Physical security information management is a software suite comprising applications and platforms, which are developed to integrate several non-connected security applications and devices, and are monitored with an all-in-one user interface.

A TMR study projects the global physical security information management market to grow at a compound annual growth rate (CAGR) of 18.1% during the forecast period between 2016 and 2024. The physical security information management market was valued at US $ 823.1 Mn in 2015 and it is anticipated to reach a valuation of US $ 3832.1 Mn, by the end of the assessment period.

The rising value proposition, which is achieved by the adoption of integrated platforms and security systems across various industries has emerged as a key growth driver for the physical security information management market.

Organizations, across industries, have witnessed a rise in security breaches in recent times, and this has also led to an increase in demand for physical security information management systems.

The global physical security information management market is studied based on component, end-use, and region.

Based on component, it is segmented into software and services. The software segment comprises off the shelf and customized software. The services segment includes systems integration, operation and maintenance, and consulting and training.

Cloud-based customized software is expected to generate high demand in the physical security information management market, in future.

Based on end-use, the physical security information management market is classified into banking, transportation and logistics, residential, retail, telecom and information technology, industrial manufacturing, healthcare, hospital, and government and defense sector.

The government and defense sector, in 2015, dominated the global physical security information management market, accounting for 11.6% of the overall share. The government and defense sector end-use segment is anticipated to grow at a CAGR of 20% in the overall physical security information management market in future.

The hospitality end-use segment is also anticipated to witness a surge in demand for physical security information management systems owing to increased need to protect hotel infrastructures.

The transportation and logistics end-use segment is also expected to generate huge demand in the overall physical security information management market, in future. This is because of the

increasing need to monitor transportation activities in the logistics industry, which is likely to fuel demand for physical security information management solutions. This,in turn, propels the overall physical security information management market.

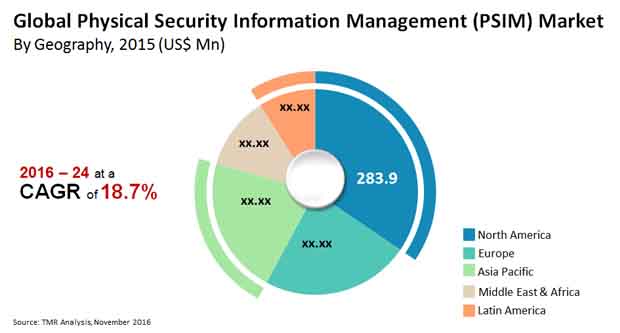

The global physical security information management market is divided into five regions: Asia Pacific, North America, Middle East and Africa, Europe, and Latin America.

North America accounted for a major share in the global physical security information management market in 2015, holding 36% of the overall share. A key growth driver is the increasing usage of physical security information management software across various industries, located in this region.

Also, North America has many established physical security information management system vendors, leading to greater adoption of the software in this region. These factors are expected to propel the physical security information management market in North America, in future as well.

The physical security information management market is extremely fragmented. Some of the key players in the market include NEC Corporation, CNL Software, Tyco International Ltd., NICE Ltd., Milestone Systems A/S, and Genetec Inc.

Several key market players are looking to manufacture superior products to gain an edge over the competitors.

Video management system (VMS) vendors and third-party vendors have signed joint partnerships to provide end-users with integrated solutions that meet the requirements.

The use of automation in physical security information management systems has resulted in a substantial decline in operational costs, which has positively impacted the physical security information management market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Physical Security Information Management (PSIM) Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Physical Security Information Management (PSIM) Market Overview

4.3. Key Market Indicators

4.3.1. Physical Security Information Management (PSIM) End-users in Emerging Economies

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Global Physical Security Information Management (PSIM) Market Analysis and Forecasts, 2014 – 2024

4.5.1. Market Revenue Projections (US$ Mn)

4.5.2. Physical Security Information Management (PSIM) Market - Global End-use End-user Scenario

4.6. Porter’s Five Force Analysis

4.7. Value Chain Analysis

4.7.1. List of Active Market Participants (suppliers/distributors/manufacturers/vendors)

4.7.2. Forward – Backward Integration Scenario

4.8. Product’s Lifecycle and Characteristics Analysis

4.9. Analysis of Key Projects for PSIM

4.10. Market Outlook

5. Global Physical Security Information Management (PSIM) Market Analysis and Forecasts, By Component

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size (US$ Mn) Forecast By Component

