Analysts’ Viewpoint on Pain Management Therapeutics Market Scenario

Personalization of pain therapies has been led by genetic evaluation tests based on analyzing patient’s deoxyribonucleic acid (DNA) to find appropriate medication for efficient pain management and avoid medicines that could cause severe side-effects. Availability of personalized pain therapies providing more accurate, efficient, and cost-efficient treatment is expected to present significant opportunities for pain management therapeutics market players in the near future. Moreover, several alternative medications with extended release are in development phase for the treatment of chronic and post-operative pain management. Approval of efficient alternative medicines for mild to chronic pain is expected to drive the global pain management therapeutics market size during the forecast period. Furthermore, a broad array of drugs has been developed for the treatment of multiple pain and inflammatory conditions driven by continuous improvement in the biopharmaceutical properties of available drugs.

Treatments for chronic pain are as different as the causes. Milder forms of pain could be relieved by over-the-counter medications such as Tylenol (acetaminophen) or nonsteroidal anti-inflammatory drugs (NSAIDs) such as aspirin, ibuprofen, and naproxen. Both acetaminophen and NSAIDs relieve pain caused by muscle aches and stiffness, and additionally, NSAIDs reduce inflammation (swelling and irritation). Topical pain relievers are also available, such as creams, lotions, or sprays, which are applied to the skin in order to relieve pain and inflammation from sore muscles and arthritis.

The number of patients suffering from chronic pain is rising constantly across the globe. According to the Centers for Disease Control and Prevention (CDC), in 2019, 20.4% of adults in the U.S. had chronic pain and 7.4% of adults had chronic pain that frequently limited life or work activities. According to the European Pain Federation, around 80 million adults in Europe suffer from chronic pain. Increase in incidence rate of cancer across the world contributes to a rise in the demand for pain management therapeutics. This includes pain occurring from cancer therapy as well as from incursion of cancer cells on to bones and other healthy body parts. WHO projections suggest that the global cancer prevalence would increase by around 75% from 2008 to 2030. Therefore, surge in incidence of chronic pain continues to encourage the usage of pain management drugs, which in turn is driving the global market.

Doctors usually prescribe medicines in the initial stages of pain, followed by other treatment options. Prescription drugs are easy and cost-effective without any ambiguity. Moreover, high cost of other alternate pain relief methods such as chiropractics, acupuncture, and acupressure have further driven the prescription drugs market, as cost of one session could equal the cost of complete therapeutic pain relief course for a patient through drugs. Increase in awareness about the availability of medications for pain management propels the consumption and acceptance of pain management drugs over other treatment options. Therefore, high availability, easy access, high awareness, cost effectiveness, and quick relief have made pain management therapeutics more preferable to other treatment options.

In terms of therapeutic, the opioids segment dominated the global market in 2021. Opioids are the most widely prescribed pain management medications to treat moderate to severe chronic pain. Analgesics care in the form of analgesics is provided to cancer patients and treat severe constant pain in patients suffering from terminal illnesses. These are generally administered via subcutaneous, oral, or intramuscular route. Other routes of administration include nasal insufflation, patient-controlled analgesia, and transdermal and oral mucosa routes via lozenges. Opioids can be segmented into three major classes: strong agonists (fentanyl, oxymorphone, and morphine), mild-to-moderate agonists (codeine and hydroxycodone), and opioids with mixed receptor reactions (buprenophrine and pentazocine). The opioids segment has been segregated into oxycodones, hydrocodones, tramadol, and others. The hydrocodones sub-segment led the opioids segment in 2021 due to the introduction and adoption of abuse-deterrent formulations (ADFs).

On the other hand, the NSAIDs (non-steroidal anti-inflammatory drugs) segment is expected to gain pain management therapeutics market share during the forecast period owing to increase in the adoption of NSAIDs to manage mild to moderate pain with proven efficacy and fewer side-effects in the last few decades. Unlike opioids, NSAIDs are not associated with tolerance and dependence, hence the preference for NSAIDs is increasing over other pain management therapeutics.

