Analysts’ Viewpoint

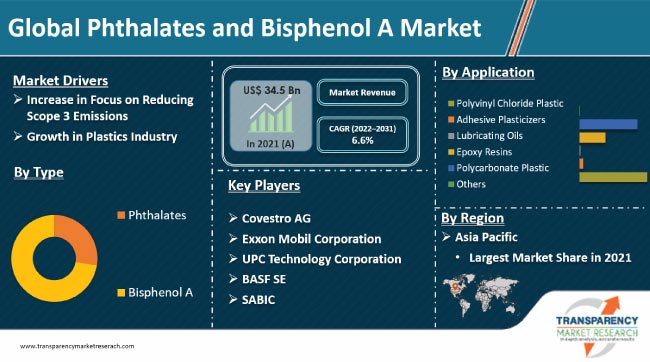

The phthalates and bisphenol A market size is estimated to grow at a steady pace during the forecast period, primarily due to the wide usage of these chemical building blocks in the plastics industry. Phthalates, a family of industrial chemicals, are used to soften PVC plastic. They are also employed as solvents in cosmetics and other consumer products. Extensive usage of bisphenol A (BPA) in the manufacture of polycarbonate plastic, a shatter-resistant and clear material used in products such as plastic bottles, food containers, and sports safety equipment, is also anticipated to boost market development.

Scientific evidence suggests that BPA and phthalates may be associated with various health issues. Therefore, market players are investing significantly in R&D activities to develop greener and bio-based alternatives to ensure environmental safety.

Phthalates and BPA are referred to as ‘everywhere chemicals,’ due to their extensive application in various plastic products that are used in daily life. However, the usage of BPA and phthalates in consumer products can lead to health concerns. Nevertheless, these chemicals are still being employed in various products, as it is difficult to develop economical and safe replacements.

Phthalates, often called plasticizers, are a group of chemicals employed to make plastics more durable. Some phthalates help dissolve other materials. Phthalates are employed in various products such as lubricating oils, personal care products (shampoos, hair sprays, and soaps), and vinyl flooring.

BPA is a colorless, crystalline solid belonging to the family of organic compounds. It is best known for its usage in the manufacture of polycarbonate plastics and epoxy resins, particularly those found in water bottles, baby bottles, and food and beverage containers.

Companies across the globe are striving to lower greenhouse gas (GHG) emissions. They are regularly assessing their energy usage in offices, factories, warehouses, and fleets. Companies are also concentrating on reducing their scope 3 emissions, which arise from activities in a wider value chain.

The impact of scope 3 emissions varies from one company or industry to another. Large amounts of emissions occur upstream via suppliers and raw materials. Development of the scope 3 strategy begins with understanding the implications of a specific business. Companies are anticipated to work closely with suppliers and customers in order to measure and manage these emissions. Organizations that approach scope 3 emissions systematically and strategically not only make progress on commitments, but also reap significant benefits, such as an increase in market share.

Reporting on scope 3 is not yet mandatory in the U.S. However, it is a requirement of the Science-based Targets Initiative’s (SBTi) Net Zero Standard, with which more than 3,000 global organizations are affiliated. The International Sustainability Standards Board (ISSB) and the U.S. Electronic Subcontracting Reporting System (eSRS) have also drafted recommendations requiring some disclosure of scope 3 emissions. The ISSB also requires qualitative information to explain how reported emissions were calculated.

Advancements in material science and engineering have led to widespread and diverse usage of plastics in various products. Plastics help make products cheaper, lighter, stronger, safer, and more durable and versatile. Therefore, they are employed significantly in consumer goods. Thus, expansion in the plastics industry is contributing to phthalates and bisphenol A market growth.

Plastics can be designed to keep food fresh for longer periods of time. They also provide therapeutic benefits through time-release pharmaceuticals and other medical applications. Furthermore, they can prevent electronics and other household items from starting or spreading fires. Phthalates are regularly added to PVC (vinyl) products to soften and make them more flexible. They allow manufacturers to create products that possess all the vital qualities of vinyl (resistance to oxygen and chemicals, durability, etc.), while being flexible and resistant to breakage.

