Analysts’ Viewpoint on Market Scenario

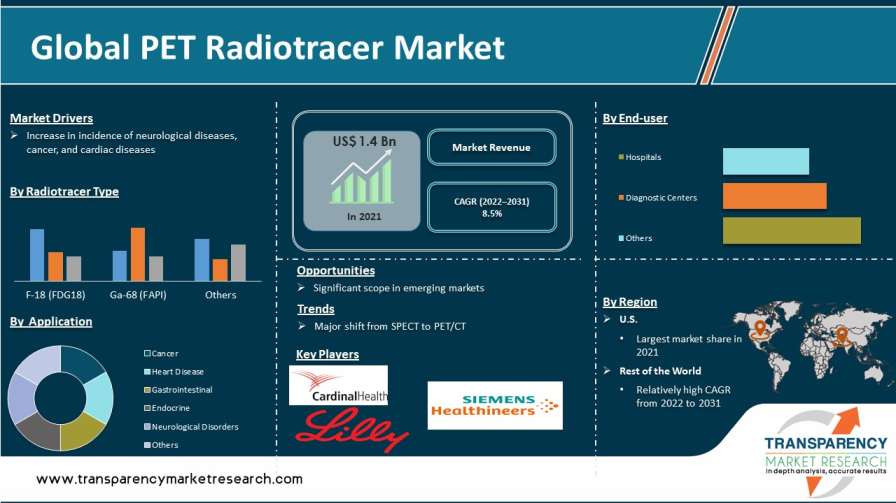

PET radiotracer, also known as PET tracer, is a positron-emitting radiopharmaceutical used in positron emission tomography (PET). Increase in incidence of neurological, cancer, and cardiac diseases; rise in capability to produce PET scan radiotracers such as Fapi radiotracer and nuclear imaging in-house; and growth in preference for PET/CT and PET scans are the key factors anticipated to drive the market size for PET radiotracers.

Key players are engaging in significant research & development activities to widen their product portfolios and thus broaden their revenue streams. For instance, on June 19, 2020, Lantheus Holdings, Inc. completed the acquisition of Progenics Pharmaceuticals, Inc., an oncology company focused on the development and commercialization of innovative targeted imaging agents.

Radiotracers used in positron emission tomography (PET) are chemical compounds comprising more than one atom replaced by a radioisotope. Each tracer consists of a positron-emitting isotope (radioactive tag) bound to an organic ligand (targeting agent).

PET radiotracers are administered intravenously. Radiotracers are used for tracking the mechanism of chemical reactions taking part in a biological system such as glucose metabolism, amino acid uptake, glucocorticoid synthesis, and other metabolic studies. Different types of radiotracers are used in PET for metabolic studies for visualization using PET imaging.

The International Atomic Energy Agency (IAEA) plays an important role in assisting the transfer of radiotracer technology to developing member states. Commonly used PET radiotracers for imaging are F 18 FDG, C-11 Methionine, F 18 fluoroethyl-l-tyrosine (FET), F 18 fluoro-dihydroxy-l-phenylalanine (F-DOPA), and C 11 Etomidate.

According to the American Nuclear Society, more than 10,000 hospitals throughout the world use radioisotopes. Nearly 90% of these are used for the diagnosis of infectious diseases, cancer, neurological disorders, and other diagnostic applications, allowing for cerebral blood flow visualization, tumor protein synthesis, neuroendocrine imaging, myocardial perfusion, and other studies.

PET is an important molecular imaging technology utilized for the assessment of neurological disorders. According to World Health Organization’s (WHO) 2021 estimates, nearly 55 million people across the globe have dementia, with Alzheimer's disease being the most common cause accounting for 60% to 70% of all dementia diagnoses.

PET scanners provide comprehensive visualization of neurological abnormalities including determination of the location of the epileptic seizures before surgery, diagnosis of movement disorders, and ability to identify and diagnose early stages of Alzheimer’s and other dementia. Diagnostic tracers for neurological indications have become a key area of interest across the world.

Large numbers of manufacturers are focusing on the introduction of tracers capable of detecting beta-amyloid plaque density in patients with cognitive impairment who are being evaluated for Alzheimer’s disease.

PET scans could be used to evaluate organs and/or tissues for the presence of disease or other conditions. PET could also be used to evaluate the function of organs such as heart and brain.

