Analysts’ Viewpoint

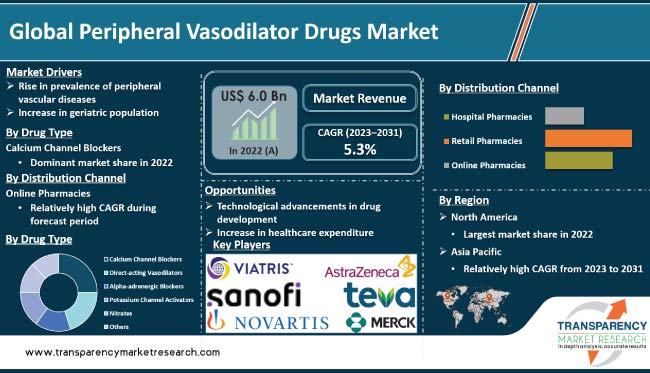

The global peripheral vasodilator drugs market is expected to witness steady growth in the next few years, driven by rise in prevalence of cardiovascular diseases & peripheral vascular disorders and increase in geriatric population. Advancements in drug delivery technology and increase in focus on research & development are likely to propel market expansion in the next few years. Furthermore, rise in sedentary lifestyles that lead to surge in risk factors for cardiovascular diseases are fueling market development.

Advancements in technology and drug delivery systems offer significant opportunities to market players. Companies are investing significantly in research & development of nitric oxide-based vasodilators that provide better efficacy, safety, and convenience for patients.

Peripheral vasodilator drugs are a class of medications used to treat conditions related to the constriction of blood vessels in the peripheral tissues of the body. These drugs work by relaxing the smooth muscles in the walls of blood vessels, leading to an increase in blood flow to the affected areas. Peripheral vasodilators are commonly used to treat conditions such as hypertension, angina, peripheral artery disease (PAD), and Raynaud's disease. These are also used in the treatment of erectile dysfunction, where the drugs can increase blood flow to the penis, leading to improved sexual function.

Increase in prevalence of hypertension and other cardiovascular diseases is a major factor driving the global peripheral vasodilator drugs market. As these conditions become more common, demand for effective treatments is likely to rise, thus driving innovation and development in the peripheral vasodilator drugs industry. According to the World Health Organization (WHO), hypertension affects around 1.13 billion people globally, and is a major cause of morbidity and mortality.

Prevalence of PAD and Raynaud's disease is also increasing due to factors such as aging population, sedentary lifestyle, and unhealthy dietary habits. According to a study published in The Lancet in 2019, PAD affects an estimated 200 million people across the world. The National Institute of Arthritis and Musculoskeletal and Skin Diseases estimates that Raynaud's disease affects around 5% to 10% of the overall population. These conditions are expected to drive the demand for peripheral vasodilator drugs in the next few years.

Rise in awareness about peripheral vascular diseases and importance of early diagnosis and treatment are propelling peripheral vasodilator drugs market demand. Governments and healthcare organizations are also undertaking various initiatives to raise awareness about these diseases and promote their prevention and treatment, which is driving the demand for these drugs.

The global peripheral vasodilator drugs market is expected to be driven by technological advancements in drug development, resulting in the creation of novel and enhanced therapies for a range of conditions. Advances in technology has led to development of new peripheral vasodilator drugs. For example, computer-aided drug design (CADD) allows researchers to use computational methods to predict the properties of new drug molecules, reducing the time and cost associated with traditional drug discovery methods.

Advances in imaging technology have enabled researchers to better understand the mechanisms of action of existing drugs and develop new drugs with improved efficacy and safety profiles. For instance, the usage of positron emission tomography (PET) imaging has led to the development of new drugs that target specific receptors in the body, allowing for more precise treatment of diseases. Furthermore, advancements in gene editing technology, such as CRISPR-Cas9, have allowed researchers to manipulate genes in cells and animals more easily, enabling the development of new drug targets and discovery of new drugs.

