Analysts’ Viewpoint on Plant-based Protein Market Scenario

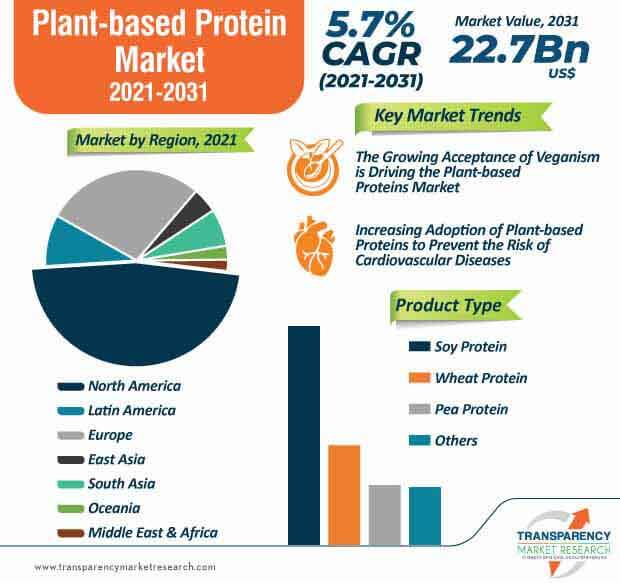

“The increasing focus of health-conscious consumer in finding alternatives for animal-based food is driving the demand for plant-based proteins. Product manufacturers are taking efforts to increase the production of plant-based proteins. There is a surging demand for such products after the coronavirus outbreak. The increasing popularity of veganism is accelerating the plant-based protein market in the Asia Pacific region. Small- and medium-scale product manufacturing companies are taking advantage of the growing trend of consuming plant-based food, and marking their presence in the global market. However, the high cost of plant-based protein products and little knowledge about their benefits are the major factors hammering market growth. Commonly occurring allergies due to consuming soy proteins also hinder the growth of the market.”

Consumers are more conscious about the food they eat after the spread of COVID-19 virus. Proteins are important ingredients for muscle strength. There is a surging demand for healthy food alternatives and plant-based proteins during the coronavirus pandemic. This will continue to drive the plant-based protein market. Increasing health awareness and importance of plant proteins for better immunity system fuel the demand for plant-based protein from consumers across the globe. Consumers are becoming aware of organic food alternatives that are natural and environment-friendly. Manufacturers of plant-based proteins are increasing their production capacity to fulfil the rising demand from consumers. People are consciously taking efforts to stay fit and healthy during the pandemic. Increasing government activities to promote plant proteins, along with rising popularity of these products are propelling the plant-based protein market.

The rising popularity of vegan or vegetarian food is driving the demand for plant-based proteins. Plant-based proteins are likely to provide all essential nutrients required for your body, along with amino acids. Consumers are reducing their use of animal-based products and animal-based food such as milk, meat, meat products, etc. This factor is positively influencing the plant-based protein market.

With the growing trend of many consumers shifting toward veganism, there is an increasing demand for plant-based proteins to improve health and boost immunity. The dependency on animal-protein is reducing globally with the rising awareness of animal welfare in developing countries. Food habits are changing with rapid awareness about health & nutrition after the threatening effects of coronavirus pandemic.

The surging demand for nutritious food is due to increasing incidences of cardiovascular diseases, diabetes, hypertension, obesity, and other lifestyle diseases, among the global population, has changed the consumer preference toward vegan food. This factor is contributing to the plant-based protein market. Owing to rapid spread of the diseases transmitted from animals or insects, people are more prone to consume plant-based food. The growing vegan trend has led to an upsurge in manufacturer presence in the sector. Obesity is the leading cause of death in North America. Vegan diet or plant-based proteins are considered to reduce the risk of cancer, obesity, and cardiovascular diseases by enhancing the glucagon activity.

