Analysts’ Viewpoint on Point-of-Care Coagulation Testing Devices Market Scenario

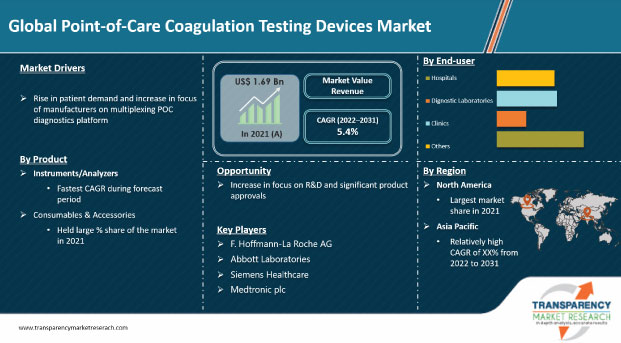

Increase in point-of-care coagulation testing (POCT) in developed countries and rise in prevalence of blood clotting disorders are driving the global point-of-care coagulation testing devices market. Various point-of-care (POC) assays are available for a number of coagulation tests. These assays are easy to perform and have a faster turnaround time than their laboratory counterparts. Portability, easy usage, and connectivity are propelling the demand for POC coagulation testing procedures. North America and Europe are likely to be major markets for manufacturers in the near future, owing to the availability of low-cost devices, increase in chronic diseases, and rise in popularity of portable testing equipment in these regions.

Coagulation, or clotting, is the process of conversion of liquid blood into a gel-like clot to stop bleeding. The capability of the body cells to prevent blood loss after a vascular injury by forming a blood clot is vital to sustaining health. A number of coagulation or clotting factors are involved that lead to a physiological procedure called hemostasis. Hemostasis is the mechanism of clotting that involves activation, adhesion, and aggregation of platelets mediated by several clotting factors, eventually leading to the repair of the injured tissue. The absence of any of these factors could lead to a rare, but serious blood clotting disease and excessive bleeding. Point-of-care testing (POCT) can be defined as a fast, specific medical diagnostic testing of bodily fluids at the bedside. It is often termed as decentralized diagnostic testing.

Rise in prevalence of blood clotting disorders, increase in POCT coagulation in developed countries, and surge in usage of anticoagulant therapy are the factors driving the global POC coagulation testing devices market. Furthermore, increase in prevalence of cardiovascular diseases & cancer, constant product & technology innovations, and funding by the government are propelling the global market. However, lack of awareness in developing countries and regulatory challenges are projected to restrain the global point-of-care coagulation testing devices market. A number of studies have shown that 60% to 70% of deep vein thrombosis in developing countries is clinically undiagnosed. Nevertheless, players in the point-of-care coagulation devices market are establishing a stronger foothold in developed and emerging markets.

The COVID-19 pandemic has had a negative impact on the global point-of-care coagulation testing devices market. Several affected countries deferred non-essential surgeries and patient visits during the breakout year of the pandemic. This led to a substantial decline in overall non-emergency surgery and treatments, thereby limiting the usage of point-of-care coagulation testing instruments during preoperative or post-operative conditions. The pandemic caused a decline in key players’ revenue. However, demand for vital function monitoring viscoelastic devices, including venous thromboembolism (VTE) and Thromboelastography (TEG), has increased during the pandemic, as these devices help detect pulmonary embolism (PE) and venous thromboembolism (VTE) among critically ill COVID-19 patients. According to the Intensive Care Medicine Journal, in May 2020, the incidence of prothrombotic conditions in patients with severe symptoms of COVID-19 infection increased significantly. This resulted in a rise in number of coagulation tests such as prothrombin time (PT), D-dimer, TEG, and activated partial thromboplastin time (aPTT).

In terms of product, the consumables & accessories segment accounted for major share of the global point-of-care coagulation testing devices market in 2021. Increase in usage of kits & reagents, which provide results in less time; growth in usage of POC testing strips that provide reliable results; rise in demand for quicker results; and surge in POC testing are the major factors augmenting the consumables & accessories segment. Rapid coagulation testing methods are increasingly adopted by patients. Moreover, adoption of POC coagulation analyzers is projected to rise in the near future, which is likely to drive the segment. The usage of disposable consumables is increasing due to the rise in awareness about the prevention of blood-borne diseases, such as hepatitis B and HIV, among the people. Thus, assurance of patient safety due to usage of disposable consumables and reliable results is propelling the segment.

