Global Pharmaceutical Hot Melt Extrusion Market: Snapshot

The global market for pharmaceutical hot melt extrusion has gained a significant momentum, thanks to the versatile usage of the extrudate. The upswing in the popularity of hot melt extrusion, on account of the increasing awareness among consumers regarding the benefits it offers compared to the conventional processing techniques, such as reduced time to market and optimized product efficiency, is also supporting the growth of this market substantially.

On the other hand, the rising concerns over the quality and the non-compliance of regulatory requirements have been restraining the market’s progression. Apart from this, the inadequacy of the formulation due to the properties of API and incompetence in delivering on-time supplies may also restrict this market from growing steadily in the near future.

The opportunity in the global market for pharmaceutical hot melt extrusion is likely to increase from a value of US$26.6 mn in 2015 to US$36.4 mn by 2024, swelling at a CAGR of 3.90% during the period from 2016 to 2024. In terms of volume, the market is expected to expand at a CAGR of more than 4.7% over the same period of time.

Strong Presence of Established Players to Ensure North America’s Dominance

On the regional front, the worldwide market for pharmaceutical hot melt extrusion has been categorized into North America, Asia Pacific, Latin America, Europe, and the Middle East and Africa. With a share of nearly 38%, North America led the global market in 2015. Thanks to the presence of a number of established players, this regional market is likely to continue to dominate over the next few years.

Europe has also been witnessing steady growth in its market for pharmaceutical hot melt extrusion and is expected to remain so due to the high demand for improved medical equipment and the increasing adoption of extruders. However, it is Asia Pacific, which will exhibit the most prominent growth rate over the forthcoming years.

The increasing research and development initiatives and the improving situation of the healthcare facilities in emerging economies, such as China, India, and Japan, Asia Pacific is likely to boost the Asia Pacific market for pharmaceutical hot melt extrusion in the near future. The increasing standard of medical and healthcare infrastructure and the rising number of government initiatives is also projected to reflect positively on this regional market in the years to come.

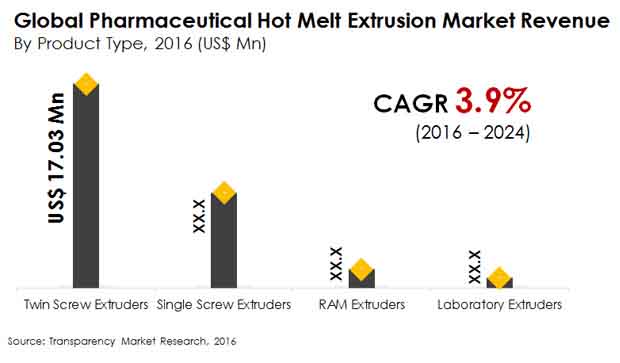

Demand for Twin Screw Extruders to Remain High

Based on the type of products, the global pharmaceutical hot melt extrusion market is classified into single screw extruder, twin screw extruder, laboratory extruder, and RAM extruder. Among these, the twin screw extruders segment is the key contributor to this market currently and is anticipated to remain enjoying most prominent demand over the coming years. Laboratory extruders, among other products, are likely to demonstrate a greater rate of demand in the near future.

At the forefront of the global pharmaceutical hot melt extrusion market are Baker Perkins Ltd., Coperion GmbH, Gabler GmbH & Co. KG, Leistritz AG, Milacron Holdings Corp., Thermo Fisher Scientific Inc., and Xtrutech Ltd.

Pharmaceutical Hot Melt Extrusion Market to Thrive on Rise in the Number of New Drugs with Low Bioavailability

The method of applying heat and pressure to melt a polymer and then pushing it into an orifice in a continual process is known as hot melt extrusion. In the food, plastic, and rubber sectors, it is a commonly used packaging technology. More than half of all plastic materials, including panels, cylinders, food, bags, fibres, foams, and films are made with hot melt extrusion (HME). Growing prominence of the technology in the pharmaceutical sector is likely to foster growth of the global pharmaceutical hot melt extrusion market in the years to come

Growing Awareness about the Benefits of the Process to Spell Growth for the Market

The use of the hot melt extrusion (HME) method in systems of drug-delivery systems, mostly transdermal patches and in the forms of solid dosage, has been prompted by the emergence of new medications with difficult solubility and bioavailability. Hot melt extrusion makes use of pressure, heat, and agitation to combine materials and force them into the desired shape via an extrusion tube. The rising demand for hot melt extrusion in pharmaceutical applications is being driven by an increase in the number of new drugs with low bioavailability and the introduction of such drugs to the market. This factor is foreseen to trigger expansion of the global pharmaceutical hot melt extrusion market in the years to come.

