Analysts’ Viewpoint on Pigments Market Scenario

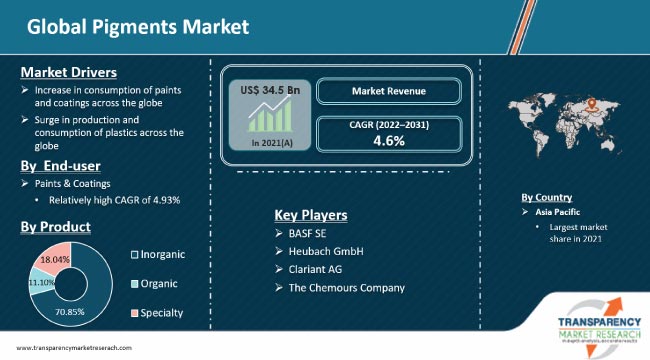

Rapid urbanization and the subsequent growth in the construction sector are augmenting the global pigments market. Infrastructure development across the globe is expected to boost the demand for paints and coatings in the construction sector. Increase in the production of automobiles and rise in the demand for industrial paints are also expected to contribute to the growth of the pigments market during the forecast period. Key players operating in the market are investing significantly in the R&D of high-quality products that are less harmful to the environment. They are also diversifying their businesses by manufacturing organic, bio-based pigments, and specialty pigments to stay competitive in the market.

Pigments are insoluble products that can be employed to impart colors to paints, inks, plastics, papers, cosmetics, rubbers, concrete blocks, tiles, etc. They are an integral part of our day-to-day life. Prussian blue, azo pigments, ultramarine, mica powder, YInMn blue, and Alizarin crimson are some examples of pigments. Pigments provide vibrant colors to substrates, thus making products look more appealing. Pigment molecules contain electrons that occupy different levels of energy when exposed to light. They possess the ability to reflect or absorb light of specific wavelengths, which results in the appearance of colors.

The use of pigments in automotive coatings helps enhance their esthetic appeal and offers properties such as tinting strength, brightness, and fastness. Furthermore, the usage of pigments helps impart opacity, gloss, durability, resistance to heat and light, and excellent color effect to automotive coatings.

Pigments are extensively utilized in the formulation of paints, as they impart color. They also improve the esthetic appeal and offer heat and light stability to paints & coatings. The paints & coatings industry has expanded significantly in emerging economies due to industrial development in the last few years. The per capita consumption of paints in India, China, Singapore, South Korea, and the ASEAN and GCC countries is likely to increase significantly in the near future due to economic growth in these countries.

Increase in the demand for decorative and industrial paints and rise in housing construction and infrastructural development are anticipated to fuel the pigments market during the forecast period. Expansion in marine, furniture, and consumer goods sectors is also contributing to a surge in the demand for industrial paints, thereby driving the global pigments market.

Global production of plastics is increasing significantly, doubling in volume between 2000 and 2019, to reach 460 million tons. Rise in demand for plastics in packaging, automotive, and building & construction industries is driving the production of plastics worldwide. Unique and advantageous properties of plastic have enabled the material to be used as a substitute for wood, paper, and rubber. Consumption of plastics has increased substantially in both developed and developing countries in the last few years. Economic growth, rise in disposable income, and rapid urbanization in countries such as China, India, Brazil, and South Africa are projected to drive the demand for plastics in the near future. This, in turn, is expected to fuel the pigments market during the forecast period.

Technological breakthrough in the development of nanomaterials has opened new avenues for advancements in several industries. Nanotechnology is being extensively applied in the pigments industry. Nano-sized inorganic pigments are gaining traction in various industrial applications, owing to their superior performance than conventional pigments. Adoption of nanotechnology in the production of pigments improves their tribological coating, mechanical, and optical properties. Nano-pigments offer key advantages such as durability and stability to UV radiation and heat; enhanced hardness and toughness; resistance to scratch, abrasion, and weather; improved transparency; and decreased water permeability, over traditional pigments. Nano-pigments are used in cosmetics, photovoltaic cells, cathode ray tubes, and ceramic pigments. These pigments have a smaller particle size, which leads to a larger surface area.

