Analysts’ Viewpoint on Plasma Sterilizers Market Scenario

All medical and scientific equipment cannot be effectively sterilized in a steam sterilizer (autoclave). Complicated and technologically advanced equipment is likely to be damaged by the high temperature and humidity of steam sterilization. This has led to the development of plasma gas-based sterilizers, wherein selected medical devices are sterilized at low temperature in order to maintain their properties.

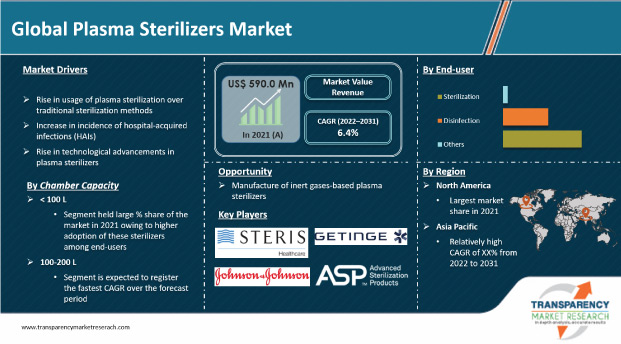

Global demand for plasma sterilizers is expected to be influenced by their value-added advantages over conventional sterilization methods. Gas plasma sterilization using hydrogen peroxide facilitates sterilization at a lower temperature. This is likely to propel the demand for hydrogen peroxide plasma sterilizers for thermo-sensitive materials during the forecast period. Rise in number of hospitals & clinics, ambulatory surgery centers, and healthcare organizations in developing countries is expected to propel the global plasma sterilizers market in the near future.

Post the peak of the COVID-19 pandemic, companies in the plasma sterilizers market are focusing on investing in new technologies in order to improve their product portfolios. Market players should concentrate on investing in manufacturing of inert gases-based plasma sterilizers such as nitrogen (NO2), oxygen (O2), helium (He), neon (Ne), argon (Ar), and xenon (Xe), which are likely to create lucrative opportunities in the market.

Rise in burden of HAIs across the world is expected to drive the global market for plasma sterilizers throughout the forecast period.

Hospital-acquired infections (HAIs) are complications of healthcare. They are linked to high morbidity and mortality. These complications include central line-associated bloodstream infections, catheter-associated urinary tract infections (UTIs), and ventilator-associated pneumonia (VAP). The most common bacteria associated with HAIs include C. difficile, methicillin-resistant Staphylococcus aureus (MRSA), Klebsiella, E. coli, Enterococcus, and Pseudomonas species. Rise in burden of HAIs across the world is expected to drive the global market for plasma sterlizers throughout the forecast period.

An article published in the National Center for Biotechnology Information (NCBI) stated that out of every 100 hospitalized patients, seven patients in advanced countries and 10 patients in emerging countries develop hospital-acquired infections.

Hospitalization in the U.S. has been increasing gradually. In 2018, around 6.7% individuals in the U.S. were hospitalized at least once. In May 2022, about 47 states in the U.S. reported an increase in COVID-19 hospitalizations. This increase in hospitalizations was accompanied by a 31% rise in seven-day average infection rates and 10% rise in COVID-19 deaths. Growth in hospitalization rate increases the occurrence of HAIs, thereby driving the demand for medical instruments, including sterilization equipment.

The COVID-19 pandemic has disrupted the global healthcare system. Temporary hospitals are being set up to deal with the rise in number of cases of novel Coronavirus. The spread of COVID-19 has surged the demand for sterilization equipment due to the rising cases of HAIs in hospitals and other healthcare settings. About 10% of the reported COVID-19 positive cases require ICU involvement, with several patients requiring urgent tracheal intubation for profound and sudden hypoxia. Around 21% to 31% of COVID-19 patients in the U.S. required hospitalization, and 5% to 11% required intensive care during critical COVID-19 pandemic. Increase in demand for hospital beds and ICUs, proliferation of isolation facilities, and rise in awareness among consumers about sterilization products for medical devices is likely to augment the global market during the forecast period.

In terms of chamber capacity, the < 100 L segment accounted for more than 50% share of the global market in terms of revenue in 2021. This is attributed to higher adoption of these chamber capacity sterilizers among end-users including hospitals & clinics, ambulatory surgery centers, and healthcare organizations.

The sterilization segment held the largest share of the global market in 2021. This trend is anticipated continue during the forecast period due to the increase in incidence of HAIs, rise in number of surgeries performed, stringent regulatory mandates for infection control, and growth in healthcare facilities.

