Once presaged as an essential aspect of a balanced diet in several cultures, dairy usage in some categories has witnessed a decline over the past two decades, as consumers respond to the worries over hormone usage, allergens, and the perceived unhealthy profile of some dairy offerings. This has transformed the landscape for dairy producers, globally, as they work towards keeping pace with the evolving consumption attitudes and the distinctions in consumer attitudes from region to region, while cashing in on the potential opportunities in dairy product consumption. Dairy alternatives such as plant-based milk have a perceived health halo among consumers, capturing the attention of dairy product providers.

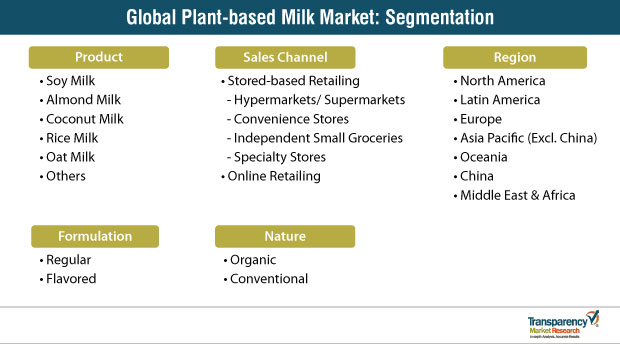

Transparency Market Research (TMR) recently published a report on the plant-based milk market, in which, analysts showcase a positive viewpoint of the industry on account of changing consumption patterns and the growing preference for sustainable, organic, and plant-based foods. The study unveils the key elements driving market growth, while highlighting the developments made by market competitors.

Humans first imbibed the idea of the consuming milk of other mammals following the domestication of animals during the Neolithic Revolution. The rise in urban population, and expansion of railway networks in the mid-19th century, further revolutionized milk production and supply. Over the last three decades of the 19th century, milk demand in most parts of the world surged significantly. Although milk held a legacy of strong market hold over centuries, the preference for plant-based milk has also been there over centuries, although not regarded as a substitute for dairy milk. Recipes from Levant, back in the 13th century, describe the first-ever plant-based milk—almond milk, whereas, soy milk was another plant-based milk consumed in China during the 14th century. Medieval England also marked the use of almond milk in several dishes.

In the recent past, these products gained recognition under the plant-base category, ever since consumer perception transformed and the preference for dairy alternatives grew. The plant-based milk market is expected to record a revenue of ~ US$ 14 Bn in 2019, and is expected to grow at a CAGR of ~ 8% through the forecast period.

Consumers Opting for Label-friendly Products

The clean label trend shows no signs of slowing down, with the consistent urge of consumers to reformulate products with no synthetics and artificial additives. As the demand for 'clean label' products continues to escalate, the consumption of plant-based milk is expected to grow.

Demand for Plant-based Nutrition Sources

As millennials and Generation Zers explore sustainable, healthy plant-based alternatives to conventional staples such as milk, providers hope to cash in on this trend. The demand for plant-based protein sources has escalated significantly, resulting in significant preference for plant-based milk. The interest in veganism is soaring, especially among millennials, wherein, a significantly larger consumer base is making healthier choices. This has offered growth opportunities for plant-based milk market competitors.

Growing Levels of Lactose Intolerance

The growing levels of lactose intolerance have propelled consumers to opt for dairy-free alternatives. Several recommendations by governments and health organizations are directed towards the effective management of lactose intolerance, one of which is preferring lactose-free milk and dairy products, thereby accelerating the growth of the plant-based milk market.

Although plant-based milk is gaining immense popularity among health-conscious consumers, the relatively lower level of protein present in these dairy alternatives is likely to impact the overall consumption of the product. Another challenge faced by plant-based milk providers is the tedious process of legal and regulatory inspection, as industry associations prevent manufacturers from using labels that could misguide consumers regarding the nutritional value of the product.

Plant-based Milk Market: Key Strategies for Growth

Focus on Offering Flavored Formulations

Companies serving the plant-based milk market are centering their focus on flavored formulations to entice consumers, particularly the younger generation. Although there is notable consumption of regular plant-based milk formulations by consumers, companies aim to differentiate themselves from their competitors by focusing on flavored formulations. For example, Danone provides a range of flavored plant-based milk products, for which the company combines industry expertise and research capabilities to innovate flavors.

Strengthen Distribution through Online Retail Channels

The role of e-Commerce in proliferating the sales of food and beverage products continues to be in the focus of manufacturers. Distribution through online platforms is becoming a profitable strategy for companies, as e-Commerce has made it easy for companies to reach consumers. Furthermore, increased smartphone penetration further supports this aspect. Although food and beverage offerings are penetrating retail stores, companies continue to emphasize on permeating online retail platforms to cash in on the opportunities held by e-Commerce.

