Analysts’ Viewpoint

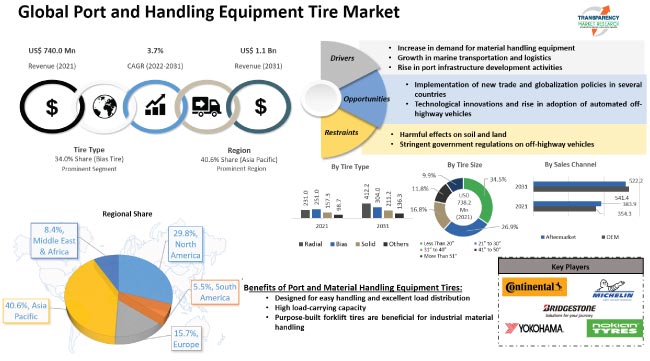

Rise in competitiveness between off the road (OTR) tire manufacturers and implementation of new trade and globalization policies in several countries are expected to boost port equipment tires market demand. Ongoing port infrastructure development activities are helping create a sustainable ecosystem in emerging and underdeveloped countries. This is augmenting market expansion.

Increase in demand for material handling equipment and growth in marine transportation and logistics are anticipated to fuel the market for port equipment tires. Future trends in the port and handling equipment tire market include electrification and hybridization of motor train as well as autonomous functionalities. Leading port equipment tire manufacturers, including Continental AG, Yokohama Tire Corporation, Nokian Tyres Plc, and Michelin, are engaged in R&D activities to expand their product portfolios.

Tires for port equipment are designed for heavy-duty applications. Port & harbor equipment tires with high load-carrying capacity consume less energy than other tires such as pneumatic or solid rubber tires. Port and terminal tires are some of the types of pneumatic tires used on large machines. According to the port & harbor equipment tires market analysis, demand for heavy-duty forklifts, aerial lifts, and other automated equipment is rising for material handling and other industrial applications at ports.

Demand for port and material handling tires for container handlers, reach stackers, straddle carriers, gantry cranes, and other equipment is high across the globe. Technological advancements in tires and rise in demand for earthmoving equipment that meets modern needs for heavy-duty solutions are likely to fuel port equipment tires market development during the forecast period. Increase in demand for industrial material handling equipment is augmenting material handling tires industry growth.

Hybrid port and material handling equipment combines tried-and-true heavy-duty technology with cutting-edge, eco-efficient features to increase productivity and decrease fuel consumption and emissions. Expansion of the manufacturing sector is expected to positively impact the global port and handling equipment tire market growth during the forecast period.

Industry 4.0 is expected to make it possible to gather real-time data from all participants in the supply chain, from manufacturers to consumers, and analyze and use it to enhance operations, designs, and products through immediate feedback. Real-time coordination between systems and processes is rising in the manufacturing sector. Therefore, automated systems are likely to dominate production operations, assisted by innovative technologies such as the Internet of Things (IoT). Increase in number of containers at ports and rise in number of international firms that need container handling equipment are fueling port trailer tires business growth.

Rise in popularity of online shopping has led to an increase in need for sophisticated material-handling machinery in warehouse facilities. Material handling equipment is increasingly being used by e-commerce and third-party logistics companies to organize merchandise in warehouses and distribution centers.

Significant growth in e-commerce and logistics sectors is augmenting the demand for port and handling equipment. Hence, demand for tires required for these equipment is consistently increasing.

Rapid adoption of new technologies is creating value-grab opportunities in logistics. Increase in number of small and medium-sized businesses is also anticipated to fuel the demand for material handling equipment. Small and medium-sized businesses are growing rapidly worldwide, especially in India, South Africa, and Russia. Increase in retail operations across the globe is driving the demand for warehouses. This is further boosting the demand for material handling equipment and their tires.

Based on tire type, the port and handling equipment tire market has been classified into radial, bias, solid, and others. The bias segment held 34.0% share of the business in 2021. Bias tires are gaining popularity due to their affordability, improved vehicle stability, and ability to produce a sidewall that is damage-resistant.

Radial and solid tires provide improved traction control and fuel efficiency. Hence, demand for these tires is high at ports for loading and unloading, shifting, and putting operations. Growth in maritime transportation & logistics is further augmenting the demand for these tires.

The port and handling equipment tires market is also expanding due to the establishment of new trade and globalization policies by numerous countries. Rise in demand for forklift and port vehicles is expected to drive the port and handling equipment tire market in developing countries such as Brazil, Mexico, and India.