High-molecular weight phthalates, such as di(2-ethylhexyl) phthalate (DEHP) and diisononyl phthalate (DiNP), are employed as plasticizers to impart flexibility to polyvinyl chloride (PVC) materials that are used to make food packaging, flooring, and medical equipment. On the other hand, low-molecular weight phthalates, such as diethyl phthalate (DEP) and dibutyl phthalate (DBP), are added to shampoos, lotions, and other personal care products to preserve their fragrance.

BPA is used in the industrial manufacture of polycarbonate plastic products. These comprise common consumer goods such as reusable plastic tableware and bottles for drinks, CDs and DVDs, and sports equipment. Epoxy resins that contain BPA are used to coat the inside of water pipes and food and beverage cans in order to improve their shelf life. Epoxy resins containing BPA also help avoid the feeling of strong metallic taste in food or drinks.

In terms of type, the phthalates and bisphenol A industry has been bifurcated into phthalates and bisphenol A. The bisphenol A segment holds higher market share.

Wide usage of BPA in the manufacture of polycarbonate, a hard, clear plastic that is used in various consumer products, is anticipated to drive the bisphenol A segment during the forecast period. The segment is projected to grow at a CAGR of 7.4% in terms of value during the forecast period.

According to the phthalates and bisphenol A market analysis, the business size increased significantly in Asia Pacific in 2021. This trend is expected to continue during the forecast period. The region is anticipated to offer lucrative opportunities for manufacturers during the forecast period, led by the rise in usage of chemicals, primarily in the plastics sector. In terms of value, Asia Pacific held 44.6% share in 2021.

Europe is an attractive region of the global phthalates and bisphenol A (BPA) industry. The region accounted for 25.1% share in 2021. Germany is driving market progress in the region primarily due to the rise in investments in the plastics sector in the country.

The market in Latin America and Middle East & Africa is expected to expand at a moderate pace during the forecast period. These regions held 10.1% and 6.3%, respectively, in 2021.

The global market is highly consolidated. A small number of large-scale vendors control major share, as per the phthalates and bisphenol A market research report. Most of the companies are making substantial investments in R&D activities to introduce environmentally-friendly products.

Key players are expanding their product portfolios and carrying out mergers and acquisitions to increase their market share. Covestro AG, Exxon Mobil Corporation, UPC Technology Corporation, BASF SE, and SABIC are some of the prominent participants in the phthalates and bisphenol A market.

Key players have been profiled in the phthalates and bisphenol A market report based on parameters such as company overview, product portfolio, business strategies, financial overview, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 34.5 Bn |

|

Market Forecast Value in 2031 |

US$ 65.0 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 34.5 Bn in 2021

The industry is expected to grow at a CAGR of 6.6% from 2022 to 2031

Focus on reduction of scope 3 emissions and growth in plastics industry

Bisphenol A was the largest type segment that held 73.1% value share in 2021

Asia Pacific was the most lucrative region that held 44.6% share in 2021

Covestro AG, Exxon Mobil Corporation, UPC Technology Corporation, BASF SE, and SABIC

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Phthalates and Bisphenol A Market Analysis and Forecast, 2022-2031

2.6.1. Global Phthalates and Bisphenol A Market Volume (Thousand Tons)

2.6.2. Global Phthalates and Bisphenol A Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Type Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Phthalates and Bisphenol A

3.2. Impact on the Demand of Phthalates and Bisphenol A– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Import Export Analysis

