Analysts’ Viewpoint

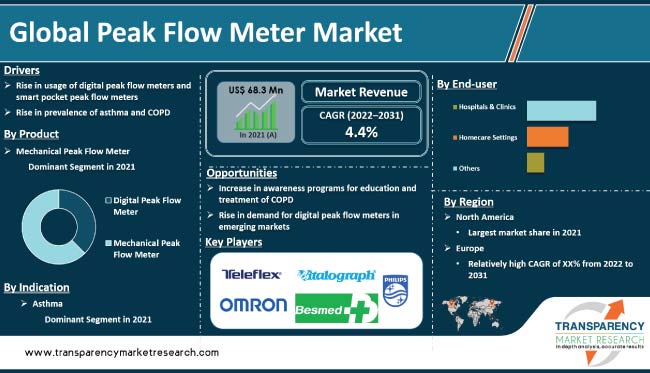

High prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma; increase in geriatric population with respiratory diseases; surge in research & development initiatives for asthma; and rise in demand for diagnostic imaging devices are propelling the global peak flow meter market. Demand for these meters was affected by the COVID-19 pandemic, which shifted this niche pedestal industry to the mainstream.

Rise in chronic respiratory diseases and implementation of new treatments for several diseases across the world presents significant opportunities for companies in the market. Manufacturers are focusing on the development of technologically advanced and low cost devices.

Mobile health apps are empowering patients to keep track of their illnesses. Furthermore, asthma patients are self-monitoring their health using commercially available digital peak flow meters. These advancements are expected to propel market expansion during the forecast period.

A peak flow meter is an instrument that gauges the amount of air that can be forcibly throPeak Flow Meter Market Introduction wn out of the lungs in a single, quick breath. It flags off changes to the airways in people with asthma or COPD.

Peak flow measurements could reveal worsening respiratory symptom in a person. Presently, there is only one test to measure the peak flow. However, it is a helpful tool to determine the type of treatment to start, including urgent care.

Peak expiratory flow can be easily measured using a typical peak flow meter. The device comprises a spring-loaded pivoted vane that rotates inside of a drum. When air is forced through the inlet, the vane rotates to a degree proportional to the maximum flow developed.

The device is typically used by asthmatics to gauge their peak expiratory flow rate (PEFR or peak flow). PEFR is the fastest rate at which a person can exhale air from lungs.

Demand for digital peak flow meters has increased due to technological advancements such as improved monitor adherence. These meters are simpler to use and can produce more accurate results. Therefore, a larger percentage of people are using these devices. High cost of these devices, as compared to mechanical peak flow meters, is likely to restrain the segment.

Access to smart peak flow devices could present significant opportunities for companies in the market. Smart peak flow devices are portable, easy to operate, and connected to mobile phones, owing to their size and simple technology.

The market is driven by rise in demand for pocket peak flow meters. Ease of accurate measurement of peak expiratory flow rate and forced expiratory volume is driving the demand for digital peak flow meters.

Rise in prevalence of asthma and COPD is a major factor boosting the global peak flow meter market. Mortality rate is increasing owing to these two respiratory illnesses. The market is anticipated to be driven by other factors such as rise in smoking, growing disposable income, and surge in healthcare awareness.

Increase in adoption of these devices among people for use at home due to affordability and portability is augmenting growth opportunities for peak flow meter market.

Healthcare organizations have initiated numerous awareness programs, including online education programs, environmental initiatives, and medication maintenance programs. Several healthcare professionals also run these programs. Public and healthcare professionals across the world have been included in these programs to achieve the primary goal of these awareness programs, which is to control respiratory diseases such as asthma, COPD, and others. Therefore, demand for peak flow meters is likely to increase due to rise in awareness programs for COPD and asthma education and treatment.

In terms of product, the digital peak flow meter segment is projected to account for major market share during the forecast period. This is ascribed to increase in respiratory disorders such as asthma and chronic obstructive pulmonary disease (COPD). Adoption of these devices is high among patients and healthcare providers due to low cost.

Companies operating in the market are introducing advanced products for detection and treatment of several respiratory diseases. For instance, Smart Peak Flow, the first medical peak flow device that is fully certified and connects to a smartphone app, was introduced in the market.

The tiny gadget fits into any smartphone's headphone jack. Users only need to blow three times into the mouthpiece for the companion app to track changing lung function over time. The app offers a chart of results that show whether a patient is in a green (safe), yellow, or red (at risk) zone, allowing accurate results to be instantly shared with a doctor or caregiver.

Based on indication, the asthma segment led the peak flow meter market in 2021. These devices have been prescribed to patients with asthma, COPD, and other respiratory diseases to monitor the severity of their disease and their response to therapy at home.