Increasing sales of plant-based proteins during coronavirus pandemic help product manufacturers to compete with top market players. Factors such as growing offline and online channels, development of the eCommerce industry, and rapidly expanding online businesses boost the sales of soy proteins, pea proteins, and wheat proteins. Companies in the plant-based protein market are developing innovative products to fulfil the demand for consumers. Manufacturers are increasing the availability for an innovative range of products in a variety of different forms. Supplements and nutritional powders are some of the most popular products among consumers. Various ongoing research activities in developing plant-based food products help grow the market exponentially. Manufacturers in the plant-based protein market are exploring opportunities in product quality and nutritional advantages. North America accounts for the largest share of the plant-based protein market due to increasing trend of taking dietary supplements, hectic lifestyles, and acceptance of plant-based products.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 13.1 Bn |

|

Market Forecast Value in 2031 |

US$ 22.7 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Plant-based Protein Market is expected to Reach US$ 22.7 Bn By 2031

Plant-based Protein Market is estimated to rise at a CAGR of 5.6% during forecast period

Increase in demand for natural and organic products is expected to drive the Plant-based Protein Market

Asia Pacific is more attractive for vendors in the Plant-based Protein Market

Key players of Plant-based Protein Market are AGT Food & Ingredients, Inc, Batory Foods, Ag Processing Inc, Archer-Daniels Midland Co, Biopress S.A.S, Burcon Nutrascience Corporation, Cargill Inc, CHS Incm, Cosucra Groupe Warcoing, Crown Soya Protein Group, Devansoy Inc, E. I. DU PONT DE NEMOURS AND COMPANY, Fuji Oil Holdings Inc, Glanbia plc, Gushen Group Co., Ltd, Ingredion Inc., ROQUETTE FRERES, Shandong Yuwang Ecological Food Industry Co., Ltd., The Scoular Company, Wilmar International Ltd

