The global paints & coatings fillers market is witnessing a steady growth, owing to a significant surge in demand for a range of applications in industrial, automotive, and architectural sectors. Moreover, growing awareness among consumers and end-users is expected to positively influence the demand for sustainable products that contain low toxic profiles and environmental footprint. In various countries across developed regions, such as North America and Europe, the demand for paints and coatings fillers produced using eco-friendly materials is growing. Furthermore, government initiatives to curb environmental degradation and air pollution in these countries is expected to propel the demand for paints and coatings fillers during the forecast period (2019-2027). In terms of volume, the paints & coating fillers market is expected to reach ~25,465-kilo tons by the end of 2027.

Significant rise in the infrastructure development projects, especially in Asia Pacific, growth of the industrial sector worldwide, and ascending demand for automobiles are some of the leading factors that are likely to propel the growth of the paints & coatings fillers market during the forecast period.

At present, more than 10% of powder coatings make use of metallic pigments and as per current trends, the demand is for architectural coatings is projected to grow at a consistent pace in the coming years. Key participants operating in the current paints & coatings fillers market landscape are continually engaged in the development of new products with improved functional and chemical properties. For several decades, players in the paints & coatings fillers market are focusing on the development of metallic powder coatings that are suitable for architectural applications. For instance, in May 2018, AGC announced that architectural coatings with superior quality can be produced by blending highly-durable polyester resins with FEVE resins.

The architectural coatings application segment is expected to hold the highest share of the paints & coatings fillers market during the forecast period, as a result of growing focus on research and development activities. The segment is expected to reach a value of ~US$ 1.9 Bn by 2027. The demand for architectural coatings is estimated to surpass ~7,658-kilo tons in 2019.

In the current scenario, owing to the mounting concerns over environmental safety, the adoption of raw materials with significantly low toxicity and VOC residual levels is on the rise.

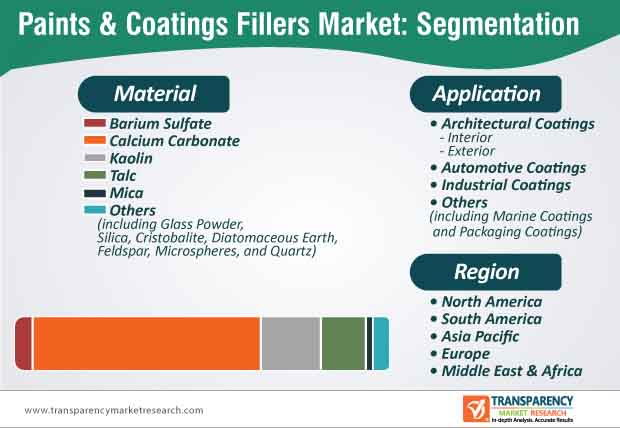

Calcium carbonate is expected to be the most favored material among end users, owing to its range of benefits and applications. It is increasingly being used as paints and coatings filler for high gloss coating products. Moreover, calcium carbonate plays a critical role in increasing the overall volume and thickness of paints, and also improves the durability and wear resistance of coatings. Due to these favorable properties of calcium carbonate, its applications, especially in the architectural sector, is expected to witness a significant growth during the forecast period. Although calcium carbonate is poised to dominate the paints & coatings fillers market, the demand for paints and coating fillers made from other materials such as kaolin, mica, barium sulfate, etc., is expected to grow at a steady pace.

In terms of material, the calcium carbonate segment is leading the paints & coatings fillers market. The calcium carbonate material segment is estimated to reach a value of ~US$ 1.8 Bn in 2019 and accounts for a market share of ~62%.

Stakeholders in the paints & coatings fillers market are entering into strategic partnerships to improve the distribution of their products. For instance, in November 2019, Omya and Kronos entered an agreement to improve the distribution of titanium dioxide pigments in Switzerland. Anticipating the growing demand for calcium carbonate, several participants in the paints & coatings fillers market are focusing on improving the production capacity of calcium carbonate in their manufacturing units. Furthermore, Asia Pacific is likely to attract significant investments in the coming years, owing to the booming industrial and architectural sectors in India, China, Indonesia, and Malaysia, among others.

Analysts’ Viewpoint

The paints & coatings fillers market is expected to expand at a CAGR of ~5% during the forecast period. The growth of the market can be attributed to the increasing demand for sustainable and eco-friendly products derived from raw materials, including calcium carbonate, kaolin, and mica. The ascending demand from the architectural segment is expected to fuel the growth of the market for paints & coatings fillers in the near future. Players operating in the current market landscape should focus on expanding their footprint by entering into strategic partnerships and collaborating with regional companies, particularly in the Asia Pacific region.

