Analysts’ Viewpoint

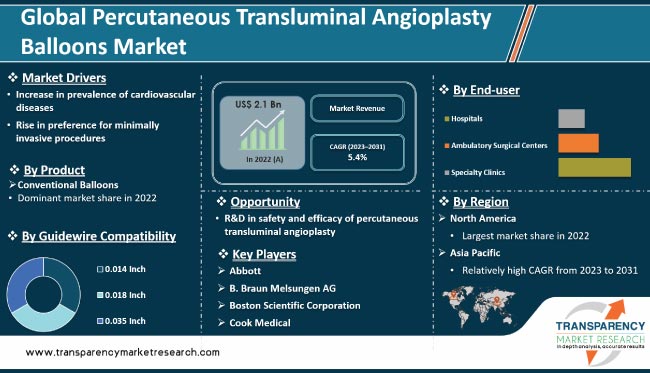

Rise in demand for minimally invasive surgical procedures and increase in prevalence of cardiovascular diseases are key factors driving the global percutaneous transluminal angioplasty balloons market size. Percutaneous transluminal angioplasty procedure is a widely accepted treatment for patients suffering from cardiovascular diseases.

North America is a prominent market for percutaneous transluminal angioplasty balloons due to the surge in healthcare expenditure in the region. Key players are offering a variety of products to cater to the growth in preference for effective minimally invasive procedures. R&D in safety and efficacy of percutaneous transluminal angioplasty is likely to offer lucrative opportunities for market players.

Percutaneous Transluminal Angioplasty (PTA) is a minimally invasive medical procedure used for the treatment of various cardiovascular diseases such as atherosclerosis, peripheral artery disease, and coronary artery disease. PTA balloons are employed to widen or dilate narrowed or blocked blood vessels, thus allowing for better blood flow.

PTA is a widely accepted treatment for cardiovascular diseases, as it offers several advantages over traditional surgical procedures. It is minimally invasive, as it involves small incisions and usually does not require general anesthesia. This reduces the risk of complications and allows for a faster recovery time. Additionally, PTA is often performed as an outpatient procedure, which is more convenient for patients and can help reduce healthcare costs.

PTA balloons are available in various sizes and types. They are typically made of polyethylene terephthalate (PET) and are designed to be inflated to a specific pressure. When inflated, the balloon expands the narrowed or blocked blood vessel, thus allowing for better blood flow.

PTA balloons have been in use for many years. Recent advances in technology have led to the development of new and innovative products that offer improved performance and ease of use. These advancements have resulted in growth in adoption of PTA balloons for the treatment of cardiovascular diseases (CVDs).

CVD is a significant global health issue and one of the leading causes of death worldwide. The prevalence of CVD is increasing due to factors such as aging population, unhealthy lifestyle, and surge in cases of obesity and diabetes.

According to the World Health Organization (WHO), CVD is the leading cause of death globally, accounting for around 17.9 million deaths in 2019. As per the Centers for Disease Control and Prevention (CDC), CVD is responsible for one in every four deaths in the U.S. Thus, surge in incidence of CVDs is projected to spur percutaneous transluminal angioplasty balloons market growth in the near future.

Advancements in PTA balloon technology, such as drug-coated balloons and scoring balloons, have further increased its efficacy and safety, making it a popular minimally invasive treatment option among healthcare providers and patients.

Patients prefer minimally invasive procedures due to reduced hospital stay, faster recovery time, and lower risk of complications. Additionally, patients can return to their daily activities sooner, which reduces the disruption caused by PTA.

Advanced PTA balloons offer improved performance and are easy to use. These balloons are designed to be more precise and durable, which helps improve patient outcomes and reduce procedure time. Hence, R&D of new and improved PTA balloons is boosting market development.

According to the latest percutaneous transluminal angioplasty balloons market analysis, the conventional balloons product segment is expected to dominate the global landscape from 2023 to 2031. Conventional balloons are the most commonly used PTA balloons. These balloons are non-coated and have no drug-eluting or cutting capabilities. This makes them a cost-effective and widely available option for the treatment of cardiovascular diseases.