In terms of volume, the automated guided vehicles (AGVs) application segment is anticipated to dominate the global industry during the forecast period. Deployment of AGVs in warehouses and distribution centers without a permanent conveying system or operator intervention is expected to drive the segment. AGVs are suited for a range of industrial requirements due to their ability to follow programmable guidelines for the optimization of picking, storage, and raw material transport operations.

The container handlers segment is also projected to hold significant share of the global port and handling equipment tire market in the near future. The port and handling equipment tire business is growing due to the irreplaceable ability of these tires to handle huge loads.

Asia Pacific dominated the global industry in 2021. It is likely to lead the market during the forecast period, owing to the rise in port infrastructure development activities in the region. Increase in number of warehouses is also estimated to drive the demand for port trailer tires in Asia Pacific.

Growth in end-use industries such as mining, construction, marine transportation, manufacturing, and material handling in countries such as China and India is projected to increase the Asia Pacific port equipment tires market share in the near future.

Asia Pacific is followed by Europe and North America in terms of tire demand for port and handling equipment. Material handling equipment is widely used in the industrial sector in Europe. This is fueling the demand for tires for these equipment. The U.S. port equipment tires market size is growing due to the rise in number of prominent players operating in the region.

Expansion of the mining sector in South Africa and GCC countries is expected to augment the demand for tires used for port and handling equipment operations. This is contributing to market expansion in Middle East & Africa.

The global port and handling equipment market is consolidated, with the presence of a few manufacturers who control majority of the share. Leading companies are adopting new technologies to increase their market share. They are developing container handling equipment tires with high load-carrying capacity.

Implementation of strategies, such as mergers and acquisitions and product portfolio expansion, is anticipated to offer lucrative opportunities for players in port equipment market.

Prominent players identified in the port and handling equipment tire market are NORTEC, Bridgestone Corporation, Interco Tire Corporation, Apollo Tyres Ltd., JK Tire & Industries Ltd, Continental AG, Yokohama Rubber Co. Ltd., Michelin, Trelleborg AB, Nokian Tyres Plc, Deere & Company, Maxxis International, Nexen Tire Corporation, Titan International Inc., Balkrishna Industries Ltd, and Sumitomo Rubber Industries Ltd.

Leading players have been profiled in the port and handling equipment tire market report based on parameters such as business strategies, company overview, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 740.0 Mn |

|

Market Forecast Value in 2031 |

US$ 1.1 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 740.0 Mn in 2021.

It expected to grow at a CAGR of 3.7% by 2031.

It is likely to be valued at US$ 1.1 Bn in 2031.

Increase in demand for material handling equipment, rise in port infrastructure development activities, and growth in marine transportation and logistics.

The bias tire type segment held 34.0% share in 2021.

Asia Pacific is a highly lucrative region for vendors.

NORTEC, Interco Tire Corporation, Yokohama Rubber Co. Ltd., Apollo Tyres Ltd., JK Tire & Industries Ltd, Bridgestone Corporation, Continental AG, Michelin, Deere & Company, Trelleborg AB, Nokian Tyres Plc, Maxxis International, Sumitomo Rubber Industries Ltd., Nexen Tire Corporation, Titan International Inc., and Balkrishna Industries Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value, Thousand Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. COVID-19 Impact Analysis – Port and Handling Equipment Tire Market

5. Pricing Analysis

6. Global Port and Handling Equipment Tire Market, By Material Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

6.2.1. Synthetic Rubber

6.2.2. Natural Rubber

6.2.3. Carbon Black

6.2.4. Fabrics & Wire

7. Global Port and Handling Equipment Tire Market, By Tire Size

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

7.2.1. Less Than 20”

7.2.2. 21” to 30”

7.2.3. 31” to 40”

7.2.4. 41” to 50”

7.2.5. More Than 51”

8. Global Port and Handling Equipment Tire Market, By Tire Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

8.2.1. Radial

8.2.2. Bias

8.2.3. Solid

8.2.4. Others

9. Global Port and Handling Equipment Tire Market, By Application

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

9.2.1. Tug Boats

9.2.2. Cranes

9.2.3. Ship Loaders

9.2.4. Reach Stackers

9.2.5. Automated Guided Vehicles (AGVs)

9.2.6. Forklift Trucks

9.2.7. Container Handlers

9.2.8. Terminal Tractors

9.2.9. Terminal Trailers

9.2.10. Straddle/Shuttle Carriers

9.2.11. Others

10. Global Port and Handling Equipment Tire Market, By Sales Channel

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.2.1. OEM

10.2.2. Aftermarket

11. Global Port and Handling Equipment Tire Market, By Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Port and Handling Equipment Tire Market