5.4.1. Software, 2014 – 2024 (US$ Mn)

5.4.1.1. Off-the Shelf

5.4.1.1.1. On-premise

5.4.1.1.2. Cloud-based

5.4.1.2. Customized

5.4.1.2.1. On-premise

5.4.1.2.2. Cloud-based

5.4.2. Service, 2014 – 2024 (US$ Mn)

5.4.2.1. Installation/ System Integration

5.4.2.2. Operation & Maintenance

5.4.2.3. Consulting & Training

5.5. Component Comparison Matrix

5.6. Market Attractiveness by Component

6. Global Physical Security Information Management (PSIM) Market Analysis and Forecasts, By End-user

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn) Forecast By End-user

6.4.1. Residential, 2014 – 2024 (US$ Mn)

6.4.2. Banking, Financial Services & Insurance (BFSI), 2014 – 2024 (US$ Mn)

6.4.3. Retail, 2014 – 2024 (US$ Mn)

6.4.4. Transportation & Logistics, 2014 – 2024 (US$ Mn)

6.4.5. Government & Defense Sector), 2014 – 2024 (US$ Mn)

6.4.6. Industrial Manufacturing, 2014 – 2024 (US$ Mn)

6.4.7. Healthcare, 2014 – 2024 (US$ Mn)

6.4.8. Telecom & IT, 2014 – 2024 (US$ Mn)

6.4.9. Hospitality, 2014 – 2024 (US$ Mn)

6.4.10. Energy & Utility, 2014 – 2024 (US$ Mn)

6.4.11. Others (Educational Institutions, Religious Buildings, Stadiums and Other Infrastructure), 2014 – 2024 (US$ Mn)

6.5. End-user Comparison Matrix

6.6. Market Attractiveness by End-user

7. Global Physical Security Information Management (PSIM) Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Policies and Regulations