Paints & Coatings Fillers Market: Overview

Key Growth Drivers of Paints & Coatings Fillers Market

Major Challenges for Paints & Coatings Fillers Market

Lucrative Opportunities for Paints & Coatings Fillers Market

Asia Pacific to Dominate Paints & Coatings Fillers Market

High Usage of Calcium Carbonate in Applications of Paints and Coatings

Key Strategies Adopted by Market Players The global paints & coatings fillers market is fragmented. The top three players -

constituted 27.4% share of the global paints & coatings fillers market in 2018.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Paints & Coatings Fillers Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators/Definitions

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porters Five Forces Analysis

4.5. Value Chain Analysis

4.5.1. List of Potential Customers

4.6. Global Production Output

4.7. Pricing Analysis

4.7.1. Price Trend Analysis, by Material

4.7.2. Price Trend Analysis, by Region

5. Global Paints & Coatings Fillers Market Analysis and Forecast, by Material

5.1. Introduction & Key Findings

5.2. Global Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

5.2.1. Barium Sulfate

5.2.2. Calcium Carbonate

5.2.3. Kaolin

5.2.4. Talc

5.2.5. Mica

5.2.6. Others

5.3. Global Paints & Coatings Fillers Market Attractiveness Analysis, by Material

6. Global Paints & Coatings Fillers Market Analysis and Forecast, by Application

6.1. Introduction & Key Findings

6.2. Global Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.2.1.1. Architectural Coatings

6.2.1.1.1. Interior

6.2.1.1.2. Exterior

6.2.1.2. Automotive Coatings

6.2.1.3. Industrial Coatings

6.2.1.4. Pharmaceutical

6.2.1.5. Others

6.3. Global Paints & Coatings Fillers Market Attractiveness Analysis, by Application

7. Global Paints & Coatings Fillers Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

7.3. Global Paints & Coatings Fillers Market Attractiveness Analysis, by Region, 2018

8. North America Paints & Coatings Fillers Market Analysis and Forecast

8.1. Key Findings

8.2. North America Paints & Coatings Fillers Market Forecast, by Material, 2018–2027

8.3. North America Paints & Coatings Fillers Market Forecast, by Application, 2018–2027

8.4. North America Paints & Coatings Fillers Market Forecast, by Country, 2018–2027

8.4.1. U.S. Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

8.4.2. U.S. Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.4.3. Canada Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

8.4.4. Canada Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.5. North America Paints & Coatings Fillers Market Attractiveness Analysis

9. Europe Paints & Coatings Fillers Market Analysis and Forecast

9.1. Key Findings

9.2. Europe Paints & Coatings Fillers Market Forecast, by Material, 2018–2027

9.3. Europe Paints & Coatings Fillers Market Forecast, by Application, 2018–2027

9.4. Europe Paints & Coatings Fillers Market Forecast, by Country and Sub-region, 2018–2027

9.4.1. Germany Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.2. Germany Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.3. France Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.4. France Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.5. U.K. Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.6. U.K. Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.7. Italy Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.8. Italy Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.9. Spain Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.10. Spain Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.11. Russia & CIS Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.12. Russia & CIS Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.13. Rest of Europe Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4.14. Rest of Europe Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.5. Europe Paints & Coatings Fillers Market Attractiveness Analysis

10. Asia Pacific Paints & Coatings Fillers Market Analysis and Forecast

10.1. Key Findings

10.2. Asia Pacific Paints & Coatings Fillers Market Forecast, by Material, 2018–2027

10.3. Asia Pacific Paints & Coatings Fillers Market Forecast, by Application, 2018–2027

10.4. Asia Pacific Paints & Coatings Fillers Market Forecast, by Country and Sub-region, 2018–2027

10.4.1. China Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.2. China Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.3. Japan Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.4. Japan Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.5. India Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.6. India Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.7. Singapore Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.8. Singapore Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.9. Malaysia Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.10. Malaysia Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.11. Thailand Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.12. Thailand Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.13. Indonesia Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.14. Indonesia Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.15. Rest of Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.4.16. Rest of Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.5. Asia Pacific Paints & Coatings Fillers Market Attractiveness Analysis

11. Latin America Paints & Coatings Fillers Market Analysis and Forecast

11.1. Key Findings

11.2. Latin America Paints & Coatings Fillers Market Forecast, by Material, 2018–2027

11.3. Latin America Paints & Coatings Fillers Market Forecast, by Application, 2018–2027

11.4. Latin America Paints & Coatings Fillers Market Forecast, by Country and Sub-region, 2018–2027

11.4.1. Brazil Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

11.4.2. Brazil Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.4.3. Mexico Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