Expand Oat Milk Portfolio

Oat milk is a consumer-friendly and planet-friendly plant-based milk product, having a smaller carbon footprint as compared to dairy milk. Moreover, as consumer thirst for oat milk continues to surge, some dairy farmers producing non-dairy milks are proliferating the production of oat milk. As the TMR study demonstrates oat milk as a high-growth market, expansion of the oat milk portfolio remains a profitable strategy.

Scrutinizing the Competitive Scenario

In 2019, Danone's Silk brand unveiled an oat-based beverage product - Oat Yeah - which is milk alternative. The launch of this product was attributed to falling soy milk sales.

In 2019, Blue Diamond, a grower-owned cooperative firm and the world's leading almond marketer and processor, expanded its extensive Almond Breeze product line with the addition of a dairy-free product favored by Latin Americans - Almond Breeze Almondmilk Horchata.

Considering the present scenario, the plant-based milk market remains consolidated in nature. However, it is expected to become fragmented during the forecast period. Large companies are diversifying their existing portfolios and upgrading their production facilities to ensure that they are fully-equipped to cater to the growing consumer demand for plant-based milk. Plant-based product providers are regularly offering consumers more innovative products, including unique ingredients and flavors. Innovation in plant-based milk helps meet the evolving consumer demand for healthier beverages, without compromising on the taste, texture, flavor, and nutritional qualities of the product.

Analysts’ Perspective of the Plant-based Milk Market

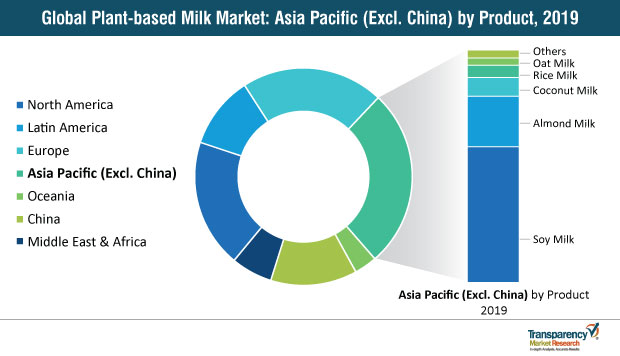

Consumers’ reconsideration regarding the consumption of animal proteins and dairy, on health, environmental, and ethical grounds, has led to the cutting out of dairy. As a result, the plant-based milk industry is witnessing a boom. Owing to this, TMR’s analysts have a positive perspective of the market. Although APAC (Excl. China) is expected to be remain the leading plant-based milk market, Latin America is projected to showcase high-growth. Owing to this, market entrants planning geographical expansion could consider the lucrative Latin American market for plant-based milk. Moreover, as consumers are becoming more inclined towards products that are simple and those that contain less or no artificial ingredients, plant-based milk of organic nature is likely to be a promising avenue for businesses.

Plant-based Milk Market Witnessing Growth Due to Radical Shift towards Veganism

Soy to Remain the Most Preferred Source of Plant-based Milk

Plant-based Milk – A Profitable Business Opportunity

Change in Perception over Plant-based Products and Plant-based Milk

According to a report by The Humane Society of the United States (HSUS), there is an ever increasing demand for animal-derived products from animals raised without any kind of antibiotics and hormones. The cumulative ingestion of antibiotics and hormones in livestock may unfavorably affect human and animal health.

Health Benefits of Plant-based Milk and Increasing Demand for Plant-based Protein Sources to Drive Sales

Growing Plant-based Food and Beverage Industry Boosting the Plant-based Milk Market

Plant-based Milk: Market Players

Key players operating in the plant-based milk market, as profiled in the study, include

Plant-based Milk Market is projected to reach US$ 30 Bn by the end of 2029

Plant-based Milk Market is expected to grow at a CAGR of 8% during 2019-2029

The increasing shift in consumer preference for plant-based food products in daily diets expected to drive Plant-based Milk Market

North America is a more attractive region for vendors in the Plant-based Milk Market

Key vendors in the Plant-based Milk Market are Groupe Danone. Pacific Foods of Oregon, Inc. The Hain Celestial Group Inc. Turtle Mountain LLC. Vitasoy International Holdings Limited. Natura Foods, Sunopta Inc and others