In terms of product, the global pigments market has been segmented into inorganic, organic, and specialty. According to the pigments market trends, the inorganic segment dominated the global market and accounted for 70.85% share in 2021. The segment is estimated to grow at an above-average CAGR of 4.21% during the forecast period. Increase in the consumption of white-colored pigments in paints & coatings is expected to propel the segment during the forecast period.

Organic and specialty segments are expected to grow significantly during the forecast period, as per the pigments market demand analysis. Organic pigments are available in an array of colors such as red, yellow, brown, and black. They offer excellent light fastness, uniformity in color, and tinting strength. Specialty pigments are widely used in the automotive sector.

Based on end-use, the global pigments market has been classified into paints & coatings, printing inks, plastics, construction materials, and others. The paints & coatings segment accounted for 50.95% share of the global market in 2021. The segment is estimated to grow at an above-average CAGR of 4.93% during the forecast period. Rise in construction activities, increase in the number of infrastructural development projects in growing economies such as India, China, Vietnam, and GCC, and expansion in the automotive sector in developing countries are driving the paints & coatings segment.

Asia Pacific dominated the global market and held 43.22% share in 2021, and it is expected to grow at an average CAGR of 4.88% during the forecast period. Increase in demand for paints & coatings in countries such as China, India, and Japan is driving the market in Asia Pacific. Expansion of the automotive sector is also expected to fuel the market in Asia Pacific during the forecast period.

The global pigments market is dominated by a few large and medium players operating across the world. The top few players operating in the global market cumulatively accounted for more than 50% share in 2021. Key players are focusing on technological innovations, business expansion through mergers & acquisitions, financial restructuring and investments, and capacity expansion to have a large global presence and enhance their pigments market share. The Chemours Company, CRISTAL, Tronox Limited, BASF SE, LANXESS, Clariant International AG, Ferro Corporation, KRONOS Worldwide Inc., Sun Chemical Corporation, Cathay Industries Group, Heubach GmbH, Gharda Chemicals Limited, Sudarshan Chemical Industries Limited, and Altana AG are prominent entities operating in the market.

Each of these players has been profiled in the pigments market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 34.5 Bn |

|

Market Forecast Value in 2031 |

US$ 53.8 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn For Value and Kilo Tons For Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The pigments market stood at US$ 34.5 Bn in 2021

The pigments market is expected to grow at a CAGR of 4.6% from 2022 to 2031

Increase in consumption of paints & coatings and rise in demand and production of plastics are driving the global pigments market

The inorganic segment held largest share of 70.85% of the global market in 2021

Asia Pacific was the most lucrative region and held 43.22% share of the global market in 2021

Chemours Company, CRISTAL, Tronox Limited, BASF SE, LANXESS, Clariant International AG, Ferro Corporation, KRONOS Worldwide Inc., Sun Chemical Corporation, Cathay Industries Group, Heubach GmbH, Gharda Chemicals Limited, Sudarshan Chemical Industries Limited, and Altana AG

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.4.1. Market Dynamics

2.4.2. Drivers

2.4.3. Restraints

2.4.4. Opportunities

2.5. Global Pigments Market Analysis and Forecast, 2020-2031

2.5.1. Global Pigments Market Volume (Kilo Tons)

2.5.2. Global Pigments Market Revenue (US$ Mn)

2.6. Porter’s Five Forces Analysis

2.7. Regulatory Landscape

2.8. Value Chain Analysis

2.8.1. List of Raw Material Providers

2.8.2. List of Manufacturers

2.8.3. List of Dealers/Distributors

2.8.4. List of Potential Customers

2.9. Production Overview

2.10. Product Specification Analysis

2.11. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Global Pigments Market Analysis and Forecast, by Product, 2020–2031