Detection of cancer and evaluation of cancer treatment are the common applications of PET, which has been recognized as a promising diagnostic tool to predict biological and physiological changes at the molecular level. Thus, PET offers a potential area for applications including stem cell research.

The PET technique allows researchers to study the normal processes in the brain (central nervous system) of normal individuals and patients with neurologic illnesses without physical/structural damage to the brain. When a region of the brain is active, it uses more fuel in the form of oxygen and sugar (glucose).

According to the American Nuclear Society, 90% of radioisotopes are used in gamma cameras or PET scan nuclear diagnostics. The remaining 10% are used in radioactive therapeutic drugs to treat diseases such as cancer and heart diseases, and gastrointestinal, endocrinal, and neurological disorders.

In terms of radiotracer type, the global market has been classified into F-18 (FDG18), Ga-68 (FAPI), and others. The F-18 (FDG18) segment dominated the global market in 2021, as FDG is the most commonly used radiotracer in clinical PET imaging. Different scientific research studies have stated that FDG PET has a sensitivity of more than 70% in detection of seizure foci as compared to other F-18 agents. This is driving the usage of FDG as a prominent PET drug tracer.

Based on radiotracer type, the global PET radiotracer market has been segregated into cancer, heart disease, gastrointestinal, endocrine, neurological disorders, and others. Most of the radioisotopes across the globe are used in oncology for diagnosis or radiation therapy. F-18 and Ga-68-based radioisotopes are primarily used in the diagnosis of cancer.

In terms of end-user, the hospitals segment dominated the global market for PET radiotracer in 2021. The trend is anticipated to continue during the forecast period. Increase in patient preference for hospitals for PET radiotracer diagnosis is expected to propel the hospitals segment during the forecast period.

Furthermore, the hospitals segment is likely to grow at a high CAGR during the forecast period owing to the increase in number of neurology, cancer, and cardiac patients; availability of advanced PET systems at low cost; and presence of trained medical personnel.

The U.S. and Europe, cumulatively, accounted for more than 95% market share for PET radiotracer in 2021. The U.S. was the dominant market in 2021. The trend is anticipated to continue during the forecast period.

Growth of the market in the U.S. can be ascribed to the increase in usage of fluorine-18 for various diseases. According to the U.S. Centers for Disease Control, an estimated 2,096,000 clinical PET scans were performed in hospital and non-hospital sites using fixed PET imaging systems or mobile PET services in 2020.

The report concludes with the company profiles section, which includes information about key players in the global PET radiotracer industry. Key players are focusing on adopting strategies such as acquisition & collaboration, geographic expansion, expansion of distribution channels, and R&D to enhance their share in the global market.

PET radiotracer companies analyzed in the report are ABX advanced biochemical compounds GmbH, Blue Earth Diagnostics, Cardinal Health, Eli Lilly and Company, GE Healthcare, IBA Radiopharma Solutions, Jubilant Pharma Limited, Lantheus Holdings, Inc., Siemens Healthineers AG, and Yantai Dongcheng Pharmaceutical Group Co., Ltd.

Each of these players has been profiled in the PET radiotracer market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.4 Bn |

|

Market Forecast Value in 2031 |

More than US$ 3.2 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

8.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, the qualitative analysis includes PET radiotracer market drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.4 Bn in 2021.

The market is projected to reach more than US$ 3.2 Bn by 2031.

The global market grew at a CAGR of 3.9% from 2017 to 2021.

The global market is anticipated to grow at a CAGR of 8.5% from 2022 to 2031.

The F-18 [FDG18] segment held more than 90% share of the global PET radiotracer market in 2021.

The U.S. is expected to account for the major share of the global PET radiotracer market during the forecast period.