1. Global Plant-based Milk Market - Executive Summary

1.1. Global Plant-based Milk Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Key Trends Impacting the Market

3.1. Marketers Reach Out to Millennial

3.2. Desirable Health Claims by Manufacturers and Brand Owners

3.3. Shortened M&A Activity

3.4. Heightened Product Launch Frequency

4. Product Innovation / Development Trends

5. Product Oriented Market Buzz

6. Risk and Opportunities

6.1. Associated Risk

6.2. Opportunities

7. Market Dynamics

7.1. Macro-economic Factors

7.2. Drivers

7.3. Market Restraints

7.4. Trend Analysis- Impact on Time Line (2019-2029)

7.5. Forecast Factors – Relevance and Impact

7.6. Technology Roadmap

8. Consumer Behavior Analysis

8.1. Value Spend of Target Product

8.2. Path to Purchase: Paved with Digitization

8.3. Influence of Packaging on Purchasing

8.4. Brand Loyalty: Head Vs Heart

8.5. Quest for Quality

8.6. Frugality: Product Habit or Passing Fad

8.7. Factors Influencing Market Behavior by the Costumers of all Age Group

8.8. Most Effective Advertising Format Today

8.9. Social Media Influencing Customer’s Decision Making

8.10. Preferred Social media Platforms for Branding

8.11. Key Challenges Associated with the Market Suppliers

8.12. Concerned Consumers towards Private Label Brands

9. Social Media Sentiment Analysis

9.1. Consumer perception for target products on social media platforms- Positive and Negative Mentions

9.2. Trending Brands

9.3. Trending #hashtags

9.4. Social Media Platform Mentions (% of total mentions)

9.5. Region-wise Social Media Mentions (% total mentions)

9.6. Trending Subject Titles

10. Supply Chain Analysis

10.1. Profitability and Gross Margin Analysis By Competition

10.2. List of Active Participants- By Region

10.2.1. Raw Material Suppliers

10.2.2. Key Manufacturers

10.2.3. Integrators

10.2.4. Key Distributor/Retailers

11. Policy and Regulatory Landscape

11.1. Dietary Supplement Health and Education Act (DSHEA)

11.2. Federal Food & Cosmetics Act

11.3. Europe Food & Safety Authority

11.4. State Food and Drug Administration (SFDA)

11.5. Foods for Specified Health Uses

11.6. FSSAI

11.7. Food Packaging Claims

11.8. Labeling and Claims

11.9. Import/Export Regulations

12. Global Plant-based Milk Market Pricing Analysis

12.1. Price Point Assessment by Product

12.2. Regional Average Pricing Analysis

12.2.1. North America

12.2.2. Latin America

12.2.3. Europe

12.2.4. Asia Pacific Ex. China (APEC)

12.2.5. China

12.2.6. Oceania

12.2.7. Middle East and Africa

12.3. Price Forecast till 2029

12.4. Factors Influencing Pricing

13. Global Plant-based Milk Market- Trade Analysis

13.1. Plant-based Milk Market- Exports to the World

13.1.1. List of Key Exporters

13.1.2. Key Exporting Countries/Regions- Market Share Analysis (2018E)

13.1.3. Value (US$ Mn) of Export

13.1.4. Volume (Units) of Export

13.2. Plant-based Milk Market- Imports to the World

13.2.1. List of Key Importers

13.2.2. Key importing Countries/Regions- Market Share Analysis (2018E)

13.2.3. Value (US$ Mn) of Import

13.2.4. Volume (Units) of Import

13.3. Global Plant-based Milk Market- Supply Demand Scenario (Global Production, Sales, Import, Export)

14. Global Plant-based Milk Market Analysis and Forecast

14.1. Market Size Analysis (2014-2018) and Forecast (2019-2029)

14.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

14.1.2. Absolute $ Opportunity

14.2. Global Plant-based Milk Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

14.2.1. Forecast Factors and Relevance of Impact

14.2.2. Regional Plant-based Milk Market Business Performance Summary

15. Global Plant-based Milk Market Analysis By Product

15.1. Introduction

15.1.1. Y-o-Y Growth Comparison By Product

15.1.2. Basis Point Share (BPS) Analysis By Product

15.2. Plant-based Milk Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Product

15.2.1. Soy Milk

15.2.2. Almond Milk

15.2.3. Coconut milk

15.2.4. Rice Milk

15.2.5. Oat Milk

15.2.6. Others (Cashew and Hemp Seeds Milk)

15.3. Market Attractiveness Analysis By Product

16. Global Plant-based Milk Market Analysis By Formulation

16.1. Introduction

16.1.1. Y-o-Y Growth Comparison By Formulation

16.1.2. Basis Point Share (BPS) Analysis By Formulation

