Analysts’ Viewpoint

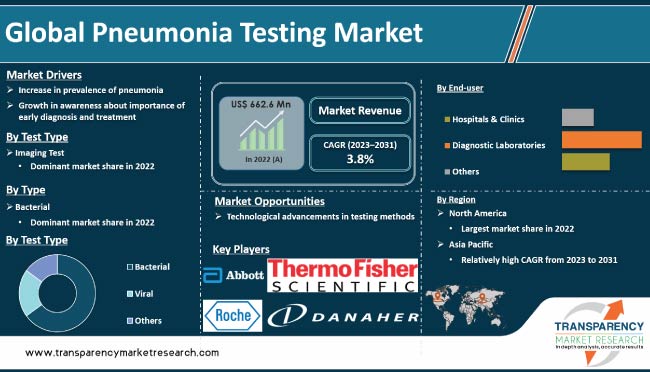

Increase in prevalence of pneumonia, advancements in testing technologies, and growth in awareness about the importance of early diagnosis and treatment are some of the key pneumonia testing market drivers. Demand for pneumonia testing is rising owing to the growth in incidence of respiratory infections, particularly in elderly and immunocompromised populations. This is likely to augment pneumonia testing market dynamics in the near future.

Leading players are focusing on developing new, more accurate, and efficient testing technologies for pneumonia, such as polymerase chain reaction (PCR) and loop-mediated isothermal amplification (LAMP). This is creating lucrative pneumonia testing market opportunities for key players. However, high cost of some of the advanced pneumonia tests in lower-income countries is projected to hamper market statistics during the forecast period.

Pneumonia testing refers to medical tests used to diagnose pneumonia, a lung infection that causes inflammation in one or both lungs. In some cases, a physician may also order a chest CT scan or a bronchoscopy. The specific tests used for pneumonia diagnosis depend on various factors such as a patient's age, medical history, and symptoms.

Various types of pneumonia testing methods are available in the market. These include chest X-rays, sputum test, blood tests, and rapid antigen test. Increase in adoption of home-based testing and telemedicine is expected to boost pneumonia testing market growth in the near future.

Rise in incidence of pneumonia has resulted in growth in need for accurate and timely diagnosis of the disease. This is driving the demand for pneumonia testing, which helps in identifying the causative agent of the disease and providing appropriate treatment. The elderly population is more susceptible to pneumonia and other respiratory infections.

Pneumonia is one of the leading causes of death worldwide. According to The Centers for Disease Control and Prevention (CDC), pneumonia caused more than 50,000 deaths in the U.S. in 2019. As per the World Health Organization (WHO), pneumonia is a significant global health issue, especially for children under five years of age. In 2019, it was responsible for 14.0% of all deaths in children under five and 22.0% of all deaths in children aged one to five years, resulting in 740,180 deaths worldwide.

Development of new and more sensitive and specific testing methods is augmenting the global pneumonia testing business. The need for rapid and accurate test results has become increasingly important owing the rise in outbreak of pandemics. Rapid diagnostic tests, such as rapid antigen tests, can provide results in just a few minutes, allowing healthcare providers to quickly diagnose and treat patients with pneumonia.

Molecular diagnostic techniques, such as PCR, provide highly accurate results. These techniques are particularly important in detecting antibiotic-resistant strains of pneumonia. Pneumonia is a major global health concern, particularly in developing countries where access to healthcare is limited. Therefore, development of new testing methods is likely to help address this challenge, as early and accurate diagnosis is key to better patient outcomes.

Government agencies are allocating funds to support research and development of new and innovative diagnostic techniques for pneumonia. This is leading to the development of more accurate and efficient tests for pneumonia. Governments are investing in building and expanding healthcare infrastructure, including setting up of diagnostic centers and hospitals. This increased access to healthcare facilities is ultimately fueling the demand for pneumonia testing.

Governments of various countries are implementing policies that mandate the testing of individuals for pneumonia, particularly in high-risk populations such as the elderly, young children, and individuals with underlying health conditions. Several governments are providing subsidies and incentives to healthcare providers and manufacturers to encourage them to develop more affordable pneumonia testing solutions. This is likely to help make testing more accessible to a larger section of the population.

As per the pneumonia testing market research report, the bacterial type segment is anticipated to hold major share of the global market during the forecast period.

Pneumonia is often caused by bacterial infections, such as streptococcus pneumoniae and haemophilus influenzae. The bacterial type of pneumonia can be diagnosed through laboratory tests, such as cultures or antigen detection tests, which can accurately identify the specific type of bacterium causing the infection.

Bacterial pneumonia is a common form of pneumonia. Early and accurate diagnosis is crucial in choosing the appropriate treatment. Tests for bacterial pneumonia have high sensitivity and specificity, making them a reliable option for detecting the presence of bacterial infections.