12.1. Market Snapshot

12.2. North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

12.2.1. Synthetic Rubber

12.2.2. Natural Rubber

12.2.3. Carbon Black

12.2.4. Fabrics & Wire

12.3. North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

12.3.1. Less Than 20”

12.3.2. 21” to 30”

12.3.3. 31” to 40”

12.3.4. 41” to 50”

12.3.5. More Than 51”

12.4. North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

12.4.1. Radial

12.4.2. Bias

12.4.3. Solid

12.4.4. Others

12.5. North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

12.5.1. Tug Boats

12.5.2. Cranes

12.5.3. Ship Loaders

12.5.4. Reach Stackers

12.5.5. Automated Guided Vehicles (AGVs)

12.5.6. Forklift Trucks

12.5.7. Container Handlers

12.5.8. Terminal Tractors

12.5.9. Terminal Trailers

12.5.10. Straddle/Shuttle Carriers

12.5.11. Others

12.6. North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis – North America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.7.3. Mexico

13. Europe Port and Handling Equipment Tire Market

13.1. Market Snapshot

13.2. Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

13.2.1. Synthetic Rubber

13.2.2. Natural Rubber

13.2.3. Carbon Black

13.2.4. Fabrics & Wire

13.3. Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

13.3.1. Less Than 20”

13.3.2. 21” to 30”

13.3.3. 31” to 40”

13.3.4. 41” to 50”

13.3.5. More Than 51”

13.4. Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

13.4.1. Radial

13.4.2. Bias

13.4.3. Solid

13.4.4. Others

13.5. Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

13.5.1. Tug Boats

13.5.2. Cranes

13.5.3. Ship Loaders

13.5.4. Reach Stackers

13.5.5. Automated Guided Vehicles (AGVs)

13.5.6. Forklift Trucks

13.5.7. Container Handlers

13.5.8. Terminal Tractors

13.5.9. Terminal Trailers

13.5.10. Straddle/Shuttle Carriers

13.5.11. Others

13.6. Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – Europe Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031

13.7.1. Germany

13.7.2. U. K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Nordic Countries

13.7.7. Russia & CIS

13.7.8. Rest of Europe

14. Asia Pacific Port and Handling Equipment Tire Market

14.1. Market Snapshot

14.2. Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

14.2.1. Synthetic Rubber

14.2.2. Natural Rubber

14.2.3. Carbon Black

14.2.4. Fabrics & Wire

14.3. Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

14.3.1. Less Than 20”

14.3.2. 21” to 30”

14.3.3. 31” to 40”

14.3.4. 41” to 50”

14.3.5. More Than 51”

14.4. Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

14.4.1. Radial

14.4.2. Bias

14.4.3. Solid

14.4.4. Others

14.5. Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

14.5.1. Tug Boats

14.5.2. Cranes

14.5.3. Ship Loaders

14.5.4. Reach Stackers

14.5.5. Automated Guided Vehicles (AGVs)

14.5.6. Forklift Trucks

14.5.7. Container Handlers

14.5.8. Terminal Tractors

14.5.9. Terminal Trailers

14.5.10. Straddle/Shuttle Carriers

14.5.11. Others

14.6. Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – Asia Pacific Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031

14.7.1. China

14.7.2. India

14.7.3. Japan

14.7.4. ASEAN Countries

14.7.5. South Korea

14.7.6. ANZ

14.7.7. Rest of Asia Pacific

15. Middle East & Africa Port and Handling Equipment Tire Market

15.1. Market Snapshot

15.2. Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

15.2.1. Synthetic Rubber

15.2.2. Natural Rubber

15.2.3. Carbon Black

15.2.4. Fabrics & Wire

15.3. Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

15.3.1. Less Than 20”

15.3.2. 21” to 30”

15.3.3. 31” to 40”

15.3.4. 41” to 50”

15.3.5. More Than 51”

15.4. Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

15.4.1. Radial

15.4.2. Bias

15.4.3. Solid

15.4.4. Others

15.5. Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

15.5.1. Tug Boats

15.5.2. Cranes

15.5.3. Ship Loaders

15.5.4. Reach Stackers

15.5.5. Automated Guided Vehicles (AGVs)

15.5.6. Forklift Trucks

15.5.7. Container Handlers

15.5.8. Terminal Tractors

15.5.9. Terminal Trailers

15.5.10. Straddle/Shuttle Carriers

15.5.11. Others

15.6. Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. Key Country Analysis – Middle East & Africa Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031