Conventional balloons are easy to use and can be quickly inflated and deflated, thus allowing for precise control during PTA. These balloons are available in a range of sizes, from 1 mm to over 30 mm. This makes them compatible with a variety of blood vessels. Conventional balloons also have a well-established safety record, as they are associated with a low rate of complications. Therefore, they are a preferred choice for healthcare providers.

Conventional PTA balloons can also be used in combination with other devices, such as stents, to further improve blood flow and reduce the risk of restenosis (re-narrowing of the blood vessel). This makes them a versatile treatment option for a range of cardiovascular diseases, including atherosclerosis, coronary artery disease, and peripheral artery disease.

According to the latest percutaneous transluminal angioplasty balloons market trends, the 0.014 inch guidewire compatibility segment is projected to account for the largest share during the forecast period. 0.014” guidewire facilitates navigation through narrow and tortuous blood vessels. It provides access to smaller blood vessels, allowing for a wider range of treatment options. 0.014” guidewire is particularly useful for the treatment of peripheral artery disease and coronary artery disease, where the blood vessels are often narrow and winding.

0.014” guidewire is highly maneuverable, which allows for precise control during PTA. It is highly flexible and can be navigated through tight spaces and around bends, thus reducing the risk of damage to the blood vessels. These advantages make the 0.014” guidewire a popular choice for healthcare providers who require a high degree of precision during various procedures.

0.014” guidewire is compatible with a wide range of PTA balloon catheters. This enables healthcare providers to select from a variety of balloons and tailor the treatment to the patient's specific needs. The flexibility allows for more personalized treatment plans, which can improve patient outcomes.

According to the latest percutaneous transluminal angioplasty balloons market research, the coronary angioplasty segment is expected to dominate the market from 2023 to 2031. Coronary angioplasty is commonly used for the treatment of coronary artery disease, a condition where the blood vessels that supply the heart with oxygen and nutrients become narrowed or blocked.

Coronary angioplasty is a minimally invasive procedure, as it involves only a small incision or puncture in the skin. This reduces recovery time and risk of complications such as bleeding, infection, and scarring. Coronary angioplasty has a high success rate.

The hospitals end-user segment accounted for the largest share during the forecast period. Hospitals offer a wide range of healthcare services, including PTA. These healthcare settings have the necessary infrastructure and equipment, such as advanced imaging technologies and trained healthcare professionals, to perform complex procedures.

Thus, they are often the first choice for patients and healthcare providers for cardiovascular treatments.

According to the latest percutaneous transluminal angioplasty balloons market forecast, North America is estimated to dominate the industry from 2023 to 2031. Rise in prevalence of cardiovascular diseases and presence of advanced healthcare infrastructure are driving market expansion in the region.

The U.S. is a major growth engine of the industry in North America due to the presence of leading manufacturers and increase in investment in R&D of new products. Surge in healthcare expenditure and growth in adoption of minimally invasive procedures are also fueling the demand for PTA balloons in North America.

The market in Asia Pacific is expected to grow at the fastest rate during the forecast period. Rise in geriatric population, increase in investment in healthcare infrastructure, and high prevalence of cardiovascular diseases are boosting market dynamics of the region.

The global percutaneous transluminal angioplasty balloons market report profiles key vendors based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Abbott, B. Braun Melsungen AG, Boston Scientific Corporation, Cook Medical, Cordis, Medtronic, MicroPort Scientific Corporation, Opto Circuits (India) Ltd., Spectranetics (Philips Healthcare), and Terumo Corporation are prominent entities operating in the market.

Manufacturers are investing substantially in R&D of robust PTA balloons to increase their percutaneous transluminal angioplasty balloons market share. They are utilizing advanced materials and innovative designs to improve the performance and usability of their products. Some PTA balloons now have hydrophilic coatings, which ease their navigation through blood vessels. Additionally, some balloons are now designed to be compatible with smaller access sheaths, thus reducing the size of the incision needed for PTA.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.1 Bn |

|

Market Forecast Value in 2031 |

More than US$ 3.5 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.1 Bn in 2022

It is projected to reach more than US$ 3.5 Bn by the end of 2031

The CAGR is anticipated to be 5.4% from 2023 to 2031

Increase in prevalence of cardiovascular diseases and rise in preference for minimally invasive procedures