ABX advanced biochemical compounds GmbH, Blue Earth Diagnostics, Cardinal Health, Eli Lilly and Company, GE Healthcare, IBA Radiopharma Solutions, Jubilant Pharma Limited, Lantheus Holdings Inc., Siemens Healthineers AG, and Yantai Dongcheng Pharmaceutical Group Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global PET Radiotracer Market

4. Market Overview

4.1. Introduction

4.1.1. Radiotracer Type Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global PET Radiotracer Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario by Region/globally

5.2. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.3. Technological Advancements

5.4. COVID 19 Impact Analysis

6. Global PET Radiotracer Market Analysis and Forecast, by Radiotracer Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Radiotracer Type, 2017–2031

6.3.1. F-18 (FDG18)

6.3.2. Ga-68 (FAPI)

6.3.3. Others

6.4. Market Attractiveness Analysis, by Radiotracer Type

7. Global PET Radiotracer Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Cancer

7.3.2. Heart Disease

7.3.3. Gastrointestinal

7.3.4. Endocrine

7.3.5. Neurological Disorders

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global PET Radiotracer Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global PET Radiotracer Market Analysis and Forecast, by Country/Region

9.1. Key Findings

9.2. Market Value Forecast, by Country/Region

9.2.1. U.S.

9.2.2. Europe

9.2.3. Rest of the World

9.3. Market Attractiveness Analysis, by Country/Region

10. U.S. PET Radiotracer Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Radiotracer Type, 2017–2031

10.2.1. F-18 (FDG18)

10.2.2. Ga-68 (FAPI)

10.2.3. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Cancer

10.3.2. Heart Disease

10.3.3. Gastrointestinal

10.3.4. Endocrine

10.3.5. Neurological Disorders

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.3. Others

10.5. Market Attractiveness Analysis

10.5.1. By Radiotracer Type

10.5.2. By Application

10.5.3. By End-user

11. Europe PET Radiotracer Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Radiotracer Type, 2017–2031

11.2.1. F-18 (FDG18)

11.2.2. Ga-68 (FAPI)

11.2.3. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Cancer

11.3.2. Heart Disease

11.3.3. Gastrointestinal

11.3.4. Endocrine

11.3.5. Neurological Disorders

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Radiotracer Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Rest of the World PET Radiotracer Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Radiotracer Type, 2017–2031

12.2.1. F-18 (FDG18)

12.2.2. Ga-68 (FAPI)

12.2.3. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Cancer

12.3.2. Heart Disease

12.3.3. Gastrointestinal

12.3.4. Endocrine

12.3.5. Neurological Disorders

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.3. Others

12.5. Market Attractiveness Analysis

12.5.1. By Radiotracer Type

12.5.2. By Application

12.5.3. By End-user

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis By Company (2021)

13.3. Company Profiles

13.3.1. ABX advanced biochemical compounds GmbH

13.3.1.1. Company Overview

13.3.1.2. Strategic Overview

13.3.1.3. SWOT Analysis

13.3.2. Blue Earth Diagnostics

13.3.2.1. Company Overview

13.3.2.2. Financial Overview

13.3.2.3. Strategic Overview

13.3.2.4. SWOT Analysis

13.3.3. Cardinal Health

13.3.3.1. Company Overview

13.3.3.2. Financial Overview

13.3.3.3. Strategic Overview

13.3.3.4. SWOT Analysis

13.3.4. Eli Lilly and Company

13.3.4.1. Company Overview

13.3.4.2. Financial Overview

13.3.4.3. Strategic Overview

13.3.4.4. SWOT Analysis

13.3.5. GE Healthcare

13.3.5.1. Company Overview

13.3.5.2. Financial Overview

13.3.5.3. Strategic Overview

13.3.5.4. SWOT Analysis

13.3.6. IBA Radiopharma Solutions

13.3.6.1. Company Overview

13.3.6.2. Financial Overview

13.3.6.3. Strategic Overview

13.3.6.4. SWOT Analysis

13.3.7. Jubilant Pharma Limited

13.3.7.1. Company Overview

13.3.7.2. Financial Overview

13.3.7.3. Strategic Overview

13.3.7.4. SWOT Analysis

13.3.8. Lantheus Holdings, Inc.

13.3.8.1. Company Overview

13.3.8.2. Financial Overview

13.3.8.3. Strategic Overview

13.3.8.4. SWOT Analysis

13.3.9. Siemens Healthineers AG

13.3.9.1. Company Overview

13.3.9.2. Financial Overview

13.3.9.3. Strategic Overview

13.3.9.4. SWOT Analysis

13.3.10. Yantai Dongcheng Pharmaceutical Group Co., Ltd.

13.3.10.1. Company Overview

13.3.10.2. Financial Overview

13.3.10.3. Strategic Overview

13.3.10.4. SWOT Analysis

List of Tables

Table 01: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Radiotracer Type, 2017–2031