16.2. Plant-based Milk Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Formulation

16.2.1. Regular

16.2.2. Flavoured

16.3. Market Attractiveness Analysis By Formulation

17. Global Plant-based Milk Market Analysis By Nature

17.1. Introduction

17.1.1. Y-o-Y Growth Comparison By Nature

17.1.2. Basis Point Share (BPS) Analysis By Nature

17.2. Plant-based Milk Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Nature

17.2.1. Organic

17.2.2. Conventional

17.3. Market Attractiveness Analysis By Nature

18. Global Plant-based Milk Market Analysis By Distribution Channel

18.1. Introduction

18.1.1. Y-o-Y Growth Comparison By Distribution Channel

18.1.2. Basis Point Share (BPS) Analysis By Distribution Channel

18.2. Plant-based Milk Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Distribution Channel

18.2.1. Store Based Retailing

18.2.1.1. Hypermarket/Supermarket

18.2.1.2. Convenience store

18.2.1.3. Independent Small Groceries

18.2.1.4. Speciality Stores

18.2.2. Online Retailing

18.3. Market Attractiveness Analysis By Distribution Channel

19. Global Plant-based Milk Market Analysis and Forecast, By Region

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Region

19.1.2. Y-o-Y Growth Projections By Region

19.2. Plant-based Milk Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) Analysis By Region

19.2.1. North America

19.2.2. Europe

19.2.3. APEC

19.2.4. China

19.2.5. Oceania

19.2.6. Latin America

19.2.7. Middle East and Africa

19.3. Market Attractiveness Analysis By Region

20. North America Plant-based Milk Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

20.2.1. Market Attractiveness By Country

20.2.1.1. U.S.

20.2.1.2. Canada

20.2.2. By Product

20.2.3. By Formulation

20.2.4. By Nature

20.2.5. By Distribution Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Product

20.3.3. By Formulation

20.3.4. By Nature

20.3.5. By Distribution Channel

20.4. Drivers and Restraints: Impact Analysis

21. Latin America Plant-based Milk Market Analysis and Forecast

21.1. Introduction

21.1.1. Basis Point Share (BPS) Analysis By Country

21.1.2. Y-o-Y Growth Projections By Country

21.1.3. Key Regulations

21.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

21.2.1. By Country

21.2.1.1. Brazil

21.2.1.2. Mexico

21.2.1.3. Chile

21.2.1.4. Peru

21.2.1.5. Argentina

21.2.1.6. Rest of Latin America

21.2.2. By Product

21.2.3. By Formulation

21.2.4. By Nature

21.2.5. By Distribution Channel

21.3. Market Attractiveness Analysis

21.3.1. By Country

21.3.2. By Product

21.3.3. By Formulation

21.3.4. By Nature

21.3.5. By Distribution Channel

21.4. Drivers and Restraints: Impact Analysis

22. Europe Plant-based Milk Market Analysis and Forecast

22.1. Introduction

22.1.1. Basis Point Share (BPS) Analysis By Country

22.1.2. Y-o-Y Growth Projections By Country

22.1.3. Key Regulations

22.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

22.2.1. By Country

22.2.1.1. EU-4 (Germany, France, Italy, Spain)

22.2.1.2. U.K.

22.2.1.3. BENELUX

22.2.1.4. Nordic

22.2.1.5. Russia

22.2.1.6. Poland

22.2.1.7. Rest of Europe

22.2.2. By Product

22.2.3. By Formulation

22.2.4. By Nature

22.2.5. By Distribution Channel

22.3. Market Attractiveness Analysis

22.3.1. By Country

22.3.2. By Product

22.3.3. By Formulation

22.3.4. By Nature

22.3.5. By Distribution Channel

22.4. Drivers and Restraints: Impact Analysis

23. APEC Plant-based Milk Market Analysis and Forecast

23.1. Introduction

23.1.1. Basis Point Share (BPS) Analysis By Country

23.1.2. Y-o-Y Growth Projections By Country

23.1.3. Key Regulations

23.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

23.2.1. By Country

23.2.1.1. Japan

23.2.1.2. India

23.2.1.3. South Korea

23.2.1.4. ASEAN

23.2.2. By Product

23.2.3. By Formulation

23.2.4. By Nature

23.2.5. By Distribution Channel

23.3. Market Attractiveness Analysis

23.3.1. By Country

23.3.2. By Product

23.3.3. By Formulation

23.3.4. By Nature

23.3.5. By Distribution Channel

23.4. Drivers and Restraints: Impact Analysis

24. China Plant-based Milk Market Analysis and Forecast

24.1. Introduction

24.1.1. Basis Point Share (BPS) Analysis By Country

24.1.2. Y-o-Y Growth Projections By Country

24.1.3. Key Regulations

