Analysts’ Viewpoint

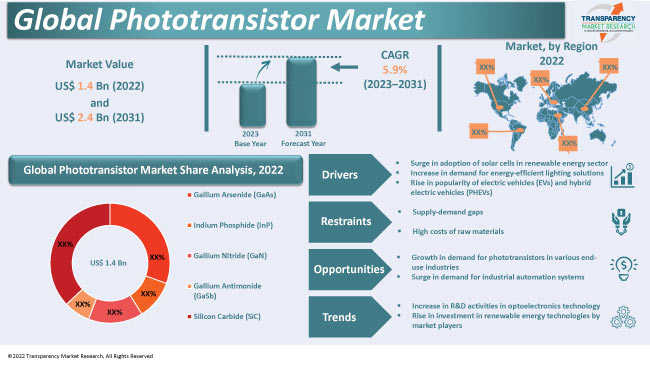

Increase in demand for automation in several end-use industries including automotive, aerospace & defense, consumer electronics, IT & telecommunication, healthcare, and energy & power is boosting the demand for phototransistors. This is expected to drive the global phototransistor market size during the forecast period. Moreover, rise in adoption of electric vehicles and increase in investment in renewable energy plants in developed and developing nations are some of the key factors fueling phototransistor market development.

Companies operating in the global market are investing significantly in R&D in optoelectronics technology. Furthermore, leading players are taking efforts to cater to the rise in demand for energy-efficient lighting solutions. However, increase in prices of raw materials is likely to hamper market statistics during the forecast period.

A phototransistor is a type of electronic component that utilizes light exposure to function as a switch and amplifier of electrical current. When the light reaches the junction, a reverse current is generated that is proportional to the amount of light. Therefore, phototransistors are commonly utilized to convert light pulses into digital electrical signals. Phototransistors are powered by light, unlike traditional electronic components that rely on electric current. These components offer a high level of amplification, are relatively low in cost, and are extensively utilized in various applications.

Growth in the automobile industry is creating lucrative opportunities for phototransistor manufacturers operating in the global market. Rise in production of automotive devices and growth in popularity of electric vehicles (EVs) as well as hybrid electric vehicles (PHEVs), worldwide, is driving the demand for phototransistors. Additionally, the automotive industry is being driven by an increase in investment in R&D of automotive technologies and rise in competition among players to expand the usage of phototransistors in automotive applications. Consumers are increasingly preferring environment-friendly transportation options including EVs. Several governments are also taking initiatives to promote energy-efficient electric vehicles. Phototransistors are used in anti-lock braking systems as well as in headlights.

Development of Perovskite Solar Cell (PSC) technology has fueled the creation of a new generation of photovoltaic systems that are affordable, versatile, and highly effective. Thin-film solar cells that utilize organic materials, quantum dots, hybrid materials, and perovskite materials have all witnessed notable enhancements in power conversion efficiencies.

Several governments around the world have started investing significantly in the renewable energy sector due to depletion of fossil fuels and increase in global temperatures. In 2021, the U.S. solar industry received approximately US$ 33.0 Bn in private investment, as reported by the Solar Energy Industries Association. Utilization of solar energy helps reduce pollution and carbon dioxide emissions. In contrast to silicon, organic phototransistor materials are more versatile and cost-effective to manufacture. Solar cells created from these materials exhibit a laboratory efficiency of over 25%. Therefore, increase in adoption of solar energy is contributing to market progress.

In terms of material, the global industry has been classified into gallium arsenide (GaAs), indium phosphide (InP), gallium nitride (GaN), gallium antimonide (GaSb), and silicon carbide (SiC). The silicon carbide material segment dominated the global industry and held major share in 2022. It and is likely to maintain its dominance during the forecast period.

Silicon carbide offers excellent optical and electronics properties. This wide bandgap material is suitable for phototransistors. SiC is not only the lightest, but also the hardest ceramic material, which offers low thermal expansion and high thermal conductivity. Silicon carbide is ideal for applications that demand high sensitivity and high resistance to radiation.

The surface mount packaged type segment held major share of 66.2% in 2022, and it is expected to grow at a prominent CAGR during the forecast period. This is expected to be due to the rise in adoption of surface mount technology for miniaturizing electronic devices. This technology aids in the assembly of several electronic components on PCBs. Additionally, it is generally utilized to manufacture compact and smaller phototransistors that can be integrated into electronics devices.

