors

10.2.3. Capacitive Linear Position Sensors

10.2.4. Eddy Current Linear Position Sensors

10.2.5. Fiber-optic Linear Position Sensors

10.2.6. Ultrasonic Linear Position and Proximity Sensors

10.2.7. Magnetic Proximity Sensors

10.2.8. Capacitive Proximity Sensors

10.2.9. Others

10.3. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

10.3.1. Contact Sensors

10.3.2. Non-contact Sensors

10.4. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Machine Tools

10.4.2. Test Equipment

10.4.3. Motion Systems

10.4.4. Material Handling

10.4.5. Robotics

10.4.6. Others

10.5. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

10.5.1. Industrial

10.5.2. Automotive

10.5.3. Aerospace & Defense

10.5.4. Healthcare

10.5.5. Security

10.5.6. Transport

10.5.7. Consumer & Home Appliances

10.5.8. IT Infrastructure

10.5.9. Energy & Utility

10.5.10. Others

10.6. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Contact Type

10.7.3. By Application

10.7.4. By End-use Vertical

10.7.5. By Country

11. Europe Position and Proximity Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

11.2.1. Linear Voltage Differential Transformers

11.2.2. Magnetostrictive Linear Position Sensors

11.2.3. Capacitive Linear Position Sensors

11.2.4. Eddy Current Linear Position Sensors

11.2.5. Fiber-optic Linear Position Sensors

11.2.6. Ultrasonic Linear Position and Proximity Sensors

11.2.7. Magnetic Proximity Sensors

11.2.8. Capacitive Proximity Sensors

11.2.9. Others

11.3. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

11.3.1. Contact Sensors

11.3.2. Non-contact Sensors

11.4. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Machine Tools

11.4.2. Test Equipment

11.4.3. Motion Systems

11.4.4. Material Handling

11.4.5. Robotics

11.4.6. Others

11.5. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

11.5.1. Industrial

11.5.2. Automotive

11.5.3. Aerospace & Defense

11.5.4. Healthcare

11.5.5. Security

11.5.6. Transport

11.5.7. Consumer & Home Appliances

11.5.8. IT Infrastructure

11.5.9. Energy & Utility

11.5.10. Others

11.6. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Contact Type

11.7.3. By Application

11.7.4. By End-use Vertical

11.7.5. By Country/Sub-region

12. Asia Pacific Position and Proximity Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

12.2.1. Linear Voltage Differential Transformers

12.2.2. Magnetostrictive Linear Position Sensors

12.2.3. Capacitive Linear Position Sensors

12.2.4. Eddy Current Linear Position Sensors

12.2.5. Fiber-optic Linear Position Sensors

12.2.6. Ultrasonic Linear Position and Proximity Sensors

12.2.7. Magnetic Proximity Sensors

12.2.8. Capacitive Proximity Sensors

12.2.9. Others

12.3. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

12.3.1. Contact Sensors

12.3.2. Non-contact Sensors

12.4. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Machine Tools

12.4.2. Test Equipment

12.4.3. Motion Systems

12.4.4. Material Handling

12.4.5. Robotics

12.4.6. Others

12.5. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

12.5.1. Industrial

12.5.2. Automotive

12.5.3. Aerospace & Defense

12.5.4. Healthcare

12.5.5. Security

12.5.6. Transport

12.5.7. Consumer & Home Appliances

12.5.8. IT Infrastructure

12.5.9. Energy & Utility

12.5.10. Others

12.6. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Contact Type

12.7.3. By Application

12.7.4. By End-use Vertical

12.7.5. By Country/Sub-region

13. Middle East & Africa Position and Proximity Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

13.2.1. Linear Voltage Differential Transformers

13.2.2. Magnetostrictive Linear Position Sensors

13.2.3. Capacitive Linear Position Sensors

13.2.4. Eddy Current Linear Position Sensors

13.2.5. Fiber-optic Linear Position Sensors

13.2.6. Ultrasonic Linear Position and Proximity Sensors

13.2.7. Magnetic Proximity Sensors

13.2.8. Capacitive Proximity Sensors

13.2.9. Others

13.3. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

13.3.1. Contact Sensors

13.3.2. Non-contact Sensors

13.4. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Machine Tools

13.4.2. Test Equipment

13.4.3. Motion Systems

13.4.4. Material Handling

13.4.5. Robotics

13.4.6. Others

13.5. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

13.5.1. Industrial

13.5.2. Automotive

13.5.3. Aerospace & Defense

13.5.4. Healthcare

13.5.5. Security

13.5.6. Transport

13.5.7. Consumer & Home Appliances

13.5.8. IT Infrastructure

13.5.9. Energy & Utility

13.5.10. Others

13.6. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Contact Type

13.7.3. By Application

13.7.4. By End-use Vertical

13.7.5. By Country/Sub-region

14. South America Position and Proximity Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

14.2.1. Linear Voltage Differential Transformers

14.2.2. Magnetostrictive Linear Position Sensors

14.2.3. Capacitive Linear Position Sensors

14.2.4. Eddy Current Linear Position Sensors

14.2.5. Fiber-optic Linear Position Sensors

14.2.6. Ultrasonic Linear Position and Proximity Sensors

14.2.7. Magnetic Proximity Sensors

14.2.8. Capacitive Proximity Sensors

14.2.9. Others

14.3. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Contact Type, 2017–2031

14.3.1. Contact Sensors

14.3.2. Non-contact Sensors

14.4. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.4.1. Machine Tools

14.4.2. Test Equipment

14.4.3. Motion Systems

14.4.4. Material Handling

14.4.5. Robotics

14.4.6. Others

14.5. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by End-use Vertical, 2017–2031