Usage of big data analytics and machine learning algorithms is propelling market development. These tools allow researchers to analyze vast amounts of data, such as genomic and proteomic data, to identify new drug targets and predict the efficacy and safety of new drugs. Hence, these technological advancements are expected to bolster market expansion in the next few years.

In terms of drug type, the calcium channel blockers segment dominated the global market in 2022. Calcium channel blockers (CCBs) are medications that block the entry of calcium into the muscles of blood vessels, which helps to relax and widen them, thereby increasing blood flow. This mechanism makes them an ideal treatment option for various conditions such as hypertension and Raynaud's disease.

Increase in prevalence of hypertension, which has led to rise in demand for antihypertensive medications, including CCBs, is another factor augmenting the segment. Moreover, rise in adoption of CCBs as a first-line treatment for hypertension, in combination with the drug's efficacy and safety profile, is fueling demand for CCBs. Availability of different types of CCB, such as dihydropyridine and non-dihydropyridine, also provides a range of options for physicians to choose from.

Surge in the global geriatric population has led to increase in incidence of age-related conditions such as hypertension and angina, which, in turn, has fueled demand for CCBs. Therefore, the calcium channel blockers segment is likely to dominate the global peripheral vasodilator drugs market during the forecast period.

Based on distribution channel, the online pharmacies segment led the global peripheral vasodilator drugs market in 2022. This can be ascribed to increase in penetration of the Internet and growing trend of e-commerce. Online pharmacies offer several benefits to consumers, such as convenience, ease of access, and cost-effectiveness. These provide an easy and convenient option for consumers to purchase these drugs, without having to physically visit a brick-and-mortar store. This has led to surge in consumer preference for online pharmacies.

Online pharmacies offer competitive pricing and a range of options to consumers, enabling them to compare and choose the best product for their needs. Additionally, availability of doorstep delivery and discounts add to the attractiveness of online pharmacies, making them a preferred choice for many consumers.

North America dominated the global peripheral vasodilator drugs industry, accounting for significant share in 2022. This can be ascribed to high prevalence of hypertension and other cardiovascular diseases and increase in geriatric population in the region. Peripheral vasodilator drugs are commonly used to treat conditions such as hypertension, angina, and Raynaud's disease, which are prevalent in North America. According to the American Heart Association, around 45% of adults in the U.S. have hypertension, which is a major risk factor for cardiovascular diseases such as heart attack and stroke. This has led to significant demand for peripheral vasodilator drugs in the region.

Asia Pacific is expected to witness a surge in peripheral vasodilator drugs industry growth during the forecast period, driven by rise in prevalence of cardiovascular diseases, increase in geriatric population, and improving healthcare infrastructure. The trend is expected to continue in the next few years, making Asia Pacific a significant market for peripheral vasodilator drugs. The region encompasses several developing countries with large populations that are witnessing an increase in prevalence of these ailments, resulting in substantial need for peripheral vasodilator drugs.

The peripheral vasodilator drugs market in Europe is characterized by presence of several established players. The market in the region is expected to witness moderate growth in the next few years. Rise in prevalence of cardiovascular diseases, increase in the geriatric population, and adoption of advanced medical technologies are driving the market in the region. The market in Europe is highly competitive, with several players competing based on price, product differentiation, and regional presence.

This report provides profiles of leading players operating in the global peripheral vasodilator drugs industry. These include Pfizer, Inc., Novartis AG, GSK plc, AstraZeneca, Merck & Co., Inc., Sanofi, Bayer AG, Abbott Laboratories, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, Viatris, Inc., Sun Pharmaceutical Industries Ltd., and Lupin. These players engage in merger & acquisition, strategic collaborations, and new product launches to expand their presence and gain peripheral vasodilator drugs market share.

The peripheral vasodilator drugs industry report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements in the peripheral vasodilator drugs business.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 6.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 9.0 Bn |

|

Growth Rate (CAGR) 2023-2031 |

5.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 6.0 Bn in 2022.

It is projected to reach more than US$ 9.0 Bn by 2031.

The CAGR is anticipated to be 5.3% from 2023 to 2031.

The calcium channel blockers segment accounted for the largest share in 2022.