6. Production Output Analysis (Thousand Tons), 2021

6.1. North America

6.2. Europe

6.3. Asia Pacific

6.4. Latin America

6.5. Middle East and Africa

7. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

7.1. Price Comparison Analysis by Type

7.2. Price Comparison Analysis by Region

8. Global Phthalates and Bisphenol A Market Analysis and Forecast, by Type, 2022–2031

8.1. Key Findings

8.2. Global Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

8.2.1. Phthalates

8.2.1.1. Benzyl Butyl Phthalate (BBzP)

8.2.1.2. Diisobutyl Phthalate (DiBP)

8.2.1.3. Dibutyl Phthalate (DnBP)

8.2.1.4. Diisodecyl Phthalate (DIDP)

8.2.1.5. Dipropylheptyl Phthalate (DPHP)

8.2.1.6. Diisononyl Phthalate (DINP)

8.2.1.7. Di (2-ethylhexyl) Phthalate (DEHP)

8.2.1.8. Others

8.2.2. Bisphenol A

8.3. Global Phthalates and Bisphenol A Market Attractiveness, by Type

9. Global Phthalates and Bisphenol A Market Analysis and Forecast, by Application, 2022–2031

9.1. Key Findings

9.2. Global Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.2.1. Polyvinyl Chloride Plastic

9.2.2. Adhesive Plasticizers

9.2.3. Lubricating Oils

9.2.4. Epoxy Resins

9.2.5. Polycarbonate Plastic

9.2.6. Others

9.3. Global Phthalates and Bisphenol A Market Attractiveness, by Application

10. Global Phthalates and Bisphenol A Market Analysis and Forecast, End-use, 2022–2031

10.1. Key Findings

10.2. Global Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

10.2.1. Construction

10.2.2. Automotive

10.2.3. Food and Beverage

10.2.4. Medical

10.2.5. Electronics

10.2.6. Sports

10.2.7. Personal Care

10.2.8. Textile

10.2.9. Adhesive

10.2.10. Others

10.3. Global Phthalates and Bisphenol A Market Attractiveness, by End-use

11. Global Phthalates and Bisphenol A Market Analysis and Forecast, by Region, 2022–2031

11.1. Key Findings

11.2. Global Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Phthalates and Bisphenol A Market Attractiveness, by Region

12. North America Phthalates and Bisphenol A Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. North America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.3. North America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.4. North America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

12.5. North America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

12.5.1. U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.5.2. U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.3. U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

12.5.4. Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.5.5. Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.6. Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

12.6. North America Phthalates and Bisphenol A Market Attractiveness Analysis

13. Europe Phthalates and Bisphenol A Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.3. Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.4. Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5. Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.5.1. Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.2. Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.3. Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.4. France Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.5. France Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.6. France Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.7. U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.8. U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.9. U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.10. Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.11. Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.12. Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.13. Italy Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.14. Italy. Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.15. Italy Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.16. Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.17. Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.18. Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.5.19. Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.5.20. Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.21. Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.6. Europe Phthalates and Bisphenol A Market Attractiveness Analysis

14. Asia Pacific Phthalates and Bisphenol A Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type

14.3. Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.4. Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5. Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.5.1. China Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.2. China Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.3. China Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.4. Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.5. Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.6. Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.7. India Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.8. India Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.9. India Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.10. South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.11. South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.12. South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.13. Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.14. Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.15. Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.16. ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.17. ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.18. ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.5.19. Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.5.20. Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.21. Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.6. Asia Pacific Phthalates and Bisphenol A Market Attractiveness Analysis

15. Latin America Phthalates and Bisphenol A Market Analysis and Forecast, 2022–2031

15.1. Key Findings

15.2. Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

15.3. Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.4. Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

15.5. Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

15.5.1. Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

15.5.2. Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.5.3. Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

15.5.4. Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

15.5.5. Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.5.6. Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

15.5.7. Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

15.5.8. Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.5.9. Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

15.6. Latin America Phthalates and Bisphenol A Market Attractiveness Analysis

16. Middle East & Africa Phthalates and Bisphenol A Market Analysis and Forecast, 2022–2031

16.1. Key Findings

16.2. Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.3. Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.4. Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5. Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

16.5.1. GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.2. GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.3. GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.4. UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.5. UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.6. UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.7. Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.8. Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.9. Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.10. Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.11. Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.12. Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.13. Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.14. Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.15. Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.16. Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.17. Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.18. Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.19. Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.20. Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.21. Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.22. South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.23. South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.24. South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.5.25. Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2022–2031

16.5.26. Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.27. Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

16.6. Middle East & Africa Phthalates and Bisphenol A Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2021

17.3. Market Footprint Analysis

17.3.1. By Type

17.3.2. By End-use

17.4. Company Profiles

17.4.1. Covestro AG

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Type Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.2. Exxon Mobil Corporation

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.3. UPC Technology Corporation

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.4. Shandong Qilu Plasticizer Co Ltd

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.5. Zhenjiang Union Chemical Industry Co., Ltd.