24.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

24.2.1. By Product

24.2.2. By Formulation

24.2.3. By Nature

24.2.4. By Distribution Channel

24.3. Market Attractiveness Analysis

24.3.1. By Product

24.3.2. By Formulation

24.3.3. By Nature

24.3.4. By Distribution Channel

24.4. Drivers and Restraints: Impact Analysis

25. Oceania Plant-based Milk Market Analysis and Forecast

25.1. Introduction

25.1.1. Basis Point Share (BPS) Analysis By Country

25.1.2. Y-o-Y Growth Projections By Country

25.1.3. Key Regulations

25.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

25.2.1. By Product

25.2.2. By Formulation

25.2.3. By Nature

25.2.4. By Distribution Channel

25.3. Market Attractiveness Analysis

25.3.1. By Product

25.3.2. By Formulation

25.3.3. By Nature

25.3.4. By Distribution Channel

25.4. Drivers and Restraints: Impact Analysis

26. Middle East and Africa (MEA) Plant-based Milk Market Analysis and Forecast

26.1. Introduction

26.1.1. Basis Point Share (BPS) Analysis By Country

26.1.2. Y-o-Y Growth Projections By Country

26.1.3. Key Regulations

26.2. Plant-based Milk Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

26.2.1. By Country

26.2.1.1. GCC Countries

26.2.1.2. South Africa

26.2.1.3. North Africa

26.2.1.4. Rest of MEA

26.2.2. By Product

26.2.3. By Formulation

26.2.4. By Nature

26.2.5. By Distribution Channel

26.3. Market Attractiveness Analysis

26.3.1. By Country

26.3.2. By Product

26.3.3. By Formulation

26.3.4. By Nature

26.3.5. By Distribution Channel

26.4. Drivers and Restraints: Impact Analysis

27. Competition Assessment

27.1. Global Plant-based Milk Market Competition - a Dashboard View

27.2. Global Plant-based Milk Market Structure Analysis

27.3. Global Plant-based Milk Market Company Share Analysis

27.3.1. For Tier 1 Market Players, 2017

27.3.2. Company Market Share Analysis of Top 10 Players, By Region

27.4. Key Participants Market Presence (Intensity Mapping) by Region

28. Brand Assessment

28.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

28.2. Plant-based Milk Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

28.3. Brand Strategy

28.4. Key Brands

29. Competition Deep-dive (Manufacturers/Suppliers)

29.1. Groupe Danone

29.1.1. Overview

29.1.2. Product Portfolio

29.1.3. Sales Footprint

29.1.4. Channel Footprint

29.1.4.1. Distributors List

29.1.4.2. Distribution Channel (Clients)

29.1.5. Strategy Overview

29.1.5.1. Marketing Strategy

29.1.5.2. Culture Strategy

29.1.5.3. Channel Strategy

29.1.6. SWOT Analysis

29.1.7. Financial Analysis

29.1.8. Revenue Share

29.1.8.1. By Product

29.1.8.2. By Region

29.1.9. Key Clients

29.1.10. Analyst Comments

29.2. Pacific Foods of Oregon, Inc.

29.2.1. Overview

29.2.2. Product Portfolio

29.2.3. Sales Footprint

29.2.4. Channel Footprint

29.2.4.1. Distributors List

29.2.4.2. Distribution Channel (Clients)

29.2.5. Strategy Overview

29.2.5.1. Marketing Strategy

29.2.5.2. Culture Strategy

29.2.5.3. Channel Strategy

29.2.6. SWOT Analysis

29.2.7. Financial Analysis

29.2.8. Revenue Share

29.2.8.1. By Product

29.2.8.2. By Region

29.2.9. Key Clients

29.2.10. Analyst Comments

29.3. The Hain Celestial Group Inc.

29.3.1. Overview

29.3.2. Product Portfolio

29.3.3. Sales Footprint

29.3.4. Channel Footprint

29.3.4.1. Distributors List

29.3.4.2. Distribution Channel (Clients)

29.3.5. Strategy Overview

29.3.5.1. Marketing Strategy

29.3.5.2. Culture Strategy

29.3.5.3. Channel Strategy

29.3.6. SWOT Analysis

29.3.7. Financial Analysis

29.3.8. Revenue Share

29.3.8.1. By Product

29.3.8.2. By Region

29.3.9. Key Clients

29.3.10. Analyst Comments

29.4. Turtle Mountain LLC

29.4.1. Overview

29.4.2. Product Portfolio

29.4.3. Sales Footprint

29.4.4. Channel Footprint

29.4.4.1. Distributors List

29.4.4.2. Distribution Channel (Clients)

29.4.5. Strategy Overview

29.4.5.1. Marketing Strategy

29.4.5.2. Culture Strategy

29.4.5.3. Channel Strategy

29.4.6. SWOT Analysis

29.4.7. Financial Analysis

29.4.8. Revenue Share

29.4.8.1. By Product

29.4.8.2. By Region

29.4.9. Key Clients

29.4.10. Analyst Comments

29.5. Vitasoy International Holdings Limited.

29.5.1. Overview

29.5.2. Product Portfolio

29.5.3. Sales Footprint

29.5.4. Channel Footprint

29.5.4.1. Distributors List

