Analyst Viewpoint

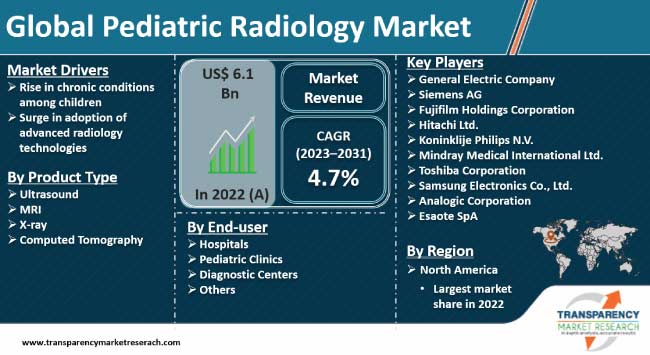

Rise in chronic conditions among children and surge in adoption of advanced radiology technologies are driving the global pediatric radiology market value. Increase in cases of chronic diseases, such as obesity, diabetes, and asthma, in children along with environmental factors, including exposure to toxins and pollution, are boosting the demand for pediatric radiology.

Growth in parental concerns over radiation exposure, high implementation costs, and lack of awareness regarding pediatric radiology are some of the factors leading to pediatric radiology market limitations. Key players in the market are investing in advanced technologies and launching new products to expand their product portfolio.

Pediatric radiology is a subtype of radiology that focuses on imaging and diagnosis of diseases and conditions in children. There are several types of imagining techniques such as X-rays, ultrasounds, CT scans, and MRIs, which are employed to determine and identify problems in pediatric patients. Pediatric imaging techniques are important to diagnose various diseases and infections in children.

Fetal MRI in pediatric radiology is employed to provide detailed information about the anatomic structure of a fetus including the fetal brain, spine, face and neck, chest, and lungs, to determine the cases of birth defects and minimize further complications. Ultrasound is employed to evaluate abdominal, pelvic, or scrotal pain in children. It is a useful modality as it involves no irradiation or sedation and can be performed repeatedly at the patient's bedside. MRI is used to help diagnose a wide range of conditions in children due to injury, illness, or congenital abnormalities.

Pediatric radiology plays a major role in the diagnosis and treatment of various pediatric diseases. X-ray, ultrasound, MRI, and CT scans are some of the imaging technologies that are utilized to determine the condition of internal organs to identify abnormalities and infections.

There is a significant growth in the amount of population suffering from pediatric diseases. Surge in prevalence of chronic diseases, such as obesity, diabetes, and asthma, in children is fueling the pediatric radiology market landscape. According to the World Health Organization (WHO), the number of children with obesity or overweight under the age of 5 has increased from 32 million in 1990 to 41 million in 2016 worldwide. The Centers for Disease Control and Prevention (CDC) stated that an estimated 6.2 million children under the age of 18 in the U.S. have asthma.

Pneumonia is one of the most common chronic diseases among children. Around 800,000 children under the age of five die from pneumonia each year, more than any other infectious disease, according to UNICEF's April 2021 report. This additionally includes more than 153,000 newborn babies. Hence, rise in cases of pneumonia is boosting the pediatric radiology market size.

Increase in number of premature births and rise in adoption for preventive care are augmenting the demand for pediatric interventional radiology procedures. A study conducted by the World Health Organization, the U.N. Children’s Fund, UNICEF, and the London School of Hygiene and Tropical Medicine and published in 2023 reported that 1 in 10 babies around the world are born prematurely - before 37 weeks - leading to deaths, disability and chronic illnesses. According to the CDC, approximately 9.2 million children in the U.S. are admitted to the emergency department for injuries such as falls, road traffic, and burns. This, in turn, is projected to spur the pediatric radiology market revenue in the near future.

Major hospitals and pediatric clinics across the globe are adopting advanced radiology technologies. In August 2018, Lucile Packard Children’s Hospital Stanford established a surgical center that included a novel hybrid operating suite that provides immediate evaluation of post-surgical interventions. These types of advancements increase patient safety and reduce hospital stays, resulting in lower treatment costs.

