Analysts’ Viewpoint on Pharmaceutical Cartridges Market Scenario

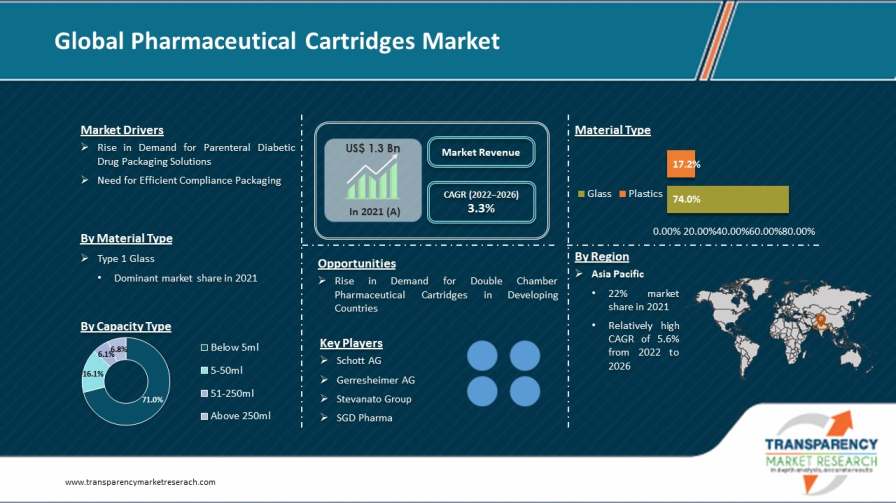

The global pharmaceutical cartridges market is anticipated to grow at a moderate pace during the forecast period owing to the rise in demand for safe pharmaceutical packaging for drugs, increase in consumer preference for precise packaging, product innovations by manufacturers, and favorable government policies. Introduction of innovative pharmaceutical cartridges is also a key factor augmenting the global pharmaceutical cartridges market. Benefits of pharmaceutical cartridges such as lightweight packaging, secure packaging solution for pharmaceutical products, and high demand for accurate dosage are also some of the pharmaceutical cartridges market drivers. Leading players in the market should focus on maintaining the quality of products and expand their manufacturing capacities to increase their market share.

Pharmaceutical cartridges can be referred to as cylindrical shaped glass containers that are ideal for solid or liquid forms of pharmaceutical dosages. These are generally designed for specific apparatuses such as autoinjectors and pre-filled syringes. Insulin, dental anesthesia, and other emergency drugs for allergies are some of the drugs that can be placed in cartridges using a pharmaceutical cartridge filling equipment.

Patients are given parenteral medications when it is difficult to administer oral medications or when intravenous delivery is the sole option. Parenteral medications are required for the treatment of chronic diseases such as cancer, diabetes, hepatic failure, renal failure, and chronic intestinal ailments. Demand for parenteral medications is rising due to the increase in incidence of chronic diseases worldwide. This, in turn, is boosting the demand for parenteral packing, thereby bolstering the pharmaceutical cartridges market outlook.

Chronic diseases, usually referred to as non-communicable diseases (NCDs), are diseases that evolve over an extended period of time as a result of various genetic, environmental, and behavioral variables. According to the World Health Organization (WHO), non-communicable diseases (NCDs) account for 41 million mortalities annually, i.e. roughly 71% of all fatalities worldwide. Self-administered parental care for diabetic patients has been rising across the globe. The focus on parental drug administration has prompted innovation in the field of pharmaceutical cartridges. Thus, the pharmaceutical cartridges market growth forecast appears promising owing to the increase in demand for parental diabetic drug packaging solutions.

The COVID-19 pandemic has disrupted normal business operations. It has impacted the overall demand and supply chain of the packaging industry. The packaging industry has been adversely affected, as it is directly associated with human interaction. However, food & beverage and pharmaceutical industries have remained operational even during the peak of the COVID-19 pandemic.