According to the latest phototransistor market forecast analysis, Asia Pacific is estimated to dominate the global market in the next few years. The phototransistor market growth in Asia Pacific is attributable to the lucrative presence of electronic device manufacturers in countries, such as China, Japan, Taiwan, and South Korea. Furthermore, growth in automotive and renewable energy sectors is contributing to the phototransistor industry growth in Asia Pacific.

Key players in the region are increasingly investing in research and development activities in the field of electronics and semiconductors. This is positively impacting the phototransistor market value in Asia Pacific.

North America is also a major market for phototransistors, and the region held. 29.2% of global market share in 2021. The phototransistor market size in North America is anticipated to increase during the forecast period, owing to the presence of several prominent manufacturing corporations in the region that offer optoelectronics components for various industries.

According to the latest phototransistor industry research analysis, the global market is highly fragmented, with the presence of established players controlling majority of the share. Moreover, several players are following the phototransistor market trends to gain lucrative growth opportunities. These players are implementing innovative strategies to increase their phototransistor market share. Some of the prominent strategies include the expansion of product portfolios, mergers, and collaborations.

Kingbright Company, LLC, LITE-ON Technology, Inc., ROHM CO., LTD., Vishay Intertechnology, Inc., EVERLIGHT ELECTRONICS CO., LTD., Excelitas Technologies Corp., Honeywell International Inc., Toshiba Corporation, and TT Electronics are some of the key players operating in the global market.

Key players have been profiled in the phototransistor market report based on parameters such as company overview, recent developments, business strategies, product portfolio, business segments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.4 Bn |

|

Market Forecast Value in 2031 |

US$ 2.4 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.4 Bn in 2022

It is expected to grow at a CAGR of 5.9% by 2031

It would be worth US$ 2.4 Bn in 2031

The U.S. held approximately 27.2% share in 2022

The surface mount package type segment held major share of 65.2% in 2022

Increase in research & development in the field of optoelectronics technology and growth in investment in renewable energy technology

Asia Pacific is a more lucrative region for vendors

ams-OSRAM International GmbH, Kingbright Company, LLC, LITE-ON Technology, Inc., ROHM CO., LTD, Vishay Intertechnology, Inc., EVERLIGHT ELECTRONICS CO., LTD, Excelitas Technologies Corp., Honeywell International Inc., Toshiba Corporation, TT Electronics., and Würth Elektronik Group

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Phototransistor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Optoelectronics Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Phototransistor Market Analysis, by Material

5.1. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

5.1.1. Gallium Arsenide (GaAs)

5.1.2. Indium Phosphide (InP)

5.1.3. Gallium Nitride (GaN)

5.1.4. Gallium Antimonide (GaSb)

5.1.5. Silicon Carbide (SiC)

5.2. Market Attractiveness Analysis, by Material

6. Global Phototransistor Market Analysis, by Package Type

6.1. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

6.1.1. Surface Mount

6.1.2. Through Hole

6.2. Market Attractiveness Analysis, by Package Type

7. Global Phototransistor Market Analysis, by End-use Industry

7.1. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

7.1.1. Automotive

7.1.2. Aerospace & Defense

7.1.3. Consumer Electronics

7.1.4. IT & Telecommunication

7.1.5. Healthcare

7.1.6. Energy & Power

7.1.7. Others

7.2. Market Attractiveness Analysis, by End-use Industry

8. Global Phototransistor Market Analysis and Forecast, by Region

8.1. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Phototransistor Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

9.3.1. Gallium Arsenide (GaAs)

9.3.2. Indium Phosphide (InP)

9.3.3. Gallium Nitride (GaN)

9.3.4. Gallium Antimonide (GaSb)

9.3.5. Silicon Carbide (SiC)

9.4. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

9.4.1. Surface Mount

9.4.2. Through Hole

9.5. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.5.1. Automotive

9.5.2. Aerospace & Defense

9.5.3. Consumer Electronics

9.5.4. IT & Telecommunication

9.5.5. Healthcare

9.5.6. Energy & Power

9.5.7. Others

9.6. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Material

9.7.2. By Package Type

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Phototransistor Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