7.3. Market Size (US$ Mn) Forecast By Region, 2014 – 2024 (US$ Mn)

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

7.4. Market Attractiveness by Country/Region

8. North America Physical Security Information Management (PSIM) Market Analysis and Forecast

8.1. Key Findings

8.2. Policies and Regulations

8.3. Price Trend Analysis

8.4. Key Trends

8.5. Market Size (US$ Mn) Forecast By Component

8.5.1. Software, 2014 – 2024 (US$ Mn)

8.5.1.1. Off-the Shelf

8.5.1.1.1. On-premise

8.5.1.1.2. Cloud-based

8.5.1.2. Customized

8.5.1.2.1. On-premise

8.5.1.2.2. Cloud-based

8.5.2. Service, 2014 – 2024 (US$ Mn)

8.5.2.1. Installation/ System Integration

8.5.2.2. Operation & Maintenance

8.5.2.3. Consulting & Training

8.6. Market Size (US$ Mn) Forecast By End-user

8.6.1. Residential, 2014 – 2024 (US$ Mn)

8.6.2. Banking, Financial Services & Insurance (BFSI), 2014 – 2024 (US$ Mn)

8.6.3. Retail, 2014 – 2024 (US$ Mn)

8.6.4. Transportation & Logistics, 2014 – 2024 (US$ Mn)

8.6.5. Government & Defense Sector, 2014 – 2024 (US$ Mn)

8.6.6. Industrial Manufacturing, 2014 – 2024 (US$ Mn)

8.6.7. Healthcare, 2014 – 2024 (US$ Mn)

8.6.8. Telecom & IT, 2014 – 2024 (US$ Mn)

8.6.9. Hospitality, 2014 – 2024 (US$ Mn)

8.6.10. Energy & Utility, 2014 – 2024 (US$ Mn)

8.6.11. Others (Educational Institutions, Religious Buildings, Stadiums and Other Infrastructure), 2014 – 2024 (US$ Mn)

8.7. Market Size (US$ Mn) Forecast By Country, 2014 - 2024

8.7.1. The U.S.

8.7.2. Canada

8.7.3. Rest of North America

8.8. Market Attractiveness Analysis

8.8.1. By Component

8.8.2. By End-user

8.8.3. By Country

9. Europe Physical Security Information Management (PSIM) Market Analysis and Forecast

9.1. Key Findings

9.2. Policies and Regulations

9.3. Price Trend Analysis

9.4. Key Trends

9.5. Market Size (US$ Mn) Forecast By Component

9.5.1. Software, 2014 – 2024 (US$ Mn)

9.5.1.1. Off-the Shelf

9.5.1.1.1. On-premise

9.5.1.1.2. Cloud-based

9.5.1.2. Customized

9.5.1.2.1. On-premise

9.5.1.2.2. Cloud-based

9.5.2. Service, 2014 – 2024 (US$ Mn)

9.5.2.1. Installation/ System Integration

9.5.2.2. Operation & Maintenance

9.5.2.3. Consulting & Training

9.6. Market Size (US$ Mn) Forecast By End-user

9.6.1. Residential, 2014 – 2024 (US$ Mn)

9.6.2. Banking, Financial Services & Insurance (BFSI), 2014 – 2024 (US$ Mn)

9.6.3. Retail, 2014 – 2024 (US$ Mn)

9.6.4. Transportation & Logistics, 2014 – 2024 (US$ Mn)

9.6.5. Government & Defense Sector, 2014 – 2024 (US$ Mn)

9.6.6. Industrial Manufacturing, 2014 – 2024 (US$ Mn)

9.6.7. Healthcare, 2014 – 2024 (US$ Mn)

9.6.8. Telecom & IT, 2014 – 2024 (US$ Mn)

9.6.9. Hospitality, 2014 – 2024 (US$ Mn)

9.6.10. Energy & Utility, 2014 – 2024 (US$ Mn)

9.6.11. Others (Educational Institutions, Religious Buildings, Stadiums and Other Infrastructure), 2014 – 2024 (US$ Mn)

9.7. Market Size (US$ Mn) Forecast By Country, 2014 - 2024

9.7.1. The U.K.

9.7.2. Germany

9.7.3. France

9.7.4. Italy

9.7.5. Rest of Europe

9.8. Market Attractiveness Analysis

9.8.1. By Component

9.8.2. By End-user

9.8.3. By Country

10. Asia Pacific Physical Security Information Management (PSIM) Market Analysis and Forecast

10.1. Key Findings

10.2. Policies and Regulations

10.3. Price Trend Analysis

10.4. Key Trends

10.5. Market Size (US$ Mn) Forecast By Component

10.5.1. Software, 2014 – 2024 (US$ Mn)

10.5.1.1. Off-the Shelf

10.5.1.1.1. On-premise

10.5.1.1.2. Cloud-based

10.5.1.2. Customized

10.5.1.2.1. On-premise

10.5.1.2.2. Cloud-based

10.5.2. Service, 2014 – 2024 (US$ Mn)

10.5.2.1. Installation/ System Integration

10.5.2.2. Operation & Maintenance

10.5.2.3. Consulting & Training

10.6. Market Size (US$ Mn) Forecast By Country, 2014 - 2024

10.6.1. India

10.6.2. China

10.6.3. Japan

10.6.4. South Korea

10.6.5. Rest of Asia Pacific

10.7. Market Attractiveness Analysis

10.7.1. By Component

10.7.2. By End-user

10.7.3. By Country

11. Middle East and Africa (MEA) Physical Security Information Management (PSIM) Market Analysis and Forecast

11.1. Key Findings

11.2. Policies and Regulations

11.3. Price Trend Analysis

11.4. Key Trends

11.5. Market Size (US$ Mn) Forecast By Component

11.5.1. Software, 2014 – 2024 (US$ Mn)

11.5.1.1. Off-the Shelf

11.5.1.1.1. On-premise

11.5.1.1.2. Cloud-based

11.5.1.2. Customized

11.5.1.2.1. On-premise

11.5.1.2.2. Cloud-based