11.4.4. Mexico Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.4.5. Rest of Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

11.4.6. Rest of Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.5. Latin America Paints & Coatings Fillers Market Attractiveness Analysis

12. Middle East & Africa Paints & Coatings Fillers Market Analysis and Forecast

12.1. Key Findings

12.2. Middle East & Africa Paints & Coatings Fillers Market Forecast, by Material, 2018–2027

12.3. Middle East & Africa Paints & Coatings Fillers Market Forecast, by Application, 2018–2027

12.4. Middle East & Africa Paints & Coatings Fillers Market Forecast, by Country and Sub-region, 2018–2027

12.4.1. GCC Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

12.4.2. GCC Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.4.3. South Africa Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

12.4.4. South Africa Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.4.5. Rest of Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

12.4.6. Rest of Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.5. Middle East & Africa Paints & Coatings Fillers Market Attractiveness Analysis

13. Competition Landscape

13.1. Global Paints & Coatings Fillers Market Share Analysis, by Company, 2018

13.2. Company Profiles

13.2.1. Minerals Technologies Inc.

13.2.1.1. Company Description

13.2.1.2. Business Overview

13.2.1.3. Financial Details

13.2.1.4. Key Developments

13.2.2. Omya AG

13.2.2.1. Company Description

13.2.2.2. Business Overview

13.2.3. Imerys

13.2.3.1. Company Description

13.2.3.2. Business Overview

13.2.3.3. Financial Details

13.2.3.4. Key Developments

13.2.4. Sibelco

13.2.4.1. Company Description

13.2.4.2. Business Overview

13.2.4.3. Financial Details

13.2.4.4. Key Developments

13.2.5. Gebrüder Dorfner GmbH & Co

13.2.5.1. Company Description

13.2.5.2. Business Overview

13.2.5.3. Financial Details

13.2.5.4. Key Developments

13.2.6. 3M

13.2.6.1. Company Description

13.2.6.2. Business Overview

13.2.6.3. Financial Details

13.2.6.4. Key Developments

13.2.7. Willamette Valley Company

13.2.7.1. Company Description

13.2.7.2. Business Overview

13.2.8. IMCD N.V.

13.2.8.1. Company Description

13.2.8.2. Business Overview

13.2.8.3. Financial Details

13.2.8.4. Key Developments

13.2.9. Huber Engineered Materials

13.2.9.1. Company Description

13.2.9.2. Business Overview

13.2.10. Mississippi Lime Company

13.2.10.1. Company Description

13.2.10.2. Business Overview

13.2.11. Shaanxi Fuhua Chemical Co., Ltd.

13.2.11.1. Company Description

13.2.11.2. Business Overview

13.2.12. Nippon Electric Glass Co.,Ltd

13.2.12.1. Company Description

13.2.12.2. Business Overview

13.2.12.3. Financial Details

13.2.12.4. Key Developments

13.2.13. U.S. Aggregates Inc.

13.2.13.1. Company Description

13.2.13.2. Business Overview

13.2.14. Excalibar Minerals LLC

13.2.14.1. Company Description

13.2.14.2. Business Overview

13.2.15. Solvay S.A.

13.2.15.1. Company Description

13.2.15.2. Business Overview

13.2.15.3. Financial Details

13.2.15.4. Key Developments

13.2.16. Ashapura Group

13.2.16.1. Company Description

13.2.16.2. Business Overview

13.2.16.3. Financial Details

13.2.16.4. Key Developments

13.2.17. Vanderbilt Minerals, LLC

13.2.17.1. Company Description

13.2.17.2. Business Overview

List of Tables

Table 01: List of Potential Customers

Table 02: List of Potential Customers

Table 03: Global Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 04: Global Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 05: Global Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–202

Table 06: Global Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 07: Global Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Region, 2018–2027

Table 08: Global Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 09: Global Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 10: North America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 11: North America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 12: North America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 13: North America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 14: North America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 15: U.S. Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 16: U.S. Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 17: U.S. Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 18: U.S. Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 19: Canada Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 20: Canada Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 21: Canada Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 22: Canada Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 23: Europe Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 24: Europe Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 25: Europe Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–202

Table 26: Europe Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 27: Europe Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 28: Europe Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 29: Germany Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 30: Germany Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 31: Germany Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 32: Germany Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 33: France Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 34: France Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 35: France Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–202

