As the COVID-19 pandemic enters year two, searching for innovative solutions to sustainable and new eCommerce packaging designs is growing prominent. Major brands such as PepsiCo, Diageo, and Absolut are seen developing paper bottles to offer sustainability benefits to eco-conscious consumers. Stakeholders in the paper bottles market are capitalizing on this opportunity to boost production capabilities during the ongoing pandemic. Although innovations in paper bottles are picking pace, poor market sentiments due to the pandemic are affecting growth of the paper bottles market. Manufacturers operating in the production of the paper bottles are restricted to carry the production activities limited to a certain time and with a limited working capacity. Moreover, due to the disruption in the supply chain and logistics, companies in the paper bottles market also are facing difficulties in the procurement of recycled raw material and other pulp extracts used in the manufacturing of paper bottles. Therefore, this is expected to add economic and financial challenges for the manufacturers of paper bottles across various regions.

However, even during the pandemic, R&D activities were still carried out effectively on the testing of paper bottle prototypes for use in the beverages industry. Along with the manufacturing of sustainable products, manufacturers these days are also preferring to pack the product with sustainable packaging in order to comply with sustainable manufacturing practices. Thus, stakeholders are focusing on critical industries including food & beverages (F&B), homecare, and personal care products to establish stable revenue streams during these unprecedented times of the pandemic.

There is an extensive demand in rigid packaging, owing to the improved protection to the product and availability of a variety of packaging formats. Other factors such as versatility and improved recyclability as compared to flexible packaging are also boosting the demand for rigid packaging from manufacturers.

In addition, eCommerce and online sales are emerging as major revenue generating sources in the paper bottles market.

Paper is being highly publicized as a substitute for plastic packaging and even, bio-plastics. However, the current available data indicates that paper packaging generally requires several times more mass to fulfill the same function as its plastic counterpart. Thus, the overall environmental impact tends to be higher for paper, except in its carbon footprint. Stakeholders in the paper bottles market are gaining awareness that paper packaging will continue to grow for adoption, but is not a substantial threat to plastics.

As the paper bottles market is projected to reach US$ 93.9 Mn in 2029, it is likley that several companies will be adopting paper packaging to reduce plastic waste.

Coca Cola has been gaining recognition for joining forces with partner Paboco to look for alternatives involving paper and creating bottles using it. Companies in the paper bottles market are realizing the importance of R&D, and increasing investments to create paper bottles that can be recycled such as any other type of paper.

The paper bottles market is expected to surpass 126,864 thousand units by 2029. Manufacturers are increasing efforts to overcome various challenges to develop fully bio-based paper bottles. They are introducing bio-based barriers that withstand both water vapor and oxygen transmission.

The paper bottles market is estimated to clock a CAGR of 5.4% in terms of value during the forecast period. Manufacturers are overcoming challenges such as increasing proficiency in the proprietary bottle base technology that uses the fiber properties to stay intact when exposed to high pressure for developing fully bio-based paper bottles.

Since water is expected to dictate the highest value and volume growth among all end user types in the paper bottles market, manufacturers are taking advantage of this opportunity to increase focus on the patented packaging technology. Paper Water Bottle - an industry-leading pulp packaging company, is gaining popularity for its patented packaging technology that is redefining liquid packaging through the use of natural materials and barriers.

Analysts’ Viewpoint

Although the COVID-19 pandemic has led to a volatile demand and supply of products, manufacturers in the paper bottles market are riding the crest of popularity with the help of paper packaging for beverage and water applications. Paper bottles are gaining prominence in the packaged water segment. However, the cap and closure for these paper bottles is aluminum or plastic-based, which creates challenges in recycling, since this demands efficient collection and sorting to achieve high end-of-life processing success rates. Hence, companies should increase research to develop tethered caps made from either a bio-composite or pure paper to simplify recycling of paper bottles in the future.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Paper Bottles Market Overview

3.1. Global Economic Outlook

3.2. Packaging Market Overview

3.3. Global Paper Recycling Industry Outlook

3.4. Key Market Regulations

3.5. Key Industry Perspective: What Industry Leaders are saying?

3.6. Technological Trends for Paper Bottles Market

3.7. Manufacturing Process of Paper Bottles

3.8. Value Chain Analysis

3.8.1. Exhaustive List of Active Participants

3.8.1.1. Raw-material Supplier

3.8.1.2. Paper Bottles Manufacturers

3.8.1.3. End Users/Brand Owners

3.8.2. Profitability Margins

3.9. Macro-economic Factors – Correlation Analysis

3.10. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Paper Bottles Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Paper Bottles Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