Based on indication, the cancer pain segment accounted for the largest share of the global pain management therapeutics market in 2021 owing to increasing cases of cancer across the world. Globally, rise in prevalence of cancer is propelling the demand for pain therapeutics in the management of cancer pain. According to International Association of Study of Pain, for the more than 10 million people worldwide who are diagnosed with some form of cancer each year, pain associated with their condition is a serious concern. According to International Agency for Research on Cancer (IARC) estimates, 17.0 million new cancer cases and 9.5 million cancer deaths were reported globally in 2018. By 2040, the global burden is expected to rise to 27.5 million new cancer cases and 16.3 million cancer deaths due to increase in the geriatric population.

As per pain management therapeutics market forecast, the chronic back pain segment is likely to gain market share during the forecast period due to rise in prevalence of chronic low back pain. Nearly 65 million people in the U.S. report an episode of back pain. Some 16 million adults (8%) experience persistent or chronic back pain, and as a result are limited in certain everyday activities. Lower back pain affects an estimated 540 million people across the globe. More than one in ten suffer from lower back pain.

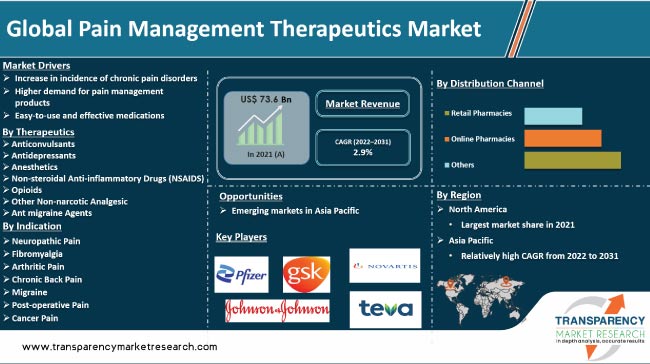

North America is expected to account for the largest share of the global pain management therapeutics market during the forecast period. This is ascribed to improved healthcare policies, changes in lifestyle, advancement in healthcare facilities, and availability of effective and convenient treatment options in the U.S. and Canada.

The market in Asia Pacific is likely to grow at a rapid pace in the next few years. Developing countries in the region such as Japan, China, and India are expected to contribute to the rise in demand for therapeutic pain management therapeutics, increase in awareness, and early availability of pain management therapeutic products.

The pain management therapeutics market report concludes with the company profiles section that includes key information about major players in the market. Key players are focusing on product launches, mergers & acquisitions, partnerships, and collaborations to enhance their pain management therapeutics market share. Abbott, AstraZeneca plc, Pfizer, Inc., Depomed, Inc. Endo International plc, GlaxoSmithKline plc, Johnson & Johnson, Mallinckrodt Pharmaceuticals, Merck & Co., Inc., Novartis AG, Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., Venus Remedies Limited, and Q Biomed, Inc. are the prominent players operating in the global market.

Each of these players has been profiled in the pain management therapeutics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 73.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 98.0 Bn |

|

Compound Annual Growth Rate (CAGR) |

2.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global pain management therapeutics market was valued at US$ 73.6 Bn in 2021.

The global market is projected to reach more than US$ 98.0 Bn by 2031.

The global pain management therapeutics market is anticipated to grow at a CAGR of 2.9% from 2022 to 2031.

Increase in incidence of chronic pain disorders is driving the global market.