Development of various new drugs to curb the spread of COVID-19 has boosted the demand for pharmaceutical packaging (including pharmaceutical cartridges). Availability of government aid to increase the production of various pharmaceutical drugs & products has created a positive pharmaceutical cartridges market scenario.

According to the pharmaceutical cartridges market demand analysis, expansion of production facilities by pharmaceutical manufacturers during COVID-19 is propelling the global market. Rise in trade of various pharmaceutical products during the pandemic is also augmenting the demand for pharmaceutical cartridges, as per the pharmaceutical cartridges market sales analysis. Overall, the pharmaceutical cartridges market aspects appear positive during the COVID-19 pandemic. Thus, the global pharmaceutical cartridges market assessment seems lucrative during the forecast period.

Initially, prefilled syringes were the common and preferred solutions among medical practitioners. However, users would commonly encounter accidents due to the breakage of needle sticks. As a result, packaging needs to be user-friendly and safe. Cartridges do not contain any needles; therefore, any risk of damage is completely eliminated. Furthermore, pharmaceutical cartridges are ideal for pharmaceutical products that are sensitive to temperature due to their preservative qualities. Pharmaceutical cartridges offer users a safer alternative to pharmaceutical packaging. Thus, the need for efficient compliance packaging is projected to create pharmaceutical cartridges market opportunities.

High demand for pharmaceutical cartridges is encouraging key pharmaceutical packaging manufacturers to expand their cartridges product portfolio. For example, Scott AG, a leading pharmaceutical packaging manufacturer of cartridges, is striving to expand its cartridges portfolio in order to meet customer requirements. The company provides a board range of cartridges that includes single and double camber cartridges, high-speed filling cartridges, and break resistance cartridges. It also offers customized solutions. Additionally, Scott AG is focusing on enhancing the filling efficiency. Its products are ISO certified and 100% inspected. Thus, the company’s cartridges systems do not have any defects.

Developing countries such as China and India constitute around 60% share of the pharmaceutical cartridges market in Asia Pacific. Rise in demand for pharmaceutical products and entry of various local & global pharmaceutical manufacturers into these regions are augmenting the market in Asia Pacific. Growth in awareness about health care is also driving the demand for pharmaceutical cartridges in the region. Furthermore, rise in government initiatives is propelling the demand for pharmaceutical cartridges Asia Pacific.

Global manufacturers of pharmaceutical packaging are primarily focusing on multi-compartment pharmaceutical packaging products. Dual chamber cartridges allow different drugs to be stored in single units, without contamination, for a longer period of time, thus increasing the shelf life of drugs. All-in-one design of dual chamber cartridges eliminates the possibility of overdosing on a drug. Furthermore, they are compatible for single and multi-dosage pens applications.

The production cost of dual chamber cartridges is higher than that of single chamber cartridges, due to the additional customization. Dual chamber cartridges are widely used in developed economies. Rise in disposable income of the people in developing countries is creating lucrative opportunities for dual chamber cartridges manufacturers in these regions.

Governments of countries in the African subcontinent are helping international pharmaceutical companies set up production facilities in the region. Import of pharmaceuticals from around the world is restricted in African countries. This has transformed the pharmaceutical medication manufacturing environment in Middle East & Africa. As a result, the need for pharmaceutical packaging products is likely to rise in the region. Thus, global medicinal drug manufacturers are likely to establish and expand their facilities in Middle East & Africa. This is projected to create lucrative opportunities for the pharmaceutical cartridges market in the region.

Pharmaceutical packaging manufacturers prefer plastic over glass for the packaging of drugs. This can be ascribed to the rise in demand for more economical and value-based packaging solutions. Polymers such as cyclic olefin copolymers (COC) and cyclic olefin polymers (COP) are preferred by parenteral drug producers and packaging solution providers. Various key players in the market are collaborating to meet the demand for such polymers. Furthermore, introduction of polymers is slated to favor market growth, as pharmaceutical packaging products are expected to be available at more economical prices in the near future.

