Analysts’ Viewpoint

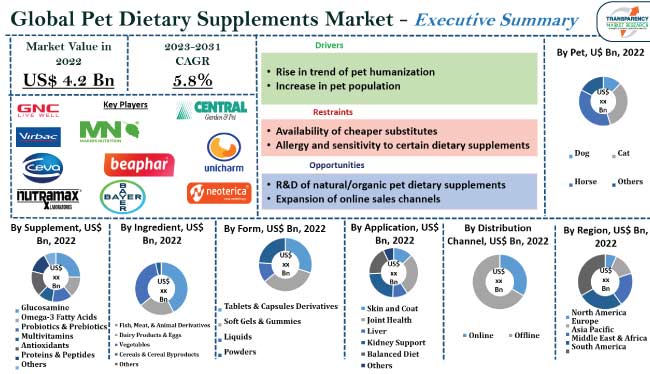

Increase in trend of pet humanization and rise in pet population are projected to boost the pet dietary supplements market size during the forecast period. Organic and natural pet food products are gaining traction among the populace. Herbal pet supplements are replacing conventional pet dietary supplements due to their ability to stimulate levels of systemic antioxidants and minimize the impacts caused by free radicals in pets’ blood.

Availability of cheaper substitutes and allergy and sensitivity to certain dietary supplements are likely to limit the pet dietary supplements market growth in the next few years. Major vendors are focused on developing allergen-free supplements to expand their customer base. They are also offering affordable products to increase their pet dietary supplements industry share.

Pet supplements are any products that are added to a pet's regular diet. These supplements contain components that are meant to boost pet health. Supplements include concentrated amounts of vitamins and minerals. These components provide various nutritional and medicinal benefits to pets. Vitamins, minerals, amino acids, herbs, botanicals, and enzymes are a few examples of supplements.

Many joint supplements contain glucosamine and chondroitin, which are components of a substance found in cartilage. Supplements containing these components may help joint cartilage remain healthy or repair, as well as promote the fluid that lubricates the joints.

Recent trends in pet dietary supplement ingredients include glucosamine, omega-3 fatty acids, probiotics & prebiotics, multivitamins, antioxidants, and proteins & peptides. Increase in awareness of pet owners about their pets' health and well-being is driving pet supplement innovation and product development.

Pet dietary supplement packaging and branding play a major role in the global pet dietary supplements industry. They attract the attention of pet owners and convey important information about the product's quality, purpose, and benefits. Pet owners are increasingly looking for convenient and portable packaging that is easy to open. They are also preferring recyclable and biodegradable packaging.

Changes in cultural and socioeconomic conditions are leading to a surge in the humanization of pets. Increase in disposable income is also contributing to the high demand for pet health supplements. Pet owners are treating their pets as family members or even substitutes for children. They are providing pets with the same care and attention as humans. Such trends are encouraging growth in expenditure on pet dietary supplements.

Surge in awareness regarding pet nutrition based on age, weight, breed, and physical activity is fueling the pet dietary supplements market value. Pet food supplements help maintain a pet's overall health and physical condition. Pet owners who humanize their pets are more likely to seek customized animal health supplements. Humanized pets are considered emotional companions. Thus, pet owners are willing to invest in products that support their pets' emotional well-being. Supplements that help reduce stress, anxiety, or cognitive decline are of particular interest.

The COVID-19 pandemic impacted almost every aspect of day-to-day life. The likelihood of people acquiring a new pet increased as they went into isolation. Pet ownership is rising globally, especially in millennial households. Rise in pet population is leading to diversity in pet health needs, which is anticipated to propel the pet dietary supplements market expansion.

Different breeds and ages of pets may require specific dietary supplements to address various health concerns, ranging from joint health to skin and coat care. This diversity fuels demand for a wide range of supplement products. Additionally, advancements in veterinary care and nutrition have led to a surge in the lifespan of companion animals. Pet owners are more inclined to invest in their pets' long-term health, including the use of dietary supplements to promote a longer and healthier life. Some pets have specific dietary needs or sensitivities that require supplementation. Hence, growth in pet population is likely to boost the number of pets with unique dietary requirements. This, in turn, is projected to create lucrative pet dietary supplements market opportunities for vendors.

Rise in the lifespan of pets can lead to age-related illnesses. Veterinary and pet nutritionists are advising owners to use dietary supplements to preserve the general health of their pets as owners take a more proactive approach to avoid unfavourable health conditions. Moreover, a larger population of pets, including dogs, cats, and other companion animals, translates to a larger customer base for pet dietary supplements. Such a scenario is estimated to augment the pet dietary supplements market progress in the near future.