Abbott, AstraZeneca plc, Pfizer, Inc., Depomed, Inc. Endo International plc, GlaxoSmithKline plc, Johnson & Johnson, Mallinckrodt Pharmaceuticals, Merck & Co., Inc., Novartis AG, Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., Venus Remedies Limited, and Q Biomed, Inc. are the prominent players oerating in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pain Management Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Therapeutics Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pain Management Therapeutics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Mergers & Acquisitions

5.3. Covid 19 Impact Analysis

6. Global Pain Management Therapeutics Market Analysis and Forecast, by Therapeutic

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Therapeutic, 2017–2031

6.3.1. Anticonvulsants

6.3.2. Antidepressants

6.3.3. Anesthetics

6.3.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

6.3.5. Opioids

6.3.6. Other Non-narcotic Analgesic

6.3.7. Antimigraine Agents

6.4. Market Attractiveness Analysis, by Therapeutic

7. Global Pain Management Therapeutics Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. Neuropathic Pain

7.3.2. Fibromyalgia

7.3.3. Arthritic Pain

7.3.4. Chronic Back Pain

7.3.5. Migraine

7.3.6. Post-operative Pain

7.3.7. Cancer Pain

7.4. Market Attractiveness Analysis, by Indication

8. Global Pain Management Therapeutics Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Oral

8.3.2. Parenteral

8.3.3. Others

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Pain Management Therapeutics Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Retail Pharmacies

9.3.2. Online Pharmacies

9.3.3. Others

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Pain Management Therapeutics Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Pain Management Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Therapeutic, 2017–2031

11.2.1. Anticonvulsants

11.2.2. Antidepressants

11.2.3. Anesthetics

11.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

11.2.5. Opioids

11.2.6. Other Non-narcotic Analgesic

11.2.7. Antimigraine Agents

11.3. Market Value Forecast, by Indication, 2017–2031

11.3.1. Neuropathic Pain

11.3.2. Fibromyalgia

11.3.3. Arthritic Pain

11.3.4. Chronic Back Pain

11.3.5. Migraine

11.3.6. Post-operative Pain

11.3.7. Cancer Pain

11.4. Market Value Forecast, by Route of Administration, 2017–2031

11.4.1. Oral

11.4.2. Parenteral

11.4.3. Others

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Retail Pharmacies

11.5.2. Online Pharmacies

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Therapeutic

11.7.2. By Indication

11.7.3. By Route of Administration

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Pain Management Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Therapeutic, 2017–2031

12.2.1. Anticonvulsants

12.2.2. Antidepressants

12.2.3. Anesthetics

12.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

12.2.5. Opioids

12.2.6. Other Non-narcotic Analgesic

12.2.7. Antimigraine Agents

12.3. Market Value Forecast, by Indication, 2017–2031

12.3.1. Neuropathic Pain

12.3.2. Fibromyalgia

12.3.3. Arthritic Pain

12.3.4. Chronic Back Pain

12.3.5. Migraine

12.3.6. Post-operative Pain

12.3.7. Cancer Pain

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Oral

12.4.2. Parenteral

12.4.3. Others

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Retail Pharmacies

12.5.2. Online Pharmacies

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Therapeutic

12.7.2. By Indication

12.7.3. By Route of Administration

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Pain Management Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Therapeutic, 2017–2031

13.2.1. Anticonvulsants

13.2.2. Antidepressants

13.2.3. Anesthetics

13.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

13.2.5. Opioids

13.2.6. Other Non-narcotic Analgesic

13.2.7. Antimigraine Agents

13.3. Market Value Forecast, by Indication, 2017–2031

13.3.1. Neuropathic Pain

13.3.2. Fibromyalgia

13.3.3. Arthritic Pain

13.3.4. Chronic Back Pain

13.3.5. Migraine

13.3.6. Post-operative Pain

13.3.7. Cancer Pain

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Oral

13.4.2. Parenteral

13.4.3. Others

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Retail Pharmacies

13.5.2. Online Pharmacies

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Therapeutic

13.7.2. By Indication

13.7.3. By Route of Administration

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Pain Management Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Therapeutic, 2017–2031

