Analysts’ Viewpoint

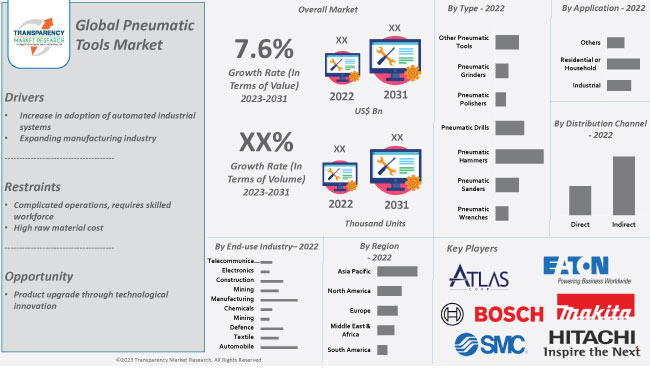

Expansion of manufacturing industries, surge in construction activities, and growth of the automobile sector, is driving the pneumatic tools market demand. Rapid industrialization is expected to augment the demand for pneumatic tools, offering lucrative opportunities for market expansion.

Pneumatic systems work to optimize processes by improving and supplementing the manufacturing floor. The market is expected to grow at a steady pace in the near future due to the increase in demand for pneumatic tools in automated industrial systems.

Manufacturers are focusing on product enhancements and innovation, as well as investments in R&D activities, and mergers & acquisitions, to enhance their pneumatic tools market share. They are accelerating their production capabilities to cater to various end-use industries.

Pneumatics play a very important role in industrial development. Pneumatic tools are compressed air driven power tools. They are used for power drilling, grinding, fastening, and other applications. Pneumatic tools are widely used in industrial fields because of their high stability, long working life, and simple maintenance, offering quick response times and quick action control.

Common types of pneumatic tools include pneumatic hammer and pneumatic wrench. These are commonly used for pile driving and forging. Unlike electric motors, pneumatic tools do not use any electricity at the point where work is being done, ensuring less risk of a spark or gas explosion. Pneumatic tools use lower pressure and smaller forces, so they tend to be lighter and more compact. This is extremely crucial in hand tools. There are also pneumatic tools that are powered by compressed carbon dioxide, supplied in compact containers or cylinders.

Rise in usage of pneumatic tools in automated industrial systems across the globe is expected to spur market development. The application of pneumatic tools is increasing in automated industrial systems such as automatic door opening systems in industries, elevators, and forklifts. A variety of pneumatic tools is used in assembly lines in the automotive industry, in machinery stations of production chains (in the agro-food industry), in the chemical and pharmaceutical industry, and in dentistry.

Pneumatic technology applied to industry helps to perform numerous rotational, percussive, or direction-changing movements at high speed and precisely. Other advantages of pneumatics is the hygiene factor and the ease of procuring compressed air directly from the environment using an electric compressor. These benefits of pneumatic tools are driving market progress.

Industrial automation control systems impact the wider enterprise, in terms of enhanced productivity both on the plant floor and in other areas of the organization. Thus, expanding usage of industrial automation systems in automotive industry and textile industry, is expected to positively impact pneumatic tools market growth in the near future.

The use of pneumatic tools is increasing in manufacturing industries to perform activities such as metal cutting, hammering, hole drilling, and surface finishing. This is expected to offer considerable pneumatic tools market opportunities.

Pneumatic drills can be used for both boring and fastening. Pneumatic tools do not tend to overheat which make them more useful compared to electric tools. Additionally, pneumatic tools cause less fatigue and strain on the hands during and after work.

Profitability and productivity are the key concerns of industries. Toward this end, possessing heavy equipment movers is crucial. Pneumatic tools seamlessly adapt to the ever-evolving manufacturing configurations. Pneumatic tools and equipment use compressed air to create a seal between heavy objects and the floor for moving around heavy equipment.

In the global pneumatic tools industry, Europe holds major share, and is dominated by Germany and the U.K. Increase in emphasis on R&D activities and presence of numerous manufacturers are bolstering market statistics in the region. The rise in number of manufacturing plants and production plants in many regions of the European Union is a key pneumatic tools market trend.

North America is also an attractive market for pneumatic tools. Expansion of infrastructure and industrial development in the region are the primary market catalysts. Additionally, DIY pneumatic tools are highly popular in North America, which reduces labor expenditure and promotes regional growth.

According to the pneumatic tools market forecast, Asia Pacific is one of the fastest growing markets in terms of CAGR and is expected to become the world's largest pneumatic tools market during the forecast period. The compound annual growth rate (CAGR) in this region is expected to be the highest during the forecast period due to the booming automobile industry in India and China. Increase in disposable income and surge in construction and infrastructure development activities are the main factors driving the market in the region.

The pneumatic tools market report highlights the fact that product development is a major strategy of pneumatic tools manufacturers. The market is highly competitive, with the presence of various global and regional players.