Hydrogen peroxide sterilizer involves a low-temp sterilizer process commonly used in the application of sterilizing medical devices. Hydrogen peroxide-based low-temperature sterilization is a new sterilization technology for temperature-dependent medical devices. The hydrogen peroxide gas segment held substantial market share in 2021. The trend is expected to continue throughout the forecast period due to benefits offered by hydrogen peroxide plasma in low temperature sterilization such as no chemical residues, short aeration time, safe handling, and safe for the environment.

North America dominated the global plasma sterilizers market in 2021. Growth of the market in the region can be ascribed to technological advancements in plasma sterilizers, presence of leading players, increase in demand for sterilization technologies in the healthcare industry to minimize the occurrence of HAIs, and surge in number of surgical procedures performed.

The market in Asia Pacific is likely to be driven by surge in geriatric population, rise in incidence of various diseases, and government initiatives to curb HAIs. According to the United Nations Population Fund (UNFPA), one in four people in Asia Pacific will be above 60 years old by 2050. The population aged above 60 in the region will triple between 2010 and 2050, reaching nearly 1.3 billion. This older population is prone to develop various diseases, which could require hospitalization. This is expected to augment the market during the forecast period.

The plasma sterilizers market report includes vital information about key players operating in the global market. Companies are focusing on strategies such as new product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Antonio Matachana, S. A., ASP Global Manufacturing GmbH (Fortive Corporation), Cisa Production S.r.l. Unipersonale, Getinge AB, Johnson & Johnson Services, Inc. (Sterilmed Medical), HUMAN MEDITEK CO., LTD., Steelco S.p.A. (MIELE Group), STERIS plc, Tuttnauer (Fortissimo Capital), and VitroSteril (RBChimica) are some of the prominent players operating in the market.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 590.0 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1,101 Mn |

|

Compound Annual Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value & Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global plasma sterilizers market was valued at US$ 590.0 Mn in 2021.

The global plasma sterilizers market is projected to reach more than US$ 1,101 Mn by 2031.

The global plasma sterilizers market expanded at a CAGR of 7.7% from 2017 to 2021.

The global plasma sterilizers market is anticipated to expand at a CAGR of 6.4% from 2022 to 2031.

Increase in incidence of hospital-acquired infections (HAIs) and rise in preference for plasma sterilizers over traditional sterilization methods drive the global plasma sterilizers market.

The < 100 L (less than 100 liter) segment accounted for more than 50% share of the global plasma sterilizers market in 2021.

North America is expected to account for major share of the global market during the forecast period.

Antonio Matachana, S. A., ASP Global Manufacturing GmbH (Fortive Corporation), Cisa Production S.r.l. Unipersonale, Getinge AB, Johnson & Johnson Services, Inc. (Sterilmed Medical), HUMAN MEDITEK CO., LTD., Steelco S.p.A. (MIELE Group), STERIS plc, Tuttnauer (Fortissimo Capital), and VitroSteril (RBChimica) are the prominent players operating in the global plasma sterilizers market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Plasma Sterilizers Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

5. Key Insights

5.1. Technological Advancements

5.2. End-user Pricing Analysis, by Region

5.3. Competitor’s Product/Brand Pricing, by Regional Level

5.4. Supply Chain Analysis, by Region (Margin Percentage)

5.5. Regulatory Scenario by Region/Globally

5.6. COVID-19 Impact Analysis

6. Global Plasma Sterilizers Market Analysis and Forecasts, by Chamber Capacity

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

6.3.1. < 100 L

6.3.2. 100-200 L

6.3.3. > 200 L

6.4. Market Attractiveness Analysis, by Chamber Capacity

7. Global Plasma Sterilizers Market Analysis and Forecasts, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value & Volume Forecast By Application, 2017–2031

7.3.1. Sterilization

7.3.2. Disinfection

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Plasma Sterilizers Market Analysis and Forecasts, by Source Gas

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value & Volume Forecast, by Source Gas, 2017–2031

8.3.1. Hydrogen Peroxide Gas

8.3.2. Others

8.4. Market Attractiveness Analysis, by Source Gas

9. Global Plasma Sterilizers Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value & Volume Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Plasma Sterilizers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