4.1. Introduction and Definitions

4.2. Global Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

4.2.1. Inorganic

4.2.1.1. Titanium Dioxide

4.2.1.2. Iron Oxide

4.2.1.3. Carbon Black

4.2.1.4. Chromium Compounds

4.2.1.5. Others

4.2.2. Organic

4.2.2.1. Azo

4.2.2.2. Phthalocyanine

4.2.2.3. Quinacridone

4.2.2.4. Others

4.2.3. Specialty

4.2.3.1. Classic Organic

4.2.3.2. Metallic

4.2.3.3. High-performance Organic

4.2.3.4. Light Interference

4.2.3.5. Complex Inorganic

4.2.3.6. Fluorescent

4.2.3.7. Luminescent/Phosphorescent

4.2.3.8. Thermochromic

4.2.3.9. Others

4.3. Global Pigments Market Attractiveness, by Product

5. Global Pigments Market Analysis and Forecast, by End-use, 2020–2031

5.1. Introduction and Definitions

5.2. Global Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use,

5.2.1. Paints & Coatings

5.2.2. Printing Inks

5.2.3. Plastics

5.2.4. Construction Materials

5.2.5. Others

5.3. Global Pigments Market Attractiveness, by End-use

6. Global Pigments Market Analysis and Forecast, by Region, 2020–2031

6.1. Key Findings

6.2. Global Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2020–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Pigments Market Attractiveness, by Region

7. North America Pigments Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. North America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

7.3. North America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

7.4. North America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2020–2031

7.4.1. U.S. Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

7.4.2. U.S. Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

7.4.3. Canada Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

7.4.4. Canada Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

7.5. North America Pigments Market Attractiveness Analysis

8. Europe Pigments Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.3. Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4. Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.2. Germany Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.3. France Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.4. France Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.5. U.K. Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.6. U.K. Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.7. Italy Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.8. Italy Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.9. Spain Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.10. Spain Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.11. Russia & CIS Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.12. Russia & CIS Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.4.13. Rest of Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.14. Rest of Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

8.5. Europe Pigments Market Attractiveness Analysis

9. Asia Pacific Pigments Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Asia Pacific Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020-2031

9.3. Asia Pacific Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4. Asia Pacific Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.2. China Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4.3. Japan Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.4. Japan Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4.5. India Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.6. India Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4.7. ASEAN Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.8. ASEAN Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4.9. Rest of Asia Pacific Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.10. Rest of Asia Pacific Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5. Asia Pacific Pigments Market Attractiveness Analysis

10. Latin America Pigments Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

10.3. Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4. Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.2. Brazil Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.3. Mexico Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.4. Mexico Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.5. Rest of Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.6. Rest of Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5. Latin America Pigments Market Attractiveness Analysis

11. Middle East & Africa Pigments Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

11.3. Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4. Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.2. GCC Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.3. South Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.4. South Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.5. Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.6. Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5. Middle East & Africa Pigments Market Attractiveness Analysis

12. Global Pigments Company Market Share Analysis, 2021

12.1. Competition Matrix

12.2. Market Footprint Analysis

12.2.1. By Product

12.2.2. By End-use

12.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.3.1. The Chemours Company

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. Financial Details

12.3.1.4. Strategic Overview

12.3.2. CRISTAL

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. Financial Details

12.3.2.4. Strategic Overview

12.3.3. Tronox Limited

12.3.3.1. Company Description

12.3.3.2. Business Overview

12.3.3.3. Financial Details

12.3.3.4. Strategic Overview

12.3.4. BASF SE

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. Financial Details

12.3.4.4. Strategic Overview

12.3.5. LANXESS

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. Financial Details

12.3.5.4. Strategic Overview

12.3.6. Clariant International AG

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. Financial Details

12.3.6.4. Strategic Overview

12.3.7. Ferro Corporation

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. Financial Details

12.3.7.4. Strategic Overview

12.3.8. KRONOS Worldwide Inc.

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Details

12.3.8.4. Strategic Overview

12.3.9. Sun Chemical Corporation

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Details

12.3.9.4. Strategic Overview

12.3.10. Cathay Industries Group

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Details

12.3.10.4. Strategic Overview

12.3.11. Heubach GmbH

12.3.11.1. Company Description

12.3.11.2. Business Overview

12.3.11.3. Financial Details

12.3.11.4. Strategic Overview

12.3.12. Gharda Chemicals Limited

12.3.12.1. Company Description

12.3.12.2. Business Overview

12.3.12.3. Financial Details

12.3.12.4. Strategic Overview

12.3.13. Sudarshan Chemical Industries Limited

12.3.13.1. Company Description

12.3.13.2. Business Overview

12.3.13.3. Financial Details

12.3.13.4. Strategic Overview

12.3.14. Altana AG

12.3.14.1. Company Description

12.3.14.2. Business Overview

12.3.14.3. Financial Details

12.3.14.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 01: Average Price Range of Pigments, by Product, US$/Ton, 2021