The conventional balloons product segment held the largest share in 2022

North America is expected to account for the largest share from 2023 to 2031

Abbott, B. Braun Melsungen AG, Boston Scientific Corporation, Cook Medical, Cordis, Medtronic, MicroPort Scientific Corporation, Opto Circuits (India) Ltd., Spectranetics (Philips Healthcare), and Terumo Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Percutaneous Transluminal Angioplasty Balloons Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, 2017 – 2031

5. Key Insights

5.1. Technological Advancement

5.2. Pipeline Analysis

5.3. Disease Incidence and Prevalence

5.4. Regulatory Scenario

5.5. COVID-19 Impact Analysis

6. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast By Product, 2017 – 2031

6.3.1. Conventional Balloons

6.3.2. Drug-eluting Balloons

6.3.3. Cutting and Scoring Balloons

6.4. Market Attractiveness By Product

7. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, By Guidewire Compatibility

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast By Guidewire Compatibility, 2017 – 2031

7.3.1. 0.014 Inch

7.3.2. 0.018 Inch

7.3.3. 0.035 Inch

7.4. Market Attractiveness By Guidewire Compatibility

8. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, By Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast By Application, 2017 – 2031

8.3.1. Coronary Angioplasty

8.3.2. Peripheral Angioplasty

8.4. Market Attractiveness By Application

9. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, By End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By End-user, 2017 – 2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Specialty Clinics

9.4. Market Attractiveness By End-user

10. Global Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product, 2017 – 2031

11.2.1. Conventional Balloons

11.2.2. Drug-eluting Balloons

11.2.3. Cutting and Scoring Balloons

11.3. Market Value Forecast By Guidewire Compatibility, 2017 – 2031

11.3.1. 0.014 Inch

11.3.2. 0.018 Inch

11.3.3. 0.035 Inch

11.4. Market Value Forecast By Application, 2017 – 2031

11.4.1. Coronary Angioplasty

11.4.2. Peripheral Angioplasty

11.5. Market Value Forecast By End-user, 2017 – 2031

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Specialty Clinics

11.6. Market Value Forecast By Country, 2017 – 2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Guidewire Compatibility

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product, 2017 – 2031

12.2.1. Conventional Balloons

12.2.2. Drug-eluting Balloons

12.2.3. Cutting and Scoring Balloons

12.3. Market Value Forecast By Guidewire Compatibility, 2017 – 2031

12.3.1. 0.014 Inch

12.3.2. 0.018 Inch

12.3.3. 0.035 Inch

12.4. Market Value Forecast By Application, 2017 – 2031

12.4.1. Coronary Angioplasty

12.4.2. Peripheral Angioplasty

12.5. Market Value Forecast By End-user, 2017 – 2031

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Specialty Clinics

12.6. Market Value Forecast By Country, 2017 – 2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Guidewire Compatibility

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country

13. Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product, 2017 – 2031

13.2.1. Conventional Balloons

13.2.2. Drug-eluting Balloons

13.2.3. Cutting and Scoring Balloons

13.3. Market Value Forecast By Guidewire Compatibility, 2017 – 2031

13.3.1. 0.014 Inch

13.3.2. 0.018 Inch

13.3.3. 0.035 Inch

13.4. Market Value Forecast By Application, 2017 – 2031

13.4.1. Coronary Angioplasty

13.4.2. Peripheral Angioplasty

13.5. Market Value Forecast By End-user, 2017 – 2031

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Specialty Clinics

13.6. Market Value Forecast By Country, 2017 – 2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Guidewire Compatibility

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country

14. Latin America Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product, 2017 – 2031

14.2.1. Conventional Balloons

14.2.2. Drug-eluting Balloons

14.2.3. Cutting and Scoring Balloons

14.3. Market Value Forecast By Guidewire Compatibility, 2017 – 2031

14.3.1. 0.014 Inch

14.3.2. 0.018 Inch

14.3.3. 0.035 Inch

14.4. Market Value Forecast By Application, 2017 – 2031

14.4.1. Coronary Angioplasty

14.4.2. Peripheral Angioplasty

14.5. Market Value Forecast By End-user, 2017 – 2031

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Specialty Clinics

14.6. Market Value Forecast By Country, 2017 – 2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Guidewire Compatibility