Table 36: France Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 37: U.K. Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 38: U.K. Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 39: U.K. Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 40: U.K. Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 41: Italy Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 42: Italy Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 43: Italy Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 44: Italy Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 45: Spain Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 46: Spain Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 47: Spain Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 48: Spain Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 49: Russia & CIS Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 50: Russia & CIS Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 51: Russia & CIS Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 52: Russia & CIS Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 53: Rest of Europe Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 54: Rest of Europe Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 55: Rest of Europe Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 56: Rest of Europe Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 57: Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 58: Asia Pacific Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 59: Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 60: Asia Pacific Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 61: Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 62: Asia Pacific Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 63: China Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 64: China Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 65: China Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 66: China Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 67: Japan Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 68: Japan Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 69: Japan Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 70: Japan Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 71: India Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 72: India Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 73: India Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 74: India Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 75: Singapore Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 76: Singapore Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 77: Singapore Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 78: Singapore Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 79: Malaysia Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 80: Malaysia Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 81: Malaysia Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 82: Malaysia Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 83: Thailand Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 84: Thailand Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 85: Thailand Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 86: Thailand Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 87: Indonesia Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 88: Indonesia Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 89: Indonesia Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 90: Indonesia Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 91: Rest of Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 92: Rest of Asia Pacific Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 93: Rest of Asia Pacific Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 94: Rest of Asia Pacific Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 95: Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 96: Latin America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 97: Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 98: Latin America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 99: Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 100: Latin America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 101: Brazil Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 102: Brazil Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 103: Brazil Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 104: Brazil Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 105: Mexico Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 106: Mexico Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 107: Mexico Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 108: Mexico Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 109: Rest of Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 110: Rest of Latin America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 111: Rest of Latin America Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 112: Rest of Latin America Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 113: Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 114: Middle East & Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 115: Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 116: Middle East & Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 117: Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 118: Middle East & Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 119: GCC Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 120: GCC Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 121: GCC Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 122: GCC Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 123: South Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 124: South Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 125: South Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 126: South Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 127: Rest of Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Material, 2018–2027

Table 128: Rest of Middle East & Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Material, 2018–2027

Table 129: Rest of Middle East & Africa Paints & Coatings Fillers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 130: Rest of Middle East & Africa Paints & Coatings Fillers Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: Global Paints & Coatings Fillers Market Volume Share, by Application, 2018

Figure 02: Global Paints & Coatings Fillers Market Volume Share, by Material, 2018

Figure 03: Global Paints & Coatings Fillers Market Volume Share, by Region, 2018

Figure 04: Production Output of Paints & Coatings Fillers, by Region, 2018

Figure 05: Global Paints & Coatings Fillers Price Trend, by Material (US$/Ton), 2018–2027

Figure 06: Global Paints & Coatings Fillers Price Trend, by Region (US$/Ton), 2018–2027

Figure 07: Global Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 08: Global Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 09: Global Paints & Coatings Fillers Market Volume Share, by Region, 2018 and 2027

Figure 10: Global Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 11: Global Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 12: Global Paints & Coatings Fillers Market Attractiveness Analysis, by Region

Figure 13: North America Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 14: North America Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 15: North America Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 16: North America Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 17: North America Paints & Coatings Fillers Market Volume Share, by Country, 2018 and 2027

Figure 18: North America Paints & Coatings Fillers Market Attractiveness Analysis, by Country

Figure 19: Europe Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 20: Europe Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 21: Europe Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 22: Europe Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 23: Europe Paints & Coatings Fillers Market Volume Share, by Country, 2018 and 2027

Figure 24: Europe Paints & Coatings Fillers Market Attractiveness Analysis, by Country and Sub-region

Figure 25: Asia Pacific Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 26: Asia Pacific Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 27: Asia Pacific Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 28: Asia Pacific Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 29: Asia Pacific Paints & Coatings Fillers Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 30: Asia Pacific Paints & Coatings Fillers Market Attractiveness Analysis, by Country and Sub-region

Figure 31: Latin America Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 32: Latin America Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 33: Latin America Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 34: Latin America Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 35: Latin America Paints & Coatings Fillers Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 36: Latin America Paints & Coatings Fillers Market Attractiveness Analysis, by Country and Sub-region

Figure 37: Middle East & Africa Paints & Coatings Fillers Market Volume, by Material, 2018 and 2027

Figure 38: Middle East & Africa Paints & Coatings Fillers Market Attractiveness Analysis, by Material

Figure 39: Middle East & Africa Paints & Coatings Fillers Market Volume, by Application, 2018 and 2027

Figure 40: Middle East & Africa Paints & Coatings Fillers Market Attractiveness Analysis, by Application

Figure 41: Middle East & Africa Paints & Coatings Fillers Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 42: Middle East & Africa Paints & Coatings Fillers Market Attractiveness Analysis, by Country and Sub-region

Figure 43: Global Paints & Coatings Fillers Market Share, by Company, 2018