According to the global pneumonia testing market forecast report, North America is projected to dominate the global landscape during the forecast period. The pneumonia testing market size in the region is estimated to increase during the forecast period, owing to the high incidence of pneumonia in countries such as the U.S. and growth in awareness about early-stage stage diagnosis and testing.

North America has a well-established medical infrastructure, with advanced laboratory facilities and highly trained medical professionals. It also has strong regulatory support for medical technology, including pneumonia testing. This helps ensure the quality and accuracy of tests and encourages investment in research and development.

As per the pneumonia testing market analysis report, the market in Asia Pacific is growing at a rapid pace due to several factors such as increase in incidence of pneumonia, rise in elderly population, and presence of various governmental initiatives to raise awareness about pneumonia. Growth in healthcare expenditure and development of new and advanced diagnostic technologies are also boosting pneumonia testing market development in Asia Pacific.

High incidence of pneumonia, advanced healthcare infrastructure, presence of several leading players, and rise in awareness about the importance of early diagnosis and treatment are some of the factors contributing to market growth in Europe.

Large numbers of players, from large multinational corporations to small, niche companies, operate in the global pneumonia testing market. New entrants and existing players are constantly developing and launching new and innovative products to gain an edge in this highly competitive market.

BD (Becton, Dickinson and Company), F. Hoffmann-La Roche Ltd., Abbott, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., BIOMÉRIEUX, Danaher, Hologic, Inc., Quidel Corporation, QIAGEN, Cepheid, Hologic, Inc., Luminex Corporation, and Bio-Rad Laboratories, Inc. are some the key pneumonia testing market players operating across the globe. These players are engaged in mergers & acquisitions and strategic collaborations to increase their market share.

The pneumonia testing market report profiles the top players based on various parameters including company overview, financial summary, business strategies, product portfolio, business segments, and recent advancements.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 662.6 Mn |

|

Forecast (Value) in 2031 |

More than US$ 843.8 Mn |

|

Growth Rate (CAGR) 2023-2031 |

3.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 662.6 Mn in 2022

It is projected to reach more than US$ 843.8 Mn by 2031

The CAGR is anticipated to be 3.8% from 2023 to 2031

The bacterial segment accounted for more than 60.0% share in 2022

North America is likely to account for the largest share during the forecast period

BD (Becton, Dickinson and Company), F. Hoffmann-La Roche Ltd., Abbott, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., BIOMÉRIEUX, Danaher, Hologic, Inc., Quidel Corporation, QIAGEN, Cepheid, Luminex Corporation, and Bio-Rad Laboratories, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pneumonia Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pneumonia Testing Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Overview of Pneumonia (Causes, Symptoms and Treatment)

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Brief about the Diagnosis/Testing of Pneumonia

5.4. COVID 19 Impact on Industry

6. Global Pneumonia Testing Market Analysis and Forecast, By Test Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Test Type, 2017 - 2031

6.3.1. Blood Test

6.3.2. Imaging Test

6.3.3. Sputum Test

6.3.4. Urine Test

6.3.5. Others

6.4. Market Attractiveness By Test Type

7. Global Pneumonia Testing Market Analysis and Forecast, By Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Type, 2017 - 2031

7.3.1. Bacterial

7.3.1.1. Streptococcus

7.3.1.2. Legionella

7.3.1.3. Chlamydophila

7.3.1.4. Mycoplasma Pneumoniae

7.3.2. Viral

7.3.3. Others

7.4. Market Attractiveness By Type

8. Global Pneumonia Testing Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals & Clinics

8.3.2. Diagnostic Laboratories

8.3.3. Others

8.4. Market Attractiveness By End-user

9. Global Pneumonia Testing Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Pneumonia Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Test Type, 2017 - 2031

10.2.1. Blood Test

10.2.2. Imaging Test

10.2.3. Sputum Test

10.2.4. Urine Test

10.2.5. Others

10.3. Market Value Forecast By Type, 2017 - 2031

10.3.1. Bacterial

10.3.1.1. Streptococcus

10.3.1.2. Legionella

10.3.1.3. Chlamydophila

10.3.1.4. Mycoplasma Pneumoniae

10.3.2. Viral

10.3.3. Others

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals & Clinics

10.4.2. Diagnostic Laboratories

10.4.3. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Test Type

10.6.2. By Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Pneumonia Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Test Type, 2017 - 2031

11.2.1. Blood Test

11.2.2. Imaging Test

11.2.3. Sputum Test

11.2.4. Urine Test

11.2.5. Others

11.3. Market Value Forecast By Type, 2017 - 2031

11.3.1. Bacterial

11.3.1.1. Streptococcus

11.3.1.2. Legionella

11.3.1.3. Chlamydophila

11.3.1.4. Mycoplasma Pneumoniae

11.3.2. Viral

11.3.3. Others

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals & Clinics

11.4.2. Diagnostic Laboratories

11.4.3. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Test Type

11.6.2. By Type

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Pneumonia Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Test Type, 2017 - 2031