14.5.1. Industrial

14.5.2. Automotive

14.5.3. Aerospace & Defense

14.5.4. Healthcare

14.5.5. Security

14.5.6. Transport

14.5.7. Consumer & Home Appliances

14.5.8. IT Infrastructure

14.5.9. Energy & Utility

14.5.10. Others

14.6. Position and Proximity Sensors Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Contact Type

14.7.3. By Application

14.7.4. By End-use Vertical

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Position and Proximity Sensors Market Competition Matrix - a Dashboard View

15.1.1. Global Position and Proximity Sensors Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. AMS AG

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Allegro Microsystems, LLC

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Honeywell International, Inc.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Infineon Technologies AG

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. MTS Systems Corporation

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Panasonic Corporation

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Qualcomm Technologies, Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Renishaw PLC

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. STMicroelectronics N.V.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. TE Connectivity Ltd.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Vishay Intertechnology, Inc.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 2: Global Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 3: Global Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 4: Global Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 5: Global Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 6: Global Position and Proximity Sensors Market Forecast, by Region, 2017‒2031

Table 7: North America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 8: North America Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 9: North America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 10: North America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 11: North America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 12: North America Position and Proximity Sensors Market Forecast, by Country, 2017‒2031

Table 13: Europe Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 14: Europe Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 15: Europe Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 16: Europe Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 17: Europe Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 18: Europe Position and Proximity Sensors Market Forecast, by Country and Sub-region, 2017‒2031

Table 19: Asia Pacific Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 20: Asia Pacific Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 21: Asia Pacific Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 22: Asia Pacific Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 23: Asia Pacific Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 24: Asia Pacific Position and Proximity Sensors Market Forecast, by Country and Sub-region, 2017‒2031

Table 25: Middle East & Africa Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 26: Middle East & Africa Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 27: Middle East & Africa Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 28: Middle East & Africa Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 29: Middle East & Africa Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 30: Middle East & Africa Position and Proximity Sensors Market Forecast, by Country and Sub-region, 2017‒2031

Table 31: South America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 32: South America Position and Proximity Sensors Market Forecast, by Product Type, 2017‒2031

Table 33: South America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Contact Type, 2017‒2031

Table 34: South America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 35: South America Position and Proximity Sensors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 36: South America Position and Proximity Sensors Market Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Position and Proximity Sensors Market

Figure 02: Porter Five Forces Analysis – Global Position and Proximity Sensors Market

Figure 03: Technology Road Map - Global Position and Proximity Sensors Market

Figure 04: Global Position and Proximity Sensors Market, Value (US$ Mn), 2017-2031

Figure 05: Global Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 08: Global Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 09: Global Position and Proximity Sensors Market Projections, by Contact Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 11: Global Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 12: Global Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 13: Global Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 14: Global Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 15: Global Position and Proximity Sensors Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global Position and Proximity Sensors Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Position and Proximity Sensors Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America Position and Proximity Sensors Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 21: North America Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 22: North America Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 23: North America Position and Proximity Sensors Market Projections, by Contact Type (US$ Mn), 2017‒2031

Figure 24: North America Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 25: North America Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 26: North America Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 27: North America Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 28: North America Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 29: North America Position and Proximity Sensors Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 30: North America Position and Proximity Sensors Market, Incremental Opportunity, by Country, 2023‒2031

Figure 31: North America Position and Proximity Sensors Market Share Analysis, by Country, 2022 and 2031

Figure 32: Europe Position and Proximity Sensors Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 35: Europe Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 36: Europe Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 37: Europe Position and Proximity Sensors Market Projections, by Contact Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 39: Europe Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 40: Europe Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 41: Europe Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 42: Europe Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 43: Europe Position and Proximity Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe Position and Proximity Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Position and Proximity Sensors Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 46: Asia Pacific Position and Proximity Sensors Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 50: Asia Pacific Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 51: Asia Pacific Position and Proximity Sensors Market Projections, by Contact Type, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 53: Asia Pacific Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 54: Asia Pacific Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 56: Asia Pacific Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 57: Asia Pacific Position and Proximity Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific Position and Proximity Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Position and Proximity Sensors Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 60: Middle East & Africa Position and Proximity Sensors Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 64: Middle East & Africa Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 65: Middle East & Africa Position and Proximity Sensors Market Projections, by Contact Type, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 67: Middle East & Africa Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 68: Middle East & Africa Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 70: Middle East & Africa Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 71: Middle East & Africa Position and Proximity Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa Position and Proximity Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Position and Proximity Sensors Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 74: South America Position and Proximity Sensors Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: South America Position and Proximity Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: South America Position and Proximity Sensors Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 77: South America Position and Proximity Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 78: South America Position and Proximity Sensors Market Share Analysis, by Product Type, 2022 and 2031

Figure 79: South America Position and Proximity Sensors Market Projections, by Contact Type, Value (US$ Mn), 2017‒2031

Figure 80: South America Position and Proximity Sensors Market, Incremental Opportunity, by Contact Type, 2023‒2031

Figure 81: South America Position and Proximity Sensors Market Share Analysis, by Contact Type, 2022 and 2031

Figure 82: South America Position and Proximity Sensors Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 83: South America Position and Proximity Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 84: South America Position and Proximity Sensors Market Share Analysis, by Application, 2022 and 2031

Figure 85: South America Position and Proximity Sensors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 86: South America Position and Proximity Sensors Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America Position and Proximity Sensors Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 88: Global Position and Proximity Sensors Market Competition

Figure 89: Global Position and Proximity Sensors Market Company Share Analysis