10.3.1. Gallium Arsenide (GaAs)

10.3.2. Indium Phosphide (InP)

10.3.3. Gallium Nitride (GaN)

10.3.4. Gallium Antimonide (GaSb)

10.3.5. Silicon Carbide (SiC)

10.4. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

10.4.1. Surface Mount

10.4.2. Through Hole

10.5. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.5.1. Automotive

10.5.2. Aerospace & Defense

10.5.3. Consumer Electronics

10.5.4. IT & Telecommunication

10.5.5. Healthcare

10.5.6. Energy & Power

10.5.7. Others

10.6. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Material

10.7.2. By Package Type

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Phototransistor Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

11.3.1. Gallium Arsenide (GaAs)

11.3.2. Indium Phosphide (InP)

11.3.3. Gallium Nitride (GaN)

11.3.4. Gallium Antimonide (GaSb)

11.3.5. Silicon Carbide (SiC)

11.4. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

11.4.1. Surface Mount

11.4.2. Through Hole

11.5. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. Automotive

11.5.2. Aerospace & Defense

11.5.3. Consumer Electronics

11.5.4. IT & Telecommunication

11.5.5. Healthcare

11.5.6. Energy & Power

11.5.7. Others

11.6. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Material

11.7.2. By Package Type

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Phototransistor Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

12.3.1. Gallium Arsenide (GaAs)

12.3.2. Indium Phosphide (InP)

12.3.3. Gallium Nitride (GaN)

12.3.4. Gallium Antimonide (GaSb)

12.3.5. Silicon Carbide (SiC)

12.4. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

12.4.1. Surface Mount

12.4.2. Through Hole

12.5. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. Automotive

12.5.2. Aerospace & Defense

12.5.3. Consumer Electronics

12.5.4. IT & Telecommunication

12.5.5. Healthcare

12.5.6. Energy & Power

12.5.7. Others

12.6. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Material

12.7.2. By Package Type

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Phototransistor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

13.3.1. Gallium Arsenide (GaAs)

13.3.2. Indium Phosphide (InP)

13.3.3. Gallium Nitride (GaN)

13.3.4. Gallium Antimonide (GaSb)

13.3.5. Silicon Carbide (SiC)

13.4. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

13.4.1. Surface Mount

13.4.2. Through Hole

13.5. Phototransistor Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.5.1. Automotive

13.5.2. Aerospace & Defense

13.5.3. Consumer Electronics

13.5.4. IT & Telecommunication

13.5.5. Healthcare

13.5.6. Energy & Power

13.5.7. Others

13.6. Phototransistor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Material

13.7.2. By Package Type

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Phototransistor Market Competition Matrix - a Dashboard View

14.1.1. Global Phototransistor Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ams-OSRAM International GmbH

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. EVERLIGHT ELECTRONICS CO., LTD

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Excelitas Technologies Corp.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Honeywell International Inc

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Kingbright Company, LLC

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. LITE-ON Material, Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. ROHM CO., LTD

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Toshiba Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. TT Electronics

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Vishay InterMaterial, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Material

16.1.2. By Package Type

16.1.3. By End-use Industry

16.1.4. Region

List of Tables

Table 1: Global Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 2: Global Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 3: Global Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 4: Global Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 5: Global Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 6: Global Phototransistor Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 7: Global Phototransistor Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 8: North America Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 9: North America Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 10: North America Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 11: North America Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 12: North America Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 13: North America Phototransistor Market Size & Forecast, by Country Value (US$ Mn), 2017-2031

Table 14: North America Phototransistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 15: Europe Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 16: Europe Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 17: Europe Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 18: Europe Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 19: Europe Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 20: Europe Phototransistor Market Size & Forecast, by Country Value (US$ Mn), 2017-2031

Table 21: Europe Phototransistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 22: Asia Pacific Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 23: Asia Pacific Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 24: Asia Pacific Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 25: Asia Pacific Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 26: Asia Pacific Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 27: Asia Pacific Phototransistor Market Size & Forecast, by Country Value (US$ Mn), 2017-2031

Table 28: Asia Pacific Phototransistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 29: Middle East & Africa Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 30: Middle East & Africa Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 31: Middle East & Africa Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 32: Middle East & Africa Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 33: Middle East & Africa Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 34: Middle East & Africa Phototransistor Market Size & Forecast, by Country Value (US$ Mn), 2017-2031

