Analyst Viewpoint

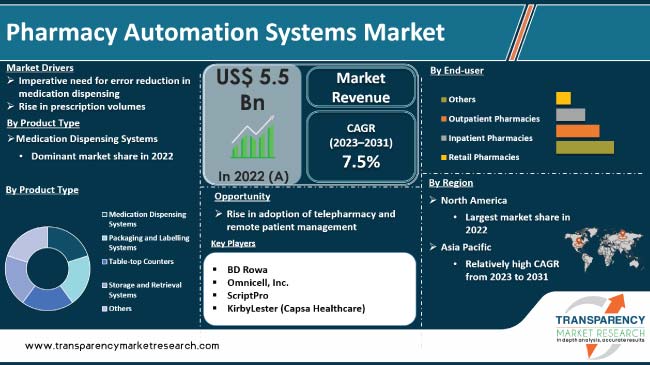

The global pharmacy automation systems market size is experiencing robust growth driven by the increase in demand for efficient and accurate medication dispensing processes. Rise in burden of chronic diseases, coupled with the need to minimize medication errors, is also fueling the adoption of pharmacy automation systems.

The future scope of the pharmacy automation systems market includes ongoing technological advancements, the integration of automation in diverse pharmacy functions, and the potential for increased market penetration globally. Rise in prescription volumes is likely to offer lucrative opportunities to vendors in the global pharmacy automation systems industry.

Pharmacy automation systems are designed to streamline and enhance the efficiency of various tasks within a pharmacy setting. These systems enhance medication management, reduce operational costs, and improve patient safety in healthcare settings. The integration of robotics, artificial intelligence, and advanced software solutions is further amplifying the capabilities of these systems.

The pharmacy automation systems market landscape is poised for continued expansion as pharmacies aim for higher efficiency and improved patient care. Pharmacy automation systems encompass a range of solutions such as automated medication dispensing systems, robotic prescription filling systems, and inventory management systems, enhancing operational efficiency in pharmacies and healthcare facilities.

Increase in adoption of advanced technologies to streamline pharmaceutical processes is boosting the demand for pharmacy automation systems. The imperative need for error reduction in medication dispensing, rise in prevalence of chronic diseases, and expanding global healthcare infrastructure are also driving the pharmacy automation systems market value.

Integration of artificial intelligence and robotics is a notable trend, empowering pharmacies with enhanced precision and speed in medication dispensing. The pharmacy automation systems market trajectory is also shaped by the growing awareness of the benefits of pharmacy automation in minimizing errors, improving patient safety, and optimizing workflow efficiency. The global pharmacy automation systems industry is poised for sustained growth as the healthcare sector continues to prioritize patient-centric care.

The need for pharmaceutical services is rising in the healthcare sector as a result of an aging population, rising rates of chronic illnesses, and population growth in general. The workflows of traditional pharmacies are being strained by this increase in prescription volumes. Pharmacy automation systems, such as prescription verification and robotic dispensing systems, assist pharmacies in effectively managing their growing workload.

Pharmacy wait times are decreased, operational efficiency is increased, and a greater volume of prescriptions can be handled by pharmacies thanks to these systems. Pharmacies are turning more and more to automation in order to meet the growing demand for healthcare services and streamline their operations. This, in turn, is propelling the pharmacy automation systems market revenue.

Pharmacists and pharmacy staff are more likely to make mistakes as a result of stress or exhaustion due to pressure to manage a high volume of prescriptions. By automating repetitive and time-consuming tasks, pharmacy automation lessens this burden and frees up pharmacy staff members to concentrate on more intricate and patient-centered facets of their jobs. This decrease in workload lowers the possibility of human error and promotes a healthier work environment.

According to the latest pharmacy automation systems market trends, the medication dispensing systems product type segment held largest share in 2022. This growth can be ascribed to the escalating demand for efficient, accurate, and secure medication dispensing processes in healthcare settings. Medication dispensing systems offer a comprehensive solution to manage and dispense medications, reducing the risk of errors and enhancing patient safety. Hospitals, clinics, and retail pharmacies are increasingly adopting these systems to optimize workflow and ensure precise medication administration.