29.5.4.2. Distribution Channel (Clients)

29.5.5. Strategy Overview

29.5.5.1. Marketing Strategy

29.5.5.2. Culture Strategy

29.5.5.3. Channel Strategy

29.5.6. SWOT Analysis

29.5.7. Financial Analysis

29.5.8. Revenue Share

29.5.8.1. By Product

29.5.8.2. By Region

29.5.9. Key Clients

29.5.10. Analyst Comments

29.6. Natura Foods

29.6.1. Overview

29.6.2. Product Portfolio

29.6.3. Sales Footprint

29.6.4. Channel Footprint

29.6.4.1. Distributors List

29.6.4.2. Distribution Channel (Clients)

29.6.5. Strategy Overview

29.6.5.1. Marketing Strategy

29.6.5.2. Culture Strategy

29.6.5.3. Channel Strategy

29.6.6. SWOT Analysis

29.6.7. Financial Analysis

29.6.8. Revenue Share

29.6.8.1. By Product

29.6.8.2. By Region

29.6.9. Key Clients

29.6.10. Analyst Comments

29.7. Sunopta Inc.

29.7.1. Overview

29.7.2. Product Portfolio

29.7.3. Sales Footprint

29.7.4. Channel Footprint

29.7.4.1. Distributors List

29.7.4.2. Distribution Channel (Clients)

29.7.5. Strategy Overview

29.7.5.1. Marketing Strategy

29.7.5.2. Culture Strategy

29.7.5.3. Channel Strategy

29.7.6. SWOT Analysis

29.7.7. Financial Analysis

29.7.8. Revenue Share

29.7.8.1. By Product

29.7.8.2. By Region

29.7.9. Key Clients

29.7.10. Analyst Comments

29.8. Freedom Foods Group Ltd

29.8.1. Overview

29.8.2. Product Portfolio

29.8.3. Sales Footprint

29.8.4. Channel Footprint

29.8.4.1. Distributors List

29.8.4.2. Distribution Channel (Clients)

29.8.5. Strategy Overview

29.8.5.1. Marketing Strategy

29.8.5.2. Culture Strategy

29.8.5.3. Channel Strategy

29.8.6. SWOT Analysis

29.8.7. Financial Analysis

29.8.8. Revenue Share

29.8.8.1. By Product

29.8.8.2. By Region

29.8.9. Key Clients

29.8.10. Analyst Comments

29.9. Earth’s Own Food Company Inc

29.9.1. Overview

29.9.2. Product Portfolio

29.9.3. Sales Footprint

29.9.4. Channel Footprint

29.9.4.1. Distributors List

29.9.4.2. Distribution Channel (Clients)

29.9.5. Strategy Overview

29.9.5.1. Marketing Strategy

29.9.5.2. Culture Strategy

29.9.5.3. Channel Strategy

29.9.6. SWOT Analysis

29.9.7. Financial Analysis

29.9.8. Revenue Share

29.9.8.1. By Product

29.9.8.2. By Region

29.9.9. Key Clients

29.9.10. Analyst Comments

29.10. Mc Cormick & Co.

29.10.1. Overview

29.10.2. Product Portfolio

29.10.3. Sales Footprint

29.10.4. Channel Footprint

29.10.4.1. Distributors List

29.10.4.2. Distribution Channel (Clients)

29.10.5. Strategy Overview

29.10.5.1. Marketing Strategy

29.10.5.2. Culture Strategy

29.10.5.3. Channel Strategy

29.10.6. SWOT Analysis

29.10.7. Financial Analysis

29.10.8. Revenue Share

29.10.8.1. By Product

29.10.8.2. By Region

29.10.9. Key Clients

29.10.10. Analyst Comments

29.11. Goya Foods

29.11.1. Overview

29.11.2. Product Portfolio

29.11.3. Sales Footprint

29.11.4. Channel Footprint

29.11.4.1. Distributors List

29.11.4.2. Distribution Channel (Clients)

29.11.5. Strategy Overview

29.11.5.1. Marketing Strategy

29.11.5.2. Culture Strategy

29.11.5.3. Channel Strategy

29.11.6. SWOT Analysis

29.11.7. Financial Analysis

29.11.8. Revenue Share

29.11.8.1. By Product

29.11.8.2. By Region

29.11.9. Key Clients

29.11.10. Analyst Comments

29.12. The Hershey Company

29.12.1. Overview

29.12.2. Product Portfolio

29.12.3. Sales Footprint

29.12.4. Channel Footprint

29.12.4.1. Distributors List

29.12.4.2. Distribution Channel (Clients)

29.12.5. Strategy Overview

29.12.5.1. Marketing Strategy

29.12.5.2. Culture Strategy

29.12.5.3. Channel Strategy

29.12.6. SWOT Analysis

29.12.7. Financial Analysis

29.12.8. Revenue Share

29.12.8.1. By Product

29.12.8.2. By Region

29.12.9. Key Clients

29.12.10. Analyst Comments

29.13. Blue Diamond Growers, Inc.

29.13.1. Overview

29.13.2. Product Portfolio

29.13.3. Sales Footprint

29.13.4. Channel Footprint

29.13.4.1. Distributors List

29.13.4.2. Distribution Channel (Clients)

29.13.5. Strategy Overview

29.13.5.1. Marketing Strategy

29.13.5.2. Culture Strategy

29.13.5.3. Channel Strategy

29.13.6. SWOT Analysis

29.13.7. Financial Analysis

29.13.8. Revenue Share

29.13.8.1. By Product

29.13.8.2. By Region

29.13.9. Key Clients

29.13.10. Analyst Comments

29.14. Edward & Sons

29.14.1. Overview

29.14.2. Product Portfolio

29.14.3. Sales Footprint

29.14.4. Channel Footprint

