Analysts’ Viewpoint

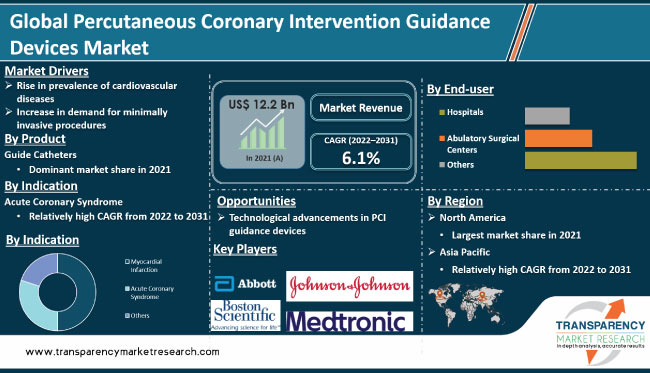

Percutaneous coronary intervention guidance devices are used in diagnosis and treatment of cardiovascular diseases. The global percutaneous coronary intervention guidance devices market is driven by the rise in prevalence of cardiovascular diseases, increase in awareness about early diagnosis & treatment of these diseases, and surge in demand for minimally invasive procedures, including percutaneous coronary intervention (PCI).

Growth in geriatric population, advancements in medical technology & devices, and rise in healthcare spending by government and private entities are other key factors fueling market expansion. Increase in healthcare spending and improvement in healthcare infrastructure in developing countries are anticipated to augment market development.

Growth in demand for cost-effective healthcare solutions and procedures is creating lucrative opportunities for market players. Manufacturers are focusing on advancements in technology, particularly in areas such as image guidance, real-time visualization, and improved device designs, to increase their market share.

PCI guidance devices are medical instruments used to guide catheter-based procedures to diagnose and treat heart conditions, including blocked arteries. These devices help physicians accurately navigate through blood vessels to reach the heart and deliver medications or devices, such as stents, to restore blood flow.

Usage of PCI guidance devices is increasing in the diagnosis and treatment of heart conditions such as coronary artery disease. Rise in geriatric population and growth in prevalence of cardiovascular diseases are driving market statistics.

The COVID-19 pandemic has had a significant impact on the percutaneous coronary intervention guidance devices market. PCI procedures and sales declined due to the suspension of non-emergency medical procedures amid nationwide lockdowns. However, demand for PCI guidance devices increased as the pandemic progressed, driven by the rise in number of COVID-19 patients with heart complications and need for timely diagnosis and treatment.

Minimally invasive procedures are preferred over traditional surgeries, as they result in less trauma to patients and faster recovery. PCI guidance devices help in performing these procedures with greater precision and accuracy. Rise in awareness about minimally invasive procedures among patients and healthcare providers has led to an increase in demand for PCI guidance devices.

Usage of these devices has helped reduce cost, shorten recovery time, and minimize complications. Thus, rise in demand for minimally invasive procedures in cardiovascular health is driving the percutaneous coronary intervention guidance devices market.

Rise in prevalence of cardiovascular diseases is augmenting the demand for PCI procedures, which require guidance devices to ensure the procedure's accuracy and effectiveness. Aging population and surge in unhealthy lifestyle habits are leading to an increase in incidence of cardiovascular diseases such as coronary artery disease and heart attack. This, in turn, is driving the demand for PCI procedures. PCI guidance devices provide real-time information to physicians during surgical procedures, leading to better patient outcomes.

According to the American Heart Association, cardiovascular disease is a major health issue across the world and is the leading cause of death in several countries, including the U.S. Cardiovascular diseases accounted for about one in three deaths in the country in 2020.

According to the percutaneous coronary intervention guidance devices market research, technological advancements have led to the development of more sophisticated and effective PCI guidance devices. These devices use advanced imaging techniques and navigation systems to accurately guide catheters and stents to the target area in coronary arteries, thereby improving the success rate and safety of PCI procedures.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) to enhance image analysis & diagnosis accuracy, development of bioresorbable scaffolds (BRS) to reduce restenosis, and introduction of hybrid closure devices to lower vascular complications & improve procedural efficiency are the technological advancements that are likely to accelerate market progress. Furthermore, development of Fractional Flow Reserve (FFR) wire & sensor technology and integration of wearable technology to monitor patients and improve post-procedural care are projected to bolster the demand for PCI guidance devices.

In terms of product, the guide catheters segment accounted for the largest share of the global percutaneous coronary intervention guidance devices market in 2021. This can be ascribed to the ability of guide catheters to provide safe and efficient access to coronary arteries.

Advancements in guide catheter technology and design, such as better trackability and stability, have increased their popularity and usage in PCI procedures. Furthermore, surge number of PCI procedures performed globally, increase in geriatric population, and rise in incidence of cardiovascular diseases are boosting the segment.

North America dominated the percutaneous coronary intervention guidance devices global industry in 2021. Well-established healthcare infrastructure, high incidence of cardiovascular diseases, and presence of leading key players can be ascribed to the region's global dominance.

Favorable reimbursement policies for PCI procedures and rise in preference for minimally invasive procedures, including PCI, among healthcare providers are also driving the demand for PCI guidance devices in North America.