The PT/INR segment held the largest share of the market in terms of revenue in 2021. The segment is anticipated to dominate the global market owing to the growing trend of point-of-care testing and self-monitoring with PT tests. Moreover, high reliability of the coagulation status on the PT test is one of the factors likely to drive the segment during the forecast period. Key players are focused on the launch of technologically advanced products. For instance, Roche developed a Bluetooth-enabled PT/INR testing CoaguChek device that helps patients and health care providers to check coagulation status and help in remote care. Similarly, Siemens Healthineers launched the FDA-approved POC PT/INR device called Xprecia Stride Coagulation Analyzer. This device has demonstrated PT/INR testing performance equivalency with the Roche CoaguChek XS POC system.

The clinics segment is anticipated to grow at a rapid pace during the forecast period. Factors such as faster results, convenience of testing, prevalence of chronic diseases, and preoperative testing are attributed to the growth of the clinics segment. According to a report, in 2018, around 129 million adults in the U.S. had been diagnosed with at least one chronic condition; 61 million adults among them had one chronic condition, while 68 million had more than two chronic conditions. Furthermore, rise in number of private clinics and increase in skilled personnel to perform the tests are the major factors augmenting the clinics segment. For instance, India had an estimated 69,000 private and public clinics in 2019. Similarly, China had more than 50,000 private and public clinics.

North America is projected to be a highly attractive region of the global point-of-care coagulation testing devices market during the forecast period. The region accounted for the largest share of the global market in 2021. High prevalence of cardiac diseases, technologically advanced countries, and rise in awareness about coagulation disorders are factors propelling the market in North America. Recent FDA approvals for point-of-care coagulation testing devices such as Abbott's i-STAT indicate increasing demand and support among the public and private sectors along with manufacturers’ focus to capture this rising demand. The U.S. accounted for large share of the market in North America due to the rise in cases of chronic diseases and surge in uptake of early disease detection procedures in the country.

The market in Asia Pacific is likely to grow at the fastest CAGR from 2022 to 2031. The region is witnessing gradual adoption of novel products, increase in health care expenditure, and changes in dynamics in the in vitro diagnostics industry. This is expected to drive the adoption of new technologies among hospitals and diagnostic laboratories.

The point-of-care coagulation testing devices market report includes vital information about the key players operating in the global market. Prominent players are focusing on strategies such as new product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Teleflex Incorporated, F. Hoffmann-La Roche AG, Abbott Laboratories, Siemens Healthineers, Medtronic plc, Haemonetics Corporation, HemoSonics, LLC, Micropoint Bioscience, Inc., Werfen, Sienco, Inc., and Koninklijke Philips N.V. are some of the key players operating in the global market.

Each of these players has been profiled in the global point-of-care coagulation testing devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.69 Bn |

|

Market Forecast Value in 2031 |

More than US$ 3.06 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global point-of-care coagulation testing devices market was valued at US$ 1.69 Bn in 2021

The global market is projected to reach more than US$ 3.06 Bn by 2031

The global point-of-care coagulation testing devices market grew at a CAGR of 2.53% from 2017 to 2021

The global point-of-care coagulation testing devices market is anticipated to grow at a CAGR of 5.4% from 2022 to 2031

Rise in patient demand and increase in focus of manufacturers on multiplexing POC diagnostics platform are driving the global point-of-care coagulation testing devices market

The PT/INR segment held the largest share of around 70% of the market in terms of revenue in 2021

North America is expected to account for major share of the global point-of-care coagulation testing devices market during the forecast period

F. Hoffmann-La Roche AG, Abbott Laboratories, Siemens Healthineers, Medtronic plc, Haemonetics Corporation, HemoSonics, LLC, Micropoint Bioscience, Inc., Werfen, Sienco, Inc., and Koninklijke Philips N.V.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Point-of-Care Coagulation Testing Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Point-of-Care Coagulation Testing Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

