Numerous technological advancements fostering market growth, coupled with disparity in broadcasting regulations in various regions is what the playout solutions landscape is expected to experience during the forecast period. The dynamics of the playout solutions market, as found by a recent report published by Transparency Market Research (TMR), suggest that, the influx of revenue will continue to increase, as the demand for smart-sizing conventional playout systems prevails.

The need to integrate multiple units performing designated functionalities into a single software application so as to achieve simplification in the otherwise labyrinth installation and maintenance processes is likely to disrupt end-use industries regarding the adoption of playout solutions. Market players are observed partnering with broadcasters to secure long-term growth opportunities in the highly competitive sphere. All-in-all, market players can look at an above-average growth pace of the playout solutions market, with an anticipated CAGR of ~8% during 2019-2027.

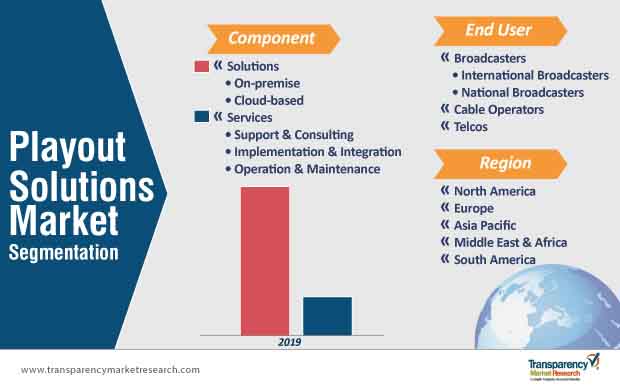

Since data security is paramount, broadcasters, telcos, and cable operators are seen scrambling towards cloud-based playout solutions, away from the on-premise ones. Besides security, even scalability, flexibility, and agility are the key drivers alluring end users towards cloud-based solutions.

That being said, on-premise solutions can ensure profitability to large enterprises, while cloud-based solutions serve small- and mid-sized enterprises with their 'pay as you grow' revenue model. Given the large number of benefits offered by cloud-based solutions over on-premise solutions, the former are projected to witness adoption at a CAGR of ~14% during the forecast period, while legacy enterprises will continue to rely on the latter.

As end users continue to look for ways to achieve marginal growth, playout solutions remain coveted to optimize resources by controlling overhead costs. Among others, broadcasters - including international and national ones - make leading end users of the playout solutions market, with a projected overall share of ~53% in 2019. The rising importance of digital media as an effective advertising platform is likely to drive the adoption of playout solutions from the broadcaster user base. However, irregularities in regulations in different regions could cause a roadblock to the otherwise steady stride of the market.

Two opportunities lay open in the playout solutions market for stakeholders.

Since automation holds the key to a successful future in any industry, the advent of 5G technology will serve as a propeller to automation. Currently, broadcasters and content providers leverage the proficiency of AR, VR, and AI technology to understand user behavior and to offer personalized content. These technologies are likely to bring value to user engagement, and be paramount to the digital advertisement industry. Since the rendering of digital content will highly rely on the speed of Internet connections, the introduction of 5G technology will remain integral for the adoption of playout solutions to broadcast digital content.

Another lucrative opportunity can also be derived from user engagement to the content distribution platform. With growing media consumption, content management companies seek better systems with enhanced storage capacities, which offers an opportunity to playout solution providers to offer storage space for efficient broadcast to content distribution companies.

The digital economy concept is scaling up at an impressive rate, as digital revenue continues to grow as a result of the increasing consumption of digital media. Authors of the report opine that, a shift toward digitalization is a major boost to the growth of playout solutions, and as companies do away with their legacy systems, the digital advertising of assets will create opportunities for the playout solutions market.

Since the market is home to numerous participants, user attrition rate will remain high, which pushes these players to enrich their portfolios with innovative offerings. For instance, Amagi Media announced the launch of CLOUDPORT UHD, which boasts of the competency to broadcast media without using GDU processors. In addition, inorganic growth strategies such as acquisitions and mergers also serve as an instrument to widen the clientele base.