According to the World Health Organization (WHO), asthma affects 339 million people worldwide, and older adults account for the majority of asthma deaths. Asthma affects 1% to 18% of the global population, and the prevalence has been rising.

Asthma is frequently underdiagnosed and undertreated, particularly in low- and middle-income countries. Increase in number of asthmatic patients is anticipated to drive the global peak flow market share during the forecast period.

In terms of end-user, the hospitals & clinics segment accounted for major market share in 2021. Demand for peak flow meters is high in hospitals and clinics. Increase in number of hospitals & clinics is likely to drive the need for these devices to provide proper care to newborn patients.

Peak flow meters feature a simple application and less complex design, which helps homecare facilities in early diagnosis of asthma and chronic respiratory conditions among the geriatric population. These factors are expected to drive the demand for these devices in hospitals and clinics during the forecast period.

North America accounted for the largest share of the global market in 2021. The region is home to a large number of medical device manufacturers and is a hub for healthcare products, which makes it a significant market for these devices.

Medical device companies in North America have significant R&D and manufacturing capabilities, which allows innovation and development of new and advanced products. Government initiatives to improve the healthcare infrastructure and increase access to healthcare services are likely to propel market expansion in the region.

The global peak flow meter business is fragmented, with the presence of a small number of leading players. Expansion of product portfolio and mergers & acquisitions are key strategies adopted by prominent manufacturers. DeVilbiss Healthcare LLC, Koninklijke Philips N.V., Vitalograph Ltd., ResMed, Inc., Haag-Streit Group, Medline Industries, Inc., nSpire Health, Inc., Teleflex, Inc., Vyaire Medical Inc., Omron Healthcare Co., Ltd., Ambisea Technology, and Contec Medical Systems are the prominent industry players.

This global peak flow meter market report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in Value in 2021 |

US$ 68.3 Mn |

|

Forecast Value in 2031 |

More than US$ 104.3 Mn |

|

Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Peak Flow Meter Market Analysis |

It includes segmentation analysis and regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 68.3 Mn in 2021.

It is projected to reach more than US$ 104.3 Mn by 2031.

The CAGR is anticipated be 4.4% from 2022 to 2031.

Rise in usage of digital peak flow meters & smart pocket peak flow meters, rise in prevalence of asthma & COPD, higher per capita healthcare costs, rise in awareness among patients, and early diagnosis & treatment of diseases.

North America is likely to account for major share during the forecast period.

DeVilbiss Healthcare LLC, Koninklijke Philips N.V., Vitalograph Ltd., ResMed, Inc., Haag-Streit Group, Medline Industries, Inc., nSpire Health, Inc., Teleflex, Inc., Vyaire Medical, Inc., Omron Healthcare Co., Ltd., Ambisea Technology, and Contec Medical Systems.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Peak Flow Meter Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Peak Flow Meter Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Insights on Prevalence and Incidence of Respiratory Disease

5.2. Pricing Analysis

5.3. Technological Advancement

5.4. Key Industry Events

5.5. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long-term impact)

6. Global Peak Flow Meter Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Digital Peak Flow Meter

6.3.2. Mechanical Peak Flow Meter

6.4. Market Attractiveness Analysis, by Product

7. Global Peak Flow Meter Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. Chronic Obstructive Pulmonary Disease (COPD)

7.3.2. Asthma

7.3.3. Others

7.4. Market Attractiveness Analysis, by Indication

8. Global Peak Flow Meter Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Clinics

8.3.2. Homecare Settings

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Peak Flow Meter Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Peak Flow Meter Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Digital Peak Flow Meter

10.2.2. Mechanical Peak Flow Meter

10.3. Market Value Forecast, by Indication, 2017–2031

10.3.1. Chronic Obstructive Pulmonary Disease (COPD)

10.3.2. Asthma

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Clinics

10.4.2. Homecare Settings

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Peak Flow Meter Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Digital Peak Flow Meter

11.2.2. Mechanical Peak Flow Meter

11.3. Market Value Forecast, by Indication, 2017–2031

11.3.1. Chronic Obstructive Pulmonary Disease (COPD)

11.3.2. Asthma

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Clinics

11.4.2. Homecare Settings

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Peak Flow Meter Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Digital Peak Flow Meter

12.2.2. Mechanical Peak Flow Meter

12.3. Market Value Forecast, by Indication, 2017–2031

12.3.1. Chronic Obstructive Pulmonary Disease (COPD)

12.3.2. Asthma

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Clinics

12.4.2. Homecare Settings

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Peak Flow Meter Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Digital Peak Flow Meter