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.6. Zhuhai Unicizers Industrial Co Ltd

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.7. BASF SE

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.8. DIC CORPORATION

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.9. LG Chem

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.10. Mitsui Chemicals

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.11. Evonik Industries AG

17.4.11.1. Company Revenue

17.4.11.2. Business Overview

17.4.11.3. Product Segments

17.4.11.4. Geographic Footprint

17.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.12. SABIC

17.4.12.1. Company Revenue

17.4.12.2. Business Overview

17.4.12.3. Product Segments

17.4.12.4. Geographic Footprint

17.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.13. Eastman Chemical Company

17.4.13.1. Company Revenue

17.4.13.2. Business Overview

17.4.13.3. Product Segments

17.4.13.4. Geographic Footprint

17.4.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.14. Perstorp Holding AB

17.4.14.1. Company Revenue

17.4.14.2. Business Overview

17.4.14.3. Product Segments

17.4.14.4. Geographic Footprint

17.4.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.15. Shandong Hongxin Chemicals Co. Ltd.

17.4.15.1. Company Revenue

17.4.15.2. Business Overview

17.4.15.3. Product Segments

17.4.15.4. Geographic Footprint

17.4.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.16. KUMHO P&B CHEMICALS. INC

17.4.16.1. Company Revenue

17.4.16.2. Business Overview

17.4.16.3. Product Segments

17.4.16.4. Geographic Footprint

17.4.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.16.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

17.4.17. NAN YA PLASTICS CORPORATION

17.4.17.1. Company Revenue

17.4.17.2. Business Overview

17.4.17.3. Product Segments

17.4.17.4. Geographic Footprint

17.4.17.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.17.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 2: Global Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 3: Global Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 4: Global Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 5: Global Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 6: Global Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 7: Global Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Region, 2022–2031

Table 8: Global Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 9: North America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 10: North America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 11: North America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 12: North America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 13: North America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 14: North America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 15: North America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Country, 2022–2031

Table 16: North America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 17: U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 18: U.S. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 19: U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 20: U.S. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: U.S. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 22: U.S. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 23: Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 24: Canada Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 25: Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 26: Canada Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 27: Canada Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 28: Canada Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 29: Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 30: Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 31: Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 32: Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 33: Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 34: Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 35: Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2022–2031

Table 36: Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 37: Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 38: Germany Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 39: Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 40: Germany Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 41: Germany Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 42: Germany Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 43: France Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 44: France Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 45: France Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 46: France Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 47: France Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 48: France Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 49: U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 50: U.K. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 51: U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 52: U.K. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 53: U.K. Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 54: U.K. Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 55: Italy Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 56: Italy Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 57: Italy Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 58: Italy Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 59: Italy Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 60: Italy Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 61: Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 62: Netherlands Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 63: Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 64: Netherlands Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 65: Netherlands Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 66: Netherlands Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 67: Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 68: Russia & CIS Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 69: Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 70: Russia & CIS Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 71: Russia & CIS Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 72: Russia & CIS Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 73: Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 74: Rest of Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 75: Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 76: Rest of Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 77: Rest of Europe Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 78: Rest of Europe Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 79: Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 80: Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 81: Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 82: Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 83: Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 84: Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 85: Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 87: China Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 88: China Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type 2022–2031