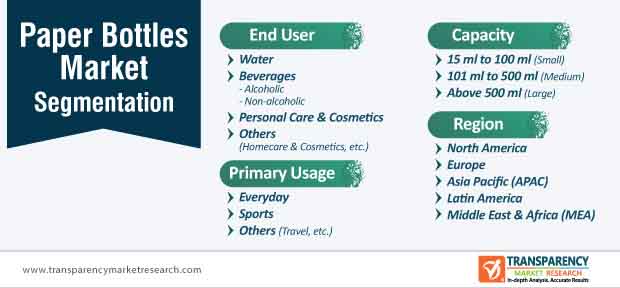

7. Global Paper Bottles Market Analysis and Forecast, By Capacity

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

7.1.2. Y-o-Y Growth Projections, By Capacity

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

7.2.1. 15 ml – 100 ml (small)

7.2.2. 101 ml – 500 ml (medium)

7.2.3. Above 500 ml (large)

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

7.3.1. 15 ml – 100 ml (small)

7.3.2. 101 ml – 500 ml (medium)

7.3.3. Above 500 ml (large)

7.4. Market Attractiveness Analysis, By Capacity

8. Global Paper Bottles Market Analysis and Forecast, By Primary Usage

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Primary Usage

8.1.2. Y-o-Y Growth Projections, By Primary Usage

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

8.2.1. Everyday

8.2.2. Sports

8.2.3. Others (Travel, etc.)

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

8.3.1. Everyday

8.3.2. Sports

8.3.3. Others (Travel, etc.)

8.4. Market Attractiveness Analysis, By Primary Usage

9. Global Paper Bottles Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

9.2.1. Water

9.2.2. Beverages

9.2.2.1. Alcoholic

9.2.2.2. Non-alcoholic

9.2.3. Cosmetics & Personal Care

9.2.4. Others (Homecare & Toiletries, etc.)

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

9.3.1. Water

9.3.2. Beverages

9.3.2.1. Alcoholic

9.3.2.2. Non-alcoholic

9.3.3. Cosmetics & Personal Care

9.3.4. Others (Homecare & Toiletries, etc.)

9.4. Market Attractiveness Analysis, By End Use

10. Global Paper Bottles Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Region

10.1.2. Y-o-Y Growth Projections, By Region

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific (APAC)

10.2.5. Middle East & Africa (MEA)

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific (APAC)

10.3.5. Middle East & Africa (MEA)

10.4. Market Attractiveness Analysis, By Region

11. North America Paper Bottles Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

11.5.1. 15 ml – 100 ml (small)

11.5.2. 101 ml – 500 ml (medium)

11.5.3. Above 500 ml (large)

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

11.7.1. Everyday

11.7.2. Sports

11.7.3. Others (Travel, etc.)

11.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

11.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

11.9.1. Water

11.9.2. Beverage

11.9.2.1. Alcoholic

11.9.2.2. Non-alcoholic

11.9.3. Cosmetics & Personal Care

11.9.4. Others (Homecare & Toiletries, etc.)

11.10. Market Attractiveness Analysis

11.10.1. By Capacity

11.10.2. By Primary Usage

11.10.3. By End Use

12. Latin America Paper Bottles Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

12.5.1. 15 ml – 100 ml (small)

12.5.2. 101 ml – 500 ml (medium)

12.5.3. Above 500 ml (large)

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

12.7.1. Everyday

12.7.2. Sports

12.7.3. Others (Travel, etc.)

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

12.9.1. Water

12.9.2. Beverage

12.9.2.1. Alcoholic

12.9.2.2. Non-alcoholic

12.9.3. Cosmetics & Personal Care

12.9.4. Others (Homecare & Toiletries, etc.)

12.10. Market Attractiveness Analysis

12.10.1. By Capacity

12.10.2. By Primary Usage

12.10.3. By End Use

13. Europe Paper Bottles Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029 By Country

13.3.1. Germany

13.3.2. Spain

13.3.3. Italy

13.3.4. France

13.3.5. U.K.

13.3.6. BENELUX

13.3.7. Nordic

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

13.5.1. 15 ml – 100 ml (small)