Atlas Copco, Makita Corporation, Delton Pneumatics, Bosch Tool Corporation, Toku Pneumatic Co, Ltd., EATON Corporation Inc., HITACHI Ltd., Dom Pneumatic Tools, Apex Tool Group, and SMC Corporation are the prominent entities profiled in the pneumatic tools market.

Each of these players has been profiled in the pneumatic tools market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 89.6 Bn |

|

Market Forecast Value in 2031 |

US$ 134.1 Bn |

|

Growth Rate (CAGR) |

7.6 % |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 89.6 Bn in 2022

It is estimated to be 7.6% from 2023 to 2031

Expanding manufacturing industry and rise in adoption of automated industrial systems

The pneumatic wrenches type segment accounted for significant share in 2022

Asia Pacific is likely to be one of the lucrative markets during the forecast period

Atlas Copco, Toku Pneumatic Co, Ltd., Makita Corporation, Delton Pneumatics, Bosch Tool Corporation, EATON Corporation Inc., Apex Tool Group, HITACHI Ltd., Dom Pneumatic Tools, and SMC Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Standards and Regulations Framework

5.8. Technological Overview

5.9. Global Pneumatic Tools Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projections (US$ Bn)

5.9.2. Market Revenue Projections (Thousand Units)

6. Global Pneumatic Tools Market Analysis and Forecast, By Type

6.1. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Pneumatic Wrenches

6.1.2. Pneumatic Sanders

6.1.3. Pneumatic Hammers

6.1.4. Pneumatic Drills

6.1.5. Pneumatic Polishers

6.1.6. Pneumatic Grinders

6.1.7. Other Pneumatic Tools

6.2. Incremental Opportunity, By Type

7. Global Pneumatic Tools Market Analysis and Forecast, By Application

7.1. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

7.1.1. Industrial

7.1.2. Residential or Household

7.1.3. Others

7.2. Incremental Opportunity, By Application

8. Global Pneumatic Tools Market Analysis and Forecast, By End-use Industry

8.1. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

8.1.1. Automobile

8.1.2. Textile

8.1.3. Defense

8.1.4. Mining

8.1.5. Chemicals

8.1.6. Manufacturing

8.1.7. Mining

8.1.8. Construction

8.1.9. Electronics

8.1.10. Telecommunications

8.2. Incremental Opportunity, By End-use Industry

9. Global Pneumatic Tools Market Analysis and Forecast, By Distribution Channel

9.1. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. North America Pneumatic Tools Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.2.1. Demand Side Analysis

10.2.2. Supply Side Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Key Supplier Analysis

10.5. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

10.5.1. Pneumatic Wrenches

10.5.2. Pneumatic Sanders

10.5.3. Pneumatic Hammers

10.5.4. Pneumatic Drills

10.5.5. Pneumatic Polishers

10.5.6. Pneumatic Grinders

10.5.7. Other Pneumatic Tools

10.6. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

10.6.1. Industrial

10.6.2. Residential or Household

10.6.3. Others

10.7. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

10.7.1. Automobile

10.7.2. Textile

10.7.3. Defense

10.7.4. Mining

10.7.5. Chemicals

10.7.6. Manufacturing

10.7.7. Mining

10.7.8. Construction

10.7.9. Electronics

10.7.10. Telecommunications

10.8. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.8.1. Direct

10.8.2. Indirect

10.9. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Pneumatic Tools Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.2.1. Demand Side Analysis

11.2.2. Supply Side Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Supplier Analysis

11.5. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Pneumatic Wrenches

11.5.2. Pneumatic Sanders

11.5.3. Pneumatic Hammers

11.5.4. Pneumatic Drills

11.5.5. Pneumatic Polishers

11.5.6. Pneumatic Grinders

11.5.7. Other Pneumatic Tools

11.6. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.6.1. Industrial

11.6.2. Residential or Household

11.6.3. Others

11.7. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

11.7.1. Automobile

11.7.2. Textile

11.7.3. Defense

11.7.4. Mining

11.7.5. Chemicals

11.7.6. Manufacturing

11.7.7. Mining

11.7.8. Construction

11.7.9. Electronics

11.7.10. Telecommunications

11.8. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.9.1. U.K.

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Pneumatic Tools Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.2.1. Demand Side Analysis

12.2.2. Supply Side Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Supplier Analysis

12.5. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Pneumatic Wrenches

12.5.2. Pneumatic Sanders

12.5.3. Pneumatic Hammers

12.5.4. Pneumatic Drills

12.5.5. Pneumatic Polishers

12.5.6. Pneumatic Grinders

12.5.7. Other Pneumatic Tools

12.6. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.6.1. Industrial

12.6.2. Residential or Household

12.6.3. Others

12.7. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

12.7.1. Automobile

12.7.2. Textile

12.7.3. Defense

12.7.4. Mining

12.7.5. Chemicals

12.7.6. Manufacturing

12.7.7. Mining

12.7.8. Construction

12.7.9. Electronics

12.7.10. Telecommunications

12.8. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Pneumatic Tools Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.2.1. Demand Side Analysis

13.2.2. Supply Side Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Supplier Analysis

13.5. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.5.1. Pneumatic Wrenches