Asia Pacific is anticipated to remain the dominant region of the global pharmaceutical cartridges market during the forecast period. The market in the region is estimated to grow 1.3x its current market value by the end of the forecast period. Asia Pacific is anticipated to account for around 24% share of the market in terms of value by 2026.

Asia Pacific is a constantly growing market for pharmaceutical cartridges. Consistent growth of the market in the region can be ascribed to the lower cost of pharmaceutical cartridges offered by manufacturers in Asia Pacific than that in other regions. The market in Asia Pacific is estimated to register the highest CAGR of 5.6% during the forecast period, owing to the high demand for pharmaceutical cartridges among small-scale industries in the region.

The pharmaceutical cartridges market in North America and Europe is likely to witness moderate growth during the forecast period.

The pharmaceutical cartridges market competition analysis includes company profiles section, which comprises key information about major players in the global pharmaceutical cartridges market. Leading players analyzed in the report are Gerresheimer AG, Schott AG, Nipro Corporation, West Pharmaceutical Services, Inc., SGD Pharma, Baxter Healthcare Corporation, Sigma-Aldrich Corporation, Stevanato Group, Pierrel Group, and Transcoject GmbH.

Each of these companies has been summarized in the pharmaceutical cartridges market report based on factors such as financial overview, company overview, business strategies, business segments, application portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.3 Bn |

|

Market Forecast Value in 2026 |

US$ 1.5 Bn |

|

Growth Rate (CAGR) |

3.3% (Year-to-Year) |

|

Forecast Period |

2022–2026 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

In 2021, the global pharmaceutical cartridges market was valued at US$ 1.3 Bn

During 2017-2021, the global pharmaceutical cartridges market grew at a CAGR of 3.0%

By the end of 2026, the global pharmaceutical cartridges market is projected to reach US$ 1.5 Bn

During 2022-2026, the global pharmaceutical cartridges market is anticipated to grow at a CAGR of 3.3%

Rise in demand for parenteral diabetic drug packaging solutions

The glass material is majorly preferred by pharmaceutical cartridges manufacturers

Asia Pacific is estimated to witness high demand for pharmaceutical cartridges during the forecast period

Schott AG, Gerresheimer AG, Nipro Corporation, West Pharmaceutical Services, Inc., Stevanato Group, and SDG Pharma

The China pharmaceutical cartridges market is anticipated to grow 1.4 times the current market value during the forecast period

The global pharmaceutical cartridges market is estimated to create a growth opportunity of US$ 223.8 Mn during the forecast period

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Pharmaceutical Cartridges Market Overview

3.1. Introduction

3.2. Global Pharmaceutical Cartridges Market Overview

3.3. Pharmaceutical Cartridges Market (US$ Mn) and Forecast

3.4. Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Capacity Type Suppliers

3.4.1.2. Pharmaceutical Cartridges Manufacturers

3.4.1.3. End Users

3.4.2. Profitability Margins

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Pharmaceutical Cartridges Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Pharmaceutical Cartridges Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Pharmaceutical Cartridges Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

7.1.2. Y-o-Y Growth Projections, By Material Type

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

7.2.1. Glass

7.2.1.1. Type 1

7.2.1.2. Type 2

7.2.1.3. Type 3

7.2.2. Plastics

7.2.2.1. Cyclo Olefin Polymer (COP)

7.2.2.2. Cyclic Olefin Copolymer (COC)

7.2.2.3. Polyethylene (PE)

7.2.2.4. Polypropylene (PP)

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Material Type

7.3.1. Glass

7.3.1.1. Type 1

7.3.1.2. Type 2

7.3.1.3. Type 3

7.3.2. Plastics

7.3.2.1. Cyclo Olefin Polymer (COP)

7.3.2.2. Cyclic Olefin Copolymer (COC)

7.3.2.3. Polyethylene (PE)

7.3.2.4. Polypropylene (PP)

7.4. Market Attractiveness Analysis, By Material Type

8. Global Pharmaceutical Cartridges Market Analysis and Forecast, By Capacity Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Capacity Type