13.5.2. 101 ml – 500 ml (medium)

13.5.3. Above 500 ml (large)

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

13.7.1. Everyday

13.7.2. Sports

13.7.3. Others (Travel, etc.)

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

13.9.1. Water

13.9.2. Beverage

13.9.2.1. Alcoholic

13.9.2.2. Non-alcoholic

13.9.3. Cosmetics & Personal Care

13.9.4. Others (Homecare & Toiletries, etc.)

13.10. Market Attractiveness Analysis

13.10.1. By Capacity

13.10.2. By Primary Usage

13.10.3. By End Use

14. Asia Pacific Paper Bottles Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029 By Country

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Australia and New Zealand

14.3.6. Rest of APAC

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

14.5.1. 15 ml – 100 ml (small)

14.5.2. 101 ml – 500 ml (medium)

14.5.3. Above 500 ml (large)

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

14.7.1. Everyday

14.7.2. Sports

14.7.3. Others (Travel, etc.)

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

14.9.1. Water

14.9.2. Beverage

14.9.2.1. Alcoholic

14.9.2.2. Non-alcoholic

14.9.3. Cosmetics & Personal Care

14.9.4. Others (Homecare & Toiletries, etc.)

14.10. Market Attractiveness Analysis

14.10.1. By Capacity

14.10.2. By Primary Usage

14.10.3. By End Use

15. Middle East and Africa Paper Bottles Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

15.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

15.3.1. North Africa

15.3.2. GCC countries

15.3.3. South Africa

15.3.4. Turkey

15.3.5. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

15.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

15.5.1. 15 ml – 100 ml (small)

15.5.2. 101 ml – 500 ml (medium)

15.5.3. Above 500 ml (large)

15.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Primary Usage

15.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Primary Usage

15.7.1. Everyday

15.7.2. Sports

15.7.3. Others (Travel, etc.)

15.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

15.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

15.9.1. Water

15.9.2. Beverage

15.9.2.1. Alcoholic

15.9.2.2. Non-alcoholic

15.9.3. Cosmetics & Personal Care

15.9.4. Others (Homecare & Toiletries, etc.)

15.10. Market Attractiveness Analysis

15.10.1. By Capacity

15.10.2. By Primary Usage

15.10.3. By End Use

16. Country-wise Analysis and Forecast for Paper Bottles Market

16.1. United States (U.S.) Paper Bottles Market Analysis 2021 & 2029

16.1.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.1.1.1. By Capacity

16.1.1.2. By Primary Usage

16.1.1.3. By End Use

16.2. Mexico Paper Bottles Market Analysis 2021 & 2029

16.2.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.2.1.1. By Capacity

16.2.1.2. By Primary Usage

16.2.1.3. By End Use

16.3. Germany Paper Bottles Market Analysis 2021 & 2029

16.3.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.3.1.1. By Capacity

16.3.1.2. By Primary Usage

16.3.1.3. By End Use

16.4. France Paper Bottles Market Analysis 2021 & 2029

16.4.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.4.1.1. By Capacity

16.4.1.2. By Primary Usage

16.4.1.3. By End Use

16.5. United Kingdom (U.K.) Paper Bottles Market Analysis 2021 & 2029

16.5.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.5.1.1. By Capacity

16.5.1.2. By Primary Usage

16.5.1.3. By End Use

16.6. Italy Paper Bottles Market Analysis 2021 & 2029

16.6.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.6.1.1. By Capacity

16.6.1.2. By Primary Usage

16.6.1.3. By End Use

16.7. GCC Countries Paper Bottles Market Analysis 2021 & 2029

16.7.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.7.1.1. By Capacity

16.7.1.2. By Primary Usage

16.7.1.3. By End Use

16.8. China Paper Bottles Market Analysis 2021 & 2029

16.8.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.8.1.1. By Capacity

16.8.1.2. By Primary Usage

16.8.1.3. By End Use

16.9. Japan Paper Bottles Market Analysis 2021 & 2029

16.9.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.9.1.1. By Capacity

16.9.1.2. By Primary Usage

16.9.1.3. By End Use

16.10. India Paper Bottles Market Analysis 2021 & 2029

16.10.1. Market Value (US$ Mn) & Volume Analysis and Forecast by Market Taxonomy

16.10.1.1. By Capacity

16.10.1.2. By Primary Usage

16.10.1.3. By End Use

17. Competitive Landscape

17.1. Market Structure

17.2. Competition Dashboard

17.3. Company Market Share Analysis

17.4. List of Brand Owners/End Users for Paper Bottles

17.5. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.6. Competition Deep Dive