11.5.2. Service, 2014 – 2024 (US$ Mn)

11.5.2.1. Installation/ System Integration

11.5.2.2. Operation & Maintenance

11.5.2.3. Consulting & Training

11.6. Market Size (US$ Mn) Forecast By End-user

11.6.1. Residential, 2014 – 2024 (US$ Mn)

11.6.2. Banking, Financial Services & Insurance (BFSI), 2014 – 2024 (US$ Mn)

11.6.3. Retail, 2014 – 2024 (US$ Mn)

11.6.4. Transportation & Logistics, 2014 – 2024 (US$ Mn)

11.6.5. Government & Defense Sector, 2014 – 2024 (US$ Mn)

11.6.6. Industrial Manufacturing, 2014 – 2024 (US$ Mn)

11.6.7. Healthcare, 2014 – 2024 (US$ Mn)

11.6.8. Telecom & IT, 2014 – 2024 (US$ Mn)

11.6.9. Hospitality, 2014 – 2024 (US$ Mn)

11.6.10. Energy & Utility, 2014 – 2024 (US$ Mn)

11.6.11. Others (Educational Institutions, Religious Buildings, Stadiums and Other Infrastructure), 2014 – 2024 (US$ Mn)

11.7. Market Size (US$ Mn) Forecast By Country

11.7.1. GCC Countries

11.7.2. South Africa

11.7.3. Rest of MEA

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By End-user

11.8.3. By Country

12. South America Physical Security Information Management (PSIM) Market Analysis and Forecast

12.1. Key Findings

12.2. Policies and Regulations

12.3. Price Trend Analysis

12.4. Key Trends

12.5. Market Size (US$ Mn) Forecast By Component

12.5.1. Software, 2014 – 2024 (US$ Mn)

12.5.1.1. Off-the Shelf

12.5.1.1.1. On-premise

12.5.1.1.2. Cloud-based

12.5.1.2. Customized

12.5.1.2.1. On-premise

12.5.1.2.2. Cloud-based

12.5.2. Service, 2014 – 2024 (US$ Mn)

12.5.2.1. Installation/ System Integration

12.5.2.2. Operation & Maintenance

12.5.2.3. Consulting & Training

12.6. Market Size (US$ Mn) Forecast By End-user

12.6.1. Residential), 2014 – 2024 (US$ Mn)

12.6.2. Banking, Financial Services & Insurance (BFSI), 2014 – 2024 (US$ Mn)

12.6.3. Retail, 2014 – 2024 (US$ Mn)

12.6.4. Transportation & Logistics, 2014 – 2024 (US$ Mn)

12.6.5. Government & Defense Sector, 2014 – 2024 (US$ Mn)

12.6.6. Industrial Manufacturing, 2014 – 2024 (US$ Mn)

12.6.7. Healthcare, 2014 – 2024 (US$ Mn)

12.6.8. Telecom & IT, 2014 – 2024 (US$ Mn)

12.6.9. Hospitality, 2014 – 2024 (US$ Mn)

12.6.10. Energy & Utility, 2014 – 2024 (US$ Mn)

12.6.11. Others (Educational Institutions, Religious Buildings, Stadiums and Other Infrastructure), 2014 – 2024 (US$ Mn)

12.7. Market Size (US$ Mn) Forecast By Country, 2014 - 2024

12.7.1. Brazil

12.7.2. Argentina

12.7.3. Rest of South America

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By End-user

12.8.3. By Country

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis by Company (2015)

13.3. Company Profiles

13.3.1. NEC Corporation

13.3.1.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.1.2. Market Presence, By Segment and Geography

13.3.1.3. Key Developments

13.3.1.4. Strategy and Historical Roadmap

13.3.1.5. Revenue and Operating Profits

13.3.2. CNL Software Ltd.

13.3.2.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.2.2. Market Presence, By Segment and Geography

13.3.2.3. Key Developments

13.3.2.4. Strategy and Historical Roadmap

13.3.2.5. Revenue and Operating Profits

13.3.3. VidSys, Inc.

13.3.3.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.3.2. Market Presence, By Segment and Geography

13.3.3.3. Key Developments

13.3.3.4. Strategy and Historical Roadmap

13.3.3.5. Revenue and Operating Profits

13.3.4. Tyco International Ltd. (Proximex Corporation)

13.3.4.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.4.2. Market Presence, By Segment and Geography

13.3.4.3. Key Developments

13.3.4.4. Strategy and Historical Roadmap

13.3.4.5. Revenue and Operating Profits

13.3.5. NICE Systems Ltd.

13.3.5.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.5.2. Market Presence, By Segment and Geography

13.3.5.3. Key Developments

13.3.5.4. Strategy and Historical Roadmap

13.3.5.5. Revenue and Operating Profits

13.3.6. Mer Inc.

13.3.6.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.6.2. Market Presence, By Segment and Geography

13.3.6.3. Key Developments

13.3.6.4. Strategy and Historical Roadmap

13.3.6.5. Revenue and Operating Profits

13.3.7. Intergraph Corporation

13.3.7.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.7.2. Market Presence, By Segment and Geography

13.3.7.3. Key Developments

13.3.7.4. Strategy and Historical Roadmap

13.3.7.5. Revenue and Operating Profits

13.3.8. videoNEXT Federal, Inc.