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country

15. Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Product, 2017 - 2031

15.2.1. Conventional Balloons

15.2.2. Drug-eluting Balloons

15.2.3. Cutting and Scoring Balloons

15.3. Market Value Forecast By Guidewire Compatibility, 2017 - 2031

15.3.1. 0.014 Inch

15.3.2. 0.018 Inch

15.3.3. 0.035 Inch

15.4. Market Value Forecast By Application, 2017 - 2031

15.4.1. Coronary Angioplasty

15.4.2. Peripheral Angioplasty

15.5. Market Value Forecast By End-user, 2017 - 2031

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Specialty Clinics

15.6. Market Value Forecast By Country, 2017 - 2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Guidewire Compatibility

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country

16. Competition Landscape

16.1. Market Player – Competition Matrix (by Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2021)

16.3. Company Profiles

16.3.1. Abbott

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Indication Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. B. Braun Melsungen AG

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Indication Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Boston Scientific Corporation

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Indication Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Cook Medical

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Indication Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Cordis

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Indication Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.6. Medtronic

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Indication Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.7. MicroPort Scientific Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Indication Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.8. Opto Circuits (India) Ltd.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Indication Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.9. Terumo Corporation

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Indication Portfolio

16.3.9.3. Financial Overview

16.3.10. Spectranetics (Philips Healthcare)

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Indication Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 03: Global Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 09: North America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 14: Europe Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 19: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 24: Latin America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Guidewire Compatibility, 2017–2031

Table 29: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Product (2022)

Figure 03: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Guidewire Compatibility (2022)

Figure 04: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application (2022)

Figure 05: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user (2022)

Figure 06: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Region (2022)

Figure 07: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Product, 2022 and 2031

Figure 08: Global Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 09: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Conventional Balloons, 2023–2031

Figure 10: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Drug-eluting Balloons, 2023–2031

Figure 11: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Guidewire Compatibility, 2022 and 2031

Figure 12: Global Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Guidewire Compatibility, 2023–2031

Figure 13: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 14: Global Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 15: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Coronary Angioplasty, 2023–2031

Figure 16: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Peripheral Angioplasty, 2023–2031

Figure 17: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share Analysis (%), by End-user, 2022 and 2031

Figure 18: Global Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031

Figure 19: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2023–2031

Figure 20: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ambulatory Surgical Centers, 2023–2031

Figure 21: Global Percutaneous Transluminal Angioplasty Balloons Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Specialty Clinics, 2023–2031

Figure 22: Global Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Region, 2022 and 2031

Figure 23: Global Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Region, 2023–2031

Figure 24: North America Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 25: North America Percutaneous Transluminal Angioplasty Balloons Market Value Share, by Country, 2022 and 2031

Figure 26: North America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Country, 2022-2031

Figure 27: North America Percutaneous Transluminal Angioplasty Balloons Market Value Share Analysis (%), by Product, 2022 and 2031

Figure 28: North America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 29: North America Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 30: North America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 31: North America Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user, 2022 and 2031

Figure 32: North America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031

Figure 33: Europe Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 34: Europe Percutaneous Transluminal Angioplasty Balloons Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 35: Europe Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 36: Europe Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Product, 2022 and 2031

Figure 37: Europe Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 38: Europe Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 39: Europe Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 40: Europe Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user, 2022 and 2031

Figure 41: Europe Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031

Figure 42: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 43: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 44: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 45: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Value Share Analysis (%), by Product, 2022 and 2031

Figure 46: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 47: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 48: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 49: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user, 2022 and 2031

Figure 50: Asia Pacific Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031

Figure 51: Latin America Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 52: Latin America Percutaneous Transluminal Angioplasty Balloons Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 53: Latin America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Latin America Percutaneous Transluminal Angioplasty Balloons Market Value Share Analysis (%), by Product, 2022 and 2031

Figure 55: Latin America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 56: Latin America Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 57: Latin America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 58: Latin America Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user, 2022 and 2031

Figure 59: Latin America Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031

Figure 60: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 61: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 62: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 63: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Value Share Analysis (%), by Product, 2022 and 2031

Figure 64: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Product, 2023–2031

Figure 65: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by Application, 2022 and 2031

Figure 66: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by Application, 2023–2031

Figure 67: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Value Share (%), by End-user, 2022 and 2031

Figure 68: Middle East & Africa Percutaneous Transluminal Angioplasty Balloons Market Attractiveness Analysis, by End-user, 2023–2031