The growing understanding among vendors about the benefits of adopting pharmaceutical hot melt extrusion over conventional processing methods is estimated to be the key growth driver of the global pharmaceutical hot melt extrusion market. In the manufacture of hot melt extrusion, adjusting the functional parameters is relatively easy. As a result, the screw components can now be conveniently modified to accommodate different agitator styles. Hot melt extrusion has also aided in the suit optimization in a specific cases. The die plates may also be swapped depending on the extrude diameter. As a result of these features and advantages, the demand for pharmaceutical hot melt extrusion is increasing, resulting in market growth.

The market has been segmented as below:

|

By Product Type |

|

|

By End Users |

|

|

By Region |

|

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pharmaceutical Hot Melt Extrusion Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.4.4. Trends

4.5. Global Pharmaceutical Hot Melt Extrusion Analysis and Forecasts, 2016–2024

4.5.1. Market Volume Projections, 2016–2024

4.5.3. Market Revenue Projections (US$ Mn)

4.6. Pharmaceutical Hot Melt Extrusion - Global Supply Demand Scenario

4.7. Porter’s Five Force Analysis

4.8. Value Chain Analysis

4.9. Market Outlook

4.10. Technology Assessment Analysis

4.11. cGMP Regulations

4.12. CMO/Pharma Company End-User Licensing

5. Global Pharmaceutical Hot Melt Extrusion Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value and Volume Forecast By Product, 2016–2024

5.4.1. Twin Screw Extruders

5.4.2. Single Screw Extruder

5.4.3. Laboratory Extruder

5.4.4. RAM Extruder

5.5. Product Comparison Matrix

5.6. Market Attractiveness By Product

6. Global Pharmaceutical Hot Melt Extrusion Analysis and Forecasts, By End User

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value and Volume Forecast By End User, 2016–2024

6.3.1. Research Laboratory

6.3.2. CMO

6.3.3. Pharma Companies

6.4. End User Comparison Matrix

6.5. Market Attractiveness By End User

7. Global Pharmaceutical Hot Melt Extrusion Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Policies and Regulations

7.3. Market Value and Volume Forecast By Region

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Latin America

7.3.5. Middle East and Africa

7.4. Market Attractiveness By Country/Region

8. North America Pharmaceutical Hot Melt Extrusion Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.1.2. Policies and Regulations

8.2. Market Value and Volume Forecast By Product, 2016–2024

8.2.1. Twin Screw Extruders

8.2.2. Single Screw Extruder

8.2.3. Laboratory Extruder

8.2.4. RAM Extruder

8.3. Market Value and Volume Forecast By End User, 2016–2024

8.3.1. Research Laboratory

8.3.2. CMO

8.3.3. Pharma Companies

8.4. Market Value and Volume Forecast By Country, 2016–2024

8.4.1. US

8.4.2. Canada

8.5. Market Attractiveness Analysis

8.5.1. By Product

8.5.2. By End User

8.5.3. By Country

9. Europe Pharmaceutical Hot Melt Extrusion Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Policies and Regulations

9.2. Market Value and Volume Forecast By Product, 2016–2024

9.2.1. Twin Screw Extruders

9.2.2. Single Screw Extruder

9.2.3. Laboratory Extruder

9.2.4. RAM Extruder

9.3. Market Value and Volume Forecast By End User, 2016–2024

9.3.1. Research Laboratory

9.3.2. CMO

9.3.3. Pharma Companies

9.4. Market Value and Volume Forecast By Country, 2016–2024

9.4.1. Germany

9.4.2. France

9.4.3. Italy

9.4.4. U.K.

9.4.5. Spain

9.4.6. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End User

9.5.3. By Country

10. Asia Pacific Pharmaceutical Hot Melt Extrusion Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Policies and Regulations