According to the latest global pet dietary supplements market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Increase in awareness about pet supplements and rise in adoption of companion animals are fueling the market dynamics of the region. Presence of major pet dietary supplement manufacturers and large distribution network is also propelling market statistics in Asia Pacific.

The sector in North America is anticipated to grow at a steady pace during the forecast period. Surge in number of households with pets is driving market revenue in the region. Dogs are the leading pets in the U.S., followed by cats.

Most pet dietary supplement companies are investing significantly in comprehensive R&D activities, primarily to develop natural and organic products. They are also investing in brand promotions to expand their customer base.

Bayer AG, Beaphar, Central Garden & Pet Company, Ceva Sante Animale S.A., GNC Holdings, LLC, Makers Nutrition, LLC, Neoterica GmbH, Nutramax Laboratories, Inc., Unicharm Corporation, and Virbac Corporation are prominent entities operating in the industry.

Each of these players has been profiled in the global pet dietary supplements market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.2 Bn |

| Market Forecast Value in 2031 | US$ 6.9 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | The global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 4.2 Bn in 2022

It is projected to reach US$ 6.9 Bn by the end of 2031

Rise in trend of pet humanization and increase in pet population

The dog pet segment accounted for highest share in 2022

Asia Pacific accounted for 34.0% share in 2022

Bayer AG, Beaphar, Central Garden & Pet Company, Ceva Sante Animale S.A., GNC Holdings, LLC, Makers Nutrition, LLC, Neoterica GmbH, Nutramax Laboratories, Inc., Unicharm Corporation, and Virbac Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Ingredient Analysis

5.7. Industry SWOT Analysis

5.8. Key Supplier Analysis

5.9. Global Pet Dietary Supplements Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Bn)

5.9.2. Market Volume Projection (Million Units)

6. Global Pet Dietary Supplements Market Analysis and Forecast, By Pet

6.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

6.1.1. Dog

6.1.2. Cat

6.1.3. Horse

6.1.4. Others (Rabbit, etc.)

6.2. Incremental Opportunity Analysis, By Pet

7. Global Pet Dietary Supplements Market Analysis and Forecast, By Supplement

7.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

7.1.1. Glucosamine

7.1.2. Omega-3 Fatty Acids

7.1.3. Probiotics & Prebiotics

7.1.4. Multivitamins

7.1.5. Antioxidants

7.1.6. Proteins & Peptides

7.1.7. Others (S-Adenosyl Methionine, etc.)

7.2. Incremental Opportunity Analysis, By Supplement

8. Global Pet Dietary Supplements Market Analysis and Forecast, By Ingredient

8.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

8.1.1. Fish, Meat, & Animal Derivatives

8.1.2. Dairy Products & Eggs

8.1.3. Vegetables

8.1.4. Cereals & Cereal Byproducts

8.1.5. Others (Sugars, Ascorbic Acid, etc.)

8.2. Incremental Opportunity Analysis, By Ingredient

9. Global Pet Dietary Supplements Market Analysis and Forecast, By Form

9.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

9.1.1. Tablets & Capsules Derivatives

9.1.2. Soft Gels & Gummies

9.1.3. Liquids

9.1.4. Powders

9.2. Incremental Opportunity Analysis, By Form

10. Global Pet Dietary Supplements Market Analysis and Forecast, By Application

10.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

10.1.1. Skin and Coat

10.1.2. Joint Health

10.1.3. Liver

10.1.4. Kidney Support

10.1.5. Balanced Diet

10.1.6. Others (Immune Health, Anti-inflammatory, etc.)

10.2. Incremental Opportunity Analysis, By Application

11. Global Pet Dietary Supplements Market Analysis and Forecast, By Distribution Channel

11.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.2. Incremental Opportunity Analysis, By Distribution Channel

12. Global Pet Dietary Supplements Market Analysis and Forecast, By Region

12.1. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity Analysis, By Region

