Analyst Viewpoint

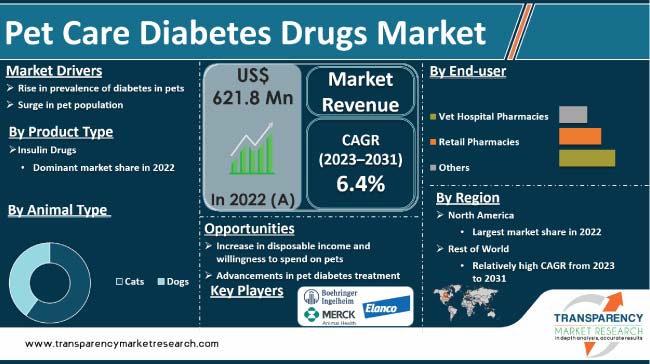

Rise in prevalence of diabetes and surge in pet population are driving the pet care diabetes drugs market size. Growth in awareness among pet owners about the importance of effective diabetes management is also boosting the demand for pet care diabetes drugs. Sedentary lifestyles, improper diets, and genetic predispositions contribute to the surge in pet diabetes cases, necessitating the demand for advanced and efficient diabetes drugs.

Pet care diabetes drugs market opportunities abound in the development and introduction of innovative diabetes drugs for pets. With a discerning consumer base that values their pets as integral family members, there is growth in demand for drugs that manage diabetes effectively, address potential side effects, and enhance overall pet well-being. Major players in the global pet care diabetes drugs industry are investing in the R&D of next-generation diabetes drugs tailored to the specific needs of pets.

Diabetes mellitus is a prevalent metabolic disorder affecting pets, including dogs and cats, necessitating meticulous management to enhance their quality of life. As the incidence of diabetes in pets continues to rise, researchers and veterinarians are actively exploring innovative strategies and pharmaceutical interventions to address this health concern.

The existing arsenal of pet care diabetes drugs encompasses a range of insulin formulations, oral hypoglycemic agents, and emerging therapeutics designed to regulate blood glucose levels effectively. Insulin analogs, such as glargine and detemir, have gained prominence for their sustained action, offering improved glycemic control in diabetic pets.

Recent research has focused on the development of novel medications, including incretin mimetics and sodium-glucose co-transporter inhibitors, mirroring advancements in human diabetes management. These drugs aim to enhance insulin sensitivity and regulate glucose absorption, showcasing a promising avenue for future pet care diabetes treatments.

Despite these strides, challenges persist in tailoring diabetes management to individual pets, considering variations in species, breeds, and underlying health conditions. Researchers are exploring personalized medicine approaches, leveraging genetic insights to optimize treatment regimens.

In recent years, there has been a noticeable surge in the incidence of diabetes among domesticated animals, particularly in cats and dogs. This alarming trend has heightened the demand for specialized pharmaceutical interventions, sparking a burgeoning market for diabetes drugs tailored to the unique physiological needs of pets.

Surge in prevalence of diabetes in pets is a multifaceted issue rooted in various factors. Changes in lifestyle and dietary habits of pets, mirroring those of their human counterparts, play a pivotal role. Sedentary lifestyles, coupled with an increase in the consumption of processed foods, have contributed to weight-related problems in pets, making them susceptible to diabetes. Additionally, genetic predispositions and environmental factors further compound the risk, necessitating a focused approach to managing and treating diabetes in the animal kingdom.

Rise in pet diabetes cases is intensifying the demand for effective and pet-friendly pharmaceutical solutions, thereby contributing to the pet care diabetes drugs market growth. Pet owners, increasingly attuned to the health and well-being of their animal companions, are seeking reliable medications to manage diabetes in their pets. Veterinary healthcare providers are witnessing a growing influx of cases, prompting them to prescribe specialized drugs to control blood sugar levels and enhance the quality of life for diabetic pets. In response to this escalating need, pet care diabetes drug companies are investing in research and development to formulate innovative and palatable drugs tailored specifically for pets.

Increase in number of households are adopting animal companions, which is boosting the demand for specialized healthcare, including diabetes management. This phenomenon is particularly pronounced in regions where pet ownership is becoming more widespread and culturally ingrained.

The expanding pet population creates a larger pool of potential consumers for pet care products and services. With the increasing number of pets, there is a proportional uptick in the occurrence of health conditions, including diabetes. As pets become integral members of families, owners are increasingly willing to invest in their well-being, thereby driving the pet care diabetes drugs market demand.