Increase in investment in advanced technology and frequent product launches by market players are boosting the pediatric radiology market trajectory. Moreover, new initiatives by several governments and private organizations to spread awareness related to pediatric diagnostic imaging is also driving the industry growth. In December 2018, the American College of Radiology (ACR) and the Radiological Society of North America (RSNA) launched a new section - RadInfo 4 Kids - on their official website. The informational website focuses on providing information about radiology to children and their guardians.

North America held the largest market share in 2022, according to the latest pediatric radiology market analysis. Increase in investment in research and development, availability of modern healthcare facilities, and presence of beneficial reimbursement laws are some of the major factors propelling the market dynamics of the region.

Rise in cases of premature births, surge in prevalence of pediatric diseases, and approval and launch of new products are augmenting the pediatric radiology market statistics in North America. In 2022, according to the CDC, preterm birth affected about 1 of every 10 infants born in the U.S. The same source stated that, in 2022, the rate of preterm birth among African-American women (14.6%) was about 50 percent higher than the rate of preterm birth among white or Hispanic women (9.4% and 10.1%, respectively). Premature babies are at higher risk of neurological complications, as a result, there is demand for child radiology which helps to detect infections or defects.

The global landscape is highly competitive, with several opportunities for expansion and innovation. Companies operating in the pediatric radiology industry are adopting various strategies, such as mergers and acquisitions and new product development, to support medical research and improve patient care.

General Electric Company, Siemens AG, Fujifilm Holdings Corporation, Hitachi Ltd., Koninklijke Philips N.V., Mindray Medical International Ltd., Toshiba Corporation, Samsung Electronics Co., Ltd., Analogic Corporation, and Esaote SpA are some of the major pediatric radiology manufacturers.

Each of these companies has been profiled in the pediatric radiology market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 6.1 Bn |

| Market Forecast (Value) in 2031 | US$ 9.2 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2019-2022 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.1 Bn in 2022

It is anticipated to grow at a CAGR of 4.7% from 2023 to 2031

Rise in chronic conditions among children and surge in adoption of advanced radiology technologies

North America was the leading region in 2022

General Electric Company, Siemens AG, Fujifilm Holdings Corporation, Hitachi Ltd., Koninklijke Philips N.V., Mindray Medical International Ltd., Toshiba Corporation, Samsung Electronics Co., Ltd., Analogic Corporation, Esaote SpA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pediatric Radiology Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pediatric Radiology Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Pediatric Radiology Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Ultrasound

6.3.2. MRI

6.3.3. X-ray

6.3.4. Computed Tomography

6.4. Market Attractiveness Analysis, by Product Type

7. Global Pediatric Radiology Market Analysis and Forecast, by Modality

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Modality, 2017–2031

7.3.1. Standalone Devices

7.3.2. Table-top Devices

7.3.3. Portable Devices

7.4. Market Attractiveness Analysis, by Modality

8. Global Pediatric Radiology Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Pediatric Clinics

8.3.3. Diagnostic Centers

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Pediatric Radiology Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Pediatric Radiology Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product Type, 2017–2031

10.3.1. Ultrasound

10.3.2. MRI

10.3.3. X-ray

10.3.4. Computed Tomography

10.4. Market Value Forecast, by Modality, 2017–2031

10.4.1. Standalone Devices

10.4.2. Table-top Devices

10.4.3. Portable Devices

10.5. Market Value Forecast, by End-user, 2017–2031

10.5.1. Hospitals

10.5.2. Pediatric Clinics

10.5.3. Diagnostic Centers

10.5.4. Others

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Modality

10.7.3. By End-user

10.7.4. By Country

11. Europe Pediatric Radiology Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product Type, 2017–2031

11.3.1. Ultrasound

11.3.2. MRI

11.3.3. X-ray

11.3.4. Computed Tomography

11.4. Market Value Forecast, by Modality, 2017–2031

11.4.1. Standalone Devices

11.4.2. Table-top Devices

11.4.3. Portable Devices

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Pediatric Clinics

11.5.3. Diagnostic Centers

11.5.4. Others

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Modality

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Asia Pacific Pediatric Radiology Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product Type, 2017–2031