15.7.1. GCC

15.7.2. South Africa

15.7.3. Turkey

15.7.4. Rest of Middle East & Africa

16. South America Port and Handling Equipment Tire Market

16.1. Market Snapshot

16.2. South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Material Type

16.2.1. Synthetic Rubber

16.2.2. Natural Rubber

16.2.3. Carbon Black

16.2.4. Fabrics & Wire

16.3. South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

16.3.1. Less Than 20”

16.3.2. 21” to 30”

16.3.3. 31” to 40”

16.3.4. 41” to 50”

16.3.5. More Than 51”

16.4. South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

16.4.1. Radial

16.4.2. Bias

16.4.3. Solid

16.4.4. Others

16.5. South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Application

16.5.1. Tug Boats

16.5.2. Cranes

16.5.3. Ship Loaders

16.5.4. Reach Stackers

16.5.5. Automated Guided Vehicles (AGVs)

16.5.6. Forklift Trucks

16.5.7. Container Handlers

16.5.8. Terminal Tractors

16.5.9. Terminal Trailers

16.5.10. Straddle/Shuttle Carriers

16.5.11. Others

16.6. South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

16.6.1. OEM

16.6.2. Aftermarket

16.7. Key Country Analysis – South America Port and Handling Equipment Tire Market Size Analysis & Forecast, 2017-2031

16.7.1. Brazil

16.7.2. Argentina

16.7.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2021

17.2. Pricing comparison among key players

17.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. NORTEC

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Interco Tire Corporation

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Yokohama Rubber Co. Ltd.

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Apollo Tyres Ltd.

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. JK Tire & Industries Ltd

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Bridgestone Corporation

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Continental AG

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Michelin

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. Deere & Company

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. Trelleborg AB

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Nokian Tyres Plc

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Maxxis International

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Sumitomo Rubber Industries Ltd.

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. Nexen Tire Corporation

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Titan International Inc.

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Balkrishna Industries Ltd

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

18.17. Other Key Players

18.17.1. Company Overview

18.17.2. Company Footprints

18.17.3. Production Locations

18.17.4. Product Portfolio

18.17.5. Competitors & Customers

18.17.6. Subsidiaries & Parent Organization

18.17.7. Recent Developments

18.17.8. Financial Analysis

18.17.9. Profitability

18.17.10. Revenue Share

List of Tables

Table 1: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 2: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 3: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 4: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 5: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 6: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 7: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 8: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 9: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 10: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 12: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 14: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 15: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 16: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 17: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 18: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 19: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 20: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 21: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 22: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 24: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 26: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 27: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 28: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 29: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 30: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 31: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 32: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 33: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 34: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 36: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 38: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 39: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 40: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 41: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 42: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 43: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 44: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 45: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 46: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 48: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 50: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 51: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 52: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 53: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 54: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 55: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 56: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 57: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 58: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 60: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Table 62: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 63: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Table 64: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 65: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Table 66: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 67: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 68: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 69: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 70: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 72: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 2: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 3: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 4: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 5: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 6: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 7: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 8: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 9: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 10: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 11: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 12: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 13: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 14: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 15: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 16: Global Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 17: Global Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 18: Global Port and Handling Equipment Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 19: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 20: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 21: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 23: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 24: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 25: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 26: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 27: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 28: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 29: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 30: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 31: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 32: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 33: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 34: North America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 35: North America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 36: North America Port and Handling Equipment Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 37: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 38: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 39: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 40: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 41: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 42: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 43: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 44: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 45: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 46: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 47: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 48: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 49: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 50: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 51: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 52: Europe Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 53: Europe Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 54: Europe Port and Handling Equipment Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 55: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 56: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 57: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 59: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 60: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 61: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 62: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 63: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 64: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 65: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 66: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 68: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 69: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 70: Asia Pacific Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 71: Asia Pacific Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 72: Asia Pacific Port and Handling Equipment Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 73: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 74: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 75: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 76: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 77: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 78: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 79: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 80: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 81: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 82: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 83: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 84: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 85: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 86: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 87: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 88: Middle East & Africa Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 89: Middle East & Africa Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 90: Middle East & Africa Port and Handling Equipment Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 91: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Material Type, 2017‒2031

Figure 92: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Figure 93: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022‒2031

Figure 94: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017‒2031

Figure 95: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Figure 96: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2022‒2031

Figure 97: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017‒2031

Figure 98: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Figure 99: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2022‒2031

Figure 100: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Figure 101: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 102: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 103: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Figure 104: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 105: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 106: South America Port and Handling Equipment Tire Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 107: South America Port and Handling Equipment Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 108: South America Port and Handling Equipment Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031