Adoption rates play a pivotal role in shaping the pet care diabetes drugs market landscape. As adoption rates soar, more pets from diverse backgrounds and health conditions find homes. Shelter pets, in particular, may come with pre-existing health issues, including diabetes. This underscores the need for effective diabetes drugs and reflects the growing awareness and responsibility pet owners feel toward the overall health of their adopted companions.

According to the latest pet care diabetes drugs market analysis, the cats animal type segment held largest share in 2022. According to the latest data from the Centers for Disease Control and Prevention (CDC), cats are more susceptible to diabetes, with a prevalence rate of 1 in 100 cats in the U.S., as opposed to 1 in 300 dogs. This higher prevalence in felines is attributed to factors such as breed predisposition, lifestyle, and dietary habits. Certain cat breeds, such as Burmese and Abyssinian, exhibit a genetic predisposition to diabetes, amplifying the overall prevalence within the feline population.

The American Veterinary Medical Association (AVMA) underscores the impact of lifestyle on diabetes prevalence, noting that indoor cats face an increased risk due to reduced physical activity and potential obesity. In contrast, dogs, being more active by nature, experience a comparatively lower incidence of diabetes. This aligns with the pet care diabetes drugs market trends favoring feline diabetes drugs as the need for effective management and treatment options intensifies.

According to the latest pet care diabetes drugs market insights, North America held largest share in 2022. Presence of advanced healthcare infrastructure, heightened awareness regarding pet health, and increase in prevalence of diabetes in pets are driving the market dynamics of the region. North America boasts a robust network of veterinary clinics and pet healthcare facilities, equipped with state-of-the-art diagnostic and treatment options. Pet owners in the region are highly attuned to their pets' health needs, and as a result, there is a growing demand for diabetes management drugs for pets.

The proactive approach to pet care and the availability of a wide range of specialized pet pharmaceuticals are contributing to the pet care diabetes drugs market share in North America. Leading pharmaceutical companies in the region are continually investing in research and development activities to introduce innovative and effective diabetes drugs tailored to the specific needs of pets. Additionally, a higher disposable income among pet owners allows for greater spending on premium healthcare products, including diabetes medications for pets.

North America benefits from a comprehensive regulatory framework that ensures the safety and efficacy of pet pharmaceuticals. Strict quality standards and regulatory compliance instill confidence in pet owners, encouraging them to opt for prescription medications, thereby bolstering the pet care diabetes drugs market revenue in the region.

The rest of the world exhibits a promising pet care diabetes drugs market trajectory, with an anticipated highest Compound Annual Growth Rate (CAGR) during the forecast period. Factors contributing to this growth include increase in pet population, rise in awareness about pet health, and improvement in economic conditions. As emerging economies invest in pet healthcare infrastructure and education, there is a growing acceptance and adoption of specialized medications, driving the market expansion in the rest of the world. The region's potential for growth is underscored by the evolving pet care landscape and a rising emphasis on preventive healthcare for companion animals.

Boehringer Ingelheim International GmbH, Elanco, and Merck Animal Health are key players operating in this market. These players are adopting merger & acquisition, strategic collaboration, and new product launch strategies to expand their market presence.

The pet care diabetes drugs market report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 621.8 Mn |

| Forecast (Value) in 2031 | More than US$ 1.1 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Mn/Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 621.8 Mn in 2022

It is projected to reach more than US$ 1.1 Bn by the end of 2031

It is anticipated to be 6.4% from 2023 to 2031

Rise in prevalence of diabetes and surge in pet population

The cats segment accounted for the largest share in 2022

North America is anticipated to account for the leading share during the forecast period

Boehringer Ingelheim International GmbH, Elanco, and Merck Animal Health

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pet Care Diabetes Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pet Care Diabetes Drugs Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Epidemiology of Diabetes in Pets

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry

6. Global Pet Care Diabetes Drugs Market Analysis and Forecasts, By Animal Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Animal Type, 2017 - 2031

6.3.1. Cats

6.3.2. Dogs

6.4. Market Attractiveness By Animal Type

7. Global Pet Care Diabetes Drugs Market Analysis and Forecasts, By Product Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Product Type, 2017 - 2031

7.3.1. Insulin Drugs

7.3.2. SGLT2 Inhibitors

7.3.3. Others

7.4. Market Attractiveness By Product Type

8. Global Pet Care Diabetes Drugs Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Vet Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Others