(Key Market Players / Manufacturers)

17.6.1. Frugalpac

17.6.1.1. Overview

17.6.1.2. Financials

17.6.1.3. Strategy

17.6.1.4. Recent Developments

17.6.1.5. SWOT Analysis

17.6.2. Paper Water Bottle

17.6.2.1. Overview

17.6.2.2. Financials

17.6.2.3. Strategy

17.6.2.4. Recent Developments

17.6.2.5. SWOT Analysis

17.6.3. Kagzi Bottles (India)

17.6.3.1. Overview

17.6.3.2. Financials

17.6.3.3. Strategy

17.6.3.4. Recent Developments

17.6.3.5. SWOT Analysis

17.6.4. Just Water

17.6.4.1. Overview

17.6.4.2. Financials

17.6.4.3. Strategy

17.6.4.4. Recent Developments

17.6.4.5. SWOT Analysis

17.6.5. Paboco

17.6.5.1. Overview

17.6.5.2. Financials

17.6.5.3. Strategy

17.6.5.4. Recent Developments

17.6.5.5. SWOT Analysis

17.6.6. PAPACKS Sales GmbH

17.6.6.1. Overview

17.6.6.2. Financials

17.6.6.3. Strategy

17.6.6.4. Recent Developments

17.6.6.5. SWOT Analysis

17.6.7. LYS PACKAGING

17.6.7.1. Overview

17.6.7.2. Financials

17.6.7.3. Strategy

17.6.7.4. Recent Developments

17.6.7.5. SWOT Analysis

17.6.8. Choose Packaging

17.6.8.1. Overview

17.6.8.2. Financials

17.6.8.3. Strategy

17.6.8.4. Recent Developments

17.6.8.5. SWOT Analysis

17.6.9. PULP PACKAGING INTERNATIONAL

17.6.9.1. Overview

17.6.9.2. Financials

17.6.9.3. Strategy

17.6.9.4. Recent Developments

17.6.9.5. SWOT Analysis

17.6.10. Pulpex Ltd.

17.6.10.1. Overview

17.6.10.2. Financials

17.6.10.3. Strategy

17.6.10.4. Recent Developments

17.6.10.5. SWOT Analysis

17.6.11. Shruti Agro

17.6.11.1. Overview

17.6.11.2. Financials

17.6.11.3. Strategy

17.6.11.4. Recent Developments

17.6.11.5. SWOT Analysis

17.6.12. 3EPack Group

17.6.12.1. Overview

17.6.12.2. Financials

17.6.12.3. Strategy

17.6.12.4. Recent Developments

17.6.12.5. SWOT Analysis

18. Assumptions and Acronyms Used

19. Research Methodology

LIST OF TABLES

Table 01: Global Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 02: Global Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 03: Global Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 04: Global Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 05: Global Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 06: Global Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 07: Global Paper Bottles Market Volume (000 Units) Analysis by Region, 2015H-2029F

Table 08: Global Paper Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2029F

Table 09: North America Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 10: North America Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 11: North America Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 12: North America Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 13: North America Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 14: North America Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 15: North America Paper Bottles Market Volume (000 Units) Analysis by Country, 2015H-2029F

Table 16: North America Paper Bottles Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 17: Latin America Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 18: Latin America Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 19: Latin America Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 20: Latin America Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 21: Latin America Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 22: Latin America Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 23: Latin America Paper Bottles Market Volume (000 Units) Analysis by Country, 2015H-2029F

Table 24: Latin America Paper Bottles Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 25: Europe Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 26: Europe Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 27: Europe Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 28: Europe Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 29: Europe Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 30: Europe Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 31: Europe Paper Bottles Market Volume (000 Units) Analysis by Country, 2015H-2029F

Table 32: Europe Paper Bottles Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 33: Asia-Pacific Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 34: Asia-Pacific Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 35: Asia-Pacific Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 36: Asia-Pacific Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 37: Asia-Pacific Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 38: Asia-Pacific Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 39: Asia-Pacific Paper Bottles Market Volume (000 Units) Analysis by Country, 2015H-2029F