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

5. Global Plant-based Protein Market Demand Analysis 2016–2020 and Forecast, 2021–2031

5.1. Historical Market Volume (in Metric Tons) Analysis, 2016–2020

5.2. Current and Future Market Volume (in Metric Tons) Projections, 2021–2031

6. Global Plant-based Protein Market - Pricing Analysis

6.1. Regional Pricing Analysis

6.2. Global Average Pricing Analysis Benchmark

7. Global Plant-based Protein Market Demand Value (US$ Mn) Analysis 2016–2020 and Forecast, 2021–2031

7.1. Historical Market Value (US$ Mn) Analysis, 2016–2020

7.2. Current and Future Market Value (US$ Mn) Projections, 2021–2031

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Industry Value Added

8.1.3. Global Urbanization Growth Outlook

8.1.4. Global Food Security Index Outlook

8.1.5. Global Rank – Ease of Doing Business

8.1.6. Global Rank – Trading Across Borders

8.2. Impact of COVID-19 on Animal Feed Industry Market

8.2.1. Manufacturer/Processors

8.2.2. Supply Chain and Logistics

8.2.3. Wholesalers/Traders

8.2.4. Retailers

8.3. Impact of COVID-19 on Beverage Industry

8.4. COVID-19 Risk Assessment/Impact

8.5. Global Animal Feed Industry Outlook

8.6. Global Beverage Industry Outlook

8.7. Products offered by Key Players

8.8. End User Industry Demand Analysis

8.9. Key Certifications/Claims

8.10. Key Regulations

8.11. Market Dynamics

8.11.1. Drivers

8.11.2. Restraints

8.11.3. Opportunity Analysis

8.12. Forecast Factors - Relevance & Impact

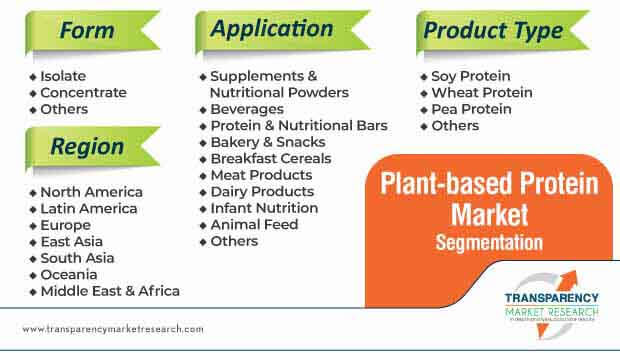

9. Global Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031, By Product Type

9.1. Introduction / Key Findings

9.2. Historical Market Value (US$ Mn) and Volume (in Metric Tons) Analysis By Product Type, 2016–2020

9.3. Current and Future Market Value (US$ Mn) and Volume (in Metric Tons) Analysis and Forecast By Product Type, 2021–2031

9.3.1. Soy Protein

9.3.2. Wheat Protein

9.3.3. Pea Protein

9.3.4. Others

9.4. Market Attractiveness Analysis By Product Type

10. Global Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031, By Form

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Analysis By Form, 2016–2020

10.3. Current and Future Market Size (US$ Mn) and Volume (in Metric Tons) Analysis and Forecast By Form, 2021–2031

10.3.1. Isolate

10.3.2. Concentrate

10.3.3. Others

10.4. Market Attractiveness Analysis By Form

11. Global Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031, By Application

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Analysis By Application, 2016–2020

11.3. Current and Future Market Size (US$ Mn) and Volume (in Metric Tons) Analysis and Forecast By Application, 2021–2031

11.3.1. Supplements & Nutritional Powders

11.3.2. Beverages

11.3.3. Protein & Nutritional Powders

11.3.4. Bakery & Snacks

11.3.5. Breakfast Cereals

11.3.6. Meat Products

11.3.7. Dairy Products

11.3.8. Infant Nutrition

11.3.9. Animal Feed

11.3.10. Others

11.4. Market Attractiveness Analysis By Application

12. Global Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031, by Region

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Analysis By Region, 2016–2020

12.3. Current Market Size (US$ Mn) and Volume (in Metric Tons) Analysis and Forecast By Region, 2021–2031

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. East Asia

12.3.5. South Asia

12.3.6. Oceania

12.3.7. Middle East and Africa (MEA)

12.4. Market Attractiveness Analysis By Region

13. North America Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

13.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

13.3.1. By Country

13.3.1.1. U.S.

13.3.1.2. Canada

13.3.2. By Product Type

13.3.3. By Form

13.3.4. By Application

13.4. Market Attractiveness Analysis

13.4.1. By Country

13.4.2. By Product Type

13.4.3. By Form

13.4.4. By Application

13.5. Drivers and Restraints - Impact Analysis

14. Latin America Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Volume Trend Analysis By Market Taxonomy, 2016–2020