Table 89: China Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 90: China Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 91: China Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 92: China Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 93: Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 94: Japan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 95: Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 96: Japan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 97: Japan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 98: Japan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 99: India Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 100: India Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 101: India Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 102: India Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 103: India Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 104: India Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 105: South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 106: South Korea Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 107: South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 108: South Korea Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 109: South Korea Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 110: South Korea Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 111: Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 112: Taiwan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 113: Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 114: Taiwan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 115: Taiwan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 116: Taiwan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 117: ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 118: ASEAN Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 119: ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 120: ASEAN Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 121: ASEAN Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 122: ASEAN Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 123: Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 124: Rest of Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 125: Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 126: Rest of Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 127: Rest of Asia Pacific Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 128: Rest of Asia Pacific Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 129: Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 130: Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 131: Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 132: Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 133: Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 134: Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 135: Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2022–2031

Table 136: Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 137: Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 138: Brazil Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 139: Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 140: Brazil Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 141: Brazil Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 142: Brazil Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 143: Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 144: Mexico Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 145: Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 146: Mexico Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 147: Mexico Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 148: Mexico Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 149: Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 150: Rest of Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 151: Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 152: Rest of Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 153: Rest of Latin America Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 154: Rest of Latin America Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 155: Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 156: Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 157: Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 158: Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 159: Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 160: Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 161: Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2022–2031

Table 162: Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 163: GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 164: GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 165: GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 166: GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 167: GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 168: GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 169: GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Sub-country, 2022–2031

Table 170: GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Sub-country, 2022–2031

Table 171: UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 172: UAE Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 173: UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 174: UAE Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 175: UAE Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 176: UAE Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 177: Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 178: Saudi Arabia Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 179: Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 180: Saudi Arabia Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 181: Saudi Arabia Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 182: Saudi Arabia Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 183: Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 184: Rest of GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 185: Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 186: Rest of GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 187: Rest of GCC Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 188: Rest of GCC Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 189: Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 190: Iran Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 191: Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 192: Iran Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 193: Iran Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 194: Iran Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 195: Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 196: Uzbekistan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 197: Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 198: Uzbekistan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 199: Uzbekistan Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 200: Uzbekistan Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 201: Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 202: Turkey Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 203: Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 204: Turkey Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 205: Turkey Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 206: Turkey Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 207: South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 208: South Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 209: South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 210: South Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 211: South Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 212: South Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 213: Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Type, 2022–2031

Table 214: Rest of Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 215: Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by Application, 2022–2031

Table 216: Rest of Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 217: Rest of Middle East & Africa Phthalates and Bisphenol A Market Volume (Thousand Tons) Forecast, by End-use, 2022–2031

Table 218: Rest of Middle East & Africa Phthalates and Bisphenol A Market Value (US$ Mn) Forecast, by End-use, 2022–2031

List of Figures

Figure 1: Global Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 2: Global Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 3: Global Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 4: Global Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 5: Global Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 6: Global Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 7: Global Phthalates and Bisphenol A Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 8: Global Phthalates and Bisphenol A Market Attractiveness, by Region

Figure 9: North America Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 10: North America Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 11: North America Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 12: North America Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 13: North America Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 14: North America Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 15: North America Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 16: North America Phthalates and Bisphenol A Market Attractiveness, by Country and Sub-region

Figure 17: Europe Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 18: Europe Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 19: Europe Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 20: Europe Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 21: Europe Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 22: Europe Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 23: Europe Phthalates and Bisphenol A Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Europe Phthalates and Bisphenol A Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 26: Asia Pacific Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 27: Asia Pacific Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 28: Asia Pacific Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 29: Asia Pacific Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 30: Asia Pacific Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 31: Asia Pacific Phthalates and Bisphenol A Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 32: Asia Pacific Phthalates and Bisphenol A Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 34: Latin America Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 35: Latin America Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 36: Latin America Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 37: Latin America Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 38: Latin America Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 39: Latin America Phthalates and Bisphenol A Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 40: Latin America Phthalates and Bisphenol A Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Phthalates and Bisphenol A Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 42: Middle East & Africa Phthalates and Bisphenol A Market Attractiveness, by Type

Figure 43: Middle East & Africa Phthalates and Bisphenol A Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 44: Middle East & Africa Phthalates and Bisphenol A Market Attractiveness, by Application

Figure 45: Middle East & Africa Phthalates and Bisphenol A Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 46: Middle East & Africa Phthalates and Bisphenol A Market Attractiveness, by End-use

Figure 47: Middle East & Africa Phthalates and Bisphenol A Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 48: Middle East & Africa Phthalates and Bisphenol A Market Attractiveness, by Country and Sub-region