8.1.2. Y-o-Y Growth Projections, By Capacity Type

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

8.2.1. Below 5 ml

8.2.2. 5-50 ml

8.2.3. 51-250 ml

8.2.4. Above 250 ml

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Capacity Type

8.3.1. Below 5 ml

8.3.2. 5-50 ml

8.3.3. 51-250 ml

8.3.4. Above 250 ml

8.4. Market Attractiveness Analysis, By Capacity Type

9. Global Pharmaceutical Cartridges Market Analysis and Forecast, By Region

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Region

9.1.2. Y-o-Y Growth Projections By Region

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East & Africa

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East & Africa

9.4. Market Attractiveness Analysis By Region

10. North America Pharmaceutical Cartridges Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

10.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Material Type

10.5.1. Glass

10.5.1.1. Type 1

10.5.1.2. Type 2

10.5.1.3. Type 3

10.5.2. Plastics

10.5.2.1. Cyclo Olefin Polymer (COP)

10.5.2.2. Cyclic Olefin Copolymer (COC)

10.5.2.3. Polyethylene (PE)

10.5.2.4. Polypropylene (PP)

10.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

10.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Capacity Type

10.7.1. Below 5 ml

10.7.2. 5-50 ml

10.7.3. 51-250 ml

10.7.4. Above 250 ml

10.8. Market Attractiveness Analysis

10.8.1. By Country

10.8.2. By Material Type

10.8.3. By Capacity Type

11. Latin America Pharmaceutical Cartridges Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Material Type

11.5.1. Glass

11.5.1.1. Type 1

11.5.1.2. Type 2

11.5.1.3. Type 3

11.5.2. Plastics

11.5.2.1. Cyclo Olefin Polymer (COP)

11.5.2.2. Cyclic Olefin Copolymer (COC)

11.5.2.3. Polyethylene (PE)

11.5.2.4. Polypropylene (PP)

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Capacity Type

11.7.1. Below 5 ml

11.7.2. 5-50 ml

11.7.3. 51-250 ml

11.7.4. Above 250 ml

11.8. Market Attractiveness Analysis

11.8.1. By Country

11.8.2. By Material Type

11.8.3. By Capacity Type

12. Europe Pharmaceutical Cartridges Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Country

12.3.1. Germany

12.3.2. Italy

12.3.3. Spain

12.3.4. Russia

12.3.5. U.K.

12.3.6. France

12.3.7. Benelux

12.3.8. Rest of Europe

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Material Type

12.5.1. Glass

12.5.1.1. Type 1

12.5.1.2. Type 2

12.5.1.3. Type 3

12.5.2. Plastics

12.5.2.1. Cyclo Olefin Polymer (COP)

12.5.2.2. Cyclic Olefin Copolymer (COC)

12.5.2.3. Polyethylene (PE)

12.5.2.4. Polypropylene (PP)

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Capacity Type

12.7.1. Below 5 ml

12.7.2. 5-50 ml

12.7.3. 51-250 ml

12.7.4. Above 250 ml

12.8. Market Attractiveness Analysis

12.8.1. By Country

12.8.2. By Material Type

12.8.3. By Capacity Type

13. Asia Pacific Pharmaceutical Cartridges Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Country

13.3.1. China

13.3.2. India

13.3.3. ASEAN

13.3.4. Australia & New Zealand

13.3.5. Japan

13.3.6. Rest of Asia Pacific

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Material Type

13.5.1. Glass

13.5.1.1. Type 1

13.5.1.2. Type 2

13.5.1.3. Type 3

13.5.2. Plastics