Other major players operating in the global playout solutions market and profiled in the report include

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Playout Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2023 and 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Ecosystem Analysis

4.4.3.1. Key End User/Customers Analysis

4.4.3.2. Market Channel Development Trends

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Key Market Indicator

4.5.1. Broadcasting Industry Overview

4.5.2. No of Broadcasting Events, by Content Type (SVoD+TVoD)

4.5.2.1. Live Sports

4.5.2.2. Recorded Sports

4.5.2.3. Movies

4.5.2.4. Live Music

4.5.2.5. Others (Science and Discovery etc.)

4.6. Adoption of the Playout Solutions, by Content Type

4.6.1. News

4.6.2. Sports

4.6.3. Entertainment and Lifestyle

4.6.4. Science and Discovery

4.6.5. Others (Cartoon, teleshopping, etc.)

4.7. Pricing Model Analysis

4.8. Analysis of supported types of video files

4.8.1. HDV

4.8.2. Windows Media Video

4.8.3. Mpeg

4.9. Global Playout Solutions Market Analysis and Forecast, 2017 - 2027

4.9.1. Market Revenue Analysis (US$ Mn)

4.9.1.1. Historic Growth Trends, 2013-2018

4.9.1.2. Forecast Trends, 2019-2027

4.9.2. Market Opportunity Assessment – By Region/ Country (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.9.2.1. By Component

4.9.2.2. By End-user

4.9.2.3. By Region/Country

4.10. Competitive Scenario and Trends

4.10.1. Playout Solutions Market Concentration Rate

4.10.1.1. List of Emerging, Prominent and Leading Players

4.10.2. Mergers & Acquisitions, Expansions

4.11. Market Outlook

5. Global Playout Solutions Market Analysis and Forecasts, by Component

5.1. Introduction & Definitions

5.2. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

5.2.1. Solutions

5.2.1.1. On-premise

5.2.1.2. Cloud

5.2.2. Services

5.2.2.1. Support & Consulting

5.2.2.2. Implementation & Integration

5.2.2.3. Operation & Maintenance

6. Global Playout Solutions Market Analysis and Forecasts, by End-user

6.1. Introduction & Definitions

6.2. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

6.2.1. Broadcasters

6.2.1.1. International Broadcasters

6.2.1.2. National Broadcasters

6.2.2. Cable Operators

6.2.3. Telcos

7. Global Playout Solutions Market Analysis and Forecast, by Region

7.1. Overview

7.2. Playout Solutions Market Size (US$ Mn) Forecast, by Region, 2017-2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Playout Solutions Market Analysis and Forecast

8.1. Key Findings

8.2. Impact Analysis of Drivers and Restraints

8.3. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

8.3.1. Solutions

8.3.1.1. On-premise

8.3.1.2. Cloud

8.3.2. Services

8.3.2.1. Support & Consulting

8.3.2.2. Implementation & Integration

8.3.2.3. Operation & Maintenance

8.4. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

8.4.1. Broadcasters

8.4.1.1. International Broadcasters

8.4.1.2. National Broadcasters

8.4.2. Cable Operators

8.4.3. Telcos

8.5. Playout Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017-2027

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

9. Europe Playout Solutions Market Analysis and Forecast

9.1. Key Findings

9.2. Impact Analysis of Drivers and Restraints

9.3. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

9.3.1. Solutions

9.3.1.1. On-premise

9.3.1.2. Cloud

9.3.2. Services

9.3.2.1. Support & Consulting

9.3.2.2. Implementation & Integration

9.3.2.3. Operation & Maintenance

9.4. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

9.4.1. Broadcasters

9.4.1.1. International Broadcasters

9.4.1.2. National Broadcasters

9.4.2. Cable Operators

9.4.3. Telcos

9.5. Playout Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017-2027

9.5.1. Germany

9.5.2. France

9.5.3. The U.K.

9.5.4. Rest of Europe

10. Asia Pacific Playout Solutions Market Analysis and Forecast

10.1. Key Findings

10.2. Impact Analysis of Drivers and Restraints

10.3. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

10.3.1. Solutions

10.3.1.1. On-premise

10.3.1.2. Cloud

10.3.2. Services

10.3.2.1. Support & Consulting

10.3.2.2. Implementation & Integration

10.3.2.3. Operation & Maintenance

10.4. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

10.4.1. Broadcasters

10.4.1.1. International Broadcasters

10.4.1.2. National Broadcasters

10.4.2. Cable Operators

10.4.3. Telcos

10.5. Playout Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017-2027

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. Rest of Asia Pacific

11. Middle East & Africa (MEA) Playout Solutions Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers and Restraints

11.3. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

11.3.1. Solutions

11.3.1.1. On-premise

11.3.1.2. Cloud

11.3.2. Services

11.3.2.1. Support & Consulting

11.3.2.2. Implementation & Integration

11.3.2.3. Operation & Maintenance

11.4. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

11.4.1. Broadcasters

11.4.1.1. International Broadcasters

11.4.1.2. National Broadcasters

11.4.2. Cable Operators

11.4.3. Telcos

11.5. Playout Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017-2027

11.5.1. GCC Countries

11.5.2. South Africa

11.5.3. Rest of MEA

12. South America Playout Solutions Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Playout Solutions Market Size (US$ Mn) Forecast, by Component, 2017-2027