Table 02: Pigments Price Trend Analysis, by Product (US$/Ton), 2021

Table 03: Global Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 04: Global Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 05: Global Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 06: Global Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 07: Global Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2020 - 2031

Table 08: North America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 09: North America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 10: North America Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 11: North America Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 12: North America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2020 - 2031

Table 13: U.S. Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 14: U.S. Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 15: U.S. Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 16: U.S. Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 17: Canada Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 18: Canada Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 19: Canada Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 20: Canada Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 21: Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 22: Europe Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 23: Europe Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 24: Europe Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 25: Europe Pigments Market Volume (Kilo Tons) Forecast, by Country & Sub-region, 2020 - 2031

Table 26: Europe Pigments Market Value (US$ Bn) Forecast, by Country & Sub-region, 2020 - 2031

Table 27: Germany Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 28: Germany Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 29: Germany Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 30: Germany Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 31: France Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 32: France Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 33: France Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 34: France Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 35: U.K. Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 36: U.K. Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 37: U.K. Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 38: U.K. Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 39: Italy Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 40: Italy Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 41: Italy Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 42: Italy Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 43: Spain Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 44: Spain Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 45: Spain Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 46: Spain Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 47: Russia & CIS Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 48: Russia & CIS Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 49: Russia & CIS Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 50: Russia & CIS Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 51: Rest of Europe Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 52: Rest of Europe Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 53: Rest of Europe Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 54: Rest of Europe Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 55: Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 56: Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 57: Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 58: Asia Pacific Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 59: Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Country & Sub-region, 2020 - 2031

Table 60: Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Country & Sub-region, 2020 - 2031

Table 61: China Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 62: China Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 63: China Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 64: China Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 65: India Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 66: India Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 67: India Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 68: India Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 69: Japan Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 70: Japan Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 71: Japan Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 72: Japan Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 73: ASEAN Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 74: ASEAN Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 75: ASEAN Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 76: ASEAN Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 77: Rest of Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 78: Rest of Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 79: Rest of Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 80: Rest of Asia Pacific Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 81: Latin America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 82: Latin America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 83: Latin America Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 84: Latin America Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 85: Latin America Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country & Sub-region, 2020 - 2031

Table 86: Brazil Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 87: Brazil Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 88: Brazil Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 89: Brazil Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 90: Mexico Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 91: Mexico Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 92: Mexico Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 93: Mexico Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 94: Rest of Latin America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 95: Rest of Latin America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 96: Rest of Latin America Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 97: Rest of Latin America Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 98: Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 99: Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 100: Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 101: Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 102: Middle East & Africa Pigments Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country & Sub-region, 2020 - 2031

Table 103: GCC Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 104: GCC Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 105: GCC Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 106: GCC Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 107: South Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 108: South Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 109: South Africa Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 110: South Africa Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

Table 111: Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 - 2031

Table 112: Rest of Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 - 2031

Table 113: Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by End-user, 2020 - 2031

Table 114: Rest of Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by End-user, 2020 - 2031

List of Figures

Figure 01: Market Snapshot, Global Pigments Market

Figure 02: Global Pigments Market Volume Share, by Inorganic, 2021

Figure 04: Global Pigments Market Volume Share, by Specialty, 2021

Figure 03: Global Pigments Market Volume Share, by Organic, 2021

Figure 05: Market Segmentation

Figure 06: Product Segmentation

Figure 07: Iron Oxide Raw Material Analysis – Manufacturing/Extraction Process

Figure 08: Titanium Dioxide Raw Material Analysis – Manufacturing/Extraction Process

Figure 09: Manufacturing of Azo Pigments

Figure 10: Manufacturing of Phthalocyanine Pigments

Figure 11: Global Pigments Market Volume Share Analysis, by Product, 2021 and 2031

Figure 12: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis for Inorganic, 2020 - 2031

Figure 13: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis for Organic, 2020 - 2031

Figure 14: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis for Specialty, 2020 - 2031

Figure 15: Global Pigments Market Attractiveness Analysis, by Product

Figure 16: Global Pigments Market Volume Share Analysis, by End-user, 2021 and 2031

Figure 17: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis, by Paints & Coatings, 2020 - 2031

Figure 18: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis, by Printing Inks, 2020 - 2031

Figure 19: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis, by Plastics, 2020 - 2031

Figure 20: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis, by Construction Materials, 2020 - 2031

Figure 21: Global Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Analysis, by Others, 2020 - 2031

Figure 22: Global Pigments Market Attractiveness Analysis, by End-user

Figure 23: Global Pigments Market Volume Share Analysis, by Region, 2021 and 2031