North America is expected to account for the leading share during the forecast period.

Pfizer, Inc., Novartis AG, GSK plc, AstraZeneca, Merck & Co., Inc., Sanofi, Bayer AG, Abbott Laboratories, Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., and Lupin are the prominent players in the industry.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Peripheral Vasodilator Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Peripheral Vasodilator Drugs Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Regulatory Scenario by Region/globally

5.3. COVID-19 Pandemics Impact on Industry

6. Global Peripheral Vasodilator Drugs Market Analysis and Forecast, by Drug Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Type, 2017–2031

6.3.1. Calcium Channel Blockers

6.3.2. Direct-acting Vasodilators

6.3.3. Alpha-adrenergic Blockers

6.3.4. Potassium Channel Activators

6.3.5. Nitrates

6.3.6. Others

6.4. Market Attractiveness Analysis, by Drug Type

7. Global Peripheral Vasodilator Drugs Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Peripheral Vasodilator Drugs Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Peripheral Vasodilator Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Drug Type, 2017–2031

9.2.1. Calcium Channel Blockers

9.2.2. Direct-acting Vasodilators

9.2.3. Alpha-adrenergic Blockers

9.2.4. Potassium Channel Activators

9.2.5. Nitrates

9.2.6. Others

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Drug Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Peripheral Vasodilator Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Type, 2017–2031

10.2.1. Calcium Channel Blockers

10.2.2. Direct-acting Vasodilators

10.2.3. Alpha-adrenergic Blockers

10.2.4. Potassium Channel Activators

10.2.5. Nitrates

10.2.6. Others

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Drug Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Peripheral Vasodilator Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Type, 2017–2031

11.2.1. Calcium Channel Blockers

11.2.2. Direct-acting Vasodilators

11.2.3. Alpha-adrenergic Blockers

11.2.4. Potassium Channel Activators

11.2.5. Nitrates

11.2.6. Others

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Drug Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Peripheral Vasodilator Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Type, 2017–2031

12.2.1. Calcium Channel Blockers

12.2.2. Direct-acting Vasodilators

12.2.3. Alpha-adrenergic Blockers

12.2.4. Potassium Channel Activators

12.2.5. Nitrates

12.2.6. Others

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Pharmacies

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Drug Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Peripheral Vasodilator Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Type, 2017–2031

13.2.1. Calcium Channel Blockers

13.2.2. Direct-acting Vasodilators

13.2.3. Alpha-adrenergic Blockers

13.2.4. Potassium Channel Activators

13.2.5. Nitrates

13.2.6. Others

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Pharmacies

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Drug Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Pfizer, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Novartis AG

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. GSK plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. AstraZeneca

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Merck & Co., Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Sanofi

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Bayer AG

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Abbott Laboratories

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Bristol-Myers Squibb Company

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Boehringer Ingelheim International GmbH

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Teva Pharmaceutical Industries Ltd.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Viatris, Inc.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Sun Pharmaceutical Industries Ltd.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Lupin

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

List of Tables

Table 01: Global Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 02: Global Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 05: North America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: North America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 08: Europe Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 11: Asia Pacific Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Asia Pacific Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 14: Latin America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Latin America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 17: Middle East & Africa Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 18: Middle East & Africa Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 03: Global Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 04: Global Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 05: Global Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 06: Global Peripheral Vasodilator Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 10: North America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 11: North America Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 12: North America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 13: North America Peripheral Vasodilator Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 17: Europe Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 18: Europe Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 19: Europe Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 20: Europe Peripheral Vasodilator Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 24: Asia Pacific Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 25: Asia Pacific Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 26: Asia Pacific Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 27: Asia Pacific Peripheral Vasodilator Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 31: Latin America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 32: Latin America Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Latin America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 34: Latin America Peripheral Vasodilator Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Peripheral Vasodilator Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Peripheral Vasodilator Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 38: Middle East & Africa Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 39: Middle East & Africa Peripheral Vasodilator Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: Middle East & Africa Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 41: Middle East & Africa Peripheral Vasodilator Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Peripheral Vasodilator Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Peripheral Vasodilator Drugs Market Share Analysis, by Company, 2022