12.3.1. Solutions

12.3.1.1. On-premise

12.3.1.2. Cloud

12.3.2. Services

12.3.2.1. Support & Consulting

12.3.2.2. Implementation & Integration

12.3.2.3. Operation & Maintenance

12.4. Playout Solutions Market Size (US$ Mn) Forecast, by End-user, 2017-2027

12.4.1. Broadcasters

12.4.1.1. International Broadcasters

12.4.1.2. National Broadcasters

12.4.2. Cable Operators

12.4.3. Telcos

12.5. Playout Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017-2027

12.5.1. Brazil

12.5.2. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Revenue Share Analysis (%), by Company (2018)

14. Company Profiles

14.1. Grass Valley, LLC

14.1.1. Business Overview

14.1.2. Revenue

14.1.3. Key Strategy

14.2. Amagi Media Labs Pvt. Ltd.

14.2.1. Business Overview

14.2.2. Key Strategy

14.2.3. Key Development

14.3. Evertz Microsystem Limited

14.3.1. Business Overview

14.3.2. Revenue

14.3.3. Key Strategy

14.4. BroadStream Solutions, Inc.

14.4.1. Business Overview

14.4.2. Key Strategy

14.4.3. Key Development

14.5. Broadcasting Center Europe (BCE)

14.5.1. Business Overview

14.5.2. Key Strategy

14.5.3. Key Development

14.6. Harmonic, Inc.,

14.6.1. Business Overview

14.6.2. Revenue

14.6.3. Key Strategy

14.7. Brainstorm Multimedia

14.7.1. Business Overview

14.7.2. Key Strategy

14.7.3. Key Development

14.8. Imagine Communications Corp.

14.8.1. Business Overview

14.8.2. Key Strategy

14.8.3. Key Development

14.9. SES S.A.

14.9.1. Business Overview

14.9.2. Revenue

14.9.3. Key Strategy

14.10. Talia Limited

14.10.1. Business Overview

14.10.2. Key Strategy

14.10.3. Key Development

14.11. Encompass Digital Media, Inc.

14.11.1. Business Overview

14.11.2. Key Strategy

14.11.3. Key Development

15. Key Takeaways

List of Tables

Table 1: Pricing Model Analysis

Table 2: List of Emerging, Prominent and Leading Players in Playout Solutions Market (2018)

Table 3: Alliances & Expansions in Playout Solutions Market

Table 4: Global Playout Solutions Market Size, by Component, 2017–2027

Table 5: Global Playout Solutions Market Size, by End-user, 2017–2027

Table 6: Global Playout Solutions Market Regional CAGR 2019-2027(%)

Table 7: Global Playout Solutions Market Size, by Regions, 2017–2027

Table 8: North America Playout Solutions Market Size, by Component, 2017–2027

Table 9: North America Playout Solutions Market Size, by End-User, 2017–2027

Table 10: North America Playout Solutions Market Size, by Country, 2017–2027

Table 11: Europe Playout Solutions Market Size, by Component, 2017–2027

Table 12: Europe Playout Solutions Market Size, by End-User, 2017–2027

Table 13: Europe Playout Solutions Market Size, by Country, 2017–2027

Table 14: Asia Pacific Playout Solutions Market Size, by Component, 2017–2027

Table 15: Asia Pacific Playout Solutions Market Size, by End-User, 2017–2027

Table 16: Asia Pacific Playout Solutions Market Size, by Country, 2017–2027

Table 17: Middle East & Africa Playout Solutions Market Size, by Component, 2017–2027

Table 18: Middle East & Africa Playout Solutions Market Size, by End-User, 2017–2027

Table 19: Middle East & Africa Playout Solutions Market Size, by Country, 2017–2027

Table 20: South America Playout Solutions Market Size, by Component, 2017–2027

Table 21: South America Playout Solutions Market Size, by End-User, 2017–2027

Table 22: South America Playout Solutions Market Size, by Country, 2017–2027

Table 23: Global Playout Solutions Market Competition Matrix

List of Figures

Figure 1: Global Playout Solutions Market Size (US$ Mn) and Forecast, 2017–2027

Figure 2: Global Playout Solutions Market CAGR Breakdown

Figure 3: Global Playout Solutions Market Regional Outline – CAGR (2019-2027)

Figure 4: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 5: Top Economies GDP Landscape, 2018

Figure 6: Global ICT Spending

Figure 7: Global ICT Spending (%), by Region, 2019E

Figure 8: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 10: Global ICT Spending (%), by Type, 2019E

Figure 11: Digital Marketing Channel Investment Priorities (2018)

Figure 12: Growth rates are expected to remain steady, even as the industry is being transformed

Figure 13: Digital revenues will continue to make up more and more of the industry’s income

Figure 14: No. of Broadcasting Events, by Content Type (SVoD+TVoD)