6. Global Point-of-Care Coagulation Testing Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Instruments / Analyzers

6.3.2. Consumables & Accessories

6.4. Market Attractiveness Analysis, by Product

7. Global Point-of-Care Coagulation Testing Devices Market Analysis and Forecast, by Method

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Method, 2017–2031

7.3.1. PT/INR

7.3.2. Viscoelastic Coagulation Monitoring

7.3.3. Others (ACT, aPTT, etc.)

7.4. Market Attractiveness Analysis, by Method

8. Global Point-of-Care Coagulation Testing Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostic Laboratories

8.3.3. Clinics

8.4. Market Attractiveness Analysis, by End-user

9. Global Point-of-Care Coagulation Testing Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Point-of-Care Coagulation Testing Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Instruments / Analyzers

10.2.2. Consumables & Accessories

10.3. Market Value Forecast, by Method, 2017–2031

10.3.1. PT/INR

10.3.2. Viscoelastic Coagulation Monitoring

10.3.3. Others (ACT, aPTT, etc.)

11. Europe Point-of-Care Coagulation Testing Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Instruments / Analyzers

11.2.2. Consumables & Accessories

11.3. Market Value Forecast, by Method, 2017–2031

11.3.1. PT/INR

11.3.2. Viscoelastic Coagulation Monitoring

11.3.3. Others (ACT, aPTT, etc.)

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories

11.4.3. Clinics

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Method

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Point-of-Care Coagulation Testing Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Instruments / Analyzers

12.2.2. Consumables & Accessories

12.3. Market Value Forecast, by Method, 2017–2031

12.3.1. PT/INR

12.3.2. Viscoelastic Coagulation Monitoring

12.3.3. Others (ACT, aPTT, etc.)

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories

12.4.3. Clinics

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Method

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Point-of-Care Coagulation Testing Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Instruments / Analyzers

13.2.2. Consumables & Accessories

13.3. Market Value Forecast, by Method, 2017–2031

13.3.1. PT/INR

13.3.2. Viscoelastic Coagulation Monitoring

13.3.3. Others (ACT, aPTT, etc.)

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories

13.4.3. Clinics

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Method

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Point-of-Care Coagulation Testing Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Instruments / Analyzers

14.2.2. Consumables & Accessories

14.3. Market Value Forecast, by Method, 2017–2031

14.3.1. PT/INR

14.3.2. Viscoelastic Coagulation Monitoring

14.3.3. Others (ACT, aPTT, etc.)

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Diagnostic Laboratories

14.4.3. Clinics

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Method

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche AG

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Abbott Laboratories

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Siemens Healthineers

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Medtronic plc

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Haemonetics Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. HemoSonics, LLC

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Micropoint Bioscience, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Werfen

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Sienco, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Koninklijke Philips N.V.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 02: Global Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method, 2022-2031

Table 03: Global Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user, 2022-2031

Table 04: Global Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Region, 2022-2031

Table 05: North America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 06: North America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method, 2022-2031

Table 07: North America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user, 2022-2031

Table 08: North America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Country, 2022-2031

Table 09: Europe Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 10: Europe Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method, 2022-2031

Table 11: Europe Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user, 2022-2031

Table 12: Europe Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

Table 13: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product

Table 14: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method

Table 15: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user

Table 16 Asia Pacific Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region

Table 17: Latin America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product

Table 18: Latin America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method, 2022-2031

Table 19: Latin America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user, 2022-2031

Table 20: Latin America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

Table 21: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 22: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Method, 2022-2031

Table 23: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by End-user, 2022-2031

Table 24: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

List of Figures

Figure 01: Global Point-of-Care Coagulation Testing Devices Market Size (US$ Mn) Forecast 2022-2031

Figure 02: Global Point-of-Care Coagulation Testing Devices Market Value Share, by Method, 2022

Figure 03: Global Point-of-Care Coagulation Testing Devices Market Value Share, by Product, 2022

Figure 04: Global Point-of-Care Coagulation Testing Devices Market Value Share, by End-user, 2022

Figure 05: Global Point-of-Care Coagulation Testing Devices Market Value Share, by Region, 2022