13.5.2.1. Cyclo Olefin Polymer (COP)

13.5.2.2. Cyclic Olefin Copolymer (COC)

13.5.2.3. Polyethylene (PE)

13.5.2.4. Polypropylene (PP)

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Capacity Type

13.7.1. Below 5 ml

13.7.2. 5-50 ml

13.7.3. 51-250 ml

13.7.4. Above 250 ml

13.8. Market Attractiveness Analysis

13.8.1. By Country

13.8.2. By Material Type

13.8.3. By Capacity Type

14. Middle East & Africa Pharmaceutical Cartridges Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

14.3.1. North Africa

14.3.2. GCC countries

14.3.3. South Africa

14.3.4. Rest of MEA

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Material Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Material Type

14.5.1. Glass

14.5.1.1. Type 1

14.5.1.2. Type 2

14.5.1.3. Type 3

14.5.2. Plastics

14.5.2.1. Cyclo Olefin Polymer (COP)

14.5.2.2. Cyclic Olefin Copolymer (COC)

14.5.2.3. Polyethylene (PE)

14.5.2.4. Polypropylene (PP)

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Capacity Type

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Capacity Type

14.7.1. Below 5 ml

14.7.2. 5-50 ml

14.7.3. 51-250 ml

14.7.4. Above 250 ml

14.8. Market Attractiveness Analysis

14.8.1. By Country

14.8.2. By Material Type

14.8.3. By Capacity Type

15. Country wise Pharmaceutical Cartridges Market Analysis, 2022-2026

15.1. U.S. Rigid Packaging Containers Market Analysis

15.1.1. By Material Type

15.1.2. By Capacity Type

15.2. Canada Rigid Packaging Containers Market Analysis

15.2.1. By Material Type

15.2.2. By Capacity Type

15.3. Brazil Rigid Packaging Containers Market Analysis

15.3.1. By Material Type

15.3.2. By Capacity Type

15.4. Mexico Rigid Packaging Containers Market Analysis

15.4.1. By Material Type

15.4.2. By Capacity Type

15.5. Argentina Rigid Packaging Containers Market Analysis

15.5.1. By Material Type

15.5.2. By Capacity Type

15.6. Germany Rigid Packaging Containers Market Analysis

15.6.1. By Material Type

15.6.2. By Capacity Type

15.7. Spain Rigid Packaging Containers Market Analysis

15.7.1. By Material Type

15.7.2. By Capacity Type

15.8. France Rigid Packaging Containers Market Analysis

15.8.1. By Material Type

15.8.2. By Capacity Type

15.9. U.K. Rigid Packaging Containers Market Analysis

15.9.1. By Material Type

15.9.2. By Capacity Type

15.10. Italy Rigid Packaging Containers Market Analysis

15.10.1. By Material Type

15.10.2. By Capacity Type

15.11. Benelux Rigid Packaging Containers Market Analysis

15.11.1. By Material Type

15.11.2. By Capacity Type

15.12. Russia Rigid Packaging Containers Market Analysis

15.12.1. By Material Type

15.12.2. By Capacity Type

15.13. China Rigid Packaging Containers Market Analysis

15.13.1. By Material Type

15.13.2. By Capacity Type

15.14. India Rigid Packaging Containers Market Analysis

15.14.1. By Material Type

15.14.2. By Capacity Type

15.15. Japan Rigid Packaging Containers Market Analysis

15.15.1. By Material Type

15.15.2. By Capacity Type

16. Competitive Landscape

16.1. Market Structure

16.2. Competition Dashboard

16.3. Company Market Share Analysis

16.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

16.5. Competition Deep Dive

(Key Global Market Players)