10.2.1. < 100 L

10.2.2. 100-200 L

10.2.3. > 200 L

10.3. Market Value & Volume Forecast, by Application, 2017–2031

10.3.1. Sterilization

10.3.2. Disinfection

10.3.3. Others

10.4. Market Value & Volume Forecast, by Source Gas, 2017–2031

10.4.1. Hydrogen Peroxide Gas

10.4.2. Others

10.5. Market Value & Volume Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Chamber Capacity

10.6.2. By Application

10.6.3. By Source Gas

10.6.4. By Country

11. Europe Plasma Sterilizers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

11.2.1. < 100 L

11.2.2. 100-200 L

11.2.3. > 200 L

11.3. Market Value & Volume Forecast, by Application, 2017–2031

11.3.1. Sterilization

11.3.2. Disinfection

11.3.3. Others

11.4. Market Value & Volume Forecast, by Source Gas, 2017–2031

11.4.1. Hydrogen Peroxide Gas

11.4.2. Others

11.5. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Chamber Capacity

11.6.2. By Application

11.6.3. By Source Gas

11.6.4. By Country/Sub-region

12. Asia Pacific Plasma Sterilizers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

12.2.1. < 100 L

12.2.2. 100-200 L

12.2.3. > 200 L

12.3. Market Value & Volume Forecast, by Application, 2017–2031

12.3.1. Sterilization

12.3.2. Disinfection

12.3.3. Others

12.4. Market Value & Volume Forecast, by Source Gas, 2017–2031

12.4.1. Hydrogen Peroxide Gas

12.4.2. Others

12.5. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Chamber Capacity

12.6.2. By Application

12.6.3. By Source Gas

12.6.4. By Country/Sub-region

13. Latin America Plasma Sterilizers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

13.2.1. < 100 L

13.2.2. 100-200 L

13.2.3. > 200 L

13.3. Market Value & Volume Forecast, by Application, 2017–2031

13.3.1. Sterilization

13.3.2. Disinfection

13.3.3. Others

13.4. Market Value & Volume Forecast, by Source Gas, 2017–2031

13.4.1. Hydrogen Peroxide Gas

13.4.2. Others

13.5. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Chamber Capacity

13.6.2. By Application

13.6.3. By Source Gas

13.6.4. By Country/Sub-region

14. Middle East & Africa Plasma Sterilizers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value & Volume Forecast, by Chamber Capacity, 2017–2031

14.2.1. < 100 L

14.2.2. 100-200 L

14.2.3. > 200 L

14.3. Market Value & Volume Forecast, by Application, 2017–2031

14.3.1. Sterilization

14.3.2. Disinfection

14.3.3. Others

14.4. Market Value & Volume Forecast, by Source Gas, 2017–2031

14.4.1. Hydrogen Peroxide Gas

14.4.2. Others

14.5. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Chamber Capacity

14.6.2. By Application

14.6.3. By Source Gas

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by Tier and Size of companies)

15.2. Market Share Analysis/Ranking, by Company, 2021

15.3. Company Profiles

15.3.1. Antonio Matachana, S. A.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. ASP Global Manufacturing GmbH (Fortive Corporation)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Cisa Production S.r.l. Unipersonale

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Getinge AB

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Johnson & Johnson Services, Inc. (Sterilmed Medical)

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. HUMAN MEDITEK CO., LTD.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Steelco S.p.A. (MIELE Group)

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. STERIS plc

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Tuttnauer (Fortissimo Capital)

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. VitroSteril (RBChimica)

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Other Prominent Players

List of Tables

Table 01: Global Plasma Sterilizers Market Value (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 02: Global Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 03: Global Plasma Sterilizers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 05: Global Plasma Sterilizers Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: Global Plasma Sterilizers Market Volume (Units) Forecast, by Region, 2017–2031

Table 07: North America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Plasma Sterilizers Market Volume (Units) Forecast, by Country, 2017–2031

Table 09: North America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 10: North America Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 11: North America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: North America Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 13: North America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Source Gas, 2017–2031

Table 14: North America Plasma Sterilizers Market Volume (Units) Forecast, by Source Gas, 2017–2031

Table 15: Europe Plasma Sterilizers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Europe Plasma Sterilizers Market Volume (Units) Forecast, by Country/Sub-region, 2017–2031

Table 17: Europe Plasma Sterilizers Market Size (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 18: Europe Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 19: Europe Plasma Sterilizers Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Europe Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 21: Europe Plasma Sterilizers Market Size (US$ Mn) Forecast, by Source Gas, 2017–2031

Table 22: Europe Plasma Sterilizers Market Volume (Units) Forecast, by Source Gas, 2017–2031

Table 23: Asia Pacific Plasma Sterilizers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Asia Pacific Plasma Sterilizers Market Volume (Units) Forecast, by Country/Sub-region, 2017–2031

Table 25: Asia Pacific Plasma Sterilizers Market Size (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 26: Asia Pacific Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 27: Asia Pacific Plasma Sterilizers Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Asia Pacific Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 29: Asia Pacific Plasma Sterilizers Market Size (US$ Mn) Forecast, by Source Gas, 2017–2031

Table 30: Asia Pacific Plasma Sterilizers Market Volume (Units) Forecast, by Source Gas, 2017–2031

Table 31: Latin America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Latin America Plasma Sterilizers Market Volume (Units) Forecast, by Country/Sub-region, 2017–2031

Table 33: Latin America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 34: Latin America Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 35: Latin America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Latin America Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 37: Latin America Plasma Sterilizers Market Size (US$ Mn) Forecast, by Source Gas, 2017–2031