13.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.8.2. Market Presence, By Segment and Geography

13.3.8.3. Key Developments

13.3.8.4. Strategy and Historical Roadmap

13.3.8.5. Revenue and Operating Profits

13.3.9. S2 Security Corporation

13.3.9.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.9.2. Market Presence, By Segment and Geography

13.3.9.3. Key Developments

13.3.9.4. Strategy and Historical Roadmap

13.3.9.5. Revenue and Operating Profits

13.3.10. Milestone Systems A/S.

13.3.10.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.10.2. Market Presence, By Segment and Geography

13.3.10.3. Key Developments

13.3.10.4. Strategy and Historical Roadmap

13.3.10.5. Revenue and Operating Profits

13.3.11. Genetec Inc.

13.3.11.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.11.2. Market Presence, By Segment and Geography

13.3.11.3. Key Developments

13.3.11.4. Strategy and Historical Roadmap

13.3.11.5. Revenue and Operating Profits

13.3.12. AxxonSoft

13.3.12.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.12.2. Market Presence, By Segment and Geography

13.3.12.3. Key Developments

13.3.12.4. Strategy and Historical Roadmap

13.3.12.5. Revenue and Operating Profits

14. Key Takeaways

List of Tables

Table 1: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 2: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 3: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 4: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 5: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 6: Global Physical Information Management Market Size (US$ Mn) Forecast, by End-User, 2014 – 2024

Table 7: Global Physical Security Information Management Market Size (US$ Mn) Forecast, by Region, 2014 – 2024

Table 8: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 9: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 10: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 11: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 12: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 13: North America Physical Information Management Market Size (US$ Mn) Forecast, by End-user, 2014 – 2024

Table 14: North America Physical Security Information Management Market Size (US$ Mn) Forecast, by Country, 2014 – 2024

Table 15: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 16: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 17: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 18: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 19: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 20: Europe Physical Information Management Market Size (US$ Mn) Forecast, by End-user, 2014 – 2024

Table 21: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, by Country, 2014 – 2024

Table 22: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 23: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 24: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 25: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 26: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 27: Asia Pacific Physical Information Management Market Size (US$ Mn) Forecast, by End-user, 2014 – 2024

Table 28: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, by Country, 2014 – 2024

Table 29: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 30: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 31: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 32: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 33: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 34: MEA Physical Information Management Market Size (US$ Mn) Forecast, by End-user, 2014 – 2024

Table 35: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, by Country, 2014 – 2024

Table 36: South America Physical Security Information Management Market Size (US$ Mn) Forecast, by Component, 2014 – 2024

Table 37: South America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, 2014 – 2024

Table 38: South America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Off-the Shelf, 2014 – 2024

Table 39: South America Physical Security Information Management Market Size (US$ Mn) Forecast, by Software, Customized, 2014 – 2024

Table 40: South America Physical Security Information Management Market Size (US$ Mn) Forecast, by Service, 2014 – 2024

Table 41: South America Physical Information Management Market Size (US$ Mn) Forecast, by End-user, 2014 – 2024

List of Figures

Figure 01: Global Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 02: Global Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 03: Market Value Share, by End-user (%), 2016

Figure 04: Market Value Share, by Component (%), 2016

Figure 05: Global Opportunity Growth Analysis (US$ Mn), 2014 - 2024

Figure 06: Global Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 07: Market Size (US$ Mn) Forecast by Component - Software

Figure 08: Market Size (US$ Mn) Forecast by Component - Service

Figure 09: Global Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 10: Market Size (US$ Mn) Forecast by Software - Off-the Shelf

Figure 11: Market Size (US$ Mn) Forecast by Software - Customized

Figure 12: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 13: Market Share (Value %) Forecast by Software, Customized

Figure 14: Global Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 15: Market Size (US$ Mn) Forecast by Service, Installation/System Integration

Figure 16: Market Size (US$ Mn) Forecast by Service, Operation & Maintenance

Figure 17: Market Size (US$ Mn) Forecast by Service, Consulting & Training

Figure 18: Physical Security Information Management Market Attractiveness, by Component

Figure 19: Global Physical Security Information Management Market Value Share Analysis, by End-User, 2016 and 2024

Figure 20: Market Size (US$ Mn) Forecast by End-User, Residential

Figure 21: Market Size (US$ Mn) Forecast by End-User, Retail

Figure 22: Market Size (US$ Mn) Forecast by End-User, BFSI

Figure 23: Market Size (US$ Mn) Forecast by End-User, Telecom & IT

Figure 24: Market Size (US$ Mn) Forecast by End-User, Transportation & Logistics

Figure 25: Market Size (US$ Mn) Forecast by End-User, Government & Defense Sector