Figure 06: Global Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 07: Global Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 08: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Instruments/Analyzers, 2022-2031

Figure 09: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Consumables & Accessories, 2022-2031

Figure 10: Global Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 11: Global Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 12: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) Forecast, by PT/INR, 2022-2031

Figure 13: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) Forecast, by Others, 2022-2031

Figure 14: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) Forecast, by Viscoelastic Coagulation Monitoring, 2022-2031

Figure 15: Global Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: Global Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Hospitals, 2022-2031

Figure 18: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Diagnostic Laboratories, 2022-2031

Figure 19: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Clinics, 2022-2031

Figure 20: Global Point-of-Care Coagulation Testing Devices Market Revenue (US$ Mn) by Other End-users, 2022-2031

Figure 21: Global Point-of-Care Coagulation Testing Devices Market Value Share, by Region, 2021 and 2031

Figure 22: Global Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 23: North America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast 2022-2031

Figure 24: North America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 25: North America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 26: North America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 27: North America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 28: North America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 29: North America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 30: North America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 31: North America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 32: Europe Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast 2022-2031

Figure 33: Europe Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 34: Europe Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 35: Europe Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 36: Europe Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 37: Europe Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 38: Europe Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 39: Europe Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Europe Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast 2022-2031

Figure 42: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 43: Asia Pacific Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 44: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 45: Asia Pacific Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 46: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 47: Asia Pacific Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 48: Asia Pacific Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Asia Pacific Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 50: Latin America Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast 2022-2031

Figure 51: Latin America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 52: Latin America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 53: Latin America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 54: Latin America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 55: Latin America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 56: Latin America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 57: Latin America Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Latin America Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 59: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value (US$ Mn) Forecast 2022-2031

Figure 60: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 61: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 62: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Method, 2021 and 2031

Figure 63: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Method, 2022–2031

Figure 64: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 65: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 66: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Value Share Analysis, by Country/Sub-region

Figure 67: Middle East & Africa Point-of-Care Coagulation Testing Devices Market Attractiveness Analysis, by Country/Sub-region

Figure 68: Global Point-of-Care Coagulation Testing Devices Market Analysis, by Top Company Ranking, 2022

Figure 69: F. Hoffmann-La Roche AG Revenue (US$ Bn)

Figure 70: F. Hoffmann-La Roche AG R&D Expenses

Figure 71: F. Hoffmann-La Roche AG Breakdown of Net Sales, by Business Division

Figure 72: F. Hoffmann-La Roche AG Breakdown of Net Sales, by Country/Region

Figure 73: Abbott Laboratories Revenue (US$ Bn)

Figure 74: Abbott Laboratories R&D Intensity and Sales & Marketing (%),

Figure 75: Abbott Laboratories Breakdown of Net Sales, by Business Division

Figure 76: Abbott Laboratories Breakdown of Net Sales, by Country/Region

Figure 77: Abbott Laboratories Revenue (US$ Mn)

Figure 78: Abbott Laboratories R&D Expenses (US$ Mn)

Figure 79: Abbott Laboratories Breakdown of Net Sales, by Business Division

Figure 80: Abbott Laboratories Breakdown of Net Sales, by Country/Region

Figure 81: Medtronic plc Revenue (US$ Mn)

Figure 82: Medtronic plc Breakdown of Net Sales (%), by Region

Figure 83: Medtronic plc R&D Expenditure (US$ Mn)

Figure 84: Medtronic plc Breakdown of Net Sales (%), by Business Segment

Figure 85: Haemonetics Corporation Revenue (US$ Mn)

Figure 86: Haemonetics Corporation R&D Expenses (US$ Mn)

Figure 87: Haemonetics Corporation Net Sales Breakdown (%), by Region

Figure 88: Haemonetics Corporation Net Sales Breakdown (%), by Business Segment

Figure 89: Werfen Revenue (US$ Mn)

Figure 90: Werfen Breakdown of Net Sales (%), by Region

Figure 91: Werfen Breakdown of Net Sales (%), by Business Segment

Figure 92: Koninklijke Philips N.V. Revenue (US$ Mn)

Figure 93: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Region

Figure 94: Koninklijke Philips N.V. R&D Expenditure (US$ Mn)

Figure 95: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Business Segment