Table 02: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global PET Radiotracer Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Country/Region, 2017–2031

Table 05: U.S. PET Radiotracer Market Value (US$ Mn) Forecast, by Radiotracer Type, 2017–2031

Table 06: U.S. PET Radiotracer Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: U.S. PET Radiotracer Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: Europe PET Radiotracer Market Value (US$ Mn) Forecast, by Radiotracer Type, 2017–2031

Table 09: Europe PET Radiotracer Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: Europe PET Radiotracer Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe PET Radiotracer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Rest of the World PET Radiotracer Market Value (US$ Mn) Forecast, by Radiotracer Type, 2017–2031

Table 13: Rest of the World PET Radiotracer Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Rest of the World PET Radiotracer Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global PET Radiotracer Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 02: Global PET Radiotracer Market Value Share Analysis, by Radiotracer Type, 2021 and 2031

Figure 03: Global PET Radiotracer Market Attractiveness Analysis, by Radiotracer Type, 2022–2031

Figure 04: Global PET Radiotracer Market Value (US$ Mn) Forecast, by F-18 (FDG18), 2017–2031

Figure 05: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Ga-68 (FAPI), 2017–2031

Figure 06: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 07: Global PET Radiotracer Market Value Share Analysis, by Application, 2021 and 2031

Figure 08: Global PET Radiotracer Market Attractiveness Analysis, by Application, 2022–2031

Figure 09: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Cancer, 2017–2031

Figure 10: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Heart Disease, 2017–2031

Figure 11: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Gastrointestinal, 2017–2031

Figure 12: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Endocrine, 2017–2031

Figure 13: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Neurological Disorders, 2017–2031

Figure 14: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 15: Global PET Radiotracer Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: Global PET Radiotracer Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Hospitals, 2017–2031

Figure 18: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Diagnostic Centers, 2017–2031

Figure 19: Global PET Radiotracer Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 20: Global PET Radiotracer Market Value Share Analysis, by Country/Region, 2021 and 2031

Figure 21: Global PET Radiotracer Market Attractiveness Analysis, by Country/Region, 2022–2031

Figure 22: U.S. PET Radiotracer Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: U.S. PET Radiotracer Market Value Share Analysis, by Radiotracer Type, 2021 and 2031

Figure 24: U.S. PET Radiotracer Market Attractiveness Analysis, by Radiotracer Type, 2022–2031

Figure 25: U.S. PET Radiotracer Market Value Share Analysis, by Application, 2021 and 2031

Figure 26: U.S. PET Radiotracer Market Attractiveness Analysis, by Application, 2022–2031

Figure 27: U.S. PET Radiotracer Market Value Share Analysis, by End-user, 2021 and 2031

Figure 28: U.S. PET Radiotracer Market Attractiveness Analysis, by End-user, 2022–2031

Figure 29: Europe PET Radiotracer Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe PET Radiotracer Market Value Share Analysis, by Radiotracer Type, 2021 and 2031

Figure 31: Europe PET Radiotracer Market Attractiveness Analysis, by Radiotracer Type, 2022–2031

Figure 32: Europe PET Radiotracer Market Value Share Analysis, by Application, 2021 and 2031

Figure 33: Europe PET Radiotracer Market Attractiveness Analysis, by Application, 2022–2031

Figure 34: Europe PET Radiotracer Market Value Share Analysis, by End-user, 2021 and 2031

Figure 35: Europe PET Radiotracer Market Attractiveness Analysis, by End-user, 2022–2031

Figure 36: Europe PET Radiotracer Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 37: Europe PET Radiotracer Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 38: Rest of the World PET Radiotracer Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Rest of the World PET Radiotracer Market Value Share Analysis, by Radiotracer Type, 2021 and 2031

Figure 40: Rest of the World PET Radiotracer Market Attractiveness Analysis, by Radiotracer Type, 2022–2031

Figure 41: Rest of the World PET Radiotracer Market Value Share Analysis, by Application, 2021 and 2031

Figure 42: Rest of the World PET Radiotracer Market Attractiveness Analysis, by Application, 2022–2031

Figure 43: Rest of the World PET Radiotracer Market Value Share Analysis, by End-user, 2021 and 2031

Figure 44: Rest of the World PET Radiotracer Market Attractiveness Analysis, by End-user, 2022–2031