16.5.1. Schott AG

16.5.1.1. Overview

16.5.1.2. Financials

16.5.1.3. Strategy

16.5.1.4. Recent Developments

16.5.1.5. SWOT Analysis

16.5.2. Gerresheimer AG

16.5.2.1. Overview

16.5.2.2. Financials

16.5.2.3. Strategy

16.5.2.4. Recent Developments

16.5.2.5. SWOT Analysis

16.5.3. Nipro Corporation

16.5.3.1. Overview

16.5.3.2. Financials

16.5.3.3. Strategy

16.5.3.4. Recent Developments

16.5.3.5. SWOT Analysis

16.5.4. West Pharmaceutical Services, Inc.

16.5.4.1. Overview

16.5.4.2. Financials

16.5.4.3. Strategy

16.5.4.4. Recent Developments

16.5.4.5. SWOT Analysis

16.5.5. Stevanato Group

16.5.5.1. Overview

16.5.5.2. Financials

16.5.5.3. Strategy

16.5.5.4. Recent Developments

16.5.5.5. SWOT Analysis

16.5.6. SGD Pharma

16.5.6.1. Overview/p>

16.5.6.2. Financials

16.5.6.3. Strategy

16.5.6.4. Recent Developments

16.5.6.5. SWOT Analysis

16.5.7. Baxter Healthcare Corporation

16.5.7.1. Overview

16.5.7.2. Financials

16.5.7.3. Strategy

16.5.7.4. Recent Developments

16.5.7.5. SWOT Analysis

16.5.8. Sigma-Aldrich Corporation

16.5.8.1. Overview

16.5.8.2. Financials

16.5.8.3. Strategy

16.5.8.4. Recent Developments

16.5.8.5. SWOT Analysis

16.5.9. Pierrel group

16.5.9.1. Overview

16.5.9.2. Financials

16.5.9.3. Strategy

16.5.9.4. Recent Developments

16.5.9.5. SWOT Analysis

16.5.10. Transcoject GmbH

16.5.10.1. Overview

16.5.10.2. Financials

16.5.10.3. Strategy

16.5.10.4. Recent Developments

16.5.10.5. SWOT Analysis

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 02: Global Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 03: Global Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 04: Global Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 05: Global Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 06: Global Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 07: Global Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 08: Global Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 09: Global Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Region 2017(H)-2021(A)

Table 10: Global Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Region 2022(E)-2026(F)

Table 11: Global Pharmaceutical Cartridges Market Historic Volume (Units), By Region 2017(H)-2021(A)

Table 12: Global Pharmaceutical Cartridges Market Forecast Volume (Units), By Region 2022(E)-2026(F)

Table 13: North America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 14: North America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 15: North America Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 16: North America Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 17: North America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 18: North America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 19: North America Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 20: North America Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 21: North America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 22: North America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 23: North America Pharmaceutical Cartridges Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 24: North America Pharmaceutical Cartridges Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 25: Latin America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 26: Latin America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 27: Latin America Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 28: Latin America Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 29: Latin America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 30: Latin America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 31: Latin America Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 32: Latin America Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 33: Latin America Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 34: Latin America Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 35: Latin America Pharmaceutical Cartridges Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 36: Latin America Pharmaceutical Cartridges Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 37: Europe Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 38: Europe Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 39: Europe Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 40: Europe Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 41: Europe Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 42: Europe Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 43: Europe Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 44: Europe Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 45: Europe Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 46: Europe Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 47: Europe Pharmaceutical Cartridges Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 48: Europe Pharmaceutical Cartridges Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 49: Asia Pacific Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 50: Asia Pacific Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 51: Asia Pacific Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 52: Asia Pacific Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 53: Asia Pacific Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 54: Asia Pacific Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 55: Asia Pacific Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 56: Asia Pacific Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 57: Asia Pacific Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 58: Asia Pacific Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 59: Asia Pacific Pharmaceutical Cartridges Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 60: Asia Pacific Pharmaceutical Cartridges Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 61: MEA Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Material Type 2017(H)-2021(A)

Table 62: MEA Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Material Type 2022(E)-2026(F)

Table 63: MEA Pharmaceutical Cartridges Market Historic Volume (Units), By Material Type 2017(H)-2021(A)