The percutaneous coronary intervention guidance devices market size in Asia Pacific is expected to grow at a rapid pace during the forecast period. Rise in awareness about advanced medical technologies and their benefits is fueling market progress in Asia Pacific.

Growth in prevalence of age-related cardiovascular diseases due to the increase in geriatric population and surge in number of hospitals and clinics, especially in countries such as China and India, is augmenting market dynamics in Asia Pacific.

Europe held significant global percutaneous coronary intervention guidance devices market share in 2021. The market in the region is driven by the increase in incidence of cardiovascular diseases, advancements in medical technology, and growth in healthcare expenditure.

This report provides profiles of leading players operating in the global percutaneous coronary intervention guidance devices market. These include Abbott, Boston Scientific Corporation, Medtronic, Johnson & Johnson Services, Inc., Terumo Corporation, Biosensors International Group, Ltd., B. Braun SE, Cordis, Meril Life Sciences Pvt. Ltd., CONMED Corporation, Emirates Health Services (EHS), and Koninklijke Philips N.V.

Prominent players are engaging in mergers & acquisitions, strategic collaborations, and new product launches to expand their presence and increase market share.

Leading players have been profiled in the percutaneous coronary intervention guidance devices market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 12.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 23.5 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 12.2 Bn in 2021.

It is projected to reach more than US$ 23.5 Bn by 2031.

The CAGR is anticipated to be 6.1% from 2022 to 2031.

The guide catheters segment accounted for more than 50.0% share in 2021.

North America is expected to hold significant share during the forecast period.

Abbott, Boston Scientific Corporation, Medtronic, Johnson & Johnson Services, Inc., Terumo Corporation, Biosensors International Group, Ltd., B. Braun SE, Cordis, Meril Life Sciences Pvt. Ltd., CONMED Corporation, Emirates Health Services (EHS), and Koninklijke Philips N.V.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Percutaneous Coronary Intervention Guidance Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Percutaneous Coronary Intervention Guidance Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Technologiacal Advancements

5.3. Disease Prevalence & Incidence Rate globally with key countries

5.4. Regulatory Scenario by Region/globally

5.5. COVID 19 Impact on Industry

6. Percutaneous Coronary Intervention Guidance Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Percutaneous Sheath Introducers

6.3.2. Guide Catheters

6.3.3. Guidewires

6.3.4. Others

6.4. Market Attractiveness Analysis, by Product

7. Percutaneous Coronary Intervention Guidance Devices Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. Myocardial Infarction

7.3.2. Acute Coronary Syndrome

7.3.3. Others

7.4. Market Attractiveness Analysis, by Indication

8. Percutaneous Coronary Intervention Guidance Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Percutaneous Coronary Intervention Guidance Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Respiratory Disposables Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Percutaneous Sheath Introducers

10.2.2. Guide Catheters

10.2.3. Guidewires

10.2.4. Others

10.3. Market Value Forecast, by Indication, 2017–2031

10.3.1. Myocardial Infarction

10.3.2. Acute Coronary Syndrome

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Respiratory Disposables Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Percutaneous Sheath Introducers

11.2.2. Guide Catheters

11.2.3. Guidewires

11.2.4. Others

11.3. Market Value Forecast, by Indication, 2017–2031

11.3.1. Myocardial Infarction

11.3.2. Acute Coronary Syndrome

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Respiratory Disposables Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Percutaneous Sheath Introducers

12.2.2. Guide Catheters

12.2.3. Guidewires

12.2.4. Others

12.3. Market Value Forecast, by Indication, 2017–2031

12.3.1. Myocardial Infarction

12.3.2. Acute Coronary Syndrome

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Respiratory Disposables Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Percutaneous Sheath Introducers

13.2.2. Guide Catheters

13.2.3. Guidewires

13.2.4. Others

13.3. Market Value Forecast, by Indication, 2017–2031

13.3.1. Myocardial Infarction

13.3.2. Acute Coronary Syndrome

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Respiratory Disposables Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Percutaneous Sheath Introducers

14.2.2. Guide Catheters

14.2.3. Guidewires

14.2.4. Others

14.3. Market Value Forecast, by Indication, 2017–2031

14.3.1. Myocardial Infarction

14.3.2. Acute Coronary Syndrome

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Boston Scientific Corporation

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Medtronic

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Johnson & Johnson Services, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Terumo Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Biosensors International Group, Ltd.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. B. Braun SE

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Cordis

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Meril Life Sciences Pvt. Ltd.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. CONMED Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Koninklijke Philips N.V.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.12. Emirates Health Services (EHS)

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Global Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 07: North America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 10: Europe Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 11: Europe Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 19: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 03: Global Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 04: Global Percutaneous Cronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 05: Global Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 06: Global Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 07: Global Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 08: Global Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 09: Global Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 10: North America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 12: North America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 13: North America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 14: North America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 15: North America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: North America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: North America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 18: North America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: Europe Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 21: Europe Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 22: Europe Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 23: Europe Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 24: Europe Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 25: Europe Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 26: Europe Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 30: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 31: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 32: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 33: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 39: Latin America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 40: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 41: Latin America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 42: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Latin America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Latin America Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 48: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 49: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 50: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 51: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Percutaneous Coronary Intervention Guidance Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Global Percutaneous Coronary Intervention Guidance Devices Market Share Analysis, by Company, 2021