14.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

14.3.1. By Country

14.3.1.1. Brazil

14.3.1.2. Mexico

14.3.1.3. Rest of Latin America

14.3.2. By Product Type

14.3.3. By Form

14.3.4. By Application

14.4. Market Attractiveness Analysis

14.4.1. By Country

14.4.2. By Product Type

14.4.3. By Form

14.4.4. By Application

14.5. Drivers and Restraints - Impact Analysis

15. Europe Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

15.1. Introduction

15.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

15.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

15.3.1. By Country

15.3.1.1. Germany

15.3.1.2. Italy

15.3.1.3. France

15.3.1.4. U.K.

15.3.1.5. Spain

15.3.1.6. BENELUX

15.3.1.7. Nordic

15.3.1.8. Russia

15.3.1.9. Poland

15.3.1.10. Rest of Europe

15.3.2. By Product Type

15.3.3. By Form

15.3.4. By Application

15.4. Market Attractiveness Analysis

15.4.1. By Country

15.4.2. By Product Type

15.4.3. By Form

15.4.4. By Application

15.5. Drivers and Restraints - Impact Analysis

16. South Asia Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

16.1. Introduction

16.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

16.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

16.3.1. By Country

16.3.1.1. India

16.3.1.2. Thailand

16.3.1.3. Indonesia

16.3.1.4. Malaysia

16.3.1.5. Rest of South Asia

16.3.2. By Product Type

16.3.3. By Form

16.3.4. By Application

16.4. Market Attractiveness Analysis

16.4.1. By Country

16.4.2. By Product Type

16.4.3. By Form

16.4.4. By Application

16.5. Drivers and Restraints - Impact Analysis

17. East Asia Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

17.1. Introduction

17.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

17.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

17.3.1. By Country

17.3.1.1. China

17.3.1.2. Japan

17.3.1.3. South Korea

17.3.2. By Product Type

17.3.3. By Form

17.3.4. By Application

17.4. Market Attractiveness Analysis

17.4.1. By Country

17.4.2. By Product Type

17.4.3. By Form

17.4.4. By Application

17.5. Drivers and Restraints - Impact Analysis

18. Oceania Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

18.1. Introduction

18.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

18.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

18.3.1. By Country

18.3.1.1. Australia

18.3.1.2. New Zealand

18.3.2. By Product Type

18.3.3. By Form

18.3.4. By Application

18.4. Market Attractiveness Analysis

18.4.1. By Country

18.4.2. By Product Type

18.4.3. By Form

18.4.4. By Application

18.5. Drivers and Restraints - Impact Analysis

19. Middle East and Africa Plant-based Protein Market Analysis 2016–2020 and Forecast 2021–2031

19.1. Introduction

19.2. Historical Market Size (US$ Mn) and Volume (in Metric Tons) Trend Analysis By Market Taxonomy, 2016–2020

19.3. Market Size (US$ Mn) and Volume (in Metric Tons) Forecast By Market Taxonomy, 2021–2031

19.3.1. By Country

19.3.1.1. GCC Countries

19.3.1.2. Turkey

19.3.1.3. South Africa

19.3.1.4. Rest of Middle East and Africa

19.3.2. By Product Type

19.3.3. By Form

19.3.4. By Application

19.4. Market Attractiveness Analysis

19.4.1. By Country

19.4.2. By Product Type

19.4.3. By Form

19.4.4. By Application

19.5. Drivers and Restraints - Impact Analysis

20. Market Structure Analysis

20.1. Market Analysis by Tier of Companies

20.2. Market Concentration

20.3. Market Presence Analysis

21. Competition Analysis

21.1. Competition Dashboard

21.2. Competition Deep Dive

21.2.1. AGT Food & Ingredients, Inc.

21.2.1.1. Overview

21.2.1.2. Product Portfolio

21.2.1.3. Sales Footprint

21.2.1.4. Key Developments

21.2.1.5. Strategy Overview

21.2.2. Batory Foods.

21.2.2.1. Overview

21.2.2.2. Product Portfolio

21.2.2.3. Sales Footprint

21.2.2.4. Key Developments

21.2.2.5. Strategy Overview

21.2.3. Ag Processing Inc.

21.2.3.1. Overview

21.2.3.2. Product Portfolio

21.2.3.3. Sales Footprint

21.2.3.4. Key Developments

21.2.3.5. Strategy Overview

21.2.4. Archer-Daniels Midland Co

21.2.4.1. Overview

21.2.4.2. Product Portfolio

21.2.4.3. Sales Footprint

21.2.4.4. Key Developments

21.2.4.5. Strategy Overview

21.2.5. Biopress S.A.S

21.2.5.1. Overview

21.2.5.2. Product Portfolio

21.2.5.3. Sales Footprint

21.2.5.4. Key Developments

21.2.5.5. Strategy Overview

21.2.6. Burcon Nutrascience Corporation

21.2.6.1. Overview

21.2.6.2. Product Portfolio

21.2.6.3. Sales Footprint

21.2.6.4. Key Developments

21.2.6.5. Strategy Overview

21.2.7. Cargill Inc.

21.2.7.1. Overview

21.2.7.2. Product Portfolio

21.2.7.3. Sales Footprint

21.2.7.4. Key Developments

21.2.7.5. Strategy Overview

21.2.8. CHS Inc

21.2.8.1. Overview

21.2.8.2. Product Portfolio

21.2.8.3. Sales Footprint

21.2.8.4. Key Developments

21.2.8.5. Strategy Overview

21.2.9. Cosucra Groupe Warcoing

21.2.9.1. Overview

21.2.9.2. Product Portfolio

21.2.9.3. Sales Footprint