29.14.4.1. Distributors List

29.14.4.2. Distribution Channel (Clients)

29.14.5. Strategy Overview

29.14.5.1. Marketing Strategy

29.14.5.2. Culture Strategy

29.14.5.3. Channel Strategy

29.14.6. SWOT Analysis

29.14.7. Financial Analysis

29.14.8. Revenue Share

29.14.8.1. By Product

29.14.8.2. By Region

29.14.9. Key Clients

29.14.10. Analyst Comments

29.15. Chef’s Choice Food Manufacturer Company Limited

29.15.1. Overview

29.15.2. Product Portfolio

29.15.3. Sales Footprint

29.15.4. Channel Footprint

29.15.4.1. Distributors List

29.15.4.2. Distribution Channel (Clients)

29.15.5. Strategy Overview

29.15.5.1. Marketing Strategy

29.15.5.2. Culture Strategy

29.15.5.3. Channel Strategy

29.15.6. SWOT Analysis

29.15.7. Financial Analysis

29.15.8. Revenue Share

29.15.8.1. By Product

29.15.8.2. By Region

29.15.9. Key Clients

29.15.10. Analyst Comments

29.16. Alpina Foods

29.16.1. Overview

29.16.2. Product Portfolio

29.16.3. Sales Footprint

29.16.4. Channel Footprint

29.16.4.1. Distributors List

29.16.4.2. Distribution Channel (Clients)

29.16.5. Strategy Overview

29.16.5.1. Marketing Strategy

29.16.5.2. Culture Strategy

29.16.5.3. Channel Strategy

29.16.6. SWOT Analysis

29.16.7. Financial Analysis

29.16.8. Revenue Share

29.16.8.1. By Product

29.16.8.2. By Region

29.16.9. Key Clients

29.16.10. Analyst Comments

29.17. Liwayway Holdings Company Limited

29.17.1. Overview

29.17.2. Product Portfolio

29.17.3. Sales Footprint

29.17.4. Channel Footprint

29.17.4.1. Distributors List

29.17.4.2. Distribution Channel (Clients)

29.17.5. Strategy Overview

29.17.5.1. Marketing Strategy

29.17.5.2. Culture Strategy

29.17.5.3. Channel Strategy

29.17.6. SWOT Analysis

29.17.7. Financial Analysis

29.17.8. Revenue Share

29.17.8.1. By Product

29.17.8.2. By Region

29.17.9. Key Clients

29.17.10. Analyst Comments

29.18. The Bridge s.r.l.

29.18.1. Overview

29.18.2. Product Portfolio

29.18.3. Sales Footprint

29.18.4. Channel Footprint

29.18.4.1. Distributors List

29.18.4.2. Distribution Channel (Clients)

29.18.5. Strategy Overview

29.18.5.1. Marketing Strategy

29.18.5.2. Culture Strategy

29.18.5.3. Channel Strategy

29.18.6. SWOT Analysis

29.18.7. Financial Analysis

29.18.8. Revenue Share

29.18.8.1. By Product

29.18.8.2. By Region

29.18.9. Key Clients

29.18.10. Analyst Comments

29.19. Pure-Harvest Corp

29.19.1. Overview

29.19.2. Product Portfolio

29.19.3. Sales Footprint

29.19.4. Channel Footprint

29.19.4.1. Distributors List

29.19.4.2. Distribution Channel (Clients)

29.19.5. Strategy Overview

29.19.5.1. Marketing Strategy

29.19.5.2. Culture Strategy

29.19.5.3. Channel Strategy

29.19.6. SWOT Analysis

29.19.7. Financial Analysis

29.19.8. Revenue Share

29.19.8.1. By Product

29.19.8.2. By Region

29.19.9. Key Clients

29.19.10. Analyst Comments

29.20. Kaslink Foods Oy Ltd

29.20.1. Overview

29.20.2. Product Portfolio

29.20.3. Sales Footprint

29.20.4. Channel Footprint

29.20.4.1. Distributors List

29.20.4.2. Distribution Channel (Clients)

29.20.5. Strategy Overview

29.20.5.1. Marketing Strategy

29.20.5.2. Culture Strategy

29.20.5.3. Channel Strategy

29.20.6. SWOT Analysis

29.20.7. Financial Analysis

29.20.8. Revenue Share

29.20.8.1. By Product

29.20.8.2. By Region

29.20.9. Key Clients

29.20.10. Analyst Comments

29.21. Others (On additional request)

30. Recommendation- Critical Success Factors

31. Research Methodology

32. Assumptions & Acronyms Used

List of Tables

List of figures

Figure:1 Global Plant-based Milk Market Value (US$ Mn) and Volume (MT) Forecast, 2019-2029

Figure:2 Global Plant-based Milk Market Absolute $ Opportunity (US$ Mn), 2019-2029

Figure:3 Global Plant-based Milk Market Share (%) & BPS Analysis by Region, 2019 - 2029

Figure:4 Global Plant-based Milk Market Y-o-Y Growth Rate (%) by Region, 2019 - 2029

Figure:5 Global Plant-based Milk Market Value (US$ Mn) Analysis & Forecast by Region, 2019-2029

Figure:6 Global Plant-based Milk Market Attractiveness Index by Region, 2019 - 2029

Figure:7 Global Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:8 Global Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:9 Global Plant-based Milk Market Value (US$ Mn) Analysis & Forecast by Product, 2019-2029