Table 64: MEA Pharmaceutical Cartridges Market Forecast Volume (Units), By Material Type 2022(E)-2026(F)

Table 65: MEA Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Capacity Type 2017(H)-2021(A)

Table 66: MEA Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Capacity Type 2022(E)-2026(F)

Table 67: MEA Pharmaceutical Cartridges Market Historic Volume (Units), By Capacity Type 2017(H)-2021(A)

Table 68: MEA Pharmaceutical Cartridges Market Forecast Volume (Units), By Capacity Type 2022(E)-2026(F)

Table 69: MEA Pharmaceutical Cartridges Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 70: MEA Pharmaceutical Cartridges Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 71: MEA Pharmaceutical Cartridges Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 72: MEA Pharmaceutical Cartridges Market Forecast Volume (Units), By Country 2022(E)-2026(F)

List of Figures

Figure 01: Global Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 02: Global Pharmaceutical Cartridges Market Attractiveness Analysis by Material Type, 2022E-2026F

Figure 03: Global Pharmaceutical Cartridges Market Y-o-Y Analysis by Material Type, 2019H-2026F

Figure 04: Global Pharmaceutical Cartridges Market Share Analysis by Capacity Type, 2022E & 2026F

Figure 05: Global Pharmaceutical Cartridges Market Attractiveness Analysis by Capacity Type, 2022E-2026F

Figure 06: Global Pharmaceutical Cartridges Market Y-o-Y Analysis by Capacity Type, 2019H-2026F

Figure 07: Global Pharmaceutical Cartridges Market Share Analysis by Region, 2022E & 2026F

Figure 08: Global Pharmaceutical Cartridges Market Attractiveness Analysis by Region, 2022E-2026F

Figure 09: Global Pharmaceutical Cartridges Market Y-o-Y Analysis by Region, 2019H-2026F

Figure 10: North America Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 11: North America Pharmaceutical Cartridges Market Value Share Analysis by Capacity Type 2022(E)

Figure 12: North America Pharmaceutical Cartridges Market Value Share Analysis by Country 2022(E)

Figure 13: Latin America Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 14: Latin America Pharmaceutical Cartridges Market Value Share Analysis by Capacity Type 2022(E)

Figure 15: Latin America Pharmaceutical Cartridges Market Value Share Analysis by Country 2022(E)

Figure 16: Europe Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 17: Europe Pharmaceutical Cartridges Market Value Share Analysis by Capacity Type 2022(E)

Figure 18: Europe Pharmaceutical Cartridges Market Value Share Analysis by Country 2022(E)

Figure 19: Asia Pacific Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 20: Asia Pacific Pharmaceutical Cartridges Market Value Share Analysis by Capacity Type 2022(E)

Figure 21: Asia Pacific Pharmaceutical Cartridges Market Value Share Analysis by Country 2022(E)

Figure 22: MEA Pharmaceutical Cartridges Market Share Analysis by Material Type, 2022E & 2026F

Figure 23: MEA Pharmaceutical Cartridges Market Value Share Analysis by Capacity Type 2022(E)

Figure 24: MEA Pharmaceutical Cartridges Market Value Share Analysis by Country 2022(E)

Figure 25: U.S. Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 26: U.S. Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 27: Canada Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 28: Canada Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 29: Brazil Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 30: Brazil Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 31: Mexico Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 32: Mexico Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 33: Argentina Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 34: Argentina Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 35: Germany Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 36: Germany Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 37: Spain Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 38: Spain Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 39: France Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 40: France Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 41: U.K. Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 42: U.K. Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 43: Italy Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 44: Italy Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 45: Russia Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 46: Russia Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 47: China Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 48: China Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 49: India Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 50: India Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E

Figure 51: Japan Pharmaceutical Cartridges Market Value Share Analysis, by Material Type, 2022E & 2026F

Figure 52: Japan Pharmaceutical Cartridges Market Value Share Analysis, by Capacity Type, 2022E