12.3.1. Ultrasound

12.3.2. MRI

12.3.3. X-ray

12.3.4. Computed Tomography

12.4. Market Value Forecast, by Modality, 2017–2031

12.4.1. Standalone Devices

12.4.2. Table-top Devices

12.4.3. Portable Devices

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Pediatric Clinics

12.5.3. Diagnostic Centers

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Modality

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Latin America Pediatric Radiology Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product Type, 2017–2031

13.3.1. Ultrasound

13.3.2. MRI

13.3.3. X-ray

13.3.4. Computed Tomography

13.4. Market Value Forecast, by Modality, 2017–2031

13.4.1. Standalone Devices

13.4.2. Table-top Devices

13.4.3. Portable Devices

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Pediatric Clinics

13.5.3. Diagnostic Centers

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Modality

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Middle East & Africa Pediatric Radiology Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Product Type, 2017–2031

14.3.1. Ultrasound

14.3.2. MRI

14.3.3. X-ray

14.3.4. Computed Tomography

14.4. Market Value Forecast, by Modality, 2017–2031

14.4.1. Standalone Devices

14.4.2. Table-top Devices

14.4.3. Portable Devices

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Pediatric Clinics

14.5.3. Diagnostic Centers

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Modality

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. General Electric Company

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Siemens AG

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Fujifilm Holdings Corporation

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Hitachi Ltd.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Koninklije Philips N.V.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Mindray Medical International Ltd.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Toshiba Corporation

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Samsung Electronics Co., Ltd.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Analogic Corporation

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Esaote SpA

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 03: Global Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Pediatric Radiology Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Pediatric Radiology Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 08: North America Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Pediatric Radiology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 12: Europe Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Pediatric Radiology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 16: Asia Pacific Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Pediatric Radiology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 20: Latin America Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Pediatric Radiology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Pediatric Radiology Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa Pediatric Radiology Market Size (US$ Mn) Forecast, by Modality, 2017–2031

Table 24: Middle East & Africa Pediatric Radiology Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Pediatric Radiology Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Pediatric Radiology Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Pediatric Radiology Market Value Share, by Product Type, 2022

Figure 04: Global Pediatric Radiology Market Revenue (US$ Mn), by Modality, 2022

Figure 05: Global Pediatric Radiology Market Value Share, by Modality, 2022

Figure 06: Global Pediatric Radiology Market Revenue (US$ Mn), by End-user, 2022

Figure 07: Global Pediatric Radiology Market Value Share, by End-user, 2022

Figure 08: Global Pediatric Radiology Market Value Share, by Region, 2022

Figure 09: Global Pediatric Radiology Market Value (US$ Mn) Forecast, 2023–2031

Figure 10: Global Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 11: Global Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 12: Global Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 13: Global Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023-2031

Figure 14: Global Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023-2031

Figure 16: Global Pediatric Radiology Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Pediatric Radiology Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Pediatric Radiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Pediatric Radiology Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Pediatric Radiology Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 22: North America Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 23: North America Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: North America Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023–2031

Figure 26: North America Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Europe Pediatric Radiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Pediatric Radiology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Pediatric Radiology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 31: Europe Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 32: Europe Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: Europe Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023–2031

Figure 35: Europe Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023–2031

Figure 36: Asia Pacific Pediatric Radiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Pediatric Radiology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Pediatric Radiology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 40: Asia Pacific Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 41: Asia Pacific Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 43: Asia Pacific Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023–2031

Figure 44: Asia Pacific Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023–2031

Figure 45: Latin America Pediatric Radiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Pediatric Radiology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Pediatric Radiology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 49: Latin America Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 50: Latin America Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 52: Latin America Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023–2031

Figure 53: Latin America Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023–2031

Figure 54: Middle East & Africa Pediatric Radiology Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Pediatric Radiology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Pediatric Radiology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Pediatric Radiology Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 58: Middle East & Africa Pediatric Radiology Market Value Share Analysis, by Modality, 2022 and 2031

Figure 59: Middle East & Africa Pediatric Radiology Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Pediatric Radiology Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 61: Middle East & Africa Pediatric Radiology Market Attractiveness Analysis, by Modality, 2023–2031

Figure 62: Middle East & Africa Pediatric Radiology Market Attractiveness Analysis, by End-user, 2023–2031