Table 35: Middle East & Africa Phototransistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 36: South America Phototransistor Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 37: South America Phototransistor Market Size & Forecast, by Material, Volume (Million Units), 2017-2031

Table 38: South America Phototransistor Market Size & Forecast, by Package Type, Value (US$ Mn), 2017-2031

Table 39: South America Phototransistor Market Size & Forecast, by Package Type Volume (Million Units), 2017-2031

Table 40: South America Phototransistor Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 41: South America Phototransistor Market Size & Forecast, by Country Value (US$ Mn), 2017-2031

Table 42: South America Phototransistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Phototransistor Market Share Analysis, by Region

Figure 02: Global Phototransistor Price Trend Analysis (Average Price, US$)

Figure 03: Global Phototransistor Market, Value (US$ Mn), 2017-2031

Figure 04: Global Phototransistor Market, Volume (Million Units), 2017-2031

Figure 05: Global Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 06: Global Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 07: Global Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 08: Global Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 09: Global Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 10: Global Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 11: Global Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 12: Global Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 13: Global Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 14: Global Phototransistor Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 15: Global Phototransistor Market Share Analysis, by Region, 2022 and 2031

Figure 16: Global Phototransistor Market Attractiveness, By Region, Value (US$ Mn), 2023-2031

Figure 17: North America Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 18: North America Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 19: North America Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 20: North America Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 21: North America Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 22: North America Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 23: North America Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 24: North America Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 25: North America Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 26: North America Phototransistor Market Size & Forecast, by Country Revenue (US$ Mn), 2017-2031

Figure 27: North America Phototransistor Market Share Analysis, by Country 2022 and 2031

Figure 28: North America Phototransistor Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 29: Europe Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 30: Europe Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 31: Europe Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 32: Europe Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 33: Europe Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 34: Europe Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 35: Europe Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 36: Europe Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 37: Europe Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 38: Europe Phototransistor Market Size & Forecast, by Country Revenue (US$ Mn), 2017-2031

Figure 39: Europe Phototransistor Market Share Analysis, by Country 2022 and 2031

Figure 40: Europe Phototransistor Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 41: Asia Pacific Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 42: Asia Pacific Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 43: Asia Pacific Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 44: Asia Pacific Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 45: Asia Pacific Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 46: Asia Pacific Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 47: Asia Pacific Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 48: Asia Pacific Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 49: Asia Pacific Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 50: Asia Pacific Phototransistor Market Size & Forecast, by Country Revenue (US$ Mn), 2017-2031

Figure 51: Asia Pacific Phototransistor Market Share Analysis, by Country 2022 and 2031

Figure 52: Asia Pacific Phototransistor Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 53: Middle East & Africa Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 54: Middle East & Africa Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 55: Middle East & Africa Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 56: Middle East & Africa Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 57: Middle East & Africa Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 58: Middle East & Africa Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 59: Middle East & Africa Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 60: Middle East & Africa Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 61: Middle East & Africa Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 62: Middle East & Africa Phototransistor Market Size & Forecast, by Country Revenue (US$ Mn), 2017-2031

Figure 63: Middle East & Africa Phototransistor Market Share Analysis, by Country 2022 and 2031

Figure 64: Middle East & Africa Phototransistor Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 65: South America Phototransistor Market Size & Forecast, by Material, Revenue (US$ Mn), 2017-2031

Figure 66: South America Phototransistor Market Share Analysis, by Material, 2022 and 2031

Figure 67: South America Phototransistor Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 68: South America Phototransistor Market Size & Forecast, by Packaging Type, Revenue (US$ Mn), 2017-2031

Figure 69: South America Phototransistor Market Share Analysis, by Packaging Type, 2022 and 2031

Figure 70: South America Phototransistor Market Attractiveness, By Packaging Type, Value (US$ Mn), 2023-2031

Figure 71: South America Phototransistor Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 72: South America Phototransistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 73: South America Phototransistor Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 74: South America Phototransistor Market Size & Forecast, by Country Revenue (US$ Mn), 2017-2031

Figure 75: South America Phototransistor Market Share Analysis, by Country 2022 and 2031

Figure 76: South America Phototransistor Market Attractiveness, By Country Value (US$ Mn), 2023-2031