10.2. Market Value and Volume Forecast By Product, 2016–2024

10.2.1. Twin Screw Extruders

10.2.2. Single Screw Extruder

10.2.3. Laboratory Extruder

10.2.4. RAM Extruder

10.3. Market Value and Volume Forecast By End User, 2016–2024

10.3.1. Research Laboratory

10.3.2. CMO

10.3.3. Pharma Companies

10.4. Market Value and Volume Forecast By Country, 2016–2024

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Australia

10.4.5. New Zealand

10.4.6. Rest of APAC

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End User

10.5.3. By Country

11. Latin America Pharmaceutical Hot Melt Extrusion Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Policies and Regulations

11.2. Market Value and Volume Forecast By Product, 2016–2024

11.2.1. Twin Screw Extruders

11.2.2. Single Screw Extruder

11.2.3. Laboratory Extruder

11.2.4. RAM Extruder

11.3. Market Value and Volume Forecast By End User, 2016–2024

11.3.1. Research Laboratory

11.3.2. CMO

11.3.3. Pharma Companies

11.4. Market Value and Volume Forecast By Country, 2016–2024

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Rest of Latin America

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End User

11.5.3. By Country

12. Middle East and Africa Pharmaceutical Hot Melt Extrusion Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Policies and Regulations

12.2. Market Value and Volume Forecast By Product, 2016–2024

12.2.1. Twin Screw Extruders

12.2.2. Single Screw Extruder

12.2.3. Laboratory Extruder

12.2.4. RAM Extruder

12.3. Market Value and Volume Forecast By End User, 2016–2024

12.3.1. Research Laboratory

12.3.2. CMO

12.3.3. Pharma Companies

12.4. Market Value and Volume Forecast By Country, 2016–2024

12.4.1. Saudi Arabia

12.4.2. UAE

12.4.3. South Africa

12.4.4. Rest of MEA

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End User

12.5.3. By Country

13. Competition Landscape

13.1. Market Share Analysis By Company (2015)

13.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.2.1. Baker Perkins Limited

13.2.1.1. Overview

13.2.1.2. Financials

13.2.1.3. Recent Developments

13.2.1.4. Strategy

13.2.2. Coperion GmbH

13.2.2.1. Overview

13.2.2.2. Financials

13.2.2.3. Recent Developments

13.2.2.4. Strategy

13.2.3. Xtrutech Ltd

13.2.3.1. Overview

13.2.3.2. Financials

13.2.3.3. Recent Developments

13.2.3.4. Strategy

13.2.4. Gabler GmbH & Co. KG

13.2.4.1. Overview

13.2.4.2. Financials

13.2.4.3. Recent Developments

13.2.4.4. Strategy

13.2.5. Leistritz AG

13.2.5.1. Overview

13.2.5.2. Financials

13.2.5.3. Recent Developments

13.2.5.4. Strategy

13.2.6. Milacron Holdings Corp.

13.2.6.1. Overview

13.2.6.2. Financials

13.2.6.3. Recent Developments

13.2.6.4. Strategy

13.2.7. Thermo Fisher Scientific, Inc.

13.2.7.1. Overview

13.2.7.2. Financials

13.2.7.3. Recent Developments

13.2.7.4. Strategy

14. Key Takeaways

List of Tables

Table 1: Global Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 2: Global Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 3: Global Market Size (US$ Mn) and Volume (Units) Forecast, by Region, 2014–2024

Table 4: North America Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 5: North America Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 6: North America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 7: Europe Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 8: Europe Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 9: Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 10: Asia Pacific Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 11: Asia Pacific Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 12: Asia Pacific Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 13: Latin America Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 14: Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 15: Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 16: Middle East & Africa Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2014–2024

Table 17: Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 18: Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

List of Figures

Figure 1: Global Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 2: Global Market Value Share, by Product (2015)

Figure 3: Global Market Value Share, by End User (2015)

Figure 4: Global Market Value Share, by Region (2015)