14.2.1. Anticonvulsants

14.2.2. Antidepressants

14.2.3. Anesthetics

14.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

14.2.5. Opioids

14.2.6. Other Non-narcotic Analgesic

14.2.7. Antimigraine Agents

14.3. Market Value Forecast, by Indication, 2017–2031

14.3.1. Neuropathic Pain

14.3.2. Fibromyalgia

14.3.3. Arthritic Pain

14.3.4. Chronic Back Pain

14.3.5. Migraine

14.3.6. Post-operative Pain

14.3.7. Cancer Pain

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Oral

14.4.2. Parenteral

14.4.3. Others

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Retail Pharmacies

14.5.2. Online Pharmacies

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Therapeutic

14.7.2. By Indication

14.7.3. By Route of Administration

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Pain Management Therapeutics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Therapeutic, 2017–2031

15.2.1. Anticonvulsants

15.2.2. Antidepressants

15.2.3. Anesthetics

15.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

15.2.5. Opioids

15.2.6. Other Non-narcotic Analgesic

15.2.7. Antimigraine Agents

15.3. Market Value Forecast, by Indication, 2017–2031

15.3.1. Neuropathic Pain

15.3.2. Fibromyalgia

15.3.3. Arthritic Pain

15.3.4. Chronic Back Pain

15.3.5. Migraine

15.3.6. Post-operative Pain

15.3.7. Cancer Pain

15.4. Market Value Forecast, by Route of Administration, 2017–2031

15.4.1. Oral

15.4.2. Parenteral

15.4.3. Others

15.5. Market Value Forecast, by Distribution Channel, 2017–2031

15.5.1. Retail Pharmacies

15.5.2. Online Pharmacies

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Therapeutic

15.7.2. By Indication

15.7.3. By Route of Administration

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Abbott Laboratories

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Financial Analysis

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. AstraZeneca plc

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Financial Analysis

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. Pfizer, Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Financial Analysis

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. Depomed, Inc.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Financial Analysis

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Endo International plc

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Financial Analysis

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. GlaxoSmithKline plc

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Financial Analysis

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Johnson & Johnson Services, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Financial Analysis

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Mallinckrodt Pharmaceuticals

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Financial Analysis

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. Merck & Co., Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Financial Analysis

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Novartis AG

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Financial Analysis

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

16.3.11. Purdue Pharma L.P.

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Financial Analysis

16.3.11.3. Growth Strategies

16.3.11.4. SWOT Analysis

16.3.12. Teva Pharmaceutical Industries Ltd

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Financial Analysis

16.3.12.3. Growth Strategies

16.3.12.4. SWOT Analysis

16.3.13. Venus Remedies Limited

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Financial Analysis

16.3.13.3. Growth Strategies

16.3.13.4. SWOT Analysis

16.3.14. Q Biomed, Inc.

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Financial Analysis

16.3.14.3. Growth Strategies

16.3.14.4. SWOT Analysis

List of Tables

Table 01: Global Pain Management Therapeutics Market Value Share, by Therapeutic, 2021

Table 02: Global Pain Management Therapeutics Market Value Share, by Indication, 2021

Table 03: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 04: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 05: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 06: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 07: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 09: North America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 10: North America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 11: North America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: North America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Europe Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 14: Europe Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Europe Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 16: Europe Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Europe Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 19: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 20: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 21: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 22: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 23: Latin America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 24: Latin America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 25: Latin America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 26: Latin America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 27: Latin America Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 28: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic, 2017–2031

Table 29: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 30: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 31: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 32: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Pain Management Therapeutics Market Snapshot

Figure 02: Global Pain Management Therapeutics Market Segments With Leading Market Share (%), 2021

Figure 03: Key Industry Developments (Pain Management Therapeutics Market)

Figure 04: Global Pain Management Therapeutics Market Value (US$ Mn) Forecast, 2017‒2031

Figure 05: Global Pain Management Therapeutics Market Value Share (%), by Therapeutic (2021)

Figure 06: Global Pain Management Therapeutics Market Value Share (%), by Indication (2021)

Figure 07: Global Pain Management Therapeutics Market Value Share (%), by Route of Administration (2021)

Figure 08: Global Pain Management Therapeutics Market Value Share(%), by Distribution Channel (2021)

Figure 09: Global Pain Management Therapeutics Market Value Share (%), by Region (2021)