8.4. Market Attractiveness By End-user

9. Global Pet Care Diabetes Drugs Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Rest of World

9.3. Market Attractiveness By Country/Region

10. North America Pet Care Diabetes Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Animal Type, 2017 - 2031

10.2.1. Cats

10.2.2. Dogs

10.3. Market Value Forecast By Product Type, 2017 - 2031

10.3.1. Insulin Drugs

10.3.2. SGLT2 Inhibitors

10.3.3. Others

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Vet Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Animal Type

10.6.2. By Product Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Pet Care Diabetes Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Animal Type, 2017 - 2031

11.2.1. Cats

11.2.2. Dogs

11.3. Market Value Forecast By Product Type, 2017 - 2031

11.3.1. Insulin Drugs

11.3.2. SGLT2 Inhibitors

11.3.3. Others

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Vet Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Animal Type

11.6.2. By Product Type

11.6.3. By End-user

11.6.4. By Country

12. Rest of World Pet Care Diabetes Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Animal Type, 2017 - 2031

12.2.1. Cats

12.2.2. Dogs

12.3. Market Value Forecast By Product Type, 2017 - 2031

12.3.1. Insulin Drugs

12.3.2. SGLT2 Inhibitors

12.3.3. Others

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Vet Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Others

12.5. Market Attractiveness Analysis

12.5.1. By Animal Type

12.5.2. By Product Type

12.5.3. By End-user

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of Companies)

13.2. Market Share Analysis By Company (2022)

13.3. Company Profiles

13.3.1. Boehringer Ingelheim International GmbH

13.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.1.2. Product Portfolio

13.3.1.3. Financial Overview

13.3.1.4. SWOT Analysis

13.3.1.5. Strategic Overview

13.3.2. Elanco

13.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.2.2. Product Portfolio

13.3.2.3. Financial Overview

13.3.2.4. SWOT Analysis

13.3.2.5. Strategic Overview

13.3.3. Merck Animal Health

13.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.3.2. Product Portfolio

13.3.3.3. Financial Overview

13.3.3.4. SWOT Analysis

13.3.3.5. Strategic Overview

List of Tables

Table 01: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 02: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 03: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 07: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 08: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 11: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 14: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Pet Care Diabetes Drugs Market Size, by Animal Type, 2022

Figure 02: Global Pet Care Diabetes Drugs Market share (%), by Animal Type, 2022

Figure 03: Global Pet Care Diabetes Drugs Market Size, by Product Type, 2022

Figure 04: Global Pet Care Diabetes Drugs Market share (%), by Product Type, 2022

Figure 05: Global Pet Care Diabetes Drugs Market Size, by End-user, 2022

Figure 06: Global Pet Care Diabetes Drugs Market share (%), by End-user, 2022

Figure 07: Global Pet Care Diabetes Drugs Market, by Region (2022 and 2031)

Figure 08: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 10: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2022

Figure 11: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2031

Figure 12: Global Pet Care Diabetes Drugs Market Attractiveness Analysis, by Animal Type, 2023–2031

Figure 13: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 14: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 15: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2031

Figure 16: Global Pet Care Diabetes Drugs Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 17: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 18: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 19: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2031

Figure 20: Global Pet Care Diabetes Drugs Market Attractiveness Analysis, by End-user, 2023–2031

Figure 21: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Region, 2022 and 2031

Figure 22: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Region, 2022

Figure 23: Global Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Region, 2031

Figure 24: Global Pet Care Diabetes Drugs Market Attractiveness Analysis, by Region, 2023–2031

Figure 25: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 26: North America Pet Care Diabetes Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 27: North America Pet Care Diabetes Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 28: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 29: North America Pet Care Diabetes Drugs Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 30: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 31: North America Pet Care Diabetes Drugs Market Attractiveness Analysis, by Product Type, 2023-31

Figure 32: North America Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 33: North America Pet Care Diabetes Drugs Market Attractiveness Analysis, by End-user, 2023-2031

Figure 34: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 35: Europe Pet Care Diabetes Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 36: Europe Pet Care Diabetes Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 37: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 38: Europe Pet Care Diabetes Drugs Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 39: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 40: Europe Pet Care Diabetes Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 41: Europe Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 42: Europe Pet Care Diabetes Drugs Market Attractiveness Analysis, by End-user, 2023-2031

Figure 43: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 44: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 45: Rest of World Pet Care Diabetes Drugs Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 46: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 47: Rest of World Pet Care Diabetes Drugs Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 48: Rest of World Pet Care Diabetes Drugs Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 49: Rest of World Pet Care Diabetes Drugs Market Attractiveness Analysis, by End-user, 2023-2031