13. North America Pet Dietary Supplements Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

13.7.1. Dog

13.7.2. Cat

13.7.3. Horse

13.7.4. Others (Rabbit, etc.)

13.8. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

13.8.1. Glucosamine

13.8.2. Omega-3 Fatty Acids

13.8.3. Probiotics & Prebiotics

13.8.4. Multivitamins

13.8.5. Antioxidants

13.8.6. Proteins & Peptides

13.8.7. Others (S-Adenosyl Methionine, etc.)

13.9. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

13.9.1. Fish, Meat, & Animal Derivatives

13.9.2. Dairy Products & Eggs

13.9.3. Vegetables

13.9.4. Cereals & Cereal Byproducts

13.9.5. Others (Sugars, Ascorbic Acid, etc.)

13.10. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

13.10.1. Tablets & Capsules Derivatives

13.10.2. Soft Gels & Gummies

13.10.3. Liquids

13.10.4. Powders

13.11. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

13.11.1. Skin and Coat

13.11.2. Joint Health

13.11.3. Liver

13.11.4. Kidney Support

13.11.5. Balanced Diet

13.11.6. Others (Immune Health, Anti-inflammatory, etc.)

13.12. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

13.12.1. Online

13.12.2. Offline

13.13. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

13.13.1. U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Pet Dietary Supplements Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

14.7.1. Dog

14.7.2. Cat

14.7.3. Horse

14.7.4. Others (Rabbit, etc.)

14.8. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

14.8.1. Glucosamine

14.8.2. Omega-3 Fatty Acids

14.8.3. Probiotics & Prebiotics

14.8.4. Multivitamins

14.8.5. Antioxidants

14.8.6. Proteins & Peptides

14.8.7. Others (S-Adenosyl Methionine, etc.)

14.9. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

14.9.1. Fish, Meat, & Animal Derivatives

14.9.2. Dairy Products & Eggs

14.9.3. Vegetables

14.9.4. Cereals & Cereal Byproducts

14.9.5. Others (Sugars, Ascorbic Acid, etc.)

14.10. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

14.10.1. Tablets & Capsules Derivatives

14.10.2. Soft Gels & Gummies

14.10.3. Liquids

14.10.4. Powders

14.11. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

14.11.1. Skin and Coat

14.11.2. Joint Health

14.11.3. Liver

14.11.4. Kidney Support

14.11.5. Balanced Diet

14.11.6. Others (Immune Health, Anti-inflammatory, etc.)

14.12. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.2. Offline

14.13. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

1.1.1. Germany

1.1.2. U.K.

1.1.3. France

1.1.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Pet Dietary Supplements Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

15.7.1. Dog

15.7.2. Cat

15.7.3. Horse

15.7.4. Others (Rabbit, etc.)

15.8. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

15.8.1. Glucosamine

15.8.2. Omega-3 Fatty Acids

15.8.3. Probiotics & Prebiotics

15.8.4. Multivitamins

15.8.5. Antioxidants

15.8.6. Proteins & Peptides

15.8.7. Others (S-Adenosyl Methionine, etc.)

15.9. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

15.9.1. Fish, Meat, & Animal Derivatives

15.9.2. Dairy Products & Eggs

15.9.3. Vegetables

15.9.4. Cereals & Cereal Byproducts

15.9.5. Others (Sugars, Ascorbic Acid, etc.)

15.10. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

15.10.1. Tablets & Capsules Derivatives

15.10.2. Soft Gels & Gummies

15.10.3. Liquids

15.10.4. Powders

15.11. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

15.11.1. Skin and Coat

15.11.2. Joint Health

15.11.3. Liver

15.11.4. Kidney Support

15.11.5. Balanced Diet

15.11.6. Others (Immune Health, Anti-inflammatory, etc.)

15.12. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.2. Offline

15.13. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Pet Dietary Supplements Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Demographic Overview

16.3. Key Trend Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Price Trend Analysis

16.6.1. Weighted Average Selling Price (US$)

16.7. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

16.7.1. Dog

16.7.2. Cat

16.7.3. Horse

16.7.4. Others (Rabbit, etc.)

16.8. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

16.8.1. Glucosamine

16.8.2. Omega-3 Fatty Acids

16.8.3. Probiotics & Prebiotics

16.8.4. Multivitamins

16.8.5. Antioxidants

16.8.6. Proteins & Peptides

16.8.7. Others (S-Adenosyl Methionine, etc.)

16.9. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

16.9.1. Fish, Meat, & Animal Derivatives

16.9.2. Dairy Products & Eggs

16.9.3. Vegetables

16.9.4. Cereals & Cereal Byproducts

16.9.5. Others (Sugars, Ascorbic Acid, etc.)

16.10. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

16.10.1. Tablets & Capsules Derivatives

16.10.2. Soft Gels & Gummies

16.10.3. Liquids

16.10.4. Powders

16.11. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

16.11.1. Skin and Coat

16.11.2. Joint Health

16.11.3. Liver

16.11.4. Kidney Support

16.11.5. Balanced Diet

16.11.6. Others (Immune Health, Anti-inflammatory, etc.)

16.12. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

16.12.1. Online

16.12.2. Offline

16.13. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. Middle East & Africa Pet Dietary Supplements Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Demographic Overview