Figure 10: Global Pain Management Therapeutics Market Value Share Analysis, by Therapeutic, 2021 and 2031

Figure 11: Global Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 12: Global Pain Management Therapeutics Market Value Share Analysis, by Indication, 2021 and 2031

Figure 13: Global Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 14: Global Pain Management Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 15: Global Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 16: Global Pain Management Therapeutics Market Value Share(%), by Distribution Channel, 2021 and 2031

Figure 17: Global Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 18: Global Pain Management Therapeutics Market Value Share Analysis, by Region 2021 and 2031

Figure 19: Global Pain Management Therapeutics Market Attractiveness Analysis, by Region, 2022–2031

Figure 20: North America Pain Management Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 21: North America Pain Management Therapeutics Market Value Share (%), by Therapeutic, 2021 and 2031

Figure 22: North America Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 23: North America Pain Management Therapeutics Market Value Share (%), by Indication, 2021 and 2031

Figure 24: North America Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 25: North America Pain Management Therapeutics Market Value Share (%), by Route of Administration, 2021 and 2031

Figure 26: North America Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 27: North America Pain Management Therapeutics Market Share (%), by Distribution Channel, 2021 and 2031

Figure 28: North America Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 29: North America Pain Management Therapeutics Market Value Share (%), by Country, 2021 and 2031

Figure 30: North America Pain Management Therapeutics Market Attractiveness Analysis, by Country, 2022–2031

Figure 31: Europe Pain Management Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 32: Europe Pain Management Therapeutics Market Value Share (%), by Therapeutic, 2021 and 2031

Figure 33: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 34: Europe Pain Management Therapeutics Market Value Share (%), by Indication, 2021 and 2031

Figure 35: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 36: Europe Pain Management Therapeutics Market Value Share (%), by Route of Administration, 2021 and 2031

Figure 37: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 38: Europe Pain Management Therapeutics Market Share (%), by Distribution Channel, 2021 and 2031

Figure 39: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 40: Europe Pain Management Therapeutics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 41: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Pain Management Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 43: Asia Pacific Pain Management Therapeutics Market Value Share (%), by Therapeutic, 2021 and 2031

Figure 44: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 45: Asia Pacific Pain Management Therapeutics Market Value Share (%), by Indication, 2021 and 2031

Figure 46: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 47: Asia Pacific Pain Management Therapeutics Market Value Share (%), by Route of Administration, 2021 and 2031

Figure 48: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 49: Asia Pacific Pain Management Therapeutics Market Share (%), by Distribution Channel, 2021 and 2031

Figure 50: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 51: Asia Pacific Pain Management Therapeutics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 52: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 53: Latin America Pain Management Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 54: Latin America Pain Management Therapeutics Market Value Share (%), by Therapeutic, 2021 and 2031

Figure 55: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 56: Latin America Pain Management Therapeutics Market Value Share (%), by Indication, 2021 and 2031

Figure 57: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 58: Latin America Pain Management Therapeutics Market Value Share (%), by Route of Administration, 2021 and 2031

Figure 59: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 60: Latin America Pain Management Therapeutics Market Share (%), by Distribution Channel, 2021 and 2031

Figure 61: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 62: Latin America Pain Management Therapeutics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 63: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 64: Middle East & Africa Pain Management Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 65: Middle East & Africa Pain Management Therapeutics Market Value Share (%), by Therapeutic, 2021 and 2031

Figure 66: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Therapeutic, 2022–2031

Figure 67: Middle East & Africa Pain Management Therapeutics Market Value Share (%), by Indication, 2021 and 2031

Figure 68: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Indication, 2022–2031

Figure 69: Middle East & Africa Pain Management Therapeutics Market Value Share (%), by Route of Administration, 2021 and 2031

Figure 70: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 71: Middle East & Africa Pain Management Therapeutics Market Share (%), by Distribution Channel, 2021 and 2031

Figure 72: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 73: Middle East & Africa Pain Management Therapeutics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 74: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031