Figure 5: Global Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 6: Global Twin Screw Extruder Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 7: Global Single Screw Extruder Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 8: Global Lab Extruder Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 9: Global RAM Extruder Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 10: Global Pharmaceutical Hot Melt Extrusion Market Attractiveness Analysis, by Product Type

Figure 11: Global Market Value Share Analysis, by End-User, 2016 and 2024

Figure 12: Global Research Laboratory Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 13: Global CMO Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 14: Global Pharma Companies Market Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 15: Global Pharmaceutical Hot Melt Extrusion Market Attractiveness Analysis, by End-User

Figure 16: Global Market Value Share Analysis, by Region, 2016 and 2024

Figure 17: Global Market Attractiveness Analysis, by Region

Figure 18: North America Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 19: North America Market Size and Volume Y-o-Y Growth Projections, 2016–2024

Figure 20: North America Market Attractiveness Analysis, by Country

Figure 21: North America Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 22: North America Market Value Share Analysis, by End-user, 2016 and 2024

Figure 23: North America Market Value Share Analysis, by Country, 2016 and 2024

Figure 24: U.S. Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 25: U.S. Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 26: Canada Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 27: Canada Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 28: North America Market Attractiveness by Product Type

Figure 29: North America Market Attractiveness by End-User

Figure 30: Europe Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 31: Europe Market Size and Volume Y-o-Y Growth Projections, 2016–2024

Figure 32: Europe Market Attractiveness Analysis, by Country

Figure 33: Europe Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 34: Europe Market Value Share Analysis, by End-User, 2016 and 2024

Figure 35: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 36: Germany Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 37: Germany Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 38: France Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 39: France Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 40: Italy Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 41: Italy Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 42: U.K. Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 43: U.K. Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 44: Spain Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 45: Spain Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 46: Rest of Europe Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 47: Rest of Europe Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 48: Europe Pharmaceutical Hot Melt Extrusion Market Attractiveness, by Product Type

Figure 49: Europe Market Attractiveness, by End-User

Figure 50: Asia Pacific Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 51: Asia Pacific Market Size and Volume Y-o-Y Growth Projections, 2016–2024

Figure 52: Asia Pacific Market Attractiveness Analysis, by Country

Figure 53: Asia Pacific Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 54: Asia Pacific Market Value Share Analysis, by End-User, 2016 and 2024

Figure 55: Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

Figure 56: China Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 57: China Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 58: Japan Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 59: Japan Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 60: India Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 61: India Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 62: Australia Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 63: Australia Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 64: New Zealand Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 65: New Zealand Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 66: Rest of Asia Pacific Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 67: Rest of Asia Pacific Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 68: Asia Pacific Market Attractiveness Analysis, by Product Type

Figure 69: Asia Pacific Market Attractiveness Analysis, by End-User

Figure 70: Latin America Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 71: Latin America Market Size and Volume Y-o-Y Growth Projections, 2016–2024

Figure 72: Latin America Market Attractiveness Analysis, by Country

Figure 73: Latin America Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 74: Latin America Market Value Share Analysis, by End-User, 2016 and 2024

Figure 75: Latin America Market Value Share Analysis, by Country, 2016 and 2024

Figure 76: Brazil Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 77: Brazil Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 78: Mexico Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 79: Mexico Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 80: Rest of Latin America Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 81: Rest of Latin America Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 82: Latin America Market Attractiveness Analysis, by Product Type

Figure 83: Latin America Pharmaceutical Hot Melt Extrusion Market Attractiveness Analysis, by End-User

Figure 84: MEA Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 85: MEA Market Size and Volume Y-o-Y Growth Projections, 2016–2024

Figure 86: MEA Market Attractiveness Analysis, by Country

Figure 87: MEA Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 88: Middle East & Africa Pharmaceutical Hot Melt Extrusion Market Value Share Analysis, by End-User, 2016 and 2024

Figure 89: MEA Market Value Share Analysis, by Country, 2016 and 2024

Figure 90: Saudi Arabia Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 91: Saudi Arabia Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 92: UAE Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 93: UAE Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 94: RSA Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 95: RSA Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 96: Rest of Middle East & Africa Pharmaceutical Hot Melt Extrusion Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 97: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 98: MEA Pharmaceutical Hot Melt Extrusion Market Attractiveness Analysis, by Product Type

Figure 99: MEA Market Attractiveness Analysis, by End-User