Key features such as barcode verification, automated inventory management, and real-time tracking contribute to the segment's attractiveness. The growing emphasis on minimizing medication errors, improving operational efficiency, and enhancing patient care is propelling the adoption of advanced medication dispensing systems.

According to the latest pharmacy automation systems market analysis, the retail pharmacies end-user segment accounted for major share in 2022. Increase in need for operational efficiency, error reduction, and enhanced patient care is boosting the demand for pharmacy automation systems in retail pharmacies.

Pharmacy automation systems offer retail pharmacies a comprehensive solution to streamline medication dispensing processes, manage inventory, and improve overall workflow. The demand for these systems is particularly prominent in retail settings where high prescription volumes require precise and rapid medication dispensing.

Automation technologies such as robotic prescription filling systems, automated dispensing cabinets, and inventory management systems empower retail pharmacies to optimize their operations, reduce errors, and enhance customer service. As retail pharmacies strive to meet the evolving demands of the healthcare landscape and provide efficient pharmaceutical services, the adoption of pharmacy automation systems becomes integral.

According to the latest pharmacy automation systems market insights, North America held largest share in 2022. Presence of robust healthcare infrastructure, high healthcare expenditure, and strong emphasis on technological advancements in the pharmaceutical sector are driving the market dynamics of North America. The widespread adoption of pharmacy automation systems across various healthcare settings, including hospitals, retail pharmacies, and clinics, is contributing significantly to the pharmacy automation systems industry share in North America.

The U.S. was a major market for pharmacy automation systems in 2022. Increase in focus on patient safety, surge in need for operational efficiency, and rise in prevalence of chronic diseases are fueling the pharmacy automation systems market statistics in the country. Regulatory initiatives and healthcare reforms further stimulate the adoption of advanced technologies, making the U.S. a key contributor to the regional market.

Major pharmacy automation system companies are strategically focusing on product innovations, partnerships, and collaborations to consolidate their market presence. They are emphasizing the development of user-friendly and scalable solutions to meet the evolving needs of pharmacies.

The global industry is consolidated, with the presence of a small number of leading automation system providers. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by leading players.

BD Rowa, Omnicell, Inc., ScriptPro, KirbyLester (Capsa Healthcare), Swisslog Healthcare (KUKA), ARxIUM, Parata Systems, LLC, and McKesson Corporation are prominent players operating in this market. Each of these players has been profiled in the pharmacy automation systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 5.5 Bn |

| Market Forecast Value in 2031 | More than US$ 10.7 Bn |

| Growth Rate (CAGR) | 7.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.5 Bn in 2022

It is projected to reach more than US$ 10.7 Bn by the end of 2031

It is anticipated to be 7.5% from 2023 to 2031

Imperative need for error reduction in medication dispensing and rise in prescription volumes

The medication dispensing systems was the largest product type segment in 2022

North America is anticipated to account for the leading share during the forecast period

BD Rowa, Omnicell, Inc., ScriptPro, KirbyLester (Capsa Healthcare), Swisslog Healthcare (KUKA), ARxIUM, Parata Systems, LLC, and McKesson Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pharmacy Automation Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Technological Advancement

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry

6. Global Pharmacy Automation Systems Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Medication Dispensing Systems

6.3.2. Packaging and Labelling Systems

6.3.3. Table-top Counters

6.3.4. Storage and Retrieval Systems

6.3.5. Others (Medication Compounding Systems, etc.)

6.4. Market Attractiveness Analysis, by Product Type

7. Global Pharmacy Automation Systems Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Retail Pharmacies

7.3.2. Inpatient Pharmacies

7.3.3. Outpatient Pharmacies

7.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

7.4. Market Attractiveness Analysis, by End-user

8. Global Pharmacy Automation Systems Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Pharmacy Automation Systems Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017–2031