17.3. Key Trend Analysis

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Price Trend Analysis

17.6.1. Weighted Average Selling Price (US$)

17.7. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Pet, 2017 - 2031

17.7.1. Dog

17.7.2. Cat

17.7.3. Horse

17.7.4. Others (Rabbit, etc.)

17.8. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Supplement, 2017 - 2031

17.8.1. Glucosamine

17.8.2. Omega-3 Fatty Acids

17.8.3. Probiotics & Prebiotics

17.8.4. Multivitamins

17.8.5. Antioxidants

17.8.6. Proteins & Peptides

17.8.7. Others (S-Adenosyl Methionine, etc.)

17.9. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Ingredient, 2017 - 2031

17.9.1. Fish, Meat, & Animal Derivatives

17.9.2. Dairy Products & Eggs

17.9.3. Vegetables

17.9.4. Cereals & Cereal Byproducts

17.9.5. Others (Sugars, Ascorbic Acid, etc.)

17.10. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Form, 2017 - 2031

17.10.1. Tablets & Capsules Derivatives

17.10.2. Soft Gels & Gummies

17.10.3. Liquids

17.10.4. Powders

17.11. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

17.11.1. Skin and Coat

17.11.2. Joint Health

17.11.3. Liver

17.11.4. Kidney Support

17.11.5. Balanced Diet

17.11.6. Others (Immune Health, Anti-inflammatory, etc.)

17.12. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.2. Offline

17.13. Pet Dietary Supplements Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis (%), 2022

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Bayer AG

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Beaphar

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Central Garden & Pet Company

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Ceva Sante Animale S.A.

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. GNC Holdings, LLC

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Makers Nutrition, LLC

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Neoterica GmbH

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Nutramax Laboratories, Inc.

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. Unicharm Corporation

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Virbac Corporation

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Other Key Players

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

19. Go To Market Strategy

19.1.1. Identification of Potential Market Spaces

19.1.2. Understanding Buying Process of Customers

19.1.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 2: Global Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 3: Global Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 4: Global Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 5: Global Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 6: Global Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 7: Global Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 8: Global Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 9: Global Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 10: Global Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 11: Global Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 12: Global Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 13: Global Pet Dietary Supplements Market Value, By Region, US$ Bn, 2017-2031

Table 14: Global Pet Dietary Supplements Market Volume, By Region, Million Units, 2017-2031

Table 15: North America Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 16: North America Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 17: North America Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 18: North America Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 19: North America Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 20: North America Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 21: North America Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 22: North America Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 23: North America Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 24: North America Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 25: North America Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 26: North America Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 27: North America Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Table 28: North America Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Table 29: Europe Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 30: Europe Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 31: Europe Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 32: Europe Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 33: Europe Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 34: Europe Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 35: Europe Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 36: Europe Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 37: Europe Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 38: Europe Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 39: Europe Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 40: Europe Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 41: Europe Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Table 42: Europe Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Table 43: Asia Pacific Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 44: Asia Pacific Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 45: Asia Pacific Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 46: Asia Pacific Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 47: Asia Pacific Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 48: Asia Pacific Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 49: Asia Pacific Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 50: Asia Pacific Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 51: Asia Pacific Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 52: Asia Pacific Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 53: Asia Pacific Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 54: Asia Pacific Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 55: Asia Pacific Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Table 56: Asia Pacific Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Table 57: Middle East & Africa Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 58: Middle East & Africa Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 59: Middle East & Africa Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 60: Middle East & Africa Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 61: Middle East & Africa Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 62: Middle East & Africa Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 63: Middle East & Africa Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 64: Middle East & Africa Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 65: Middle East & Africa Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 66: Middle East & Africa Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 67: Middle East & Africa Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 68: Middle East & Africa Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 69: Middle East & Africa Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Table 70: Middle East & Africa Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Table 71: South America Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Table 72: South America Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Table 73: South America Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Table 74: South America Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Table 75: South America Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Table 76: South America Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Table 77: South America Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Table 78: South America Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Table 79: South America Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Table 80: South America Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Table 81: South America Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Table 82: South America Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Table 83: South America Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Table 84: South America Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

List of Figures

Figure 1: Global Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 2: Global Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 3: Global Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 4: Global Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 5: Global Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 6: Global Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 7: Global Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 8: Global Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 9: Global Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 10: Global Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 11: Global Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 12: Global Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 13: Global Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 14: Global Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 15: Global Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 16: Global Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 17: Global Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 18: Global Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 19: Global Pet Dietary Supplements Market Value, By Region, US$ Bn, 2017-2031

Figure 20: Global Pet Dietary Supplements Market Volume, By Region, Million Units, 2017-2031