21.2.9.4. Key Developments

21.2.9.5. Strategy Overview

21.2.10. Crown Soya Protein Group

21.2.10.1. Overview

21.2.10.2. Product Portfolio

21.2.10.3. Sales Footprint

21.2.10.4. Key Developments

21.2.10.5. Strategy Overview

21.2.11. Devansoy Inc.

21.2.11.1. Overview

21.2.11.2. Product Portfolio

21.2.11.3. Sales Footprint

21.2.11.4. Key Developments

21.2.11.5. Strategy Overview

21.2.12. E. I. DU PONT DE NEMOURS AND COMPANY

21.2.12.1. Overview

21.2.12.2. Product Portfolio

21.2.12.3. Sales Footprint

21.2.12.4. Key Developments

21.2.12.5. Strategy Overview

21.2.13. Fuji Oil Holdings Inc.

21.2.13.1. Overview

21.2.13.2. Product Portfolio

21.2.13.3. Sales Footprint

21.2.13.4. Key Developments

21.2.13.5. Strategy Overview

21.2.14. Glanbia plc

21.2.14.1. Overview

21.2.14.2. Product Portfolio

21.2.14.3. Sales Footprint

21.2.14.4. Key Developments

21.2.14.5. Strategy Overview

21.2.15. Gushen Group Co., Ltd.

21.2.15.1. Overview

21.2.15.2. Product Portfolio

21.2.15.3. Sales Footprint

21.2.15.4. Key Developments

21.2.15.5. Strategy Overview

21.2.16. Ingredion Inc.

21.2.16.1. Overview

21.2.16.2. Product Portfolio

21.2.16.3. Sales Footprint

21.2.16.4. Key Developments

21.2.16.5. Strategy Overview

21.2.17. ROQUETTE FRERES

21.2.17.1. Overview

21.2.17.2. Product Portfolio

21.2.17.3. Sales Footprint

21.2.17.4. Key Developments

21.2.17.5. Strategy Overview

21.2.18. Shandong Yuwang Ecological Food Industry Co., Ltd.

21.2.18.1. Overview

21.2.18.2. Product Portfolio

21.2.18.3. Sales Footprint

21.2.18.4. Key Developments

21.2.18.5. Strategy Overview

21.2.19. The Scoular Company

21.2.19.1. Overview

21.2.19.2. Product Portfolio

21.2.19.3. Sales Footprint

21.2.19.4. Key Developments

21.2.19.5. Strategy Overview

21.2.20. Wilmar International Ltd.

21.2.20.1. Overview

21.2.20.2. Product Portfolio

21.2.20.3. Sales Footprint

21.2.20.4. Key Developments

21.2.20.5. Strategy Overview

21.2.21. Others (Available on Request)

22. Assumptions and Acronyms Used

23. Research Methodology

List of Tables

Table 01: Global Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2016-2031

Table 02: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Product Type, 2016-2031

Table 03: Global Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 04: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 05: Global Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 06: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 07: Global Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Region, 2016-2031

Table 08: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Region, 2016-2031

Table 09: Global Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2016-2031

Table 10: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Type, 2016-2031

Table 11: North America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 12: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 13: North America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 14: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 15: North America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 16: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 17: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 18: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 19: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 20: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 21: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 22: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 23: Europe Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 24: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 25: Europe Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 26: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 27: Europe Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 28: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 29: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 30: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 31: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 32: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 33: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 34: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 35: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 36: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 37: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 38: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 39: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 40: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 41: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 42: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 43: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 44: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 45: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 46: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