12.2.1. Blood Test

12.2.2. Imaging Test

12.2.3. Sputum Test

12.2.4. Urine Test

12.2.5. Others

12.3. Market Value Forecast By Type, 2017 - 2031

12.3.1. Bacterial

12.3.1.1. Streptococcus

12.3.1.2. Legionella

12.3.1.3. Chlamydophila

12.3.1.4. Mycoplasma Pneumoniae

12.3.2. Viral

12.3.3. Others

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals & Clinics

12.4.2. Diagnostic Laboratories

12.4.3. Others

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Test Type

12.6.2. By Type

12.6.3. By End-user

12.6.4. By Country

13. Latin America Pneumonia Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Test Type, 2017 - 2031

13.2.1. Blood Test

13.2.2. Imaging Test

13.2.3. Sputum Test

13.2.4. Urine Test

13.2.5. Others

13.3. Market Value Forecast By Type, 2017 - 2031

13.3.1. Bacterial

13.3.1.1. Streptococcus

13.3.1.2. Legionella

13.3.1.3. Chlamydophila

13.3.1.4. Mycoplasma Pneumoniae

13.3.2. Viral

13.3.3. Others

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals & Clinics

13.4.2. Diagnostic Laboratories

13.4.3. Others

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Test Type

13.6.2. By Type

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Pneumonia Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Test Type, 2017 - 2031

14.2.1. Blood Test

14.2.2. Imaging Test

14.2.3. Sputum Test

14.2.4. Urine Test

14.2.5. Others

14.3. Market Value Forecast By Type, 2017 - 2031

14.3.1. Bacterial

14.3.1.1. Streptococcus

14.3.1.2. Legionella

14.3.1.3. Chlamydophila

14.3.1.4. Mycoplasma Pneumoniae

14.3.2. Viral

14.3.3. Others

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals & Clinics

14.4.2. Diagnostic Laboratories

14.4.3. Others

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Test Type

14.6.2. By Type

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. BD (Becton, Dickinson and Company)

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. F. Hoffmann-La Roche Ltd.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Abbott

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Siemens Healthcare GmbH

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Thermo Fisher Scientific Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. BIOMÉRIEUX

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Danaher

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Hologic, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Quidel Corporation

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. QIAGEN

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Cepheid

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Hologic, Inc.

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. Luminex Corporation

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. Bio-Rad Laboratories, Inc.

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

List of Tables

Table 01: Global Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 02: Global Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 03: Global Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 04: Global Pneumonia Testing Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 06: North America Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 07: North America Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 08: North America Pneumonia Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 10: Europe Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Europe Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 12: Europe Pneumonia Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 14: Asia Pacific Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 15: Asia Pacific Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 16: Asia Pacific Pneumonia Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 18: Latin America Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 19: Latin America Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 20: Latin America Pneumonia Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Pneumonia Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 22: Middle East & Africa Pneumonia Testing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Middle East & Africa Pneumonia Testing Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 24: Middle East & Africa Pneumonia Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 03: Global Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 04: Global Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 05: Global Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 06: Global Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 07: Global Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 08: Global Pneumonia Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 09: Global Pneumonia Testing Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 12: North America Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 13: North America Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 14: North America Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 15: North America Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 16: North America Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 17: North America Pneumonia Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 18: North America Pneumonia Testing Market Attractiveness Analysis, by Country, 2023–2031

Figure 19: Europe Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 21: Europe Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 22: Europe Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 23: Europe Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 24: Europe Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 25: Europe Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 26: Europe Pneumonia Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Europe Pneumonia Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 28: Asia Pacific Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 30: Asia Pacific Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 31: Asia Pacific Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 32: Asia Pacific Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 33: Asia Pacific Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 34: Asia Pacific Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 35: Asia Pacific Pneumonia Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Asia Pacific Pneumonia Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 39: Latin America Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 40: Latin America Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 41: Latin America Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 42: Latin America Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 43: Latin America Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 44: Latin America Pneumonia Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Latin America Pneumonia Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Middle East & Africa Pneumonia Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Pneumonia Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 48: Middle East & Africa Pneumonia Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 49: Middle East & Africa Pneumonia Testing Market Value Share Analysis, by Type, 2022 and 2031

Figure 50: Middle East & Africa Pneumonia Testing Market Attractiveness Analysis, by Type, 2023–2031

Figure 51: Middle East & Africa Pneumonia Testing Market Value Share Analysis, By End-user, 2022 and 2031

Figure 52: Middle East & Africa Pneumonia Testing Market Attractiveness Analysis, By End-user, 2023–2031

Figure 53: Middle East & Africa Pneumonia Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Middle East & Africa Pneumonia Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Global Pneumonia Testing Market Share Analysis, by Company, 2022