Figure 26: Market Size (US$ Mn) Forecast by End-User, Hospitality

Figure 27: Market Size (US$ Mn) Forecast by End-User, Industrial Manufacturing

Figure 28: Market Size (US$ Mn) Forecast by End-User, Energy & Utility

Figure 29: Market Size (US$ Mn) Forecast by End-User, Healthcare

Figure 30: Market Size (US$ Mn) Forecast by End-User, Others

Figure 31: Physical Security Information Management Market Analysis, by End-User (Top 6)

Figure 32: Global Physical Security Information Management Market Value Share Analysis, by Region, 2016 and 2024

Figure 33: Physical Security Information Management Market Attractiveness Analysis, by Region

Figure 34: North America Price Trend Analysis

Figure 35: North America Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 36: North America Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 37: North America Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 38: North America Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 39: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 40: Market Share (Value %) Forecast by Software, Customized

Figure 41: North America Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 42: North America Physical Security Information Management Market Value Share Analysis, by End-user, 2016 and 2024

Figure 43: North America Physical Security Information Management Market Value Share Analysis, by Country, 2016 and 2024

Figure 44: Market Attractiveness, by Component (2015)

Figure 45: Market Attractiveness, by End-user (2015)

Figure 46: Market Attractiveness, by Country (2015)

Figure 47: Europe Price Trend Analysis

Figure 48: Europe Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 49: Europe Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 50: Europe Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 51: Europe Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 52: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 53: Market Share (Value %) Forecast by Software, Customized

Figure 54: Europe Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 55: Europe Physical Security Information Management Market Value Share Analysis, by End-user, 2016 and 2024

Figure 56: Europe Physical Security Information Management Market Value Share Analysis, by Country, 2016 and 2024

Figure 57: Market Attractiveness, by Component (2015)

Figure 58: Market Attractiveness, by End-user (2015)

Figure 59: Market Attractiveness, by Country (2015)

Figure 60: Asia Pacific Price Trend Analysis

Figure 61: Asia Pacific Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 62: Asia Pacific Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 63: Asia Pacific Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 64: Asia Pacific Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 65: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 66: Market Share (Value %) Forecast by Software, Customized

Figure 67: Asia Pacific Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 68: Asia Pacific Physical Security Information Management Market Value Share Analysis, by End-user, 2016 and 2024

Figure 69: Asia Pacific Physical Security Information Management Market Value Share Analysis, by Country, 2016 and 2024

Figure 70: Market Attractiveness, by Component (2015)

Figure 71: Market Attractiveness, by End-user (2015)

Figure 72: Market Attractiveness, by Country (2015)

Figure 73: MEA Price Trend Analysis

Figure 74: MEA Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 75: MEA Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 76: MEA Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 77: MEA Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 78: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 79: Market Share (Value %) Forecast by Software, Customized

Figure 80: MEA Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 81: MEA Physical Security Information Management Market Value Share Analysis, by End-user, 2016 and 2024

Figure 82: MEA Physical Security Information Management Market Value Share Analysis, by Country, 2016 and 2024

Figure 83: Market Attractiveness, by Component (2015)

Figure 84: Market Attractiveness, by End-user (2015)

Figure 85: Market Attractiveness, by Country (2015)

Figure 86: South America Price Trend Analysis

Figure 87: South America Physical Security Information Management Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 88: South America Physical Security Information Management Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 89: South America Physical Security Information Management Market Value Share Analysis, by Component, 2016 and 2024

Figure 90: South America Physical Security Information Management Market Value Share Analysis, by Software, 2016 and 2024

Figure 91: Market Share (Value %) Forecast by Software, Off-the Shelf

Figure 92: Market Share (Value %) Forecast by Software, Customized

Figure 93: South America Physical Security Information Management Market Value Share Analysis, by Service, 2016 and 2024

Figure 94: South America Physical Security Information Management Market Value Share Analysis, by End-user, 2016 and 2024

Figure 95: South America Physical Security Information Management Market Value Share Analysis, by Country, 2016 and 2024

Figure 96: Market Attractiveness, by Component (2015)

Figure 97: Market Attractiveness, by End-user (2015)

Figure 98: Market Attractiveness, by Country (2015)

Figure 99: Global Physical Security Information Management Market Share Analysis by Company (2015)