Figure 15: Adoption of the Playout Solutions, by Content Type (2018)

Figure 16: Global Playout Solutions Market Historic Growth Trends (US$ Mn), 2012 – 2017

Figure 17: Global Playout Solutions Market Y-o-Y Growth (Value %), 2013 – 2017

Figure 18: Global Playout Solutions Market Forecast Trends (US$ Mn), 2017 - 2027

Figure 19: Global Playout Solutions Market Y-o-Y Growth (Value %), 2017 - 2027

Figure 20: Global Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 21: Global Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 22: Global Playout Solutions Market Opportunity Analysis, by Region (2019)

Figure 23: North America Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 24: North America Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 25: Europe Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 26: Europe Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 27: Asia Pacific Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 28: Asia Pacific Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 29: Middle East and Africa Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 30: Middle East and Africa Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 31: South America Playout Solutions Market Opportunity Analysis, by Component (2019)

Figure 32: South America Playout Solutions Market Opportunity Analysis, by End-user (2019)

Figure 33: Global Playout Solutions Market Share Analysis, by Component (2019)

Figure 34: Global Playout Solutions Market Share Analysis, by Component (2027)

Figure 35: Global Playout Solutions Market Share Analysis, by End-user (2019)

Figure 36: Global Playout Solutions Market Share Analysis, by End-user (2027)

Figure 37: Global Playout Solutions Market Share Analysis, by Region (2019)

Figure 38: Global Playout Solutions Market Share Analysis, by Region (2027)

Figure 39: North America Playout Solutions Market Share Analysis, by Component (2019)

Figure 40: North America Playout Solutions Market Share Analysis, by Component (2027)

Figure 41: North America Playout Solutions Market Share Analysis, by End-user (2019)

Figure 42: North America Playout Solutions Market Share Analysis, by End-user (2027)

Figure 43: North America Playout Solutions Market Share Analysis, by Country (2019)

Figure 44: North America Playout Solutions Market Share Analysis, by Country (2027)

Figure 45: Europe Playout Solutions Market Share Analysis, by Component (2019)

Figure 46: Europe Playout Solutions Market Share Analysis, by Component (2027)

Figure 47: Europe Playout Solutions Market Share Analysis, by End-user (2019)

Figure 48: Europe Playout Solutions Market Share Analysis, by End-user (2027)

Figure 49: Europe Playout Solutions Market Share Analysis, by Country (2019)

Figure 50: Europe Playout Solutions Market Share Analysis, by Country (2027)

Figure 51: Asia Pacific Playout Solutions Market Share Analysis, by Component (2019)

Figure 52: Asia Pacific Playout Solutions Market Share Analysis, by Component (2027)

Figure 53: Asia Pacific Playout Solutions Market Share Analysis, by End-user (2019)

Figure 54: Asia Pacific Playout Solutions Market Share Analysis, by End-user (2027)

Figure 55: Asia Pacific Playout Solutions Market Share Analysis, by Country (2019)

Figure 56: Asia Pacific Playout Solutions Market Share Analysis, by Country (2027)

Figure 57: Middle East & Africa Playout Solutions Market Share Analysis, by Component (2019)

Figure 58: Middle East & Africa Playout Solutions Market Share Analysis, by Component (2027)

Figure 59: Middle East & Africa Playout Solutions Market Share Analysis, by End-user (2019)

Figure 60: Middle East & Africa Playout Solutions Market Share Analysis, by End-user (2027)

Figure 61: Middle East & Africa Playout Solutions Market Share Analysis, by Country (2019)

Figure 62: Middle East & Africa Playout Solutions Market Share Analysis, by Country (2027)

Figure 63: South America Playout Solutions Market Share Analysis, by Component (2019)

Figure 64: South America Playout Solutions Market Share Analysis, by Component (2027)

Figure 65: South America Playout Solutions Market Share Analysis, by End-user (2019)

Figure 66: South America Playout Solutions Market Share Analysis, by End-user (2027)

Figure 67: South America Playout Solutions Market Share Analysis, by Country (2019)

Figure 68: South America Playout Solutions Market Share Analysis, by Country (2027)

Figure 69: Market Share Analysis (2018)

Figure 70: Harmonic, Inc. Net Sales, by Region, 2018 (US$ Mn)

Figure 71: Harmonic, Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 72: SES S.A. Net Sales, by Region, 2018 (US$ Mn)

Figure 73: SES S.A. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 74: Evertz Microsystems Limited Net Sales (US$ Mn), by Geography, 2018

Figure 75: Evertz Microsystems Limited Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 76: Grass Valley USA, LLC (Belden Inc.)Net Sales (US$ Mn), by Geography, 2018

Figure 77: Grass Valley USA, LLC (Belden Inc.)Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018