13.5.2. Pneumatic Sanders

13.5.3. Pneumatic Hammers

13.5.4. Pneumatic Drills

13.5.5. Pneumatic Polishers

13.5.6. Pneumatic Grinders

13.5.7. Other Pneumatic Tools

13.6. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.6.1. Industrial

13.6.2. Residential or Household

13.6.3. Others

13.7. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

13.7.1. Automobile

13.7.2. Textile

13.7.3. Defense

13.7.4. Mining

13.7.5. Chemicals

13.7.6. Manufacturing

13.7.7. Mining

13.7.8. Construction

13.7.9. Electronics

13.7.10. Telecommunications

13.8. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Pneumatic Tools Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.2.1. Demand Side Analysis

14.2.2. Supply Side Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Supplier Analysis

14.5. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.5.1. Pneumatic Wrenches

14.5.2. Pneumatic Sanders

14.5.3. Pneumatic Hammers

14.5.4. Pneumatic Drills

14.5.5. Pneumatic Polishers

14.5.6. Pneumatic Grinders

14.5.7. Other Pneumatic Tools

14.6. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.6.1. Industrial

14.6.2. Residential or Household

14.6.3. Others

14.7. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

14.7.1. Automobile

14.7.2. Textile

14.7.3. Defense

14.7.4. Mining

14.7.5. Chemicals

14.7.6. Manufacturing

14.7.7. Mining

14.7.8. Construction

14.7.9. Electronics

14.7.10. Telecommunications

14.8. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Pneumatic Tools Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share % - 2022

15.3. Company Profiles (Details – Company Overview, Product Portfolio, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Apex Tool Group

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Sales Area/Geographical Presence

15.3.1.4. Revenue

15.3.1.5. Strategy & Business Overview

15.3.2. Atlas Copco.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Sales Area/Geographical Presence

15.3.2.4. Revenue

15.3.2.5. Strategy & Business Overview

15.3.3. Bosch Tool Corporation

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Sales Area/Geographical Presence

15.3.3.4. Revenue

15.3.3.5. Strategy & Business Overview

15.3.4. Delton Pneumatics

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Sales Area/Geographical Presence

15.3.4.4. Revenue

15.3.4.5. Strategy & Business Overview

15.3.5. Dom Pneumatic Tools

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Sales Area/Geographical Presence

15.3.5.4. Revenue

15.3.5.5. Strategy & Business Overview

15.3.6. EATON Corporation Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Sales Area/Geographical Presence

15.3.6.4. Revenue

15.3.6.5. Strategy & Business Overview

15.3.7. HITACHI Ltd

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Sales Area/Geographical Presence

15.3.7.4. Revenue

15.3.7.5. Strategy & Business Overview

15.3.8. Makita Corporation

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Sales Area/Geographical Presence

15.3.8.4. Revenue

15.3.8.5. Strategy & Business Overview

15.3.9. SMC Corporation

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Sales Area/Geographical Presence

15.3.9.4. Revenue

15.3.9.5. Strategy & Business Overview

15.3.10. Toku Pneumatic Co, Ltd.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Sales Area/Geographical Presence

15.3.10.4. Revenue

15.3.10.5. Strategy & Business Overview

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Distribution Channel

16.1.5. By Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 4: Global Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 5: Global Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global Pneumatic Tools Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Pneumatic Tools Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 13: North America Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 14: North America Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 15: North America Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 16: North America Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 17: North America Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Table 20: North America Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Table 21: Europe Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 24: Europe Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 25: Europe Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: Europe Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 27: Europe Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Table 30: Europe Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Table 31: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 33: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 34: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 35: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Table 40: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Table 41: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 43: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 44: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 45: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Table 50: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Table 51: South America Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Table 53: South America Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Table 54: South America Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Table 55: South America Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 56: South America Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 57: South America Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Table 60: South America Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

List of Figures

Figure 1: Global Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 5: Global Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 6: Global Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 7: Global Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Pneumatic Tools Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Pneumatic Tools Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 20: North America Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 21: North America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 22: North America Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 23: North America Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 24: North America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Figure 29: North America Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Figure 30: North America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 31: Europe Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 35: Europe Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 36: Europe Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 37: Europe Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 38: Europe Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 39: Europe Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Figure 44: Europe Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Figure 45: Europe Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 46: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 50: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 51: Asia Pacific Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 52: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Figure 59: Asia Pacific Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Figure 60: Asia Pacific Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 61: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 65: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 66: Middle East & Africa Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 67: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 70: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Figure 74: Middle East & Africa Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Figure 75: Middle East & Africa Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 76: South America Pneumatic Tools Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Pneumatic Tools Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Pneumatic Tools Market Value (US$ Bn), by Application, 2017-2031

Figure 80: South America Pneumatic Tools Market Volume (Thousand Units), by Application 2017-2031

Figure 81: South America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 82: South America Pneumatic Tools Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 83: South America Pneumatic Tools Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 84: South America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America Pneumatic Tools Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Pneumatic Tools Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Pneumatic Tools Market Value (US$ Bn), by Country, 2017-2031

Figure 89: South America Pneumatic Tools Market Volume (Thousand Units), by Country 2017-2031

Figure 90: South America Pneumatic Tools Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031