9.2.1. Medication Dispensing Systems

9.2.2. Packaging and Labelling Systems

9.2.3. Table-top Counters

9.2.4. Storage and Retrieval Systems

9.2.5. Others (Medication Compounding Systems, etc.)

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Retail Pharmacies

9.3.2. Inpatient Pharmacies

9.3.3. Outpatient Pharmacies

9.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Pharmacy Automation Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Medication Dispensing Systems

10.2.2. Packaging and Labelling Systems

10.2.3. Table-top Counters

10.2.4. Storage and Retrieval Systems

10.2.5. Others (Medication Compounding Systems, etc.)

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Retail Pharmacies

10.3.2. Inpatient Pharmacies

10.3.3. Outpatient Pharmacies

10.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Pharmacy Automation Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Medication Dispensing Systems

11.2.2. Packaging and Labelling Systems

11.2.3. Table-top Counters

11.2.4. Storage and Retrieval Systems

11.2.5. Others (Medication Compounding Systems, etc.)

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Retail Pharmacies

11.3.2. Inpatient Pharmacies

11.3.3. Outpatient Pharmacies

11.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealend

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Pharmacy Automation Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Medication Dispensing Systems

12.2.2. Packaging and Labelling Systems

12.2.3. Table-top Counters

12.2.4. Storage and Retrieval Systems

12.2.5. Others (Medication Compounding Systems, etc.)

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Retail Pharmacies

12.3.2. Inpatient Pharmacies

12.3.3. Outpatient Pharmacies

12.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Pharmacy Automation Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Medication Dispensing Systems

13.2.2. Packaging and Labelling Systems

13.2.3. Table-top Counters

13.2.4. Storage and Retrieval Systems

13.2.5. Others (Medication Compounding Systems, etc.)

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Retail Pharmacies

13.3.2. Inpatient Pharmacies

13.3.3. Outpatient Pharmacies

13.3.4. Others (PBMOs, Mail Order Pharmacies, etc.)

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. BD Rowa

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Omnicell, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. ScriptPro

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. KirbyLester (Capsa Healthcare) Automation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Swisslog Healthcare (KUKA)

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. ARxIUM

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Parata Systems, LLC

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. McKesson Corporation

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

List of Tables

Table 01: Global Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 03: Global Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 05: North America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 06: North America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Europe Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Europe Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 09: Europe Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 18: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Pharmacy Automation Systems Market Size, by Product Type, 2022

Figure 02: Global Pharmacy Automation Systems Market Share (%), by Product Type, 2022

Figure 03: Global Pharmacy Automation Systems Market Size, by End-user, 2022

Figure 04: Global Pharmacy Automation Systems Market Share (%), by End-user, 2022

Figure 05: Global Pharmacy Automation Systems Market, by Region (2022 and 2031)

Figure 06: Global Pharmacy Automation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 07: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 08: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 09: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2031

Figure 10: Global Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 11: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 12: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 13: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2031

Figure 14: Global Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 15: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Region, 2022 and 2031

Figure 16: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Region, 2022

Figure 17: Global Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Region, 2031

Figure 18: Global Pharmacy Automation Systems Market Attractiveness Analysis, by Region, 2023–2031

Figure 19: North America Pharmacy Automation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 20: North America Pharmacy Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Pharmacy Automation Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 22: North America Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 23: North America Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 24: North America Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 25: North America Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 26: Europe Pharmacy Automation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 27: Europe Pharmacy Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 28: Europe Pharmacy Automation Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 29: Europe Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 30: Europe Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 31: Europe Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 32: Europe Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 33: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 34: Asia Pacific Pharmacy Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 35: Asia Pacific Pharmacy Automation Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 36: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 37: Asia Pacific Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 38: Asia Pacific Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 39: Asia Pacific Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 40: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 41: Latin America Pharmacy Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 42: Latin America Pharmacy Automation Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 43: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 44: Latin America Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 45: Latin America Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 46: Latin America Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 47: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 48: Middle East & Africa Pharmacy Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 49: Middle East & Africa Pharmacy Automation Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 50: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 51: Middle East & Africa Pharmacy Automation Systems Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 52: Middle East & Africa Pharmacy Automation Systems Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 53: Middle East & Africa Pharmacy Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031