Figure:10 Global Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:11 Global Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:12 Global Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:13 Global Plant-based Milk Market Value (US$ Mn) Analysis & Forecast by Nature, 2019-2029

Figure:14 Global Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:15 Global Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:16 Global Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:17 Global Plant-based Milk Market Value (US$ Mn) Analysis & Forecast by Formulation, 2019 - 2029

Figure:18 Global Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:19 Global Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel , 2019 - 2029

Figure:20 Global Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:21 Global Plant-based Milk Market Value (US$ Mn) Analysis & Forecast by Distribution Channel, 2019-2029

Figure:22 Global Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:23 North America Plant-based Milk Market Share (%) & BPS Analysis by Country, 2019 - 2029

Figure:24 North America Plant-based Milk Market Y-o-Y Growth Rate (%) by Country, 2019 - 2029

Figure:25 North America Plant-based Milk Market Attractiveness Index by Country, 2019 - 2029

Figure:26 North America Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:27 North America Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:28 North America Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:29 North America Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:30 North America Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:31 North America Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:32 North America Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:33 North America Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:34 North America Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:35 North America Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:36 North America Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:37 North America Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:38 Latin America Plant-based Milk Market Share (%) & BPS Analysis by Country, 2019 - 2029

Figure:39 Latin America Plant-based Milk Market Y-o-Y Growth Rate (%) by Country, 2019 - 2029

Figure:40 Latin America Plant-based Milk Market Attractiveness Index by Country, 2019 - 2029

Figure:41 Latin America Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:42 Latin America Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:43 Latin America Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:44 Latin America Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:45 Latin America Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:46 Latin America Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:47 Latin America Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:48 Latin America Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:49 Latin America Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:50 Latin America Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:51 Latin America Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:52 Latin America Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:53 Europe Plant-based Milk Market Share (%) & BPS Analysis by Country, 2019 - 2029

Figure:54 Europe Plant-based Milk Market Y-o-Y Growth Rate (%) by Country, 2019 - 2029

Figure:55 Europe Plant-based Milk Market Attractiveness Index by Country, 2019 - 2029

Figure:56 Europe Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:57 Europe Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:58 Europe Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:59 Europe Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:60 Europe Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:61 Europe Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:62 Europe Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:63 Europe Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:64 Europe Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:65 Europe Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel 2019 - 2029

Figure:66 Europe Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel 2019 - 2029

Figure:67 Europe Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:68 APEC Plant-based Milk Market Share (%) & BPS Analysis by Country, 2019 - 2029

Figure:69 APEC Plant-based Milk Market Y-o-Y Growth Rate (%) by Country, 2019 - 2029

Figure:70 APEC Plant-based Milk Market Attractiveness Index by Country, 2019 - 2029

Figure:71 APEC Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:72 APEC Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:73 APEC Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:74 APEC Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:75 APEC Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:76 APEC Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:77 APEC Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:78 APEC Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:79 APEC Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:80 APEC Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:81 APEC Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:82 APEC Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:83 MEA Plant-based Milk Market Share (%) & BPS Analysis by Country, 2019 - 2029

Figure:84 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Country, 2019 - 2029

Figure:85 MEA Plant-based Milk Market Attractiveness Index by Country, 2019 - 2029

Figure:86 MEA Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:87 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:88 MEA Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:89 MEA Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:90 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:91 MEA Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:92 MEA Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:93 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:94 MEA Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:95 MEA Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:96 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:97 MEA Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:98 MEA Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:99 MEA Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:100 MEA Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:101 Oceania Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 & 2029

Figure:102 Oceania Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:103 Oceania Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:104 Oceania Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:105 Oceania Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:106 Oceania Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:107 Oceania Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:108 Oceania Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:109 Oceania Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:110 Oceania Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:111 Oceania Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:112 Oceania Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029

Figure:113 China Plant-based Milk Market Share (%) & BPS Analysis by Product, 2019 - 2029

Figure:114 China Plant-based Milk Market Y-o-Y Growth Rate (%) by Product, 2019 - 2029

Figure:115 China Plant-based Milk Market Attractiveness Index by Product, 2019 - 2029

Figure:116 China Plant-based Milk Market Share (%) & BPS Analysis by Nature, 2019 - 2029

Figure:117 China Plant-based Milk Market Y-o-Y Growth Rate (%) by Nature, 2019 - 2029

Figure:118 China Plant-based Milk Market Attractiveness Index by Nature, 2019 - 2029

Figure:119 China Plant-based Milk Market Share (%) & BPS Analysis by Formulation, 2019 - 2029

Figure:120 China Plant-based Milk Market Y-o-Y Growth Rate (%) by Formulation, 2019 - 2029

Figure:121 China Plant-based Milk Market Attractiveness Index by Formulation, 2019 - 2029

Figure:122 China Plant-based Milk Market Share (%) & BPS Analysis by Distribution Channel, 2019 - 2029

Figure:123 China Plant-based Milk Market Y-o-Y Growth Rate (%) by Distribution Channel, 2019 - 2029

Figure:124 China Plant-based Milk Market Attractiveness Index by Distribution Channel, 2019 - 2029