Table 40: Asia-Pacific Paper Bottles Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 41: MEA Paper Bottles Market Volume (000 Units) Analysis by Capacity, 2015H-2029F

Table 42: MEA Paper Bottles Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 43: MEA Paper Bottles Market Volume (000 Units) Analysis by Primary Usage, 2015H-2029F

Table 44: MEA Paper Bottles Market Value (US$ Mn) Analysis by Primary Usage, 2015H-2029F

Table 45: MEA Paper Bottles Market Volume (000 Units) Analysis by End Use, 2015H-2029F

Table 46: MEA Paper Bottles Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 47: MEA Paper Bottles Market Volume (000 Units) Analysis by Region, 2015H-2029F

Table 48: MEA Paper Bottles Market Value (US$ Mn) Analysis by Region, 2015H-2029F

LIST OF FIGURES

Figure 01: Global Paper Bottles Market ASP (US$/000 Units), by Capacity, 2020A

Figure 02: Global Paper Bottles Market Value (US$ Mn) Analysis and Volume (000 Units) Projection (2015H-2020A)

Figure 03: Global Paper Bottles Market Value (US$ Mn) Analysis and Volume (000 Units) Projection (2021E-2029F)

Figure 04: Global Paper Bottles Market Incremental $ Opportunity (US$ Mn) (2021E-2029F)

Figure 05: Global Paper Bottles Market Share Analysis by Capacity, 2021E & 2029F

Figure 06: Global Paper Bottles Market Y-o-Y Analysis by Capacity, 2016H-2029F

Figure 07: Global Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 08: Global Paper Bottles Market Share Analysis by Primary Usage, 2021E & 2029F

Figure 09: Global Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 10: Global Paper Bottles Market Attractiveness Analysis by Primary Usage, 2021E-2029F

Figure 11: Global Paper Bottles Market Share Analysis by End Use, 2021E & 2029F

Figure 12: Global Paper Bottles Market Y-o-Y Analysis by End Use, 2016H-2029F

Figure 13: Global Paper Bottles Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 14: Global Paper Bottles Market Share Analysis by Region, 2021E & 2029F

Figure 15: Global Paper Bottles Market Y-o-Y Analysis by Region, 2016H-2029F

Figure 16: Global Paper Bottles Market Attractiveness Analysis by Region, 2021E-2029F

Figure 17: North America Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 18: North America Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 19: North America Paper Bottles Market Value Share Analysis by End Use, 2021(E)

Figure 20: North America Paper Bottles Market Share Analysis by Country, 2021E & 2029F

Figure 21: Latin America Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 22: Latin America Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 23: Latin America Paper Bottles Market Value Share Analysis by End Use, 2021(E)

Figure 24: Latin America Paper Bottles Market Share Analysis by Country, 2021E & 2029F

Figure 25: Europe Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 26: Europe Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 27: Europe Paper Bottles Market Value Share Analysis by End Use, 2021(E)

Figure 28: Europe Paper Bottles Market Share Analysis by Country, 2021E & 2029F

Figure 29: Asia-Pacific Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 30: Asia-Pacific Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 31: Asia-Pacific Paper Bottles Market Value Share Analysis by End Use, 2021(E)

Figure 32: Asia-Pacific Paper Bottles Market Share Analysis by Country, 2021E & 2029F

Figure 33: MEA Paper Bottles Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 34: MEA Paper Bottles Market Y-o-Y Analysis by Primary Usage, 2016H-2029F

Figure 35: MEA Paper Bottles Market Value Share Analysis by End Use, 2021(E)

Figure 36: MEA Paper Bottles Market Share Analysis by Country, 2021E & 2029F

Figure 37: U.S. Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 38: U.S. Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 39: U.S. Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 40: Mexico Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 41: Mexico Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 42: Mexico Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 43: Germany Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 44: Germany Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 45: Germany Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 46: France Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 47: France Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 48: France Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 49: U.K. Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 50: U.K. Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 51: U.K. Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 52: Italy Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 53: Italy Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 54: Italy Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 55: GCC Countries Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 56: GCC Countries Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 57: GCC Countries Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 58: China Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 59: China Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 60: China Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 61: Japan Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 62: Japan Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 63: Japan Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F

Figure 64: India Paper Bottles Market Value Share Analysis, by Capacity, 2021E &2029F

Figure 65: India Paper Bottles Market Value Share Analysis, by Primary Usage, 2021E & 2029F

Figure 66: India Paper Bottles Market Value Share Analysis, by End Use, 2021E & 2029F