Table 38: Latin America Plasma Sterilizers Market Volume (Units) Forecast, by Source Gas, 2017–2031

Table 39: Middle East & Africa Plasma Sterilizers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 40: Middle East & Africa Plasma Sterilizers Market Volume (Units) Forecast, by Country/Sub-region, 2017–2031

Table 41: Middle East & Africa Plasma Sterilizers Market Size (US$ Mn) Forecast, by Chamber Capacity, 2017–2031

Table 42: Middle East & Africa Plasma Sterilizers Market Volume (Units) Forecast, by Chamber Capacity, 2017–2031

Table 43: Middle East & Africa Plasma Sterilizers Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 44: Middle East & Africa Plasma Sterilizers Market Volume (Units) Forecast, by Application, 2017–2031

Table 45: Middle East & Africa Plasma Sterilizers Market Size (US$ Mn) Forecast, by Source Gas, 2017–2031

Table 46: Middle East & Africa Plasma Sterilizers Market Volume (Units) Forecast, by Source Gas, 2017–2031

List of Figures

Figure 01: Global Plasma Sterilizers Market Value Share, by Chamber Capacity, 2021

Figure 02: Global Plasma Sterilizers Market Value Share, by Application, 2021

Figure 03: Global Plasma Sterilizers Market Value Share, by Source Gas, 2021

Figure 04: Global Plasma Sterilizers Market Value Share, by Region, 2021

Figure 05: Global Plasma Sterilizers Market, By Region (US$ Mn), 2021

Figure 06: Global Plasma Sterilizers Market Value (US$ Mn) Forecast, 2017–2031

Figure 07: Global Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 08: Global Plasma Sterilizers Market Revenue (US$ Mn), by < 100 L, 2017–2031

Figure 09: Global Plasma Sterilizers Market Revenue (US$ Mn), by 100-200 L, 2017–2031

Figure 10: Global Plasma Sterilizers Market Revenue (US$ Mn), by > 200 L, 2017–2031

Figure 11: Global Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 12: Global Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 13: Global Plasma Sterilizers Market Revenue (US$ Mn), by Sterilization, 2017–2031

Figure 14: Global Plasma Sterilizers Market Revenue (US$ Mn), by Disinfection, 2017–2031

Figure 15: Global Plasma Sterilizers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 16: Global Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 17: Global Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 18: Global Plasma Sterilizers Market Revenue (US$ Mn), by Hydrogen Peroxide Gas, 2017–2031

Figure 19: Global Plasma Sterilizers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 20: Global Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 21: Global Plasma Sterilizers Market Value Share Analysis, by Region, 2021 and 2031

Figure 22: Global Plasma Sterilizers Market Attractiveness Analysis, by Region, 2022–2031

Figure 23: North America Plasma Sterilizers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 24: North America Plasma Sterilizers Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Plasma Sterilizers Market Value Share Analysis, by Country, 2021 and 2031

Figure 26: North America Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 27: North America Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 28: North America Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 29 North America Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 30: North America Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 31: North America Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 32: Europe Plasma Sterilizers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 33: Europe Plasma Sterilizers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Plasma Sterilizers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Europe Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 36: Europe Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 37: Europe Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 38: Europe Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 39: Europe Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 40: Europe Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 41: Asia Pacific Plasma Sterilizers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 42: Asia Pacific Plasma Sterilizers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Plasma Sterilizers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Asia Pacific Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 45: Asia Pacific Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 46: Asia Pacific Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 47: Asia Pacific Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 48: Asia Pacific Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 49: Asia Pacific Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 50: Latin America Plasma Sterilizers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 51: Latin America Plasma Sterilizers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America Plasma Sterilizers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 53: Latin America Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 54: Latin America Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 55: Latin America Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 56: Latin America Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 57: Latin America Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 58: Latin America Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 59: Middle East & Africa Plasma Sterilizers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 60: Middle East & Africa Plasma Sterilizers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa Plasma Sterilizers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Middle East & Africa Plasma Sterilizers Market Value Share Analysis, by Chamber Capacity, 2021 and 2031

Figure 63: Middle East & Africa Plasma Sterilizers Market Value Share Analysis, by Application, 2021 and 2031

Figure 64: Middle East & Africa Plasma Sterilizers Market Value Share Analysis, by Source Gas, 2021 and 2031

Figure 65: Middle East & Africa Plasma Sterilizers Market Attractiveness Analysis, by Chamber Capacity, 2022–2031

Figure 66: Middle East & Africa Plasma Sterilizers Market Attractiveness Analysis, by Application, 2022–2031

Figure 67: Middle East & Africa Plasma Sterilizers Market Attractiveness Analysis, by Source Gas, 2022–2031

Figure 68: Market Share Analysis/Ranking, by Company, 2021