Figure 21: Global Pet Dietary Supplements Market Incremental Opportunity, By Region,2023-2031

Figure 22: North America Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 23: North America Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 24: North America Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 25: North America Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 26: North America Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 27: North America Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 28: North America Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 29: North America Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 30: North America Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 31: North America Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 32: North America Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 33: North America Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 34: North America Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 35: North America Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 36: North America Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 37: North America Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 38: North America Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 39: North America Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 40: North America Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Figure 41: North America Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Figure 42: North America Pet Dietary Supplements Market Incremental Opportunity, By Country/Sub-region, 2023-2031

Figure 43: Europe Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 44: Europe Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 45: Europe Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 46: Europe Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 47: Europe Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 48: Europe Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 49: Europe Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 50: Europe Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 51: Europe Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 52: Europe Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 53: Europe Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 54: Europe Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 55: Europe Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 56: Europe Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 57: Europe Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 58: Europe Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 59: Europe Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 60: Europe Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 61: Europe Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Figure 62: Europe Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Figure 63: Europe Pet Dietary Supplements Market Incremental Opportunity, By Country/Sub-region, 2023-2031

Figure 64: Asia Pacific Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 65: Asia Pacific Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 66: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 67: Asia Pacific Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 68: Asia Pacific Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 69: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 70: Asia Pacific Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 71: Asia Pacific Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 72:Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 73: Asia Pacific Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 74: Asia Pacific Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 75: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 76: Asia Pacific Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 77: Asia Pacific Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 78: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 79: Asia Pacific Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 80: Asia Pacific Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 81: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 82: Asia Pacific Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Figure 83: Asia Pacific Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Figure 84: Asia Pacific Pet Dietary Supplements Market Incremental Opportunity, By Country/Sub-region, 2023-2031

Figure 85: Middle East & Africa Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 86:Middle East & Africa Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 87: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 88: Middle East & Africa Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 89: Middle East & Africa Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 90: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 91: Middle East & Africa Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 92: Middle East & Africa Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 93: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 94: Middle East & Africa Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 95: Middle East & Africa Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 96: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 97: Middle East & Africa Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 98: Middle East & Africa Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 99: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 100: Middle East & Africa Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 101: Middle East & Africa Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 102: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 103: Middle East & Africa Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Figure 104: Middle East & Africa Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Figure 105: Middle East & Africa Pet Dietary Supplements Market Incremental Opportunity, By Country/Sub-region, 2023-2031

Figure 106: South America Pet Dietary Supplements Market Value, By Pet, US$ Bn, 2017-2031

Figure 107: South America Pet Dietary Supplements Market Volume, By Pet, Million Units, 2017-2031

Figure 108: South America Pet Dietary Supplements Market Incremental Opportunity, By Pet 2023-2031

Figure 109: South America Pet Dietary Supplements Market Value, By Supplement, US$ Bn, 2017-2031

Figure 110: South America Pet Dietary Supplements Market Volume, By Supplement, Million Units, 2017-2031

Figure 111: South America Pet Dietary Supplements Market Incremental Opportunity, By Supplement 2023-2031

Figure 112: South America Pet Dietary Supplements Market Value, By Ingredient, US$ Bn, 2017-2031

Figure 113: South America Pet Dietary Supplements Market Volume, By Ingredient, Million Units, 2017-2031

Figure 114: South America Pet Dietary Supplements Market Incremental Opportunity, By Ingredient, 2023-2031

Figure 115: South America Pet Dietary Supplements Market Value, By Form, US$ Bn, 2017-2031

Figure 116: South America Pet Dietary Supplements Market Volume, By Form, Million Units, 2017-2031

Figure 117: South America Pet Dietary Supplements Market Incremental Opportunity, By Form, 2023-2031

Figure 118: South America Pet Dietary Supplements Market Value, By Application, US$ Bn, 2017-2031

Figure 119: South America Pet Dietary Supplements Market Volume, By Application, Million Units, 2017-2031

Figure 120: South America Pet Dietary Supplements Market Incremental Opportunity, By Application, 2023-2031

Figure 121: South America Pet Dietary Supplements Market Value, By Distribution Channel, US$ Bn, 2017-2031

Figure 122: South America Pet Dietary Supplements Market Volume, By Distribution Channel, Million Units, 2017-2031

Figure 123: South America Pet Dietary Supplements Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 124: South America Pet Dietary Supplements Market Value, By Country/Sub-region, US$ Bn, 2017-2031

Figure 125: South America Pet Dietary Supplements Market Volume, By Country/Sub-region, Million Units, 2017-2031

Figure 126: South America Pet Dietary Supplements Market Incremental Opportunity, By Country/Sub-region, 2023-2031