Table 47: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2016-2031

Table 48: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Form, 2016-2031

Table 49: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Application, 2016-2031

Table 50: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Application, 2016-2031

Table 51: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 52: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis and Forecast by Country, 2016-2031

List of Figures

Figure 01: Global Plant-Based Protein Market Value (US$ Mn) Forecast, 2021–2031

Figure 02: Global Plant-Based Protein Market Volume (MT) Forecast, 2021–2031

Figure 03: Global Plant-Based Protein Market Value Share Analysis by Product Type, 2021 E

Figure 04: Global Plant-Based Protein Market Y-o-Y Growth Rate by Product Type, 2021-2031

Figure 05: Global Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Product Type, 2021–2031

Figure 06: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Product Type, 2021–2031

Figure 07: Global Plant-Based Protein Market Value Share Analysis by Form, 2021 E

Figure 08: Global Plant-Based Protein Market Y-o-Y Growth Rate by Form, 2021-2031

Figure 09: Global Animal Feed Additive Market Value (US$ Mn) Analysis & Forecast by Form, 2021–2031

Figure 10: Global Animal Feed Additive Market Volume (in Metric Tons) Analysis & Forecast by Form, 2021–2031

Figure 11: Global Plant-Based Protein Market Value Share Analysis by Application, 2021 E

Figure 12: Global Plant-Based Protein Market Y-o-Y Growth Rate by Application, 2021-2031

Figure 13: Global Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 14: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 15: Global Plant-Based Protein Market Value Share Analysis by Region, 2021 E

Figure 16: Global Plant-Based Protein Market Y-o-Y Growth Rate by Region, 2021-2031

Figure 17: Global Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Region, 2021–2031

Figure 18: Global Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Region, 2021–2031

Figure 19: Global Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 20: Global Plant-Based Protein Market Attractiveness Analysis by Form, 2021-2031

Figure 21: Global Plant-Based Protein Market Attractiveness Analysis by Application, 2021-2031

Figure 22: Global Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 23: North America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 24: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 25: North America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 26: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 27: North America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 28: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 29: North America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 30: North America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 31: North America Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 32: North America Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 33: North America Plant-Based Protein Market Attractiveness Analysis by Application, 2021-2031

Figure 34: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 35: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 36: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 37: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 38: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 39: Latin America Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 40: Latin America Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 41: Latin America Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 42: Latin America Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 43: Latin America Plant-Based Protein Market Attractiveness Analysis by Application, 2021-2031

Figure 44: Europe Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 45: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 46: Europe Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 47: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 48: Europe Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 49: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 50: Europe Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 51: Europe Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 52: Europe Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 53: Europe Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 54: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 55: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 56: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 57: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 58: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 59: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 60: South Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 61: South Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 62: South Asia Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 63: South Asia Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 64: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 65: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 66: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 67: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 68: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 69: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 70: East Asia Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 71: East Asia Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 72: East Asia Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 73: East Asia Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 74: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 75: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 76: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 77: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 78: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 79: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 80: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 81: Oceania Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 82: Oceania Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 83: Oceania Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031

Figure 84: Oceania Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast By Type, 2021–2031

Figure 85: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast By Type, 2021–2031

Figure 86: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 87: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Type, 2021–2031

Figure 88: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Application, 2021–2031

Figure 89: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Application, 2021–2031

Figure 90: Middle East and Africa Plant-Based Protein Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 91: Middle East and Africa Plant-Based Protein Market Volume (in Metric Tons) Analysis & Forecast by Country, 2021–2031

Figure 92: Middle East and Africa Plant-Based Protein Market Attractiveness Analysis by Region, 2021-2031

Figure 93: Middle East and Africa Plant-Based Protein Market Attractiveness Analysis by Type, 2021-2031