13.2.2. Mechanical Peak Flow Meter

13.3. Market Value Forecast, by Indication, 2017–2031

13.3.1. Chronic Obstructive Pulmonary Disease (COPD)

13.3.2. Asthma

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Clinics

13.4.2. Homecare Settings

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of LATAM

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Peak Flow Meter Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Digital Peak Flow Meter

14.2.2. Mechanical Peak Flow Meter

14.3. Market Value Forecast, by Indication, 2017–2031

14.3.1. Chronic Obstructive Pulmonary Disease (COPD)

14.3.2. Asthma

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals & Clinics

14.4.2. Homecare Settings

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. DeVilbiss Healthcare LLC

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Koninklijke Philips N.V.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Medline Industries, Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Omron Healthcare Co., Ltd.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. ResMed, Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Teleflex, Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Vitalograph Ltd.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Vyaire Medical, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Ambisea Technology

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Contec Medical Systems

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. nSpire Health, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Haag-Streit Group

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Global Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Peak Flow Meter Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Peak Flow Meter Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 08: North America Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Peak Flow Meter Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 12: Europe Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Peak Flow Meter Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 16: Asia Pacific Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Peak Flow Meter Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 20: Latin America Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Peak Flow Meter Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Peak Flow Meter Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Peak Flow Meter Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 24: Middle East & Africa Peak Flow Meter Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Peak Flow Meter Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global Peak Flow Meter Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global Peak Flow Meter Market Value Share, by Product, 2021

Figure 04: Global Peak Flow Meter Market Revenue (US$ Mn), by Indication, 2021

Figure 05: Global Peak Flow Meter Market Value Share, by Indication, 2021

Figure 06: Global Peak Flow Meter Market Revenue (US$ Mn), by End-user, 2021

Figure 07: Global Peak Flow Meter Market Value Share, by End-user, 2021

Figure 08: Global Peak Flow Meter Market Value Share, by Region, 2021

Figure 09: Global Peak Flow Meter Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 11: Global Peak Flow Meter Market Attractiveness Analysis, by Product, 2022-2031

Figure 12: Global Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 13: Global Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022-2031

Figure 14: Global Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 15: Global Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Peak Flow Meter Market Value Share Analysis, by Region, 2017 and 2031

Figure 17: Global Peak Flow Meter Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Peak Flow Meter Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Peak Flow Meter Market Attractiveness Analysis, by Country, 2017–2031

Figure 20: North America Peak Flow Meter Market Value Share Analysis, by Country, 2017 and 2031

Figure 21: North America Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 22: North America Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 23: North America Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 24: North America Peak Flow Meter Market Attractiveness Analysis, by Product, 2022–2031

Figure 25: North America Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022–2031

Figure 26: North America Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022–2031

Figure 27: Europe Peak Flow Meter Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Peak Flow Meter Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 29: Europe Peak Flow Meter Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 30: Europe Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 31: Europe Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 32: Europe Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 33: Europe Peak Flow Meter Market Attractiveness Analysis, by Product, 2022–2031

Figure 34: Europe Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022–2031

Figure 35: Europe Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022–2031

Figure 36: Asia Pacific Peak Flow Meter Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Peak Flow Meter Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 38: Asia Pacific Peak Flow Meter Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 39: Asia Pacific Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 40: Asia Pacific Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 41: Asia Pacific Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 42: Asia Pacific Peak Flow Meter Market Attractiveness Analysis, by Product, 2022–2031

Figure 43: Asia Pacific Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022–2031

Figure 44: Asia Pacific Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Latin America Peak Flow Meter Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Peak Flow Meter Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 47: Latin America Peak Flow Meter Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 48: Latin America Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 49: Latin America Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 50: Latin America Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 51: Latin America Peak Flow Meter Market Attractiveness Analysis, by Product, 2022–2031

Figure 52: Latin America Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022–2031

Figure 53: Latin America Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022–2031

Figure 54: Middle East & Africa Peak Flow Meter Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Peak Flow Meter Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 56: Middle East & Africa Peak Flow Meter Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 57: Middle East & Africa Peak Flow Meter Market Value Share Analysis, by Product, 2017 and 2031

Figure 58: Middle East & Africa Peak Flow Meter Market Value Share Analysis, by Indication, 2017 and 2031

Figure 59: Middle East & Africa Peak Flow Meter Market Value Share Analysis, by End-user, 2017 and 2031

Figure 60: Middle East & Africa Peak Flow Meter Market Attractiveness Analysis, by Product, 2022–2031

Figure 61: Middle East & Africa Peak Flow Meter Market Attractiveness Analysis, by Indication, 2022–2031

Figure 62: Middle East & Africa Peak Flow Meter Market Attractiveness Analysis, by End-user, 2022–2031