Figure 24: Global Pigments Market Attractiveness Analysis, by Region

Figure 25: North America Pigments Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 26: North America Pigments Market Attractiveness, by Country

Figure 27: North America Pigments Market Volume Share, by Product, 2021 and 2031

Figure 28: North America Pigments Market Volume Share, by End-user, 2021 and 2031

Figure 29: North America Pigments Market Volume Share, by Country, 2021 and 2031

Figure 30: U.S. Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 31: U.S. Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 32: Canada Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 33: Canada Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 34: North America Pigments Market Attractiveness, by Product, 2020 - 2031

Figure 35: North America Pigments Market Attractiveness, by End-user, 2020 - 2031

Figure 36: Europe Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 37: Europe Pigments Market Attractiveness, by Country & Sub-region

Figure 38: Europe Pigments Market Volume Share, by Product, 2021 and 2031

Figure 39: Europe Pigments Market Volume Share, by End-user, 2021 and 2031

Figure 40: Europe Pigments Market Volume Share, by Country & Sub-region, 2021 and 2031

Figure 41: Germany Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 42: Germany Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 43: France Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 44: France Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 45: U.K. Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 46: U.K. Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 47: Italy Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 48: Italy Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 49: Spain Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 50: Spain Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 51: Russia & CIS Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 52: Russia & CIS Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 53: Rest of Europe Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 54: Rest of Europe Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 55: Europe Pigments Market Attractiveness, by Product, 2020 - 2031

Figure 56: Europe Pigments Market Attractiveness, by End-user, 2020 - 2031

Figure 57: Asia Pacific Pigments Market Value (US$ Bn) and Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 58: Asia Pacific Pigments Market Attractiveness Analysis, by Country & Sub-region

Figure 59: Asia Pacific Pigments Market Volume Share Analysis, by Product, 2021 and 2031

Figure 60: Asia Pacific Pigments Market Volume Share Analysis, by End-user, 2021 and 2031

Figure 61: China Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 62: China Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 63: India Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 64: India Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 65: Japan Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 66: Japan Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 67: ASEAN Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 68: ASEAN Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 69: Rest of Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 70: Rest of Asia Pacific Pigments Market Value (US$ Bn) Forecast, 2020 - 2031

Figure 71: Asia Pacific Pigments Market Attractiveness Analysis, by Product, 2020-2031

Figure 72: Asia Pacific Pigments Market Attractiveness Analysis, by End-user, 2020-2031

Figure 73: Latin America Pigments Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 74: Latin America Pigments Market Attractiveness Analysis, by Country & Sub-region

Figure 75: Latin America Pigments Market Volume Share Analysis, by Product, 2021 and 2031

Figure 76: Latin America Pigments Market Volume Share Analysis, by End-user, 2021 and 2031

Figure 77: Latin America Pigments Market Volume Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 78: Brazil Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 79: Brazil Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 80: Mexico Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 81: Mexico Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 82: Rest of Latin America Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 83: Rest of Latin America Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 84: Latin America Pigments Market Attractiveness Analysis, by Product, 2020 - 2031

Figure 85: Latin America Pigments Market Attractiveness Analysis, by End-user, 2020 - 2031

Figure 86: Middle East & Africa Pigments Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 87: Middle East & Africa Pigments Market Attractiveness Analysis, by Country & Sub-region

Figure 88: Middle East & Africa Pigments Market Volume Share Analysis, by Product, 2021 and 2031

Figure 89: Middle East & Africa Pigments Market Volume Share Analysis, by End-user, 2021 and 2031

Figure 90: Middle East & Africa Pigments Market Volume Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 91: GCC Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 92: GCC Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 93: South Africa Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 94: South Africa Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 95: Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, 2020 - 2031

Figure 96: Rest of Middle East & Africa Pigments Market Size (US$ Mn) Forecast, 2020 - 2031

Figure 97: Middle East & Africa Pigments Market Attractiveness Analysis, by Product, 2020 - 2031

Figure 98: Middle East & Africa Pigments Market Attractiveness Analysis, by End-user, 2020 - 2031

Figure 99: Inorganic Market Share Analysis, by Company, 2021

Figure 100: Organic Market Share Analysis, by Company, 2021

Figure 101: Specialty Market Share Analysis, by Company, 2021

Figure 101: Specialty Market Share Analysis, by Company, 2021